Get More Information on Photonics Market - Request Sample Report

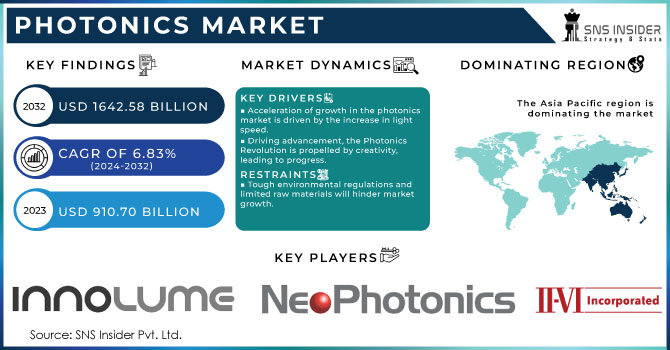

The Photonics Market size was USD 910.70 billion in 2023 to USD 1642.58 billion by 2032 and grow at a CAGR of 6.83% over the forecast period of 2024-2032.

Driven by the need of consumers for innovative products and progress in different industries. The demand for effective light-based solutions is increasing, from LiDAR in autonomous vehicles to high-resolution displays and medical advancements in bio photonics. This request is also heightened by the growing requirement for quicker data transfer in telecommunications systems. Innovation is not only meeting demand but also propelling it forward. Ongoing advancements in key photonic elements such as lasers and sensors are resulting in new and more efficient uses. Governments around the globe are realizing the potential and are making strategic investments in research and development, which is leading to a significant merging of market forces and technological progress.

VIGO Photonics, a leading company in infrared detector technology, is well placed to take advantage of this expansion. Their dedication is shown through their recent entrance into the North American market, with an emphasis on security & defense, gas sensing, and scientific instrumentation. VIGO Photonics plans to enhance their US team by bringing in expert engineers in order to offer advanced detectors and aid customers in incorporating them into innovative technologies. This growth allows VIGO Photonics to become a major influencer in shaping the upcoming advancements in light-based technology, advancements spurred by innovation and driven by market needs.

There are changes happening in the photonics industry, especially in relation to spectrometers. A variety of factors are converging to lead to a rise in demand. Spectrometers are increasingly important in multiple sectors, being used in healthcare to diagnose diseases and in material science to guarantee product quality. This technology is currently being utilized for environmental surveillance as well. Manufacturers are focusing on and integrating spectrometers into their high-volume production lines. To meet growing demand and uphold quality standards, Avantes is launching a cutting-edge system called AvaMation. Switching from manual assembly to automation is a strategic choice that allows them to capitalize on the opportunity and deliver the high-quality, dependable spectrometers that manufacturers require. For instance, they are now using robotic arms to streamline production processes.

| Report Attributes | Details |

|---|---|

| Key Segments | • By Type (LED, Optical Communication System And Components, Lasers, Detectors, Sensors And Imaging Devices, Consume Electronics And Device) • By Application (Lighting Displays , Photovoltaic, Medical Technology And Life Sciences [Bio Photonics] Production Technology, Measurement And Automated Vision , Information And Communication Technology) • By End Use Industry (Building And Construction , Safety And Defence, Medical, Media Broadcasting And Telecommunications, Industrial) |

| Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Innolume, Neophotnics Corporation, IPG Photonics Corporation, II - VI Incorporated, Hamamatsu Photonics K.K, Molex, TRUMPF, Sicoya GMBH, One Silicone chip photonics Inc, RANOVUS |

Drivers

Acceleration of growth in the photonics market is driven by the increase in light speed.

The photonics industry is seeing a rise due to a combination of strong trends. There is a rapid increase in consumer interest for cutting-edge items such as self-driving cars powered by LiDAR and high-definition displays. Bio photonics breakthroughs are transforming diagnostics and treatments in the healthcare field. Telecommunication networks need faster and more efficient data transmission, relying greatly on photonics technology. Market-driven growth is being complemented by ongoing advancements in core photonic elements such as lasers and sensors, expanding the possibilities and paving the way for innovative new uses. Global governments are strategically investing in research and development to accelerate innovation, acknowledging the potential economic and technological advancements. Due to the combination of these factors, the photonics industry is ready for an incredible evolution, paving the way for a future filled with light-centric innovations.

Driving advancement, the Photonics Revolution is propelled by creativity, leading to progress.

The field of photonics is experiencing a significant change, propelled by continuous progress in essential parts such as lasers and sensors. These are not just minor adjustments they are advancements that push the limits of what is possible and spark a wave of innovative uses. Picture medical treatments utilizing highly precise lasers, or environmental sensors capable of detecting even the most subtle changes on Earth. This is not a vision of the future; it is the emerging reality influenced by the advancements in photonics. The advantages go far beyond just the thrill of new uses. These developments are also causing an increase in productivity. Consider using less energy and utilizing light more efficiently for its intended use, which is making photonics a more sustainable technology. For instance, improved lasers can lead to more streamlined and quicker data transfer in communication networks. A chain reaction occurs when a breakthrough in a certain area generates a series of positive effects throughout the entire field of photonics.

Restraints

Tough environmental regulations and limited raw materials will hinder market growth.

The photonics sector, advocating for sustainable light-based solutions, encounters an unexpected obstacle in the form of environmental regulations. While the majority of products are naturally environmentally friendly, others depend on performance-boosting chemicals that are considered dangerous according to regulations such as REACH and RoHS. These constraints, although essential for environmental protection, restrict material options and may increase development expenses. Discovering sustainable alternatives that satisfy performance and regulatory standards is essential for the photonics sector to navigate the green paradox and sustain its environmentally-friendly trajectory.

The high expenses related to advancement are obstructing the broad use of photonics technology.

Getting more widely accepted in the photonics industry is challenged by the substantial barrier of expensive initial investments. Creating and implementing these advanced technologies frequently demands a substantial initial financial investment. This serves as an obstacle for smaller firms and initiatives operating on a tight budget. This not only impacts specific projects, but also the overall rate at which this technology with transformative potential is adopted. Coming up with innovative financing models or using modular component designs is essential to fully utilize the potential of photonics and make it accessible to all, not just the wealthy.

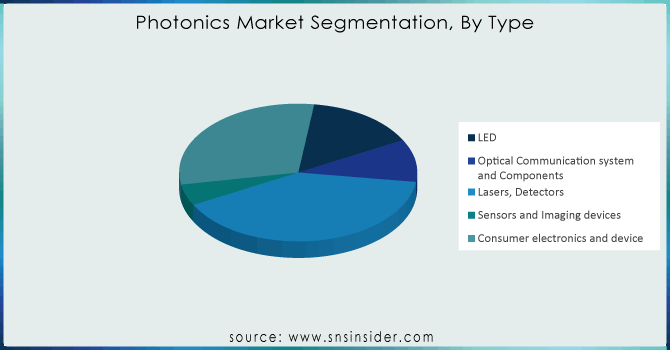

By Type

By Type, Laser, Detectors segment is the dominating segment with 40% of market in 2023. Lasers are the power sources in the field of photonics. Advancements have resulted in highly precise and controlled concentrated beams of light being generated. This includes a wide range of uses, such as industrial material processing, cutting, medical procedures, and high-speed data transmission in fiber optic networks. The impact of lasers is undeniable, from sculpting metals in car manufacturing to performing intricate eye surgeries. Detectors, serve as the vigilant observers of photonics. They change light signals into electrical signals, enabling us to perceive and understand the light in our surroundings. These sensors vary from the highly sensitive ones utilized in astronomical telescopes to the common photodiodes present in smoke detectors and smartphone cameras. They have a crucial function in a wide range of applications, including environmental monitoring, chemical analysis, security systems, and self-driving cars.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Application

In 2023, the photonics market was primarily driven by Information and communication technology, which accounted for 35% of the market share in terms of application. This highlight underscores the crucial significance of light technologies in our increasingly interconnected world. The fundamental nature of data transmission. These cables utilizing photonics enable fast data transmission across extensive distances. The reliance of ICT on photonics goes far beyond just the internet. Lasers are used to fabricate intricate components in smartphones and computers, while detectors allow cameras to capture and store our memories. The impact extends past consumer gadgets. Photonics plays a vital role in the functioning of data centers, ensuring the smooth running of cloud computing and internet services. Advanced sensors using photonics technology enable real-time monitoring of communication networks, facilitating swift issue resolution and ensuring continuous connectivity. Besides the Internet, photonics plays a significant role in ICT that extends beyond just internet usage. Lumentum Holdings Inc. is a well-known company in the photonics industry that creates lasers for producing complex parts in smartphones and computers. Teledyne FLIR LLC (FLIR), yet another significant company, provides detector technology that enables the cameras to capture our memories on these devices.

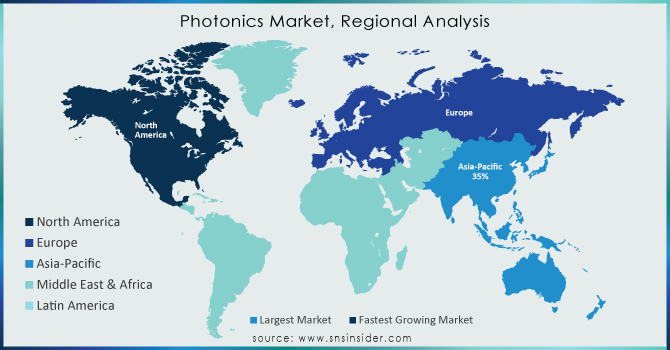

The Asia Pacific region dominated the Photonics market in 2023, with a market share of 35%. The Asia Pacific market is poised for rapid growth due to its early adoption of technology and increasing emphasis on research and development. China has emerged as a major contributor to photonics innovation, with leading companies establishing manufacturing plants and a robust supply network. China is expected to dominate a significant share of the photonics market because of its robust market presence and export capabilities. China, as the dominant force in photonics in the Asia Pacific region, is at the forefront of the global market due to its emphasis on innovation and strong manufacturing capabilities. Ever light Electronics (EVERLIGHT) is at the forefront, being a major player in the LED and optoelectronic components industry for a wide range of applications, from consumer electronics to industrial automation. Han's Laser Technology specializes in high-power lasers designed for industrial use, standing out in the market. Huawei, a significant player in both telecommunications and photonics research and development, is also a major player in manufacturing components and improving fiber optic technology. BGI Genomics (BGI) demonstrates the transformation of healthcare through the use of photonics in DNA sequencing tools. There are only a handful of shining examples; China's dynamic photonics ecosystem supports many innovative companies. China's solid domestic manufacturing sector and growing ability to export will undoubtedly ensure its continued dominance in the global photonics market.

The growth of photonics in advancing next-generation integrated electronics is expected to fuel market growth in the area. The presence of tech giants like Facebook and Microsoft in North America will drive market growth of 25% in market share in 2023, as they require efficient data processing and transmission for their large data center networks. Photonics technologies provide important improvements in rapid data processing and communication, essential elements of contemporary computer systems. Moreover, photon-based quantum computers have an advantage over electron-based ones as they can function at ambient temperatures instead of needing colder environments.

Some of the major key players in the Photonics Market are Innolume, Neophotnics Corporation, IPG Photonics Corporation, II - VI Incorporated, Hamamatsu Photonics K.K, Molex, TRUMPF, Sicoya GMBH, One Silicone chip photonics Inc, RANOVUS and other players.

| Report Attributes | Details |

| Market Size in 2023 | US$ 910.70 Billion |

| Market Size by 2032 | US$ 1642.58 Billion |

| CAGR | CAGR of 6.83% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Drivers |

|

| Market Restraints |

|

Ans. Soaring consumer demand, healthcare advancements, and continuous technological improvements are fueling the photonics market's growth.

Ans .The Photonics Market size was USD 910.70 billion in 2023 to USD 1642.58 billion by 2032 and grow at a CAGR of 6.83% over the forecast period of 2024-2032.

Ans. North America region is anticipated to record the fastest growing in the Photonics market.

Ans. The Information and communication technology segment is leading in the market revenue share in 2023.

Ans. Asia Pacific is expected to hold the largest market share in the Photonics market during the forecast period.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Photonics Market Segmentation, By Type

7.1 Introduction

7.2 LED

7.3 Optical Communication system and Components

7.4 Lasers, Detectors

7.5 Sensors and Imaging devices

7.6 Consumer electronics and device

8. Photonics Market Segmentation, By Application

8.1 Introduction

8.2 Lighting Displays

8.3 Photovoltaic

8.4 Medical technology and life sciences (Bio photonics)

8.5 Production technology

8.6 Measurement and automated vision

8.7 Information and communication technology.

9. Photonics Market Segmentation, By End User

9.1 Introduction

9.2 Building and construction

9.3 Safety and Defence

9.4 Medical

9.5 Media broadcasting and telecommunications

9.6 Industrial

10. Regional Analysis

10.1 Introduction

10.2 North America

10.2.1 Trend Analysis

10.2.2 North America Photonics Market by Country

10.2.3 North America Photonics Market By Type

10.2.4 North America Photonics Market By Application

10.2.5 North America Photonics Market By End User

10.2.6 USA

10.2.6.1 USA Photonics Market By Type

10.2.6.2 USA Photonics Market By Application

10.2.6.3 USA Photonics Market By End User

10.2.7 Canada

10.2.7.1 Canada Photonics Market By Type

10.2.7.2 Canada Photonics Market By Application

10.2.7.3 Canada Photonics Market By End User

10.2.8 Mexico

10.2.8.1 Mexico Photonics Market By Type

10.2.8.2 Mexico Photonics Market By Application

10.2.8.3 Mexico Photonics Market By End User

10.3 Europe

10.3.1 Trend Analysis

10.3.2 Eastern Europe

10.3.2.1 Eastern Europe Photonics Market by Country

10.3.2.2 Eastern Europe Photonics Market By Type

10.3.2.3 Eastern Europe Photonics Market By Application

10.3.2.4 Eastern Europe Photonics Market By End User

10.3.2.5 Poland

10.3.2.5.1 Poland Photonics Market By Type

10.3.2.5.2 Poland Photonics Market By Application

10.3.2.5.3 Poland Photonics Market By End User

10.3.2.6 Romania

10.3.2.6.1 Romania Photonics Market By Type

10.3.2.6.2 Romania Photonics Market By Application

10.3.2.6.4 Romania Photonics Market By End User

10.3.2.7 Hungary

10.3.2.7.1 Hungary Photonics Market By Type

10.3.2.7.2 Hungary Photonics Market By Application

10.3.2.7.3 Hungary Photonics Market By End User

10.3.2.8 Turkey

10.3.2.8.1 Turkey Photonics Market By Type

10.3.2.8.2 Turkey Photonics Market By Application

10.3.2.8.3 Turkey Photonics Market By End User

10.3.2.9 Rest of Eastern Europe

10.3.2.9.1 Rest of Eastern Europe Photonics Market By Type

10.3.2.9.2 Rest of Eastern Europe Photonics Market By Application

10.3.2.9.3 Rest of Eastern Europe Photonics Market By End User

10.3.3 Western Europe

10.3.3.1 Western Europe Photonics Market by Country

10.3.3.2 Western Europe Photonics Market By Type

10.3.3.3 Western Europe Photonics Market By Application

10.3.3.4 Western Europe Photonics Market By End User

10.3.3.5 Germany

10.3.3.5.1 Germany Photonics Market By Type

10.3.3.5.2 Germany Photonics Market By Application

10.3.3.5.3 Germany Photonics Market By End User

10.3.3.6 France

10.3.3.6.1 France Photonics Market By Type

10.3.3.6.2 France Photonics Market By Application

10.3.3.6.3 France Photonics Market By End User

10.3.3.7 UK

10.3.3.7.1 UK Photonics Market By Type

10.3.3.7.2 UK Photonics Market By Application

10.3.3.7.3 UK Photonics Market By End User

10.3.3.8 Italy

10.3.3.8.1 Italy Photonics Market By Type

10.3.3.8.2 Italy Photonics Market By Application

10.3.3.8.3 Italy Photonics Market By End User

10.3.3.9 Spain

10.3.3.9.1 Spain Photonics Market By Type

10.3.3.9.2 Spain Photonics Market By Application

10.3.3.9.3 Spain Photonics Market By End User

10.3.3.10 Netherlands

10.3.3.10.1 Netherlands Photonics Market By Type

10.3.3.10.2 Netherlands Photonics Market By Application

10.3.3.10.3 Netherlands Photonics Market By End User

10.3.3.11 Switzerland

10.3.3.11.1 Switzerland Photonics Market By Type

10.3.3.11.2 Switzerland Photonics Market By Application

10.3.3.11.3 Switzerland Photonics Market By End User

10.3.3.12 Austria

10.3.3.12.1 Austria Photonics Market By Type

10.3.3.12.2 Austria Photonics Market By Application

10.3.3.12.3 Austria Photonics Market By End User

10.3.3.13 Rest of Western Europe

10.3.3.13.1 Rest of Western Europe Photonics Market By Type

10.3.3.13.2 Rest of Western Europe Photonics Market By Application

10.3.3.13.3 Rest of Western Europe Photonics Market By End User

10.4 Asia-Pacific

10.4.1 Trend Analysis

10.4.2 Asia-Pacific Photonics Market by Country

10.4.3 Asia-Pacific Photonics Market By Type

10.4.4 Asia-Pacific Photonics Market By Application

10.4.5 Asia-Pacific Photonics Market By End User

10.4.6 China

10.4.6.1 China Photonics Market By Type

10.4.6.2 China Photonics Market By Application

10.4.6.3 China Photonics Market By End User

10.4.7 India

10.4.7.1 India Photonics Market By Type

10.4.7.2 India Photonics Market By Application

10.4.7.3 India Photonics Market By End User

10.4.8 Japan

10.4.8.1 Japan Photonics Market By Type

10.4.8.2 Japan Photonics Market By Application

10.4.8.3 Japan Photonics Market By End User

10.4.9 South Korea

10.4.9.1 South Korea Photonics Market By Type

10.4.9.2 South Korea Photonics Market By Application

10.4.9.3 South Korea Photonics Market By End User

10.4.10 Vietnam

10.4.10.1 Vietnam Photonics Market By Type

10.4.10.2 Vietnam Photonics Market By Application

10.4.10.3 Vietnam Photonics Market By End User

10.4.11 Singapore

10.4.11.1 Singapore Photonics Market By Type

10.4.11.2 Singapore Photonics Market By Application

10.4.11.3 Singapore Photonics Market By End User

10.4.12 Australia

10.4.12.1 Australia Photonics Market By Type

10.4.12.2 Australia Photonics Market By Application

10.4.12.3 Australia Photonics Market By End User

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Photonics Market By Type

10.4.13.2 Rest of Asia-Pacific Photonics Market By Application

10.4.13.3 Rest of Asia-Pacific Photonics Market By End User

10.5 Middle East & Africa

10.5.1 Trend Analysis

10.5.2 Middle East

10.5.2.1 Middle East Photonics Market by Country

10.5.2.2 Middle East Photonics Market By Type

10.5.2.3 Middle East Photonics Market By Application

10.5.2.4 Middle East Photonics Market By End User

10.5.2.5 UAE

10.5.2.5.1 UAE Photonics Market By Type

10.5.2.5.2 UAE Photonics Market By Application

10.5.2.5.3 UAE Photonics Market By End User

10.5.2.6 Egypt

10.5.2.6.1 Egypt Photonics Market By Type

10.5.2.6.2 Egypt Photonics Market By Application

10.5.2.6.3 Egypt Photonics Market By End User

10.5.2.7 Saudi Arabia

10.5.2.7.1 Saudi Arabia Photonics Market By Type

10.5.2.7.2 Saudi Arabia Photonics Market By Application

10.5.2.7.3 Saudi Arabia Photonics Market By End User

10.5.2.8 Qatar

10.5.2.8.1 Qatar Photonics Market By Type

10.5.2.8.2 Qatar Photonics Market By Application

10.5.2.8.3 Qatar Photonics Market By End User

10.5.2.9 Rest of Middle East

10.5.2.9.1 Rest of Middle East Photonics Market By Type

10.5.2.9.2 Rest of Middle East Photonics Market By Application

10.5.2.9.3 Rest of Middle East Photonics Market By End User

10.5.3 Africa

10.5.3.1 Africa Photonics Market by Country

10.5.3.2 Africa Photonics Market By Type

10.5.3.3 Africa Photonics Market By Application

10.5.3.4 Africa Photonics Market By End User

10.5.3.5 Nigeria

10.5.3.5.1 Nigeria Photonics Market By Type

10.5.3.5.2 Nigeria Photonics Market By Application

10.5.3.5.3 Nigeria Photonics Market By End User

10.5.3.6 South Africa

10.5.3.6.1 South Africa Photonics Market By Type

10.5.3.6.2 South Africa Photonics Market By Application

10.5.3.6.3 South Africa Photonics Market By End User

10.5.3.7 Rest of Africa

10.5.3.7.1 Rest of Africa Photonics Market By Type

10.5.3.7.2 Rest of Africa Photonics Market By Application

10.5.3.7.3 Rest of Africa Photonics Market By End User

10.6 Latin America

10.6.1 Trend Analysis

10.6.2 Latin America Photonics Market by country

10.6.3 Latin America Photonics Market By Type

10.6.4 Latin America Photonics Market By Application

10.6.5 Latin America Photonics Market By End User

10.6.6 Brazil

10.6.6.1 Brazil Photonics Market By Type

10.6.6.2 Brazil Photonics Market By Application

10.6.6.3 Brazil Photonics Market By End User

10.6.7 Argentina

10.6.7.1 Argentina Photonics Market By Type

10.6.7.2 Argentina Photonics Market By Application

10.6.7.3 Argentina Photonics Market By End User

10.6.8 Colombia

10.6.8.1 Colombia Photonics Market By Type

10.6.8.2 Colombia Photonics Market By Application

10.6.8.3 Colombia Photonics Market By End User

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Photonics Market By Type

10.6.9.2 Rest of Latin America Photonics Market By Application

10.6.9.3 Rest of Latin America Photonics Market By End User

11. Company Profiles

11.1 Innolume

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 The SNS View

11.2 Neophotnics Corporation

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 The SNS View

11.3 IPG Photonics Corporation

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 The SNS View

11.4, II - VI Incorporated

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 The SNS View

11.5 Hamamatsu Photonics K.K

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 The SNS View

11.6 Molex

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 The SNS View

11.7 TRUMPF

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 The SNS View

11.8 Sicoya GMBH

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 The SNS View

11.9 One Silicone chip photonics Inc

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 The SNS View

11.10 RANOVUS

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 The SNS View

12. Competitive Landscape

12.1 Competitive Benchmarking

12.2 Market Share Analysis

12.3 Recent Developments

12.3.1 Industry News

12.3.2 Company News

12.3.3 Mergers & Acquisitions

13. Use Case and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Type

LED

Optical Communication system and Components

Lasers, Detectors

Sensors and Imaging devices

Consume electronics and device

By Application

Lighting Displays

Photovoltaic

Medical technology and life sciences (Bio photonics)

Production technology

measurement and automated vision

Information and communication technology

By End Use Industry

Building and construction

Safety and Defence

Medical

Media broadcasting and telecommunications

Industrial

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Pet Wearable Market Size was valued at USD 3.27 billion in 2023 and is expected to grow at a CAGR of 14.77% to reach USD 11.25 billion by 2032.

The Automated Storage and Retrieval System (ASRS) Market valued at USD 7.71 billion in 2023 and is expected to grow at a CAGR of 7.79% from 2024-2032.

The Ion Milling System Market was valued at 2.22 Billion in 2023 and is projected to reach USD 4.78 Billion by 2032, growing at a CAGR of 8.90% from 2024 to 2032.

The RF Test Equipment Market size was valued at USD 3.40 billion in 2023 and is expected to reach USD 6.18 billion by 2032 and grow at a CAGR of 6.93% over the forecast period 2024-2032.

The Piezoelectric devices market size was valued at USD 32.96 billion in 2023 and is expected to grow to USD 60.05 billion by 2032 and grow at a CAGR Of 6.89 % over the forecast period of 2024-2032.

The Autonomous Last Mile Delivery Market size was valued at USD 1.10 Billion in 2023. It is estimated to reach USD 7.10 Billion by 2032, growing at a CAGR of 23.06% during 2024-2032.

Hi! Click one of our member below to chat on Phone