Get more information on Point-of-Sale (POS) Market - Request Sample Report

The Point-of-Sale Market Size was valued at USD 29.0 billion in 2023 and is expected to reach USD 112.6 billion by 2032 and grow at a CAGR of 16.3% over the forecast period 2024-2032.

The point-of-sale market has marked a transformative trend, supported by rapid technological advancement and the preferences of consumers. The most significant of these dynamics is the growing adoption of cloud-based and mobile POS solutions. This is very dominant among merchants, for PYMNTS reported lastly that 71% of merchants expect that software solutions will replace the old POS terminals soon in the coming years, now within 2024. It enhances the flexibility and scalability of systems; it also makes it possible for a business to be able to allow more integrated as well as user-friendly customer experience. Increased Mobile Payment Options The potential retailers must ensure smooth transactions through a system in ways that enhance customer satisfaction and loyalty.

Furthermore, the move towards secure features is one of the dynamics driving this market. As transactions become digitalized, anxiety levels about theft and fraud skyrocket. Advanced POSs are in good sync with the reduction of these risks. Other innovations that are quickly becoming part of the modern POS solution include encryption technologies and biometric authentication. The cutting-edge POS technology plays a critical role in curtailing theft and further strengthening security in retail spaces. Advanced display systems deployed with POS terminals leave no room for theft, and the operations can better manage efficiency.

Recent industry trends exemplify these shifts in dynamics. For example, until May 2024, many important trends have been counted such as the adoption of AI and ML at the point of sale was gaining momentum, as it not only makes current operations more efficient but also gives insights into consumer behavior. It thus enables retailers to redevelop their offerings for competitive advantage. This ability to analyze transactional data in real-time will enable business houses to make the most rational decisions concerning their inventory management and marketing practices, thus ultimately enhancing performance. That kind of trend itself will be proof of a full power shift toward making POS systems smarter and more responsive to market necessities.

In September 2024, the changing retail landscape deeply redefines the POS solutions landscape even further. Any change in the expectations of the customer would necessitate that retailers take on omnichannel strategies providing a universal shopping experience. Much emphasis is being laid today on integrating online and offline channels to let the customer engage with different brands through diverse platforms seamlessly. This omnichannel strategy is critical because it meets the demand of the consumers as well as inspires brand loyalty, which in itself fuels sales growth. The continued evolution of POS technology and the changed consumer behaviors strongly indicate a very dynamic and rapidly evolving landscape.

Drivers:

Growing Demand for Cloud-Based and Mobile POS Solutions Enhances Market Growth

Growing demand for cloud-based and mobile POS solutions is therefore significantly transforming the Point-of-Sale market. Business needs to adapt to the changing tastes of customers who now insist on seamless and flexible payment options. These systems automatically empower retailers with the ability to track data anywhere they are, hence productive inventory management, customer relationship management, and analytics. The ease of access and flexibility with which businesses can work lead to increased efficiency, thus improved customer satisfaction. Last but not least, mobile POS solutions enable retailers to reach their customers in any environment, such as in events outdoors or in pop-up shops. Such an expansion would broaden the marketplace they serve. With thousands of businesses embracing digital transformation and investing in POS technologies, strong growth is likely to prevail in the overall market. Indeed, this integration of mobile payments and cloud computing not only accelerates transactions but also personalizes the shopping experience or experience that consumers want to happen as would be more prized today. This observation results from the shift seen in general toward the offering of digital solutions in retail, which should enable any business with an interest to stay responsive and in competition with consumer behaviors.

Technological Advancements Driving Innovations in POS Systems

Technology is the primary driver of major innovation in the Point-of-Sale market using more complex and efficient systems. It is expected that with the aspirations of retailers to create and enhance their customer's experience while streamlining different operations, they would invest in the most innovative frontier technologies such as artificial intelligence, machine learning, and advanced data analytics. These technologies better POS systems by incorporating functionalities for such features as real-time inventory management and customized marketing. Predictive analytics can also allow for company decision-making that is more effective and based on the knowledge of customer behavior. Security technology improves as encryption and biometric authentication are incorporated about higher concerns about the security of data and increasing fraud cases. On the other hand, all of these technologies ensure that transactions are quite secure, and also instill confidence in the consumer's heart, which is paramount to long-run business success. As more retailers continue to implement these state-of-the-art solutions, the market for advanced POS systems is likely to expand, with more players contributing to a competitive playing field that further stimulates growth in technology. Technology will continually evolve to enable businesses to address the varied needs of their customer base while growing the POS market.

Restraint:

Data Security Concerns Hamper the Growth in the POS Market

Although there has been an array of enhancements in the Point-of-Sale market, data security issues are the most significant restraint affecting its growth. More and more transactions are shifting online, and with the increasing data breach occurrences, people are cautious about letting their personal and financial information out on the web. Alarms have been sounded through high-profile breaches regarding the vulnerabilities of various payment processing systems, and hence the consumers lack trust. This uncertainty leads to lesser adoption rates of new POS technology as a result of protecting sensitive customer information. Also, implementing regulations such as the GDPR brings even higher pressure on companies for their system to respect data protection laws. Businesses would be reluctant to invest in new POS technologies due to the probable cost of a security breach as well as the investment needed to maintain tight security measures. Considering these data security concerns, developing stakeholders in the POS market is of the utmost importance. Companies with secure and transparent operations will probably end up being the ones at the top while greater trust from consumers will strengthen the market.

Opportunity:

Integration of AI and Machine Learning in POS Systems Creates New Opportunities in the Point-of-Sale Market

Huge growth opportunities for Point of Sale abound as the integration of AI and machine learning into the POS systems will enhance the performance efficiency to fulfill customers' needs through richer analytics insights from the AI-driven analytics-the points regarding consumer behavior, purchasing patterns, and market trends that these insights hold can create customized offerings, optimal pricing structures, and personalized marketing campaigns on behalf of the retailers. In addition, AI-based POS systems can automatically execute mundane tasks, such as tracking sales and managing inventory, freeing more time for higher-level strategic initiatives among employees. More importantly, real-time data analysis enables businesses to make better decisions and, therefore, attain higher levels of sales and customer loyalty. The calls for more advanced POS systems would logically increase as more retailers realized the full potential of using AI and machine learning technology. This would not only create innovation in the POS but also bring into the market newer, more dynamic players competing with others, thus creating a lot more competition and drive in that landscape.

Challenge:

Adapting to Rapid Technological Changes in the POS Market Poses a Significant Challenge in Point-of-Sale Market

Adapting to the fast-changing times in technology is one of the significant challenges that stakeholders in the Point-of-Sale market face. Since technology evolves so fast, a business enterprise must dedicate considerable time and money to upgrading its Point-of-Sale systems to be competent in the marketplace. This is relatively challenging to small and medium-sized enterprises that have little resources to engage in availing new technologies or training employees on them. The constant need to upgrade can destabilize and make systems inefficient, which can have a cumulative impact on the overall performance of the business. In addition, as the technology is advanced, employees must continue training in the usage of the latest features of the POS and keep their knowledge continually updated regarding the newer technologies; this can result in heavy loads on resources and time. Making these systems safe and within the ambit of regulation makes it even more complex in the process of adopting technology. This would challenge businesses to manage these challenges in such a manner that innovation does not exceed its true cost. Businesses that can develop a strategic plan for the adoption of technology and training of employees shall face better opportunities to navigate the frenetic pace of the POS marketplace, avoid potential downsides from rapid changes in technology, and enhance their chance at withstanding the hurly-burly of rapid technological changes.

By Component

In 2023, the hardware segment dominated the point-of-sale market, with an estimated market share of approximately 60%. This is largely because in-shop POS terminals with the ability to execute actual face-to-face transactions are highly demanded within the retail and hospitality industries. The hardware products, such as card readers, cash drawers, barcode scanners, and receipt printers, have been the most sought after solutions for companies that would want to offer timely and safe payments. Some of the specific examples of this trend include the equipping of most retailers with contactless payment terminals that are becoming highly popular lately through customers demanding contactless transactions. Other companies such as Square and Verifone have witnessed significant sales in hardware as companies continue to shift towards more complex and user-friendly POS systems. As companies continue to invest in reliable and advanced hardware that ensures customer experience with streamlined operations, the hardware segment will lead the market in the Point-of-Sale market.

By Type

Fixed POS dominated the Point-of-Sale market in 2023, with an estimated market share of around 65%. This is because the established market consumes traditional point-of-sale systems in retail environments-these include grocery stores, restaurants, and large retail chains-all of which require reliability and functionality. Fixed POS systems do usually provide strong features, including sophisticated inventory management functionality, detailed sales reporting, and customer relationship management features, which most businesses processing an enormous volume of transactions require. For example, market leaders NCR and Toshiba are still leading in providing full fixed POS solutions tailored for various industries. Their systems not only facilitate multiple payment platforms but are also seamless with all other business operations that help in the efficient management of sales and inventory. For these very reasons, the fixed POS segment would probably continue to maintain a considerable share in the market, particularly because businesses in general are looking for dependable solutions to be able to achieve operational efficiencies as well as the best possible customer experience.

By Deployment Mode

Cloud-based deployment mode dominated the Point-of-Sale market in 2023, holding an estimated market share of more than 70%. This is due to the increased use of cloud-based solutions by retail and service providers in search of greater flexibility, scalability, and cost-effectiveness in their operations. Businesses that implement cloud-based POS systems can access real-time data from anywhere and update such applications to enhance inventory management, sales tracking, and customer relationship management. Examples include Shopify and Square, which are cloud POS providers that were able to be very successful because they are easy to use and accessed by small and medium-sized businesses to manage both transactions and analytics. Additionally, the advantage that a company does not have to set up extended IT infrastructure for the update of software automatically and integration into other applications in the business makes the cloud more attractive than on-premise deployment. Because more and more organizations become aware of the benefits that cloud technology can be advantageous for, it will certainly expand as the leading demand for POS cloud systems in the market.

By Organization Size

In 2023, the small and medium enterprise (SME) segment dominated the Point-of-Sale market, with an estimated market share of about 60%. With a significant rise in SMEs taking up POS systems for improved efficiency and customer experience, this share is held to be huge. In this dynamic retail environment, small businesses will need to compete effectively; towards this goal, they are starting to look for low-cost, scalable POS solutions that offer all the functionality they need without the layers of complexity and cost traditionally inherent in systems for large enterprises. For example, Square and Shopify have customized their offer for the SME sector by constructing friendly-to-use cloud-based POS systems through which transactions, inventory, and customer relationships may be managed together. The trend has gained further impetus with mobile payment options on the rise and increasing focus on digital transformation, allowing small and medium enterprises to embrace advanced POS technologies hitherto accessible only to larger organizations. With the demand for efficient and cost-effective POS solutions still growing, the SME segment is likely to be the dominant market segment.

By End-user

The retail segment dominated the Point-of-Sale market in 2023 with an estimated market share of around 50%. This leading presence was heavily influenced by the underlying factor of increasing adoption rates among retailers who embrace advanced POS systems to improve customer experience levels and workflow. Retail businesses, from small boutiques to huge department stores, utilize POS systems not only to process transactions but also to manage inventory, loyalty schemes, and sales analytics. For instance, giant retailers such as Walmart and Target have developed highly advanced POS solutions that are synchronized with their e-commerce solutions, thus offering seamless omnichannel shopping experiences to consumers. Of course, the smaller players will consider available options from the likes of Shopify and Square, who provide tools that are designed to take advantage of the efficacy of in-store sales while driving efficiencies in the business. And as the retail sector continues on its journey of transformation, led by the nascent use of contactless payments and following through on e-commerce tie-ins, there should be little let-up in the volumes of robust, flexible POS that continue to support the retail cluster's strong market leadership.

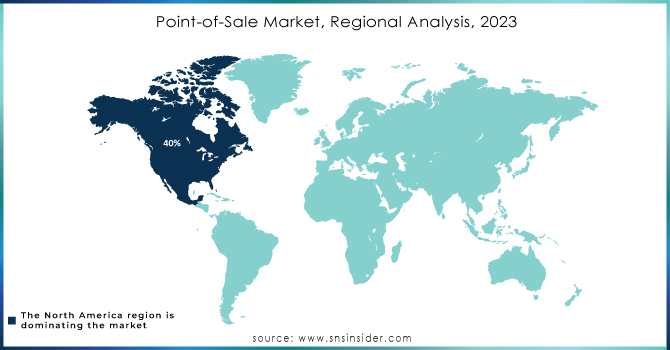

In 2023, the North American region dominated the Point-of-Sale market with an estimated market share of around 40%. This is because of the sort of high, technological basis of infrastructure set up by the electronic payment solutions of the businesses in the region. Major POS providers names include Square, Clover, and Verifone-have become significant drivers of growth in the market, largely through innovative solutions tailored to specific industries, hospitality, and health, among others. Also, with the growing demand from consumers for contactless payments and mobile transactions, retailers and other service-providing firms have upgraded their POS systems in line with the evolving demands of customers. For example, the growth of North American e-commerce-based companies has led to an immediate requirement for enhancing the POS systems that can monitor sales both off-premise and online to accelerate the region's dominance in the market.

Additionally, the fastest growth was led by the Asia-Pacific region, increasing by about 15% CAGR. This is mainly due to the fast-growing adoption of mobile payment solutions as well as smartphone penetration across China, India, and Japan. Increasing retail in the region leads to growing demand for efficient, flexible, and capable POS systems to support large volumes of transactions. For instance, the easy mobile POS solutions provided by companies like Paytm in India to enable small businesses to accept digital payments seamlessly can be used as a good example. The efforts of digital transformation and increasing customer experience are also compelling retail in Asia-Pacific to invest in the state-of-the-art technologies of POS machines, so it is a hotbed for innovation and growth in the global Point of Sale market.

Need any customization research on Point-of-Sale (POS) Market - Enquiry Now

September 2024: MarketPay launched a new generalized point-of-sale purchase solution to simplify transactions and make the customer experience better for business entities.

August 2024: Salesforce acquired the POS start-up PredictSpring to strengthen its Commerce Cloud services and improve retail point-of-sale solutions.

January 2023: VMware modernized retail point-of-sale systems with cutting-edge technologies to enhance efficiency, security, and experience in transactions.

Clover Network, Inc. (Clover Station, Clover Mini, Clover Flex)

H&L POS (H&L POS, H&L Online Ordering, H&L Reporting)

IdealPOS (IdealPOS, IdealPOS Cloud, IdealPOS Mobile)

Lightspeed (Lightspeed Retail, Lightspeed Restaurant, Lightspeed eCommerce)

NCR Corporation (NCR Silver, NCR FastPay, NCR Counterpoint)

Oracle Micros (Oracle Micros Simphony, Oracle Micros OPERA, Oracle Micros Cloud Services)

Revel Systems (Revel POS, Revel Kitchen Display System, Revel Loyalty)

Shopify (Shopify POS, Shopify Retail Kit, Shopify Payments)

Square Inc. (Square POS, Square Register, Square Reader)

SwiftPOS (SwiftPOS Front of House, SwiftPOS Back of House, SwiftPOS Loyalty)

Toast (Toast POS, Toast Go, Toast Kitchen Display System)

TouchBistro (TouchBistro POS, TouchBistro Reservations, TouchBistro Payments)

Vend (Vend POS, Vend Inventory Management, Vend eCommerce)

Verifone (Verifone VX 820, Verifone P400, Verifone Engage Series)

Windcave (Windcave Payment Gateway, Windcave SmartPay, Windcave In-Store Solutions)

Zettle (Zettle Reader, Zettle Go, Zettle for eCommerce)

Squirrel (Squirrel POS, Squirrel Mobile, Squirrel Loyalty)

PayPal Zettle (Zettle Reader, Zettle App, Zettle Online Payment)

Moka (Moka POS, Moka Inventory Management, Moka Analytics)

Epicor (Epicor ERP, Epicor Retail, Epicor Point of Sale)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 29.0 Billion |

| Market Size by 2032 | US$ 112.6 Billion |

| CAGR | CAGR of 16.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Component (Hardware, PoS Terminal Software) •By Type (Fixed PoS, Mobile PoS, Others) •By Deployment Mode (Cloud, On-premise) •By Organization Size (Large Enterprise, Small and Medium Enterprise (SME)) •By End-user (Restaurant, Hospitality, Healthcare, Retail, Warehouse, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Clover Network, Inc., H&L POS, IdealPOS, Lightspeed, NCR Corporation, Oracle Micros, Revel Systems, SwiftPOS, Square Inc., TouchBistro and other key players |

| Key Drivers | • Growing Demand for Cloud-Based and Mobile POS Solutions Enhances Market Growth • Technological Advancements Driving Innovations in POS Systems |

| RESTRAINTS | • Data Security Concerns Hamper the Growth in the POS Market |

Ans: The Point-of-Sale Market is expected to grow at a CAGR of 7.3%

Ans: The Point-of-Sale Market Size was valued at USD 1.2 billion in 2023 and is expected to reach USD 2.2 billion by 2032.

Ans: Rising demand for bio-based alternatives creates new opportunities for innovation in the biodegradable film market

Ans: Achieving widespread commercial viability due to inconsistent biodegradability standards across regions poses a significant challenge in the Point-of-Sale market

Ans: The North American region dominated the Point-of-Sale market holding the largest market share of about 35% during the forecast period.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Network Infrastructure Expansion, by Region

5.3 Cybersecurity Incidents, by Region (2020-2023)

5.4 Fixed PoS Services Usage, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Point-of-Sale Market Segmentation, by Component

7.1 Chapter Overview

7.2 Hardware

7.2.1 Hardware Market Trends Analysis (2020-2032)

7.2.2 Hardware Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 PoS Terminal Software

7.3.1 PoS Terminal Software Market Trends Analysis (2020-2032)

7.3.2 PoS Terminal Software Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Point-of-Sale Market Segmentation, by Type

8.1 Chapter Overview

8.2 Fixed PoS

8.2.1 Fixed PoS Market Trends Analysis (2020-2032)

8.2.2 Fixed PoS Market Size Estimates And Forecasts To 2032 (USD Billion)

8.3 Mobile PoS

8.3.1 Mobile PoS Market Trends Analysis (2020-2032)

8.3.2 Mobile PoS Market Size Estimates And Forecasts To 2032 (USD Billion)

8.4 Others

8.4.1 Others Market Trends Analysis (2020-2032)

8.4.2 Others Market Size Estimates And Forecasts To 2032 (USD Billion)

9. Point-of-Sale Market Segmentation, By Deployment Mode

9.1 Chapter Overview

9.2 Cloud

9.2.1 Cloud Market Trends Analysis (2020-2032)

9.2.2 Cloud Market Size Estimates And Forecasts To 2032 (USD Billion)

9.3 On-premise

9.3.1 On-premise Market Trends Analysis (2020-2032)

9.3.2 On-premise Market Size Estimates And Forecasts To 2032 (USD Billion)

10. Point-of-Sale Market Segmentation, By Organization Size

10.1 Chapter Overview

10.2 Large Enterprise

10.2.1 Large Enterprise Market Trends Analysis (2020-2032)

10.2.2 Large Enterprise Market Size Estimates And Forecasts To 2032 (USD Billion)

10.3 Small and Medium Enterprise (SME)

10.3.1 Small and Medium Enterprise (SME) Market Trends Analysis (2020-2032)

10.3.2 Small and Medium Enterprise (SME) Market Size Estimates And Forecasts To 2032 (USD Billion)

11. Point-of-Sale Market Segmentation, By End-user

11.1 Chapter Overview

11.2 Restaurant

11.2.1 Restaurant Market Trends Analysis (2020-2032)

11.2.2 Restaurant Market Size Estimates And Forecasts To 2032 (USD Billion)

11.3 Hospitality

11.3.1 Hospitality Market Trends Analysis (2020-2032)

11.3.2 Hospitality Market Size Estimates And Forecasts To 2032 (USD Billion)

11.4 Healthcare

11.4.1 Healthcare Market Trends Analysis (2020-2032)

11.4.2 Healthcare Market Size Estimates And Forecasts To 2032 (USD Billion)

11.5 Retail

11.5.1 Retail Market Trends Analysis (2020-2032)

11.5.2 Retail Market Size Estimates And Forecasts To 2032 (USD Billion)

11.6 Warehouse

11.6.1 Warehouse Market Trends Analysis (2020-2032)

11.6.2 Warehouse Market Size Estimates And Forecasts To 2032 (USD Billion)

11.7 Others

11.7.1 Others Market Trends Analysis (2020-2032)

11.7.2 Others Market Size Estimates And Forecasts To 2032 (USD Billion)

12. Regional Analysis

12.1 Chapter Overview

12.2 North America

12.2.1 Trends Analysis

12.2.2 North America Point-of-Sale Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.2.3 North America Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.2.4 North America Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.2.5 North America Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.2.6 North America Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.2.7 North America Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.2.8 USA

12.2.8.1 USA Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.2.8.2 USA Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.2.8.3 USA Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.2.8.4 USA Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.2.8.5 USA Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.2.9 Canada

12.2.9.1 Canada Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.2.9.2 Canada Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.2.9.3 Canada Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.2.9.4 Canada Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.2.9.5 Canada Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.2.10 Mexico

12.2.10.1 Mexico Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.2.10.2 Mexico Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.2.10.3 Mexico Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.2.10.4 Mexico Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.2.10.5 Mexico Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.3 Europe

12.3.1 Eastern Europe

12.3.1.1 Trends Analysis

12.3.1.2 Eastern Europe Point-of-Sale Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.3.1.3 Eastern Europe Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.4 Eastern Europe Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.3.1.5 Eastern Europe Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.1.6 Eastern Europe Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.1.7 Eastern Europe Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.3.1.8 Poland

12.3.1.8.1 Poland Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.8.2 Poland Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.3.1.8.3 Poland Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.1.8.4 Poland Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.1.8.5 Poland Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.3.1.9 Romania

12.3.1.9.1 Romania Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.9.2 Romania Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.3.1.9.3 Romania Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.1.9.4 Romania Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.1.9.5 Romania Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.3.1.10 Hungary

12.3.1.10.1 Hungary Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.10.2 Hungary Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.3.1.10.3 Hungary Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.1.10.4 Hungary Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.1.10.5 Hungary Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.3.1.11 Turkey

12.3.1.11.1 Turkey Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.11.2 Turkey Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.3.1.11.3 Turkey Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.1.11.4 Turkey Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.1.11.5 Turkey Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.3.1.12 Rest Of Eastern Europe

12.3.1.12.1 Rest Of Eastern Europe Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.12.2 Rest Of Eastern Europe Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.3.1.12.3 Rest Of Eastern Europe Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.1.12.4 Rest Of Eastern Europe Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.1.12.5 Rest Of Eastern Europe Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.3.2 Western Europe

12.3.2.1 Trends Analysis

12.3.2.2 Western Europe Point-of-Sale Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.3.2.3 Western Europe Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.4 Western Europe Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.3.2.5 Western Europe Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.6 Western Europe Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.2.7 Western Europe Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.3.2.8 Germany

12.3.2.8.1 Germany Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.8.2 Germany Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.3.2.8.3 Germany Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.8.4 Germany Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.2.8.5 Germany Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.3.2.9 France

12.3.2.9.1 France Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.9.2 France Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.3.2.9.3 France Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.9.4 France Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.2.9.5 France Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.3.2.10 UK

12.3.2.10.1 UK Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.10.2 UK Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.3.2.10.3 UK Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.10.4 UK Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.2.10.5 UK Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.3.2.11 Italy

12.3.2.11.1 Italy Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.11.2 Italy Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.3.2.11.3 Italy Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.11.4 Italy Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.2.11.5 Italy Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.3.2.12 Spain

12.3.2.12.1 Spain Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.12.2 Spain Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.3.2.12.3 Spain Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.12.4 Spain Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.2.12.5 Spain Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.3.2.13 Netherlands

12.3.2.13.1 Netherlands Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.13.2 Netherlands Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.3.2.13.3 Netherlands Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.13.4 Netherlands Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.2.13.5 Netherlands Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.3.2.14 Switzerland

12.3.2.14.1 Switzerland Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.14.2 Switzerland Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.3.2.14.3 Switzerland Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.14.4 Switzerland Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.2.12.5 Switzerland Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.3.2.15 Austria

12.3.2.15.1 Austria Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.15.2 Austria Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.3.2.15.3 Austria Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.15.4 Austria Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.2.15.5 Austria Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.3.2.16 Rest Of Western Europe

12.3.2.16.1 Rest Of Western Europe Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.16.2 Rest Of Western Europe Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.3.2.16.3 Rest Of Western Europe Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.16.4 Rest Of Western Europe Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.2.16.5 Rest Of Western Europe Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.4 Asia Pacific

12.4.1 Trends Analysis

12.4.2 Asia Pacific Point-of-Sale Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.4.3 Asia Pacific Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.4 Asia Pacific Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.4.5 Asia Pacific Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.4.6 Asia Pacific Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.4.7 Asia Pacific Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.4.8 China

12.4.8.1 China Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.8.2 China Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.4.8.3 China Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.4.8.4 China Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.4.8.5 China Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.4.9 India

12.4.9.1 India Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.9.2 India Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.4.9.3 India Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.4.9.4 India Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.4.9.5 India Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.4.10 Japan

12.4.10.1 Japan Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.10.2 Japan Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.4.10.3 Japan Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.4.10.4 Japan Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.4.10.5 Japan Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.4.11 South Korea

12.4.11.1 South Korea Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.11.2 South Korea Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.4.11.3 South Korea Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.4.11.4 South Korea Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.4.11.5 South Korea Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.4.12 Vietnam

12.4.12.1 Vietnam Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.12.2 Vietnam Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.4.12.3 Vietnam Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.4.12.4 Vietnam Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.4.12.5 Vietnam Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.4.13 Singapore

12.4.13.1 Singapore Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.13.2 Singapore Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.4.13.3 Singapore Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.4.13.4 Singapore Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.4.13.5 Singapore Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.4.14 Australia

12.4.14.1 Australia Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.14.2 Australia Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.4.14.3 Australia Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.4.14.4 Australia Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.4.14.5 Australia Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.4.15 Rest Of Asia Pacific

12.4.15.1 Rest Of Asia Pacific Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.15.2 Rest Of Asia Pacific Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.4.15.3 Rest Of Asia Pacific Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.4.15.4 Rest Of Asia Pacific Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.4.15.5 Rest Of Asia Pacific Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.5 Middle East And Africa

12.5.1 Middle East

12.5.1.1 Trends Analysis

12.5.1.2 Middle East Point-of-Sale Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.5.1.3 Middle East Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.4 Middle East Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.5.1.5 Middle East Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.5.1.6 Middle East Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.5.1.7 Middle East Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.5.1.8 UAE

12.5.1.8.1 UAE Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.8.2 UAE Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.5.1.8.3 UAE Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.5.1.8.4 UAE Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.5.1.8.5 UAE Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.5.1.9 Egypt

12.5.1.9.1 Egypt Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.9.2 Egypt Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.5.1.9.3 Egypt Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.5.1.9.4 Egypt Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.5.1.9.5 Egypt Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.5.1.10 Saudi Arabia

12.5.1.10.1 Saudi Arabia Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.10.2 Saudi Arabia Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.5.1.10.3 Saudi Arabia Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.5.1.10.4 Saudi Arabia Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.5.1.10.5 Saudi Arabia Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.5.1.11 Qatar

12.5.1.11.1 Qatar Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.11.2 Qatar Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.5.1.11.3 Qatar Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.5.1.11.4 Qatar Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.5.1.11.5 Qatar Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.5.1.12 Rest Of Middle East

12.5.1.12.1 Rest Of Middle East Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.12.2 Rest Of Middle East Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.5.1.12.3 Rest Of Middle East Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.5.1.12.4 Rest Of Middle East Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.5.1.12.5 Rest Of Middle East Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.5.2 Africa

12.5.2.1 Trends Analysis

12.5.2.2 Africa Point-of-Sale Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.5.2.3 Africa Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.2.4 Africa Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.5.2.5 Africa Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.5.2.6 Africa Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.5.2.7 Africa Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.5.2.8 South Africa

12.5.2.8.1 South Africa Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.2.8.2 South Africa Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.5.2.8.3 South Africa Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.5.2.8.4 South Africa Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.5.2.8.5 South Africa Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.5.2.9 Nigeria

12.5.2.9.1 Nigeria Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.2.9.2 Nigeria Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.5.2.9.3 Nigeria Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.5.2.9.4 Nigeria Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.5.2.9.5 Nigeria Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.5.2.10 Rest Of Africa

12.5.2.10.1 Rest Of Africa Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.2.10.2 Rest Of Africa Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.5.2.10.3 Rest Of Africa Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.5.2.10.4 Rest Of Africa Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.5.2.10.5 Rest Of Africa Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.6 Latin America

12.6.1 Trends Analysis

12.6.2 Latin America Point-of-Sale Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.6.3 Latin America Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.6.4 Latin America Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.6.5 Latin America Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.6.6 Latin America Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.6.7 Latin America Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.6.8 Brazil

12.6.8.1 Brazil Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.6.8.2 Brazil Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.6.8.3 Brazil Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.6.8.4 Brazil Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.6.8.5 Brazil Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.6.9 Argentina

12.6.9.1 Argentina Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.6.9.2 Argentina Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.6.9.3 Argentina Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.6.9.4 Argentina Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.6.9.5 Argentina Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.6.10 Colombia

12.6.10.1 Colombia Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.6.10.2 Colombia Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.6.10.3 Colombia Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.6.10.4 Colombia Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.6.10.5 Colombia Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

12.6.11 Rest Of Latin America

12.6.11.1 Rest Of Latin America Point-of-Sale Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.6.11.2 Rest Of Latin America Point-of-Sale Market Estimates And Forecasts, By Type (2020-2032) (USD Billion)

12.6.11.3 Rest Of Latin America Point-of-Sale Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.6.11.4 Rest Of Latin America Point-of-Sale Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.6.11.5 Rest Of Latin America Point-of-Sale Market Estimates And Forecasts, By End-user (2020-2032) (USD Billion)

13. Company Profiles

13.1 Clover Network, Inc.

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 SWOT Analysis

13.2 H&L POS

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 SWOT Analysis

13.3 IdealPOS

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services Offered

13.3.4 SWOT Analysis

13.4 Lightspeed

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services Offered

13.4.4 SWOT Analysis

13.5 NCR Corporation

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services Offered

13.5.4 SWOT Analysis

13.6 Oracle Micros

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services Offered

13.6.4 SWOT Analysis

13.7 Revel Systems

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services Offered

13.7.4 SWOT Analysis

13.8 SwiftPOS

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services Offered

13.8.4 SWOT Analysis

13.9 Square Inc.

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services Offered

13.9.4 SWOT Analysis

13.10 TouchBistro

13.12.1 Company Overview

13.12.2 Financial

13.12.3 Products/ Services Offered

13.12.4 SWOT Analysis

14. Use Cases and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Component

Hardware

PoS Terminal Software

By Type

Fixed PoS

Mobile PoS

Others

By Deployment Mode

Cloud

On-premise

By Organization Size

Large Enterprise

Small and Medium Enterprise (SME)

By End-user

Restaurant

Hospitality

Healthcare

Retail

Warehouse

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Business Email Compromise Market was valued at USD 1.35 billion in 2023 and is expected to reach USD 7.24 billion by 2032, growing at a CAGR of 20.53% from 2024-2032.

AI-Driven Personalization in ICT Market was valued at USD XX billion in 2023 and is expected to reach USD XX billion by 2032, growing at a CAGR of XX% from 2024-2032.

The 5G Enterprise Market was valued at USD 4.0 billion in 2023 and is expected to reach USD 43.8 billion by 2032, growing at a CAGR of 30.58% from 2024-2032.

The Voice Biometrics Market Size was $1.8 billion in 2023 and is expected to reach USD 10.85 billion by 2032 and grow at a CAGR of 22.1% by 2024-2032.

Server Market was valued at USD 111.60 billion in 2023 and is expected to reach USD 224.90 billion by 2032, growing at a CAGR of 8.14% from 2024-2032.

Risk Analytics Market was valued at USD 37.51 billion in 2023 and is expected to reach USD 109.35 billion by 2032, growing at a CAGR of 12.65% from 2024-2032.

Hi! Click one of our member below to chat on Phone