Printed Electronics Market Report & Overview:

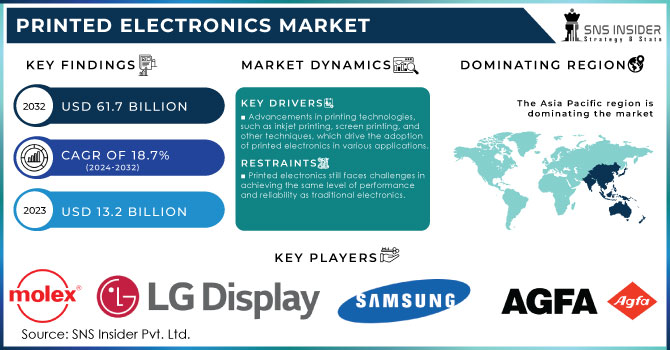

The Printed Electronics Market Size was valued at USD 12.94 billion in 2023, and is expected to reach USD 72.08 billion by 2032, and grow at a CAGR of 21.03 % over the forecast period 2024-2032. Key market drivers include increasing demand for lightweight and flexible electronic devices, advancements in printing technologies, and the rising adoption of printed electronics in various applications such as packaging, wearables, and sensors. Material utilization varies by region, with North America and Asia-Pacific leading due to strong manufacturing bases and innovation hubs. Additionally, consumer behavior trends indicate a growing acceptance of printed electronics, driven by sustainability concerns and demand for customized solutions. However, failure rates remain a challenge, emphasizing the need for improved reliability. Environmental metrics analysis highlights the lower carbon footprint of printed electronics compared to traditional manufacturing methods, enhancing their appeal in environmentally conscious markets.

Get more information on Printed Electronics Market - Request Sample Report

Printed Electronics Market Dynamics:

Drivers:

-

Rising demand for lightweight, flexible electronics in wearables and sensors is boosting printed electronics adoption and adaptability.

The growing demand for lightweight and flexible electronic devices is revolutionizing sectors such as wearables, sensors, and packaging. Printed electronics play a crucial role in this shift, providing unique benefits like adaptability, reduced weight, and enhanced functionality. Notably, flexible gold/polyurethane (Au/PU) electrodes significantly improve myoelectric signal testing, achieving an impressive signal-to-noise ratio of 21.29 dB and 92.4% accuracy, surpassing traditional metal electrodes' 12.06 dB and 83.1% accuracy. Their ability to conform to the human body’s changing morphology enhances their clinical relevance, with innovations such as a 3D-structured flexible device enabling continuous recording of neuro-organ physiological electrical signals for up to 120 days. However, ongoing challenges in fabrication technology must be addressed to fully realize the potential of these applications in the market.

Restraints:

-

High Production Costs Are Limiting the Widespread Adoption Of Printed Electronics Market

The adoption of printed electronics faces significant challenges due to high production costs, which particularly affect smaller manufacturers and limit widespread market penetration. These elevated costs are primarily attributed to the need for advanced materials, specialized printing techniques, and state-of-the-art equipment. For example, while specific pricing data for graphene is hard to obtain, recent estimates indicate that its commercial cost can range from USD100 to USD10,000 per kilogram. This price variability arises from several factors, including production method, form, quality, and quantity, making it a costly material to incorporate into printed electronic devices. Furthermore, the complexity of manufacturing processes for printed electronics adds to the financial burden, hindering innovation and slowing industry growth. As a result, many potential players find it difficult to compete with established companies that benefit from economies of scale and existing infrastructure. Addressing these production cost challenges is crucial for fostering a more competitive and accessible market for printed electronics, enabling broader adoption across various applications.

Opportunities:

-

Growth Potential for Printed Electronics in the Expanding Wearable Technology Market

The rising popularity of wearable technology, such as fitness trackers, smartwatches, and health monitors, presents a substantial opportunity for the printed electronics market. These devices require flexible, lightweight, and cost-effective components that traditional electronics often cannot provide. Printed electronics, utilizing innovative materials and manufacturing processes, can create thin, conformable sensors that seamlessly integrate into various wearable formats. This flexibility allows for improved user comfort and performance, enhancing functionality, such as real-time health monitoring and activity tracking. Moreover, as consumer demand for customization increases, printed electronics can be tailored to meet specific needs, further driving adoption in the rapidly growing wearable market. The synergy between printed electronics and wearables fosters innovation and expands market potential.

Challenges:

-

Challenges in finding high-performance materials compatible with printing processes limit the advancement of printed electronics.

The advancement of printed electronics is constrained by the limited availability of suitable materials that balance performance, flexibility, and manufacturability. Conductive inks, essential for printed circuits, often rely on silver or graphene, which can be expensive or challenging to process consistently. Organic and polymer-based materials offer flexibility but may lack the necessary conductivity and durability for long-term applications. Additionally, achieving strong adhesion between printed layers and various substrates remains problematic, affecting device reliability. Researchers are exploring alternative materials, such as carbon nanotubes and hybrid composites, but scalability and cost-efficiency remain barriers. Overcoming these material limitations is essential for expanding printed electronics into mainstream applications like flexible displays, smart packaging, and medical sensors.

Printed Electronics Market Segment Analysis:

By Material

The Ink segment held the largest revenue share of approximately 70% in the Printed Electronics Market in 2023, driven by its crucial role in enabling high-performance, flexible, and cost-effective electronic components. Conductive inks, including silver, copper, and carbon-based formulations, are widely used for their excellent electrical properties and compatibility with various substrates. Advancements in nanoparticle-based inks have further enhanced conductivity, flexibility, and durability, expanding their applications in printed circuits, sensors, and RFID tags. The growing demand for sustainable and low-cost manufacturing has also fueled innovation in eco-friendly and water-based inks. As the market evolves, continuous research into improving ink formulations will be key to enhancing the efficiency and scalability of printed electronics production.

The Substrate segment is the fastest-growing segment in the Printed Electronics Market during the forecast period of 2024-2032, Due to advancements in flexible and lightweight materials Duet also emphasizes the significance of substrates in printed electronics, impacting durability, conductivity, and functionality. Polyethylene terephthalate (PET) has become popular due to its inexpensive, flexible nature, as well as compatibility with high element printing which can procreate high information plates. Growth in this segment is further accelerated by the growing demand for flexible displays, wearables devices, and smart packaging. Further, the development of biodegradable and recyclable substrates is supporting sustainability efforts, making them an appealing option for eco-conscious manufacturers.

By Technology

The Screen Printing segment dominated the Printed Electronics Market with around 60% revenue share in 2023, driven by its versatility, cost-effectiveness, and ability to produce high-precision conductive patterns. Screen printing is widely used for manufacturing flexible circuits, sensors, RFID tags, and photovoltaic cells due to its scalability and compatibility with various substrates, including plastic, glass, and textiles. The process allows for the deposition of thick ink layers, enhancing conductivity and durability, making it ideal for applications requiring robust electrical performance. Additionally, continuous advancements in ink formulations, including nanoparticle-based conductive inks, are further improving efficiency and resolution. As industries such as consumer electronics, automotive, and healthcare expand their adoption of printed electronics, screen printing remains a preferred choice due to its reliability, adaptability to mass production, and lower production costs compared to other printing techniques.

The inkjet printing segment is the fastest-growing in the printed electronics market, expected to expand significantly over the forecast period 2024-2032. This growth is attributed to its capability to facilitate high-resolution, contactless, and material-efficient printing, thus it is considered suitable for applications where deposition of conductive inks needs to be highly precise. Inkjet printing has been widely applied in flexible circuits, OLED displays, biomedical sensors, and smart packaging because it can be rapidly prototyped and customized in a mask less/screen less manner. Furthermore, its capability to adhere to diverse substrates such as plastics, paper, and textiles also contributes to its industry-wide adoption. Its expansion is also further driven by a growing need for miniaturized and flexible electronic components in consumer electronics, healthcare, and automotive industries. Continuous developments in nanoparticle-based conductive inks and multi-material printing techniques are upgrading performance, turning inkjet printing into a compelling choice for manufacturers looking for cost-effective, scalable, and environmentally sustainable manufacturing methods.

By Device

The Displays segment accounted for the largest revenue share of approximately 57% in the printed electronics market in 2023, driven by the increasing demand for flexible, lightweight, and cost-effective display solutions. Printed electronics are widely used in OLED, LCD, and e-paper displays, offering advantages such as reduced production costs, improved energy efficiency, and enhanced design flexibility. The growing adoption of wearable devices, smartphones, digital signage, and automotive displays has further fueled this segment’s dominance. Additionally, advancements in organic and inorganic semiconductor materials have improved the performance and durability of printed displays, making them more competitive with traditional display technologies. The expansion of smart consumer electronics and IoT applications has also contributed to increased demand for printed displays, as they enable thinner and more customizable form factors. Moving forward, continuous innovations in printing techniques and material science will further enhance the adoption of printed displays in various industries, solidifying their market leadership over the forecast period.

The RFID segment is the fastest-growing in the printed electronics market over the forecast period 2024-2032, driven by increasing demand for cost-effective, flexible, and scalable tracking solutions across industries. Printed RFID tags offer advantages such as lower production costs, lightweight structures, and improved integration into various applications, including retail, logistics, healthcare, and smart packaging. The rise of e-commerce and supply chain automation has further fueled the adoption of RFID for real-time inventory tracking and asset management. Additionally, advancements in conductive inks and printing techniques have enhanced the durability and performance of printed RFID tags, making them more reliable for widespread use. As industries increasingly shift toward digitalization and IoT-based smart tracking systems, the adoption of printed RFID technology is expected to accelerate, providing seamless connectivity and operational efficiency.

Printed Electronics Regional Analysis:

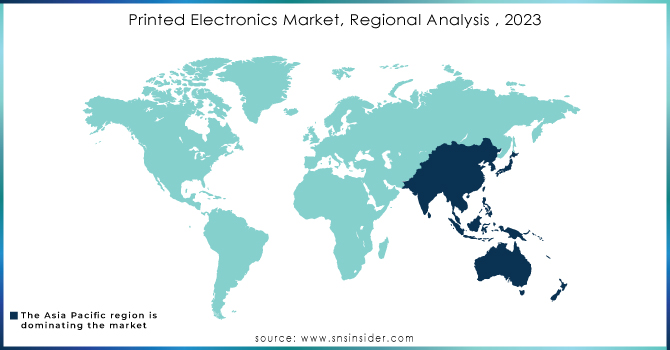

Asia-Pacific dominated the printed electronics market with a 41% revenue share in 2023 and is expected to grow at the highest CAGR over the forecast period 2024-2032. This growth is being driven by the region's robust consumer electronics manufacturing sector, swift industrialization, and the rising use of smart technologies in the automotive, healthcare, and packaging industries. Regions such as China, Japan and South Korea are continually providing investments for R&D that aids in breakthrough of flexible low-cost printed electronics. Government initiatives promoting smart manufacturing and IoT integration also rise demand. Similarly, Asia-Pacific’s large supply chain, supporting players in the market, and comparatively lower production costs garner a considerable amount of investments from around the globe. The region’s transition toward miniaturization and light-weight, flexible devices makes it more effective for applications in burgeoning fields, such as smart wearables and medical sensors. In addition, rising acceptance of RFID and OLED displays in retail and automotive sectors boost the market growth. Asia Pacific is leading the global printed electronics market with its relatively advanced technology and high-volume production capabilities.

Get Customized Report as per your Business Requirement - Request For Customized Report

Printed Electronics Market Key Players:

Some of the Major Players in Printed Electronics Market along with their products:

-

BASF SE (Germany) - Conductive inks

-

DuPont (U.S.) - Inks and substrates

-

Molex, Inc. (U.S.) - Connectors and components

-

PARC, a Xerox company (U.S.) - Technologies for printed electronics

-

E-Ink Holdings, Inc. (Taiwan) - Electronic ink

-

Thin Film Electronics ASA (Norway) - NFC tags

-

Samsung Electronics Co., Ltd. (South Korea) - Display technologies

-

LG Display Co., Ltd. (South Korea) - OLED and LCD panels

-

Agfa-Gevaert Group (Belgium) - Inks for printed electronics

-

Nissha Co., Ltd. (Japan) - Printed electronics solutions

-

NovaCentrix (U.S.) - Conductive inks and materials

List of potential customers for printed electronics, along with specific companies in each category:

Consumer Electronics Manufacturers:

-

Apple Inc.

-

Samsung Electronics

-

Sony Corporation

Automotive Manufacturers:

-

Ford Motor Company

-

Tesla, Inc.

-

General Motors

Medical Device Companies:

-

Medtronic

-

Philips Healthcare

-

Abbott Laboratories

Packaging Companies:

-

Amcor

-

Smurfit Kappa Group

-

WestRock

Retail and Brand Owners:

-

Procter & Gamble

-

Unilever

-

Coca-Cola Company

Industrial Automation Firms:

-

Siemens

-

Rockwell Automation

-

Honeywell

IoT Device Developers:

-

Nest (Google)

-

Cisco Systems

-

Intel Corporation

Aerospace and Defense Contractors:

-

Boeing

-

Lockheed Martin

-

Northrop Grumman

Telecommunication Companies:

-

Verizon Communications

-

AT&T Inc.

-

Huawei Technologies

Recent Development:

-

15 Aug 2024, BASF partners for the California Research collaborate (CARA) team with UC San Diego and developed a new 3D software system for desktop soft robotic devices using Ultrafuse TPU This method allows for the engineering of monolithic, sealed actuators and valves all in one print process, culminating in softer, biomimetic robots capable of autonomously grasping and releasing items without the need for manual assembly or post-processing.

-

On February 7, 2025, Samsung Electronics Co., Ltd. introduced its next generation of commercial displays featuring energy-efficient Samsung Color E-Paper and AI-powered solutions at Integrated Systems Europe (ISE) 2025. These, on display at booth 3F500, respond to market needs for greater energy efficiency and immersive experiences, while features such as SmartThings Pro and a 115” Smart Signage screen give companies the ability to improve usability and control of their business.

| Report Attributes | Details |

| Market Size in 2023 | USD 12.94 Billion |

| Market Size by 2032 | USD 72.08 Billion |

| CAGR | CAGR of 21.03% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Ink, Substrate) • By Technology (Inkjet, Screen, Gravure, Flexographic) • By Device (Displays, Photovoltaic, Lighting, RFID, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE (Germany), DuPont (U.S.), Molex, Inc. (U.S.), PARC, a Xerox company (U.S.), E-Ink Holdings, Inc. (Taiwan), Thin Film Electronics ASA (Norway), Samsung Electronics Co., Ltd. (South Korea), LG Display Co., Ltd. (South Korea), Agfa-Gevaert Group (Belgium), Nissha Co., Ltd. (Japan), NovaCentrix (U.S.). |