Philippines GCC Market Size:

Get More Information on Philippines GCC Market - Request Sample Report

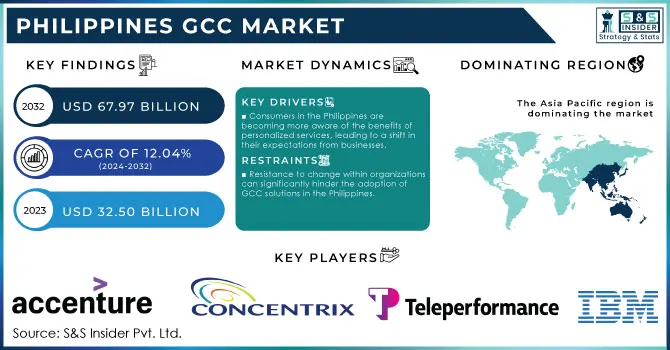

The Philippines GCC Market was valued at USD 32.50 billion in 2023 and is expected to reach USD 67.97 Billion by 2032, growing at a CAGR of 12.04% over the forecast period 2024-2032.

The Philippines has emerged as a significant player in the global capability centers (GCC) market, attracting attention from various industries seeking to leverage its strategic advantages. One of the foremost reasons the Philippines is an ideal location for GCCs is its robust and skilled workforce. The country boasts a large pool of educated professionals, particularly in fields such as information technology, engineering, finance, and customer service. The emphasis on English proficiency among Filipinos enhances communication, making it easier for companies to manage their global operations. The education system in the Philippines produces graduates who are not only skilled but also familiar with international business practices, further boosting the country’s appeal.

An illustrative application of GCCs in the Philippines can be seen in the technology sector, where many companies are establishing research and development centers. The country’s digital economy surged to about USD 36.5 billion in 2022, contributing 9.4% to the Gross Domestic Product (GDP). Digital-enabling infrastructure emerged as the largest contributor, accounting for around USD 28 billion or 77% of the total. Filipino companies improved their cybersecurity through identity and access management (57%), cloud security (55%), threat detection and correlation systems and platforms (42%), fifth-generation (5G) security strategy (42%), and Internet of Things (IoT) operational strategy (39%). Generally, software-defined area network security is gaining market popularity as a result of the ongoing use of cloud storage and solutions. These GCC centers focus on software development, cybersecurity, and data analytics, catering to the needs of their global clients. By setting up GCCs in the Philippines, tech companies can benefit from local talent while driving innovation in their product offerings. The increasing demand for digital transformation and technology solutions across industries further underscores the importance of GCCs in the Philippines.

Market Dynamics

Drivers

Consumers in the Philippines are becoming more aware of the benefits of personalized services, leading to a shift in their expectations from businesses.

Organizations are forced to take on GCC solutions that help them examine customer data, comprehend their choices, and deliver services. In such a highly competitive market now, personalization has shifted from being an added advantage to an essential requirement. By utilizing GCC technologies, businesses can run targeted marketing campaigns, offer personalized product suggestions, and deliver seamless customer support that leads to improved customer satisfaction and higher retention rates. This emergence of personalization as a consumer preference has fueled demand for GCC solutions that enable data analytics, customer segmentation, and real-time interactions. In the Philippines, the GCC market is projected to grow exponentially as companies look into enhancing their standard of doing business with consumers.

The Philippine government has been actively promoting policies aimed at fostering economic growth and attracting foreign investments.

Different measures are being taken to establish a favorable climate for companies, particularly in the technology industry. The GCC market is greatly benefiting from the government's efforts to enhance infrastructure, improve digital connectivity, and support innovation. For example, the Ease of Doing Business Act and the Philippine Innovation Act aim to simplify procedures and promote technology investments. Furthermore, the government's dedication to public-private partnerships (PPPs) is leading the way for the advancement of crucial infrastructure that fosters the expansion of the GCC market. These government initiatives play a crucial role in fostering a positive business atmosphere, drawing in foreign investors, and promoting the use of GCC solutions among local businesses. With the government's continuous focus on digitalization and innovation, the GCC market in the Philippines is expected to experience further growth.

Restraints

Resistance to change within organizations can significantly hinder the adoption of GCC solutions in the Philippines.

Many companies are used to traditional methods of functioning and may be hesitant to adopt new technologies, worried about potential disturbances to current processes. This opposition from culture can hinder the execution of digital transformation projects. Workers may feel uneasy about integrating new systems, which can result in decreased involvement and collaboration during the transition phase. Furthermore, management might be reluctant to allocate funds towards GCC solutions because they are worried about the learning curve and how it may affect productivity while being implemented. To address this resistance, companies need to focus on implementing change management tactics that promote an environment of creativity and flexibility. Giving proper training, showing the advantages of GCC solutions, and including employees in decision-making can reduce resistance and ease the shift to digital technologies.

Market Segmentation

BY SERVICE TYPE

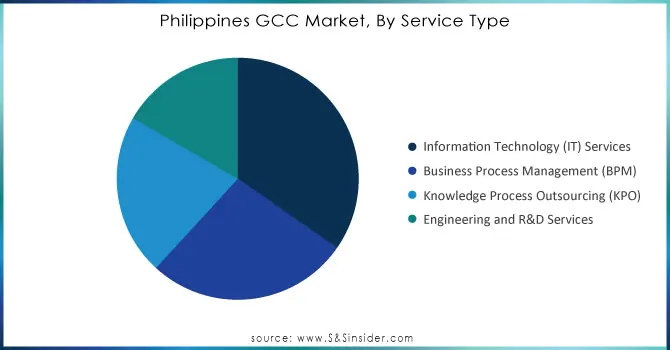

The Information Technology (IT) Services segment dominated the Philippines GCC market in 2023 with a 34% market share. This sector has seen strong growth because of the competitive labor expenses, ability to speak English, and a talented workforce in the country. IT services include software development, maintenance of applications, management of IT infrastructure, and provision of cloud services. The Philippines has established itself as an important location for IT service provision, enticing multinational corporations seeking to reduce expenses and improve service excellence. For instance, corporations such as Accenture and IBM use the Philippines as a key location for providing IT services, such as software development and IT support.

Knowledge Process Outsourcing (KPO) is projected to become the fastest-growing segment within the Philippines GCC market during 2024-2032. Knowledge Process Outsourcing (KPO) includes valuable services like market research, analytics, data management, and specialized business processes that demand a high level of skill. The rise in the segment is fueled by the growing need worldwide for advanced analytics and research services, which the Philippines can efficiently offer because of its skilled labor force and focus on specialized abilities. This pattern has drawn the interest of firms such as Deloitte and Thomson Reuters, leading them to set up hubs in the Philippines for activities like market research, financial analysis, and data processing.

Need Any Customization Research On Philippines GCC Market - Inquiry Now

BY INDUSTRY VERTICAL

The banking, financial services, and insurance (BFSI) segment dominated with a 31% market share in the Philippines GCC market in 2023. This industry benefits from a robust digital transformation agenda, driven by the need for enhanced customer experiences and operational efficiency. BFSI companies leverage technology for streamlined processes, improved risk management, and compliance with regulatory requirements. Major players like BDO Unibank and Philippine National Bank (PNB) utilize GCCs to centralize operations such as customer service, financial analysis, and fraud detection, ensuring quick response times and innovative solutions.

The manufacturing and automotive segment is projected to be the fastest-growing segment within the Philippines GCC market during 2024-2032, driven by increased demand for automation, Industry 4.0 initiatives, and advancements in supply chain management. Companies are investing heavily in technology to enhance productivity, optimize operations, and reduce costs. Notable examples include Toyota Motor Philippines, which employs GCCs for design and engineering support, and Mitsubishi Motors, which utilizes shared services for procurement and logistics. These centers are pivotal in driving innovations, improving product quality, and accelerating time-to-market for new automotive models.

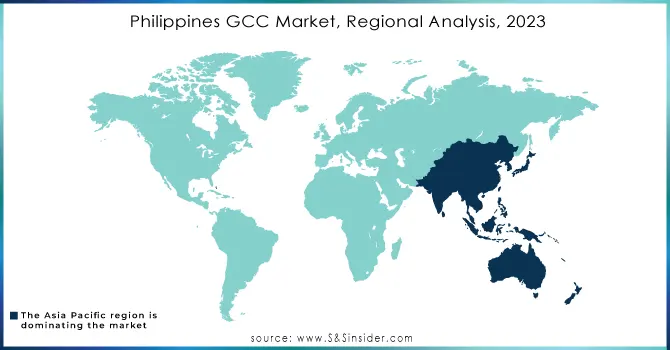

Regional Analysis

The Philippines is a preferred location to have global capability centers due to its cultural inclination towards adopting Western norms. It is also one of the highest English-speaking countries in Asia, which makes it easier for interaction. The National Capital Region (NCR), or Metro Manila dominated the market in 2023 in the Philippines GCCs market. It contains the largest number of these facilities, mainly in important locations such as Makati, Taguig (Bonifacio Global City or BGC), Pasig (Ortigas Center), Quezon City, and Manila. Metro Manila is well-suited for GCC operations due to its extensive and competent workforce, especially in fields like IT, finance, engineering, and customer service. Moreover, the area features advanced infrastructure, such as fast internet, transport systems, and commercial areas, that aid in smooth business operations. As the capital of the country, it also provides easy access to important government offices and regulatory agencies, making business operations more efficient. The selection of Metro Manila as the regional headquarters by many multinational companies helps to strengthen its status as the top hub for Global Corporate Centers in the Philippines.

Key Players

The major key players in the Philippines GCC Market are:

Accenture (Consulting, technology services, and outsourcing solutions)

Concentrix (Customer engagement services and business process outsourcing)

Teleperformance (Customer care and digital transformation services)

Sitel Group (Customer experience management and support services)

IBM (Cloud computing, AI, and business services)

Cognizant (IT services, consulting, and digital solutions)

Genpact (Business process management and digital transformation services)

Infosys (IT services, consulting, and business process management)

TCS (Tata Consultancy Services) (IT services, consulting, and business solutions)

Wipro (IT services, consulting, and business process services)

DXC Technology (IT services, cloud computing, and consulting)

HP Inc. (Printing solutions, personal computers, and IT services)

Oracle (Cloud applications and platforms, database solutions)

SAP (Enterprise software solutions and business analytics)

Alorica (Customer experience solutions and business process outsourcing)

Sitel (Customer service and support solutions)

Bain & Company (Consulting services in business strategy and management)

BPO International (Call center services and business process outsourcing)

Luxottica (Optical retail and eyewear manufacturing)

JPMorgan Chase (Financial services, investment banking, and asset management)

Recent Developments

October 2024: Sun Life Global Solutions (SLGS) Philippines, the global capability center (GCC) of the global insurance and asset management leader Sun Life, reinforces its commitment to diversity and inclusion with a comprehensive DEI&B (Diversity, Equity, Inclusion, and Belonging) career plan.

May 2024: IWG, the biggest supplier of hybrid work solutions globally, revealed the launch of four additional adaptable workspaces in the Philippines. Two new Regus centers have been opened in Nepo Centre, Angeles City, Pampanga, and Adriatico, Manila. These strategic launches are a continuation of IWG's worldwide expansion, which saw an increase of 867 locations in 2023.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 32.50 Billion |

| Market Size by 2032 | USD 67.97 Billion |

| CAGR | CAGR of 12.04% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Information Technology (IT) Services, Business Process Management (BPM), Knowledge Process Outsourcing (KPO), Engineering and R&D Services) • By Industry Vertical (Banking, Business Process Management (BPM), and Insurance (BFSI), Healthcare and Life Sciences, Retail and Consumer Goods, Manufacturing and Automotive, Telecom & IT) • By Organization Size (Large Enterprises, Small and Medium Enterprises (SMEs)) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Accenture, Concentrix, Teleperformance, Sitel Group, IBM, Cognizant, Genpact, Infosys, TCS, Wipro, DXC Technology, HP Inc., Oracle, SAP, Alorica, Sitel, Bain & Company, BPO International, Luxottica, JPMorgan Chase |

| Key Drivers | • Consumers in the Philippines are becoming more aware of the benefits of personalized services, leading to a shift in their expectations from businesses. • The Philippine government has been actively promoting policies aimed at fostering economic growth and attracting foreign investments. |

| RESTRAINTS | • Resistance to change within organizations can significantly hinder the adoption of GCC solutions in the Philippines. |

Ans: The Philippines GCC Market is expected to grow at a CAGR of 12.04% during 2024-2032.

Ans: The Philippines GCC Market was USD 32.50 Billion in 2023 and is expected to Reach USD 67.97 Billion by 2032.

Ans: The Philippine government has been actively promoting policies aimed at fostering economic growth and attracting foreign investments.

Ans: The large enterprises segment dominated the Philippines GCC Market.

Ans: Metro Manila dominated the Philippines GCC Market in 2023.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Philippines GCC Employee Productivity by Region

5.2 Compliance and Risk Metrics, by Region (2023)

5.3 Technology Adoption Rate

5.3.1 AI Integration

5.4 Geographic Distribution of Services

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Philippines GCC Market Segmentation, by Service Type

7.1 Chapter Overview

7.2 Information Technology (IT) Services

7.2.1 Information Technology (IT) Services Market Trends Analysis (2020-2032)

7.2.2 Information Technology (IT) Services Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Business Process Management (BPM)

7.3.1 Business Process Management (BPM) Market Trends Analysis (2020-2032)

7.3.2 Business Process Management (BPM) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Knowledge Process Outsourcing (KPO)

7.4.1 Knowledge Process Outsourcing (KPO) Market Trends Analysis (2020-2032)

7.4.2 Knowledge Process Outsourcing (KPO) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Engineering and R&D Services

7.5.1 Engineering and R&D Services Market Trends Analysis (2020-2032)

7.5.2 Engineering and R&D Services Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Philippines GCC Market Segmentation, by Industry Vertical

8.1 Chapter Overview

8.2 Banking, Financial Services, and Insurance (BFSI)

8.2.1 Banking, Financial Services, and Insurance (BFSI) Market Trends Analysis (2020-2032)

8.2.2 Banking, Financial Services, and Insurance (BFSI) Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Healthcare and Life Sciences

8.3.1 Healthcare and Life Sciences Market Trends Analysis (2020-2032)

8.3.2 Healthcare and Life Sciences Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Retail and Consumer Goods

8.4.1 Retail and Consumer Goods Market Trends Analysis (2020-2032)

8.4.2 Retail and Consumer Goods Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Manufacturing and Automotive

8.6.1 Manufacturing and Automotive Market Trends Analysis (2020-2032)

8.6.2 Manufacturing and Automotive Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Telecom & IT

8.7.1 Telecom & IT Market Trends Analysis (2020-2032)

8.7.2 Telecom & IT Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Philippines GCC Market Segmentation, by Organization Size

9.1 Chapter Overview

9.2 Large Enterprises

9.2.1 Large Enterprises Market Trends Analysis (2020-2032)

9.2.2 Large Enterprises Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Small and Medium Enterprises (SMEs)

9.3.1 Small and Medium Enterprises (SMEs) Market Trends Analysis (2020-2032)

9.3.2 Small and Medium Enterprises (SMEs) Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 Philippines

10.2.1 Trends Analysis

10.2.2 Philippines GCC Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 Philippines GCC Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.2.4 Philippines GCC Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.2.5 Philippines GCC Market Estimates and Forecasts, by Company Size (2020-2032) (USD Billion)

11. Company Profiles

11.1 Accenture

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Concentrix

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Teleperformance

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Sitel Group

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 IBM

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Cognizant

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Genpact

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Infosys

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 TCS (Tata Consultancy Services)

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Wipro

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

BY SERVICE TYPE

Information Technology (IT) Services

Business Process Management (BPM)

Knowledge Process Outsourcing (KPO)

Engineering and R&D Services

BY INDUSTRY VERTICAL

Banking, Financial Services, and Insurance (BFSI)

Healthcare and Life Sciences

Retail and Consumer Goods

Manufacturing and Automotive

Telecom & IT

BY ORGANIZATION SIZE

Large Enterprises

Small and Medium Enterprises (SMEs)

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The MEP Software Market was valued at USD 3.80 billion in 2023 and is expected to reach USD 9.20 Billion by 2032, growing at a CAGR of 10.34% by 2032.

High-Performance Computing Market was worth USD 47.07 billion in 2023 and is predicted to be worth USD 92.33 billion by 2032, growing at a CAGR of 7.80 % between 2024 and 2032.

The Bot Services Market Size was valued at USD 1.66 Billion in 2023 and is expected to reach USD 20.21 Billion by 2032 and grow at a CAGR of 32.04% over the forecast period 2024-2032.

The Video Surveillance Market Size was valued at USD 60.1 Billion in 2023 and will reach USD 149.5 Billion by 2032, growing at a CAGR of 10.67% by 2032.

The Generative AI Market Size was valued at USD 20.21 Billion in 2023 and is expected to reach USD 440 Billion by 2032 and grow at a CAGR of 41.31% over the forecast period 2024-2032.

The Cryptocurrency Market was valued at USD 5.08 billion in 2023 and will reach USD 15.39 Billion by 2032, growing at a CAGR of 13.13% by 2032.

Hi! Click one of our member below to chat on Phone