Power Transformer Market Report Scope & Overview:

Get More Information on Power Transformer Market - Request Sample Report

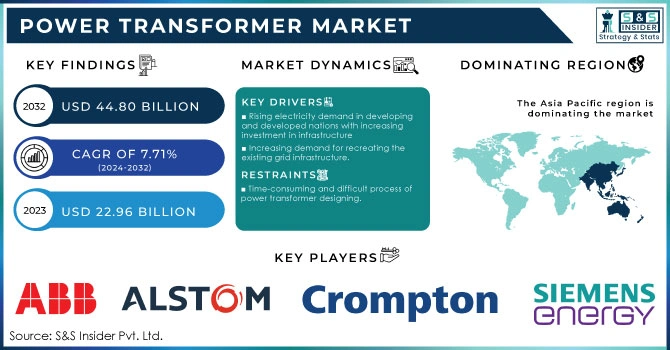

The Power Transformer Market size was valued at USD 22.96 billion in 2023 and is expected to grow to USD 44.80 billion by 2032 and grow at a CAGR of 7.71% over the forecast period of 2024-2032.

A power transformer is a device that is used to transfer electronic energy from one electric circuit to another electric circuit without a change in the frequency. The principle of electromagnetic induction is applied to operate the power transformers. These power transformers are also considered static devices as they did not have rotating or moving parts. Efficient power transmission is enabled if the voltage of the incoming power is increased. That’s why they are used in distribution networks to step up or step down the voltage.

These power transformers include a broad range of electrical transformers like autotransformers, current transformers, control transformers, distribution transformers, voltage transformers, isolation transformers, and general-purpose transformers.

Power transformers and distribution transformers are both essential components of the electrical grid, but they serve different purposes. Power transformers are responsible for transmitting electricity over long distances, while distribution transformers are responsible for delivering electricity to homes and businesses. Understanding the differences between these two types of transformers is crucial for ensuring the efficient and reliable operation of the electrical grid.

Transformers are commonly utilized to convert voltage to the desired level. In addition, power transformers are used to convert medium voltage from the source (10 kV to 50 kV) to high voltage (110 kV to 500 kV or higher) before transmitting it to the high-voltage line. This is because utilizing a higher voltage line over a long-distance results in less energy loss.

Market Dynamics

Drivers

-

Rising electricity demand in developing and developed nations with increasing investment in infrastructure

-

Increasing infrastructural spending

-

Increasing demand for recreating the existing grid infrastructure.

-

Rising transmission network research and the fast use of non-traditional and renewable energy sources for generating electricity in remote places

Restrain

-

Time-consuming and difficult process of power transformer designing.

Opportunities

-

Increasing spending by the government on technologically advanced power transformers

-

The rise in the usage of electricity in houses, public institutions, and businesses

Challenges

-

High cost related to the power consumption for the key players in the market

-

Rise in the price of raw material

Impact of Covid-19 Pandemic:

The COVID-19 pandemic has had a significant impact on the power transformer market. The global economy has been severely affected, and the power industry is no exception. The pandemic has caused a decrease in demand for power transformers due to the slowdown in construction projects and the closure of factories. Additionally, supply chain disruptions have led to delays in the delivery of raw materials and components, further affecting the production of power transformers. However, the pandemic has also created opportunities for the power transformer market. With the increase in remote work and online learning, there has been a surge in demand for reliable and uninterrupted power supply. This has led to an increased demand for power transformers in the data center and telecommunications industries.

Impact of Russia-Ukraine War:

The aftermath of the Russia-Ukraine war has left Ukraine's energy sector in a dire state. The Russian attack on power plants in residential areas has caused significant damage, leading to a collapse of the country's energy infrastructure. As a result, Ukrainians have been forced to endure frequent rolling blackouts, which have had a devastating impact on the economy. Despite efforts to restore the electricity supply, it remains far below the country's needs, exacerbating the situation.

Impact of Recession:

The power transformer market has been significantly affected by the recent economic recession. The recession has caused a decrease in demand for power transformers, resulting in a decline in sales and revenue for manufacturers. This has led to a decrease in production and employment in the industry. Furthermore, the recession has also affected investment in the power sector, resulting in a decrease in the number of new power projects. This has further reduced the demand for power transformers, as there are fewer new installations and replacements.

Market Segmentation

On the basis of rating, the power transformer market is further segmented into Small Power Transformer (Up to 60 MVA) Medium Power Transformer (61- 600 MVA), and Large Power Transformer (Above 600 MVA). Medium Power transformers dominated the market with the highest CAGR during the forecast period due to the increasing need for electric energy owing to industrialization and urbanization worldwide.

On the basis of the type of cooling method, the power transformer market is further bifurcated into oil-cooled and air-cooled transformers. The oil-cooled transformer is expected to propel the market in the foreseeable future owing to its safe to use while dealing with high voltage applications.

On the basis of phase, the power transformer market is classified into single-phase and three-phase power transformers. Three-phase transformers have dominated the market and are also expected to show a significant growth rate in the future. This is because of the affordability, lighter, and smaller at greater power ratings.

On the basis of core, the power transformer market is segmented into closed, shell, and berry. Shell Core has dominated the market with a high market share in 2022 and is also predicted to propel with a significant CAGR in the future. Because these are less expensive and are also used to minimize the cost of the circuit.

On the basis of the application, the power transformer market is segmented into Residential & Commercial, Utilities, and Industrial. The industrial segment is going to dominate the market with a significant growth rate due to the safe, risk-free, and accurate usage of electricity in Industrial use.

By Rating

-

Small Power Transformer (Up to 60 MVA)

-

Medium Power Transformer (61- 600 MVA)

-

Large Power Transformer (Above 600 MVA)

By type of cooling method (Oil-cooled and air-cooled)

-

Oil-cooled

-

Air-cooled

By Phase

-

Single

-

Three

By Core

-

Closed

-

Shell

-

Berry

By application

-

Residential & Commercial

-

Utilities

-

Industrial

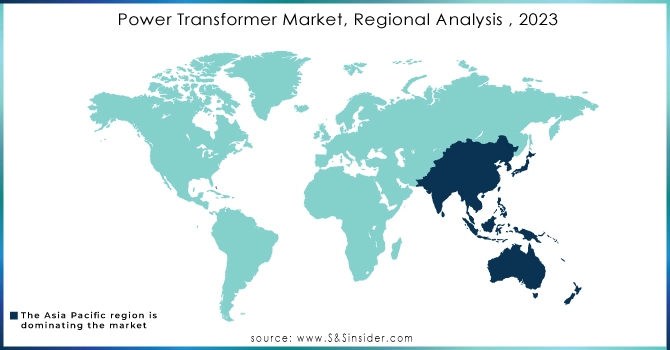

Regional Analysis

By region, the Asia Pacific region dominated the market in terms of revenue in 2022 and is forecasted to grow with a significant CAGR during the foreseeable period. Rapid economic development and the rising need for uninterrupted and reliable power supply due to the increasing population in this region are the driving factors of regional growth. China is rapidly investing in the expansion of its current electrical transmission and distribution system to satisfy the growing demand for electricity from the population due to urbanization.

Rising energy demand and a growing focus on the production of renewable electric power are the main factors that help to propel market growth. Another factor that helps Asia Pacific to grow significantly in the power transformer market is the high production of energy in the world.

Need Any Customization Research On Power Transformer Market - Inquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

Key Players

The major key players are ABB Ltd., Alstom SA, Hyosung Power & Industrial Systems Performance Group, Crompton Greaves Ltd., GE Co., Hyundai Heavy Industries Co. Ltd., Siemens Energy, Mitsubishi Electric Corporation, Toshiba Corp., Bharat Heavy Electricals Limited and other key players will be included in the final report.

| Report Attributes | Details |

| Market Size in 2023 | US$ 22.96 Billion |

| Market Size by 2032 | US$ 44.80 Billion |

| CAGR | CAGR of 7.71% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Rating (Small Power Transformer (Up to 60 MVA), Medium Power Transformer (61- 600 MVA), Large Power Transformer (Above 600 MVA)) • By type of cooling method (Oil-cooled and air-cooled), by phase (Single, Three) • By core (Closed, Shell, Berry), by application (Residential & Commercial, Utilities, Industrial) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | ABB Ltd., Alstom SA, Hyosung Power & Industrial Systems Performance Group, Crompton Greaves Ltd., GE Co., Hyundai Heavy Industries Co. Ltd., Siemens Energy, Mitsubishi Electric Corporation, Toshiba Corp., Bharat Heavy Electricals Limited |

| Key Drivers | • Rising electricity demand in developing and developed nations with increasing investment in infrastructure • Increasing infrastructural spending |

| Market Opportunities | • Increasing spending by the government on technologically advanced power transformers • The rise in the usage of electricity in houses, public institutions, and businesses |