Polyurea Coatings Market Report Scope & Overview:

The Polyurea Coatings Market Size was valued at USD 1.6 billion in 2023, and is expected to reach USD 4.7 billion by 2032, and grow at a CAGR of 12.5% over the forecast period 2024-2032. The polyurea coatings market is growing at a tremendous pace, considering the technological advancements and growing demand for high-performance solutions across various sectors. As far as functionality is concerned, polyurea coatings seem to be the most opportune solution, since they have excellent durability together with fast curing time, making them more resistant to harsh environmental conditions. They, therefore, become very famous in industrial, commercial, and residential applications due to their ability to withstand serious conditions while offering quick application, hence finding a solid place in any project works starting from infrastructure to protective coatings.

Get more information on Polyurea Coatings Market - Request Sample Report

The recent innovations in the polyurea coatings market underline industry concerns toward sustainability and improved performance. In May 2023, researchers from a European coatings technology firm introduced a new breakthrough in bio-based air-drying waterborne polyurea coatings. It will be a giant step into eco-friendly solutions by adding bio-based components to significantly lower the ecological footprint of traditional polyurea coatings. The development thus came in line with the broader trend of integrating greenness into industrial processes, reflecting increasing regulatory and consumer pressures for greener products.

Further innovation was reported in April 2024, when Azom pointed out the availability of a new type of polyurea composite coating with advanced flame retardancy. This new technology, developed by one of the global coatings manufacturers, embeds sophisticated flame retardant materials into the polyurea matrix, giving added fire resistance to the said matrix. It is important in high-safety industries, such as construction and transport, where flame retardancy must be to the best possible degree. Products that improve flame retardancy in polyurea coatings widen their range of applications, securing their use from concerns related to fire safety and opening up new markets.

In June 2024, European Coatings highlighted another breakthrough with the success in producing a composite coating that had a polyurea matrix with advanced flame-retardant capabilities. This was a derivative of further ongoing research and development for improved performance in very aggressive conditions with polyurea coatings. The new coating enhances flame resistance without sacrificing the high durability and fast curing that polyurea coatings are known for. It is this kind of progress that underlines the commitment of the industry to satisfying the changing market demand and requirements from regulations for a wide range of trustworthy solutions.

Inherent in the growing use of polyurea coatings across industries is their superior performance attribute. With their resistance to abrasion, chemicals, and water, the coatings offer significant value to works such as bridges and road projects. Besides, the fast curing time of the polyurea coating reduces downtime during its application, so it is highly utilized, particularly in projects where time is of essence. As the market becomes more demanding, so will be the attention towards sustainable and environmentally friendly products, like bio-based and low-VOC coatings; experts stipulate this will further increase the growth and acceptance of polyurea coatings in environmentally sensitive applications.

Polyurea Coatings Market Dynamics:

Drivers:

-

Increased use in infrastructure and industrial applications due to their durability and rapid curing times fuels the market growth

The high durability and fast drying time are the main driving forces that force the increased use of polyurea coatings in infrastructure and industrial applications, since those characteristics make them very suitable for demanding environments. For example, in August 2023, Bechtel, the worldwide construction and engineering company, deployed polyurea coatings in rehabilitating the San Francisco-Oakland Bay Bridge. These coatings have been chosen to bear loads from heavy traffic, environmental stressors, and corrosive elements in ways that would greatly lengthen the life of a bridge but minimize the impact of maintenance downtimes. Correspondingly, in November 2023, industrial equipment manufacturer Caterpillar will employ polyurea coatings during the creation of high-wear areas for mining machinery. Fast-curing properties of polyurea ensured quick turnarounds, and equipment could be installed much faster without compromising protective qualities to endure abrasive mining conditions. The following examples show how fast set and cure, combined with durability and protection against both physical and chemical wear, have made polyurea coatings a preferred choice for infrastructure projects and industrial applications where reduction of downtime is paramount.

-

Innovations like bio-based and low-VOC formulations enhancing environmental sustainability drives the Polyurea Coatings market

Innovations in bio-based and low-VOC formulae remodel the polyurea coatings market, offering improved environmental sustainability and catering to regulatory agencies' and consumers' rising needs for greener products. For example, AkzoNobel developed new low-VOC polyurea coatings in July 2023 to help serve the more stringent environmental regulations in Europe and North America. This was a major step down the path of low-VOC content, which significantly lessened harmful emissions typical of traditional coatings. Besides, in September 2023, Sherwin-Williams came out with its bio-based polyurea coating that uses renewable raw materials to reduce the carbon footprint associated with production and application. These innovations support global sustainability goals by attracting more environmentally sensitive consumers and businesses, hence expanding the market for polyurea coatings. On the other hand, this focus on environment-friendly solutions also poses a challenge since it requires continuous investments in research and development to come up with formulations that will achieve these new standards of environmental sustainability without sacrificing durability and performance characteristics that polyurea coatings are known for. Companies, therefore, have been scouting for new technologies and raw materials to enhance their product range in sync with this emerging market trend. Most recently, in October 2023, BASF announced the development of a new bio-based polyurea resin that would have lesser environmental impacts and high biodegradability. These examples illustrate that not only has the industry been moving toward sustainable innovation to serve environmental goals, but also to provide for market growth by serving an increasingly eco-conscious clientele.

Restraints:

-

Elevated prices compared to traditional coatings can limit adoption in cost-sensitive projects hamper the demand for polyurea coatings market

The high up-front cost of polyurea coatings in comparison with traditional coatings is one of the major barriers to adoption in projects sensitive to cost. For example, in February 2023, the municipal government of Austin, Texas, cancelled the use of polyurea coatings in a large public infrastructure project due to budget constraints and went ahead to select epoxy coatings despite having longer application times and lower durability. For example, in April 2023, a medium-sized Ohio manufacturing company that produced auto parts rejected polyurea coatings for a new production line due to the fact that the upfront cost was exorbitantly high compared to conventional polyurethane coatings. This drove them toward less expensive coatings that were not as strong, requiring more frequent maintenance. These examples demonstrate that, very often, the superior performance advantages of polyurea coatings are offset by their higher costs, making it difficult to justify such an investment for any budget-conscious entity, especially in large-scale or high-volume applications where cost efficiency is the paramount factor. The price premium hence associated with polyurea coatings remains a critical restraint, especially in markets and projects where initial expenditure is the deciding factor.

Opportunities:

-

Rising infrastructure development in emerging economies providing new growth avenues.

-

Increased demand for flame retardant and other specialized coatings in safety-critical industries.

Challenge:

-

Navigating complex and evolving regulations for chemical safety and environmental impact can pose difficulties.

Polyurea Coatings Market Segments

By Raw Material Type

The aromatic segment dominated the Polyurea Coatings Market, holding an estimated market share of approximately 60% in 2023. Aromatic polyurea coatings are preferred because of their economics and key performance attributes, making them best suited for a variety of applications in industries and commercial businesses. For instance, most infrastructure projects-such as protective coating for pipelines and industrial machinery-use predominantly aromatic polyurea, as it offers excellent mechanical properties coupled with very good resistance to chemicals. This polyurea type has less sensitivity to UV radiation and thus is suitable for indoor applications or areas of minimal sun exposure. Although it has the tendency to yellow under sunlight, its lower cost, in comparison with aliphatic polyurea, continues to give it much-needed momentum in the marketplace. Actually, the dominance of aromatic polyurea coatings within the market very much goes to demonstrate their versatility and economic advantages, especially where projects are bound by cost considerations.

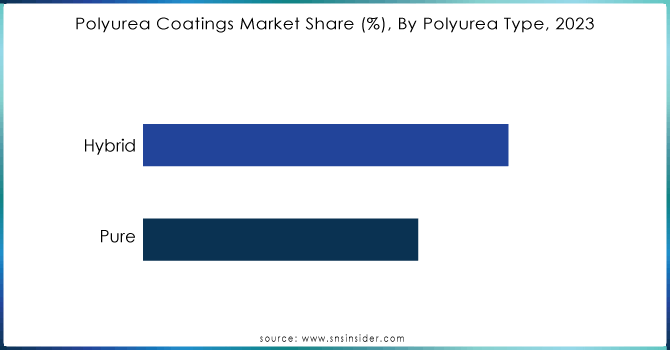

By Polyurea Type

The hybrid polyurea segment dominated the polyurea coatings market in 2023, accounting for a market share of around 65%. Hybrid polyurea coatings have balanced properties in that they bridge the benefits of pure polyurea with other resins, offering cost-effective solutions with improved performance characteristics. For example, in March 2023, a major Oil and Gas company, Chevron, applied hybrid polyurea coatings to protect storage tanks and pipelines from corrosion and harsh environmental conditions. By using hybrid polyurea, this provided the required durability and flexibility at lower costs relative to pure polyurea. For instance, in June 2023, Great Lakes Dredge & Dock Corporation, one of the big companies in marine infrastructure, selected the hybrid polyurea coatings for their coastal protection projects and cited advanced moisture resistance and application efficiency as the reason. These instances identify the dominance of the hybrid polyurea segment based on cost efficiency and versatile applications across industries.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

By Technology

The spraying technology segment dominated the polyurea coatings market in 2023, with an estimated 70% of the market. Spraying technology finds broad acceptance because it is efficient, easy to apply, and facilitates the quick and uniform covering of large areas. This method is especially useful in industrial and commercial applications where time and precision are very important. For instance, in April 2023, PPG Industries, using spraying technology to apply polyurea coatings on a newly constructed water treatment facility, provided a fast application process while the coating was smooth and even. One of the leading automobile manufacturers, Ford, used spraying technology in the company's assembly plants to apply protective coatings on vehicle underbodies in July 2023, as it offers fast methods of curing without any breaks or patches in the covering. These few examples explain how the efficiency and effectiveness of the spraying technology have come to dominate the polyurea coating market.

By End-use Industry

The building and construction segment dominated and holds the largest share of the polyurea coatings market, accounting for around 55% in 2023. The relative employment of polyurea coatings in the sector is high due to their exceptional durability, fast curing, and excellent resistance to the environment, making them fit for various end uses in construction. A prime example would be that Skanska completed in February 2023 of a massive new build-out on the face of an NYC high-rise in and out using polyurea-employing application speeds that are by design extremely fast, yet service lives of years under demanding conditions of both wet and dry exposure. Further, in September 2023, the leading contractor, named Turner Construction, in the Texas state of a new sports stadium applied the polyurea coatings for waterproofing and protecting concrete surfaces, which is another testimony for the efficacy of the technology for use in mass infrastructure projects. These are but a few examples of how demand for tough, flexible coatings in building and construction has also made that sector the largest market for polyurea coatings.

Polyurea Coatings Market Regional Analysis

In 2023, North America dominated and holds 40% market share of the global polyurea coatings market. This is probably due to the well-entrenched industrial base in the area, extensive key infrastructure projects, and high penetration of recent coating technologies. For instance, in March 2023, the United States Department of Transportation was rehabilitating the Golden Gate Bridge and used polyurea coatings, taking advantage of their durability properties to minimize disruption. For instance, in July 2023, EllisDon, the largest construction company in Canada, utilized polyurea coatings in one of the tallest residential and commercial buildings located in Toronto. It thus depicts their interest in high-performance coatings in mega-projects. These instances prove that North America dominates the market due to its robust infrastructure development and industrial applications driving demand for advanced polyurea coatings.

Moreover, in 2023, Asia-Pacific is the fastest growing region with a market share of about 30% and has been projected as the fastest-growing market for polyurea coatings with a growth rate of around 25%. Major driving forces include the growing industrialization, infrastructure development, and huge investments in the construction segment of countries such as China and India. For instance, in June 2023, China's largest construction company, China State Construction Engineering Corporation, utilized polyurea coatings in a vast urban development project in Shanghai, which leveraged the durability and faster application time associated with such coatings. In August 2023, India-based Larsen & Toubro adopted polyurea coatings in a newly built industrial facility in Mumbai, which showcases the increasing trend toward advanced coating technologies in the region. These examples prove that growth in the Asia-Pacific region has been accelerated by the rising infrastructure and industrial sectors, therefore being the fastest-growing market for polyurea coatings.

Key Players:

VersaFlex Incorporated and The Polyurea People (U.S.), Armorthane (U.S.), Lse Building Preservation Ltd (U.K.), PPG Industried, Inc. (U.S.), The Sherwin-Williams Company (U.S.), Huntsman International LLC. (the U.S.), KUDKO CHEMICAL CO.LTD. (South Korea), Rust-Oleum (U.S.), SPI Performance Coatings (U.K), Rhino Linings Corporation. (the U.S.).

Recent Developments

-

May 2024: ArmorThane introduced a polyurea coating that can be used to improve RV roof durability and perhaps change the industry by providing better solutions for coatings and repairs.

-

February 2024: DELTA Coatings International had increased its warehousing space in their headquarters in Dubai to meet the growing demand and was building a new facility nearby.

-

November 2023: Induron Protective Coatings introduced its newest product, Novasafe—a furfuryl modified, ceramic-filled novolac epoxy designed for the most extreme environments in treatment plants.

Polyurea Coatings Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | US$ 1.6 Billion |

| Market Size by 2032 | US$ 4.7 Billion |

| CAGR | CAGR of 12.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Raw Material Type (Aliphatic, Aromatic) •By Polyurea Type (Pure, Hybrid) •By technology (Spraying, Pouring, Hand Mixing) •By End-use Industry (Building & Construction, Transportation, Industrial, Landscape) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | VersaFlex Incorporated and The Polyurea People (U.S.), Armorthane (U.S.), Lse Building Preservation Ltd (U.K.), PPG Industried, Inc. (U.S.), The Sherwin-Williams Company (U.S.), Huntsman International LLC. (the U.S.), KUDKO CHEMICAL CO.LTD. (South Korea), Rust-Oleum (U.S.), SPI Performance Coatings (U.K), Rhino Linings Corporation and other players |

| Key Drivers | •Increased use in infrastructure and industrial applications due to their durability and rapid curing times fuels the market growth •Innovations like bio-based and low-VOC formulations enhancing environmental sustainability drives the Polyurea Coatings market |

| Restraints | •Elevated prices compared to traditional coatings can limit adoption in cost-sensitive projects hamper the demand for polyurea coatings market |