Private LTE Market Report Scope & Overview:

The Private LTE Market Size was valued at USD 5.72 Billion in 2023 and is expected to reach USD 16.12 Billion by 2032 and grow at a CAGR of 12.2% over the forecast period 2024-2032.

Get More Information on Private LTE Market - Request Sample Report

The Private LTE market is rapidly growing as industries seek secure, reliable, and high-performance connectivity tailored to their unique needs. Key drivers include the increasing adoption of IoT devices and industrial automation, which demand robust networks for real-time monitoring, predictive maintenance, and remote operations. Private LTE ensures high security and minimal interference, making it ideal for critical applications in manufacturing, healthcare, transportation, energy, and public safety.

The availability of shared and unlicensed spectrum, such as CBRS and MulteFire, has lowered deployment costs and made private LTE accessible to small and medium-sized enterprises. This democratization of spectrum allows organizations to establish their networks without relying on mobile operators. Additionally, the rising emphasis on data privacy and network security has heightened interest in private LTE, particularly in industries handling sensitive data, such as healthcare and finance.

The integration of edge computing further enhances private LTE's appeal by enabling low-latency, real-time data processing for applications like autonomous vehicles, augmented reality, and remote monitoring. Governments are also promoting private LTE through smart city initiatives, leveraging its reliability for traffic management, public safety, and utility monitoring.

Private LTE Market Dynamics

Key Drivers:

-

Increasing IoT Adoption and Industrial Automation Drive Private LTE Market Expansion

The rising adoption of IoT devices and industrial automation is a significant driver of the Private LTE market. As industries transition toward Industry 4.0, the need for robust and reliable communication networks has surged. Private LTE networks provide the high-speed, low-latency, and secure connectivity required to support IoT-enabled operations such as real-time monitoring, predictive maintenance, and autonomous machinery. This is particularly crucial in sectors like manufacturing, transportation, and energy, where downtime and inefficiencies can lead to substantial financial losses. Additionally, private LTE networks offer greater control and customization than public networks, allowing enterprises to optimize their systems for specific industrial applications. The integration of these networks with advanced technologies like artificial intelligence and machine learning further enhances their capabilities, enabling smarter decision-making and improved operational efficiency. With the IoT market expanding rapidly, the demand for private LTE solutions tailored to industrial needs continues to grow.

-

Rising Demand for Data Security and Privacy Accelerates Private LTE Adoption

Enterprises across industries are prioritizing data security and privacy, fueling the adoption of private LTE networks. Unlike public networks, private LTE provides businesses with exclusive control over their network infrastructure and data. This feature is especially appealing to industries such as healthcare, finance, and government, where sensitive information must be protected from cyber threats and unauthorized access. The ability to implement stringent security protocols, coupled with the reduced risk of external interference, makes private LTE networks an ideal choice for critical operations. Moreover, these networks enable organizations to comply with stringent regulatory standards governing data protection. As the frequency and complexity of cyberattacks increase, enterprises are turning to private LTE solutions to safeguard their digital assets while ensuring reliable connectivity. This growing emphasis on security and privacy is a key driver for the market's growth.

Restrain:

-

High Deployment Costs and Complexity Restrain Private LTE Market Growth

The high initial costs and complexity of deploying private LTE networks pose a significant restraint to market growth. Establishing a private LTE infrastructure requires substantial investment in hardware, software, and spectrum licensing, which can be prohibitive for small and medium-sized enterprises. Additionally, the technical expertise needed to design, deploy, and maintain these networks is often lacking within organizations, necessitating reliance on external vendors and increasing overall costs. The integration of private LTE with existing IT and operational systems can also be challenging, requiring significant time and resources to ensure compatibility and seamless operation. Furthermore, as technology evolves, organizations must continuously upgrade their networks to remain competitive, adding to long-term expenses. These financial and logistical barriers limit the widespread adoption of private LTE, particularly among smaller businesses, slowing the market's overall growth trajectory.

Private LTE Market Segments Analysis

By Component

The infrastructure segment leads the Private LTE market, accounting for 64.00% of revenue in 2023, driven by the critical role of hardware and network components in private LTE deployments. This segment includes essential elements such as base stations, core networks, and backhaul equipment that form the backbone of private LTE networks. Major players like Nokia, Ericsson, and Huawei have launched advanced infrastructure solutions tailored for industries adopting private LTE.

For instance, Nokia's Digital Automation Cloud and Ericsson's Private 5G platforms provide comprehensive network infrastructure for industrial environments, enhancing connectivity, security, and scalability.

The Services segment is witnessing the fastest growth in the Private LTE market, with a CAGR of 12.89% during the forecasted period, driven by the increasing demand for deployment, integration, and managed services. Services play a crucial role in enabling businesses to design, implement, and maintain private LTE networks. Companies like Athonet and Cisco have expanded their service offerings to address this demand.

For instance, Athonet's EPC-as-a-Service and Cisco’s managed private LTE solutions provide end-to-end support, from initial planning to network optimization. These services are particularly critical for industries lacking in-house expertise to manage complex network deployments.

By End-user

The manufacturing segment leads the Private LTE market, capturing a substantial 32.00% revenue share in 2023. The dominance is fueled by the industry's shift toward smart manufacturing and Industry 4.0, which rely heavily on reliable, high-speed, and secure connectivity. Private LTE networks empower manufacturers to implement advanced applications such as automated robotics, predictive maintenance, real-time monitoring, and quality control systems. Nokia’s Digital Automation Cloud and Ericsson’s Industry Connect enable seamless integration of IoT devices and edge computing within manufacturing facilities.

The utilities segment is experiencing the fastest growth in the Private LTE market, with a projected CAGR of 15.30% during the forecasted period 2024-2032. This growth is driven by the rising adoption of private LTE networks for smart grid management, real-time energy monitoring, and predictive maintenance of critical infrastructure. Utilities rely on private LTE for secure and reliable communication across vast geographical areas, ensuring uninterrupted power and water supply. Leading companies like Huawei, ZTE, and Mavenir are at the forefront of developing private LTE solutions for utilities.

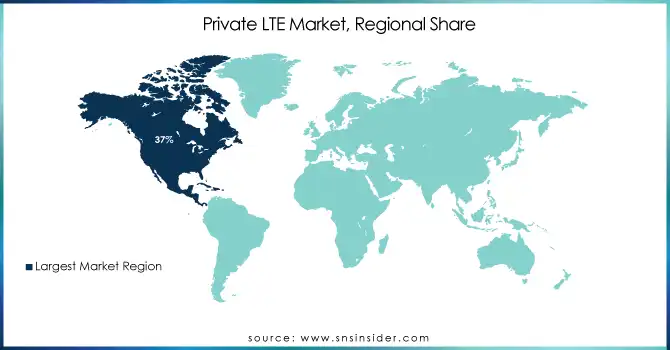

Regional Analysis

North America led the Private LTE market in 2023, accounting for an estimated 37.00% market share, driven by advanced technological adoption, extensive industrial digitization, and strong support for private LTE deployments. The presence of key players such as Nokia, Ericsson, Cisco, and Verizon significantly contribute to the region's dominance. For example, Verizon’s On-Site 5G solution and Cisco’s private LTE offerings are widely adopted across industries such as manufacturing, healthcare, and logistics.

For instance, private LTE is being used to enhance public safety communications and optimize traffic management in urban areas. North America’s robust ecosystem of IoT and edge computing technologies further cement its leadership in the Private LTE market.

The Asia Pacific region is the fastest-growing for private LTE market in 2023, with an estimated CAGR of 14.02%, fueled by rapid industrialization, urbanization, and the digital transformation of enterprises. Countries like China, Japan, and India are leading this growth, with significant investments in private LTE networks for smart manufacturing, energy, and public safety. In India, initiatives like Digital India and the adoption of CBRS-like shared spectrum frameworks have enabled cost-effective deployments of private LTE for sectors such as utilities and logistics. Japan, on the other hand, leverages private LTE to enhance smart factory operations and disaster response systems. The integration of 5G-ready private LTE solutions, coupled with the proliferation of IoT devices, further accelerates adoption in the region.

Do You Need any Customization Research on Private LTE Market - Enquire Now

Key Players

Some of the major players in the Private LTE Market are:

-

Nokia (Nokia Digital Automation Cloud (DAC), MX Industrial Edge)

-

Ericsson (Ericsson Private 5G, Industry Connect)

-

Huawei (eLTE Industrial Wireless Solution, LampSite)

-

ZTE (QCell, U-Safety)

-

NEC (NEC Private LTE Solution, Smart Wireless Transport Network)

-

Aviat Networks (CTR 8740, WTM 4000)

-

Samsung (Samsung Compact Core, Samsung Link Cell)

-

Affirmed Networks (Affirmed UnityCloud, Affirmed Mobile Core)

-

Athonet (Athonet EPC, Athonet Edge Node)

-

Airspan (Airspan AirUnity, Airspan AirVelocity)

-

ASOCS (CYRUS Private LTE, ASOCS Edge Cloud)

-

Boingo Wireless (Boingo Private LTE, Boingo Wi-Fi Offload)

-

Casa Systems (Axyom Ultra-Broadband Edge, Axyom Cloud-Native Core)

-

Cisco (Cisco Ultra Packet Core, Cisco Private 5G)

-

Comba (Comba Small Cell Systems, Comba Indoor DAS)

-

CommScope (OneCell Enterprise Small Cell, Era C-RAN Antenna System)

-

Druid Software (Raemis EPC, Druid Raemis Edge)

-

ExteNet Systems (ExteNet Private LTE, ExteNet Outdoor DAS)

Recent Trends

-

In March 2023, Athonet introduced a new private LTE solution tailored for industrial IoT applications. This solution, built on Athonet's 5G-ready core network, is versatile and can be deployed in various industrial environments such as factories, warehouses, and other sites.

-

In January 2023, Nokia unveiled a new private LTE solution designed specifically for manufacturing. This solution aims to enhance operational efficiency and productivity by connecting various devices, including sensors, machines, and robots.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.72 Billion |

| Market Size by 2032 | US$ 16.12 Billion |

| CAGR | CAGR of 12.2 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Infrastructure, Services) • By Deployment Model (Centralized, Distributed) • By Technology (Frequency Division Duplexing, Time Division Duplexing) • By Frequency Band (Licensed, Unlicensed, Shared Spectrum) • By End-user (Utilities, Mining, Oil and Gas, Manufacturing, Transportation and Logistics, Government and Public Safety, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Nokia Ericsson Huawei ZTE NEC Aviat Networks Samsung Affirmed Networks Athonet Airspan ASOCS Boingo Wireless Casa Systems Cisco Comba CommScope Druid Software ExteNet Systems |

| Key Drivers | • Increasing IoT Adoption and Industrial Automation Drive Private LTE Market Expansion • Rising Demand for Data Security and Privacy Accelerates Private LTE Adoption |

| Restraints | • High Deployment Costs and Complexity Restrain Private LTE Market Growth |