Get More Information on Polyimide Films and Tapes Market - Request Sample Report

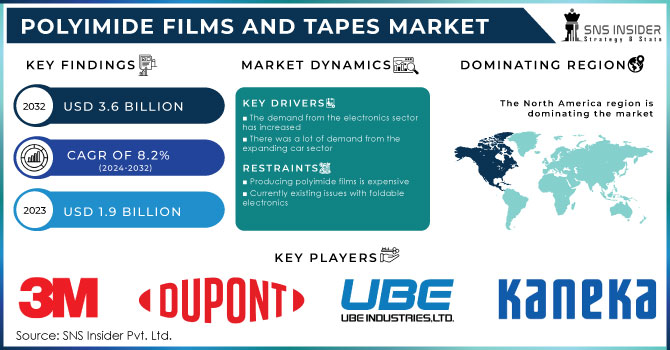

The Polyimide Films and Tapes Market size was valued at USD 1.9 Billion in 2023. It is expected to grow to USD 3.6 Billion by 2032 and grow at a CAGR of 8.2% over the forecast period of 2024-2032.

Polyimide films are increasingly used in solar panel manufacturing due to their ability to withstand environmental stressors. The growing focus on renewable energy solutions and solar technology is contributing to market growth. Moreover, the growth of the polyimide films and tapes industry is likely to be driven by the growth of the electronics and automotive industries. Polyimide films and tapes can withstand extreme temperatures, making them ideal for various automotive applications. In internal combustion engines and electric vehicles (EVs), components such as sensors, wiring, and insulation must endure high heat. The ability of polyimide materials to maintain performance under such conditions is crucial for enhancing vehicle reliability and longevity.

Polyimide films' thermal and mechanical properties are better than other polymers, driving up market demand. The industry is also growing because more and more people want flexible display and optoelectronics transparent polyimide films, and more and more aerospace applications are using them. But things like highs and lows in polyimide film prices and strict environmental rules and regulations will likely slow market growth over the next few years.

In 2023 when DuPont, a leading player in the industry, launched a new line of transparent polyimide films specifically designed for flexible display and optoelectronic applications. This innovation addresses the growing demand for high-performance, durable materials that maintain optical clarity and flexibility, particularly in advanced electronics and aerospace industries.

Moreover, Polyimide films are required in aerospace and defense because they are resistant to heat and capable of functioning under any conditions. These films are ideal for insulation and other vital functions because they are so strong and are not easily damaged by these properties. The aerospace industry is growing, and more advanced materials that can withstand these higher temperatures and harsher conditions are needed. This film is also beneficial because it can be relied on to work as wiring insulation, thermal barriers, and as part of the plane’s structure.

The Federal Aviation Administration states that the aerospace industry in the U.S. will rise by 4.3% every year through 2030 because of higher defense budgets and availability. More growth is expected as commercial air travel keeps increasing. This overall requirement for higher temperatures and harsher conditions propels the need for materials such as polyimide films, as they are stable, long-lasting, and can better protect those materials being applied to them.

Drivers

The demand from the electronics sector has increased

There was a lot of demand from the expanding car sector

It has superior thermal and mechanical qualities in comparison to other polymers

This polymer outperforms its competitors with extraordinary performance qualities, standing out for its superior thermal and mechanical capabilities. It stands out as a strong material option for a variety of applications due to its exceptional resistance to heat, impact, and wear. It stands out in a variety of sectors due to its improved tensile strength, flexibility, and durability. This polymer's exceptional mechanical strength and thermal stability provide a compelling advantage in engineering and manufacturing, enabling the creation of goods and components that can survive challenging conditions and provide dependable performance over protracted periods of usage.

According to the National Institute of Standards and Technology (NIST), polyimide films can withstand temperatures up to 500°F (260°C) without losing their mechanical integrity. This high thermal resilience allows them to outperform many other polymers in critical applications, such as aerospace, where materials must endure extreme temperatures and stress conditions. Additionally, NIST data highlights that polyimide films have an impressive tensile strength of up to 231 MPa, making them exceptionally durable and suitable for applications that require long-term reliability.

Restraint

Producing polyimide films is expensive

Currently existing issues with foldable electronics

Numerous current issues with foldable electronics prevent its broad use. The lifetime of flexible screens and other components is a major worry, as frequent folding and unfolding can shorten their lifespan. Technical challenges arise when assuring smooth operation and user experience across different form factors, particularly when it comes to software optimization and app compatibility. The complexity and high cost of the foldable display manufacturing process affect the Scalability and cost of manufacturing. To solve these problems, improvements in materials science, engineering, and software development are needed to produce durable, usable, and financially feasible foldable electronic devices that can sustain everyday usage.

Opportunity:

It is increasingly being used in aerospace applications

Since polyimide films are transparent, they are suitable for flexible displays and optoelectronics

Due to their transparency and superior thermal stability, polyimide films stand out as a top option for flexible displays and optoelectronics applications. Because of their intrinsic transparency, they provide vivid, high-quality images while keeping their structural integrity when twisted or folded. Polyimide films are an excellent choice for the creation of flexible displays, wearable technology, and other cutting-edge display technologies due to their distinctive transparency and flexibility. Their incorporation into several optoelectronic components, including touch sensors, organic light-emitting diodes (OLEDs), and solar cells, is made possible by their longevity and tolerance to high temperatures, which guarantee consistent performance. Because they provide a solid foundation for creating cutting-edge displays and optoelectronic systems, polyimide films therefore play a crucial role in expanding the field of flexible electronics.

By Application

Flexible printed circuits segment held a market share of about 54% in 2023. The increase in the growth of electronics and the rise of the electrification trend in the automotive sector, keep on increasing the FPC demand, which keeps on attracting the polyimide makers to expand their product portfolio in the application segment. It is widely used as a connector in myriad applications, where the production constraints, space savings, and flexibility restrict the serviceability of the rigid circuit board further contributing to the polyimide films market growth.

Specialty fabricated products are an emerging application segment of polyimide films, which is projected to gain a higher market share at a healthy growth rate. The increase in consumer electronics technology is increasing the new application scope for SFP. The SFP produced by these films of polyimide has a unique ability to operate at low and high operating temperatures.

By End-Use Industry

Automotive held the largest market share around 30% in 2023. Most cars now contain polyimide films, and the increasing production of cars and the increased share of electric cars drive demand. Many automotive applications include EGR valve bushings, thrust washers, seat sensor applications, and traction applications. Powertrain applications are not exposed to high temperatures, which also requires materials to be exposed to high thermal, mechanical, and electrical loads. The reinforced polyimide film is the fastest-growing region of the polyimide film segment, as next-generation compact cars are becoming more and more popular, providing more performance in one relatively small car. The increased emphasis on lightweight vehicles is also driving polyimide market growth and increased use in automotive applications. They are expected to occupy a greater market share in the automotive industry within the estimation period, as their unique features are capable of meeting the challenging demands of the automotive sector.

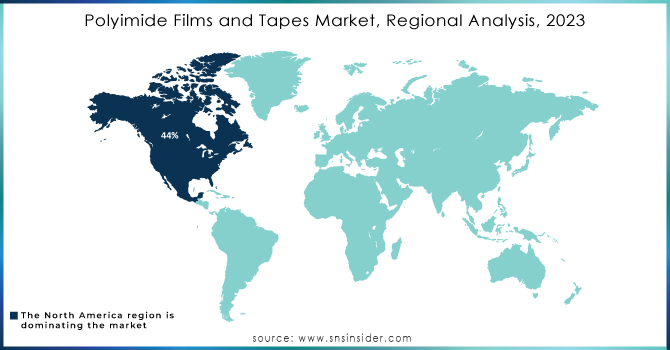

North America held the largest market share around 44% in 2023. North America drives the highest market share in the polyimide films market. The presence of major regions such as the US forming part of the leading manufacturers of aerospace platforms and automotive configurations has generated massive demand for polyimide films. The established aerospace industry in North America drives the consumption of sophisticated materials, including polyimide films as the materials can withstand high temperatures and stringent operational conditions. The U.S. aerospace and defense industries contributed over USD391 billion to the economy in 2022, depicting the high level of applications of the aerospace platforms in the region.

Conversely, polyimide film manufacturing companies and leading technologically oriented companies are based in the region, further advancing in material capabilities. In addition, North America built a massive consumption curve of polyimide films, based on the established electronics industry consuming the materials on flexible displays, semiconductors, and optoelectronics. Lastly, government regulations support technological advancements and investments in defense within the region, conducting a sustainable support curve for the polyimide markets.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

Raw Key Manufacturers

DuPont de Nemours and Company (Kapton)

PI Advanced Material Co., Ltd. (PI-8000)

Ube Industries Ltd. (UBE Polyimide Film)

3M Company (3M Polyimide Film Tape 5413)

Kaneka Corporation (Kaneka Polyimide Film)

Arakawa Chemicals Industries Inc. (Arofilm)

Taimide Tech. Inc. (Taimide PI Film)

Flexion Company, Inc. (FLEXcon Polyimide Film)

Shinmax Technology Ltd. (Shinmax Polyimide Film)

Kolon Industries Inc. (Kolon Polyimide Film)

Mitsui Chemicals, Inc. (Mitsui Polyimide Film)

Saint-Gobain Performance Plastics (Thermal Insulation Polyimide Films)

Sumitomo Bakelite Co., Ltd. (Sumpoly)

Heraeus Holding GmbH (Heraeus Polyimide Film)

Dongjin Semichem Co., Ltd. (DJC Polyimide Film)

Nitto Denko Corporation (Nitto Polyimide Tape)

Nippon Steel Chemical Co., Ltd. (NS Polyimide Film)

SABIC (SABIC Polyimide Films)

Kaptontape (Kaptontape Polyimide Tape)

Toray Industries, Inc. (Torayca Polyimide Film)

Key Users in End -Use Industry

Boeing

Lockheed Martin

Samsung Electronics

Intel Corporation

General Motors

Ford Motor Company

Verizon Communications Inc.

AT&T Inc.

Siemens AG

General Electric Company

In 2023, Ube unveiled a new range of polyimide films optimized for electric vehicle applications, focusing on enhancing thermal management and electrical insulation in EV batteries.

In 2023, Kaneka developed a new lightweight polyimide film that is being utilized in the aerospace industry for insulation applications, contributing to weight reduction in aircraft.

In 2022, PI Advanced Material Co., Ltd. introduced a high-performance polyimide film that offers improved thermal stability and flexibility, catering to the growing demands of the semiconductor industry.

| Report Attributes | Details |

|---|---|

| Market Size in 2022 | US$ 1.9 Billion |

| Market Size by 2032 | US$ 3.6 Billion |

| CAGR | CAGR of 8.2% From 2024 to 2032 |

| Base Year | 2022 |

| Forecast Period | 2024-2032 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By application (Flexible Printed Circuits, Specialty Fabricated Products, Pressure-Sensitive Tapes, Wires & Cables, Motors/Generators) • By end-use industry (Electronics, Automotive, Aerospace, Labeling, Solar, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | DuPont de Nemours and Company, PI Advanced Material Co., Ltd., 3M Company, Ube Industries Ltd., Kaneka Corporation, Arakawa Chemicals Industries Inc., Taimide Tech. Inc., FLEXcon Company, Inc., Shinmax Technology Ltd., Kolon Industries Inc., and other players. |

| DRIVERS | • The demand from the electronics sector has increased. • There was a lot of demand from the expanding car sector. • It has superior thermal and mechanical qualities in comparison to other polymers. |

| Restraints | • Producing polyimide films is expensive. • Currently existing issues with foldable electronics. |

Ans: E. I. DuPont de Nemours and Company (US), PI Advanced Material Co., Ltd. (South Korea), 3M Company (US), Ube Industries Ltd.(Japan), Kaneka Corporation (Japan), Arakawa Chemicals Industries Inc. (Japan), Taimide Tech. Inc. (Taiwan), FLEXcon Company, Inc. (US), Shinmax Technology Ltd. (Taiwan), Kolon Industries Inc. (South Korea) are the major key players of Polyimide Films and Tapes Market.

Ans: Manufacturers, Consultant, aftermarket players, association, Research institute, private and universities libraries, suppliers and distributors of the product.

Ans: Problems with how polyimide films are made and Getting the chemistry and consistency of a product right are the challenges faced by the Polyimide Films and Tapes Market.

Ans: Demand from the electronics industry has grown, Demand from the growing auto industry was high and Compared to other polymers, it has better thermal and mechanical properties.

Ans: Polyimide Films and Tapes Market Size was valued at USD 1.8 billion in 2021, and expected to reach USD 3.33 billion by 2028, and grow at a CAGR of 8.8 % over the forecast period 2022-2028.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

3.1 Market Driving Factors Analysis

3.1.2 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 PESTLE Analysis

3.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Type, 2023

5.2 Feedstock Prices, by Country, by Type, 2023

5.3 Regulatory Impact, by l Country, by Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, by Application, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new Product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Polyimide Films and Tapes Market Segmentation, by Application

7.1 Chapter Overview

7.2 Flexible Printed Circuits

7.2.1 Flexible Printed Circuits Market Trends Analysis (2020-2032)

7.2.2 Flexible Printed Circuits Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Specialty Fabricated Products

7.3.1 Specialty Fabricated Products Market Trends Analysis (2020-2032)

7.3.2 Specialty Fabricated Products Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Pressure-Sensitive Tapes

7.4.1 Pressure-Sensitive Tapes Market Trends Analysis (2020-2032)

7.4.2 Pressure-Sensitive Tapes Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Wires & Cables

7.5.1 Wires & Cables Market Trends Analysis (2020-2032)

7.5.2 Wires & Cables Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Motors/Generators

7.6.1 Motors/Generators Market Trends Analysis (2020-2032)

7.6.2 Motors/Generators Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Polyimide Films and Tapes Market Segmentation, by End-Use Industry

8.1 Chapter Overview

8.2 Electronics

8.2.1 Electronics Market Trends Analysis (2020-2032)

8.2.2 Electronics Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Automotive

8.3.1 Automotive Market Trends Analysis (2020-2032)

8.3.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Aerospace

8.4.1 Aerospace Market Trends Analysis (2020-2032)

8.4.2 Aerospace Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Labeling

8.5.1 Labeling Market Trends Analysis (2020-2032)

8.5.2 Labeling Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Solar

8.6.1 Solar Market Trends Analysis (2020-2032)

8.6.2 Solar Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Others

8.7.1 Others Market Trends Analysis (2020-2032)

8.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Polyimide Films and Tapes Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.4 North America Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.5.2 USA Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.6.2 Canada Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7.2 Mexico Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Polyimide Films and Tapes Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.5.2 Poland Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.6.2 Romania Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Polyimide Films and Tapes Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.4 Western Europe Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.5.2 Germany Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.6.2 France Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.7.2 UK Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.8.2 Italy Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.9.2 Spain Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.12.2 Austria Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Polyimide Films and Tapes Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.4 Asia Pacific Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5.2 China Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5.2 India Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5.2 Japan Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6.2 South Korea Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7.2 Vietnam Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.8.2 Singapore Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.9.2 Australia Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Polyimide Films and Tapes Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.4 Middle East Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.5.2 UAE Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Polyimide Films and Tapes Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.4 Africa Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Polyimide Films and Tapes Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.4 Latin America Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.5.2 Brazil Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.6.2 Argentina Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.7.2 Colombia Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Polyimide Films and Tapes Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Polyimide Films and Tapes Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Billion)

10. Company Profiles

10.1 DuPont de Nemours and Company

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Product / Services Offered

10.1.4 SWOT Analysis

10.2 PI Advanced Material Co., Ltd.

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Product / Services Offered

10.2.4 SWOT Analysis

10.3 3M Company

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Product / Services Offered

10.3.4 SWOT Analysis

10.4 Ube Industries Ltd.

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Product / Services Offered

10.4.4 SWOT Analysis

10.5 Kaneka Corporation

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Product / Services Offered

10.5.4 SWOT Analysis

10.6 Arakawa Chemicals Industries Inc.

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Product / Services Offered

10.6.4 SWOT Analysis

10.7 Taimide Tech. Inc.

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Product / Services Offered

10.7.4 SWOT Analysis

10.8 FLEXcon Company, Inc.

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Product / Services Offered

10.8.4 SWOT Analysis

10.9 Shinmax Technology Ltd.

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Product / Services Offered

10.9.4 SWOT Analysis

10.10 Kolon Industries Inc.

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Product / Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Application

Flexible Printed Circuits

Specialty Fabricated Products

Pressure-Sensitive Tapes

Wires & Cables

Motors/Generators

By End-Use Industry

Electronics

Automotive

Aerospace

Labeling

Solar

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Polyimide Films and Tapes Market size was valued at USD 1.9 Billion in 2023. It is expected to grow to USD 3.6 Billion by 2032 and grow at a CAGR of 8.2% over the forecast period of 2024-2032.

The NVH Testing Market Size Growth was USD 2.3 billion in 2023 and is expected to reach USD 3.9 billion by 2032 and grow at a CAGR of 6.1% by 2024-2032.

The Hydroxyapatite Market size was USD 2.45 billion in 2023 and is expected to reach USD 4.45 billion by 2032 and grow at a CAGR of 6.85% over the forecast period of 2024-2032.

Synthetic Lubricants Market was valued at USD 42.87 billion in 2023 and is expected to reach USD 56.21 Billion by 2032, growing at a CAGR of 3.07% by 2024-2032.

The Ammonium Sulfate Market Size was valued at USD 4.06 Billion in 2023 and is expected to reach USD 6.15 Billion by 2032, at a CAGR of 4.73% from 2024-2032.

Explore the Fatty Acid Ester Market, including its applications in personal care, pharmaceuticals, and food. Learn about the rising demand for bio-based esters, eco-friendly products, and how fatty acid esters are used in cosmetics, lubricants, and more.

Hi! Click one of our member below to chat on Phone