Point of Care Diagnostics/Testing Market Report Scope & Overview:

The Point of Care Diagnostics/Testing Market Size was valued at USD 44.5 billion in 2023 and is expected to reach USD 70.92 billion by 2031, and grow at a CAGR of 6% over the forecast period 2024-2031.

Point of care diagnostics/testing is a type of health analysis that is performed near the patient and does not require a laboratory environment. Point of care (POC) testing is also known as near-patient testing, bedside testing, mobile testing, remote testing, and rapid diagnosis. The approach is used to diagnose infectious diseases in areas with little healthcare infrastructure. A point-of-care (POC) diagnostic device collects specific clinical data from patients in clinical and resource-limited scenarios. Traditional clinical diagnostic techniques demand high-end and costly tools, a professional technician for operation and result interpretation, and more time, all of which depletes and costs money.

Get more information on Point Of Care Diagnostics/Testing Market - Request Sample Report

Despite substantial improvements in medical facilities in various regions' healthcare systems, the use of POC diagnostic equipment is still in its infancy.

MARKET DYNAMICS:

KEY DRIVERS:

-

Globally, the number of chronic disease cases is increasing.

-

There is an increasing demand for AI-integrated proof-of-concepts for real-time diagnostics.

RESTRAINTS:

-

The multi-layered rules imposed by international governing bodies such as the FDA and CLIA are limiting the market expansion of POC producers and creating a regulatory barrier in the promotion and sale of their goods.

-

Healthcare device producers must submit performance data for their products, detailing the benefits and drawbacks of the product on the persons who have been tested.

CHALLENGES:

-

The challenge that manufacturers face is deploying their products in accordance with regional authorities.

IMPACT OF COVID-19:

The pandemic epidemic halted operations in all sectors around the world. During the initial period of the lockdown, the healthcare industry was particularly heavily hit. Medical supplies were stacked up in huge quantities, and the number of manufactured goods increased as the supply chain within and across borders was severely disrupted by the adoption of the safety requirements. However, as the number of impacted patients decreased, regulatory authorities permitted restricted mobility and manufacturing of vital products. The loosening of rules boosted demand for healthcare items that serve the point-of-care diagnostics/testing sector.

During the pandemic, market participants invested much in the development of fast testing for COVID-19 diagnosis. According to WHO, the industry participants will collaborate in September 2020 to develop 120 million economic antigen-based quick diagnostic POC tests for developing countries. The Bill & Melinda Gates Foundation (US), SD BioSensor Inc. (South Korea), and Abbott Laboratories (US) agreed to offer the POC test products for a maximum of USD 5. The Global Fund provided USD 50 million to help low- and middle-income countries (LMICs) purchase the diagnostic test. Furthermore, the FDA authorised the POC antibody test for COVID-19 in September 2020, which will allow patients to understand their health condition and determine whether the virus has infected them or not.

Furthermore, regulatory agencies modified their point-of-care and quick testing criteria for SARS-CoV-2. These enabling factors boosted market expansion and are likely to increase during the forecast period. Glucose Testing It is a device that measures the concentration of glucose in the blood using a lancet, metre, or other device. Cardiometabolic Testing It is a sort of monitoring device that measures the risk associated with cardiovascular functions such as blood pressure, blood gas, blood fat, LDL (low-density lipoprotein) levels, and so on.

Testing for Infectious Diseases It is a gadget that identifies diseases caused by organisms like viruses, bacteria, and fungi. Coagulation Testing It is a gadget that evaluates blood clotting capacity. It will provide valuable information to clinicians on the proper deployment of clotting factor in the bleeding area. Fertility and pregnancy testing It is a device that assesses both men and women's potential to conceive naturally as well as the existence of any sexually transmitted infections.

Hematology Examination These machines do blood tests to assess total blood count, protein levels, infection, inflammation, blood-clotting disorders, anaemia, and leukaemia. Cancer/Tumor Marker Analysis It is a gadget that detects tumour markers in blood, tissue, urine, and other bodily fluids. The device monitors the protein and other chemicals produced in response to tumour cells. Urinalysis Examination This gadget detects kidney abnormalities, diabetes levels, liver difficulties, and other metabolic functions, as well as diagnoses urinary tract infections. Cholesterol It is a gadget that detects high-density and low-density proteins as well as specific lipids in the blood.

Abuse Examination It is a non-medical equipment that detects illegal chemicals in urine, saliva, blood, hair, and perspiration. Hospitals and Clinics Hospitals and Clinics are organisations that provide medical and surgical care to the injured. Diagnostic Facilities It is a facility that provides diagnostic services to the general public and medical practitioners. Self-Testing at Home It is professional caregiver healthcare help provided to patients in their homes for health services. OTC Testing Supplies It is a test that does not require a prescription and is not limited to specific healthcare settings.

Prescription-only testing solutions It is a type of test that is performed depending on a doctor's prescription. Immunoassays It is a platform for measuring specific proteins and auxiliary chemicals based on their antigen and antibody characteristics. Molecular Testing It is a platform for identifying disease through the use of molecules such as DNA, RNA, tissue, fluid, and proteins. Dipsticks It is a chemically integrated sensitive strip of paper that detects glucose, protein, and other urinary components.

KEY MARKET SEGMENTS:

by End User

-

Hospitals & Clinics

-

Diagnostic Centers

-

Homecare/Self Testing

-

Others

by Mode of Purchase

-

OTC Testing Products

-

Prescription-based testing products

by Platform

-

Immunoassays

-

Dipsticks

-

Others

by Product

-

Cardiometabolic Monitoring

-

Infectious Disease Testing

-

Coagulation Monitoring

-

Pregnancy & Fertility Testing

-

Hematology Testing

-

Cancer/Tumor Marker Testing

-

Urinalysis Testing

-

Cholesterol

-

Drugs-of-Abuse Testing

-

Others

REGIONAL ANALYSIS:

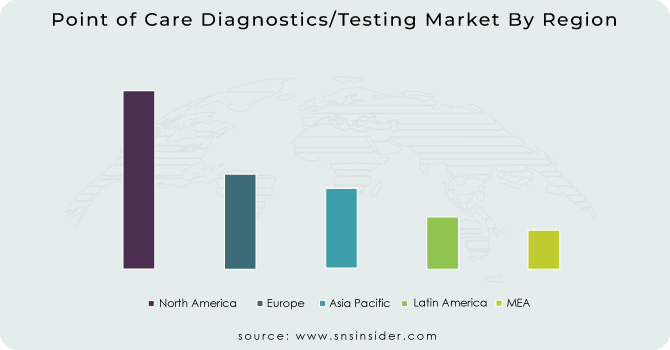

North America held the highest share of the point of care diagnostics/testing market in 2021, owing to an increasing number of market players across the region, acquisitions of industry players by healthcare behemoths, and favourable government regulations. Healthcare product providers are merging and acquiring current market participants in order to expand their product availability across the region. For business expansion, market participants are implementing business strategies such as the launch of new products, R&D activities, and collaborative product creation.

Due to restricted healthcare staff availability, diverse manufacturing facilities, changing demographics, and increasing consumer healthcare expectations, the Asia-Pacific point of care diagnostics/testing market is expected to be the fastest-growing regional market. Furthermore, comforting government rules, significant funding from industry participants, and technologically advanced product innovation are all elements boosting the point of care diagnostics/testing market.

Need any customization research on Point of Care Diagnostics/Testing Market - Enquiry Now

REGIONAL COVEREGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS:

Major players are Hoffmann-La Roche Ltd, Johnson & Johnson Services, Inc., PTS Diagnostics, Nova Biomedical, QuidelCorporation, Abbott Laboratories, Siemens Healthineers GmbH, Chembio Diagnostics, Inc., Becton, Dickinson and Company, Danaher Corporation and Other Players.

Abbott Laboratories-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 44.5 Billion |

| Market Size by 2031 | US$ 70.92 Billion |

| CAGR | CAGR of 6% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Mode of Purchase (OTC, Prescription-based) • by Platform (Immunoassays, Molecular Diagnostics, Dipsticks) • by Product (Glucose Monitoring, Cardiometabolic Monitoring, Infectious Disease Testing, Coagulation Monitoring, Pregnancy & Fertility Testing, Hematology Testing, Cancer/Tumor Marker Testing, Urinalysis Testing, Cholesterol, Drugs-of-Abuse Testing) • by End User (Hospitals & Clinics, Diagnostic Centers, Homecare/Self Testing) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Hoffmann-La Roche Ltd, Johnson & Johnson Services, Inc., PTS Diagnostics, Nova Biomedical, QuidelCorporation, Abbott Laboratories, Siemens Healthineers GmbH, Chembio Diagnostics, Inc., Becton, Dickinson and Company, Danaher Corporation. |

| Key Drivers | • Globally, the number of chronic disease cases is increasing. |

| RESTRAINTS | • Healthcare device producers must submit performance data for their products, detailing the benefits and drawbacks of the product on the persons who have been tested. |