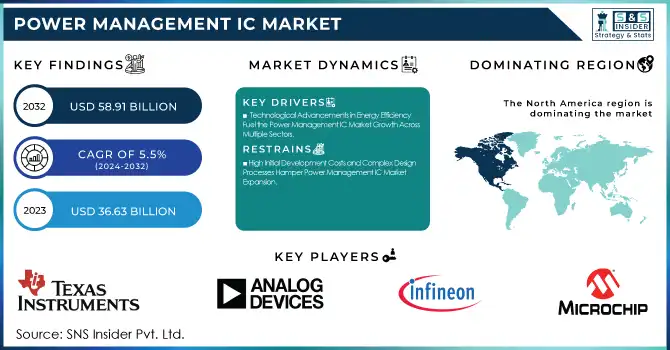

The Power Management IC Market Size was valued at USD 36.63 Billion in 2023 and is expected to reach USD 58.91 Billion by 2032 and grow at a CAGR of 5.5% over the forecast period 2024-2032.

To get more information on Power Management IC Market - Request Free Sample Report

The Power Management IC market has witnessed remarkable growth in recent years, driven by rapid advancements in technology, increasing demand for energy-efficient devices, and the expanding adoption of renewable energy sources. PMICs play a vital role in regulating and distributing power efficiently across various electronic devices and systems, making them indispensable in modern industries like automotive, consumer electronics, telecommunications, and healthcare.

The Power Management IC market is experiencing significant growth, driven by the escalating demand for energy-efficient devices across various sectors. In the United States, the emphasis on energy efficiency is underscored by the U.S. Energy Information Administration's report that, in 2023, the nation produced more energy than it consumed by a record margin of 9 quadrillion British thermal units (quads). This achievement highlights the critical role of PMICs in optimizing energy consumption, particularly in consumer electronics, automotive, and industrial applications. The proliferation of electric vehicles (EVs) and advancements in renewable energy integration further bolster the PMIC market. As EV adoption rises, efficient power management becomes essential for battery performance and vehicle reliability.

Additionally, the U.S. government's initiatives to boost natural gas and renewable energy production necessitate advanced PMIC solutions to manage power conversion and distribution effectively. Despite challenges such as balancing increased energy output with maintaining low consumer prices, the ongoing technological advancements and supportive energy policies are expected to sustain the upward trajectory of the PMIC market. The integration of PMICs in managing energy flow in renewable systems and their application in emerging technologies like 5G and IoT devices further contribute to market expansion.

Key Drivers:

Technological Advancements in Energy Efficiency Fuel the Power Management IC Market Growth Across Multiple Sectors

The rising demand for energy-efficient solutions across various industries, particularly consumer electronics, automotive, and industrial sectors, is a significant driver of the Power Management IC market. As the world grapples with increasing energy consumption, consumers and businesses are seeking ways to optimize power usage, leading to a surge in demand for PMICs. These integrated circuits are crucial in enhancing the energy efficiency of devices, from smartphones to electric vehicles (EVs). The transition to renewable energy sources, such as solar and wind, is another factor driving this trend, as PMICs help regulate and store power in these systems efficiently. In the automotive industry, especially with the rise of electric vehicles, PMICs are vital for battery management, charging systems, and overall energy optimization. The integration of PMICs in industrial automation, with energy-efficient control over motors and automation systems, further accelerates the market’s growth. Additionally, as industries focus on reducing carbon footprints, PMICs offer an essential solution by ensuring power efficiency, reducing energy waste, and prolonging the lifespan of electronic systems, thus driving market expansion.

Increased Adoption of Electric Vehicles and IoT Devices Accelerates Power Management IC Market Growth

The growing adoption of electric vehicles (EVs) and Internet of Things (IoT) devices is propelling the demand for Power Management ICs (PMICs). As EVs become more mainstream, the need for advanced power management solutions has surged. PMICs are integral in optimizing energy use, managing the battery charging process, and ensuring the efficient distribution of power across electric drivetrains. These ICs enhance the performance and lifespan of EV batteries, making them crucial for automakers transitioning to electric power. Similarly, with the exponential growth of IoT devices, which require constant power optimization, PMICs play a pivotal role in enhancing battery life and maintaining efficient power distribution in these devices. Wearables, smart home devices, and connected gadgets require compact, efficient PMICs to manage power consumption while maintaining optimal functionality. Furthermore, the rise of 5G technology, which demands more energy-intensive applications, also contributes to the need for robust power management solutions to prevent energy overloads and ensure smooth device performance. With these sectors expanding rapidly, the Power Management IC market is experiencing substantial growth driven by the demand for efficient, reliable, and sustainable power management solutions.

Restrain:

High Initial Development Costs and Complex Design Processes Hamper Power Management IC Market Expansion

While the Power Management IC market is experiencing substantial growth, it faces significant challenges due to the high initial development costs and complex design processes. Designing and manufacturing PMICs requires substantial investment in research and development (R&D), especially when creating solutions for emerging technologies such as electric vehicles and advanced IoT devices. The need for highly specialized skills and expertise to develop these ICs further adds to the financial burden.

Additionally, ensuring that PMICs are optimized for energy efficiency, safety, and compatibility with various devices can be a complex and time-consuming task. As manufacturers face rising costs to meet the stringent performance requirements of modern electronics, financial barriers can limit market entry for smaller players and slow down innovation. Moreover, the intricacies involved in designing PMICs for high-power applications, such as those used in automotive and renewable energy systems, require ongoing technological advancements, which can further increase costs. These challenges, coupled with the rapid pace of technological changes, pose a restraint to the market’s growth, as companies must balance innovation with financial feasibility.

By Product Type

The Voltage Regulators segment of the Power Management IC (PMIC) market held the largest revenue share of 37.00% in 2023, driven by the increasing demand for efficient power regulation across various industries. Voltage regulators are essential in ensuring a stable voltage supply for electronic devices, which is critical for the performance and longevity of systems. In sectors like automotive, telecommunications, consumer electronics, and industrial automation, the need for voltage regulation has grown substantially, especially with the rise of complex and power-hungry systems such as electric vehicles (EVs) and high-performance computing devices.

For example, Texas Instruments introduced the TPS7A88, a high-precision, low-dropout (LDO) regulator designed to meet the stringent requirements of automotive and industrial applications. This product is designed to provide stable output voltage even in challenging environments.

The Battery Management ICs (BMICs) segment in the Power Management IC (PMIC) market is expected to grow at the largest CAGR of 7.08% during the forecast period, fueled by the rising demand for efficient energy storage and management solutions. BMICs are essential for managing battery charge, discharge, and health monitoring, ensuring optimal performance and safety, especially in electric vehicles (EVs), renewable energy storage, and portable electronics.

For instance, STMicroelectronics introduced the STBC08, a fully integrated battery charger IC designed for electric vehicle applications, which enhances charging efficiency and reduces overall energy loss.

By Power Source

The AC-DC segment of the Power Management IC (PMIC) market dominated with the largest revenue share of 65.00% in 2023, primarily driven by the widespread use of AC-DC power converters in various industries such as consumer electronics, telecommunications, automotive, and industrial applications. AC-DC converters are essential for converting alternating current (AC) into direct current (DC), providing efficient power conversion for electronic devices and systems.

For Example, Texas Instruments introduced the UCC28780 family of AC-DC controllers designed to provide high efficiency and reduced power loss in power supplies, enhancing energy savings in applications such as home appliances and industrial power systems.

The DC-DC segment in the Power Management IC (PMIC) market is poised to experience the largest CAGR of 6.45% during the forecast period, driven by the rising demand for efficient power conversion and energy optimization in portable and automotive applications. DC-DC converters are integral to ensuring that power is efficiently transferred from one DC voltage level to another, especially in battery-powered devices like smartphones, wearables, and electric vehicles (EVs).

For example, Analog Devices launched the LTC3589, a high-efficiency, low-noise, and high-performance DC-DC converter designed for battery-powered applications like wearables and portable medical devices.

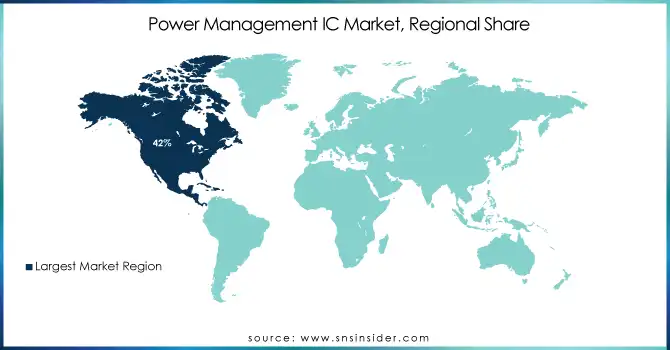

In 2023, the North American region held a dominant share in the Power Management IC market, with an estimated market share of 42%. The region's dominance can be attributed to the early adoption of advanced technologies, including power management solutions across various industries, such as consumer electronics, automotive, telecommunications, and industrial applications. The significant presence of key market players, including Texas Instruments, Analog Devices, and Microchip Technology, has also bolstered North America’s market leadership.

For instance, the U.S. government's push toward clean energy and EV adoption, supported by initiatives like the Inflation Reduction Act, which incentivizes the adoption of electric vehicles and energy-efficient technologies, has positively impacted the growth of the PMIC market.

The Asia-Pacific region is the fastest-growing region in the Power Management IC market, with an estimated CAGR of 6.45% from 2024 to 2032. This rapid growth is driven by the increasing demand for consumer electronics, automotive, and industrial applications, especially in countries like China, Japan, South Korea, and India.

Furthermore, Japan’s leadership in renewable energy and advanced technology adoption also supports the rapid growth of the PMIC market. As the demand for energy-efficient devices continues to rise, along with government incentives and infrastructure development, the Asia-Pacific region is expected to maintain its position as the fastest-growing market for PMICs in the coming years.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major players in the Power Management IC Market are:

Texas Instruments Incorporated (TPS7A02, LM2596)

Analog Devices, Inc. (ADP5065, LT8640)

Infineon Technologies AG (IR3894, CoolSET™ F3)

STMicroelectronics (ST1S14, L6924)

Semiconductor Components Industries, LLC (NCP4681DSQ25T1G, NCP4682DSQ25T1G)

Evelta Electronics (APM6612, APM6616)

Renesas Electronics Corporation (ISL95014, ISL95812)

NXP Semiconductors (PF1550, LPC54608)

Microchip Technology Inc. (MIC5365, MIC5365-2YC5-TR)

ROHM CO., LTD. (BD9E202F, BD9F100MUF)

Diodes Incorporated (AP7361, AP7331)

Semtech Corporation (SC610, SC1211)

Vishay Intertechnology Inc. (Si8641, Si3402)

In April 2024, Infineon Technologies AG launched the PSoCT 4 HVMS automotive microcontrollers, featuring high-voltage capabilities such as an integrated LIN/CXPI transceiver and a 12V regulator, along with advanced analog functionalities like CAPSENSE and inductive sensing.

In May 2024, Nanjing SemiDrive Technology Ltd., a leading Chinese SoC manufacturer of smart vehicle interiors, collaborated with ROHM to develop a smart cockpit reference design. This design incorporates SemiDrive's X9E and X9M automotive SoCs, along with PMICs, LED driver ICs, SerDes ICs, and other ROHM components.

In July 2024, Renesas Electronics teamed up with AMD to introduce a space-qualified power management solution for AMD's Versal AI Edge Adaptive SoC. The design includes key space-grade components to enhance power management efficiency.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 36.63 Billion |

| Market Size by 2032 | USD 58.91 Billion |

| CAGR | CAGR of 5.5 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Voltage Regulators, Battery Management ICs, Motor Control ICs, Multichannel ICs, Others - Power Factor Correction (PFC) ICs) • By End-user (Consumer Electronics, Automotive, Industrial, Telecommunication, Healthcare, Others - Computing and Networking) • By Power Source (AC-DC, DC-DC) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Texas Instruments Incorporated, Analog Devices, Inc., Infineon Technologies AG, STMicroelectronics, Semiconductor Components Industries, LLC, Evelta Electronics, Renesas Electronics Corporation, NXP Semiconductors, Microchip Technology Inc., ROHM CO., LTD., Diodes Incorporated, Semtech Corporation, Vishay Intertechnology Inc. |

| Key Drivers | • Technological Advancements in Energy Efficiency Fuel the Power Management IC Market Growth Across Multiple Sectors. • Increased Adoption of Electric Vehicles and IoT Devices Accelerates Power Management IC Market Growth. |

| Restraints | • High Initial Development Costs and Complex Design Processes Hamper Power Management IC Market Expansion. |

Ans: The Power Management IC Market is expected to grow at a CAGR of 5.5% during 2024-2032.

Ans: The Power Management IC Market size was USD 36.63 billion in 2023 and is expected to Reach USD 58.91 billion by 2032.

Ans: The major growth factor of the Power Management IC Market is the increasing demand for energy-efficient and sustainable power solutions across various industries.

Ans: The voltage Regulators segment dominated the Power Management IC Market.

Ans: North America dominated the Power Management IC Market in 2023.

Table Of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Product Adoption Rates by Region

5.2 Revenue Breakdown by Application

5.3 Government Incentives and Support

5.4 Patent Filings and Innovations by Region

5.5 R&D Investment Trends

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Power Management IC Market Segmentation, By Product Type

7.1 Chapter Overview

7.2 Voltage Regulators

7.2.1 Voltage Regulators Market Trends Analysis (2020-2032)

7.2.2 Voltage Regulators Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Battery Management ICs

7.3.1 Battery Management ICs Market Trends Analysis (2020-2032)

7.3.2 Battery Management ICs Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Motor Control ICs

7.4.1 Motor Control ICs Market Trends Analysis (2020-2032)

7.4.2 Motor Control ICs Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Multi-channel ICs

7.5.1 Multi-channel ICs Market Trends Analysis (2020-2032)

7.5.2 Multi-channel ICs Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Others (Power Factor Correction (PFC) ICs)

7.6.1 Others (Power Factor Correction (PFC) ICs) Market Trends Analysis (2020-2032)

7.6.2 Others (Power Factor Correction (PFC) ICs) Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Power Management IC Market Segmentation, By End-user

8.1 Chapter Overview

8.2 Consumer Electronics

8.2.1 Consumer Electronics Market Trends Analysis (2020-2032)

8.2.2 Consumer Electronics Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Automotive

8.3.1 Automotive Market Trends Analysis (2020-2032)

8.3.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Industrial

8.4.1 Industrial Market Trends Analysis (2020-2032)

8.4.2 Industrial Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Telecommunication

8.5.1 Telecommunication Market Trends Analysis (2020-2032)

8.5.2 Telecommunication Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Healthcare

8.6.1 Healthcare Market Trends Analysis (2020-2032)

8.6.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Others (Computing and Networking)

8.7.1 Others (Computing and Networking) Market Trends Analysis (2020-2032)

8.7.2 Others (Computing and Networking) Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Power Management IC Market Segmentation, By Power Source

9.1 Chapter Overview

9.2 AC-DC

9.2.1 AC-DC Market Trends Analysis (2020-2032)

9.2.2 AC-DC Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 DC-DC

9.3.1 DC-DC Market Trends Analysis (2020-2032)

9.3.2 DC-DC Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Power Management IC Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.2.4 North America Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.2.5 North America Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.2.6.2 USA Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.2.6.3 USA Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.2.7.2 Canada Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.2.7.3 Canada Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.2.8.2 Mexico Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.2.8.3 Mexico Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Power Management IC Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.3.1.6.3 Poland Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.3.1.7.3 Romania Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Power Management IC Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.3.2.5 Western Europe Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.3.2.6.3 Germany Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.7.2 France Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.3.2.7.3 France Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.8.2 UK Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.3.2.8.3 UK Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.3.2.9.3 Italy Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.3.2.10.3 Spain Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.3.2.13.3 Austria Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Power Management IC Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.4.4 Asia Pacific Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.4.5 Asia Pacific Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.4.6.2 China Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.4.6.3 China Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.4.7.2 India Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.4.7.3 India Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.4.8.2 Japan Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.4.8.3 Japan Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.4.9.2 South Korea Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.4.9.3 South Korea Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.4.10.3 Vietnam Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.4.11.2 Singapore Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.4.11.3 Singapore Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.4.12.2 Australia Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.4.12.3 Australia Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Power Management IC Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.1.4 Middle East Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.5.1.5 Middle East Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.5.1.6.3 UAE Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Power Management IC Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.2.4 Africa Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.5.2.5 Africa Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Power Management IC Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.6.4 Latin America Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.6.5 Latin America Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.6.6.2 Brazil Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.6.6.3 Brazil Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.6.7.2 Argentina Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.6.7.3 Argentina Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.6.8.2 Colombia Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.6.8.3 Colombia Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Power Management IC Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Power Management IC Market Estimates and Forecasts, By End-user (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Power Management IC Market Estimates and Forecasts, By Power Source (2020-2032) (USD Billion)

11. Company Profiles

11.1 Texas Instruments Incorporated

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Analog Devices, Inc.

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Infineon Technologies AG

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 STMicroelectronics

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Semiconductor Components Industries, LLC

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Evelta Electronics

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Renesas Electronics Corporation

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 NXP Semiconductors

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Microchip Technology Inc.

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 ROHM CO., LTD.

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

MARKET SEGMENTATION

By Product Type

Voltage Regulators

Battery Management ICs

Motor Control ICs

Multi-channel ICs

Others (Power Factor Correction (PFC) ICs)

By End-user

Consumer Electronics

Automotive

Industrial

Telecommunication

Healthcare

Others (Computing and Networking)

By Power Source

AC-DC

DC-DC

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest Of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Electric Toothbrush Market was valued at USD 4.38 billion in 2023 and is projected to reach USD 8.68 billion by 2032, growing at a robust CAGR of 7.90% during the forecast period of 2024-2032.

The EMC Filtration Market Size was valued at USD 1.50 Billion in 2023 and is expected to reach USD 2.35 Billion by 2032, at a CAGR of 5.15% During 2024-2032

The Gesture Recognition and touchless Sensing Market Size was valued at USD 19.4 billion in 2023 and is expected to reach USD 127.78 billion by 2032 and grow at a CAGR of 23.3 % over the forecast period 2024-2032.

3D Holographic Market size was valued at USD 3143 million in 2023 and is expected to grow to USD 30606.48 million by 2032 and grow at a CAGR of 28.95 % over the forecast period of 2024-2032.

The Instrument Transformer Market Size was valued at USD 7.21 Billion in 2023 and is expected to grow at a CAGR of 5.94% to reach USD 12.08 Billion by 2032.

The Outsourced Semiconductor Assembly and Test Services Market Size was valued at USD 40.10 Billion in 2023 and is expected to reach USD 77.90 Billion by 2032, growing at a CAGR of 7.67% over the forecast period 2024-2032

Hi! Click one of our member below to chat on Phone