Get More Information on Prescription Drugs Market - Request Sample Report

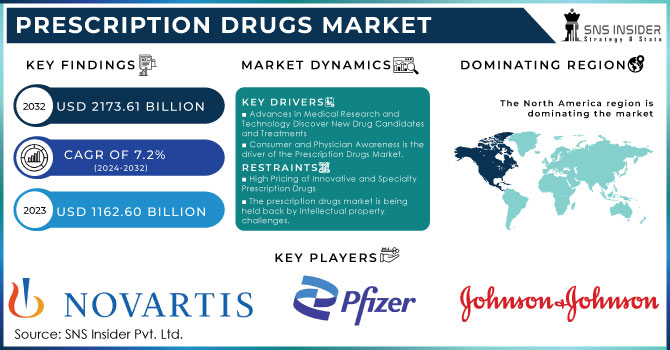

The Prescription Drugs market size was USD 1162.60 billion in 2023 and is expected to reach USD 2173.61 billion by 2032 and grow at a CAGR of 7.20% over the forecast period of 2024-2032. This report provides comprehensive insights into the Prescription Drugs Market, offering detailed analysis beyond traditional metrics such as market size and growth rate. It explores market penetration by therapeutic area, highlighting key segments like oncology, cardiovascular, and neurology. The report also delves into drug pricing trends and the impact of regulatory approvals on market dynamics. Additionally, it examines the shift between generic and branded drugs, prescription drug utilization, and spending trends across various regions. Key factors such as R&D investments, patient adherence, and the role of healthcare insurance are also discussed.

The U.S. held the largest market share in the prescription drugs market, accounting for 72% of the global market in 2023, with a market size of USD 385.05 billion. This dominance can be attributed to several key factors, including the size of the healthcare system, advanced medical infrastructure, and high spending on pharmaceuticals in the country. The U.S. has one of the largest and most developed healthcare markets, with significant demand for prescription drugs across various therapeutic areas such as oncology, cardiology, and neurology. The presence of major pharmaceutical companies and increased R&D investments have further fueled innovation and drug development. Additionally, the insurance system, which covers a significant portion of the population, drives access to medications; while aging demographics and the rise of chronic diseases contribute to higher prescription drug consumption. With regulatory bodies like the FDA ensuring rigorous drug approvals, the U.S. remains a leader in both drug innovation and consumption.

Drivers

The growing prevalence of chronic diseases and the aging population drive the prescription drugs market growth.

The growing prevalence of chronic diseases such as diabetes, hypertension, and cancer, coupled with the aging population, is a major driver of the Prescription Drugs Market. As the global population continues to age, particularly in developed regions like North America and Europe, there is an increasing demand for medications to manage age-related health conditions. Chronic diseases, which require long-term medication, are becoming more prevalent due to lifestyle changes, environmental factors, and longer life expectancies. This demographic shift is creating a larger patient base that requires continuous pharmaceutical care, thus boosting the demand for prescription drugs across various therapeutic areas such as oncology, cardiology, and neurology. As healthcare systems adapt to accommodate these rising needs, pharmaceutical companies are focusing on developing new treatments, particularly for chronic conditions, which will further accelerate market growth over the coming years.

Restrain

Rising drug costs and affordability issues act as a restraint for the prescription drugs market.

One of the significant restraints in the Prescription Drugs Market is the rising drug costs, which pose affordability challenges, especially in low- and middle-income countries. The high cost of branded medications, coupled with long treatment durations for chronic diseases, makes it difficult for a significant portion of the population to access necessary treatments. In particular, the price of specialty drugs and biologics has been escalating, putting pressure on both patients and healthcare systems. While generic drugs have provided some relief, their availability is limited in certain regions due to intellectual property regulations and market access restrictions. In addition, stringent pricing regulations in some countries may lead to lower reimbursement rates, restricting access to newer, more effective prescription medications. This affordability gap is a critical issue, and unless addressed, it may slow down the market's growth potential in the coming years.

Opportunity

Expanding demand for personalized medicine and precision drugs presents a significant opportunity for market growth.

The rise of personalized medicine and precision drugs presents a significant growth opportunity for the Prescription Drugs Market. As advancements in genomics, biotechnology, and pharmacogenomics continue to evolve, personalized treatments are becoming more effective in treating a wide range of conditions, particularly in oncology and rare genetic diseases. Personalized medicine allows for drugs tailored to an individual's genetic makeup, leading to more effective and targeted therapies with fewer side effects. This approach not only improves patient outcomes but also drives pharmaceutical companies to invest in biomarker discovery, companion diagnostics, and innovative drug formulations. Additionally, personalized medicine is transforming the way healthcare providers approach treatment plans, focusing on specific molecular targets rather than a one-size-fits-all solution. This trend is expected to fuel the growth of the market, offering patients more effective options and creating new opportunities for pharmaceutical companies in both established and emerging markets.

Challenge

Regulatory hurdles and drug approval delays pose challenges for the prescription drugs market growth.

One of the primary challenges facing the prescription drugs market is the lengthy and complex drug approval process required by regulatory agencies like the FDA and EMA. Despite the rising demand for new medications, the drug development process is time-consuming and costly, with many drugs failing at various stages of clinical trials. Regulatory requirements for clinical data, safety assessments, and post-market surveillance can delay the time to market, limiting the availability of essential drugs. Additionally, the global regulatory landscape is fragmented, with different approval procedures across regions, creating barriers for pharmaceutical companies seeking to introduce drugs in multiple markets. The complexity of ensuring regulatory compliance and gaining approval for new drugs, especially for innovative therapies and biologics, poses a significant challenge to the industry. This results in prolonged development timelines and increased costs, ultimately affecting overall market growth.

By Product Type

Prescription Drugs dominate the market in 2023, with 58%. It is owing to rising healthcare needs, growing research and developments in the field of medicine, and an increase in healthcare access. The rise in global population, as well as the dramatic increase in the prevalence of chronic diseases including cancers, diabetes, and cardiovascular diseases, has led to a corresponding increase in demand for prescribed medications. These medicines form the pillar of modern healthcare systems to treat both acute and chronic conditions through the promotion of their function in managing the disease. It addresses the futuristic innovations in drug development, i.e., biologics and personalized medicine, which have boosted the available treatment options, thereby fueling the market.

By Therapy

Oncology held the largest market share, around 28% in 2023. It is due to the growing prevalence of cancer worldwide and significant advancements in cancer treatment therapies. As cancer continues to be one of the leading causes of death globally, there is an increasing demand for more effective treatments. Oncology drugs, including chemotherapies, immunotherapies, and targeted therapies, are essential in managing various forms of cancer, which has led to a substantial market growth in this segment. Additionally, innovations in immuno-oncology, the development of biologics, and personalized medicine have significantly improved treatment outcomes, expanding the therapeutic options available for patients. The rising focus on early diagnosis, coupled with the growing investment in oncology drug development, has further fueled this market segment. Government initiatives and private sector investments in cancer research, along with increasing healthcare access, have collectively contributed to oncology's position as the largest therapeutic area in the prescription drugs market.

By Distribution Channel

Hospital pharmacies held the largest market share at around 44% in 2023. Hospitals are the centers where these conditions are treated: major surgeries, cancer, cardiovascular diseases, and chronic conditions, all of which require heavy reliance on prescription drugs. Because hospital pharmacies are set up to manage the high volume of prescriptions received at hospitals, they can tailor their offerings to include more specialized medications that are often in retail stores, such as chemotherapies, biologics, immunotherapies, and more. Also, hospitals tend to place integrated care teams where pharmacists collaborate closely with physicians to customize drug therapies for individual patients, which improves patient outcomes. The market share of prescription drugs is the largest for hospital pharmacies due to an increasing number of hospitals (especially in the developing regions) and a rising demand for complex and high-cost drugs.

North America held the largest market share, around 46% in 2023. It is due to strong healthcare infrastructure, high healthcare expenditures, and world-class pharmaceutical innovation. Compared to the rest of the region, notably the U.S., there is a better-established, more complex, and expansive healthcare system with widespread private insurance and access to prescription drugs via federally financed programs like Medicare and Medicaid. The FDA is dispensing drug approvals at a steady pace, bolstered by ongoing innovations being made by dominant players in the pharmaceutical market in North America. The U.S. is where many of the largest global pharmaceutical firms are headquartered and is also positioned at the center of drug manufacture, development, distribution, and innovation. Additionally, the growing geriatric population and rising cases of chronic conditions, including diabetes and heart disease, are also generating high precursors for prescription medications across North America. All this taken into account, the prescription drug market across the globe is still predominantly led by North America

Europe held the significant market share. This is owing to the well-established healthcare systems of the region, strict regulatory frameworks, and the rising need for innovative treatment options. In many instances, the higher coverage that universal healthcare offers in various countries means that they provide widespread access to prescription medications for tens of millions. This is particularly the case for member nations of the European Union. Moreover, Europe also hosts some of the world's broadest pharmaceutical companies and research centers, which increases a more substantial level of drug innovation, including oncology, neurology, and cardiovascular diseases. Consumer confidence is boosted, leading to market growth, as regulatory bodies such as the European Medicines Agency (EMA) test new drugs on human beings to assess whether they are safe and effective for the general public. In addition, rising mandatory medicine demand in the region is influenced by an ageing population and increasing burden from chronic diseases. Such access to healthcare and pharmaceutical innovation, along with an increasing need for these treatments, have contributed towards Europe capturing a notable share in the global prescription drugs market.

Novartis AG (Gleevec, Cosentyx)

F. Hoffmann-La Roche Ltd (Herceptin, Avastin)

Pfizer, Inc. (Ibrance, Prevnar)

Johnson & Johnson Services, Inc. (Remicade, Xarelto)

Sanofi (Lantus, Dupixent)

AbbVie, Inc. (Humira, Rinvoq)

AstraZeneca (Tagrisso, Farxiga)

Merck & Co., Inc. (Keytruda, Januvia)

GlaxoSmithKline pic. (Advair, Sensodyne)

CELGENE CORPORATION (Revlimid, Otezla)

Bristol-Myers Squibb (Opdivo, Eliquis)

Eli Lilly and Co. (Trulicity, Humalog)

Amgen Inc. (Enbrel, Neulasta)

Bayer AG (Xarelto, Eylea)

Gilead Sciences, Inc. (Harvoni, Remdesivir)

Abbott Laboratories (Humira, Freestyle Libre)

Mylan N.V. (EpiPen, Lipitor)

Teva Pharmaceutical Industries Ltd. (Copaxone, ProAir)

Baxter International Inc. (Advantage, Prandial)

Sandoz (Zolmitriptan, Enoxaparin)

In 2023, Novartis received FDA approval for Kymriah, a CAR T-cell therapy designed to treat relapsed or refractory large B-cell lymphoma. This approval marks a significant advancement in personalized cancer treatment. Kymriah offers a promising option for patients who have not responded to other therapies.

In 2023, Roche announced the FDA approval of Evrysdi for treating spinal muscular atrophy (SMA) in infants and toddlers. This approval strengthens Roche's pediatric treatment portfolio. Evrysdi offers a new therapeutic option for young patients affected by SMA.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD1162.60 Billion |

| Market Size by 2032 | USD 2173.61 Billion |

| CAGR | CAGR of7.20 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Prescription Drugs, Orphan, Generics) • By Therapy (Immunosuppressants, Oncology, Sensory Organs, Vaccines, Anticoagulants, Anti-diabetics, Others) • By Distribution Channel (Retail Pharmacies & Drug Stores, Hospital Pharmacies, Online Pharmacies) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Novartis AG, F. Hoffmann-La Roche Ltd, Pfizer, Inc., Johnson & Johnson Services, Inc., Sanofi, AbbVie, Inc., AstraZeneca, Merck & Co., Inc., GlaxoSmithKline pic., CELGENE CORPORATION, Bristol-Myers Squibb, Eli Lilly and Co., Amgen Inc., Bayer AG, Gilead Sciences, Inc., Abbott Laboratories, Mylan N.V., Teva Pharmaceutical Industries Ltd., Baxter International Inc., Sandoz |

Ans: The Prescription Drugs Market was valued at USD 1162.60 Billion in 2023.

Ans: The expected CAGR of the global Prescription Drugs Market during the forecast period is 7.20%

Ans: Prescription Drugs will grow rapidly in the Prescription Drugs Market from 2024 to 2032.

Ans: Rising drug costs and affordability issues act as a restraint for the prescription drugs market.

Ans: North America led the Prescription Drugs Market in the region with the highest revenue share in 2023.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Drug Pricing Trends

5.2 Regulatory Approvals and Market Authorizations

5.3 R&D Investment in Pharmaceuticals.

5.4 Pharmaceutical Marketing and Distribution Trends

5.5 Clinical Trials and Drug Development

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new Product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Prescription Drugs Market Segmentation by Product Type

7.1 Chapter Overview

7.2 Prescription Drugs

7.2.1 Prescription Drugs Market Trends Analysis (2020-2032)

7.2.2 Prescription Drugs Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Orphan

7.3.1 Orphan Market Trends Analysis (2020-2032)

7.3.2 Orphan Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Generics

7.4.1 Generics Market Trends Analysis (2020-2032)

7.4.2 Generics Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Prescription Drugs Market Segmentation By Therapy

8.1 Chapter Overview

8.2 Immunosuppressants

8.2.1 Immunosuppressants Market Trend Analysis (2020-2032)

8.2.2 Immunosuppressants Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Oncology

8.3.1 Oncology Market Trends Analysis (2020-2032)

8.3.2 Oncology Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Sensory Organs

8.4.1 Sensory Organs Market Trend Analysis (2020-2032)

8.4.2 Sensory Organs Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Vaccines

8.5.1 Vaccines Market Trends Analysis (2020-2032)

8.5.2 Vaccines Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Anticoagulants

8.6.1 Anticoagulants Market Trends Analysis (2020-2032)

8.6.2 Anticoagulants Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Anti-diabetics

8.7.1 Anti-diabetics Market Trends Analysis (2020-2032)

8.7.2 Anti-diabetics Market Size Estimates and Forecasts to 2032 (USD Billion)

8.8 Others

8.8.1 Others Market Trends Analysis (2020-2032)

8.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Prescription Drugs Market Segmentation By Distribution Channel

9.1 Chapter Overview

9.2 Retail Pharmacies & Drug Stores

9.2.1 Retail Pharmacies & Drug Stores Market Trends Analysis (2020-2032)

9.2.2 Retail Pharmacies & Drug Stores Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Hospital Pharmacies

9.3.1 Hospital Pharmacies Market Trends Analysis (2020-2032)

9.3.2 Hospital Pharmacies Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Online Pharmacies

9.4.1 Online Pharmacies Market Trends Analysis (2020-2032)

9.4.2 Online Pharmacies Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Prescription Drugs Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.2.4 North America Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.2.5 North America Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.2.6.2 USA Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.2.6.3 USA Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.2.7.2 Canada Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.2.7.3 Canada Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.2.8.2 Mexico Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.2.8.3 Mexico Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Prescription Drugs Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.3.1.6.3 Poland Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.3.1.7.3 Romania Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Prescription Drugs Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.3.2.5 Western Europe Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.3.2.6.3 Germany Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.7.2 France Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.3.2.7.3 France Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.8.2 UK Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.3.2.8.3 UK Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.3.2.9.3 Italy Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.3.2.10.3 Spain Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.3.2.13.3 Austria Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Prescription Drugs Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.4 Asia Pacific Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.4.5 Asia Pacific Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.6.2 China Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.4.6.3 China Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.7.2 India Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.4.7.3 India Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.8.2 Japan Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.4.8.3 Japan Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.9.2 South Korea Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.4.9.3 South Korea Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.4.10.3 Vietnam Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.11.2 Singapore Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.4.11.3 Singapore Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.12.2 Australia Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.4.12.3 Australia Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Prescription Drugs Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.1.4 Middle East Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.5.1.5 Middle East Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.5.1.6.3 UAE Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Prescription Drugs Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.2.4 Africa Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.5.2.5 Africa Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Prescription Drugs Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.6.4 Latin America Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.6.5 Latin America Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.6.6.2 Brazil Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.6.6.3 Brazil Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.6.7.2 Argentina Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.6.7.3 Argentina Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.6.8.2 Colombia Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.6.8.3 Colombia Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Prescription Drugs Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Prescription Drugs Market Estimates and Forecasts, By Therapy (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Prescription Drugs Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

11. Company Profiles

11.1 Novartis AG

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Product/ Services Offered

11.1.4 SWOT Analysis

11.2 F. Hoffmann-La Roche Ltd

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Product/ Services Offered

11.2.4 SWOT Analysis

11.3 Pfizer, Inc.

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Product/ Services Offered

11.3.4 SWOT Analysis

11.4 Johnson & Johnson Services, Inc.

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Product/ Services Offered

11.4.4 SWOT Analysis

11.5 Sanofi

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Product/ Services Offered

11.5.4 SWOT Analysis

11.6 AbbVie, Inc.

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Product/ Services Offered

11.6.4 SWOT Analysis

11.7 AstraZeneca

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Product/ Services Offered

11.7.4 SWOT Analysis

11.8 Merck & Co., Inc.

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Product/ Services Offered

11.8.4 SWOT Analysis

11.9 GlaxoSmithKline pic.

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Product/ Services Offered

11.9.4 SWOT Analysis

11.10 Celgene Corporation

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Product/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Product Type

By Therapy

By Distribution Channel

Request for Segment Customization as per your Business Requirement: Segment Customization Request

North America

Europe

Asia Pacific

Middle East & Africa

Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Cell-based Assays Market was valued at USD 17.11 billion in 2023 and is expected to reach USD 35.34 billion by 2032, growing at a CAGR of 8.36% from 2024-2032.

The Laboratory Informatics Market Size was valued at USD 3.9 billion in 2023 and is expected to reach USD 7.7 billion by 2032, growing at a CAGR of 7.9% over the forecast period 2024-2032.

The latent Tuberculosis Infection Detection Market was valued at USD 1.65 billion in 2023 and is expected to reach USD 2.71 billion by 2032, growing at a CAGR of 5.72% from 2024-2032.

The Tumor Profiling Market size was valued at USD 10.5 Billion in 2023 and is expected to reach USD 24.8 Billion by 2032, growing at a 10.04% CAGR.

The Global Digital Hearing Aids Market, valued at USD 7.36 billion in 2023, is projected to reach USD 12.57 billion by 2032 at a CAGR of 6.15% during 2024-2032.

The Bispecific Antibodies Market size was valued at USD 8.28 billion in 2023 and is expected to reach USD 220.82 billion by 2032, at a CAGR of 44.05% by 2024-2032.

Hi! Click one of our member below to chat on Phone