PMMA MICROSPHERES MARKET REPORT SCOPE & OVERVIEW:

The PMMA Microspheres Market was valued at USD 369.99 Million in 2023 and is expected to reach USD 665.53 Million by 2032, growing at a CAGR of 6.76% over the forecast period 2024-2032.

Get More Information on PMMA Microspheres Market - Request Sample Report

The growing demand for PMMA microspheres in the medical and life sciences industry is one of the main growth drivers for the market. These microspheres are also well distinguished due to their properties such as biocompatibility, optical clarity, drug delivery vehicles, diagnostic aids, and surgical implants. With the increasing integration of advanced medical technologies, the expansion of minimally invasive and non-invasive procedures, and improving healthcare investments, the global hydrocolloid dressings market will run an upward course over the assessment period. The global PMMA microspheres market in medical applications, grew at 8% annually, with PMMA microspheres used in 20% of new drug delivery systems. The surgical implantation segment experienced growth of 15% during the last three years while these are becoming preferred materials during surgical implantation owing to their biocompatibility and durability. The booming healthcare investment populations in the regions drive the use of medical technologies to create the healthy growth of PMMA microspheres in the medical applications market with an estimated growth rate of 12.5% in North America in 2023.

The other important factor increasing market growth is their use in personal care and cosmetics. PMMA microspheres are widely used in skin care products to enhance texture since they have high optical properties as well as a light, smooth feeling. They have also gained traction due to rising demand for premium and functional cosmetics coupled with a preference for green and non-toxic components. Plus, its application area in paints and coatings, signs and displays, and polymers for automotive and electronics segments highlights their versatility. The increasing global demand for high-performance materials combined with low environmental impacts is boosting the research and development of PMMA microspheres which will spur the overall market's growth in the long-term. PMMA Microspheres from the personal care & cosmetics segment utilized in 2023 grew at a rate of 13% per annum while growth is anticipated. The 9.5% rise in 2023, was complemented by global PMMA microsphere's constant increase of 7.3% during the same period, and an extraordinary annual growth of over 10% for the following years in paints and coatings, respectively. The numbers demonstrate the versatility and commercial breadth in use host potential between these industries.

PMMA Microspheres Market Dynamics

KEY DRIVERS:

-

Rising Adoption of PMMA Microspheres in Automotive and Aerospace Drives Performance and Sustainability Growth

Lightweight, Durable microspheres are in great demand across various applications and industries as they play an important role in reducing the weight and increasing the performance. In automotive applications, PMMA microspheres are primarily used in interior and exterior coatings where they enhance scratch resistance along with imparting a glossy finish. As well as having applications in polymers and films, such as in formulations to reduce the overall weight of materials used in energy-efficient vehicle designs. Likewise in aerospace, the driving force for lightweight but durable materials has increased the adoption of PMMA microspheres contributing to fuel savings and increased structural integrity. With sustainability and efficiency being the backbone of both industries, the market for specialized materials like PMMA microspheres is anticipated to exponentially grow. Adoption of PMMA microspheres for automotive applications stood at 15% in 2023 and is expected to expand annually by 8% in 2024. In aerospace, numbers grew by 12% on 2023, and forecasted to grow at a rate of 9% per year in the next following five years. Also, demand for energy-efficient vehicle materials increased by 10% this 2023 and 12% in 2024 for PMMA microspheres.

-

Rising Adoption of PMMA Microspheres in Optical Applications Drives Growth in LED and Smart Devices

The increased demand for high-quality displays and lighting systems in electronics, telecommunications, and architecture has made polysilicon microspheres developed from PMMA versatile and important building blocks for electronics. Due to their excellent optical properties like the high refractive index and transparency, they are best suitable for LED diffusers, they act as light or optical films, lenses, etc. In addition to their significance within the foam formulation sector, these microspheres are also considered a vital component of next-generation lighting, such as energy-efficient LEDs and next-generation screen technologies, at a time when energy efficiency is a major global concern. Furthermore, the increasing demand for precision optics due to the growing market for smart devices and IoT-based systems is another factor driving the growth of the PMMA microsphere market. Aligning with this trend of using optical elements as enabling tools for the innovations in nanotechnology and material sciences expected in the future, PMMA microspheres shall synergistically impact the entire infrastructure for optical components.

RESTRAIN:

-

Challenges in PMMA Microspheres Market Include Thermal Stability and Environmental Concerns Impacting Adoption and Innovation

Despite their excellent optical and mechanical properties, PMMA microspheres tend to degrade or lose performance at elevated temperatures, making them less suitable for demanding industrial environments. This limitation can hinder their adoption in sectors like aerospace and certain manufacturing processes where heat resistance is critical. Another challenge lies in the environmental concerns surrounding synthetic polymer-based materials. Although PMMA microspheres are increasingly being used for their sustainability in specific applications, they remain a petroleum-derived product. This raises concerns regarding their long-term environmental impact, including challenges in biodegradability and recycling. With the rising demand for eco-friendly materials, there is pressure on manufacturers to innovate and develop greener alternatives or improve recycling technologies.

PMMA Microspheres Market Segments

BY APPLICATION

In 2023, the PMMA microspheres market was led by the Signs & Displays segment, with 31.8% market share, due to their exceptional optical clarity, lightweight, and high durability. PMMA microspheres are widely employed in signage and display applications for high brightness, diffusion, and aesthetic appearance. The same features render them extremely valuable in advertising, retail, and outdoor signage spaces that require dynamic and durable visuals. Moreover, they have further reinforced their lead in this segment with the fast-growing digital displays and the incorporation of PMMA microspheres into LED panels and displays.

The Cosmetics Additives segment is anticipated to witness the fastest CAGR during the forecast period, owing to the high demand for premium and functional cosmetics. Put simply, PMMA microspheres are popular in the personal care space due to the smooth, soft-focus effect they provide and their ability to enhance skin feel. As such, they are used in formulations as exfoliants and fillers, riding the clean beauty and next-generation aesthetic trends. The increasing awareness regarding self-care and consumer inclination towards lightweight and non-greasy formulations is anticipated to drive their adoption. Additionally, the rising emphasis on sustainable and biodegradable alternatives in cosmetics also stimulates innovation and drives the growth of this segment.

BY END USE

The Personal Care & Cosmetics segment dominated the PMMA microspheres market in 2023, with a 42.6% market share due to their high usage in personal care or cosmetic products, including coatings agents, and color cosmetics, such as foundations, face powders, facial make-up base, lip cosmetics, and mascara among others. In this industry, PMMA microspheres are extremely desirable for texturization, a light, smooth feel, and a soft focus for wrinkle and fine-line masking. These properties are why they are necessary building blocks of high-end and functional cosmetics. The increasing demand for premium cosmetics products, increasing adoption of self-care by consumers, and rising consciousness about grooming among individuals are playing a major role in the growth of this segment. Additionally, the growing movement towards clean beauty and non-toxic ingredients has driven the use of PMMA microspheres as a safe effective cosmetic additive.

The Lifesciences & Medical segment is projected to grow at the fastest CAGR from 2024 to 2032, due to the increasing application of PMMA microspheres in novel biomedical applications. Due to their biocompatibility, accuracy, and comparably high stability, these microspheres have applications in drug delivery systems, diagnostic instruments, and minimally invasive surgical procedures. The increasing emphasis on advanced healthcare solutions and rising investment in research and development have made PMMA microspheres an indispensable component in the medical field. This segment is further driven by the rising incidence of chronic diseases, coupled with the growing popularity of targeted drug delivery and the advent of biocompatible materials used in implants. Demand for PMMA microspheres is anticipated to expand rapidly across life sciences and medical applications, as healthcare systems worldwide pursue faster and patient-centered solutions.

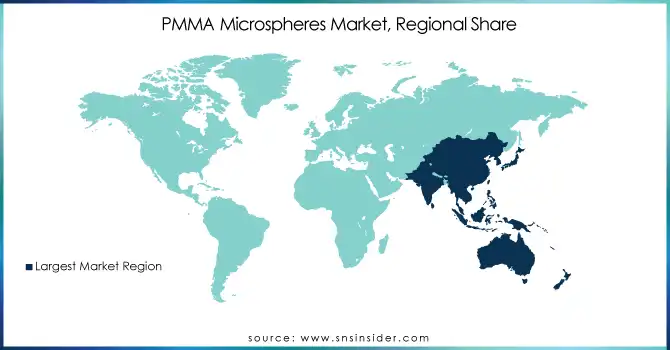

PMMA Microspheres Market Regional Analysis

In 2023, Asia-Pacific accounted for a dominant PMMA microspheres market share of 34.4% and is expected to be the fastest growing CAGR 2024-2032. The demand for PMMA microspheres is high in automotive, electronics, and consumer goods due to the booming manufacturing sectors in the region where lightweight coatings, optical films, and polymer-based components are applied. In the automotive sector, for instance, Chinese and Japanese automotive companies are incorporating PMMA microspheres into vehicle coatings and interior components to achieve weight reduction, improved durability, and aesthetics. Leading firms in South Korea and China employ PMMA microspheres for the manufacturing of LED displays, optical films, and touchscreens, thereby enhancing performance and cost efficiency in the consumer electronics business. Moreover, the increasing consumption of premium cosmetics in countries such as South Korea and Japan has complemented the growth of PMMA microspheres for use in skincare, makeup, and hair care formulations owing to their ability to enhance the feel of a formulation. This has highlighted the increase in demand for technical materials from many industries, driving the growth of PMMA microspheres in Asia-Pacific and creating growth avenues in the future.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key players

Some of the major players in the PMMA Microspheres Market are:

-

Kraton Polymers (Kraton PMMA Microspheres, Kraton Polymers PMMA Microspheres)

-

BASF SE (Rohm Plastics, Polymethyl Methacrylate Microspheres)

-

Sekisui Chemical Co., Ltd. (Sekisui PMMA Microspheres, Lumirror PMMA Microspheres)

-

Matsumoto Yushi-Seiyaku Co., Ltd. (Matsumoto PMMA Microspheres, MK Microspheres)

-

3M Company (3M PMMA Microspheres, Microbeads PMMA)

-

Everlight Chemical Industrial Corporation (Everlight PMMA Microspheres, MicroLight PMMA)

-

Chengdu Beite Fine Chemical Co., Ltd. (PMMA microspheres for coatings, PMMA microspheres for UV protection)

-

Polysciences, Inc. (Polysciences PMMA Microspheres, P-MMA microspheres for medical use)

-

ExxonMobil Chemical (ExxonMobil PMMA Microspheres, Versilon PMMA)

-

Sartorius Stedim Biotech (Sartorius PMMA Microspheres, Sartorius Custom Microspheres)

-

Luminex Corporation (Luminex PMMA Microspheres, Bio-Plex PMMA Microspheres)

-

Cospheric LLC (Cospheric PMMA Microspheres, Cospheric Custom PMMA Microspheres)

-

Spheric Technologies (Spheric PMMA Microspheres, PMMA microspheres for diagnostics)

-

Wako Pure Chemical Industries, Ltd. (Wako PMMA Microspheres, Wako nano PMMA)

-

Guangzhou Yisheng Technology Co., Ltd. (PMMA microspheres for plastic industries, PMMA microspheres for cosmetic applications)

-

Shenzhen Funminnan Technology Co., Ltd. (Funminnan PMMA microspheres, Funminnan beads for coatings)

-

Evonik Industries AG (Evonik PMMA Microspheres, Evonik Methacrylate Beads)

-

Keylink Group Ltd. (Keylink PMMA Microspheres, Keylink Transparent Microspheres)

-

Nanosphere, Inc. (Nanosphere PMMA Microspheres, Nanosphere polymer microspheres)

-

Kraton Polymers (Kraton PMMA Microspheres, Kraton Polymers Microspheres for Coatings)

Some of the Raw Material Suppliers for PMMA Microspheres companies:

-

Lucite International

-

Mitsubishi Chemical Corporation

-

LG Chem

-

Evonik Industries AG

-

SABIC

-

BASF SE

-

ExxonMobil Chemical

-

DSM Engineering Materials

-

Hexion Inc.

-

The Dow Chemical Company

RECENT TRENDS

-

In November 2024, Sartorius Stedim Biotech opened a 63,000-square-foot Center for Bioprocess Innovation in Massachusetts to advance biomanufacturing, focusing on cell and gene therapies.

-

In March 2024, SABIC launched the LNP ELCRES SLX1271SR resin, a scratch-resistant, high-gloss material for automotive exterior parts. The resin reduces VOC emissions and eliminates the need for painting, offering long-lasting durability and enhanced aesthetics.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 369.99 Million |

| Market Size by 2032 | US$ 665.53 Million |

| CAGR | CAGR of 6.76% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Signs & Displays, Cosmetics Additives, Paints & Ink Additives, Polymers & Films, Others) • By End Use (Lifesciences & Medical, Personal Care & Cosmetics, Paints & Coatings, Plastics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Kraton Polymers, BASF SE, Sekisui Chemical Co., Ltd., Matsumoto Yushi-Seiyaku Co., Ltd., 3M Company, Everlight Chemical Industrial Corporation, Chengdu Beite Fine Chemical Co., Ltd., Polysciences, Inc., ExxonMobil Chemical, Sartorius Stedim Biotech, Luminex Corporation, Cospheric LLC, Spheric Technologies, Wako Pure Chemical Industries, Ltd., Guangzhou Yisheng Technology Co., Ltd., Shenzhen Funminnan Technology Co., Ltd., Evonik Industries AG, Keylink Group Ltd., Nanosphere, Inc., Kraton Polymers, and Others |

| Key Drivers | • Rising Adoption of PMMA Microspheres in Automotive and Aerospace Drives Performance and Sustainability GrowthRising Popularity of Natural and Organic Personal Care Products Drives the Growth of the Frankincense Oil Market • Rising Adoption of PMMA Microspheres in Optical Applications Drives Growth in LED and Smart Devices |

| Restraints | • Challenges in PMMA Microspheres Market Include Thermal Stability and Environmental Concerns Impacting Adoption and Innovation |