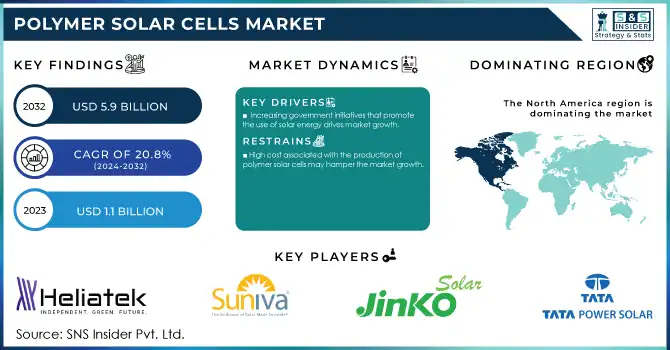

The Polymer Solar Cells Market size was USD 1.1 Billion in 2023 and is expected to reach USD 5.9 Billion by 2032 and grow at a CAGR of 20.8% over the forecast period of 2024-2032.

Get More Information on Polymer Solar Cells Market - Request Sample Report

One of the major drivers for expanding the product segment for the polymer solar cells market is the increasing demand for renewable energy. Global tendency towards using renewable energy is becoming evident governments, industries, and consumers are moving to it as a way to decrease carbon emissions and dependency on fossil fuels. Solar energy especially has been gaining traction as it is abundant, scalable, and cheaper. Polymer solar cells are an outstanding type of solar technology that has been gaining growing interest as a viable, low-cost, flexible, and large-scale applicable alternative to rally around residential and commercial buildings and portable solar systems instead of silicon-based solar cells. The increasing focus on renewable energy sources along with the decarbonization initiatives are increasing polymer solar cell acceptance which in turn is driving the growth of the market. Moreover, other government policies like subsidies, tax credits, clean energy targets, etc. promote the shift to solar sources of energy and all these factors together will act as a driver for the polymer-based solar technologies market.

The U.S. Energy Information Administration (EIA) reported that in 2021, solar power contributed approximately 3.3% to the U.S. electricity generation mix. The Biden Administration's 2021 American Jobs Plan proposed a target to cut carbon emissions by 50% to 52% by 2030, with a focus on expanding renewable energy sources, including solar.

Rapidly growing commercial and residential solar installation is a major factor driving the growth of the polymer solar cells market. With energy prices climbing and people getting more conscious about keeping the environment healthy, both businesses and households are looking for long-term, sustainable, and economical energy solutions. With the economic cost-effectiveness, lower carbon footprint, and energy independence that solar power offers, it has emerged as a preferred option. The design of polymer solar cells is lightweight, flexible, and suitable for appearance integration, so they are suitable for building integrations, roof power generation, and even window power generation. In the commercial sector, businesses are turning to rooftop solar installations to achieve corporate sustainability targets, lower operating costs and meet regulatory requirements for renewable energy consumption. On the other hand, several government incentives, including tax credit programs, grants, and rebates, are contributing to more accessible solar systems for households in residential installations. On the other hand, polymer solar cells are gaining traction with its growing demand for customizable and flexible solar solutions suitable for non-planar surfaces. The increasingly widespread adoption in both the commercial and residential sectors highlights the significant contribution of polymer solar cells to the sustainable energy transformation.

According to the European Commission, the EU added over 41 GW of solar capacity in 2022, the highest annual addition ever, driven by increasing adoption in both residential and commercial sectors.

Drivers

Increasing government initiatives that promote the use of solar energy drives market growth.

One of the most important factors creating demand for polymer solar cells over the forecast period are increasing government initiatives to adopt solar energy. Various nations and countries around the world --particularly those in the developed world-- are laying out lofty plans filled with policy, subsidies, and programs to accelerate the rollout of renewable energy and carbon neutrality goals. Such measures include tax credits, grants, feed-in tariffs, and loans at below-market interest rates, which have reduced the costs of solar energy systems for residential, commercial, and industrial users. Furthermore, regulation, especially renewable portfolio standards (RPS) and net metering policies, will force many governments to use renewable energy, thereby making solar energy more popular. As an example, the European Green Deal requires the European Union, as a whole, to reach at least 40% renewable energy by 2030, which will translate into increasing demand for innovative solar technologies such as polymer solar cells. In much the same way, the U.S. Inflation Reduction Act of 2022 contains hundreds of billions in grants and tax credits for the expansion of solar energy. These are because these measures further minimize the financial barriers for consumers while also stimulating the development of advanced solar technologies in the form of polymer solar cells, making them efficient and accessible and eventually pervasive.

Restraint

High cost associated with the production of polymer solar cells may hamper the market growth.

The major hurdles for market growth are the cost involved in the manufacturing of polymer solar cells. Polymer solar cells promise the combination of being lightweight, flexible, and environmentally friendly, but their production processes are largely based on costly raw materials, sophisticated fabrication, and special tools. The advancement of these organic electronics, for example, the synthesis of high-performance conductive polymers and organic semiconductors, is sometimes, however, costly and restricts scaling up capability. Moreover, it is still expensive, as continuous development is needed to reach the same stability and efficiency as regular silicon-based solar cells. This translates to an inability to pass these auxiliary expenses to consumers, which in turn makes polymer solar cells less competitive in more price sensitive markets. In addition, low economies of scale and a smaller manufacturing base as compared to silicon-based solar technologies also lead to the high cost of production. This, paired with their potential, means specialists are reluctant to switch to polymer solar cells until these come down in price through improved technology and production volumes.

Market segmentation

By Junction Type

The bulk heterojunction segment held the largest market share around 48% in 2023. BHJ solar cells are distinct in their architecture, where donor and acceptor materials are mixed in a single layer to create a nanoscale interpenetrating network. Such an architecture maximizes the interface for charge separation and also provides efficient charge transport, leading to improved power conversion efficacies compared to single-layer or bilayer systems. Moreover, BHJ cells are relatively simple to fabricate through solution-based methods such as spin coating or roll-to-roll printing, which are scalable and affordable methods for mass production. Their compatibility with different substrates, such as bendable and thin substrates, also makes them very useful for different applications, such as portable electronics, building-integrated photovoltaics (BIPV), and wearable devices. Meanwhile, ongoing R&D naturally further enhanced the stability and performance of BHJ polymer solar cells, assuring their market dominance compared to other competing architectures such as single-layer, bilayer, or multi-junction structures.

By Technique

The printing technique segment held the largest market share around 68% in 2023. It is owing to its mass constructability, cost-efficient and cost-efficient for mass scale production. Roll-to-roll printing, inkjet printing, and screen printing facilitate a cost-efficient and scalable manner of fabricating large-scale solar cells. Such methods are especially beneficial for the fabrication of lightweight and flexible polymer solar cells that are progressively being employed in portable electronics, building-integrated photovoltaic (BIPV), and other novel applications. Especially, product scale-up on flexible substrates through roll-to-roll process can greatly decrease production cost and lead to an affordable commercial application of polymer solar cells. In addition, in terms of print methods, printing as well allows for flexibility and makes it suitable for different consumer and industrial applications as it can be customized to fit different designs and sizes.

By Forms

Panels held the largest market share around 49% in 2023. This is due to their widespread adoption in commercial, residential, and industrial applications. Panels offer the most robust and practical solution for energy generation, providing high power output and durability compared to other formats like foils and stickers. Polymer solar panels are often integrated into traditional photovoltaic systems, making them an appealing choice for rooftop installations, solar farms, and building-integrated photovoltaics (BIPV). Their larger surface area compared to stickers and foils allows for greater energy absorption, improving overall efficiency and energy yield. Additionally, advancements in polymer solar technology have enabled the development of lightweight and flexible panels that are easier to install and transport, further boosting their popularity.

By Application

BIPV (Building Integrated Photovoltaic) held the largest market share around 35% in 2023. It is due to its advantage of integrating solar power generation into a facility, which also has an aesthetic value–such as in the case of a building. Building integrated photovoltaic, or BIPV, systems incorporate solar cells within building elements such as windows, façades and roofs, offering both an energy generation function and building material functionalities. Its seamless integration not only saves space but it also elevates the aesthetics of buildings, making it an ideal solution for architects, developers, and home builders looking to add sustainability to their designs. With rapid urbanization and high demand for energy efficient buildings, BIPV has gained attention a critical solution to provide energy independence and sustainability objectives. However, polymer solar cells are both flexible and thus lightweight, which makes them ideal for BIPV applications as they can be shaped to conform to building contours with little to no lost efficiency or performance.

Regional Analysis

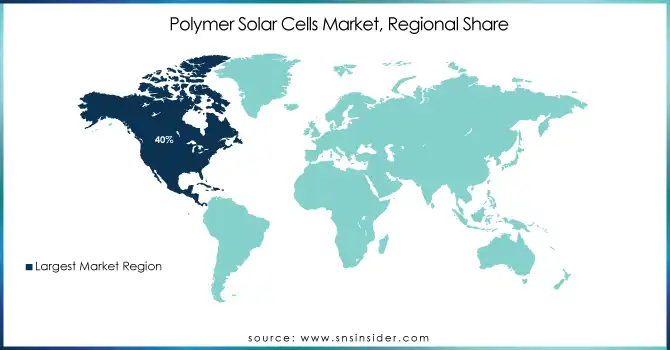

North America region held the major share of the polymer solar cells market of more than 40% in 2022. The US is the dominating country in this region. This surge is primarily attributed to the increasing number of renewable energy initiatives taking place throughout the region. Renewable energy projects, such as solar farms and installations, have experienced a substantial increase in North America. This surge can be attributed to various factors, including the growing awareness of the environmental impact of traditional energy sources, the need for sustainable energy solutions, and government incentives promoting the adoption of renewable energy. Furthermore, the North American region boasts a favorable regulatory environment that encourages the development and implementation of renewable energy projects. Government policies and initiatives, such as tax incentives, grants, and subsidies, have played a pivotal role in attracting investments and fostering the growth of the polymer solar cells market.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

Tata Power Solar Systems Limited (Solar Panels, Solar Rooftop Solutions)

Jinko Solar Holding Co. Ltd (Jinko Solar Panels, Solar Module Solutions)

Suniva Inc (High-Efficiency Solar Cells, PERC Solar Modules)

Borg Inc. (BIPV Modules, Flexible Solar Cells)

Heliatek GmbH (HeliaFilm, Organic Solar Cells)

Trina Solar Limited (Trina Solar Panels, Vertex Modules)

Solar World AG (Solar Panels, Solar Modules)

Alps Technology Inc (Flexible Solar Panels, Thin-Film Solar Modules)

Pionis Energy Technologies LLC (Flexible Solar Cells, BIPV Solutions)

Infinity PV ApS (Organic Photovoltaic Modules, Flexible Solar Film)

First Solar, Inc. (Series 6 Modules, Thin-Film Solar Modules)

Hanergy Thin Film Power Group (HanTile, Flexible Solar Panels)

Sharp Corporation (Mono Solar Panels, Residential Solar Systems)

LG Electronics (LG NeON Solar Panels, Residential Solar Modules)

REC Group (REC Alpha Series, REC TwinPeak Panels)

Sungrow Power Supply Co., Ltd. (Solar Inverters, Energy Storage Systems)

LONGi Solar (Hi-MO Series Modules, Monocrystalline Solar Panels)

Canadian Solar (KuMax Modules, Solar PV Modules)

Kyocera Corporation (Solar Modules, BIPV Systems)

Panasonic Corporation (HIT Solar Panels, HIT Double Solar Modules)

Recent Development:

In 2023: Tata Power Solar announced the successful commissioning of a 100 MW solar power project in the state of Rajasthan, marking a significant step in their renewable energy expansion.

In 2023: Jinko Solar introduced the Jinko Tiger Pro 78-cell module, designed to deliver increased efficiency and lower LCOE (Levelized Cost of Electricity), enhancing the performance of solar power generation.

In 2022, Suniva launched the OPTIM High Efficiency Solar Modules with advanced PERC (Passivated Emitter and Rear Cell) technology, offering increased energy generation efficiency for residential and commercial markets.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.1 Billion |

| Market Size by 2032 | US$ 5.9 Billion |

| CAGR | CAGR of 20.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Junction Type (Single Layer, Bilayer, Bulk Heterojunction, Multi-Junction, Others) • By Application (Bipv (Building Integrated Photovoltaic), Consumer Electronics, Automotive, Defense, Others) • By Technique (Printing Technique, Coating Technique) • By Forms (Foils, Panels, Stickers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Tata Power Solar Systems Limited, Jinko Solar Holding Co. Ltd, Suniva Inc, Borg Inc., Heliatek GmbH, Trina Solar Limited, Solar World AG, Alps Technology Inc, Pionis Energy Technologies LLC, Infinity PV ApS, and other players. |

| Drivers | • Increasing government initiatives that promote the use of solar energy drives market growth.. |

| Restraints |

• High cost associated with the production of polymer solar cells may hamper the market growth. |

Ans: Manufacturers, Consultant, aftermarket players, association, Research institute, private and universities libraries, suppliers and distributors of the product.

Ans: The polymer solar PV cells market may be divided into Europe, North America, Asia Pacific, Latin America, and the Middle East and Africa based on region.

Ans: Increasing government initiatives that promote the use of solar energy drives market growth.

Ans: Clean energy sources are becoming more popular are the restraints for Polymer Solar Cells Market.

The Polymer Solar Cells Market size was USD 1.1 Billion in 2023 and is expected to reach USD 5.9 Billion by 2032 and grow at a CAGR of 20.8% over the forecast period of 2024-2032.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 By Production Capacity and Utilization, by Country, By Type, 2023

5.2 Feedstock Prices, by Country, By Type, 2023

5.3 Regulatory Impact, by l Country, By Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, Type, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Polymer Solar Cells Market Segmentation, by Junction Type

7.1 Chapter Overview

7.2 Single Layer

7.2.1 Single Layer Market Trends Analysis (2020-2032)

7.2.2 Single Layer Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Bilayer

7.3.1 Bilayer Market Trends Analysis (2020-2032)

7.3.2 Bilayer Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Bulk Heterojunction

7.4.1 Bulk Heterojunction Market Trends Analysis (2020-2032)

7.4.2 Bulk Heterojunction Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Others

7.4.1 Others Market Trends Analysis (2020-2032)

7.4.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Polymer Solar Cells Market Segmentation, By Technique

8.1 Chapter Overview

8.2 Printing Technique

8.2.1 Printing Technique Market Trends Analysis (2020-2032)

8.2.2 Printing Technique Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Coating Technique

8.3.1 Coating Technique Market Trends Analysis (2020-2032)

8.3.2 Coating Technique Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Polymer Solar Cells Market Segmentation, By Forms

9.1 Chapter Overview

9.2 Foils

9.2.1 Foils Market Trends Analysis (2020-2032)

9.2.2 Foils Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Panels

9.3.1 Panels Market Trends Analysis (2020-2032)

9.3.2 Panels Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Stickers

9.4.1 Stickers Market Trends Analysis (2020-2032)

9.4.2 Stickers Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Polymer Solar Cells Market Segmentation, by Application

10.1 Chapter Overview

10.2 BIPV (Building Integrated Photovoltaic)

10.2.1 BIPV (Building Integrated Photovoltaic) Market Trends Analysis (2020-2032)

10.2.2 BIPV (Building Integrated Photovoltaic) Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Consumer Electronics

10.3.1 Consumer Electronics Market Trends Analysis (2020-2032)

10.3.2 Consumer Electronics Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Automotive

10.4.1 Automotive Market Trends Analysis (2020-2032)

10.4.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Billion)

10.5 Defense

10.5. Defense Market Trends Analysis (2020-2032)

10.5.2 Defense Market Size Estimates and Forecasts to 2032 (USD Billion)

10.6 Others

10.6.1 Others Market Trends Analysis (2020-2032)

10.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Polymer Solar Cells Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.2.4 North America Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.2.5 North America Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.2.6 North America Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.2.7.2 USA Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.2.7.3 USA Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.2.7.4 USA Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.2.8.2 Canada Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.2.8.3 Canada Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.2.8.4 Canada Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.2.9.2 Mexico Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.2.9.3 Mexico Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.2.9.4 Mexico Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Polymer Solar Cells Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.3.1.7.2 Poland Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.3.1.7.3 Poland Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.3.1.7.4 Poland Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.3.1.8.2 Romania Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.3.1.8.3 Romania Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.3.1.8.4 Romania Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Polymer Solar Cells Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.3.2.4 Western Europe Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.3.2.5 Western Europe Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.3.2.6 Western Europe Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.3.2.7.2 Germany Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.3.2.7.3 Germany Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.3.2.7.4 Germany Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.3.2.8.2 France Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.3.2.8.3 France Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.3.2.8.4 France Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.3.2.9.2 UK Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.3.2.9.3 UK Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.3.2.9.4 UK Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.3.2.10.2 Italy Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.3.2.10.3 Italy Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.3.2.10.4 Italy Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.3.2.11.2 Spain Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.3.2.11.3 Spain Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.3.2.11.4 Spain Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.3.2.14.2 Austria Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.3.2.14.3 Austria Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.3.2.14.4 Austria Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4 Asia-Pacific

11.4.1 Trends Analysis

11.4.2 Asia-Pacific Polymer Solar Cells Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia-Pacific Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.4.4 Asia-Pacific Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.4.5 Asia-Pacific Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.4.6 Asia-Pacific Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.4.7.2 China Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.4.7.3 China Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.4.7.4 China Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.4.8.2 India Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.4.8.3 India Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.4.8.4 India Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.4.9.2 Japan Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.4.9.3 Japan Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.4.9.4 Japan Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.4.10.2 South Korea Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.4.10.3 South Korea Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.4.10.4 South Korea Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.4.11.2 Vietnam Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.4.11.3 Vietnam Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.4.11.4 Vietnam Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.4.12.2 Singapore Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.4.12.3 Singapore Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.4.12.4 Singapore Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.4.13.2 Australia Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.4.13.3 Australia Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.4.13.4 Australia Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.14 Rest of Asia-Pacific

11.4.14.1 Rest of Asia-Pacific Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia-Pacific Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia-Pacific Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia-Pacific Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Polymer Solar Cells Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.5.1.4 Middle East Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.5.1.5 Middle East Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.5.1.6 Middle East Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.5.1.7.2 UAE Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.5.1.7.3 UAE Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.5.1.7.4 UAE Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Polymer Solar Cells Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.5.2.4 Africa Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.5.2.5 Africa Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.5.2.6 Africa Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Polymer Solar Cells Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.6.4 Latin America Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.6.5 Latin America Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.6.6 Latin America Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.6.7.2 Brazil Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.6.7.3 Brazil Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.6.7.4 Brazil Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.6.8.2 Argentina Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.6.8.3 Argentina Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.6.8.4 Argentina Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.6.9.2 Colombia Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.6.9.3 Colombia Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.6.9.4 Colombia Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Polymer Solar Cells Market Estimates and Forecasts, by Junction Type (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Polymer Solar Cells Market Estimates and Forecasts, By Technique (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Polymer Solar Cells Market Estimates and Forecasts, By Forms (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Polymer Solar Cells Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

12. Company Profiles

12.1 Tata Power Solar Systems Limited

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Jinko Solar Holding Co. Ltd

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Suniva Inc

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Borg Inc.

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Heliatek GmbH

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Trina Solar Limited

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Solar World AG

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 Alps Technology Inc

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Pionis Energy Technologies LLC

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Infinity PV ApS

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments

By Junction Type

Single Layer

Bilayer

Bulk Heterojunction

Others

By Technique

Printing Technique

Coating Technique

By Forms

Foils

Panels

Stickers

By Application

BIPV (Building Integrated Photovoltaic)

Consumer Electronics

Automotive

Defense

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Ethylene Vinyl Acetate Market Size was valued at USD 11.0 billion in 2023 and is expected to reach USD 19.2 billion by 2032 and grow at a CAGR of 6.4% over the forecast period 2024-2032.

Texture Paint Market was valued at USD 12.51 Billion in 2023 and is expected to reach USD 18.47 Billion by 2032, growing at a CAGR of 4.43% from 2024-2032.

The Nano Fertilizer Market Size was valued at USD 3.55 billion in 2023, and is expected to reach USD 12.01 billion by 2032, and grow at a CAGR of 14.5% over the forecast period 2024-2032.

The Algae Biofuel Market Size was valued at USD 9.08 billion in 2023 and is expected to reach USD 18.66 billion by 2032 and grow at a CAGR of 9.58% over the forecast period 2024-2032.

The ETFE Market Size was valued at USD 463.22 million in 2023 and is expected to reach USD 862.42 million by 2032 and grow at a CAGR of 7.15% by 2024-2032.

Organic Chemicals Market was valued at USD 12.75 billion in 2023 and is expected to reach USD 24.25 billion by 2032, growing at a CAGR of 7.40% from 2024-2032.

Hi! Click one of our member below to chat on Phone