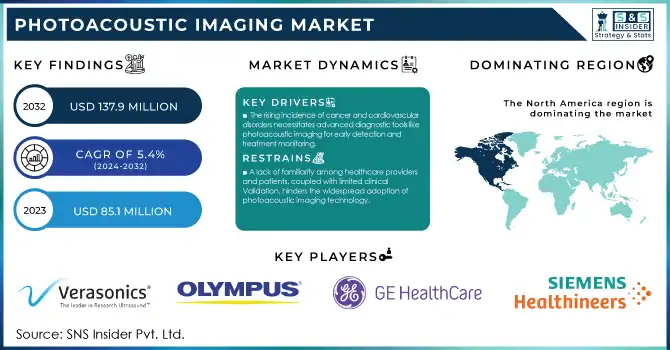

The Photoacoustic Imaging Market Size was valued at USD 85.1 million in 2023 and is expected to reach USD 137.9 million by 2032, growing at a CAGR of 5.4% over the forecast period 2024-2032.

To Get more information on Photoacoustic Imaging Market - Request Free Sample Report

Growth in the photoacoustic imaging market is attributed to various factors, including increasing government expenditure to boost medical research and growing incidences of chronic diseases. Funding for biomedical imaging research came to $1.4 billion from the National Institutes of Health (NIH) in fiscal year 2023, up 5% compared to last year. Such a substantial investment has propelled the development and increase in accessibility of advanced imaging technologies, such as photoacoustic imaging. According to the Centers for Disease Control and Prevention, 6 in 10 adults in the United States have a chronic disease, and cancer, cardiovascular diseases, and neurological disorders are some of the most prevalent causes of death and disability. There is a high unmet need for early and accurate diagnosis of these conditions, which often makes non-invasive high-resolution imaging modalities. Photoacoustic imaging's ability to provide functional and molecular information at depths beyond traditional optical imaging techniques has positioned it as a promising tool for both clinical and research applications. This market is driven due to the increasing prevalence of cancer, particularly breast cancer, and growing funding for research on non–ionizing radiation for imaging. For instance, as per cancer. According to cancer.net, in 2023 estimates are around 297,790 women in the U.S. will be diagnosed with invasive breast cancer and 55,720 will be with non-invasive breast cancer. Moreover, the increasing application spectrum is also contributing to the growth of the market.

Photoacoustic imaging has attracted increasing attention from the U.S. Food and Drug Administration (FDA), with several systems receiving clearance for clinical use in recent years. This regulatory backing has only helped to boost the confidence and trust of healthcare providers and researchers, thereby facilitating further development of the market. Additionally, the National Cancer Institute (NCI) has highlighted photoacoustic imaging as a key technology in its Cancer Moonshot initiative, allocating specific funding for its development and clinical translation. Also, the European Commission Horizon Europe program has included the development of medical imaging technologies, including photoacoustic imaging, among its research and innovation priorities with a budget of €95.5 billion for 2021–2027. The photoacoustic imaging market is being driven by these government endeavors along with the rising demand for accurate diagnostic tools.

Drivers

Continuous improvements in laser technology, ultrasound transducers, and image reconstruction algorithms have enhanced the efficiency and accuracy of photoacoustic imaging systems.

The rising incidence of cancer and cardiovascular disorders necessitates advanced diagnostic tools like photoacoustic imaging for early detection and treatment monitoring.

Technological advancements are considered to be one of the major driving factors for the photoacoustic imaging market. Advances in laser sources, ultrasound transducers, and image reconstruction algorithms have all benefited the photoacoustic imaging field in recent years. For example, high temporal resolution lasers have recently been utilized to map tissue structures at higher resolution at the microscopic level. This enhanced performance of photoacoustic imaging has improved the accuracy of disease detection in clinical scenarios, even with early-stage diseases like cancer. Furthermore, the application field of photoacoustic imaging is continuously being progressed by the technological development of multi-modal imaging techniques, such as photoacoustic combined ultrasound or photoacoustic combined MRI. These technological advancements offer a clearer image of tissue types, blood vessels, and tumors in a way that is more expansive and less susceptible to random error, providing better diagnostic data and CDAD patenting.

Newer ultrasound transducers are more sensitive and sensitive models can penetrate deeper into the tissue to provide real-time feedback to the clinician about disease progression. Also, machine learning-powered image reconstruction algorithms are making the process quicker and more efficient by speeding up the processing time and improving the clarity of the images. For example, a study published in Nature in 2023 demonstrated that photoacoustic imaging combined with laser-induced fluorescence can accurately detect breast cancer tissue with up to 95% sensitivity, illustrating the impact of these advancements on diagnostic capabilities.

Restraints

The advanced components required for photoacoustic imaging systems contribute to their high price, posing a barrier for smaller healthcare facilities and research institutions.

A lack of familiarity among healthcare providers and patients, coupled with limited clinical validation, hinders the widespread adoption of photoacoustic imaging technology.

High instrument costs are the key factor limiting the photoacoustic imaging market. Photoacoustic imaging systems involve more sophistication, thus requiring more expensive equipment such as lasers, ultrasound transducers, and advanced imaging software. Typically, these expenses are passed on to the health service providers, consequently restricting the Technology access to bigger of 3 big-sized Hospitals, Clinics, and research organizations, especially in Emerging Markets. Their maintenance and calibration also contribute to the continuing costs associated with the systems, limiting their ubiquitous adoption. The price handicap represents the most significant barrier to the implementation of photoacoustic imaging in routine clinical practice for institutions with a lower budget in the healthcare system. Additionally, the individual has confirmed that the low-cost imaging market, when compared with existing, well-established imaging modalities such as ultrasound or MRI may have high initial capital cost (HIC) and that could limit diffusion of technology. Consequently, the cost factor inhibits the broader acceptance and growth of photoacoustic imaging across different healthcare settings.

By Technology

PAT segment held the largest share of revenue, with a 48% revenue share in 2023. The reason for this large market is the capability of PAT to provide high-resolution, 3D images of biological tissues at several centimeters deep. The Park of the National Institute of Biomedical Imaging and Bioengineering (NIBIB) can correctly reflect the spurts in interest in this technology. In 2023, the U.S. Department of Defense also funded PAT research, including a $10 million grant for the development of portable PAT devices for traumatic brain injury assessment. Additionally, the clinical clearance of some PAT systems by the FDA has propelled its clinical utility in healthcare settings. The clinical translation of PAT technology was strongly advanced with the recent FDA approval of a PAT system for breast cancer imaging. Breast cancer screening rates have risen by 5% since PAT was introduced as an add-on imaging tool, according to the National Cancer Institute, reflecting the community-wide potential for impact from this work. Such initiatives and approvals from the government have strengthened the confidence of healthcare providers and thus, spurred the investments in PAT systems, boosting its market leader position. identified photoacoustic tomography (PAT) as an emerging technology that enables non-invasive imaging of cancer, cardiovascular diseases, and neurological disorders. Research funded by the NIBIB dedicated to PAT topics grew by 15% between 2022 and 2023.

By application

The oncology segment accounted for the largest revenue share of 51% in 2023. The high market share is due to the increasing need for better cancer detection and monitoring devices and larger government support for oncology research. Cancer is the second leading cause of death in the United States and an estimated 1.9 million new cancer cases will be diagnosed in 2023 according to the National Cancer Institute (NCI). In fiscal year 2023, the NCI received $7.1 billion as part of its budget for cancer imaging improvements. Introduction Photoacoustic imaging, which is a hybrid imaging modality that combines photonic imaging and acoustic imaging, has been very promising for oncologic applications since it can visualize tumor vasculature and tumor metabolism without the use of contrast agents. In 2023, the FDA recognized this potential by granting Breakthrough Device Designation for several photoacoustic imaging systems for cancer detection. Such designation has fast-tracked the regulatory review process and moved these technologies closer to the clinic. The Centers for Medicare & Medicaid Services (CMS) has already taken notice of the potential for photoacoustic imaging to help diagnose cancer, starting a coverage analysis for specific indications in 2023. The lack of reimbursement has encouraged providers to adopt photoacoustic imaging technology even more. Additionally, the Department of Defense's Congressionally Directed Medical Research Programs allocated $20 million in 2023 specifically for photoacoustic imaging research in breast and prostate cancer detection. Oncology has emerged as the leading application segment in the photoacoustic imaging market due to the aforementioned factors along with increasing government efforts and higher cancer prevalence coupled with the requirement for precise diagnostic tools.

By Type

In 2023, the pre-clinical segment accounted for approximately 78% of revenue. This dominance can be explained by the widespread applicability of photoacoustic imaging for biomedical research and drug development. Per the National Institute of Health's Office of Laboratory Animal Welfare, there has been a 5% rise in the institutions employing animal models for research in the year 2023 as compared to 2022, and more and more focus is seen on non-invasive imaging technologies. According to the FDA's Center for Drug Evaluation and Research, the use of photoacoustic imaging data derived from preclinical studies in Investigational New Drug applications grew by more than 15% in 2023. This trend is indicative of the increasing awareness of the value of photoacoustic imaging in drug evaluation and safety. In 2023, The National Institute of Biomedical Imaging and Bioengineering (NIBIB) set aside $30 million for the specific purpose of developing innovative preclinical imaging technologies, with photoacoustic imaging being one of the supported grants. Funds from this investment have accelerated the development of small animal imaging systems for high-resolution, multi-modal photo-acoustic systems. As evidence of growing demand in the pre-clinical sector, the National Science Foundation's (NSF) Division of Biological Infrastructure received 20% more applications for grants to acquire photoacoustic imaging equipment for use in academic research facilities in the year 2023. As a result of such government initiatives and research trends, the domination of the pre-clinical segment of the photoacoustic imaging market has been established.

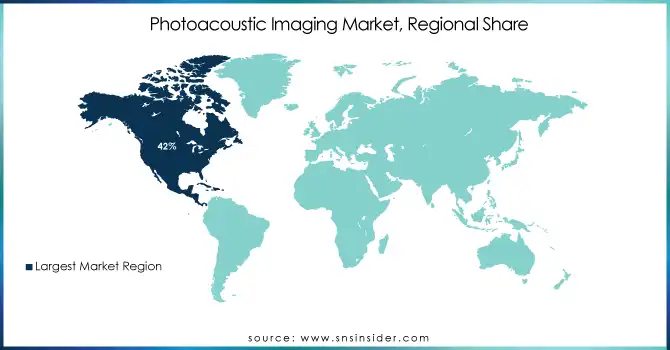

The photoacoustic imaging market was dominated by North America in 2023, with a market share of 42%. Factors contributing to this leadership position include the region's strong healthcare infrastructure, large research and development expenditures, and a business-friendly regulatory environment. Total research and development (R&D) expenditure across all sectors (federal, private, academic) in the United States was $667 billion in 2023, according to National Science Foundation data. The National Institutes of Health, the largest public funder of biomedical research in the world, allocated $41.7 billion for research grants in fiscal year 2023, with imaging research receiving a significant share. Similarly, the U.S. Food and Drug Administration has been an important driver of innovation in medical imaging, with programs for example, the Breakthrough Devices Program that have expedited the development and review of multiple photoacoustic imaging devices.

The Asia Pacific region is growing at a high rate with the fastest CAGR. Factors such as rising healthcare spending, rising awareness regarding early disease detection, and government initiatives aimed at expanding healthcare infrastructure are certainly driving this rapid growth. China, in particular, has made significant strides in photoacoustic imaging research and development. The Chinese Ministry of Science and Technology reported a 30% increase in funding for medical imaging research in 2023 compared to the previous year, with photoacoustic imaging identified as a priority area. Japan's Healthcare and Medical Strategy has designated ¥100 billion (nearly $900 million) toward promoting research on new medical technologies, including photoacoustic imaging, over five years as of 2023. The boom of the Asia Pacific market is due to a growing number of investments a massive population of patients along with a growing incidence of chronic diseases in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

In March 2024, FUJIFILM VisualSonics launched a new high-frequency photoacoustic imaging system for preclinical applications. In Collaboration with the National Cancer Institute, this system provides small animal imaging with improved resolution and sensitivity.

In January 2024, a consortium of universities received a $5M grant from the U.S. National Institutes of Health to develop an innovative intraoperative photoacoustic imaging platform for tumor margin assessment. The long-term goal of this project is to develop a technology that will improve surgical outcomes for cancer patients by providing nanoscale precision imaging guidance in real time during surgery.

Key Service Providers/Manufacturers

Siemens Healthineers (ACUSON S2000, SOMATOM Force)

GE Healthcare (Logiq E10, Vivid E95)

Olympus Corporation (Visera Elite, OLYMPUS LCI)

FujiFilm Holdings Corporation (FinePix, Synapse)

Verasonics Inc. (Vantage 256, Vantage 128)

PhotoSound Technologies (Imagio, Imagio Plus)

iThera Medical GmbH (MSOT, InVision 256)

Endra Life Sciences Inc. (Thermoacoustic, Nexus)

SonoSite, Inc. (NanoMaxx, Edge II)

Canon Medical Systems (Aplio 500, Xario 100G)

Key Users

Johns Hopkins University

Mayo Clinic

Cleveland Clinic

Stanford University

Massachusetts General Hospital

Harvard Medical School

University of California, San Francisco

Memorial Sloan Kettering Cancer Center

Karolinska Institute

University of Oxford

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 85.1 Million |

| Market Size by 2032 | USD 137.9 Million |

| CAGR | CAGR of 5.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Pre-Clinical, Clinical) • By Product (Imaging Systems, Transducers, Software & Accessories) • By Technology (Photoacoustic Imaging, Photoacoustic Tomography (PAT), Photoacoustic Microscopy (PAM)) • By Application (Oncology, Cardiology, Angiology, Histology, Interventional radiology) • By End User (Academic & Research Institutes, Hospitals & Imaging Centers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Siemens Healthineers, GE Healthcare, Olympus Corporation, FujiFilm Holdings Corporation, Verasonics Inc., PhotoSound Technologies, iThera Medical GmbH, Endra Life Sciences Inc., SonoSite, Inc., Canon Medical Systems. |

| Key Drivers | • Continuous improvements in laser technology, ultrasound transducers, and image reconstruction algorithms have enhanced the efficiency and accuracy of photoacoustic imaging systems. • The rising incidence of cancer and cardiovascular disorders necessitates advanced diagnostic tools like photoacoustic imaging for early detection and treatment monitoring. |

| Restraints | • The advanced components required for photoacoustic imaging systems contribute to their high price, posing a barrier for smaller healthcare facilities and research institutions. |

Ans. The CAGR of the Photoacoustic Imaging Market is 5.4% During the forecast period of 2024-2032.

Ans. The projected market size for the Photoacoustic Imaging Market is USD 137.9 Million by 2032.

Ans: The North American region dominated the Photoacoustic Imaging Market in 2023.

Ans: The major key players in the market are Siemens Healthineers, GE Healthcare, Olympus Corporation, FujiFilm Holdings Corporation, Verasonics Inc., PhotoSound Technologies, iThera Medical GmbH, Endra Life Sciences Inc., SonoSite, Inc., Canon Medical Systems, and others in the final report.

Ans:

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Clinical Adoption Trends (2023)

5.2 Device Volume and Market Penetration (2020–2032)

5.3 Research and Development Spending

5.4 Integration with Adjacent Technologies (2023)

5.5 Regulatory Approvals and Compliance (2023)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Photoacoustic Imaging Market Segmentation, By Type

7.1 Chapter Overview

7.2 Pre-Clinical

7.2.1 Pre-Clinical Market Trends Analysis (2020-2032)

7.2.2 Pre-Clinical Market Size Estimates And Forecasts To 2032 (USD Million)

7.3 Clinical

7.3.1 Clinical Market Trends Analysis (2020-2032)

7.3.2 Clinical Deposition Market Size Estimates And Forecasts To 2032 (USD Million)

8. Photoacoustic Imaging Market Segmentation, By Product

8.1 Chapter Overview

8.2 Imaging Systems

8.2.1 Imaging Systems Market Trends Analysis (2020-2032)

8.2.2 Imaging Systems Market Size Estimates And Forecasts To 2032 (USD Million)

8.3 Transducers

8.3.1 Transducers Market Trends Analysis (2020-2032)

8.3.2 Transducers Market Size Estimates And Forecasts To 2032 (USD Million)

8.4 Software & Accessories

8.4.1 Software & Accessories Market Trends Analysis (2020-2032)

8.4.2 Software & Accessories Market Size Estimates And Forecasts To 2032 (USD Million)

9. Photoacoustic Imaging Market Segmentation, By Technology

9.1 Chapter Overview

9.2 Photoacoustic Imaging

9.2.1 Photoacoustic Imaging Market Trends Analysis (2020-2032)

9.2.2 Photoacoustic Imaging Market Size Estimates And Forecasts To 2032 (USD Million)

9.3 Photoacoustic Tomography (PAT)

9.3.1 Photoacoustic Tomography (PAT) Market Trends Analysis (2020-2032)

9.3.2 Photoacoustic Tomography (PAT) Market Size Estimates And Forecasts To 2032 (USD Million)

9.4 Photoacoustic Microscopy (PAM)

9.4.1 Photoacoustic Microscopy (PAM) Market Trends Analysis (2020-2032)

9.4.2 Photoacoustic Microscopy (PAM) Market Size Estimates And Forecasts To 2032 (USD Million)

10. Photoacoustic Imaging Market Segmentation, By Application

10.1 Chapter Overview

10.2 Oncology

10.2.1 Oncology Market Trends Analysis (2020-2032)

10.2.2 Oncology Market Size Estimates And Forecasts To 2032 (USD Million)

10.3 Cardiology

10.3.1 Cardiology Market Trends Analysis (2020-2032)

10.3.2 Cardiology Market Size Estimates And Forecasts To 2032 (USD Million)

10.4 Angiology

10.4.1 Angiology Market Trends Analysis (2020-2032)

10.4.2 Angiology Market Size Estimates And Forecasts To 2032 (USD Million)

10.5 Histology

10.5.1 Histology Market Trends Analysis (2020-2032)

10.5.2 Histology Market Size Estimates And Forecasts To 2032 (USD Million)

10.6 Interventional radiology

10.6.1 Interventional radiology Market Trends Analysis (2020-2032)

10.6.2 Interventional radiology Market Size Estimates And Forecasts To 2032 (USD Million)

11. Photoacoustic Imaging Market Segmentation, By End User

11.1 Chapter Overview

11.2 Academic & Research Institutes

11.2.1 Academic & Research Institutes Market Trends Analysis (2020-2032)

11.2.2 Academic & Research Institutes Market Size Estimates And Forecasts To 2032 (USD Million)

11.3 Hospitals & Imaging Centers

11.3.1 Hospitals & Imaging Centers Market Trends Analysis (2020-2032)

11.3.2 Hospitals & Imaging Centers Market Size Estimates And Forecasts To 2032 (USD Million)

12. Regional Analysis

12.1 Chapter Overview

12.2 North America

12.2.1 Trends Analysis

12.2.2 North America Photoacoustic Imaging Market Estimates And Forecasts, By Country (2020-2032) (USD Million)

12.2.3 North America Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.2.4 North America Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.2.5 North America Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.2.6 North America Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.2.7 North America Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.2.8 USA

12.2.8.1 USA Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.2.8.2 USA Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.2.8.3 USA Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.2.8.4 USA Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.2.8.5 USA Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.2.9 Canada

12.2.9.1 Canada Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.2.9.2 Canada Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.2.9.3 Canada Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.2.9.4 Canada Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.2.9.5 Canada Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.2.10 Mexico

12.2.10.1 Mexico Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.2.10.2 Mexico Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.2.10.3 Mexico Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.2.10.4 Mexico Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.2.10.5 Mexico Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.3 Europe

12.3.1 Eastern Europe

12.3.1.1 Trends Analysis

12.3.1.2 Eastern Europe Photoacoustic Imaging Market Estimates And Forecasts, By Country (2020-2032) (USD Million)

12.3.1.3 Eastern Europe Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.3.1.4 Eastern Europe Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.3.1.5 Eastern Europe Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.3.1.6 Eastern Europe Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.3.1.7 Eastern Europe Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.3.1.8 Poland

12.3.1.8.1 Poland Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.3.1.8.2 Poland Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.3.1.8.3 Poland Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.3.1.8.4 Poland Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.3.1.8.5 Poland Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.3.1.9 Romania

12.3.1.9.1 Romania Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.3.1.9.2 Romania Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.3.1.9.3 Romania Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.3.1.9.4 Romania Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.3.1.9.5 Romania Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.3.1.10 Hungary

12.3.1.10.1 Hungary Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.3.1.10.2 Hungary Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.3.1.10.3 Hungary Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.3.1.10.4 Hungary Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.3.1.10.5 Hungary Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.3.1.11 Turkey

12.3.1.11.1 Turkey Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.3.1.11.2 Turkey Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.3.1.11.3 Turkey Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.3.1.11.4 Turkey Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.3.1.11.5 Turkey Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.3.1.12 Rest Of Eastern Europe

12.3.1.12.1 Rest Of Eastern Europe Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.3.1.12.2 Rest Of Eastern Europe Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.3.1.12.3 Rest Of Eastern Europe Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.3.1.12.4 Rest Of Eastern Europe Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.3.1.12.5 Rest Of Eastern Europe Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.3.2 Western Europe

12.3.2.1 Trends Analysis

12.3.2.2 Western Europe Photoacoustic Imaging Market Estimates And Forecasts, By Country (2020-2032) (USD Million)

12.3.2.3 Western Europe Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.3.2.4 Western Europe Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.3.2.5 Western Europe Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.3.2.6 Western Europe Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.3.2.7 Western Europe Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.3.2.8 Germany

12.3.2.8.1 Germany Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.3.2.8.2 Germany Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.3.2.8.3 Germany Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.3.2.8.4 Germany Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.3.2.8.5 Germany Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.3.2.9 France

12.3.2.9.1 France Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.3.2.9.2 France Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.3.2.9.3 France Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.3.2.9.4 France Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.3.2.9.5 France Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.3.2.10 UK

12.3.2.10.1 UK Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.3.2.10.2 UK Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.3.2.10.3 UK Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.3.2.10.4 UK Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.3.2.10.5 UK Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.3.2.11 Italy

12.3.2.11.1 Italy Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.3.2.11.2 Italy Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.3.2.11.3 Italy Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.3.2.11.4 Italy Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.3.2.11.5 Italy Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.3.2.12 Spain

12.3.2.12.1 Spain Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.3.2.12.2 Spain Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.3.2.12.3 Spain Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.3.2.12.4 Spain Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.3.2.12.5 Spain Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.3.2.13 Netherlands

12.3.2.13.1 Netherlands Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.3.2.13.2 Netherlands Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.3.2.13.3 Netherlands Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.3.2.13.4 Netherlands Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.3.2.13.5 Netherlands Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.3.2.14 Switzerland

12.3.2.14.1 Switzerland Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.3.2.14.2 Switzerland Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.3.2.14.3 Switzerland Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.3.2.14.4 Switzerland Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.3.2.12.5 Switzerland Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.3.2.15 Austria

12.3.2.15.1 Austria Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.3.2.15.2 Austria Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.3.2.15.3 Austria Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.3.2.15.4 Austria Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.3.2.15.5 Austria Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.3.2.16 Rest Of Western Europe

12.3.2.16.1 Rest Of Western Europe Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.3.2.16.2 Rest Of Western Europe Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.3.2.16.3 Rest Of Western Europe Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.3.2.16.4 Rest Of Western Europe Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.3.2.16.5 Rest Of Western Europe Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.4 Asia Pacific

12.4.1 Trends Analysis

12.4.2 Asia Pacific Photoacoustic Imaging Market Estimates And Forecasts, By Country (2020-2032) (USD Million)

12.4.3 Asia Pacific Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.4.4 Asia Pacific Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.4.5 Asia Pacific Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.4.6 Asia Pacific Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.4.7 Asia Pacific Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.4.8 China

12.4.8.1 China Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.4.8.2 China Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.4.8.3 China Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.4.8.4 China Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.4.8.5 China Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.4.9 India

12.4.9.1 India Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.4.9.2 India Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.4.9.3 India Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.4.9.4 India Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.4.9.5 India Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.4.10 Japan

12.4.10.1 Japan Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.4.10.2 Japan Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.4.10.3 Japan Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.4.10.4 Japan Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.4.10.5 Japan Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.4.11 South Korea

12.4.11.1 South Korea Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.4.11.2 South Korea Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.4.11.3 South Korea Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.4.11.4 South Korea Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.4.11.5 South Korea Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.4.12 Vietnam

12.4.12.1 Vietnam Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.4.12.2 Vietnam Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.4.12.3 Vietnam Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.4.12.4 Vietnam Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.4.12.5 Vietnam Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.4.13 Singapore

12.4.13.1 Singapore Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.4.13.2 Singapore Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.4.13.3 Singapore Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.4.13.4 Singapore Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.4.13.5 Singapore Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.4.14 Australia

12.4.14.1 Australia Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.4.14.2 Australia Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.4.14.3 Australia Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.4.14.4 Australia Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.4.14.5 Australia Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.4.15 Rest Of Asia Pacific

12.4.15.1 Rest Of Asia Pacific Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.4.15.2 Rest Of Asia Pacific Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.4.15.3 Rest Of Asia Pacific Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.4.15.4 Rest Of Asia Pacific Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.4.15.5 Rest Of Asia Pacific Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.5 Middle East And Africa

12.5.1 Middle East

12.5.1.1 Trends Analysis

12.5.1.2 Middle East Photoacoustic Imaging Market Estimates And Forecasts, By Country (2020-2032) (USD Million)

12.5.1.3 Middle East Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.5.1.4 Middle East Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.5.1.5 Middle East Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.5.1.6 Middle East Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.5.1.7 Middle East Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.5.1.8 UAE

12.5.1.8.1 UAE Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.5.1.8.2 UAE Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.5.1.8.3 UAE Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.5.1.8.4 UAE Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.5.1.8.5 UAE Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.5.1.9 Egypt

12.5.1.9.1 Egypt Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.5.1.9.2 Egypt Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.5.1.9.3 Egypt Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.5.1.9.4 Egypt Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.5.1.9.5 Egypt Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.5.1.10 Saudi Arabia

12.5.1.10.1 Saudi Arabia Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.5.1.10.2 Saudi Arabia Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.5.1.10.3 Saudi Arabia Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.5.1.10.4 Saudi Arabia Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.5.1.10.5 Saudi Arabia Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.5.1.11 Qatar

12.5.1.11.1 Qatar Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.5.1.11.2 Qatar Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.5.1.11.3 Qatar Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.5.1.11.4 Qatar Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.5.1.11.5 Qatar Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.5.1.12 Rest Of Middle East

12.5.1.12.1 Rest Of Middle East Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.5.1.12.2 Rest Of Middle East Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.5.1.12.3 Rest Of Middle East Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.5.1.12.4 Rest Of Middle East Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.5.1.12.5 Rest Of Middle East Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.5.2 Africa

12.5.2.1 Trends Analysis

12.5.2.2 Africa Photoacoustic Imaging Market Estimates And Forecasts, By Country (2020-2032) (USD Million)

12.5.2.3 Africa Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.5.2.4 Africa Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.5.2.5 Africa Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.5.2.6 Africa Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.5.2.7 Africa Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.5.2.8 South Africa

12.5.2.8.1 South Africa Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.5.2.8.2 South Africa Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.5.2.8.3 South Africa Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.5.2.8.4 South Africa Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.5.2.8.5 South Africa Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.5.2.9 Nigeria

12.5.2.9.1 Nigeria Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.5.2.9.2 Nigeria Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.5.2.9.3 Nigeria Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.5.2.9.4 Nigeria Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.5.2.9.5 Nigeria Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.5.2.10 Rest Of Africa

12.5.2.10.1 Rest Of Africa Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.5.2.10.2 Rest Of Africa Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.5.2.10.3 Rest Of Africa Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.5.2.10.4 Rest Of Africa Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.5.2.10.5 Rest Of Africa Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.6 Latin America

12.6.1 Trends Analysis

12.6.2 Latin America Photoacoustic Imaging Market Estimates And Forecasts, By Country (2020-2032) (USD Million)

12.6.3 Latin America Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.6.4 Latin America Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.6.5 Latin America Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.6.6 Latin America Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.6.7 Latin America Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.6.8 Brazil

12.6.8.1 Brazil Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.6.8.2 Brazil Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.6.8.3 Brazil Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.6.8.4 Brazil Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.6.8.5 Brazil Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.6.9 Argentina

12.6.9.1 Argentina Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.6.9.2 Argentina Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.6.9.3 Argentina Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.6.9.4 Argentina Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.6.9.5 Argentina Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.6.10 Colombia

12.6.10.1 Colombia Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.6.10.2 Colombia Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.6.10.3 Colombia Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.6.10.4 Colombia Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.6.10.5 Colombia Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

12.6.11 Rest Of Latin America

12.6.11.1 Rest Of Latin America Photoacoustic Imaging Market Estimates And Forecasts, By Type (2020-2032) (USD Million)

12.6.11.2 Rest Of Latin America Photoacoustic Imaging Market Estimates And Forecasts, By Product (2020-2032) (USD Million)

12.6.11.3 Rest Of Latin America Photoacoustic Imaging Market Estimates And Forecasts, By Technology (2020-2032) (USD Million)

12.6.11.4 Rest Of Latin America Photoacoustic Imaging Market Estimates And Forecasts, By Application (2020-2032) (USD Million)

12.6.11.5 Rest Of Latin America Photoacoustic Imaging Market Estimates And Forecasts, By End User (2020-2032) (USD Million)

13. Company Profiles

13.1 Siemens Healthineers

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 SWOT Analysis

13.2 GE Healthcare

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 SWOT Analysis

13.3 Olympus Corporation

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services Offered

13.3.4 SWOT Analysis

13.4 FujiFilm Holdings Corporation

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services Offered

13.4.4 SWOT Analysis

13.5 Verasonics Inc.

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services Offered

13.5.4 SWOT Analysis

13.6 PhotoSound Technologies

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services Offered

13.6.4 SWOT Analysis

13.7 iThera Medical GmbH

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services Offered

13.7.4 SWOT Analysis

13.8 Endra Life Sciences Inc.

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services Offered

13.8.4 SWOT Analysis

13.9 SonoSite, Inc.

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services Offered

13.9.4 SWOT Analysis

13.10 Canon Medical Systems.

13.12.1 Company Overview

13.12.2 Financial

13.12.3 Products/ Services Offered

13.12.4 SWOT Analysis

14. Use Cases and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Market Segments:

By Type

By Product

By Technology

By Application

By End User

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

Europe

Asia Pacific

Middle East & Africa

Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

The Breast Cancer Therapeutics Market size was valued at USD 30.22 billion in 2022 and is expected to reach USD 79.77 billion by 2030 with a growing CAGR of 12.9% over the forecast period of 2023-2030.

The Pharmaceutical Contract Packaging Market size was valued at USD 15.30 bn in 2023 and is expected to grow at a CAGR of 8.33% to reach USD 31.56 bn by 2032.

The Medical Clothing Market, valued at USD 110 Billion in 2023, The Medical Clothing Market valued USD 85.95 Billion in 2023 and anticipated to reach USD 163.84 billion by 2032 with compound annual growth rate 7.45% over the forecast period 2024-2032.

The Blood Screening Market size was estimated at USD 3.03 billion in 2023 and is expected to reach USD 6.98 billion By 2032 at a CAGR of 9.73% during the forecast period of 2024-2032.

The Pharmaceutical Packaging Equipment Market size was valued at USD 6.80 billion in 2023 & is expected to surpass USD 10.91 billion by 2032, with a growing CAGR of 5.42% over the forecast period 2024-2032.

The Esoteric Testing Market, valued at USD 25.88 Billion in 2023, with projections to reach USD 61.27 Billion by 2032 at a 10.1% CAGR growth over 2024-2032

Hi! Click one of our member below to chat on Phone