Preparative and Process Chromatography Market Overview

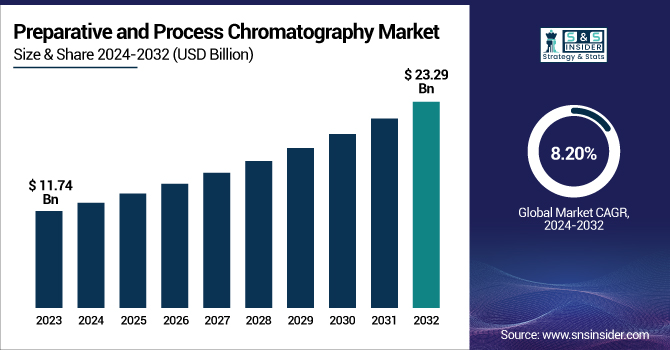

The Preparative and Process Chromatography Market was valued at USD 11.74 billion in 2023 and is expected to reach USD 23.29 billion by 2032, growing at a CAGR of 8.20% from 2024-2032.

To Get more information on Preparative and Process Chromatography Market - Request Free Sample Report

The Preparative and Process Chromatography Market report offers the first insights into market adoption and usage patterns, highlighting how technologies of chromatography are embedded in pharmaceutical, food, and biotechnology industries in 2023. It also presents regional demand differences, outlining consumption patterns of chromatography systems and consumables in major global markets. Furthermore, the report analyzes R&D investments, offering insights into technological innovations and improvements. It further delves into regulatory compliance effects, determining how strict quality controls influence industry norms. Finally, the research addresses automation and AI adoption, determining their contribution to process efficiency, scalability, and accuracy in chromatography processes.

The U.S. Preparative and Process Chromatography Market size was USD 2.89 billion in 2023 and is expected to reach USD 5.90 billion by 2032, growing at a CAGR of 8.27% over the forecast period of 2024-2032.

The market is driven by the increasing demand for chromatography techniques in biopharmaceutical manufacturing, drug purification, and chemical analysis. The rise in monoclonal antibody production and biosimilar development is further fueling the adoption of advanced chromatography systems. Growing investments in pharmaceutical research and stringent regulatory requirements for drug purification are also contributing to market expansion. Additionally, advancements in automation and high-throughput chromatography solutions are enhancing efficiency and productivity in laboratory and industrial applications.

Preparative and Process Chromatography Market Dynamics

Drivers

-

Increasing Demand for Biopharmaceuticals and Personalized Medicine is driving the market growth.

Increasing demand for biopharmaceutical manufacture, such as monoclonal antibodies, vaccines, and cell & gene therapies, has seen significant growth for preparative and process chromatography. With an expanding pipeline in the pharmaceutical sector toward personalized medicine and biologics, the requirement for drug manufacture using high-purity separation processes is now greater than ever. Industry analysis has shown biologics at more than 40% of new drug approvals in 2023, thus illustrating the increase in demand for innovative chromatography solutions. In addition, regulatory standards like those of the FDA and EMA require high purification standards, also driving market growth. Recent advancements involve improvements in single-use chromatography systems and continuous chromatography technologies that increase efficiency and lower processing costs. These technologies, combined with the explosion of biologics research, are driving the use of chromatography in pharmaceutical and biotech applications.

-

Technological Advancements in Chromatography Systems are propelling the market to grow.

Unceasing innovation in chromatography technology, including automation, artificial intelligence-based analytics, and high-throughput purification strategies, is changing the dynamics of the market. New-generation chromatography equipment with increased resolution, faster throughput times, and greater scalability serves diverse industries from pharma to food safety. Inclusion of artificial intelligence and machine learning into chromatography supports predictive maintenance and process optimization, decreases downtime, and enhances efficiency. Gilson introduced its VERITY Preparative LC system in September 2024 to boost purification capacity in CROs and biotech R&D. At the same time, Shimadzu Corporation entered into a strategic alliance with Sepragen Corporation in November 2024 to boost bioprocess chromatography solutions in Asia. All these developments are enhancing workflows, enhancing reproducibility, and broadening the horizon of chromatography applications across various industries.

Restraint

-

The high level of capital outlay needed in preparative and process chromatography systems is the major hindrance to market development.

Sophisticated chromatography equipment, for example, HPLC and preparative chromatography systems, is expensive initially and hence beyond the reach of SMEs as well as universities and research organizations. The high costs of maintenance of consumable materials such as resins, columns, and solvents, in addition to the initial purchase, contribute further to the costs of operation. For example, resins employed in biopharmaceutical purification with high purity can be costly, with some ranging from thousands of dollars per liter. The expense is further magnified by maintenance costs and the requirement for qualified personnel to operate and analyze chromatography data. Such financial burdens can restrict adoption levels, especially in developing areas, where fiscal limitations prevent investment in high-capacity chromatography technologies.

Opportunities

-

The rising need for biopharmaceuticals, such as monoclonal antibodies, vaccines, and gene therapies, is generating enormous opportunities for the preparative and process chromatography market.

Chromatography is essential in the purification and separation of biomolecules to produce high-quality and regulatory-compliant biopharmaceuticals. With the increasing trend towards personalized medicine and cell & gene therapy, the need for high-purity chromatography methods is likely to increase. In addition, top biotechnology companies and CDMOs are augmenting their bioprocessing capacities, fueling investments in large-scale chromatography equipment. For instance, international biopharma players are boosting investments in downstream processing technology, with a focus on chromatography. This tendency opens avenues for market participants to bring in high-efficiency, scalable chromatography technology solutions designed for biologics and next-generation therapies.

Challenges

-

Regulatory hurdles are the greatest challenge to producers in the process and preparative chromatography market.

The strict regulations by regulatory bodies like the FDA, EMA, and ICH require chromatography methods to achieve stringent levels of purity, reproducibility, and process validation. Compliance usually takes the form of extensive documentation, validation studies, and ongoing quality control tests, which are both time- and money-consuming. Additionally, regional differences in regulatory environments contribute to the complexity, necessitating companies to adapt their chromatography processes for various markets. The implementation of newer chromatography technologies, including continuous chromatography and AI-based automation, also necessitates further regulatory approvals, introducing another level of compliance issues. This regulatory complexity contributes to increased time-to-market for chromatography products, posing challenges for both incumbent companies and new market entrants.

Preparative and Process Chromatography Market Segmentation

By Product

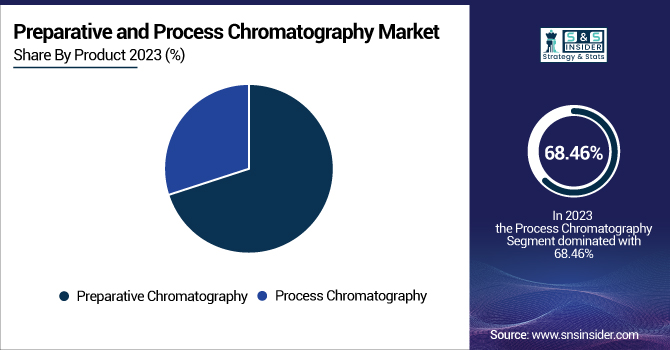

The Process Chromatography segment dominated the Preparative and Process Chromatography Market with a 68.46% market share in 2023, as it is in high demand in large-scale manufacturing of biopharmaceuticals, purification of monoclonal antibodies, and manufacture of vaccines. The segment is essential in bioprocessing processes where high-purity separation of biomolecules is needed for drug development and commercialization. Growing requirements for biologics and biosimilars, coupled with strict regulatory regulations for purification operations, have influenced substantial investments in process-scale chromatography equipment and consumables. The fact that there are mature biopharma clusters in North America and Europe has also favored the high utilization of process chromatography systems within GMP-regulated manufacturing sites.

The Preparative Chromatography segment is expected to grow at the fastest rate with 8.53% CAGR during the forecast period, owing to the growing use in small-scale drug discovery, proteomics, and research-based purification methods. With the development of personalized medicine, peptide synthesis, and oligonucleotide-based treatments, there is an emerging need for high-precision separation methods in R&D labs and pilot-scale manufacturing. Furthermore, advances in automation, artificial intelligence-based chromatography software, and miniaturized purification technologies are increasing preparative chromatography's efficiency and affordability. The growth of the CRO and biotech R&D market, especially in the developing regions of Asia Pacific, is also accelerating this trend as researchers require affordable, versatile chromatography solutions to enable early-stage drug development.

By Chromatography Type

The Liquid Chromatography segment dominated the Preparative and Process Chromatography Market with 31.20% market share in 2023 on account of its strong versatility, efficiency, and extensive use in biopharmaceutical, food, and chemical sectors. Methods such as High-Performance Liquid Chromatography (HPLC) and Ultra-High-Performance Liquid Chromatography (UHPLC) are heavily applied in protein purification, separation of biomolecules, and analysis of small-molecule drugs, thus being invaluable to research and industrial-scale manufacturing. Furthermore, the use of liquid chromatography in the production of monoclonal antibodies (mAb), the purification of vaccines, and biosimilar production has accelerated with the expansion of the biopharmaceutical sector. The combination of automated platforms and AI-based analytical software has further boosted the efficiency of liquid chromatography, making it the go-to chromatography method in preparative and process contexts.

By End User

The Bio-Pharmaceutical Industry segment dominated the Preparative and Process Chromatography Market with around 43.56% market share in 2023 because of the growing demand for biologics, monoclonal antibodies (mAbs), vaccines, and cell and gene therapies. The growing incidence of chronic diseases, cancer, and autoimmune diseases has led pharmaceutical companies to invest heavily in purification and separation technologies to guarantee high-purity drug formulations. Preparative and process chromatography is also a key part of downstream processing, protein purification, and biomolecule separation, and thus is a significant tool in the manufacture of biopharmaceuticals. The use of single-use chromatography systems, continuous bioprocessing, and automation supported by artificial intelligence also increased efficiency and scalability, further increasing the demand for chromatography in mass drug production. Regulatory authorities, for instance, the FDA and the EMA, have also pushed tight quality guidelines into the use of chromatography technologies in the biopharmaceutical industry.

Preparative and Process Chromatography Market Regional Insights

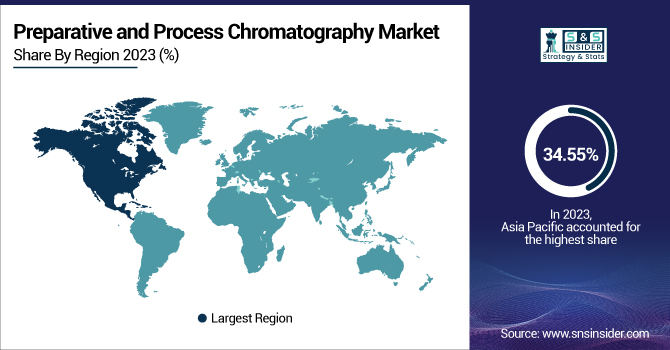

North America dominated the preparative and process chromatography market with around 34.55% market share in 2023, driven by its robust base of biopharmaceutical firms, contract development and manufacturing organizations (CDMOs), and research institutions. The United States is the leader in the region, with large investments in bioprocessing, drug discovery, and personalized medicine. The availability of prominent industry players like Thermo Fisher Scientific, Agilent Technologies, and Bio-Rad Laboratories, coupled with sophisticated regulatory systems implemented by the FDA, promotes strong adoption of chromatography methods. Moreover, government and private investment in proteomics, genomics, and biopharma R&D has further boosted demand for high-performance chromatography systems. North America's established healthcare infrastructure, robust academic research partnerships, and increasing emphasis on biologics manufacturing are factors in its market dominance.

The Asia Pacific is the fastest-growing region in preparative and process chromatography market with 9.03% CAGR throughout the forecast period, fueled by increased pharmaceutical and biotechnology investments in nations such as China, India, Japan, and South Korea. The area enjoys reduced manufacturing expenses, a growing contract research and manufacturing (CRO/CMO) sector, and rising government funding for life sciences research. China and India, especially, are experiencing an upsurge in biopharmaceutical manufacturing and biosimilar development, fueling demand for high-efficiency chromatography methods. Furthermore, international pharma firms are relocating their R&D and manufacturing activities to Asia Pacific because of its cost benefits and educated workforce. Regulatory advancements, increasing scholarly research partnerships, and improvements in the automation of chromatography also promote market growth within the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Companies in the Preparative and Process Chromatography Market

-

GE Healthcare (ÄKTAprocess, BioProcess Columns)

-

Agilent Technologies (InfinityLab Preparative LC, 1290 Infinity II Preparative LC System)

-

Danaher Corporation (NGC Chromatography Systems, Profinia Protein Purification System)

-

Bio-Rad Laboratories Inc. (NGC Medium-Pressure Chromatography Systems, UNOsphere Chromatography Media)

-

Merck KGaA (Chromabolt Prepacked Columns, Fractogel EMD Resins)

-

Thermo Fisher Scientific Inc. (Dionex ICS-6000 HPIC System, HyPeak Chromatography Systems)

-

Shimadzu Corporation (LC-20AP Preparative Liquid Chromatograph, Nexera Prep Series)

-

Novasep Holding S.A.S (Hipersep Process Chromatography Systems, BioSC Pilot)

-

Waters Corporation (AutoPurification System, Prep 150 LC System)

-

PerkinElmer Inc. (Flexar LC Preparative System, Clarus SQ 8 GC/MS)

-

Sartorius AG (Resolute BioSMB Systems, Sartobind Membrane Adsorbers)

-

Tosoh Bioscience LLC (Octave Chromatography System, TSKgel Resins)

-

YMC Co., Ltd. (YMC PilotPLUS Columns, YMC-Triart Prep LC Columns)

-

KNAUER Wissenschaftliche Geräte GmbH (AZURA Preparative HPLC, Eurokat Columns)

-

Gilson, Inc. (VERITY Preparative HPLC Systems, PLC 2020 Personal Purification System)

-

Pall Corporation (Resolute Linear Columns, Mustang Chromatography Capsules)

-

Repligen Corporation (OPUS Pre-packed Columns, XCell ATF Systems)

-

Novasep (Hipersep Flowdrive, BioSC Lab)

-

ChromaCon AG (Contichrom CUBE, Contichrom Lab)

-

Biotage AB (Isolera Dalton 2000, Flash 400 System)

Suppliers (These suppliers provide essential chromatography resins, filtration media, and purification materials critical for large-scale separation processes in biopharmaceutical, chemical, and food industries.) in the Preparative and Process Chromatography Market.

-

Purolite Corporation

-

W. R. Grace & Co.

-

Mitsubishi Chemical Corporation

-

3M Company

-

Dow Chemical Company

-

Resindion S.R.L.

-

Avantor, Inc.

-

Thermax Limited

-

Polymetrix AG

-

Daicel Corporation

Recent Developments in Preparative and Process Chromatograph

-

In September 2024, Gilson launched the VERITY Preparative LC system, a high-performance purification platform with built-in software that will assist contract research organizations (CROs) and biotech R&D scientists in synthetic drug discovery, including peptide and oligonucleotide synthesis.

-

In November 2024, Shimadzu Corporation established a strategic alliance with Sepragen Corporation, a U.S.-based company that is an expert in the manufacture of bioprocess chromatography equipment. Under this partnership, Shimadzu gained exclusive rights to sell and service Sepragen's products in Japan, South Korea, and Southeast Asia.

Preparative And Process Chromatography Market Report Scope:

Report Attributes Details Market Size in 2023 US$ 11.74 billion Market Size by 2032 US$ 23.79 billion CAGR CAGR of 8.20% From 2024 to 2032 Base Year 2023 Forecast Period 2024-2032 Historical Data 2020-2022 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments • By Product (Preparative Chromatography, Process Chromatography)

• By Chromatography Type (Liquid Chromatography, Gas Chromatography, Thin Layer Chromatography, Paper Chromatography, Others)

• By End User (Food Industry, Nutraceutical Industry, Bio-Pharmaceutical Industry, Oil & Gas Industry, Diagnostics, Academic and Research Institutes)Regional Analysis/Coverage North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) Company Profiles GE Healthcare, Agilent Technologies, Danaher Corporation, Bio-Rad Laboratories Inc., Merck KGaA, Thermo Fisher Scientific Inc., Shimadzu Corporation, Novasep Holding S.A.S, Waters Corporation, PerkinElmer Inc., Sartorius AG, Tosoh Bioscience LLC, YMC Co., Ltd., KNAUER Wissenschaftliche Geräte GmbH, Gilson, Inc., Pall Corporation, Repligen Corporation, Novasep, ChromaCon AG, Biotage AB, and other players.