Procurement Software Market Report Scope & Overview:

Get More Information on Procurement Software Market - Request Sample Report

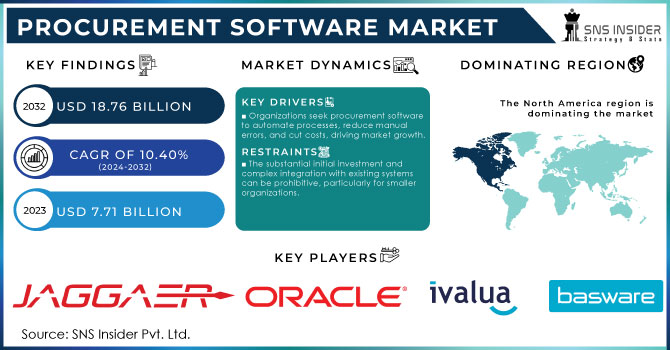

Procurement Software Market size was valued at USD 7.71 Billion in 2023. It is expected to Reach USD 18.76 Billion by 2032 and grow at a CAGR of 10.40% over the forecast period of 2024-2032.

Rise in cloud technology adoption, is set to significantly enhance the growth of procurement software market by providing key benefits such as scalability, flexibility and cost savings. Cloud-based procurement solutions store and manage your data on hosted servers that can be accessed over the internet, without requiring need on premise hardware. This setup enables businesses to have software applications and data accessible from anywhere with an internet connection, encouraging the collaboration between procurement teams while working remotely. These solutions seamlessly integrate with your other enterprise systems, making procurement processes easier and helping you see and manage the supply chain better. Software cloud updates: With regular software updates and improvements in the same, organizations can get access to all the latest features without manually upgrade. Market growth is driven by the continuous trend towards cloud-based solutions to improve operational efficiency and drive innovation in procurement operations. About 65% of mid-sized and large corporations in the U.S already use procurement software solutions to make their purchasing way easier. Companies in the US that have used procurement software report savings of 12-18% on their total spend. The use of US procurement software often decreases gestural errors in the procurement processes by as much as 75%.

The increase in the requirement of automated procurement processes and progressions in e-Procurement technology are anticipated to open new growth opportunities in the market. The rising number of cross-border transactions alongside government policies that aid in the progress in procurement advances are fuelling market advancement. Here automation in procurement for different task (like buy request, purchase order & invoice management/vender & contract assignment) is looked up to save time and make the operations more efficient. Bidvest International Logistics, one of the largest logistics South African company signed a contract with Zycus in august 2023. The acquisition will help it in accelerating the digital transformation of its procurement function as well utilizing ZyVantage, Zycus' end to end source-to-pay solution that encompasses industry-leading AI capabilities for better invoice automation and advanced analytical tools with deep embedded domain expertise into lexicons from spend data across categories helping accelerate efficiency gains further. Approximately, 70% of businesses have incorporated some form of procurement software to improve their purchasing processes. Over about 30-50% of the time it would take to purchase activities is cut down by Procurement software Procurement software reduces manual errors in procurement processes by up to 80%.

Drivers

-

Organizations seek procurement software to automate processes, reduce manual errors, and cut costs, driving market growth.

-

Innovations like AI, machine learning, and blockchain enhance procurement software capabilities, making them more attractive for improving efficiency and decision-making.

-

The growing need to automate procurement processes to improve efficiency, reduce manual errors, and cut operational costs is a major driver.

-

Innovations such as artificial intelligence (AI), machine learning, robotic process automation (RPA), and blockchain are enhancing procurement software capabilities, making them more attractive to organizations seeking improved efficiency and data insights.

The automation in procurement is one of the most influential factors driving the market as businesses are striving for enforces operational efficiency and cost reduction. Automation helps streamline different aspects of procurement from purchase order management to communication with vendors to managing invoices so as reduce human errors and speed up time taken for transactions. A 54% of procurement organizations reported that automating their procurement processes had led to substantial improvements in operational efficiency, according to a recent survey by Deloitte. Procurement automation tools are able to manage manual, repetitive and time-intensive tasks related to procurement like data entry or order matching. In addition, it reduces the associated costs and manpower by performing tasks without any supervision for almost zero errors. According to PayStream Advisors, companies saved as much as 30% on procurement processing with automated purchasing solutions in place. These solutions also bring about higher levels of compliance and visibility as automated systems offer real-time tracking, reporting that helps organization to mitigate risks keeping track on procurement policies. This trend is likely to grow as automation technology evolves, with that greater cost-effectiveness and accuracy around procurement operations will be required in the near future.

Restraints

-

The substantial initial investment and complex integration with existing systems can be prohibitive, particularly for smaller organizations.

-

Managing sensitive procurement data, especially in cloud-based systems, raises concerns about data breaches and compliance, impacting adoption.

-

The handling of sensitive procurement data raises concerns about data security and privacy, especially in the context of cloud-based solutions. Organizations must address these concerns to prevent data breaches and compliance issues.

One significant restraint in the procurement software market is the high cost associated with implementation and integration. Upfront costs for procurement software, including licensing fees and customization as well an integration with existing systems can add up. It can take a long time to implement new procurement software with existing enterprise systems such as ERP or CRM platforms. These challenges frequently stem from the requirement to customize software in order for it to conform with non-standard organizational data formats or processes, which drives up labour and technical overhead. The need for ongoing maintenance and updates can add to the financial burden. Taken together, these can discourage to adopting more advanced procurement solutions especially for smaller organizations and those with limited budgets from adopting advanced procurement solutions. As a result, the high costs of implementation and integration continue to be obstacles for universal adoption within Procurement software market.

Segment Analysis

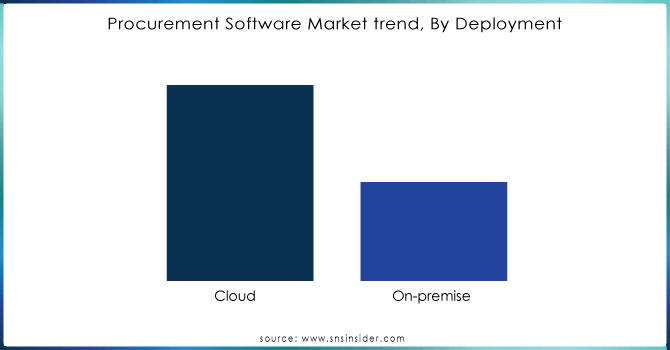

By Deployment

Cloud segment held largest share of more than 62%, and growing with significant CAGR across the forecast period. The cloud-based software provides enhanced transparency, improved pricing, faster transactional cycle times and expanded market access which are all essential in the transition to more advanced technology. The demand for procurement solutions is increasing as businesses are making ongoing investments and continuously improving their products. In January 2022, a Microsoft survey found that in the US (86%), most respondents said they would invest more on multi-cloud and hybrid cloud landscapes. A related IDC study says 35 percent of Canadian organizations have moved their applications to the cloud and another 28% are investing in cloud data management offerings. This shift underscores the growing reliance on cloud technology to support and streamline procurement processes.

Need any customization research on Procurement Software Market - Enquiry Now

By enterprise type

large enterprises dominated the market due to growing demand for an advanced procurement management solution and these contributed a total market share of more than 65%. They help to simplify complex Supply Chains with reduced complexity while providing clear information that are required for driving business growth. The companies have also benefited significantly in terms of growth just by increasing their investments/funding as well with the migration to affordable cloud solutions and so do the small & medium-sized enterprises (SMEs). Various leading organizations are offering such cost-effective technologies to target the SMEs, helping them reach wider audiences.

By end User

The retail industry held a large share 21.6% of the procurement software market as it faces constant challenges, including increased competition, collapsing margins, and weakened brand loyalty. Retailers are realizing the necessity for deploying procurement software so that they can remain profitable and competitive. The business leaders looking to procurement for cost reduction, supply risk mitigation and enhance value, driving the adoption of these solutions. Retailers use procurement software to helps integrate business processes, improves financial transparency and automates the buy-side (eProcurement) of their contract management solutions.

The Indian retail market is estimated to be worth USD 1 trillion by 2025, propelling demand for procurement services and in turn driving growth of market during forecast period. As business operation is getting digitalised day-by-day it has been observed that retailers have started implementing e-procurement solutions to automate and optimise separately their procurement processes etc. Online shopping, electronic invoicing and supplier collaboration are all forms of e-procurement platforms that lead to more efficiency and cost-cutting. They use these as a way for retail businesses to automate procurement tasks, source competitive rates from vendors and execute large numbers of goods in an efficient manner. Procurement software tools enable businesses to work with suppliers and monitor events, receive alerts about flags raised so that can be proactively accessed leading insights for better forecasting & planning.

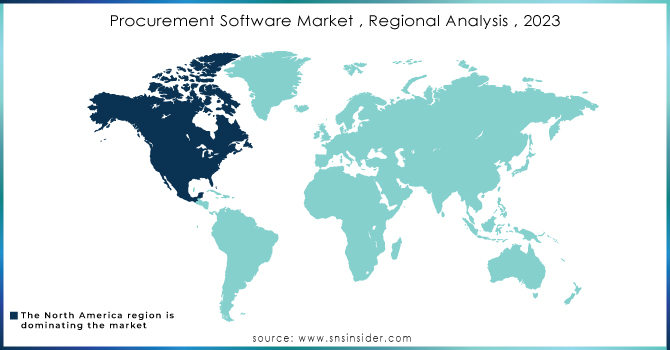

Regional analysis

North America is the largest contributor to revenue in the procurement software market due to high penetration of centralised procurement processes. Moreover, a consolidation of companies in the region is anticipated to fuel market growth. The US requires extensive support in enhancing productivity of the manufacturing sector through effective supply chain practices particularly throughout industrial activities. In US procurement software systems, Automated workflows cut the approval time of purchase orders by 45–55% 62% of US businesses have adopted procurement software. North American e-retailers are also working to elevate customer experiences through initiatives like same-day delivery it can significantly enhance customer experience and quite possible that this initiative cannot be without efficient supply chain management. Procurement software vendors in North America are rapidly adopting innovative technologies including artificial intelligence (AI), machine learning, predictive analytics, and robotic process automation (RPA) as well as blockchain technology among others to improve cost savings metrics for procurement team across a spectrum.

Asia Pacific is likely to grow at a fast pace during the forecast period as significant investments in digital transformation are being made by countries such as India and Singapore; Japan and South Korea held large potentials followed by Southeast Asian region. Japan represents key growth in this region, Japan is expected to be a dominant market for the procurement software segment. In line the country’s active Industry 4.0 agenda, manufacturing companies have invested in procurement software to automate their processes, optimize supply chain and improve operational efficiency. In case of Japan obviously they receive all brands in electronics and daily appliances, required effective software procurement must have to work seamlessly with worldwide supply chain. Another important force in the procurement software market is China, where e-commerce and digital economy are growing rapidly. The market of procurement software is gaining priority as Chinese enterprises are now using the same in their efforts to automate and digitize online transactions, digital markets, supply chain etc. Furthermore, government initiatives to modernize businesses and drive digital transformation are boosting the growth of these technologies.

Key Players:

The major players in market are JAGGAER, Basware, SAP SE, Oracle, Ivalua Inc., Workday, Inc., GEP, Zycus Inc., Coupa Software Inc., Infor, and others in the final report.

| Report Attributes | Details |

| Market Size in 2023 | US$ 7.71 Bn |

| Market Size by 2032 | US$ 18.76 Bn |

| CAGR | CAGR of 10.40% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment, (Cloud, On-premise) • By Enterprise Type, (SMEs, Large Enterprises) • By End-user, (Retail & e-Commerce, Healthcare, and Pharmaceutical, Manufacturing & Automotive, BFSI, IT & Telecom, Oil & Gas, Energy & Utilities, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | JAGGAER, Basware, SAP SE, Oracle, Ivalua Inc., Workday, Inc., GEP, Zycus Inc., Coupa Software Inc., Infor. |

| Key Drivers | • Organizations seek procurement software to automate processes, reduce manual errors, and cut costs, driving market growth. |

| Market Opportunities | • The substantial initial investment and complex integration with existing systems can be prohibitive, particularly for smaller organizations. |