Power Strip Market Size

To get more information on Power Strip Market - Request Sample Report

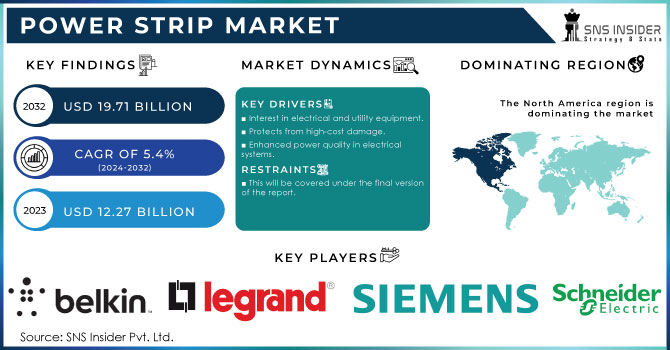

The Power Strip Market Size was valued at USD 12.65 Billion in 2023 and is expected to reach USD 19.64 Billion by 2032 and grow at a CAGR of 5.0% over the forecast period 2024-2032.

The power strip market has gained significantly in recent years, thanks to various factors such as technological development and the ever-increasing consumer demand for safety and energy efficiency. A power strip is an electrical connection device that can have multiple outlets and allows the user to plug several devices into one outlet. Household, office, and industrial users commonly employ them to power computers, TVs, and other electronic home appliances. With the mushrooming of electronics around the globe, there has been an upsurge in demand for power strips, providing an avenue for market expansion.

Energy utilization in office buildings in the United States is another noteworthy issue, where more than 25% of total energy use was attributed to plug-in devices. Many of them waste considerable energy since the devices often consume power even when switched off because the effects are now popularly termed "standby power," or "phantom load." It is mainly seen in the workplace among workstations, printers, and other electronic equipment.

APS is developed with advanced smart technologies like pre-programmed timers and sensors that automatically cut off the power supply to devices when they are not in use. These APS systems have shown a significant amount of energy savings. For instance, studies have proven that APS can minimize power consumption in workstations by 26% and up to 50% in areas of high concentration of plug-in appliances such as in printer rooms and kitchens.

Power Strip Market Dynamics

Key Drivers:

-

Increasing Adoption of Energy-Efficient Solutions Drives Demand for Advanced Power Strips in Commercial and Residential Sectors

As the focus on sustainability in the world is gaining momentum, energy-efficient solutions are in much demand in commercial and residential sectors. Power strips have become a vital part of this shift because they enable the efficient management of multiple electronic devices while minimizing the wastage of energy. Advanced power strips have the features, such as timer, motion sensing, and power-saving modes; thus, plugged-in devices in standby mode cease to consume much energy. Hence, in an industrial setup with hundreds of items connected at the same time, APS can ensure huge savings on energy.

For instance, APS limits power consumption by about 50% in heavy usage areas, such as the office and the kitchen. The large-scale adoption of these energy-efficient smart power strips is promoted by the surging importance for companies and households to be able to decrease the carbon footprint and minimize electricity costs. The government policies and environmental regulations enforcing decreased energy consumption further promote the utilization of these advanced power strips. As awareness increases all over the globe concerning issues like environmental damage, energy-efficient power strips will surely create further potential to expand and support this business during the subsequent years.

-

Technological Advancements in Smart Power Strips Fuel Growth and Appeal Among Tech-Savvy Consumers and Businesses

The technological changes have been a very key player in this power strip growth, especially in the case of smart power strips. Smart power strips are designed with capabilities beyond simple surge protection and multiple outlet designs. The new features introduced by smart power strips that allow users to control and monitor connected devices remotely include: Wi-Fi connectivity, accessing an application on smartphones, and voice control.

For instance, smart power strips can be programmed to switch devices on or off according to user preferences or send alerts when energy consumption hits a certain level. It is this degree of customization and control that has proven appealing not only to tech-savvy consumers but businesses seeking to optimize energy use. Business firms, more with a tech-based field of industry always look for smart power strips to help them boost productivity with lower bills. Continuous innovation in smart technology is expected to keep driving demand for such products and thus the market will grow.

Restrain:

-

High Risk of Overload and Fire Hazards Limits the Adoption of Power Strips in Certain Applications and Regions

Despite such widespread adoption and the benefits provided by power strips, their associated risks, such as overloads and potential fire hazards, remain a significant barrier against the adoption of such technology in many regions and applications. Overloading a power strip then may cause it to overheat and even become an electrical fire if the power strip does not include the necessary features to protect against this, such as surge protection, overload protection, or fire-resistant materials. This comes at a greater stake in commercial and industrial environments where high-power devices are often used and the chance of power strip overloading can readily happen.

Additionally, in areas where electrical safety regulations are less stringent, there is a greater chance that low-quality or incorrectly rated power strips are being used. Consequently, consumers in such regions might be reluctant to use power strips, particularly in high-power or sensitive scenarios. Manufacturers have launched modern models with in-built safety features to counter the perceived threat, however, these potential dangers act as a significant roadblock to the mass-market use of effective power strips in certain industrial environments.

Power Strip Market Key Segments

By Type

In 2023, Common Power Strip accounted for a notable market share of 60% to lead the power strip market. Most of this section contains traditional power strips that give users many sockets to plug devices into. One of the major reasons behind the popularity of these power strips is their widespread usage in homes and commercial and industrial spaces for basic power distribution. For example, Belkin, announced surge-protected power strips with an extended lifetime warranty for plugged-in devices, whereas Leviton showcased power strips featuring embedded safety stops, like circuit breakers that defend sensitive electronics. These innovations have increased the market’s attractiveness and sustained its position as the domination for those seeking to remain cost-conscious, from individual consumers through enterprise.

The Smart Power Strip segment has experienced notable growth, owing to technological advancement and the growing infiltration of smart home devices. Expected to grow the fastest with a CAGR of 7.52% between 2024-2032 Smart power strips are more than just power strips; they can integrate with home automation systems, enabling users to control devices using apps or voice assistants like Amazon Alexa or Google Assistant. That’s also the case in Legrand, which released “Smart Plug and Play” power strips that could plop themselves onto home networks. These advancements are the answer to the demand for energy-efficient and interconnected devices, mainly in smart households and businesses.

By Application

In 2023, Commercial was the largest product type segment in the power strip market generating 53% Market share. Units are predicted to observe good reasons in industrial spaces, such as offices, retail stores, and public buildings, which are required to drive the unit demand for power plugs. Power strips are built for companies to provide safe and efficient power to multiple devices such as computers, printers, and other office equipment. Top companies operating in the commercial sector, whether by product development or by type, include companies like Belkin International and Legrand. Belkin introduces surge-protected power strips built for business environments, providing features like fire-resistant housing and other improvements for heavy-use environments.

The Industrial segment is expected to witness the highest growth within the forecast period from 2024 to 2032 power strip market, with an effective CAGR of an increase of 7.62%. Industrial power strips need to be designed to accommodate high power requirements, are ruggedly constructed, and typically come with features to improve the safety of the device to meet demanding workplace needs. ABB's heavy-duty industrial power speakers will allow users to connect sensitive equipment to surge-protected multiplexing industrial-grade power strips with a high load capacity. Siemens introduced industrial power strips with built-in overload protection and durable designs for rugged environments. The growth of this segment will be fueled by the increasing demand for dedicated power strips that can manage greater voltages and power loads, as industrial segments expand, particularly in developing markets.

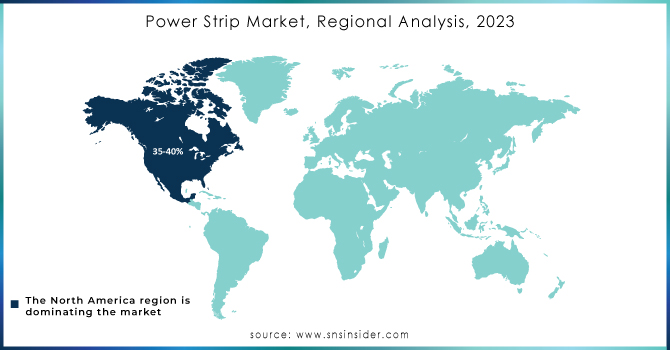

Power Strip Market Regional Analysis

North America at the lead of the power strip market in 2023. High demand for electronic devices, rising energy efficiency concerns, and continuous product innovation have paired to place It held a share of approximately 33% of the market on a global scale. This is due to the rising number of homes and establishments utilizing several electronic devices, coupled with a growing focus on energy-saving alternatives and smart home systems.

For example, Belkin, Legrand, and Schneider Electric are launching a power strip with advanced features like surge protection, energy monitoring, and smart control which helped to achieve the leading market position in the region. Power strips with surge protection, launched in the US by Belkin to protect expensive electronics, and another sold in the US by Legrand that is “smart” enough to offer energy management have drawn the interest of both residential and commercial end-users.

Asia Pacific (APAC) was the fastest-growing market for power strips in 2023 owing to the rapidly growing urbanization, the increasing acceptance of electronic devices, and increasing industrialization. The region will also hold a considerable CAGR of nearly 6.72% over the forecast period.

For instance, in the region, Schneider Electric launched its "Schneider OffGrid" portable power solution, which is aimed at providing energy-efficient power solutions for both residential and industrial purposes. Such product innovation is helping the power strip market grow in the Asia Pacific region.

To Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

Some of the major players in the Power Strip Market are:

-

Belkin International, Inc. (Belkin SurgePlus USB Swivel Charger, Belkin 12-Outlet Pivot-Plug Power Strip)

-

Schneider Electric SE (APC SurgeArrest Essential, APC Power-Saving Timer Essential)

-

Koninklijke Philips N.V. (Philips 6-Outlet Surge Protector, Philips Smart Power Strip)

-

General Electric (GE 6-Outlet Surge Protector, GE Pro 3-Outlet Power Strip)

-

Leviton Manufacturing Co., Inc. (Leviton Smart Surge Protector, Leviton Decora USB Charger)

-

Legrand SA (Legrand Radiant Power Strip, Legrand Wiremold Desktop Power Center)

-

Siemens AG (Siemens FirstSurge Surge Protective Device, Siemens Power Distribution Panel)

-

Panasonic Corporation (Panasonic Smart Power Strip, Panasonic 6-Outlet Surge Protector)

-

Delixi Electric Ltd. (Delixi Multi-Function Power Strip, Delixi Surge Protector Strip)

-

ABB Ltd (ABB Smart Surge Protector, ABB Industrial Power Strip)

-

Cyber Power Systems, Inc. (CyberPower Surge Protector P705G, CyberPower CP1500PFCLCD)

-

Falconer Electronics (Falconer Heavy-Duty Power Strip, Falconer Industrial Surge Protector)

Recent Trends

-

In June 2024, Belkin announced the launch of their new surge protection power boards in Australia which have 1 to 8 outlets and up to 1800 joules of protection. The boards had ports for USB-C fast charging, metal oxide varistors (MOVs), and better safety systems. Belkin provided an up to $70,000 Connected Equipment Warranty (CEW) for surge-related damages as well as a two-year warranty to cover every product.

-

In November 2024, Schneider Electric introduced Schneider OffGrid, a portable power station intended to be used outdoors and as a backup in case of emergencies. This renewable-energy unit also includes versatile power inputs, with USB-A, USB-C, AC outlets, DC ports, and wireless charging. It is equipped for solar recharging if you want a greener power option.

-

In December 2024, Panasonic Renewable Energy, the company responsible for the production of batteries for electric vehicles, utilized an in-house hydrogen-based renewable energy power generation system at its UK factory back. The Renewable Energy System consists of pure hydrogen fuel cell generators, photovoltaic generators, and storage batteries to deliver renewable energy to the factory.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 12.65 Billion |

| Market Size by 2032 | USD 19.64 Billion |

| CAGR | CAGR of 5.0 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Protection (Surge Protection, Fuse-based Protection, Others) • By Application (Household, Commercial, Industrial) • By Type (Common Power Strip, Specialized Power Strip, Smart Power Strip) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Belkin International, Inc., Schneider Electric SE, Koninklijke Philips N.V., General Electric, Leviton Manufacturing Co., Inc., Legrand SA, Siemens AG, Panasonic Corporation, Delixi Electric Ltd., ABB Ltd, Cyber Power Systems, Inc., Falconer Electronics. |

| Key Drivers | •Increasing Adoption of Energy-Efficient Solutions Drives Demand for Advanced Power Strips in Commercial and Residential Sectors. •Technological Advancements in Smart Power Strips Fuel Growth and Appeal Among Tech-Savvy Consumers and Businesses. |

| Restraints | • High Risk of Overload and Fire Hazards Limits the Adoption of Power Strips in Certain Applications and Regions. |