To Get More Information on Physical Security Information Management Market - Request Sample Report

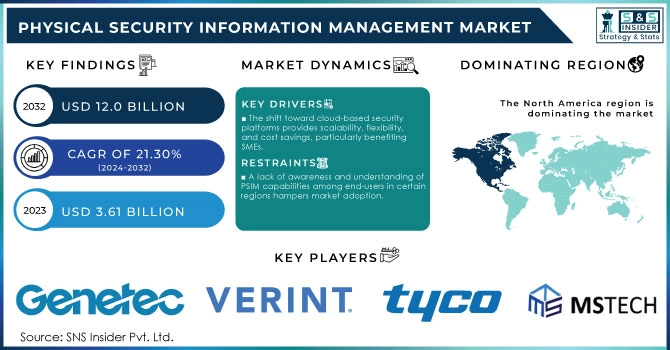

The Physical Security Information Management Market was valued at USD 3.61 billion in 2023 and is expected to reach USD 12.0 Billion by 2032, growing at a CAGR of 21.30% from 2024-2032.

The Physical Security Information Management (PSIM) market is expanding rapidly as organizations increasingly integrate multiple security systems into a unified platform to enhance security operations and incident management. PSIM solutions provide centralized control by linking video surveillance, access control, alarm systems, and other physical security tools, allowing security teams to detect, assess, and respond to threats more efficiently. The rise in security breaches and the need for proactive risk management have accelerated the adoption of PSIM across industries such as government, transportation, energy, and critical infrastructure. One of the key drivers of market growth is the increasing complexity of security infrastructures. As organizations incorporate more devices and systems, the demand for seamless coordination rises. PSIM solutions address this by offering a unified interface that simplifies security operations and reduces response times to potential incidents. Additionally, the growing adoption of cloud-based platforms is driving the market forward. Cloud-based PSIM solutions offer flexibility, scalability, and cost-effectiveness, making them particularly attractive to small and medium-sized enterprises (SMEs).

| Security Breach | PSIM Response | Impact |

|---|---|---|

| Unauthorized access | Real-time alerts from access control systems | Prevents unauthorized entry into sensitive areas |

| Cybersecurity threats | Integration with IT systems for early detection | Mitigates data breaches by isolating affected networks |

| Physical intrusions | Video surveillance and motion detection integration | Enhances situational awareness and triggers immediate security response |

| Employee misconduct | Unified monitoring of all security systems | Detects suspicious behavior and enables corrective actions |

| Equipment or infrastructure tampering | Real-time monitoring and automated alerts | Protects critical assets and infrastructure from damage or theft |

A real-world example of PSIM in action is its use during major events like the Super Bowl. PSIM systems at such events integrate video feeds from stadium cameras, access control systems, and crowd management tools, ensuring real-time monitoring and swift responses to potential security threats. Similarly, government agencies and transportation hubs like airports are adopting PSIM to improve public safety.

The increasing demand for PSIM due to rising threats to critical infrastructure, which has spurred greater investments in security technologies. The report also notes that public sector spending on security management systems increased by 12% over the past year, significantly contributing to the market's growth.

Drivers

The shift toward cloud-based security platforms provides scalability, flexibility, and cost savings, particularly benefiting SMEs.

Organizations are adopting PSIM to enable real-time threat assessment and management, improving overall security operations.

Growing incidents of data and physical security breaches are driving demand for PSIM solutions to enhance threat detection and response capabilities.

Growing occurrences of data and physical security breaches have emerged as a paramount problem facing all sectors including government, critical infrastructure, transportation, and corporate industry. Security threats—whether they stem from unauthorized access, cyber-attacks or physical risks pose a risk of financial loss, brand damage and endanger lives. Similarly, in order to counter these rising threats many organizations are implementing Physical Security Information Management (PSIM) solutions that offer centralized platforms for issue detection and streamlined response through the integration of multiple systems.

With PSIM platforms, organizations can utilize a single interface to monitor and control all security systems which include video surveillance, access control, intrusion detection and emergency communication. PSIM connects these systems together to provide security teams with the situational awareness required to quickly detect and assess any possible threats. The immediate response is vital to avoid breaches in the security systems because if not retaliated at an early stage, then more minor incidents can escalate into significant catastrophes. PSIM further facilitates the automation of alerts, providing security personnel with step-by-step guidance through predetermined response protocols via real-time data analysis.

As an example, when someone tries to breach a secure area without authorization, a PSIM can instantly notify authorities by collecting data from both surveillance cameras and access control systems. Live video feeds will then help the security team to observe the situation and initiate timely actions by either securing the area or even contacting authorities. PSIM integrates different security technologies that reduce response times and ensures potential incidents are resolved quickly. In addition, PSIM platforms also assist with post-incident reviews as they record everything related to any security event. It assists organizations in recognizing where their security infrastructure is lacking and changing their protocols in order to avoid future breaches.

Restraints

A lack of awareness and understanding of PSIM capabilities among end-users in certain regions hampers market adoption.

The upfront costs for deploying PSIM solutions, including hardware, software, and integration, can be prohibitive for smaller organizations.

The integration of multiple security systems raises concerns about data privacy and compliance with regulations, particularly in highly regulated industries.

In the Physical Security Information Management (PSIM) market, the integration of multiple security systems into a unified platform creates significant concerns around data privacy and regulatory compliance, especially in highly regulated industries like finance, healthcare, and government. These industries are governed by strict data protection laws, such as GDPR in Europe and HIPAA in the U.S., which require organizations to ensure the confidentiality, integrity, and security of personal and sensitive information. When multiple security systems—such as video surveillance, access control, and intrusion detection—are integrated through a PSIM solution, a large volume of data is generated, including personal identification, access logs, video footage, and alarm data. This data is often stored, analyzed, and shared across various departments, which increases the risk of data breaches or unauthorized access. For example, if a PSIM platform is compromised, sensitive information, such as who accessed restricted areas or when a specific alarm was triggered, could be exposed to cybercriminals or unauthorized users.

Moreover, regulatory frameworks require organizations to maintain detailed audit trails and demonstrate compliance with data protection standards. As PSIM solutions collect and analyze sensitive data, ensuring that the platform is compliant with all relevant regulations is a significant challenge. Organizations need to implement robust data encryption, access controls, and audit mechanisms to protect this information. Non-compliance could result in heavy fines, legal actions, and reputational damage.

For instance, in the healthcare sector, a breach in a PSIM system that manages patient access data could result in severe penalties under HIPAA. Therefore, ensuring that the PSIM system is compliant with industry-specific regulations and data protection laws is critical for its successful deployment and adoption.

| Challenge | How PSIM Helps |

|---|---|

| Data Sensitivity | PSIM platforms offer encryption and data masking to protect sensitive information. |

| Unauthorized Access | Multi-level user authentication and role-based access controls ensure only authorized personnel can view or manage sensitive data. |

| Audit and Compliance | PSIM provides detailed logs and reports for compliance audits, helping organizations meet regulatory requirements. |

| Data Breach Risks | Real-time monitoring and alert systems notify security teams of suspicious activity, reducing the likelihood of breaches. |

| Cross-Department Data Sharing | PSIM enables secure data sharing across departments with controlled access, ensuring compliance. |

By Application

In 2023, the access control system segment dominated the market and represented significant revenue share, due to rising demands of securing systems and networks with better protection methods. The increase can be largely ascribed to the growing implementation of such cutting-edge technologies wise biometric, smart card & precise modules that quicken safety and security mixed with convenience. These systems are being adopted by organizations to decrease risks and meet inflexible compliance, while providing with high protection to critical areas. Moreover, the increasing trend of smart buildings and the use of IoT devices have further propelled the need for advanced access control systems around PSIM market.

However, the Video Management System (VMS) segment is expected to grow at a high CAGR during the forecast period. Artificial Intelligence and Machine Learning advancements are enabling VMS solutions to provide high-level analytics including facial recognition, anomaly detection, and behavioral analysis that significantly increase security effectiveness. The growth of VMS is further propelled by the availability of HD cameras as well as integration with other security technologies. In addition, increasing need for integrated security solutions in both public and private sectors are some factors making VMS software a significant part of contemporary security infrastructure.

By Deployment

On-premise segment held significant revenue over 57.25% in 2023. On-premise deployments are typically favored by organizations with stringent requirements for data security, compliance and control since they can provide a secure environment at the customer site. It provides a low level of configurability, seamless integration within existing infrastructure and addresses complex security needs while also ensuring reliability even in the absence of an Internet connection. On-premise PSIM solutions are witnessing steady growth as sectors with high security requirements, such as government and critical infrastructure, continue to push to keep a tight rein on their security operations. General-purpose computers have become quite robust, the efficiency of on-premises systems is being enhanced by hardware and network technologies, so their appeal for organizations seeking to satisfy requirements around security or performance is increasing.

Unlike this, the cloud segment is projected to grow robustly in the forecast period. Cloud-based PSIM solutions provide valuable advantages, including a wider range of flexibility, scalability, and cost-effectiveness relative to traditional on-premises systems. By using cloud deployment, organizations are able to scale their security architecture, integrate data streams and provide real-time information from anywhere location — all of which improves collaboration and faster response times. Cloud-based models are gaining in popularity thanks to the growing need for remote accessibility, on-the-go updates and lower IT management overhead. Also, the cloud enables advanced analytics and AI capabilities providing deeper insights and predictive features for proactive security operations.

By Organization Size

In 2023, large enterprise segment the largest revenue share, as their security needs become ever more complex and their scale increases. With growing global footprints and operational environments, these organizations need next-gen PSIM that brings together multiple systems as well as data streams from disparate parts of the business. Large enterprises are making investments in PSIM systems with high integration capabilities to bring together a variety of security technologies — surveillance cameras, access control and alarm system into a single platform. Integrating with the below is important for offering a complete perspective on security operations and enhancing incident responsiveness.

On the other hand, the Small and Medium Enterprises (SMEs) sector is predicted to experience considerable growth over the forecast time frame. PSIM solutions that are cost-effective yet practical are most sought after by SMEs. PSIM providers are designing scalable, economical solutions for the unique needs of smaller businesses starting with basic features and growing as needed. In addition, with the growing thereats of cyber-attacks on sites, more and more SMEs are integrating cybersecurity into their physical security management using PSIM systems. This protects you from physical as well as digital threats and makes a strong security solution.

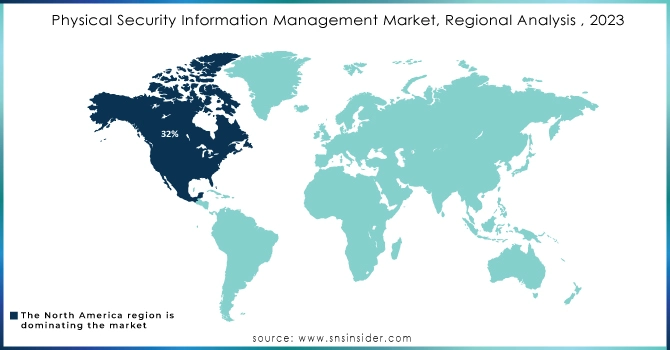

In 2023, North America dominated the market and contributed to more than 32% of the market. The strong adoption of advanced technologies, such as AI-driven analytics, integrated surveillance systems and smart infrastructure is driving the growth of this market in this region. Moreover, stringent regulatory standards and widespread infrastructure expansion smart cities and vital infrastructures boost the requirements for high-end PSIM technology even higher. The proactive approach to improving security both public and private in the nations together with heavy spending by Government as well as by the Corporate Sector, gears up North Americas Lead and Growth in PSIM market.

The rapid growth of the Asia Pacific physical security information management market is in stark contrast. Investments in smart city projects, transportation networks and critical infrastructure of the region's emerging economies are also fueling the requirement for advanced PSIM solutions. IoT device proliferation and more ubiquitous, integrated AI-driven technologies further develop these solutions by improving both their surveillance, threat detection and incident management features. Other factors such as rising geopolitical tensions and rise in demand for secure urban high density are pushing the growth of this market. APAC's dedication to modernization of security frameworks and the incorporation of advanced technologies makes it an integral contributor for driving global growth in PSIM market space.

Do You Need any Customization Research on Physical Security Information Management Market - Inquire Now

The major key players and their products

Genetec Inc. - Security Center

Verint Systems Inc. - Verint Situational Intelligence Platform

Tyco International (Johnson Controls) - Tyco PSIM

MSTech - MSP-PSIM

Qognify - Qognify VMS

Milestone Systems - XProtect

Axis Communications - Axis Camera Station

Honeywell International Inc. - Honeywell Pro-Watch

Hikvision Digital Technology Co., Ltd. - HikCentral

Vidsys, Inc. - Vidsys PSIM

AxxonSoft - Axxon Next

CNL Software - IPSecurityCenter

OnSSI (Open Security & Safety Alliance) - Ocularis

Dahua Technology Co., Ltd. - DSS Pro

3VR Security, Inc. - 3VR Video Intelligence Platform

ISAPI (International Security Alliance for Public Information) - ISAPI PSIM Solution

Pelco (a subsidiary of Schneider Electric) - Pelco VideoXpert

IntelliVision - IntelliVision AI Video Analytics

Verigo, Inc. - Verigo PSIM

PrismTech (an ESI Company) - PrismTech VMS

B2B User

Toronto Pearson International Airport

UK Metropolitan Police Service

Coca-Cola

Airports Authority of India

Major League Baseball (MLB)

Dubai International Airport

Siemens

United States Department of Defense

Walmart

New York City Transit Authority

Moscow Metro

Dubai World Trade Centre

The Port Authority of New York and New Jersey

Shanghai Railway Bureau

Macy's

United Nations

US Army

MGM Resorts

LAX Airport (Los Angeles International Airport)

Tata Consultancy Services (TCS)

In March 2024, Access Information Management, the largest privately held provider of integrated information management services globally, announced its acquisition of Triyam, a rapidly expanding software company focused on data management solutions for healthcare organizations.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.61 Billion |

| Market Size by 2032 | USD 12.0 Billion |

| CAGR | CAGR of 21.30% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment (On-premises, Cloud, Hybrid) • By Application (Access Control System, Video Management System, Intrusion Detection System, Fire Alarm System, Video Analytics System) • By Organization Size (Large Enterprises, Small & Medium Enterprises) • By End-Use (Transportation, Government & Public Sector, Healthcare, BFSI, Educational Institution, Retail & Hospitality, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Genetec Inc., Verint Systems Inc., Tyco International (Johnson Controls), MSTech, Qognify, Milestone Systems, Axis Communications, Honeywell International Inc., Hikvision Digital Technology Co., Ltd. |

| Key Drivers | • The shift toward cloud-based security platforms provides scalability, flexibility, and cost savings, particularly benefiting SMEs. • Organizations are adopting PSIM to enable real-time threat assessment and management, improving overall security operations. |

| RESTRAINTS | • A lack of awareness and understanding of PSIM capabilities among end-users in certain regions hampers market adoption. • The upfront costs for deploying PSIM solutions, including hardware, software, and integration, can be prohibitive for smaller organizations. |

Ans- Physical Security Information Management Market was valued at USD 3.61 billion in 2023 and is expected to reach USD 12.0 Billion by 2032, growing at a CAGR of 21.30% from 2024-2032.

Ans- the CAGR of Physical Security Information Management Market during the forecast period is of 21.30% from 2024-2032.

Ans- In 2023, The North America dominated the market and held the significant revenue share in 2023.

Ans- one main growth factor for the Physical Security Information Management Market is

Ans- Challenges in Physical Security Information Management Market are

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Network Infrastructure Expansion, by Region

5.3 Cybersecurity Incidents, by Region (2020-2023)

5.4 Cloud Services Usage, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Physical Security Information Management Market Segmentation, by Deployment

7.1 Chapter Overview

7.2 On- Premise

7.2.1 On- Premise Market Trends Analysis (2020-2032)

7.2.2 On- Premise Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3Cloud-Based

7.3.1Cloud-Based Market Trends Analysis (2020-2032)

7.3.2Cloud-Based Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Hybrid

7.4.1Hybrid Market Trends Analysis (2020-2032)

7.4.2Hybrid Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Physical Security Information Management Market Segmentation, by Application

8.1 Chapter Overview

8.2 Access Control System

8.2.1 Access Control System Market Trends Analysis (2020-2032)

8.2.2 Access Control System Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Video Management System

8.3.1 Video Management System Market Trends Analysis (2020-2032)

8.3.2 Video Management System Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Intrusion Detection System

8.4.1 Intrusion Detection System Market Trends Analysis (2020-2032)

8.4.2 Intrusion Detection System Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Fire Alarm System

8.5.1 Fire Alarm System Market Trends Analysis (2020-2032)

8.5.2 Fire Alarm System Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Video Analytics System

8.6.1 Video Analytics System Market Trends Analysis (2020-2032)

8.6.2 Video Analytics System Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Physical Security Information Management Market Segmentation, by Organization Size

9.1 Chapter Overview

9.2 Small and Medium-Sized Businesses

9.2.1 Small and Medium-Sized Businesses Market Trends Analysis (2020-2032)

9.2.2 Small and Medium-Sized Businesses Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Large Enterprises

9.3.1 Large Enterprises Market Trends Analysis (2020-2032)

9.3.2 Large Enterprises Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Physical Security Information Management Market Segmentation, by End-Use

10.1 Chapter Overview

10.2 BFSI

10.2.1 BFSI Market Trends Analysis (2020-2032)

10.2.2 BFSI Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Transportation

10.3.1 Transportation Market Trends Analysis (2020-2032)

10.3.2 Transportation Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Government & Public Sector

10.4.1 Government & Public SectorMarket Trends Analysis (2020-2032)

10.4.2 Government & Public SectorMarket Size Estimates and Forecasts to 2032 (USD Billion)

10.5 Healthcare

10.5.1 Healthcare Market Trends Analysis (2020-2032)

10.5.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Billion)

10.6 Retail & Hospitality

10.6.1 Retail & Hospitality Market Trends Analysis (2020-2032)

10.6.2 Retail & Hospitality Market Size Estimates and Forecasts to 2032 (USD Billion)

10.7 Educational Institution

10.7.1 Educational Institution Market Trends Analysis (2020-2032)

10.7.2 Educational Institution Market Size Estimates and Forecasts to 2032 (USD Billion)

10.8 Other

10.8.1 Other Market Trends Analysis (2020-2032)

10.8.2 Other Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Physical Security Information Management Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.2.4 North America Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.5 North America Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.2.6 North America Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.2.7.2 USA Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.7.3 USA Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.2.7.4 USA Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.2.8.2 Canada Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.8.3 Canada Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.2.8.4 Canada Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.2.9.2 Mexico Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.9.3 Mexico Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.2.9.4 Mexico Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Physical Security Information Management Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.1.7.2 Poland Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.7.3 Poland Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.1.7.4 Poland Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.1.8.2 Romania Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.8.3 Romania Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.1.8.4 Romania Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Physical Security Information Management Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.2.4 Western Europe Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.5 Western Europe Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.6 Western Europe Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.2.7.2 Germany Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.7.3 Germany Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.7.4 Germany Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.2.8.2 France Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.8.3 France Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.8.4 France Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.2.9.2 UK Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.9.3 UK Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.9.4 UK Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.2.10.2 Italy Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.10.3 Italy Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.10.4 Italy Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.2.11.2 Spain Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.11.3 Spain Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.11.4 Spain Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.2.14.2 Austria Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.14.3 Austria Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.14.4 Austria Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Physical Security Information Management Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.4.4 Asia Pacific Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.5 Asia Pacific Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.4.6 Asia Pacific Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.4.7.2 China Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.7.3 China Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.4.7.4 China Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.4.8.2 India Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.8.3 India Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.4.8.4 India Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.4.9.2 Japan Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.9.3 Japan Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.4.9.4 Japan Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.4.10.2 South Korea Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.10.3 South Korea Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.4.10.4 South Korea Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.4.11.2 Vietnam Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.11.3 Vietnam Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.4.11.4 Vietnam Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.4.12.2 Singapore Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.12.3 Singapore Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.4.12.4 Singapore Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.4.13.2 Australia Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.13.3 Australia Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.4.13.4 Australia Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Physical Security Information Management Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.5.1.4 Middle East Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.5 Middle East Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.1.6 Middle East Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.5.1.7.2 UAE Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.7.3 UAE Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.1.7.4 UAE Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Physical Security Information Management Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.5.2.4 Africa Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.5 Africa Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.2.6 Africa Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Physical Security Information Management Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.6.4 Latin America Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.5 Latin America Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.6.6 Latin America Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.6.7.2 Brazil Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.7.3 Brazil Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.6.7.4 Brazil Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.6.8.2 Argentina Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.8.3 Argentina Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.6.8.4 Argentina Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.6.9.2 Colombia Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.9.3 Colombia Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.6.9.4 Colombia Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Physical Security Information Management Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Physical Security Information Management Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Physical Security Information Management Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Physical Security Information Management Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

12. Company Profiles

12.1 Genetec Inc.

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Verint Systems Inc.

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Tyco International (Johnson Controls)

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Ricoh Company, Ltd.

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 MSTech

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Qognify

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Milestone Systems

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 Axis Communications

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Honeywell International Inc

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Hikvision Digital Technology Co., Ltd.

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Deployment

On-premises

Cloud

Hybrid

By Application

Access Control System

Video Management System

Intrusion Detection System

Fire Alarm System

Video Analytics System

By Organization Size

Large Enterprises

Small & Medium Enterprises

By End-Use

Transportation

Government & Public Sector

Healthcare

BFSI

Educational Institution

Retail & Hospitality

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Social Commerce Market Size was valued at USD 935.48 Billion in 2023 and will reach USD 10869.33 Billion by 2032 and grow at a CAGR of 31.4% by 2032.

The Enterprise File Synchronization and Sharing Market size was valued at USD 9.60 Billion in 2023 and is expected to reach USD 63.64 Billion by 2032, growing at a CAGR of 23.73% over the forecast period 2024-2032.

The Serverless Computing Market was valued at USD 19.30 billion in 2023 and will reach USD 70.52 billion by 2032, growing at a CAGR of 15.54% by 2032.

Edge-to-Cloud Architectures Market was valued at XX Bn in 2023 and will reach XX Bn with the CAGR at xx % cagr, over the forecast period by 2032.

The Predictive Analytics Market size was valued at USD 13.5 billion in 2023 and will grow to USD 82.9 billion by 2032 and grow at a CAGR of 22.4 % by 2032.

The Contextual Advertising Market Size was USD 171.6 Billion in 2023 and is expected to reach USD 608.3 Bn by 2032, growing at a CAGR of 15.1% by 2024-2032.

Hi! Click one of our member below to chat on Phone