Polycarbonate Market Report Scope & Overview:

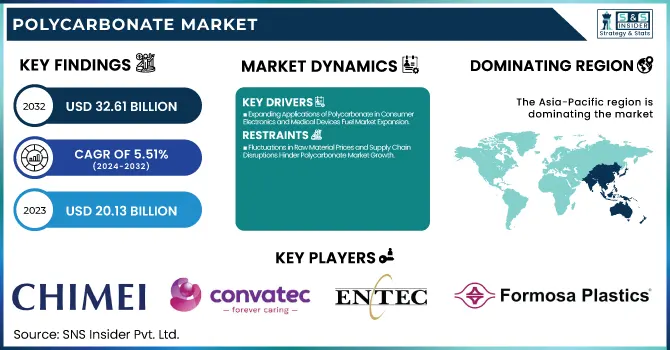

The Polycarbonate Market size was valued at USD 20.13 billion in 2023 and is expected to reach USD 32.61 billion by 2032, growing at a CAGR of 5.51% over the forecast period 2024-2032.

To Get more information on Polycarbonate Market - Request Free Sample Report

Due to the increasing demand for polycarbonate in various industries such as automotive, electronics, and construction, the global polycarbonate market is largely propelled by innovation. Our report is discovering sustainability initiatives in multiple places through bio-based and recycled solutions shaping a greener future. Manufacturers are adjusting to new policies, but the process is also about regulatory compliance. Supply chain innovations make processes more efficient, and changing consumer preferences boost demand for lightweight and durable materials. Polycarbonate serves as a cornerstone of modern manufacturing due to its various advantages, and the market has a significant place in the economy as it helps in industrial growth and technological innovations.

Polycarbonate Market Dynamics

Drivers

-

Expanding Applications of Polycarbonate in Consumer Electronics and Medical Devices Fuel Market Expansion

The use of polycarbonate in consumer electronics, such as optical discs, and in medical devices is a key factor driving market growth. Polycarbonate is lightweight, highly impact-resistant transparent making it useful for manufacturing smartphone bodies, casings for laptops, optical discs, and display panels. The surging adoption of advanced consumer electronics along with the growing penetration of smart devices enhances the demand for durable and attractive materials such as polycarbonate. Additionally, polycarbonate is used by the healthcare industry for medical-grade parts, such as syringes, IV connectors, and surgical instruments, due to its biocompatibility, resistance to sterilization, and ability to be molded into complex shapes. With the increasing need for precision medical devices and wearables, polycarbonate manufacturers are targeting the optimization of several material properties to comply with strict healthcare regulations. The trend of digitization and telemedicine also leads to greater demand for medical-grade polycarbonate. Due to the ongoing advancements in material innovation and growth in healthcare infrastructure developments, the demand in the electronics and medical applications segment of the polycarbonate market is anticipated to experience considerable growth over the next few years.

Restraints

-

Fluctuations in Raw Material Prices and Supply Chain Disruptions Hinder Polycarbonate Market Growth

The market growth is hampered by fluctuating raw material prices and frequent supply chain disruptions. The essential raw materials to produce polycarbonate are bisphenol A (BPA) and phosgene, and they are highly affected by the cost of crude oil, production costs, and geopolitical tensions resulting in fluctuations in prices. Manufacturing efficiency and cost stability are affected by supply chain disruptions such as trade restrictions, transportation constraints, and raw material shortages. The pandemic of COVID-19 has revealed weaknesses in supply chains around the world, causing production slowdowns and longer lead times. Moreover, sales volatility is intensified by strict environmental regulations about BPA and its derivatives, compelling manufacturers to seek alternative feedstocks and greener production processes. Polycarbonate makers also face risks from tariffs, labor shortages, and currency fluctuations tied to their dependence on global supply chains, which pressure margins. Exploring such strategies leads to supply chain optimization, sourcing raw materials from alternative or cheaper suppliers, new technologies that help mitigate risks from such fluctuations, etc.

Opportunities

-

Growing Adoption of Polycarbonate in Green Building and Sustainable Construction Projects Creates Market Expansion Opportunities

The growing emphasis on green building initiatives and sustainable construction practices creates lucrative growth prospects for the polycarbonate market. The demand for high-performance building material components for energy-efficient structures fills the debate: Architects and builders look for durable, lightweight, and energy-efficient materials that respond to current construction standards. Polycarbonate is well suited for roofing panels, skylights, and safety glazing applications due to its excellent thermal insulation, impact resistance, and UV stability. Global governments advocate for energy-efficient building solutions, with polycarbonate sheets as an alternative to regular glass. The high strength-to-weight ratio of the material makes for simple installation, saving on construction costs overall. Moreover, polycarbonate is further being pushed to the fore in contemporary architectural applications through advancements in smart materials and self-cleaning coatings. This preference is aligned with global sustainability goals and is fuelling demand for polycarbonates due to their light weight compared to wood and glass, making them an eco-friendly alternative. Because of the growing trend of urbanization and infrastructure developments, the demand is growing for polycarbonate in commercial and residential construction projects as well.

Challenge

-

Intense Market Competition and Price Pressure from Alternative Materials Create Challenges for Polycarbonate Manufacturers

Strong competition from alternative products, including acrylics, polypropylene, and biodegradable polymers, leads to lower prices for manufacturers in the polycarbonate market. Acrylics have much better optical clarity and scratch resistance for display applications. In packaging and in consumer goods, polypropylene offers even cheaper alternatives, thus adding some pressure on polycarbonate market share. Moreover, the increasing demand for biodegradable and bio-based polymers is also a competitive threat as industries work towards sustainability. Moreover, end-user industries, such as electronics and packaging, have a low tolerance for price increases, in turn creating high competitive rivalry that compels polycarbonate manufacturers to maximize production while ensuring the best quality. Fill in commodity output, burning rubber, ruin Commercial At the same time, commodity companies want to replace commodity output with value perception.

Polycarbonate Market Segments

By Grade

In 2023, the Standard Purpose Grade segment dominated the polycarbonate market, contributing to around 45% of the market share. That dominance stems largely from the widespread use of automotive parts, electrical housings, and multiple industrial applications. For example, in automotive, standard-purpose polycarbonate is preferred for headlamp lenses and interior components owing to its high impact resistance and clarity. Likewise, hot stamping of PEEK and PEI is widely used for durable housings and enclosures in the electrical and electronics industry, due to their thermal stability, and flame-retardant properties. The inherent versatility and cost-effectiveness of the material lead to its preference in a large number of industries, also solidifying its pole position in the market.

By Application

In 2023, the Electrical & Electronics segment dominated and accounted for a significant share of approximately 35% in the Polycarbonate Market, accounting for approximately 35% of the market share. In this sector, the rapid growth of consumer electronics, as well as 5G infrastructure and IoT-enabled devices, has effectively contributed to the demand for polycarbonate. Polycarbonate is used extensively in the manufacture of electronic housings, LED lighting components, and smartphone casings due to its impact resistance and transparency, heat, and flame-retardant capabilities. High-performance materials such as polycarbonate, as highlighted by organizations including the Institute of Electrical and Electronics Engineers (IEEE) and the International Electrotechnical Commission (IEC), are recommended to ensure the safety and durability of the devices. Moreover, government initiatives, such as India’s Production-Linked Incentive (PLI) scheme for electronics manufacturing, have been a major driver of driving domestic manufacturing of polycarbonate-based components, thereby further consolidating its dominance in the electrical & electronics segment).

Polycarbonate Regional Analysis

In 2023, Asia-Pacific dominated and accounted for approximately 45% share of the overall Polycarbonate Market. The leading position is substantially due to its growth in the automotive and electronics industries in great economies such as China, Japan, and India. China polycarbonate market is still the biggest consumer of this product, supported by its automotive industry which manufactured more than 26 million vehicles in 2023 and requires lightweight and durable materials to be utilized in the manufacturing process. Moreover, the rising penetration of electronic devices across the territory and the government's steps to promote the electronics manufacturing sector are also driving the demand for polycarbonate. Japan comes next, with the focus on innovation in consumer electronics contributing to the growth of polycarbonate applications. Moreover, the increasing urbanization and infrastructure development initiatives in India, backed by government initiatives such as Make in India, are expected to drive substantial demand for polycarbonate in construction and electrical applications. All these factors make the Asia-Pacific region the world leader in the polycarbonate market with a strong manufacturing base, along with rising demand from end-users, regionally.

Moreover, North America emerged with the highest growth in the polycarbonate market in 2023, growing at a CAGR of 6.5%. The automotive and building industries have driven this expansion, as lightweight and durable substances grow in demand due to strict fuel efficiency guidelines and building efficiency sustainability. This growth is led by the United States, where the automotive industry is switching to EVs and polycarbonate's use for battery casings and instrument panels is in high demand. Polycarbonate is further encouraged among innovations by the U.S. Department of Energy for its potential to reduce the weight of vehicles and thereby improve overall EV efficiency. Further, extensive investment in the Canadian infrastructure sector, supported by the federal as well as provincial government funding for the modernization of transport networks and buildings, is also expected to enhance the demand for high-performance materials such as polycarbonate. Additionally, the increasing awareness of environmental advantages that the use of recyclable materials in packaging and consumer goods provides is driving the market. Consequently, the North American region is expected to maintain a robust growth pattern propelled by rising applications across industries.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Chi Mei Corporation (General Purpose Polycarbonate, Optical Polycarbonate)

-

Covestro (Makrolon Polycarbonate, Bayblend)

-

Entec Polymers (Polycarbonate Resin, Polycarbonate Compounds)

-

Formosa Plastics Group (Polycarbonate Resin, Optical Grade Polycarbonate)

-

Idemitsu Kosan Co. Ltd. (Polycarbonate Resin, Engineering Plastic Compounds)

-

LG Chem (LG LEXAN Polycarbonate, LG Makrolon)

-

Lotte Chemical (Polycarbonate Resin, Optical Grade Polycarbonate)

-

Mitsubishi Engineering Plastics Corp. (Emtal Polycarbonate, High-Impact Polycarbonate)

-

Mitsubishi Chemical Corporation (Novarex Polycarbonate, Polycarbonate Sheets)

-

RTP Company (RTP 2600 Polycarbonate, Engineering Thermoplastics)

-

SABIC (Ultem Polycarbonate, Lexan Polycarbonate)

-

Teijin Industries (Teijin Tetoron Polycarbonate, Teijin Polycarbonate)

-

Trinseo (Makrolon Polycarbonate, Polycarbonate Resin)

-

Hainan Huasheng New Material Technology Co., Ltd. (Polycarbonate Resin, Engineering Plastics)

-

Luxi Group (Polycarbonate Resin, High-Impact Polycarbonate)

-

MITSUBISHI GAS CHEMICAL COMPANY, INC (Polycarbonate Resin, Optical Grade Polycarbonate)

-

Lone Star Chemical (Polycarbonate Resin, Engineering Plastic Compounds)

-

LOTTE Chemical CORPORATION (Polycarbonate Resin, Optical Grade Polycarbonate)

-

TEIJIN LIMITED (Teijin Polycarbonate, Engineering Plastics)

-

Covestro AG (Makrolon Polycarbonate, Bayblend)

Recent Development:

-

January 2025: Covestro committed to a 9-figure investment in its polycarbonate plant in Ohio. To meet the ever-growing demand for polycarbonate materials, Covestro invested in expanding production capacity and Sustainability Practices up to October 2023.

-

December 2024: SABIC launched new polycarbonate copolymers that are intended to offer improved performance and versatility. These new copolymers were designed to meet the ever-increasing demands of diverse applications, demonstrating SABICs commitment to innovation in the polycarbonate sector.

-

November 2024: Deepak Chem Tech said it would invest a total of ₹5,000 crore in a polycarbonate project. This acquisition was done with the intentions of enhancing the company's production capabilities and fortifying its position in the growing polycarbonate market which was a positive outlook for the industry.

-

November 2024: Trinseo has entered into a sale agreement for its polycarbonate technology license and polycarbonate assets in Stade, Germany, to be sold to Deepak Chem Tech Limited. This initiative was undertaken as part of Trinseo's strategic reorganization, allowing the company to concentrate on its core business areas and providing Deepak Chem Tech with the potential for expansion in the polycarbonate industry.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 20.13 Billion |

| Market Size by 2032 | USD 32.61 Billion |

| CAGR | CAGR of 5.51% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Grade (Standard Purpose Grade, Flame Retardant Grade, Medical Grade, Food Grade, Others) •By Application (Automotive & Transportation, Electrical & Electronics, Construction, Packaging, Consumer Goods, Optical Media, Medical Devices, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Covestro, SABIC, Lotte Chemical, Teijin Industries, Mitsubishi Engineering Plastics Corp., Trinseo, Idemitsu Kosan Co. Ltd., Chi Mei Corporation, LG Chem, Formosa Plastics Group and other key players |