Get more information on Process Automation and Instrumentation Market - Request Sample Report

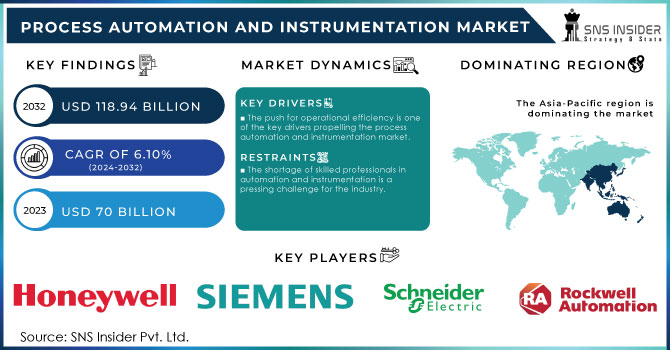

The Process Automation and Instrumentation Market Size was valued at USD 70 Billion in 2023 and is expected to reach USD 118.94 Billion by 2032, growing at a CAGR of 6.10% over the forecast period 2024-2032.

The process automation and instrumentation market has gained significant traction in recent years, driven by the increasing need for operational efficiency, safety, and regulatory compliance across various industries. Sectors such as oil and gas, chemicals, pharmaceuticals, and food and beverage are increasingly adopting automation solutions to streamline operations and reduce human error. In 2023, 60% of all occupations could automate at least 30% of their tasks, contributing to an anticipated 1.5% annual boost in global productivity. This surge in automation is expected to create between 3.3 to 6 million jobs by 2030, countering fears of job displacement. These technologies help companies achieve higher output rates, improved product quality, and more efficient resource utilization. Furthermore, the integration of the Internet of Things (IoT) and artificial intelligence (AI) into automation systems has revolutionized the industry. These advancements enable real-time data collection and analysis, allowing businesses to make informed decisions, optimize processes, and anticipate equipment failures before they occur.

In the context of industry applications, the oil and gas sector stands out as a significant contributor to the process automation and instrumentation market. With operations spanning exploration, production, refining, and distribution, the oil and gas industry requires highly automated systems to efficiently manage complex processes. Automation solutions in this sector include distributed control systems (DCS), supervisory control and data acquisition (SCADA) systems, and advanced process control (APC) technologies. These systems enable operators to monitor and control processes remotely, ensuring optimal performance while minimizing the risks associated with human intervention in hazardous environments.

Drivers

The push for operational efficiency is one of the key drivers propelling the process automation and instrumentation market.

Businesses are always looking for ways to improve productivity and lower costs, with process automation acting as a key strategy. by automating repetitive tasks, companies can reduce mistakes made by humans, maintain a consistent level of product quality, and make the most of their resources. In industries like manufacturing, oil and gas, and pharmaceuticals, improving operational efficiency results in substantial cost reductions. Automated procedures enhance manufacturing timelines, minimize operational interruptions, and enhance logistics coordination. In the manufacturing sector, automated production lines with advanced instruments can monitor quality in real-time, resulting in decreased waste and quicker turnaround times. With the escalation of global competition, the demand for operational efficiency will keep prompting investments in process automation and instrumentation technologies. Businesses that do not implement these solutions are at risk of lagging behind rivals that use automation to boost productivity.

The increasing emphasis on regulatory compliance in various industries is another significant driver for the process automation and instrumentation market.

Industries such as pharmaceuticals, food and beverage, and oil and gas are subject to stringent regulations aimed at ensuring safety, quality, and environmental sustainability. Automation solutions can help organizations comply with these regulations by providing precise control and monitoring capabilities. For example, in the United States, ISA/IEC 61511 is a key regulatory compliance standard for process automation and instrumentation, focusing on the safety lifecycle of safety instrumented systems. It emphasizes risk assessment, functional safety, comprehensive documentation, and management of change, ensuring effective design, implementation, and maintenance to enhance safety and minimize operational risks in the process industry. The rising costs associated with non-compliance, including fines, legal fees, and damage to reputation, further incentivize organizations to invest in process automation and instrumentation. As regulatory frameworks become more complex, businesses will increasingly turn to automation solutions to navigate these challenges effectively.

Restraints

The shortage of skilled professionals in automation and instrumentation is a pressing challenge for the industry.

With the rising utilization of automation technologies in organizations, there is a growing need for skilled personnel to develop, install, and upkeep these systems. A lot of schools and universities have fallen behind in adapting to the fast developments in automation technologies, resulting in a lack of necessary skills in the labor market. The lack of workers with the necessary skills may lead to increased labor expenses, causing competition among organizations and possibly causing delays in projects and obstacles in adopting automation solutions. Moreover, the intricacy of contemporary automation systems frequently necessitates expertise in fields like robotics, data analysis, and cybersecurity. Companies might find it challenging to locate individuals who possess the necessary abilities to effectively manage these intricacies. The lack of skills can also result in more dependence on outside consultants or contractors, causing costs to rise and making project management more complex. It will be crucial to address the skills gap as the industry evolves to successfully implement process automation and instrumentation technologies.

by Instruments

Field instruments dominated the process automation and instrumentation market in 2023 with a 57% market share, because of their widespread use across different industries. These devices, such as pressure transmitters, temperature sensors, flow meters, and level sensors, play a vital role in obtaining real-time data, allowing for process control and optimization. Siemens' SITRANS line of flow and temperature measurement instruments are commonly utilized in industrial settings, guaranteeing accurate supervision and regulation.

Process analyzers are projected to become the fastest-growing segment during 2024-2032. This growth is fueled by a rising need for quality assurance and regulatory compliance in various sectors such as food and beverage, pharmaceuticals, and water treatment. For instance, ABB's Process Automation Analyzer assists in the constant monitoring and regulation of essential process factors, guaranteeing superior product quality and waste reduction. As businesses prioritize automation and data-driven decision-making, the use of process analyzers is increasing at a fast pace.

by Solution

The PLC segment led the market in 2023 with a 29% market share. Their main purpose is to manage machinery and procedures using programmable instructions that can be easily adjusted to meet evolving operational requirements. Siemens and Rockwell Automation have created sophisticated PLC solutions that seamlessly integrate with other automation systems, improving efficiency and productivity. For example, Siemens' S7 series is extensively utilized in factories to oversee operations like controlling assembly lines, ensuring they run smoothly and in sync.

SCADA is expected to experience the fastest CAGR during 2024-2032. This centralized control system gathers information from distant sites, enabling data analysis and operational effectiveness. The expansion of SCADA systems is fueled by the emergence of Industry 4.0 and the growing demand for unified and automated solutions. Schneider Electric and Honeywell provide strong SCADA solutions, including Schneider's EcoStruxure, which combines IoT features for improved monitoring and control functions.

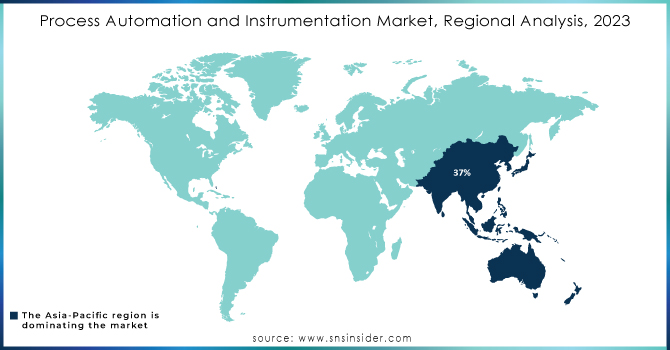

Asia-Pacific dominated in 2023 with a 37% market share and is anticipated to become the fastest-growing region during 2024-2032. The rapid growth in countries like China, India, and Japan is driven by fast industrialization, urbanization, and a growing need for efficiency in manufacturing processes. Key companies like Siemens, Mitsubishi Electric, and Yokogawa Electric are increasingly growing their presence in the area by providing creative solutions that cater to the specific demands of the local market. These companies are prioritizing smart manufacturing technologies like robotics and artificial intelligence to boost efficiency in diverse sectors like automotive, electronics, and food and beverage. The focus on sustainable practices and digital transformation in the APAC region boosts its growth, positioning it as a key investment area for process automation solutions.

Get a Customized Report as per your Business Requirement - Request For Customized Report

Key Players

The major key players in the Process Automation and Instrumentation Market are:

Siemens (SIMATIC S7-1200, SITRANS P320)

Honeywell (Experion PKS, SmartLine Pressure Transmitters)

Emerson (DeltaV Control System, Micro Motion Coriolis Flow Meters)

Schneider Electric (EcoStruxure Control Expert, Modicon M580)

ABB (ABB Ability System 800xA, 2600T Pressure Transmitters)

Rockwell Automation (PlantPAx Process Automation System, Allen-Bradley ControlLogix)

Yokogawa (CENTUM VP, EJX Series Pressure Transmitters)

Endress+Hauser (Proline Series Flow Meters, Liquiphant FTL31)

Mettler-Toledo (Ind560 Weighing Terminal, Thornton 770Max Conductivity Monitor)

KROHNE (OPTIFLEX 2200 C, OPTISENS Series)

Panasonic (FP-X Automation Controllers, ELCB Series Circuit Breakers)

Keysight Technologies (B1505A Power Device Analyzer, U1640B Handheld Multimeter)

Rohde & Schwarz (FSPN Power Meter, FPH Spectrum Analyzer)

Baker Hughes (Myscan PAX, 3D Scan)

GE Digital (Predix Platform, Proficy Smart Factory)

FLSmidth (MVP Technologies, Hot Kiln Alignment)

Azbil Corporation (Yamatake Series Control Valves, ZR Series Controllers)

Flowserve (Valtek Control Valves, Limitorque Actuators)

National Instruments (LabVIEW, PXI Systems)

Delta Electronics (DeltaVFD-B, PLC Automation Systems)

Suppliers of Raw Materials/Components for the key players:

Duke

WIKA

Texas Instruments

Texas Instruments

Omron

Toshiba

Murata Manufacturing

STMicroelectronics

Microchip Technology

Infineon Technologies

Recent Development

May 2024: ABB launched Symphony Plus SDe Series, a new range of hardware designed to upgrade existing process control systems while limiting any operational interference. The series serves power, water, oil & gas, and pharmaceutical industries to ensure smooth upgrades based on existing infrastructures.

April 2024: Siemens presented Simatic S7-1200 G2 – a next-generation controller intended for an enhanced motion control system, machine safety features, and overall performance. The solution is integrated with Siemens Xcelerator to attain industrial automation that is not only productive but cost-efficient.

February 2024: GE presented an innovative cloud-reliant solution called Autonomous Inspection, leveraging AI to automate inspections for industrial assets. The solution is integrated with the APM suite, offering unprecedented efficiency for the inspection process and valuable insights based on which the condition of industrial assets can be managed.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 70 Billion |

| Market Size by 2032 | USD 118.94 Billion |

| CAGR | CAGR of 6.10% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | By Instrument (Field Instruments, Process Analyzers) By Solution (PLC, DCS, SCADA, HMI, Functional Safety, MES) By Industry (Oil & Gas, Chemicals, Pulp & Paper, Pharmaceuticals, Metals & Mining, Energy & Power, Food & Beverages, Water & Wastewater Treatment, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Siemens, Honeywell, Emerson, Schneider Electric, ABB, Rockwell Automation, Yokogawa, Endress+Hauser, Mettler-Toledo, KROHNE, Panasonic, Keysight Technologies, Rohde & Schwarz, Baker Hughes, GE Digital, FLSmidth, Azbil Corporation, Flowserve, National Instruments, Delta Electronics. |

| Key Drivers | • The push for operational efficiency is one of the key drivers propelling the process automation and instrumentation market. • The increasing emphasis on regulatory compliance in various industries is another significant driver for the process automation and instrumentation market. |

| RESTRAINTS | • The shortage of skilled professionals in automation and instrumentation is a pressing challenge for the industry. |

Ans: The Process Automation and Instrumentation Market was USD 70 Billion in 2023 and is expected to Reach USD 118.94 Billion by 2032.

Ans: The increasing emphasis on regulatory compliance in various industries is another significant driver for the process automation and instrumentation market.

Ans: Asia-Pacific dominated the Process Automation and Instrumentation Market in 2023.

Ans: The PLC segment dominated the Process Automation and Instrumentation Market.

Ans: The Process Automation and Instrumentation Market is expected to grow at a CAGR of 6.10% during 2024-2032.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Process Automation and Instrumentation Adoption Rates, by Region (2023)

5.2 Process Automation and Instrumentation Market Trends and Innovations, by Region

5.3 Innovation Metrics

5.4 Supply Chain Metrics

6. Competitive Landscape

6.1 List of Major Companies, by Region

6.2 Market Share Analysis, by Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Process Automation and Instrumentation Market Segmentation, by Instrument

7.1 Chapter Overview

7.2 Field Instruments

7.2.1 Field Instruments Market Trends Analysis (2020-2032)

7.2.2 Field Instruments Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3 Level Transmitters

7.2.3.1 Level Transmitters Market Trends Analysis (2020-2032)

7.2.3.2 Level Transmitters Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.4 Pressure Transmitters

7.2.4.1 Pressure Transmitters Market Trends Analysis (2020-2032)

7.2.4.2 Pressure Transmitters Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.5 Temperature Transmitters

7.2.5.1 Temperature Transmitters Market Trends Analysis (2020-2032)

7.2.5.2 Temperature Transmitters Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.6 Others

7.2.6.1 Others Market Trends Analysis (2020-2032)

7.2.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Process Analyzers

7.3.1 Process Analyzers Market Trends Analysis (2020-2032)

7.3.2 Process Analyzers Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Process Automation and Instrumentation Market Segmentation, by Solution

8.1 Chapter Overview

8.2 PLC

8.2.1 8 PLC Market Trends Analysis (2020-2032)

8.2.2 8 PLC Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 DCS

8.3.1 DCS Market Trends Analysis (2020-2032)

8.3.2 DCS Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 SCADA

8.4.1 SCADA Market Trends Analysis (2020-2032)

8.4.2 SCADA Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 HMI

8.5.1 HMI Market Trends Analysis (2020-2032)

8.5.2 HMI Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Functional Safety

8.6.1 Functional Safety Market Trends Analysis (2020-2032)

8.6.2 Functional Safety Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 MES

8.7.1 MES Market Trends Analysis (2020-2032)

8.7.2 MES Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Process Automation and Instrumentation Market Segmentation, by Industry

9.1 Chapter Overview

9.2 Oil & Gas

9.2.1 Oil & Gas Market Trends Analysis (2020-2032)

9.2.2 Oil & Gas Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Chemicals

9.3.1 Chemicals Market Trends Analysis (2020-2032)

9.3.2 Chemicals Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Pulp & Paper

9.4.1 Pulp & Paper Market Trends Analysis (2020-2032)

9.4.2 Pulp & Paper Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Pharmaceuticals

9.5.1 Pharmaceuticals Market Trends Analysis (2020-2032)

9.5.2 Pharmaceuticals Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Metals & Mining

9.6.1 Metals & Mining Market Trends Analysis (2020-2032)

9.6.2 Metals & Mining Market Size Estimates and Forecasts to 2032 (USD Billion)

9.7 Food & Beverages

9.7.1 Food & Beverages Market Trends Analysis (2020-2032)

9.7.2 Food & Beverages Market Size Estimates and Forecasts to 2032 (USD Billion)

9.8 Energy & Power

9.8.1 Energy & Power Market Trends Analysis (2020-2032)

9.8.2 Energy & Power Market Size Estimates and Forecasts to 2032 (USD Billion)

9.9 Water & Wastewater Treatment

9.9.1 Water & Wastewater Treatment Market Trends Analysis (2020-2032)

9.9.2 Water & Wastewater Treatment Market Size Estimates and Forecasts to 2032 (USD Billion)

9.10 Others

9.10.1 Others Market Trends Analysis (2020-2032)

9.10.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Process Automation and Instrumentation Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.2.4 North America Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.2.5 North America Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.2.6.2 USA Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.2.6.3 USA Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.2.7.2 Canada Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.2.7.3 Canada Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.2.8.2 Mexico Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.2.8.3 Mexico Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Process Automation and Instrumentation Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.3.1.6.2 Poland Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.3.1.6.3 Poland Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.3.1.7.2 Romania Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.3.1.7.3 Romania Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Process Automation and Instrumentation Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.3.2.4 Western Europe Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.3.2.5 Western Europe Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.3.2.6.2 Germany Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.3.2.6.3 Germany Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.3.2.7.2 France Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.3.2.7.3 France Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.3.2.8.2 UK Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.3.2.8.3 UK Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.3.2.9.2 Italy Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.3.2.9.3 Italy Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.3.2.10.2 Spain Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.3.2.10.3 Spain Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.3.2.13.2 Austria Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.3.2.13.3 Austria Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.4 Asia-Pacific

10.4.1 Trends Analysis

10.4.2 Asia-Pacific Process Automation and Instrumentation Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia-Pacific Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.4.4 Asia-Pacific Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.4.5 Asia-Pacific Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.4.6.2 China Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.4.6.3 China Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.4.7.2 India Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.4.7.3 India Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.4.8.2 Japan Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.4.8.3 Japan Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.4.9.2 South Korea Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.4.9.3 South Korea Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.4.10.2 Vietnam Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.4.10.3 Vietnam Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.4.11.2 Singapore Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.4.11.3 Singapore Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.4.12.2 Australia Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.4.12.3 Australia Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia-Pacific Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia-Pacific Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Process Automation and Instrumentation Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.5.1.4 Middle East Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.5.1.5 Middle East Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.5.1.6.2 UAE Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.5.1.6.3 UAE Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Process Automation and Instrumentation Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.5.2.4 Africa Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.5.2.5 Africa Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Process Automation and Instrumentation Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.6.4 Latin America Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.6.5 Latin America Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.6.6.2 Brazil Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.6.6.3 Brazil Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.6.7.2 Argentina Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.6.7.3 Argentina Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.6.8.2 Colombia Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.6.8.3 Colombia Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Process Automation and Instrumentation Market Estimates and Forecasts, by Instrument (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Process Automation and Instrumentation Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Process Automation and Instrumentation Market Estimates and Forecasts, by Industry (2020-2032) (USD Billion)

11. Company Profiles

11.1 Siemens

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Honeywell

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Emerson

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Schneider Electric

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 ABB

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Rockwell Automation

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Yokogawa

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Endress+Hauser

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Panasonic

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Keysight Technologies

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Instruments

Field Instruments

Level Transmitters

Pressure Transmitters

Temperature Transmitters

Others

Process Analyzers

By Solution

PLC

DCS

SCADA

HMI

Functional Safety

MES

By Industry

Oil & Gas

Chemicals

Pulp & Paper

Pharmaceuticals

Metals & Mining

Food & Beverages

Energy & Power

Water & Wastewater Treatment

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Process Automation and Instrumentation Market Size was valued at USD 70 Billion in 2023 and is expected to reach USD 118.94 Billion by 2032, growing at a CAGR of 6.10% over the forecast period 2024-2032

The Smart Home Projector Market size was valued at USD 761.40 million in 2023. It is expected to hit USD 3250.52 million by 2032 and grow at a CAGR of 17.5% over the forecast period of 2024-2032.

The Immersive Display in Entertainment Market Size was valued at USD 2.73 Billion in 2023 and is expected to grow at a CAGR of 24.1% From 2025-2032.

The Consumer Electronics Market size was valued at USD 956.12 Billion in 2023 & will reach USD 1775.27 Billion by 2032, with a CAGR of 7.14% by 2024-2032.

The Biometric System Market Size was valued at USD 39.07 Billion in 2023 and is expected to grow at a CAGR of 15.33% to reach USD 140.58 Billion by 2032

USB Devices Market Size was valued at USD 32.28 billion in 2023 and is expected to reach USD 79.41 billion by 2032 and grow at a CAGR of 10.52 % by 2032.

Hi! Click one of our member below to chat on Phone