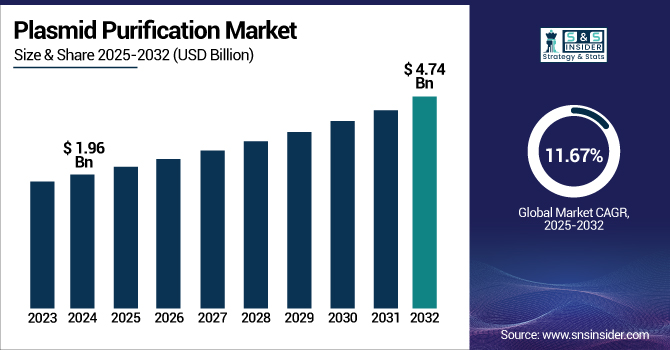

The Plasmid Purification Market Size is expected to grow at a 11.67% CAGR over the forecast period, from its valuation of USD 1.96 billion in 2024 to USD 4.74 billion by 2032.

To Get more information on Plasmid Purification Market - Request Free Sample Report

The plasmid purification market is witnessing rapid growth with the increasing requirement for purified and high-quality plasmid DNA in gene therapy, vaccine manufacturing, and molecular biology. The simultaneous advancement in purification technologies, namely silica membrane binding and anion exchange chromatography, is fueling market growth with top companies in the market, such as Thermo Fisher Scientific’s PureLink HiPure & GeneJET Plasmid Kits yielding high amounts of DNA to be transfected and Qiagen’s Plasmid Plus Kits, with scalable, efficient, reliable, and quick purification. The increased focus on personalization and automating processes and regulatory-compliant technologies is contributing considerably to market share and overall market size for plasmid purification. This change is propelling the plasmid purification market growth with increasing demand for gene-based therapies and vaccines.

The U.S. Plasmid Purification Market Size is expected to grow at a 10.52% CAGR over the forecast period, from its valuation of USD 0.43 billion in 2024 to USD 0.95 billion by 2032

The recent market trend is the growing adoption of automation to enhance efficiency and consistency in workflows. Large-scale plasmid production requires scalable methods, and the recent emphasis on automation, featured in industry updates, is driving further demand for the market to fulfill the demands of the growing gene therapy and vaccine markets.

Market Dynamics:

Drivers:

Rising Demand for Plasmid DNA in Biopharma and Gene Therapy Drive Market Expansion

The growth of the market is accelerating rapidly due to its crucial role in gene therapy, mRNA vaccine development, and recombinant protein production. The increased number of gene therapy FDA-approved drugs and clinical trials over 2000 globally is unequivocally pushing the plasmid purification market expansion as demand for the highest purity plasmid DNA. This is also driving innovation from the major companies looking for scale and regulatory-compliant purification technologies. The higher-throughput, automated systems of Opentrons or Bio-Rad are increasingly being used in both academic labs and industry. In addition to personalized medicine and the growth within artificial biology, this results in new use cases of the plasmid purification market share. Together, these forces incentivize investment and technology adoption as well as capacity expansion, signaling a future-driven market.

For instance, Thermo Fisher Scientific established a new 67,000-square-foot cGMP plasmid DNA manufacturing facility in Carlsbad, California in July 2021, therefore marking a major change in the market.

Established to satisfy the rapidly increasing demand for mRNA vaccines and plasmid DNA-based treatments, this facility helps the business to enable gene therapy and vaccine manufacture.

Restraints:

High Production Expenses and Process Sophistication Hinders Market Growth

Despite encouraging the market growth, some factors hold the market growth back. Particularly in resource-limited settings, the cost of reagents, consumables, and specialized equipment deters. Manual steps to reach DNA purity call for skilled personnel and rigorous process control, hence extending time and complexity.

For instance, for therapeutic uses, preserving endotoxin-free plasmid DNA calls for several downstream purification processes and quality control tests, hence increasing operating expenses. Furthermore, the strict regulatory conditions for clinical-grade plasmid manufacturing, such as GMP compliance, add cost and time-to-market. While automation offers relief, equipment, such as Thermo Fisher's KingFisher systems or Bio-Rad's Aurum kits, calls for large capital expenditure. Particularly in places with low financing, these obstacles impede smaller labs and CDMOs from increasing output. Ultimately, cost-hindering and procedural complexity impede further acceptance even if the market for plasmid purification is expanding globally, due to significant expenditures in advanced biotech contexts.

For instance, a recent breakthrough in the market is the release of Thermo Fisher Scientific's KingFisher PlasmidPro Maxi Processor, the only fully automated maxi-scale plasmid DNA purification technology.

Although, this invention lowers manual intervention and improves efficiency, smaller laboratories and contract development and manufacturing companies (CDMOs), especially in resource-limited environments, find great difficulty in the high capital investment needed for such advanced equipment.

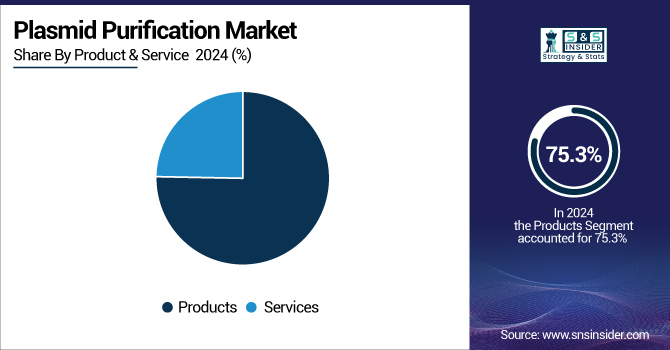

By Product & Service

Plasmid purification market share stood at 75.3%, with the products segment held the major share in 2024. The growth is driven by the availability and extensive use of plasmid purification kits/reagents with increased molecular demand of multiple conditions supporting both labs (in academic molecular biology) and biopharmaceuticals. The high demand, grounded on research, diagnostics, and therapy applications is also driving the segment’s growth in the market.

The services segment is expected to witness highest growth in the market in upcoming years due to the growing trend of outsourcing among pharmaceutical companies and academic research institutes. Many companies are looking for specialized service providers to guarantee scalability, regulatory compliance, and cost-efficiency as the demand for premium and GMP-compliant plasmid DNA increases, especially for use in gene therapy, vaccine manufacturing, and advanced molecular research. Outsourcing is a recommended approach that greatly aids plasmid purification market share expansion since it accelerates time-to-market and helps to minimize in-house resource burdens.

By Grade

With a 64.42% share, molecular-grade plasmid DNA dominated the market due to its general use in basic research, diagnostics, and regular laboratory procedures. Key factors contributing to the broad acceptance of molecular-grade goods are their dependability and economy, further extending the market size globally.

The transfection-grade segment is projected to grow at the fastest CAGR due to the rising demand for high-purity, endotoxin-free plasmid DNA drives. Sensitive uses for this kind of DNA include enhanced cell-based assays, mRNA-based vaccine development, and gene therapy, where contaminants can impact transfection effectiveness or safety. Reliable, scalable, and compliant plasmid purification techniques become more important as regulatory criteria tightens and clinical research speeds forward.

For instance, for typical research uses, the Monarch Plasmid Miniprep Kit from New England Biolabs (NEB) provides dependable and clean molecular-grade plasmid DNA, therefore greatly boosting the market growth.

By Application

The cloning and protein expression segment on is leading the market with a 52.7% revenue share, supported by the rising demand for recombinant protein generation in medication development and academic research, further boosting the market share.

The transfection and gene editing segment is expected to witness high growth throughout the forecast period driven by the synthetic biology, CRISpen technologies, and other modern gene-editing platform that demand high-quality and contaminant-free plasmid DNA. Reliable plasmid purification is a crucial first step since these applications need exact and effective delivery of genetic material into target cells. Transfection-grade plasmids are in increasing demand as gene therapy, cell treatment, and mRNA-based studies develop. This boom greatly increases the market expansion.

By End-Use

With 44.2% of the revenue, academia and research institutions held the highest plasmid purification market share in 2024. Due to the leading fundamental research and educational activities, these institutions constantly need plasmid DNA for different experimental procedures, thus improving the plasmid purification market size.

The contract research organizations (CROs) segment is expected to be the fastest-growing segment as biopharmaceutical companies outsource difficult R&D and clinical manufacturing activities, thus accelerating the market expansion through specialized and reasonably priced services.

For instance, many university research labs throughout the world, for instance, depend on Sigma-Aldrich's GenElute Plasmid Kits, which are known for consistency and performance in experimental environments.

Regional Analysis:

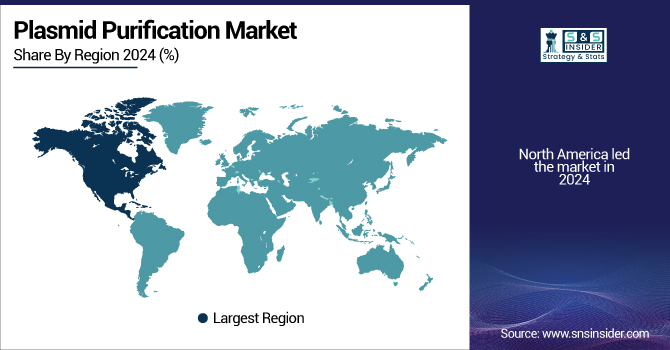

North America led the market in 2024, supported by robust biotechnology infrastructure, significant R&D spending, and a rise in gene therapy and vaccine-related research. The main contributor is the U.S., housing major market participants, such as Thermo Fisher Scientific and New England Biolabs (NEB). The market share in this area has been greatly raised by public and commercial sector’s extensive investment, and regulatory backing for gene-based medicines. Furthermore, advanced healthcare systems and top academic institutions are also supporting the market expansion, and are also helping North America contribute the most to the market.

Europe is the second fastest growing region in the plasmid purification industry, benefiting from robust academic research, pharmaceutical innovation, and EU financing initiatives. Leading nation in the region, Germany boasts biotechnology behemoths, such as Qiagen. Plasmid purification market growth in Europe is expected to increase due to the region's emphasis on precision medicine and the surging application of plasmid DNA in medicinal development. Furthermore, improving operational efficiency driving the market size in Europe are strict regulatory criteria and burgeoning acceptance of automated purification systems. Due to the well-established research ecosystem and innovative approach, Europe continues to be a strong candidate in the global market.

Asia Pacific is emerging as the fastest-growing region during 2025 to 2032 due to rising university research activity, increasing biotechnology investments, and expanding pharmaceutical manufacturing. China is the leading country in the market due to the national programs aiming at advancing gene therapy research and biotech. Advanced purification methods are also quickly adopted by nations, such as India and South Korea. With growing demand for cost-effective research-grade and clinical-grade plasmid DNA, the region is seeing a surge in outsourcing and contract research, driving significant market growth in APAC. Rising local production capacity and growing international cooperation is also supporting Asia Pacific to grab a larger share over the forecast period.

Get Customized Report as per Your Business Requirement - Enquiry Now

The major competitors operating in the market are Merck KGaA, QIAGEN, Thermo Fisher Scientific Inc., Takara Bio, Promega Corporation, Zymo Research, MP Biomedicals, New England Biolabs, MCLAB, and Applied Biological Materials Inc.

Recent Developments:

In June 2024, Thermo Fisher Scientific launched the Thermo Scientific KingFisher PlasmidPro, the first fully automated plasmid purification system designed to accelerate therapeutic development. This innovation delivers high-purity plasmid DNA in just 75 minutes, cutting process time by 50% and eliminating the need for centrifugation, marking a major advancement in automation and efficiency in the market.

In November 2024, Zymo Research received the CE IVD mark for its Quick-DNA/RNA Viral MagBead Kit, allowing its use for in vitro diagnostic applications across EU member states. This certification facilitates broader adoption of the kit in clinical settings, supporting high-throughput purification of viral DNA/RNA, including SARS-CoV-2.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.96 billion |

| Market Size by 2032 | USD 4.74 billion |

| CAGR | CAGR of 11.67% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product & Service [Products, Services] • By Grade [Molecular-Grade, Transfection Grade] • By Application [Cloning & Protein Expression, Transfection & Gene Editing, Others] • By End Use [Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, Contract Research Organizations] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Merck KGaA, QIAGEN, Thermo Fisher Scientific Inc., Takara Bio, Promega Corporation, Zymo Research, MP Biomedicals, New England Biolabs, MCLAB, and Applied Biological Materials Inc. |

Ans: The Plasmid Purification Market is projected to grow at a CAGR of 11.67% during the forecast period.

Ans: By 2032, the Plasmid Purification Market is expected to reach USD 4.74 billion, up from USD 1.96 billion in 2024.

Ans: Plasmid DNA demand is increasing with the acceleration in biopharma use and gene therapy implementation.

Ans: High production expenses and process sophistication restrict availability in developing markets.

Ans: North America is the dominant region in the Plasmid Purification Market.

Table Of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Number of Gene Therapy and Cell Therapy Trials (2023)

5.2 Regional Usage Trends in Plasmid Purification (2023)

5.3 R&D Investment in Genetic Engineering and Biologics (2023)

5.4 Biopharmaceutical and CDMO Capacity Utilization Rates (2023)

5.5 Patent Filings and Approvals Related to Plasmid-Based Products (2023)

6. Competitive Landscape

6.1 List of Major Companies By Region

6.2 Market Share Analysis By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Plasmid Purification Market Segmentation By Product & Service

7.1 Chapter Overview

7.2 Products

7.2.1 Products Market Trends Analysis (2021-2032)

7.2.2 Products Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3 Instruments

7.2.3.1 Instruments Market Trends Analysis (2021-2032)

7.2.3.2 Instruments Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.4 Kits & Reagents

7.2.4.1 Kits & Reagents Market Trends Analysis (2021-2032)

7.2.4.2 Kits & Reagents Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Services

7.3.1 Services Market Trends Analysis (2021-2032)

7.3.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Plasmid Purification Market Segmentation By Grade

8.1 Chapter Overview

8.2 Molecular-Grade

8.2.1 Molecular-Grade Market Trends Analysis (2021-2032)

8.2.2 Molecular-Grade Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Transfection Grade

8.3.1 Transfection Grade Market Trends Analysis (2021-2032)

8.3.2 Transfection Grade Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Plasmid Purification Market Segmentation By Application

9.1 Chapter Overview

9.2 Cloning & Protein Expression

9.2.1 Cloning & Protein Expression Market Trends Analysis (2021-2032)

9.2.2 Cloning & Protein Expression Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Transfection & Gene Editing

9.3.1 Transfection & Gene Editing Market Trends Analysis (2021-2032)

9.3.2 Transfection & Gene Editing Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Others

9.4.1 Others Market Trends Analysis (2021-2032)

9.4.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Plasmid Purification Market Segmentation By End-Use

10.1 Chapter Overview

10.2 Pharmaceutical & Biotechnology Companies

10.2.1 Pharmaceutical & Biotechnology Companies Market Trends Analysis (2021-2032)

10.2.2 Pharmaceutical & Biotechnology Companies Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Academic & Research Institutes

10.3.1 Academic & Research Institutes Market Trend Analysis (2021-2032)

10.3.2 Academic & Research Institutes Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Contract Research Organizations

10.4.1 Contract Research Organizations Market Trends Analysis (2021-2032)

10.4.2 Contract Research Organizations Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trend Analysis

11.2.2 North America Plasmid Purification Market Estimates and Forecasts by Country (2021-2032) (USD Billion)

11.2.3 North America Plasmid Purification Market Estimates and Forecasts by Product & Service (2021-2032) (USD Billion)

11.2.4 North America Plasmid Purification Market Estimates and Forecasts By Grade (2021-2032) (USD Billion)

11.2.5 North America Plasmid Purification Market Estimates and Forecasts by Application (2021-2032) (USD Billion)

11.2.6 North America Plasmid Purification Market Estimates and Forecasts by End-Use (2021-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Plasmid Purification Market Estimates and Forecasts by Product & Service (2021-2032) (USD Billion)

11.2.7.2 USA Plasmid Purification Market Estimates and Forecasts By Grade (2021-2032) (USD Billion)

11.2.7.3 USA Plasmid Purification Market Estimates and Forecasts by Application (2021-2032) (USD Billion)

11.2.7.4 USA Plasmid Purification Market Estimates and Forecasts by End-Use (2021-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Plasmid Purification Market Estimates and Forecasts by Product & Service (2021-2032) (USD Billion)

11.2.8.2 Canada Plasmid Purification Market Estimates and Forecasts By Grade (2021-2032) (USD Billion)

11.2.8.3 Canada Plasmid Purification Market Estimates and Forecasts by Application (2021-2032) (USD Billion)

11.2.8.4 Canada Plasmid Purification Market Estimates and Forecasts by End-Use (2021-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Plasmid Purification Market Estimates and Forecasts by Product & Service (2021-2032) (USD Billion)

11.2.9.2 Mexico Plasmid Purification Market Estimates and Forecasts By Grade (2021-2032) (USD Billion)

11.2.9.3 Mexico Plasmid Purification Market Estimates and Forecasts by Application (2021-2032) (USD Billion)

11.2.9.4 Mexico Plasmid Purification Market Estimates and Forecasts by End-Use (2021-2032) (USD Billion)

11.3 Europe

11.3.1 Trend Analysis

11.3.2 Europe Plasmid Purification Market Estimates and Forecasts by Country (2021-2032) (USD Billion)

11.3.3 Europe Plasmid Purification Market Estimates and Forecasts by Product & Service (2021-2032) (USD Billion)

11.3.4 Europe Plasmid Purification Market Estimates and Forecasts By Grade (2021-2032) (USD Billion)

11.3.5 Europe Plasmid Purification Market Estimates and Forecasts by Application (2021-2032) (USD Billion)

11.3.6 Europe Plasmid Purification Market Estimates and Forecasts by End-Use (2021-2032) (USD Billion)

11.3.7 Germany

11.3.7.1 Germany Plasmid Purification Market Estimates and Forecasts by Product & Service (2021-2032) (USD Billion)

11.3.7.2 Germany Plasmid Purification Market Estimates and Forecasts By Grade (2021-2032) (USD Billion)

11.3.7.3 Germany Plasmid Purification Market Estimates and Forecasts by Application (2021-2032) (USD Billion)

11.3.7.4 Germany Plasmid Purification Market Estimates and Forecasts by End-Use (2021-2032) (USD Billion)

11.3.8 France

11.3.8.1 France Plasmid Purification Market Estimates and Forecasts by Product & Service (2021-2032) (USD Billion)

11.3.8.2 France Plasmid Purification Market Estimates and Forecasts By Grade (2021-2032) (USD Billion)

11.3.8.3 France Plasmid Purification Market Estimates and Forecasts by Application (2021-2032) (USD Billion)

11.3.8.4 France Plasmid Purification Market Estimates and Forecasts by End-Use (2021-2032) (USD Billion)

11.3.9 UK

11.3.9.1 UK Plasmid Purification Market Estimates and Forecasts by Product & Service (2021-2032) (USD Billion)

11.3.9.2 UK Plasmid Purification Market Estimates and Forecasts By Grade (2021-2032) (USD Billion)

11.3.9.3 UK Plasmid Purification Market Estimates and Forecasts by Application (2021-2032) (USD Billion)

11.3.9.4 UK Plasmid Purification Market Estimates and Forecasts by End-Use (2021-2032) (USD Billion)

11.3.10 Italy

11.3.10.1 ItalyPlasmid Purification Market Estimates and Forecasts by Product & Service (2021-2032) (USD Billion)

11.3.10.2 Italy Plasmid Purification Market Estimates and Forecasts By Grade (2021-2032) (USD Billion)

11.3.10.3 Italy Plasmid Purification Market Estimates and Forecasts by Application (2021-2032) (USD Billion)

11.3.10.4 Italy Plasmid Purification Market Estimates and Forecasts by End-Use (2021-2032) (USD Billion)

11.3.11 Spain

11.3.11.1 Spain Plasmid Purification Market Estimates and Forecasts by Product & Service (2021-2032) (USD Billion)

11.3.11.2 Spain Plasmid Purification Market Estimates and Forecasts By Grade (2021-2032) (USD Billion)

11.3.11.3 Spain Plasmid Purification Market Estimates and Forecasts by Application (2021-2032) (USD Billion)

11.3.11.4 Spain Plasmid Purification Market Estimates and Forecasts by End-Use (2021-2032) (USD Billion)

11.3.12 Poland

11.3.12.1 Poland Plasmid Purification Market Estimates and Forecasts by Product & Service (2021-2032) (USD Billion)

11.3.12.2 Poland Plasmid Purification Market Estimates and Forecasts By Grade (2021-2032) (USD Billion)

11.3.12.3 Poland Plasmid Purification Market Estimates and Forecasts by Application (2021-2032) (USD Billion)

11.3.12.4 Poland Plasmid Purification Market Estimates and Forecasts by End-Use (2021-2032) (USD Billion)

11.3.13 Turkey

11.3.13.1 Turkey Plasmid Purification Market Estimates and Forecasts by Product & Service (2021-2032) (USD Billion)

11.3.13.2 Turkey Plasmid Purification Market Estimates and Forecasts By Grade (2021-2032) (USD Billion)

11.3.13.3 Turkey Plasmid Purification Market Estimates and Forecasts by Application (2021-2032) (USD Billion)

11.3.13.4 Turkey Plasmid Purification Market Estimates and Forecasts by End-Use (2021-2032) (USD Billion)

11.3.14 Rest of Europe

11.3.14.1 Rest of Europe Plasmid Purification Market Estimates and Forecasts by Product & Service (2021-2032) (USD Billion)

11.3.14.2 Rest of Europe Plasmid Purification Market Estimates and Forecasts By Grade (2021-2032) (USD Billion)

11.3.14.3 Rest of Europe Plasmid Purification Market Estimates and Forecasts by Application (2021-2032) (USD Billion)

11.3.14.4 Rest of Europe Plasmid Purification Market Estimates and Forecasts by End-Use (2021-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trend Analysis

11.4.2 Asia Pacific Plasmid Purification Market Estimates and Forecasts by Country (2021-2032) (USD Billion)

11.4.3 Asia Pacific Plasmid Purification Market Estimates and Forecasts by Product & Service (2021-2032) (USD Billion)

11.4.4 Asia Pacific Plasmid Purification Market Estimates and Forecasts By Grade (2021-2032) (USD Billion)

11.4.5 Asia Pacific Plasmid Purification Market Estimates and Forecasts by Application (2021-2032) (USD Billion)

11.4.6 Asia Pacific Plasmid Purification Market Estimates and Forecasts by End-Use (2021-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Plasmid Purification Market Estimates and Forecasts by Product & Service (2021-2032) (USD Billion)

11.4.7.2 China Plasmid Purification Market Estimates and Forecasts By Grade (2021-2032) (USD Billion)

11.4.7.3 China Plasmid Purification Market Estimates and Forecasts by Application (2021-2032) (USD Billion)

11.4.7.4 China Plasmid Purification Market Estimates and Forecasts by End-Use (2021-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Plasmid Purification Market Estimates and Forecasts by Product & Service (2021-2032) (USD Billion)

11.4.8.2 India Plasmid Purification Market Estimates and Forecasts By Grade (2021-2032) (USD Billion)

11.4.8.3 India Plasmid Purification Market Estimates and Forecasts by Application (2021-2032) (USD Billion)

11.4.8.4 India Plasmid Purification Market Estimates and Forecasts by End-Use (2021-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Plasmid Purification Market Estimates and Forecasts by Product & Service (2021-2032) (USD Billion)

11.4.9.2 Japan Plasmid Purification Market Estimates and Forecasts By Grade (2021-2032) (USD Billion)

11.4.9.3 Japan Plasmid Purification Market Estimates and Forecasts by Application (2021-2032) (USD Billion)

11.4.9.4 Japan Plasmid Purification Market Estimates and Forecasts by End-Use (2021-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Plasmid Purification Market Estimates and Forecasts by Product & Service (2021-2032) (USD Billion)

11.4.10.2 South Korea Plasmid Purification Market Estimates and Forecasts By Grade (2021-2032) (USD Billion)

11.4.10.3 South Korea Plasmid Purification Market Estimates and Forecasts by Application (2021-2032) (USD Billion)

11.4.10.4 South Korea Plasmid Purification Market Estimates and Forecasts by End-Use (2021-2032) (USD Billion)

11.4.11 Singapore

11.4.11.1 Singapore Plasmid Purification Market Estimates and Forecasts by Product & Service (2021-2032) (USD Billion)

11.4.11.2 Singapore Plasmid Purification Market Estimates and Forecasts By Grade (2021-2032) (USD Billion)

11.4.11.3 Singapore Plasmid Purification Market Estimates and Forecasts by Application (2021-2032) (USD Billion)

11.4.11.4 Singapore Plasmid Purification Market Estimates and Forecasts by End-Use (2021-2032) (USD Billion)

11.4.12 Australia

11.4.12.1 Australia Plasmid Purification Market Estimates and Forecasts by Product & Service (2021-2032) (USD Billion)

11.4.12.2 Australia Plasmid Purification Market Estimates and Forecasts By Grade (2021-2032) (USD Billion)

11.4.12.3 Australia Plasmid Purification Market Estimates and Forecasts by Application (2021-2032) (USD Billion)

11.4.12.4 Australia Plasmid Purification Market Estimates and Forecasts by End-Use (2021-2032) (USD Billion)

11.4.13 Rest of Asia Pacific

11.4.13.1 Rest of Asia Pacific Plasmid Purification Market Estimates and Forecasts by Product & Service (2021-2032) (USD Billion)

11.4.13.2 Rest of Asia Pacific Plasmid Purification Market Estimates and Forecasts By Grade (2021-2032) (USD Billion)

11.4.13.3 Rest of Asia Pacific Plasmid Purification Market Estimates and Forecasts by Application (2021-2032) (USD Billion)

11.4.13.4 Rest of Asia Pacific Plasmid Purification Market Estimates and Forecasts by End-Use (2021-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Trend Analysis

11.5.2 Middle East and Africa Plasmid Purification Market Estimates and Forecasts by Country (2021-2032) (USD Billion)

11.5.3 Middle East and Africa Plasmid Purification Market Estimates and Forecasts by Product & Service (2021-2032) (USD Billion)

11.5.4 Middle East and Africa Plasmid Purification Market Estimates and Forecasts By Grade (2021-2032) (USD Billion)

11.5.5 Middle East and Africa Plasmid Purification Market Estimates and Forecasts by Application (2021-2032) (USD Billion)

11.5.6 Middle East and Africa Plasmid Purification Market Estimates and Forecasts by End-Use (2021-2032) (USD Billion)

11.5.7 UAE

11.5.7.1 UAE Plasmid Purification Market Estimates and Forecasts by Product & Service (2021-2032) (USD Billion)

11.5.7.2 UAE Plasmid Purification Market Estimates and Forecasts By Grade (2021-2032) (USD Billion)

11.5.7.3 UAE Plasmid Purification Market Estimates and Forecasts by Application (2021-2032) (USD Billion)

11.5.7.4 UAE Plasmid Purification Market Estimates and Forecasts by End-Use (2021-2032) (USD Billion)

11.5.8 Saudi Arabia

11.5.8.1 Saudi Arabia Plasmid Purification Market Estimates and Forecasts by Product & Service (2021-2032) (USD Billion)

11.5.8.2 Saudi Arabia Plasmid Purification Market Estimates and Forecasts By Grade (2021-2032) (USD Billion)

11.5.8.3 Saudi Arabia Plasmid Purification Market Estimates and Forecasts by Application (2021-2032) (USD Billion)

11.5.8.4 Saudi Arabia Plasmid Purification Market Estimates and Forecasts by End-Use (2021-2032) (USD Billion)

11.5.1.9 Qatar

11.5.9.1 Qatar Plasmid Purification Market Estimates and Forecasts by Product & Service (2021-2032) (USD Billion)

11.5.9.2 Qatar Plasmid Purification Market Estimates and Forecasts By Grade (2021-2032) (USD Billion)

11.5.9.3 Qatar Plasmid Purification Market Estimates and Forecasts by Application (2021-2032) (USD Billion)

11.5.1.9.4 Qatar Plasmid Purification Market Estimates and Forecasts by End-Use (2021-2032) (USD Billion)

11.5.10 South Africa

11.5.10.1 South Africa Plasmid Purification Market Estimates and Forecasts by Product & Service (2021-2032) (USD Billion)

11.5.10.2 South Africa Plasmid Purification Market Estimates and Forecasts By Grade (2021-2032) (USD Billion)

11.5.10.3 South Africa Plasmid Purification Market Estimates and Forecasts by Application (2021-2032) (USD Billion)

11.5.10.4 South Africa Plasmid Purification Market Estimates and Forecasts by End-Use (2021-2032) (USD Billion)

11.5.11 Rest of Middle East & Africa

11.5.11.1 Rest of Middle East & Africa Plasmid Purification Market Estimates and Forecasts by Product & Service (2021-2032) (USD Billion)

11.5.11.2 Rest of Middle East & Africa Plasmid Purification Market Estimates and Forecasts By Grade (2021-2032) (USD Billion)

11.5.11.3 Rest of Middle East & Africa Plasmid Purification Market Estimates and Forecasts by Application (2021-2032) (USD Billion)

11.5.11.4 Rest of Middle East & Africa Plasmid Purification Market Estimates and Forecasts by End-Use (2021-2032) (USD Billion)

11.6 Latin America

11.6.1 Trend Analysis

11.6.2 Latin America Plasmid Purification Market Estimates and Forecasts by Country (2021-2032) (USD Billion)

11.6.3 Latin America Plasmid Purification Market Estimates and Forecasts by Product & Service (2021-2032) (USD Billion)

11.6.4 Latin America Plasmid Purification Market Estimates and Forecasts By Grade (2021-2032) (USD Billion)

11.6.5 Latin America Plasmid Purification Market Estimates and Forecasts by Application (2021-2032) (USD Billion)

11.6.6 Latin America Plasmid Purification Market Estimates and Forecasts by End-Use (2021-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Plasmid Purification Market Estimates and Forecasts by Product & Service (2021-2032) (USD Billion)

11.6.7.2 Brazil Plasmid Purification Market Estimates and Forecasts By Grade (2021-2032) (USD Billion)

11.6.7.3 Brazil Plasmid Purification Market Estimates and Forecasts by Application (2021-2032) (USD Billion)

11.6.7.4 Brazil Plasmid Purification Market Estimates and Forecasts by End-Use (2021-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Plasmid Purification Market Estimates and Forecasts by Product & Service (2021-2032) (USD Billion)

11.6.8.2 Argentina Plasmid Purification Market Estimates and Forecasts By Grade (2021-2032) (USD Billion)

11.6.8.3 Argentina Plasmid Purification Market Estimates and Forecasts by Application (2021-2032) (USD Billion)

11.6.8.4 Argentina Plasmid Purification Market Estimates and Forecasts by End-Use (2021-2032) (USD Billion)

11.6.9 Rest of Latin America

11.6.9.1 Rest of Latin America Plasmid Purification Market Estimates and Forecasts by Product & Service (2021-2032) (USD Billion)

11.6.9.2 Rest of Latin America Plasmid Purification Market Estimates and Forecasts By Grade (2021-2032) (USD Billion)

11.6.9.3 Rest of Latin America Plasmid Purification Market Estimates and Forecasts by Application (2021-2032) (USD Billion)

11.6.9.4 Rest of Latin America Plasmid Purification Market Estimates and Forecasts by End-Use (2021-2032) (USD Billion)

12. Company Profiles

12.1 Merck KGaA

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Thermo Fisher Scientific Inc.

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 QIAGEN

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Takara Bio Inc.

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Promega Corporation

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Zymo Research Corporation

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 MP Biomedicals

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 New England Biolabs (NEB)

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 MCLAB (Molecular Cloning Laboratories)

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Applied Biological Materials Inc. (ABM)

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments

By Product & Service

Products

Instruments

Kits & Reagents

Services

By Grade

Molecular-Grade

Transfection Grade

By Application

Cloning & Protein Expression

Transfection & Gene Editing

Others

By End Use

Pharmaceutical & Biotechnology Companies

Academic & Research Institutes

Contract Research Organizations

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Germany

France

UK

Italy

Spain

Poland

Turkey

Rest of Europe

Asia Pacific

China

India

Japan

South Korea

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

UAE

Saudi Arabia

Qatar

South Africa

Rest of Middle East & Africa

Latin America

Brazil

Argentina

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g., Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Echocardiography Market was estimated at US$ 2.01 billion in 2023 and is expected to reach US$ 3.54 billion by 2031 and is anticipated to increase at a CAGR of 7.21% predicted for the forecast period of 2024-2031.

The Pressure Monitoring Market was valued at USD 12.74 billion in 2023 and is expected to reach USD 27.07 billion by 2032, growing at a CAGR of 8.75% over the forecast period of 2024-2032.

The Consumer Healthcare market was valued at USD 302.87 billion in 2023 and is expected to reach USD 588.68 billion by 2032 and grow at a CAGR of 7.68% over the forecast period of 2024-2032.

The Cell Line Development Market was valued at USD 5.46 billion in 2023 and is expected to reach USD 12.56 billion by 2032, growing at a CAGR of 9.66% from 2024-2032.

The Latex Agglutination Test Kits Market was valued at USD 639.13 million in 2023 and is expected to reach USD 1049.64 million by 2032, growing at a CAGR of 5.69% over the forecast period of 2024-2032.

The Cryoablation Devices Market size will reach $1295.34 Mn by 2032, was valued at $489.53 Mn in 2023 & growing at a CAGR of 10.26% over 2024-2032.

Hi! Click one of our member below to chat on Phone