Programmable Logic Controller (PLC) Market Size

Get E-PDF Sample Report on Programmable Logic Controller (PLC) Market - Request Sample Report

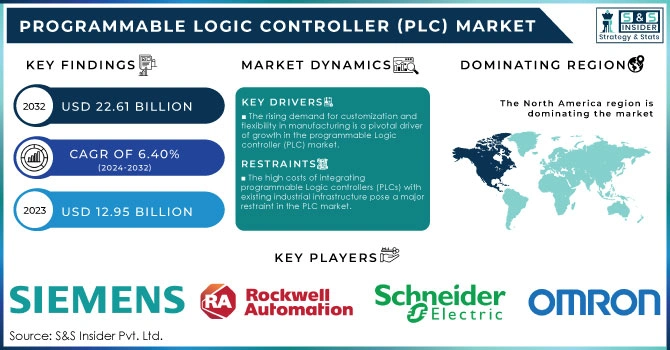

The Programmable Logic Controller (PLC) Market Size was valued at USD 12.95 billion in 2023 and is expected to grow to USD 22.61 billion by 2032 and grow at a CAGR of 6.40% over the forecast period of 2024-2032.

The programmable Logic controller (PLC) market is set for significant growth, driven by the rising automation across various sectors, including automotive, food and beverage, chemicals, pharmaceuticals, oil and gas, and energy and utilities. In the automotive industry, PLCs are increasingly utilized to optimize assembly lines and improve production efficiency, while in the food and beverage sector, they ensure consistent product quality and regulatory compliance. The oil and gas industry employs programmable Logic controller technology for efficient process control in refining and distribution. Additionally, the demand for smart manufacturing solutions, alongside advancements in Industry 4.0 technologies, is boosting the programmable Logic controller market. The integration of IoT capabilities in programmable Logic controller systems facilitates real-time data analysis, enhancing operational efficiency. Cybersecurity measures in programmable Logic controller systems are gaining importance as manufacturers focus on safeguarding critical infrastructure from cyber threats. Furthermore, advancements in programmable Logic devices (PLDs), such as those from Texas Instruments, are transforming engineering workflows. These PLDs can integrate up to 40 Logic and analog functions into a compact device, achieving a 94% reduction in board size compared to traditional designs, thus lowering system costs. As industries aim for net-zero climate goals, the demand for renewable energy sources, including hydrogen, is increasing. With a 28% rise in hydrogen demand over the past decade, industries recognize its potential as an alternative energy source. Companies will rely on advanced automation technologies to enhance production efficiency and reduce emissions. Initiatives like Emerson's PosHYdon project exemplify the integration of automation in renewable energy production, using offshore wind energy for hydrogen production through electrolysis.

Driven by rising industrial output and investments in automation technologies. With the advent of Industry 4.0, PLC systems have become integral to both process and discrete manufacturing automation, notably enhancing efficiency in sectors like automotive, electrical, and electronics. The increasing deployment of industrial robots—reportedly up by 12% in the U.S. to 44,303 units in 2023, according to the International Federation of Robotics (IFR)—further underscores this trend, as robots are key users of PLCs. Additionally, the growing trend of integrating PLCs with other industrial controls, such as Human-Machine Interfaces (HMIs) and SCADA systems, is enhancing operational visibility and reducing the workload on central controllers. However, challenges arise from the demand for product customization and the shift from batch to continuous processing, compelling manufacturers to seek more advanced automation solutions like DCS and cloud-based systems. As economic growth accelerates, particularly within the manufacturing sector, the demand for PLCs is set to rise, enabling industries to enhance efficiency, productivity, and competitiveness in an increasingly automated landscape.

Programmable Logic Controller Market Dynamics

Drivers

-

The rising demand for customization and flexibility in manufacturing is a pivotal driver of growth in the programmable Logic controller (PLC) market.

As industries transition from conventional batch processing to more tailored production methodologies, the need for adaptable and flexible automation solutions is surging. This shift is propelled by changing consumer preferences and market dynamics, which require rapid adjustments in production lines to satisfy diverse customer demands. PLC systems are celebrated for their versatility, enabling manufacturers to quickly reconfigure operations to align with varying product specifications without incurring significant downtime or retooling costs. This flexibility is particularly crucial in sectors such as automotive, food and beverage, and pharmaceuticals, where production processes must swiftly adapt to evolving regulations and consumer trends. Advancements in PLC technology enhance integration with other automation systems, including Human-Machine Interfaces (HMIs) and Supervisory Control and Data Acquisition (SCADA) systems, leading to improved operational efficiency and visibility. This integration simplifies workflows and minimizes the challenges of managing multiple control systems. As businesses increasingly adopt lean manufacturing principles aimed at reducing waste and optimizing resources, the demand for PLC solutions that provide both customization and scalability continues to rise. The ongoing evolution of Industry 4.0 technologies further amplifies this trend, as manufacturers harness Internet of Things (IoT) capabilities for enhanced real-time data analytics and better decision-making. Consequently, investments in PLC systems that support this level of customization and flexibility have become vital for organizations striving to maintain a competitive advantage in today’s fast-paced market environment. The emphasis on agile manufacturing processes will continue to propel the PLC market forward as industries seek solutions that meet their unique and changing production needs.

Restraints

-

The high costs of integrating programmable Logic controllers (PLCs) with existing industrial infrastructure pose a major restraint in the PLC market.

Many facilities still operate with legacy machinery and outdated automation systems, making it challenging and costly to implement advanced PLCs. This integration often requires extensive modifications, custom interfaces, and specialized employee training, which can be both time-intensive and expensive. Small and medium-sized enterprises (SMEs) face particular challenges in affording these costs, hindering their ability to adopt or upgrade to modern PLC systems despite the long-term benefits. The ongoing maintenance and cybersecurity expenses associated with PLCs add to the financial strain. As production environments become more interconnected with Industry 4.0 technologies, the risk of cyber threats rises, necessitating substantial investments in security measures. Protecting PLCs from malware and unauthorized access to maintain cybersecurity standards requires dedicated resources, increasing operational expenses. With 25-30% increases in raw material costs impacting sectors in China, as noted by China Daily, and 78% of Australians experiencing cost-of-living pressures, these economic challenges make it difficult for businesses to allocate resources for costly technology integration. Furthermore, high 5-10% fuel cost savings are achievable in optimized operations, as mentioned by Fuel Logic, though the upfront cost barriers in automation remain high.

Programmable Logic Controller (PLC) Market - Segment Analysis

by Type

In 2023, Modular Programmable Logic Controllers (PLCs) dominated the global PLC market, capturing around 48% of total revenue. Modular PLCs are highly valued for their scalability, adaptability, and customization capabilities, making them essential in industries with evolving automation needs. Major companies like Siemens, Rockwell Automation, and Mitsubishi Electric have propelled this growth through significant product launches. Siemens’ advanced SIMATIC modular PLC series now integrates edge computing and cloud support, enabling real-time analytics and predictive maintenance for digital transformation. Rockwell’s ControlLogix series focuses on high-speed processing and IoT compatibility, with enhanced cybersecurity for sectors like oil & gas. Mitsubishi Electric’s MELSEC iQ-R series targets high-speed data processing, emphasizing precision and efficiency for industries such as semiconductor manufacturing. Regionally, the United States, Germany, and China lead in modular PLC adoption. The U.S. benefits from strong investments in industrial automation and government initiatives like the Manufacturing USA network, while Germany’s focus on Industry 4.0 drives companies to adopt modular PLCs for operational flexibility. In China, the Made in China 2025 initiative supports modular PLCs as the nation rapidly advances its manufacturing capabilities. Looking ahead, continued innovation and government support are expected to drive modular PLC adoption, helping industries achieve smart manufacturing and future-proofing operational efficiencies.

by Industry

In 2023, the automotive sector led the Programmable Logic Controllers (PLC) market with around 30% of total revenue, driven by the industry’s high automation demands and focus on precision and efficiency in high-volume manufacturing. PLCs are essential in automotive production lines, automating processes like welding, painting, and assembly to ensure quality and reduce production times. The shift towards electric vehicles (EVs) has further fueled PLC demand, as EV manufacturing requires flexible production lines equipped to handle new battery technologies and complex electronic systems. Modular PLCs are especially valued in automotive plants due to their adaptability to frequent design updates and the flexibility needed for modern production. With high processing power and advanced I/O features, these PLCs manage complex robotic systems and seamlessly integrate with IoT devices on the factory floor. Geographic hotspots for PLC use in automotive manufacturing include North America, where EV production investments are strong; Europe, with Germany’s well-established automotive base; and Asia-Pacific, where rapid EV adoption in China and Japan propels the need for advanced PLC systems. Siemens launched the SIMATIC S7-1500 series, incorporating edge computing for real-time analytics; Rockwell expanded its Control Logix platform to enhance IoT compatibility; Mitsubishi introduced the MELSEC iQ-R series for energy-efficient precision control; and Schneider’s Modicon M580 series supports scalable, decentralized automation. These advancements enable the automotive industry to adopt smarter, more adaptable manufacturing processes, ultimately enhancing efficiency and supporting sustainable production goals.

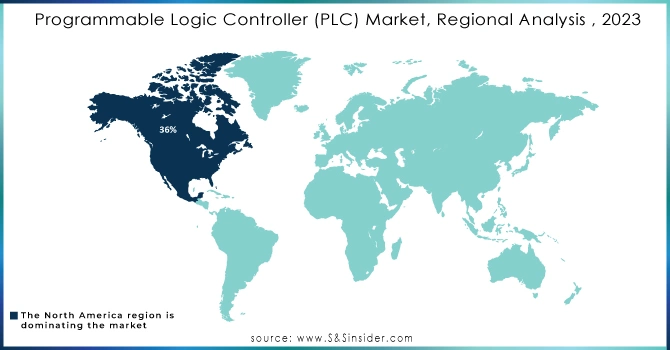

Programmable Logic Controller (PLC) Market - Regional Outlook

In 2023, North America dominated the global Programmable Logic Controller (PLC) market, accounting for approximately 36% of total revenue. This strong market position stems from significant investments in automation across core industries like automotive, manufacturing, and energy. Leading the charge, the United States has become a hub of technoLogical and industrial advancement, with numerous companies adopting high-end automation solutions to enhance productivity and efficiency. The rapid adoption of Industry 4.0 technologies and IoT further drives PLC demand, facilitating real-time data processing, predictive maintenance, and optimized energy management. The automotive sector’s shift toward electric vehicles (EVs) has intensified PLC needs, as manufacturers reconfigure production lines to handle EV-specific Component s and battery technologies. U.S. government programs, such as the Manufacturing USA network, bolster this trend by promoting advanced manufacturing technologies, further accelerating the adoption of smart automation practices. Home to leading PLC manufacturers, including Rockwell Automation and Emerson, the U.S. plays a vital role in advancing PLC technology with high-performance features. Canada also significantly contributes to the market, with its focus on renewable energy projects and infrastructure modernization driving PLC demand. Reliable, scalable PLCs are essential for monitoring and controlling complex systems in remote or challenging environments, particularly within the energy and mining sectors. North America’s leadership in the PLC market is fueled by extensive R&D investments, rapid Industry 4.0 integration, and supportive policies, solidifying the region’s competitive edge in industrial automation and smart manufacturing advancements.

In 2023, the Asia-Pacific region emerged as the fastest-growing market for Programmable Logic Controllers (PLCs), fueled by rapid industrialization, increasing automation, and substantial investments in smart manufacturing technologies. Countries such as China, Japan, South Korea, and India are at the forefront of this growth, each making unique contributions to the expanding PLC market. China plays a pivotal role in global manufacturing, focusing on enhancing production efficiency and quality. The government’s "Made in China 2025" initiative aims to modernize the manufacturing sector by promoting advanced automation, significantly driving PLC demand. Major industries in China, particularly automotive and electronics, rely heavily on PLCs for automation processes. Meanwhile, Japan emphasizes the integration of Industry 4.0 principles, with manufacturers adopting IoT and AI capabilities in their PLC systems. This shift enhances production efficiency, predictive maintenance, and real-time monitoring, positioning Japan as a leader in smart manufacturing.

India and South Korea are experiencing rapid growth in their automotive sectors, especially with the rise of electric vehicles (EVs). This transformation necessitates advanced PLCs capable of managing complex assembly lines. Government initiatives, such as India’s "Make in India" campaign, further promote automation and technology adoption, boosting PLC demand. South Korea invests significantly in research and development to create next-generation PLCs that seamlessly integrate with Industry 4.0 technologies, while the government promotes smart factory initiatives to drive automation. Southeast Asian countries like Vietnam and Thailand are becoming manufacturing hubs, attracting foreign investments and increasing the demand for PLC systems. Additionally, a strong focus on sustainability is evident, with PLCs playing crucial roles in renewable energy management and efficient manufacturing practices. Overall, the Asia-Pacific region is poised for sustained growth in the PLC market, supported by technoLogical advancements, government initiatives, and a commitment to automation across various industries.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players

Some of the major key players in Programmable Logic Controller Market with their product:

-

Siemens AG (SIMATIC S7 Series)

-

Rockwell Automation, Inc. (ControlLogix and CompactLogix)

-

Schneider Electric SE (Modicon PLCs)

-

Mitsubishi Electric Corporation (MELSEC PLC Series)

-

Omron Corporation (CP Series PLCs)

-

Honeywell International Inc. (ControlEdge PLC)

-

ABB Ltd. (AC500 PLC Series)

-

Bosch Rexroth AG (IndraControl PLC)

-

Panasonic Corporation (FP Series PLCs)

-

Beckhoff Automation GmbH (CX Series Embedded PCs)

-

GE Automation & Controls (VersaMax PLC)

-

Yaskawa Electric Corporation (MP Series PLCs)

-

National Instruments Corporation (CompactRIO)

-

B&R Industrial Automation GmbH (Automation Studio)

-

Wago Kontakttechnik GmbH (PFC200 Series)

-

Red Lion Controls, Inc. (Graphite Series PLCs)

-

Unitronics (UniStream Series)

-

KEYENCE Corporation (KV Series PLC)

-

FANUC Corporation (FANUC PLC)

-

Delta Electronics, Inc. (DVP Series PLCs)

List of Suppliers Raw Materials and Component s needed in the production of PLCs, contributing to the overall functionality and reliability of these devices for Programmable Logic Controllers

-

Texas Instruments Inc.

-

Analog Devices, Inc.

-

NXP Semiconductors N.V.

-

STMicroelectronics N.V.

-

Infineon Technologies AG

-

Microchip Technology Inc.

-

Broadcom Inc.

-

Eaton Corporation

-

Molex, LLC

-

TE Connectivity Ltd.

-

Panasonic Corporation

-

Avnet, Inc.

-

Arrow Electronics, Inc.

-

Cypress Semiconductor Corporation

-

On Semiconductor Corporation

Recent Development

-

September 2024: Schneider Electric, a leading player in energy management and digital transformation, has officially opened its new manufacturing facility at Prospace Industrial Park Pvt. Ltd in Kolkata. Covering 9 acres, this plant represents an investment of INR 140 crores (approximately USD 167 million). This expansion in smart factory capabilities is likely to boost demand in the market.

-

August 2024: Gil Automation Ltd reported that Siemens provides a comprehensive range of PLCs tailored for the food and beverage industry. These solutions aim to enhance operational efficiency, reduce inefficiencies, elevate quality standards, and adapt to changing consumer preferences. by integrating Siemens' automation solutions—such as Programmable Logic Controllers (PLCs) alongside Supervisory Control and Data Acquisition (SCADA) systems—manufacturers can achieve improved product consistency and quality. This highlights the growing demand for PLCs in the food, beverage, and tobacco sectors.

-

April 2024: Valmet introduced its latest product, the Valmet DNA, a state-of-the-art distributed control system (DCS). This advanced system features a fully web-based design enhanced by a new cybersecure architecture. Valmet's offering includes control software, hardware, engineering, and analytical tools, promising to empower customers to boost the efficiency, productivity, sustainability, and safety of their operations.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 12.95 Billion |

| Market Size by 2032 | USD 22.61 Billion |

| CAGR | CAGR of 6.40% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Modular PLC , Compact PLC , Rack PLC) • By Component (Hardware,Software,Services) • By Industry (Automotive, Chemical & Petrochemical, Paper & Pulp, Energy & Utilities, Food & Beverages, Oil & Gas, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Siemens AG, Rockwell Automation, Schneider Electric SE, Mitsubishi Electric Corporation, Omron Corporation, Honeywell International Inc., ABB Ltd., Bosch Rexroth AG, Panasonic Corporation, Beckhoff Automation GmbH, GE Automation & Controls, Yaskawa Electric Corporation, National Instruments Corporation, B&R Industrial Automation GmbH, Wago Kontakttechnik GmbH, Red Lion Controls, Inc., Unitronics, KEYENCE Corporation, FANUC Corporation, and Delta Electronics, Inc. are key players in the programmable logic controller market. |

| Key Drivers | • The rising demand for customization and flexibility in manufacturing is a pivotal driver of growth in the programmable logic controller (PLC) market. |

| RESTRAINTS | • The high costs of integrating programmable logic controllers (PLCs) with existing industrial infrastructure pose a major restraint in the PLC market. |