The Polyolefin Market size was USD 258.6 Billion in 2023 and is expected to reach USD 388.6 Billion by 2032 and grow at a CAGR of 4.6% over the forecast period of 2024-2032.

Get more information on Polyolefin Market - Request Sample Report

Growing demand for polyolefins, particularly in the packaging market, is a key factor driving the growth of the global polyolefins market. Lightweight, and high barrier properties make Polyethylene (PE) and Polypropylene (PP) the major players in flexible and rigid packaging. These are crucial for maintaining product integrity, extending shelf life, and facilitating safe transportation of goods. Polyolefins are essential for efficient and economic packaging as they are needed to meet the massive volume growth in e-commerce and online retailing. Moreover, growing consumer inclination towards sustainable packaging is acknowledged with recyclable polyolefin materials development done by the global sustainability goals. The global demand for polyolefin-based packaging is fueled by increasing consumption in food, beverages, and healthcare industries with advances in manufacturing technologies.

According to the NITI Aayog, Polyethylene (PE) and Polypropylene (PP) constitute approximately 33% and 29% of polymer usage in the packaging sector, respectively. This significant consumption underscores the reliance on polyolefins for packaging applications.

The high performance and wide applications of polyolefins, due to technological innovations, have made them essential in many areas of industry. Advanced technologies like metallocene catalyst technology have led to high-performance polyolefins with enhanced strength, flexibility, and clarity, thus, accommodating the specific application demands in packaging, automotive, and construction. Advanced polymerization techniques have further facilitated the development of special polyolefin grades and enabled manufacturers to modulate properties such as impact strength, thermal stability, and recyclability. Progress in the technology of compounding and blending has further broadened the application of polyolefins for multilayer films and other advanced materials. These innovations not only enhance polyolefin performance and flexibility but also sustainability via the commercialization of both recyclable and bio-based types of the material, in line with the objectives of the circular economy.

According to the Ministry of Statistics and Programme Implementation (MoSPI), the consumption of plastics in India is approximately 4 million tonnes per annum (MTPA), with about 60% comprising polyolefins primarily used as packaging materials.

Drivers

Increasing demand for plastics across the globe drives market growth.

One of the major factors driving the market growth is the growing consumption of plastics worldwide owing to their versatility, low cost, and wide applications in various end-use industries, including packaging, automotive, construction, health care, and electronics. Plastics are indispensable in manufacturing and consumer goods due to the durability, lightweight nature, and processability of polyolefins (e.g., polyethylene (PE), and polypropylene (PP)). On the one hand, the e-commerce sector flourished which in turn increased the demand for plastic packaging solutions; on the other hand, increasing innovations in healthcare and technology end-use industries increased the consumption of plastics in medical devices, personal protective equipment (PPE), and electronic components. In addition, the establishment of better infrastructure and rapid urbanization in emerging economies have driven the demand for plastics in construction and piping applications. The new sustainable development milestones of recycled plastic and bio-based plastic have been thundering back to the market, which has stimulated the rapid growth of this market segment in the context of stricter environmental control and global response to reduce plastic waste issues. The increasing dependence on plastics forms the backbone of a high-growth industry globally.

Restraint

Fluctuation in the raw material prices may hamper the market growth.

The factor hindering the growth of the polyolefin market is the significant fluctuations in the prices of raw materials, which directly affect the cost of production of plastics and the profitability of plastic producers. Plastics, mainly polyolefins (e.g. polyethylene (PE) and polypropylene (PP)) originate from petrochemical feedstocks, including crude oil and natural gas. The fluctuations in crude oil prices due to geopolitical tensions, imbalance in the global energy supply, and changes in regulations add to uncertainty in the cost of raw materials. Moreover, the instability in the price is due to the disruption of the supply chain eg natural disasters, labor strikes, transportation problems, etc. It is often tough for manufacturers to pass on higher sequential costs to end-users, and this can adversely affect profitability and market size. A wider emphasis on alternate materials and recycled plastics provides a greater challenge as it requires investment in new technologies and processes. Managing these real fluctuations will require strategic sourcing, even multi-year contracts with suppliers, and innovation in sustainable raw material substitutes to balance risks and continue growth.

Market segmentation

By Type

Polyethylene (PE) held the largest market share around 39% in 2023. It is owing to its the most widely used polymers in the world, providing a unique synergy of properties including high durability, chemical resistance, flexibility, and low weight. Due to these properties, it is a preferable material to use for packaging, which is the primary end-use industry, especially in food, beverages, and consumer durables. In construction, PE is mainly found in pipes, films and insulation whereas in automotive and healthcare industries, it is widely used as part of devices and single-use disposables. Moreover, polymerization technology has improved such as metallocene-catalyzed PE to produce a higher-quality PE with better performance properties allowing for various applications. In developed and emerging markets, its position is anything but weak given its importance for industry and other consumer needs around the world.

By End-Use Industry

Film & Sheet held the largest market share around 27% in 2023. It is used in multiple end-use sectors including packaging, agriculture, construction, and consumer products. Specifically, films, especially polyolefins, i.e., polyethylene (PE) and polypropylene (PP), are widely used due to their flexibility, lightweight, and barrier properties for protection as packaging material. The expansion of the e-commerce sector has led increase in the demand for packaging films as companies search for economical, lightweight, and strong mediums for shipping products. In agricultural applications, films are also important for greenhouse coverings, mulch, and crop protection, which improve yield and crop efficiency. Films have been used in construction to serve as vapor barriers, insulation, and protective coverings.

Regional Analysis

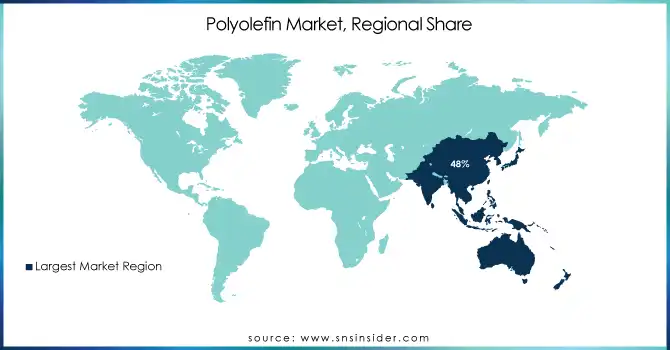

Asia Pacific region held the major share of the polyolefin market of more than 48% in 2023. This is owing to fast industrialization, increasing manufacturing base and large consumer population. The expansion primarily stems from countries, China, India, and Japan leading the pack with driving demand from automotive, packaging, electronics, construction, and agriculture sectors. Given China is the leading producer and consumer of plastics globally, the country is a key driver of demand for polyolefins, films and sheets. A strong manufacturing base, competitive labor costs and access to raw materials, combined with significant investments in polymer manufacturing technologies, have turned the region into a global center for plastic production. Moreover, the region is benefiting from the trend of urbanization, rising disposable income, increasing consumer goods and need for packaging materials in developing countries such as India and Southeast Asia. Moreover, the emphasis on sustainability and recycling programs in Asia-Pacific is in line with other nations managing plastic waste, which will create growth and progress in the Asia-Pacific plastics market.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

Sinopec Corp. (Polyethylene, Polypropylene)

LyondellBasell Industries Holdings B.V. (Polyethylene, Polypropylene)

PetroChina Company Limited (Polyethylene, Polypropylene)

Total Energies (Polystyrene, Polyethylene)

Chevron Corporation (Polyethylene, Polypropylene)

Repsol (Polypropylene, Polystyrene)

Dow (Polyethylene, Polypropylene)

Exxon Mobil Corporation (Polyethylene, Polypropylene)

Braskem (Polypropylene, Polyethylene)

Borealis AG (Polyethylene, Polypropylene)

Formosa Plastics Group (Polyethylene, Polypropylene)

INEOS (Polyethylene, Polystyrene)

DSM (Polyamide, Polyester)

LG Chem (Polyethylene, Polypropylene)

Sabic (Polyethylene, Polypropylene)

Reliance Industries (Polyethylene, Polypropylene)

Hanwa Chemical (Polyethylene, Polypropylene)

Mitsui Chemicals (Polypropylene, Polystyrene)

Kraton Polymers (Styrenic Block Copolymers, Polypropylene)

LG Chem (Polyethylene, ABS)

Recent Development:

In 2024: Sinopec announced a major investment in expanding its polyethylene production capacity with the construction of a new facility in China to meet rising demand for packaging applications.

In 2023: LyondellBasell launched a new polyethylene product made from 100% renewable feedstock, in line with its sustainability goals to reduce its carbon footprint.

In 2023: PetroChina increased its polyolefin production capacity by 1 million tons per year through a new facility in Xinjiang, China, to meet growing regional demand.

| Report Attributes | Details |

| Market Size in 2023 | US$ 258.6 Bn |

| Market Size by 2032 | US$ 388.6 Bn |

| CAGR | CAGR of 4.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Polyethylene (PE), Polypropylene (PP), Ethylene Vinyl Acetate (EVA), Thermoplastic Polyolefins (TPO), Polyoxymethylene (POM), Polycarbonate (PC), Polymethyl Methacrylate (PMMA),Others ) • By Application (Film & Sheet, Injection Molding, Blow Molding, Profile Extrusion, Fibers & fabrics, and Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Sinopec Corp.; LyondellBasell Industries Holdings B.V.; PetroChina Company Limited; Total Energies; Chevron Corporation; Repsol; Dow; Exxon Mobil Corporation; Braskem; Borealis AG |

| Key Drivers | • Increasing demand for plastics across the globe drives market growth. |

| Market Restraint | • Fluctuation in the raw material prices may hamper the market growth. |

The expected market size of the Polyolefin Market is USD 388.6 billion in 2032.

The expected CAGR of the global Polyolefin Market during the forecast period is 4.6%.

The major key players are Sinopec Corp.; LyondellBasell Industries Holdings B.V.; PetroChina Company Limited; TotalEnergies; Chevron Corporation; Repsol; Dow; Exxon Mobil Corporation; Braskem; Borealis AG

Asia-Pacific contributes major to the Polyolefin Market.

Fluctuation in the raw material prices and High cost associated with the polyolefins are the restraining factor of the Polyolefin Market.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

3.1 Market Driving Factors Analysis

3.1.2 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 PESTLE Analysis

3.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1by Production Capacity and Utilization, by Country, by Type, 2023

5.2 Feedstock Prices, by Country, by Type, 2023

5.3 Regulatory Impact, by Country, by Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, Type, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3by Product Type Benchmarking

6.3.1by Product Type specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion Plans and New Product Launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Polyolefin Market Segmentation, by Product Type

7.1 Chapter Overview

7.2 Polyethylene (PE)

7.2.1 Polyethylene (PE) Market Trends Analysis (2020-2032)

7.2.2 Polyethylene (PE) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Polypropylene (PP)

7.3.1 Polypropylene (PP) Market Trends Analysis (2020-2032)

7.3.2 Polypropylene (PP) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Ethylene Vinyl Acetate (EVA)

7.4.1 Ethylene Vinyl Acetate (EVA) Market Trends Analysis (2020-2032)

7.4.2 Ethylene Vinyl Acetate (EVA) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Thermoplastic Polyolefins (TPO)

7.5.1 Thermoplastic Polyolefins (TPO) Market Trends Analysis (2020-2032)

7.5.2 Thermoplastic Polyolefins (TPO) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Polyoxymethylene (POM)

7.6.1 Polyoxymethylene (POM) Market Trends Analysis (2020-2032)

7.6.2 Polyoxymethylene (POM) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 Polycarbonate (PC)

7.7.1 Polycarbonate (PC) Market Trends Analysis (2020-2032)

7.7.2 Polycarbonate (PC) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.8 Polymethyl Methacrylate (PMMA)

7.8.1 Polymethyl Methacrylate (PMMA) Market Trends Analysis (2020-2032)

7.8.2 Polymethyl Methacrylate (PMMA) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.9 Others

7.9.1 Others Market Trends Analysis (2020-2032)

7.9.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Polyolefin Market Segmentation, by End-User Industry

8.1 Chapter Overview

8.2 Film & Sheet

8.2.1 Film & Sheet Market Trends Analysis (2020-2032)

8.2.2 Film & Sheet Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Injection Molding

8.3.1 Injection Molding Market Trends Analysis (2020-2032)

8.3.2 Injection Molding Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Blow Molding

8.4.1 Blow Molding Market Trends Analysis (2020-2032)

8.4.2 Blow Molding Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Profile Extrusion

8.5.1 Profile Extrusion Market Trends Analysis (2020-2032)

8.5.2 Profile Extrusion Market Size Estimates and Forecasts to 2032 (USD Billion

8.6 Fibers & fabrics

8.6.1 Fibers & fabrics Market Trends Analysis (2020-2032)

8.6.2 Fibers & fabrics Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Others

8.7.1 Others Market Trends Analysis (2020-2032)

8.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Polyolefin Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Polyolefin Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.2.4 North America Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Polyolefin Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.2.5.2 USA Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Polyolefin Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.2.6.2 Canada Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Polyolefin Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.2.7.2 Mexico Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Polyolefin Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Polyolefin Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Polyolefin Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.3.1.5.2 Poland Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Polyolefin Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.3.1.6.2 Romania Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Polyolefin Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Polyolefin Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Polyolefin Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Polyolefin Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Polyolefin Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.3.2.4 Western Europe Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Polyolefin Market Estimates and forecasts, by Product Type (2020-2032) (USD Billion)

9.3.2.5.2 Germany Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Polyolefin Market Estimates and forecasts, by Product Type (2020-2032) (USD Billion)

9.3.2.6.2 France Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Polyolefin Market Estimates and forecasts, by Product Type (2020-2032) (USD Billion)

9.3.2.7.2 UK Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Polyolefin Market Estimates and forecasts, by Product Type (2020-2032) (USD Billion)

9.3.2.8.2 Italy Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Polyolefin Market Estimates and forecasts, by Product Type (2020-2032) (USD Billion)

9.3.2.9.2 Spain Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Polyolefin Market Estimates and forecasts, by Product Type (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Polyolefin Market Estimates and forecasts, by Product Type (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Polyolefin Market Estimates and forecasts, by Product Type (2020-2032) (USD Billion)

9.3.2.12.2 Austria Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Polyolefin Market Estimates and forecasts, by Product Type (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Polyolefin Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Polyolefin Market Estimates and forecasts, by Product Type (2020-2032) (USD Billion)

9.4.4 Asia Pacific Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Polyolefin Market Estimates and forecasts, by Product Type (2020-2032) (USD Billion)

9.4.5.2 China Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Polyolefin Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.4.5.2 India Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Polyolefin Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.4.5.2 Japan Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Polyolefin Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.4.6.2 South Korea Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Polyolefin Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.2.7.2 Vietnam Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Polyolefin Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.4.8.2 Singapore Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Polyolefin Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.4.9.2 Australia Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Polyolefin Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Polyolefin Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Polyolefin Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.5.1.4 Middle East Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Polyolefin Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.5.1.5.2 UAE Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Polyolefin Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Polyolefin Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Polyolefin Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Polyolefin Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Polyolefin Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Polyolefin Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.5.2.4 Africa Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Polyolefin Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Polyolefin Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Polyolefin Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Polyolefin Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.6.4 Latin America Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Polyolefin Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.6.5.2 Brazil Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Polyolefin Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.6.6.2 Argentina Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Polyolefin Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.6.7.2 Colombia Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Polyolefin Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Polyolefin Market Estimates and Forecasts, by End-User Industry (2020-2032) (USD Billion)

10. Company Profiles

10.1 Sinopec Corp.

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Product / Services Offered

10.1.4 SWOT Analysis

10.2 LyondellBasell Industries Holdings B.V.,

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Product / Services Offered

10.2.4 SWOT Analysis

10.3 PetroChina Company Limited

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Product / Services Offered

10.3.4 SWOT Analysis

10.4 Total Energies

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Product / Services Offered

10.4.4 SWOT Analysis

10.5 Chevron Corporation

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Product / Services Offered

10.5.4 SWOT Analysis

10.6 Repsol

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Product / Services Offered

10.6.4 SWOT Analysis

10.7 Dow

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Product / Services Offered

10.7.4 SWOT Analysis

10.8 Exxon Mobil Corporation

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Product / Services Offered

10.8.4 SWOT Analysis

10.9 Braskem

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Product / Services Offered

10.9.4 SWOT Analysis

10.10 Borealis AG

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Product / Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Product Type

Polyethylene (PE)

Polypropylene (PP)

Ethylene Vinyl Acetate (EVA)

Thermoplastic Polyolefins (TPO)

Polyoxymethylene (POM)

Polycarbonate (PC)

Polymethyl Methacrylate (PMMA)

Others

By End-User Industry

Film & Sheet

Injection Molding

Blow Molding

Profile Extrusion

Fibers & fabrics

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Bioadhesives market size was USD 7.01 Billion in 2023 and is expected to reach USD 15.15 Billion by 2032, growing at a CAGR of 8.93 % from 2024 to 2032.

The Marine Lubricants Market Size was valued at USD 6.5 Billion in 2023 and is expected to reach USD 7.8 Billion by 2032 and grow at a CAGR of 2.07% over the forecast period 2024-2032.

The Biorationals Market size was USD 1.24 Billion in 2023 and is expected to reach USD 2.67 Billion by 2032, growing at a CAGR of 8.90 % from 2024 to 2032.

The Filled Fluoropolymer Market was valued at USD 3.8 billion in 2023 and is expected to reach USD 6.3 billion by 2032 at a CAGR of 5.8% from 2024-2032.

The Asphalt Market size was valued at USD 249.2 million in 2023. It is expected to grow to USD 389.9 million by 2032 and grow at a CAGR of 5.1% by 2024-2032.

The Epoxy Adhesives Market Size was valued at USD 9.6 billion in 2023 and is expected to reach USD 14.8 billion by 2032 and grow at a CAGR of 4.9% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone