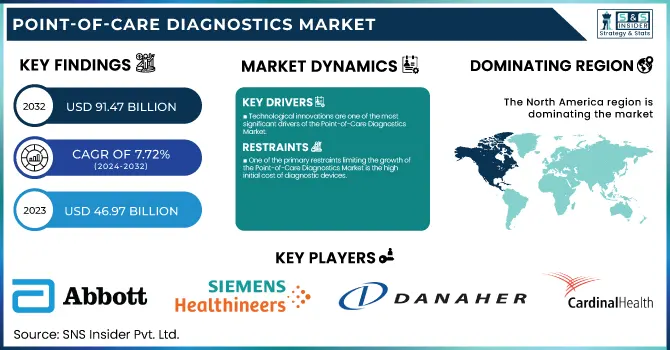

Point-of-Care Diagnostics Market Size & Growth:

The Point-of-Care Diagnostics Market size was valued at USD 46.97 billion in 2023, projected to reach USD 91.47 billion by 2032, exhibiting CAGR of 7.72% from 2024-2032.

To Get more information on Point-of-Care Diagnostics Market - Request Free Sample Report

The global point-of-care diagnostics market has experienced substantial expansion driven by the growing need for swift and precise diagnostic solutions that improve clinical decision-making and patient results. POC diagnostics allows for testing to be conducted at or close to the patient's site, providing faster results than conventional laboratory testing. This benefit has propelled their use in numerous applications, such as testing for infectious diseases, glucose levels, cardiac indicators, and pregnancy assessments.

Innovations in biosensors, microfluidics, and compact diagnostic tools have driven the market's development, enhancing device usability, portability, and efficiency. Recent advancements feature the emergence of AI-driven POC platforms, enhancing test precision and effectiveness. For example, in May 2023, BD obtained 510(k) approval for its Kiestra MRSA imaging application, utilizing AI to speed up test turnaround times. Likewise, improvements in immunoassay analyzers, such as the Dxl 9000 introduced by Danaher Corporation in that same year, have broadened the testing functionalities of POC devices.

Another important factor is the increasing incidence of chronic and infectious diseases, especially in areas with restricted access to centralized healthcare services. The increase in worldwide diabetes cases has driven the need for glucose monitoring devices. Moreover, partnerships and projects focused on enhancing accessibility and affordability are influencing the market. In December 2023, Thermo Fisher Scientific collaborated with Project HOPE to enhance HIV testing services in Sub-Saharan Africa, highlighting the importance of POC diagnostics in tackling healthcare issues in underserved areas. With healthcare systems placing greater emphasis on decentralization and at-home care, the POC diagnostics market is set to expand further, fueled by innovations, an escalating disease burden, and the demand for affordable, immediate diagnostic solutions.

Point-of-Care Diagnostics Market Dynamics

Drivers

-

Technological innovations are one of the most significant drivers of the Point-of-Care Diagnostics Market.

Microfluidics refers to the precise control and manipulation of fluids that are geometrically constrained to a small scale, and recent progress in this area has led to the development of benchtop devices set to deliver the ability to quickly obtain results in a compact, portable format. This has transformed the healthcare domain, predominantly during emergencies, in remote locations, or low-resource settings. The incorporation of biosensors into diagnostic platforms has further improved their accuracy and sensitivity, resulting in faster and more reliable outcomes. Other technologies such as digital and mobile health platforms are expanding POC diagnostic accessibility, enabling patients to conveniently receive test results and track their health status via smartphone and wearable devices. Detailed AI-based diagnostics also revolutionize POC testing by automating data analysis, improving the precision of diagnostics, and lowering human error. These innovations are driving up the effectiveness and reduced cost of POC diagnostics which are leading to the fast uptake of POC diagnostics around the world.

-

The global rise in chronic conditions like diabetes, cardiovascular diseases, and respiratory disorders has been a major factor in increasing the demand for point-of-care testing.

The global rise in chronic diseases like diabetes, cardiac problems, and respiratory conditions has been a major factor in the surging demand for point-of-care testing. These conditions require continuous monitoring and management, and POC diagnostic tests are ideally suited to meet these goals. Patients can actively manage their conditions with a focus on immediate results, decreasing complication potential, and promoting quality of life. One of the examples of POC devices is the ones being used for monitoring blood glucose levels for diabetes patients that help manage better disease outcomes.

Beyond chronic diseases, the endemic spread of infectious diseases such as tuberculosis and HIV has fueled the demand for POC diagnostic solutions. Point-of-care (POC) devices offer rapid detection, allowing prompt diagnosis and treatment from healthcare professionals to patients which reduces the spread of infection and also reduces the cost of healthcare. Antimicrobial resistance (AMR) is continuing to grow and putting more attention on the use of more rapid, more targeted diagnostics at the point of care are less focused on inappropriate treatments and getting better outcomes. Rising demand for timely diagnosis & treatment in healthcare establishments and home care settings is projected to boost the point-of-care diagnostics market growth.

Restraint

-

One of the primary restraints limiting the growth of the Point-of-Care Diagnostics Market is the high initial cost of diagnostic devices.

The high capital cost of diagnostic devices is one of the major recycling market restraints that hinder the growth of Point-of-Care Diagnostics Market. The long-term benefits of rapid diagnosis and lower healthcare costs are clear and incredibly significant, but the upfront costs for novel point-of-care devices can be restrictive, particularly for complex and highly accurate systems. In developing parts of the world or in rural communities, budget limitations prevent the implementation of such technologies, which has become a barrier for healthcare providers. Moreover, the cost of manufacturing, followed by regulatory approvals, and finally, maintenance all add up to make these devices less affordable for smaller healthcare facilities and patients with limited financial means. These factors can hinder the broad adoption of point-of-care diagnostics, especially in resource-constrained settings.

Point-of-Care Diagnostics Market Segmentation Analysis

By Product

In 2023, the blood glucose monitoring segment dominated the point-of-care diagnostics market with 54% of market share, propelled by the rising incidence of diabetes and the commitment of market participants to create innovative products utilizing advanced technologies. A notable advancement in this area was the introduction of Dexcom ONE+, an innovative Continuous Glucose Monitoring (CGM) system by Dexcom, Inc., designed to improve diabetes management for individuals in the Netherlands in Feb 2024.

The pregnancy and fertility testing segment is projected to witness significant growth throughout the forecast period, driven by increasing fertility worries and heightened awareness about sexual health. The growing use of testing kits, especially in advanced markets such as the U.S., Germany, and the U.K., is a crucial element driving the growth of this segment.

By Sample

In 2023, The blood sample segment dominated the Point-of-Care (POC) Diagnostics Market owing to its utility in providing high-quality and proof testing for a wide range of chronic and infectious diseases. With the rising incidence of diabetes, cardiovascular diseases, infections, etc., the demand for blood-based tests is expected to grow. Such tests provide rapid, on-site results and are pivotal to care during emergencies and chronic disease management. Blood sample tests are more convenient than ever, due to advancements in technology, including continuous glucose monitoring (CGM) and portable testing devices. Moreover, both patients and healthcare professionals prefer blood-based tests due to their ease of use and minimal processing time. As the market continues to shift, with the emergence of home healthcare and affordable testing, blood-based POC diagnostics will become the mainstay.

The urine sample segment is expected to significantly expand at a high CAGR during the forecast period, owing to the increasing prevalence of kidney disorders. According to 2023 data from the CDC, an estimated 35.5 million U.S. adults are estimated to have chronic kidney disease (CKD), accounting for approximately 1 in 7 adults in the country. Also, it can be used widely for the diagnosis of chronic kidney diseases (CKD) and it can be used because the prevalence of CKD has been growing significantly in recent times and is likely to increase the demand for urine-based tests which are widely used for kidney disease diagnosis. Thus, the urine segment is expected to see growth as both healthcare providers and patients look for more accessible and affordable kidney health management solutions.

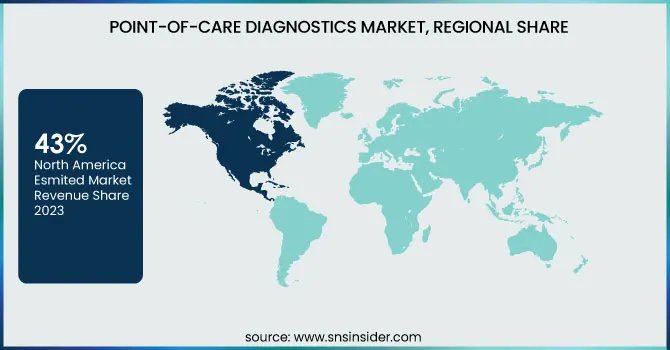

Point-of-Care Diagnostics Market Regional Insights

North America dominated the market with 43% of market share in 2023, driven by factors including the growing geriatric population, and increased spending on healthcare. Technological advancements, including broad adoption across Picture Archiving and Communication Systems (PACS) and Electronic Medical Records (EMRs), as well as compact diagnostic toolsets that provide faster results, are some of the key drivers for this dominance. The market in the region is further driven by the presence of significant players, such as Abbott, BIOMERIEUX, BD, Siemens Healthineers AG, QIAGEN, Quidel Corporation, and Quest Diagnostics. For instance, Abbott had been granted FDA clearance for FreeStyle Libre 3 integrated continuous glucose monitoring system in the United States in April 2023, which is expected to further strengthen its stance.

Asia Pacific is projected to be one of the fastest-growing regions for the point-of-care diagnostics market with a 8.97% CAGR throughout the forecast period. This growth is driven by growing healthcare infrastructure development and the increasing prevalence of chronic and targeted diseases including diabetes and cancer and infectious diseases including HIV, Syphilis, and RSV. The need for rapid and precise results is expected to drive the demand for point-of-care diagnostics in settings such as operating rooms, emergency departments, ICUs, Pathology labs, and hospitals. Furthermore, a strong product pipeline in infectious and cardiac marker segments from the region is anticipated to provide traction to growth till 2032.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Point-of-Care Diagnostics Market Companies

-

Abbott (i-STAT System, FreeStyle Libre Continuous Glucose Monitoring System)

-

Roche Diagnostics (Accu-Chek Guide Glucometer, Cobas Liat PCR System)

-

Siemens Healthineers (epoc Blood Analysis System, CLINITEST Rapid COVID-19 Antigen Test)

-

Danaher Corporation (Cepheid GeneXpert System, HemoCue Hb 801 Hemoglobin Analyzer)

-

Quidel Corporation (Sofia SARS Antigen FIA, QuickVue At-Home OTC COVID-19 Test)

-

Becton, Dickinson, and Company (BD Veritor Plus System, BD FACSPresto Near-Patient CD4 Counter)

-

Cardinal Health (SureTemp Thermometer, Instra-Therm Infrared Thermometer)

-

BioMérieux (VIKIA Malaria Rapid Test, BIOFIRE FilmArray)

-

Thermo Fisher Scientific (TaqMan Point-of-Care Molecular Diagnostics, Procalcitonin (PCT) Test)

-

Cepheid (GeneXpert Infinity System, Xpert MTB/RIF Assay)

-

Nova Biomedical (StatStrip Glucose/Ketone Meter, Stat Profile Prime Plus Analyzer)

-

HemoCue (HemoCue Glucose 201 RT, HemoCue HbA1c 501)

-

OraSure Technologies (OraQuick HIV Test, OraQuick HCV Rapid Antibody Test)

-

EKF Diagnostics (Quo-Lab HbA1c Analyzer, DiaSpect Tm Hemoglobin Analyzer)

-

Accriva Diagnostics (Hemochron Signature Elite, VerifyNow System)

-

Chembio Diagnostics (DPP HIV-Syphilis System, STAT-PAK Assay)

-

Trinity Biotech (Uni-Gold HIV Test, Premier Hb9210 HbA1c Analyzer)

-

ARKRAY, Inc. (Glucocard Shine Blood Glucose Meter, ADAMS A1c HA-8180V Analyzer)

-

PTS Diagnostics (CardioChek Plus Analyzer, A1CNow+ System)

Key suppliers

Supplies diagnostic test kits and instruments like lateral flow immunoassay tests and molecular diagnostic tools

-

Thermo Fisher Scientific

-

Roche Diagnostics

-

Abbott Laboratories

-

Siemens Healthineers

-

Danaher Corporation

-

Quidel Corporation

-

BioMérieux

-

Becton, Dickinson and Company

-

Cepheid (a subsidiary of Danaher)

-

OraSure Technologies

Recent Developments

-

October 2023: QIAGEN announced that its IVD kit and automated testing platform, NeuMoDx, received CE certification. This achievement significantly boosted the company’s market presence and revenue, enhancing its competitive position.

-

May 2023: Danaher Corporation launched the Dxl 9000 Access Immunoassay Analyzer, capable of running up to 215 tests per hour. This innovation expanded the company’s point-of-care diagnostics portfolio and strengthened its market offerings.

-

May 2023: BD secured 510(k) clearance for its Kiestra Methicillin-resistant Staphylococcus aureus (MRSA) imaging application, which utilizes AI technology. The application accelerates test turnaround times by automating the labor-intensive process of assessing bacterial growth on Petri dishes.

-

December 2023: Thermo Fisher Scientific Inc. partnered with Project HOPE, a global health and humanitarian organization, to improve access to HIV testing services for youth living with HIV in Sub-Saharan Africa. This collaboration aims to enhance HIV care and treatment accessibility in the region.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 41.79 Billion |

| Market Size by 2032 | US$ 128.62 Billion |

| CAGR | CAGR of 13.27% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Blood Glucose Monitoring, Infectious Disease Monitoring, Cardiometabolic Disease Testing, Hematology Testing, Others) •By Sample (Blood, Nasal and Oropharyngeal Swabs, Urine, Others) •By End-User (Hospital Bedside, Physician’s Office Lab, Urgent Care & Retail Clinics, Home & Self Testing) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Abbott, Roche Diagnostics, Siemens Healthineers, Danaher Corporation, Quidel Corporation, Becton, Dickinson, and Company, Cardinal Health, BioMérieux, Thermo Fisher Scientific, Cepheid, Nova Biomedical, HemoCue, OraSure Technologies, EKF Diagnostics, Accriva Diagnostics, Chembio Diagnostics, Trinity Biotech, ARKRAY, Inc., PTS Diagnostics, and other players. |

| Key Drivers | •Technological innovations are one of the most significant drivers of the Point-of-Care Diagnostics Market. •The global rise in chronic conditions like diabetes, cardiovascular diseases, and respiratory disorders has been a major factor in increasing the demand for point-of-care testing. |

| Restraints | •One of the primary restraints limiting the growth of the Point-of-Care Diagnostics Market is the high initial cost of diagnostic devices. |