Get more information on Power to Gas Market - Request Sample Report

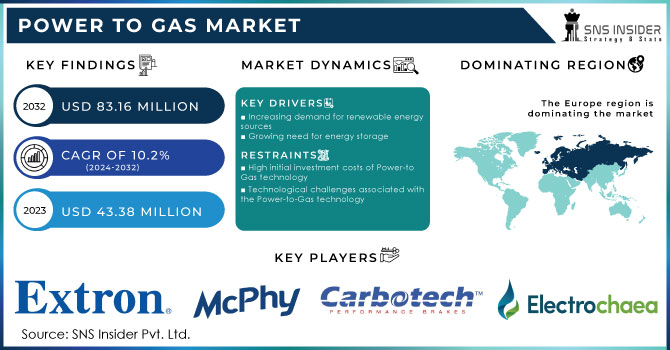

The Power to Gas Market size was valued at USD 43.38million in 2023 and is expected to reach USD 83.16 million by 2032 with a growing CAGR of 10.2% over the forecast period of 2024-2032.

The advantages of Power-to-Gas are numerous. Firstly, it provides a solution to the intermittent nature of renewable energy sources by enabling the storage of excess electricity in the form of hydrogen or methane. During periods of high demand for energy, this stored energy can then be used. Additionally, Power-to-Gas offers a means to decarbonize various sectors, such as transportation and heating, by providing a clean alternative to fossil fuels. The utilization of hydrogen or methane as energy carriers can significantly reduce greenhouse gas emissions and contribute to the mitigation of climate change. Furthermore, Power-to-Gas technology promotes the efficient use of existing infrastructure. By injecting methane produced through methanation into the natural gas grid, it becomes possible to utilize the existing gas infrastructure for the storage and distribution of renewable energy.

The concept of "Power-to-Gas" refers to technology that enables the conversion of surplus electricity into hydrogen or methane gas. This innovative process holds immense potential for the integration of renewable energy sources into our existing energy systems. Excess electricity generated from renewable sources, such as wind or solar power, is utilized to produce green hydrogen gas through electrolysis. This process involves splitting water molecules into hydrogen and oxygen using an electric current. The hydrogen produced can then be stored and utilized as a clean energy source in various applications. Moreover, Power-to-Gas technology also allows for the conversion of hydrogen into methane gas through a process called methanation. This step involves combining hydrogen with carbon dioxide, typically sourced from industrial emissions or biogas production, to produce methane. The resulting methane can be injected into the natural gas grid, stored for later use, or utilized as fuel for transportation.

One of the key drivers behind the expansion of the power-to-gas market is the increasing penetration of renewable energy sources, such as wind and solar power. These sources often generate more electricity than is immediately required, leading to curtailment or wastage. Power-to-gas technology provides a solution by converting this excess electricity into hydrogen or methane gas, which can be stored for later use or injected into the natural gas grid. The power-to-gas market also plays a crucial role in addressing the challenge of energy storage. As renewable energy sources become more prevalent, the need for efficient and scalable energy storage solutions becomes paramount. Power-to-gas technology offers a viable option by converting surplus electricity into a storable form, allowing for a flexible and on-demand energy supply. Furthermore, power-to-gas systems have the potential to contribute to the decarbonization of various sectors. Hydrogen produced through power-to-gas can be used as a fuel for transportation, heating, and industrial processes, offering a clean alternative to fossil fuels. Methane produced through this process, known as synthetic natural gas, can be injected into the existing natural gas infrastructure, reducing the carbon footprint of the gas grid. The power-to-gas market is witnessing significant growth globally, with several countries investing in research and development and implementing pilot projects. Germany, in particular, has emerged as a leader in this field, with numerous power-to-gas facilities already in operation. The European Union has also recognized the potential of power-to-gas technology and has included it in its strategic energy plans.

Drivers

Increasing demand for renewable energy sources

Growing need for energy storage

With the intermittent nature of renewable energy sources, efficient energy storage solutions are becoming crucial. Power-to-gas technology enables the storage of excess energy in the form of hydrogen or methane, which can be converted back into electricity when required, addressing the need for reliable energy storage.

Restrain

High initial investment costs of Power-to-Gas technology

Technological challenges associated with the Power-to-Gas technology

Power-to-gas technology is still in its early stages, and there are ongoing challenges in terms of efficiency, scalability, and cost-effectiveness. Overcoming these technological hurdles is essential for the widespread adoption of this technology.

Opportunities

Expansion of hydrogen economy

Rising demand from the transportation sector

Power-to-gas technology can play a crucial role in decarbonizing various sectors, such as transportation and heating. Hydrogen produced through power-to-gas can be used as a clean fuel for vehicles, reducing greenhouse gas emissions and improving air quality. Additionally, injecting renewable methane into existing natural gas pipelines can help reduce the carbon footprint of heating systems.

Challenges

Scalability of power-to-gas technology

While small-scale pilot projects have demonstrated the feasibility of the concept, scaling up to meet the energy demands of entire regions or countries remains a significant hurdle. Adequate infrastructure, such as pipelines and storage facilities, must be developed to accommodate the large-scale deployment of power-to-gas systems.

Russia- Ukraine war has resulted in a decrease in gas supplies from Russia to Ukraine, which has had a direct effect on the availability and pricing of natural gas. As a result, countries heavily reliant on Russian gas imports, such as Ukraine and some European nations, have been forced to seek alternative energy sources. Germany, in particular, depends on Russia for about 50% of its natural gas needs. In August 2022, European gas prices reached a record high of 345 euros/MWh. This surge was primarily caused by Russia's strategic manipulation of its natural gas exports in response to punitive EU sanctions. Additionally, the high temperatures experienced during the summer further exacerbated the situation by increasing demand and limiting supply.

One of the key alternatives that have gained prominence is Power-to-Gas technology. The Russia-Ukraine war has accelerated the adoption of Power-to-Gas technology, as countries strive to reduce their dependence on Russian gas imports. This shift has created a significant market opportunity for companies involved in the development and implementation of Power-to-Gas solutions. As a result, the industry has witnessed a surge in investments, research, and development activities. Furthermore, the conflict has also highlighted the importance of energy security and diversification. Countries that were previously reliant on Russian gas have recognized the need to diversify their energy sources to mitigate the risks associated with geopolitical tensions. This has led to increased investments in renewable energy infrastructure, including Power-to-Gas projects.

Impact of Recession:

One of the major challenges faced by the Power-to-Gas market during the recession is the limited availability of funding. Investors are more cautious and hesitant to allocate resources to projects that may have uncertain returns. This lack of financial support has impeded the development and expansion of Power-to-Gas technologies. Furthermore, the recession has also affected the regulatory environment. Governments, grappling with economic instability, have shifted their focus away from renewable energy initiatives. This has resulted in a decrease in policy support and incentives for the Power-to-Gas sector, further hindering its growth.

By Technology

Methanation

Electrolysis

By Capacity

Less than 100 kW

100–999 kW

1000 kW

More than 1000 kW

By End-user

Commercial

Residential

Utility

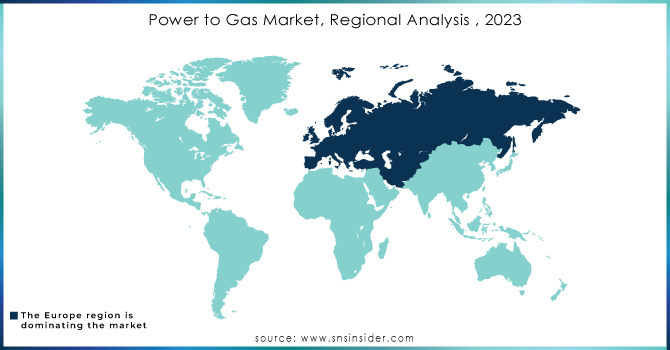

Europe dominated the Power-to-Gas market and is expected to grow with a significant CAGR during the forecast period. The reason behind this dominance is significant investments in renewable energy sources, such as wind and solar power. These sources often generate excess electricity during periods of low demand. By converting this surplus energy into gas, Europe has found an effective way to store and utilize it efficiently, thereby reducing wastage. In addition, Europe's well-established infrastructure and interconnected energy grids have facilitated the integration of Power-to-Gas systems. The continent's extensive pipeline network enables the transportation and distribution of hydrogen and methane gas to various end-users, including industries, households, and transportation sectors. This seamless integration has further propelled Europe's dominance in the Power-to-Gas market. Moreover, Europe's commitment to reducing greenhouse gas emissions and transitioning towards a sustainable energy future has been a driving force behind the growth of the Power-to-Gas market. By utilizing hydrogen and methane gas as clean energy alternatives, Europe has been able to reduce its reliance on fossil fuels and mitigate the environmental impact of traditional energy sources.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

The major key players are Electrochaea, Carbotech, McPhy Energy, Exytron, Avacon, ITM Power, Aquahydrex, MAN Energy Solutions, Nel Hydrogen, Fuel Cell Energy, Hydrogenic, Green Hydrogen, Siemens AG, ThyssenKrupp, and other key players mentioned in the final report.

In January 2023, Energie 360° partnered with the German company Electrochaea GmbH to accelerate the advancement of the power-to-gas technology concept.

In March 2022, the grid operator Avacon successfully integrated 20% hydrogen into a sub-grid as part of the European distribution grid initiative Ready4H2, which was conducting a trial to blend hydrogen into the natural gas grid.

In June 2023, MAN Energy Solutions made a significant announcement by selling its gas turbine business to China's CSIC Longjiang GH Gas Turbine Co Ltd (GHGT).

| Report Attributes | Details |

| Market Size in 2023 | US$ 43.38 Mn |

| Market Size by 2032 | US$ 83.16 Mn |

| CAGR | CAGR of 10.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Methanation and Electrolysis) • By Capacity (Less than 100 kW, 100–999 kW, 1000 kW, and More than 1000 kW) • By End-user (Commercial, Residential, and Utility) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Electrochaea, Carbotech, McPhy Energy, Exytron, Avacon, ITM Power, Aquahydrex, MAN Energy Solutions, Nel Hydrogen, Fuel Cell Energy, Hydrogenic, Green Hydrogen, Siemens AG, ThyssenKrupp |

| Key Drivers | • Increasing demand for renewable energy sources • Growing need for energy storage |

| Market Restraints | • High initial investment costs of Power-to-Gas technology • Technological challenges associated with the Power-to-Gas technology |

Ans: The market size of the Power to Gas Market is valued at USD 43.38 million in 2023.

Ans: The expected CAGR of the Power to Gas Market during the forecast period is 10.2%.

Ans: The major key players in the Power to Gas Market are Electrochaea, Carbotech, McPhy Energy, Exytron, Avacon, ITM Power, Aquahydrex, MAN Energy Solutions, Nel Hydrogen, Fuelcell Energy, Hydrogenic, Green Hydrogen, Siemens AG, and ThyssenKrupp.

Ans: Europe is the dominating region of the Power to Gas Market.

Ans: The Power to Gas Market is bifurcated into 3 major segments: 1. By Technology 2. By Capacity 3. By End-user.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 Impact of Ukraine- Russia War

4.2 Impact of Ongoing Recession

4.2.1 Introduction

4.2.2 Impact on major economies

4.2.2.1 US

4.2.2.2 Canada

4.2.2.3 Germany

4.2.2.4 France

4.2.2.5 United Kingdom

4.2.2.6 China

4.2.2.7 Japan

4.2.2.8 South Korea

4.2.2.9 Rest of the World

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Power to Gas Market Segmentation, By Technology

8.1 Methanation

8.2 Electrolysis

9. Power to Gas Market Segmentation, By Capacity

9.1 Less than 100 kW

9.2 100–999 kW

9.3 1000 kW

9.4 More than 1000 kW

10. Power to Gas Market Segmentation, By End-user

10.1 Commercial

10.2 Residential

10.3 Utility

11. Regional Analysis

11.1 Introduction

11.2 North America

11.2.1 North America Power to Gas Market by Country

11.2.2North America Power to Gas Market by Technology

11.2.3 North America Power to Gas Market by Capacity

11.2.4 North America Power to Gas Market by End-user

11.2.5 USA

11.2.5.1 USA Power to Gas Market by Technology

11.2.5.2 USA Power to Gas Market by Capacity

11.2.5.3 USA Power to Gas Market by End-user

11.2.6 Canada

11.2.6.1 Canada Power to Gas Market by Technology

11.2.6.2 Canada Power to Gas Market by Capacity

11.2.6.3 Canada Power to Gas Market by End-user

11.2.7 Mexico

11.2.7.1 Mexico Power to Gas Market by Technology

11.2.7.2 Mexico Power to Gas Market by Capacity

11.2.7.3 Mexico Power to Gas Market by End-user

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Eastern Europe Power to Gas Market by Country

11.3.1.2 Eastern Europe Power to Gas Market by Technology

11.3.1.3 Eastern Europe Power to Gas Market by Capacity

11.3.1.4 Eastern Europe Power to Gas Market by End-user

11.3.1.5 Poland

11.3.1.5.1 Poland Power to Gas Market by Technology

11.3.1.5.2 Poland Power to Gas Market by Capacity

11.3.1.5.3 Poland Power to Gas Market by End-user

11.3.1.6 Romania

11.3.1.6.1 Romania Power to Gas Market by Technology

11.3.1.6.2 Romania Power to Gas Market by Capacity

11.3.1.6.4 Romania Power to Gas Market by End-user

11.3.1.7 Turkey

11.3.1.7.1 Turkey Power to Gas Market by Technology

11.3.1.7.2 Turkey Power to Gas Market by Capacity

11.3.1.7.3 Turkey Power to Gas Market by End-user

11.3.1.8 Rest of Eastern Europe

11.3.1.8.1 Rest of Eastern Europe Power to Gas Market by Technology

11.3.1.8.2 Rest of Eastern Europe Power to Gas Market by Capacity

11.3.1.8.3 Rest of Eastern Europe Power to Gas Market by End-user

11.3.2 Western Europe

11.3.2.1 Western Europe Power to Gas Market by Technology

11.3.2.2 Western Europe Power to Gas Market by Capacity

11.3.2.3 Western Europe Power to Gas Market by End-user

11.3.2.4 Germany

11.3.2.4.1 Germany Power to Gas Market by Technology

11.3.2.4.2 Germany Power to Gas Market by Capacity

11.3.2.4.3 Germany Power to Gas Market by End-user

11.3.2.5 France

11.3.2.5.1 France Power to Gas Market by Technology

11.3.2.5.2 France Power to Gas Market by Capacity

11.3.2.5.3 France Power to Gas Market by End-user

11.3.2.6 UK

11.3.2.6.1 UK Power to Gas Market by Technology

11.3.2.6.2 UK Power to Gas Market by Capacity

11.3.2.6.3 UK Power to Gas Market by End-user

11.3.2.7 Italy

11.3.2.7.1 Italy Power to Gas Market by Technology

11.3.2.7.2 Italy Power to Gas Market by Capacity

11.3.2.7.3 Italy Power to Gas Market by End-user

11.3.2.8 Spain

11.3.2.8.1 Spain Power to Gas Market by Technology

11.3.2.8.2 Spain Power to Gas Market by Capacity

11.3.2.8.3 Spain Power to Gas Market by End-user

11.3.2.9 Netherlands

11.3.2.9.1 Netherlands Power to Gas Market by Technology

11.3.2.9.2 Netherlands Power to Gas Market by Capacity

11.3.2.9.3 Netherlands Power to Gas Market by End-user

11.3.2.10 Switzerland

11.3.2.10.1 Switzerland Power to Gas Market by Technology

11.3.2.10.2 Switzerland Power to Gas Market by Capacity

11.3.2.10.3 Switzerland Power to Gas Market by End-user

11.3.2.11.1 Austria

11.3.2.11.2 Austria Power to Gas Market by Technology

11.3.2.11.3 Austria Power to Gas Market by Capacity

11.3.2.11.4 Austria Power to Gas Market by End-user

11.3.2.12 Rest of Western Europe

11.3.2.12.1 Rest of Western Europe Power to Gas Market by Technology

11.3.2.12.2 Rest of Western Europe Power to Gas Market by Capacity

11.3.2.12.3 Rest of Western Europe Power to Gas Market by End-user

11.4 Asia-Pacific

11.4.1 Asia-Pacific Power to Gas Market by Country

11.4.2 Asia-Pacific Power to Gas Market by Technology

11.4.3 Asia-Pacific Power to Gas Market by Capacity

11.4.4 Asia-Pacific Power to Gas Market by End-user

11.4.5 China

11.4.5.1 China Power to Gas Market by Technology

11.4.5.2 China Power to Gas Market by Capacity

11.4.5.3 China Power to Gas Market by End-user

11.4.6 India

11.4.6.1 India Power to Gas Market by Technology

11.4.6.2 India Power to Gas Market by Capacity

11.4.6.3 India Power to Gas Market by End-user

11.4.7 Japan

11.4.7.1 Japan Power to Gas Market by Technology

11.4.7.2 Japan Power to Gas Market by Capacity

11.4.7.3 Japan Power to Gas Market by End-user

11.4.8 South Korea

11.4.8.1 South Korea Power to Gas Market by Technology

11.4.8.2 South Korea Power to Gas Market by Capacity

11.4.8.3 South Korea Power to Gas Market by End-user

11.4.9 Vietnam

11.4.9.1 Vietnam Power to Gas Market by Technology

11.4.9.2 Vietnam Power to Gas Market by Capacity

11.4.9.3 Vietnam Power to Gas Market by End-user

11.4.10 Singapore

11.4.10.1 Singapore Power to Gas Market by Technology

11.4.10.2 Singapore Power to Gas Market by Capacity

11.4.10.3 Singapore Power to Gas Market by End-user

11.4.11 Australia

11.4.11.1 Australia Power to Gas Market by Technology

11.4.11.2 Australia Power to Gas Market by Capacity

11.4.11.3 Australia Power to Gas Market by End-user

11.4.12 Rest of Asia-Pacific

11.4.12.1 Rest of Asia-Pacific Power to Gas Market by Technology

11.4.12.2 Rest of Asia-Pacific Power to Gas Market by Capacity

11.4.12.3 Rest of Asia-Pacific Power to Gas Market by End-user

11.5 Middle East & Africa

11.5.1 Middle East

11.5.1.1 Middle East Power to Gas Market by Country

11.5.1.2 Middle East Power to Gas Market by Technology

11.5.1.3 Middle East Power to Gas Market by Capacity

11.5.1.4 Middle East Power to Gas Market by End-user

11.5.1.5 UAE

11.5.1.5.1 UAE Power to Gas Market by Technology

11.5.1.5.2 UAE Power to Gas Market by Capacity

11.5.1.5.3 UAE Power to Gas Market by End-user

11.5.1.6 Egypt

11.5.1.6.1 Egypt Power to Gas Market by Technology

11.5.1.6.2 Egypt Power to Gas Market by Capacity

11.5.1.6.3 Egypt Power to Gas Market by End-user

11.5.1.7 Saudi Arabia

11.5.1.7.1 Saudi Arabia Power to Gas Market by Technology

11.5.1.7.2 Saudi Arabia Power to Gas Market by Capacity

11.5.1.7.3 Saudi Arabia Power to Gas Market by End-user

11.5.1.8 Qatar

11.5.1.8.1 Qatar Power to Gas Market by Technology

11.5.1.8.2 Qatar Power to Gas Market by Capacity

11.5.1.8.3 Qatar Power to Gas Market by End-user

11.5.1.9 Rest of Middle East

11.5.1.9.1 Rest of Middle East Power to Gas Market by Technology

11.5.1.9.2 Rest of Middle East Power to Gas Market by Capacity

11.5.1.9.3 Rest of Middle East Power to Gas Market by End-user

11.5.2 Africa

11.5.2.1 Africa Transfusion Diagnostics Market by Country

11.5.2.2 Africa Power to Gas Market by Technology

11.5.2.3 Africa Power to Gas Market by Capacity

11.5.2.4 Africa Power to Gas Market by End-user

11.5.2.5 Nigeria

11.5.2.5.1 Nigeria Power to Gas Market by Technology

11.5.2.5.2 Nigeria Power to Gas Market by Capacity

11.5.2.5.3 Nigeria Power to Gas Market by End-user

11.5.2.6 South Africa

11.5.2.6.1 South Africa Power to Gas Market by Technology

11.5.2.6.2 South Africa Power to Gas Market by Capacity

11.5.2.6.3 South Africa Power to Gas Market by End-user

11.5.2.7 Rest of Africa

11.5.2.7.1 Rest of Africa Power to Gas Market by Technology

11.5.2.7.2 Rest of Africa Power to Gas Market by Capacity

11.5.2.7.3 Rest of Africa Power to Gas Market by End-user

11.6 Latin America

11.6.1 Latin America Power to Gas Market by Country

11.6.2 Latin America Power to Gas Market by Technology

11.6.3 Latin America Power to Gas Market by Capacity

11.6.4 Latin America Power to Gas Market by End-user

11.6.5 Brazil

11.6.5.1 Brazil America Power to Gas Market by Technology

11.6.5.2 Brazil America Power to Gas Market by Capacity

11.6.5.3 Brazil America Power to Gas Market by End-user

11.6.6 Argentina

11.6.6.1 Argentina America Power to Gas Market by Technology

11.6.6.2 Argentina America Power to Gas Market by Capacity

11.6.6.3 Argentina America Power to Gas Market by End-user

11.6.7 Colombia

11.6.7.1 Colombia America Power to Gas Market by Technology

11.6.7.2 Colombia America Power to Gas Market by Capacity

11.6.7.3 Colombia America Power to Gas Market by End-user

11.6.8 Rest of Latin America

11.6.8.1 Rest of Latin America Power to Gas Market by Technology

11.6.8.2 Rest of Latin America Power to Gas Market by Capacity

11.6.8.3 Rest of Latin America Power to Gas Market by End-user

12 Company Profile

12.1 Electrochaea

12.1.1 Company Overview

12.1.2 Financials

12.1.3 Product/Services Offered

12.1.4 SWOT Analysis

12.1.5 The SNS View

12.2 Carbotech

12.2.1 Company Overview

12.2.2 Financials

12.2.3 Product/Services Offered

12.2.4 SWOT Analysis

12.2.5 The SNS View

12.3 McPhy Energy

12.3.1 Company Overview

12.3.2 Financials

12.3.3 Product/Services Offered

12.3.4 SWOT Analysis

12.3.5 The SNS View

12.4 Exytron

12.4.1 Company Overview

12.4.2 Financials

12.4.3 Product/Services Offered

12.4.4 SWOT Analysis

12.4.5 The SNS View

12.5 Avacon

12.5.1 Company Overview

12.5.2 Financials

12.5.3 Product/Services Offered

12.5.4 SWOT Analysis

12.5.5 The SNS View

12.6 ITM Power

12.6.1 Company Overview

12.6.2 Financials

12.6.3 Product/Services Offered

12.6.4 SWOT Analysis

12.6.5 The SNS View

12.7 Aquahydrex

12.7.1 Company Overview

12.7.2 Financials

12.7.3 Product/Services Offered

12.7.4 SWOT Analysis

12.7.5 The SNS View

12.8 MAN Energy Solutions

12.8.1 Company Overview

12.8.2 Financials

12.8.3 Product/Services Offered

12.8.4 SWOT Analysis

12.8.5 The SNS View

12.9 Nel Hydrogen

12.9.1 Company Overview

12.9.2 Financials

12.9.3 Product/Services Offered

12.9.4 SWOT Analysis

12.9.5 The SNS View

12.10 Fuelcell Energy

12.10.1 Company Overview

12.10.2 Financials

12.10.3 Product/Services Offered

12.10.4 SWOT Analysis

12.10.5 The SNS View

12.11 Hydrogenic

12.11.1 Company Overview

12.11.2 Financials

12.11.3 Product/Services Offered

12.11.4 SWOT Analysis

12.11.5 The SNS View

12.12 Green Hydrogen

12.12.1 Company Overview

12.12.2 Financials

12.12.3 Product/Services Offered

12.12.4 SWOT Analysis

12.12.5 The SNS View

12.13 Siemens AG

12.13.1 Company Overview

12.13.2 Financials

12.13.3 Product/Services Offered

12.13.4 SWOT Analysis

12.13.5 The SNS View

12.14 ThyssenKrupp

12.14.1 Company Overview

12.14.2 Financials

12.14.3 Product/Services Offered

12.14.4 SWOT Analysis

12.14.5 The SNS View

13. Competitive Landscape

13.1 Competitive Benchmarking

13.2 Market Share Analysis

13.3 Recent Developments

13.3.1 Industry News

13.3.2 Company News

13.3.3 Mergers & Acquisition

14. USE Cases and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Water Desalination Equipment Market size was valued at USD 16.14 billion in 2023 and is expected to grow to USD 33.07 billion by 2031 with a growing CAGR of 9.8% over the forecast period of 2024-2031.

The Offshore Decommissioning Market size was valued at USD 5.5 billion in 2022 and is expected to grow to USD 9.8 billion by 2030 with an emerging CAGR of 7.5% over the forecast period of 2023-2030.

The Power Distribution Unit (PDU) Market size was USD 3.94 billion in 2023 and is expected to reach USD 7.76 billion by 2032, growing at a CAGR of 7.83% over the forecast period of 2024-2032.

The High-Speed Engine Market size was valued at USD 24.58 billion in 2022 and is expected to grow to USD 33.38 billion by 2030 and grow at a CAGR of 3.9% over the forecast period of 2023-2030.

The Small Gas Engines Market size was valued at USD 3.26 Billion in 2023 and is projected to reach USD 5.19 Billion by 2032, growing at a compound annual growth rate (CAGR) of 5.3% over the forecast period of 2024 to 2032.

The Drilling Waste Management Market size was valued at USD 6.19 billion in 2023 and is expected to grow to USD 10.82 billion by 2032 and grow at a CAGR of 6.4% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone