Physical Security Market Report Scope & Overview:

Get More Information on Physical Security Market - Request Sample Report

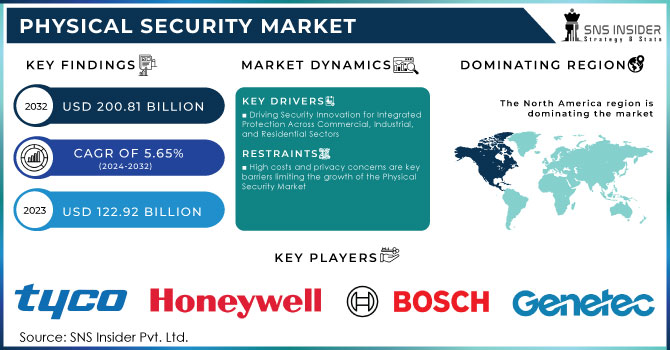

The Physical Security Market Size was valued at USD 122.92 Billion in 2023 and is expected to reach USD 200.81 Billion by 2032 and grow at a CAGR of 5.65% over the forecast period 2024-2032.

The physical security market is growing very rapidly with increasing concerns about crime, terrorism, and vandalism. The changing nature of global threats ensures that organizations are investing more in high-level security across different sectors. These are a few reasons why the demand is increasing for an integrated security system comprised of video surveillance, access control, and intrusion detection technology. It has also seen advances in artificial intelligence and machine learning that make security solutions more attractive for business and government use. With ongoing investments in infrastructure and increased regulatory compliance, the physical security market is poised for significant expansion, as entities prioritize safety and protection against emerging threats.

The U.S. Physical Security market highlights trends and growth tendencies based on new technologies. The market size was expected to reach approximately USD 405 billion by 2023, with a year-over-year growth rate of around 9% projected for 2024. The majority of investments in this market came from video surveillance systems, which accounted for about USD 28 billion of the equipment market (American Security Force, ASIS International). The security services segment is bigger, with services reaching about USD 319 billion, and guarding services are significant in that respect (ASIS International). There is a growing force pushing companies toward integration of physical and cybersecurity measures as it seems to be an attempt toward a holistic strategy in fighting evolving threats (American Security Force).

Physical Security Market Dynamics

KEY DRIVERS:

-

Driving Security Innovation for Integrated Protection Across Commercial, Industrial, and Residential Sectors

The driving force of the current market for Physical Security is the critical need for integrating comprehensive protection for commercial, industrial, and residential sectors. This is the time that organizations are seeking integrated solutions such as video surveillance, access control, and physical intrusion detection in protecting their respective infrastructures from theft, vandalism, and terrorism. Increased threat by governments and private enterprise has compelled much investment in state-of-the-art security technologies; the trend has propelled the development and adoption of advanced physical security systems.

-

Smart Security Evolution IoT and AI Are Transforming Physical Security Systems for Enhanced Efficiency and Rapid Response

The growing integration of IoT and AI-based technologies into physical security systems is another driver of the market. Predictive threat monitoring is provided by smart buildings that run on cloud-based access control and systems for real-time surveillance. Smart cities and automated infrastructure monitoring have paved the way to deploy massive scales of physical security solutions. It improves response time but enhances operational efficiency and data-driven decision-making to drive further growth in the market.

RESTRAIN:

-

High costs and privacy concerns are key barriers limiting the growth of the Physical Security Market

The physical security market faces high installation costs and recurring maintenance cost for sophisticated security systems is a barrier to the market. All-inclusive solutions are not adopted by small and medium enterprises because they do not possess resources in those organizations. Moreover, privacy concerns associated with surveillance technologies such as face recognition hinder its widespread adoption. Most strenuous rules and compliance conditions pose bigger difficulties for businesses when it comes to the effective operation and scaling of their physical security measures. It is essential to overcome these to unlock the full capacity of this market.

Physical Security Market Segmentation Overview

BY SYSTEM

The physical security market is dominated by the systems segment with a total market share of 68.25% in 2023, and there is growing demand for a comprehensive solution that includes surveillance, access control as well as intrusion detection. Organizations across all industries are looking for overall security systems that would protect their critical infrastructure against new threats such as theft and terrorism. In addition, cloud-based technologies and artificial intelligence have further advanced these systems to make them function more effectively and user-friendly.

The services segment is projected to experience rapid growth, with an anticipated compound annual growth rate (CAGR) of 8.35% throughout the forecast period. Services encompass the installation, upkeep, and upgrading of the equipment as well as software, that further propels performance by providing the user with optimum control of the complete security infrastructure. High infrastructure development in developing countries along with technology upgrades such as Ultra High Definition (UHD) surveillance are propelling high demand for added physical security services.

BY ORGANIZATION SIZE

The large enterprise segment was the market leader in 2023, capturing over 63.45% of global revenue. The reasons behind it include more substantial infrastructure to be safeguarded, much more critical information to be protected, and greater revenue to be spent. So, they are the early adopters of physical security. Further, protecting their data from thefts, cyberattacks, and unauthorized access allows the segment shift toward physical security solutions.

The SMEs segment is expected to grow rapidly at CAGR of 7.28% over the Forecast period. This segment can more be due to theft, environmental danger, and intruders, as a lot of resources and people also need to be protected in small businesses.

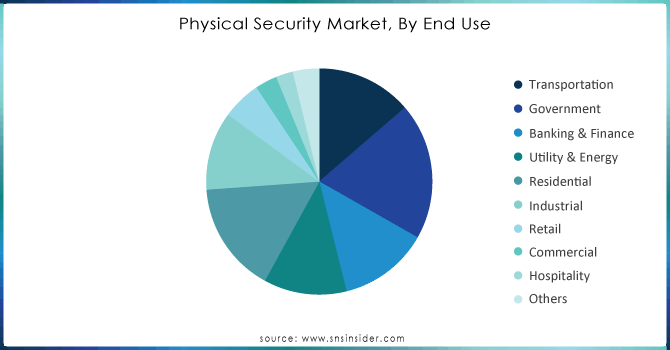

BY END-USE

The government segment emerged as the market leader in 2023, representing over 19.56% of the total revenue share. These trends are supported by the increasing government spending on national security and public safety initiatives that are triggered by the global threats from terrorism and cyberattacks. The governments are investing future-security technologies, including surveillance systems and access control technologies, towards safeguarding critical infrastructure and public space.

The residential segment is expected to grow at a high rate of 6.58% during the forecast period due to the innumerable damaged assets and resources subjected to thefts and other attacks. The application in residential properties has improved user experience along with protection of the assets from any kind of risks. Safety is ensured through well-rounded video surveillance systems, smart access control, and quick intrusion detection system.

Need any customization research on Physical Security Market - Enquiry Now

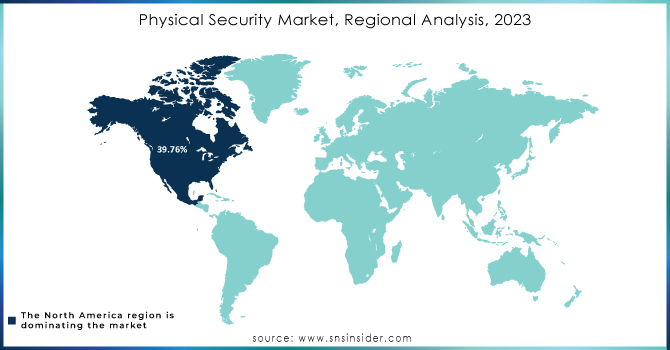

Physical Security Market Regional Analysis

In 2023, North America dominated the Physical Security market, holding the highest share with over 39.76% of market revenue. Robust economic growth in conjunction with regulatory reforms, along with rising investments in security solutions by SMEs, fuels a high rate of adoption of advanced physical security systems in the region. Emphasis on increasing security measures against growing threats further cements North America's leadership in market growth and innovation for physical security technologies.

The Asia Pacific region will have the highest CAGR of 6.35% during the forecast period. The increase in this region can be attributed to the rising demand for smart security solutions in India and China. Notable investments by the Chinese government in safe city projects, mainly concentrating on city surveillance and monitoring traffic, are likely to fuel the growth of the market.

Key Players in Physical Security Market

Some of the major players in the Physical Security Market are:

-

Tyco International (CCTV Systems, Access Control Solutions)

-

Honeywell (Video Surveillance Systems, Intrusion Detection Systems)

-

Bosch Security Systems (Security Cameras, Alarm Systems)

-

Axis Communications (Network Cameras, Video Encoders)

-

Genetec (Security Center, AutoVu)

-

ADT Inc. (Commercial Security Systems, Home Security Solutions)

-

Cisco Systems (Cisco Video Surveillance, Security Management Solutions)

-

Hikvision (IP Cameras, Video Management Software)

-

Pelco (Video Surveillance Cameras, Video Management Systems)

-

Securitas AB (Guarding Services, Mobile Patrol Services)

-

G4S (Integrated Security Solutions, Cash Solutions)

-

Stanley Security (Access Control Systems, Video Surveillance Solutions)

-

Schneider Electric (EcoStruxure Security Expert, Video Management Software)

-

IBM (Security Information and Event Management, Physical Security Solutions)

-

Milestone Systems (Video Management Software, Open Platform Solutions)

-

FLIR Systems (Thermal Imaging Cameras, Surveillance Solutions)

-

Dahua Technology (Surveillance Cameras, Video Recorders)

-

Verint Systems (Video Intelligence Solutions, Security Solutions)

-

LenelS2 (OnGuard Security Management System, Mobile Access Solutions)

-

Motorola Solutions (Two-Way Radios, Video Security Solutions)

RECENT TRENDS

-

In Sep 2024, Rhombus, a leader in cloud-managed physical security, announces the rollout of two new solutions to its much longer list of security offerings: the R600 Multisensor Camera and the E50 Environmental Sensor.

-

In May 2024, Verkada announced that it would be launching a new AI-powered search in Beta for its customers. Making use of large language and large vision models, AI-powered search from Verkada is set to empower its customers to apply natural language in the searching of video security camera footage containing people and vehicles, thus making their investigations more intuitive and efficient.

-

In April 2024, LVT (LiveView Technologies, Inc.), the leader of customizable mobile surveillance solutions, announced its integration with Immix and two new cameras that further empower security leaders to monitor and protect a range of environments. More than 94% of Fortune 100 retailers use LVT’s advanced mobile surveillance units and security solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 122.92 Billion |

| Market Size by 2032 | USD 200.81 Billion |

| CAGR | CAGR of 5.65% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Systems (Physical Access Control System (PACS), Video Surveillance System, Perimeter Intrusion Detection and Prevention, Physical Security Information Management (PSIM), Physical Identity & Access Management (PIAM), Fire and Life Safety), Services (System Integration, Remote Monitoring, Others)), • By Size (Large Enterprises, SMEs), • By End Use (Transportation, Government, Banking & Finance, Utility & Energy, Residential, Industrial, Retail, Commercial, Hospitality, Others |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Tyco International, Honeywell, Bosch Security Systems, Axis Communications, Genetec, ADT Inc., Cisco Systems, Hikvision, Pelco, Securitas AB, G4S, Stanley Security, Schneider Electric, IBM, Milestone Systems, FLIR Systems, Dahua Technology, Verint Systems, LenelS2, Motorola Solutions |

| Key Drivers | • Driving Security Innovation for Integrated Protection Across Commercial, Industrial, and Residential Sectors • Smart Security Evolution IoT and AI Are Transforming Physical Security Systems for Enhanced Efficiency and Rapid Response |

| RESTRAINTS | • High costs and privacy concerns are key barriers limiting the growth of the Physical Security Market |