Pharmacovigilance Market Report Scope and Overview:

Get More Information on Pharmacovigilance Market - Request Free Sample Report

The Pharmacovigilance Market Size valued USD 7.20 billion in 2023, and estimated to reach USD 18.52 billion by 2032 with CAGR 11.09% over the forecast period 2024-2032.

The pharmacovigilance market is focused on ensuring drug safety and efficacy by meticulously monitoring and evaluating pharmaceutical products post-market release. This crucial process involves identifying, assessing, understanding, and preventing adverse drug reactions or other drug-related issues. By prioritizing patient safety and optimizing drug benefits, pharmacovigilance plays a pivotal role in enhancing overall healthcare outcomes.

For instance, the Indian Pharmacopoeia Commission, the National Coordination Centre for pharmacovigilance has its 30th skill development programme on pharmacovigilance scheduled for August 2024. As a part of this work, the IPC continues to expand its expertise status as a WHO collaborating centre.

Several factors drive a robust pharmacovigilance market with the growing occurrence of adverse drug reactions (ADRs), along with complexity in drug regimens for chronic diseases namely cancer, diabetes and other cardiovascular disorders is highly driving the demand. Use of medicines for chronic conditions in non-hospital settings (e.g., a WHO report 2017), Apart from the expanding drug development pipeline (including personalized medicines, biosimilars and orphan drugs), creating an increased demand for strict safety monitoring. The move towards decentralized clinical trials and adaptive trial designs is also further complicating matters which in turn is driving the demand for more comprehensive pharmacovigilance services suite.

Pharmacovigilance relies heavily on a robust data supply chain. Data originates from various sources including healthcare providers, patients, pharmaceutical companies, regulatory agencies, and public databases. Efficient data flow from these sources is crucial for timely and accurate safety assessments. However, challenges like data delays and inconsistencies can hinder pharmacovigilance effectiveness. Key performance indicators such as time to case creation, case completion rate, and data quality are essential for monitoring data supply chain performance.

Cost-saving and increasing operational pressures have made these pharmaceutical companies outsource certain functions of pharmacovigilance such as medical writing, data collection/reporting etc. Evidence of this trend advancing the pharmacovigilance market forward includes collaboration between major players IQVIA and Alibaba Cloud to deploy their clinical solutions in China.

The pharmacovigilance market is also highly fragmented with fast changing technological landscape. Harnessing big data, AI and cloud solutions as integrated concepts will reinvent the traditional approaches to pharmacovigilance. Compared to this, the creation of AI algorithms for signal detection (for a wide variety of data sources) is undoubtedly an innovative accomplishment.

The pharmacovigilance market is characterized by a dynamic competitive landscape, with mergers and acquisitions being a prevalent strategy for growth and expansion. However, Pharmalex GmbH's recent acquisition of Cpharm Australia has given a boost to its geographical presence and option services but the industry operates within a stringent regulatory environment, with bodies like the US FDA playing a crucial role in oversight. Growing ADR reporting demand likely to drive mounting regulatory compliance pressures on healthcare providers.

It can be concluded that the pharmacovigilance market will continue to grow in future as well and there are multiple factors responsible for this huge increase including high rate of drug consumption, increasing number of ADRs, advancement in technology and changing regulatory landscape.

Oracle, for instance, has significantly enhanced its Argus and Safety One Intake solutions with AI-powered features, demonstrating a strong commitment to technological innovation in drug safety.

Pharmacovigilance Market Dynamics

Drivers

-

The Pharmacovigilance Market Grows With Greater Public Attention

A growth in public and regulatory awareness related to drug safety helps a significant cause for the earnings growth of pharmaceutical companies that offers chance to rise pharmacovigilance market. Not only more people are learning about adverse drug reactions (ADRs), but there is a greater demand for stronger systems to monitor the safety of drugs. Therefore, the demand for an end-to-end pharmacovigilance solution is greater than ever.

Drivers- government initiatives to increase public awareness related to medication safety & proper use and the counteractive function of pharmacovigilance, Fannin developments are helping boost the demand for adventure travel. For example, campaigns led by the Uppsala Monitoring Centre and various national medicines regulatory authorities enrich public awareness and boost spontaneous ADR reporting.

This greater public participation in drug safety encourages a healthier pharmacovigilance network and increases market growth. Examples include investigations of collaborations between pharmaceutical companies and service providers to enlarge market capacities.

Growing adoption of pharmacovigilance outsourcing by pharmaceutical companies is favouring the expansion in global pharmacovigilance market. By outsourcing pharmacovigilance functions, pharma companies can focus their resources on core competencies and avail the benefits of economies of scale to substantially reduce operational costs leading to direct cost savings.

Outsourcing enables companies to pay full attention on their core competencies i.e. drug research & developing and commercialization while ensuring end-to-end processes, faster standards of efficiency as well as complying with regulations for best practices in the industry from external partners taking care at all levels of complete or any other degree needed drug safety monitoring service.

This, in turn, is aiding expansion of the global pharmacovigilance outsourcing market resultant to increased demand for such services.

In December 2023, Thermo Fisher Scientific introduced the CorEvitas Pharmacovigilance Platform for Clinical Research Registries.

In September 2023, Medac GmbH enhanced its drug safety monitoring capabilities through a partnership with ArisGlobal Solutions.

Restraints

-

Concerns Regarding Funding And Uneven Healthcare Budget Distribution Negatively Impact On Pharmacovigilance Market Growth

There are many barriers to the pharmacovigilance market which may hamper its performance, such as lack of capital investment and scarcity of available professionals. Scarce financial resources are currently limiting the establishment of comprehensive drug safety monitoring systems, and affecting ability to address disease-specific challenges. In addition, lack of adequately trained personnel leads to delays in reporting adverse events/difficulties in performing safety monitoring and also results in poor regulatory compliances. Addressing the challenges mentioned above would entail major financial resources required for training and supporting these initiatives in pharmacovigilance.

Market Segmentation Overview

By Product Life Cycle

The post-marketing phase (Phase IV) dominated the pharmacovigilance market, accounted with 74.03% in 2023. This phase is crucial for detecting unexpected adverse drug reactions (ADRs) in a large patient population after drug commercialization.

While Phase IV led the market, the Phase III clinical trial segment is projected to experience significant growth and these trials provide essential data on drug efficacy, safety, and interactions before market launch. Industry players are investing in advanced trial management technologies to enhance efficiency and drive growth in this segment.

By Service Provider

The contract outsourcing segment held the largest share of the pharmacovigilance market with 72% in 2023, driven by the surge in Contract Research Organizations (CROs) offering comprehensive clinical trial solutions, particularly in Asia-Pacific regions like India, China, and Japan. This segment is poised for rapid growth due to cost-effective, flexible, and high-quality services provided by outsourcing partners. Pharmacovigilance outsourcing now encompasses a wide array of complex services, including benefit-risk assessment, signal detection, pharmacoeconomic analysis, and risk management planning.

By Type

Spontaneous reporting is the predominated method in pharmacovigilance, accounted for over 30% of the market in 2023. Its effectiveness in identifying new, serious, and rare adverse drug reactions (ADRs) at a relatively low cost has driven its widespread adoption by both regulatory authorities and pharmaceutical companies.

However, the targeted spontaneous reporting segment is projected to experience significant growth which is driven by initiatives from organizations like ENCePP, this method offers advantages such as cost-efficiency, feasibility in resource-limited settings, and utility in routine monitoring. These factors are expected to increase the demand for targeted spontaneous reporting in the future.

By Process Flow

Signal detection is led segment in the pharmacovigilance market with 39% in 2023 which involves identifying potential safety concerns by analyzing various data sources such as spontaneous reports, clinical trials, and real-world data.

The case data management segment is poised for rapid growth and this segment focuses on organizing and analyzing adverse event data from multiple sources, including spontaneous reports, clinical trials, and literature. Advanced technologies like artificial intelligence are being increasingly adopted to improve efficiency and extract valuable insights from this data.

By Therapeutic Area

The oncology segment was the largest with 70% in 2023 and fastest-growing sector within the pharmacovigilance market. Due to the complex nature of cancer treatments and the potential for severe adverse reactions, rigorous safety monitoring is crucial.

The increasing number of cancer research initiatives, coupled with significant government funding for oncology research (such as the U.S. Cancer Moonshot initiative), is driving the demand for specialized pharmacovigilance services in this area.

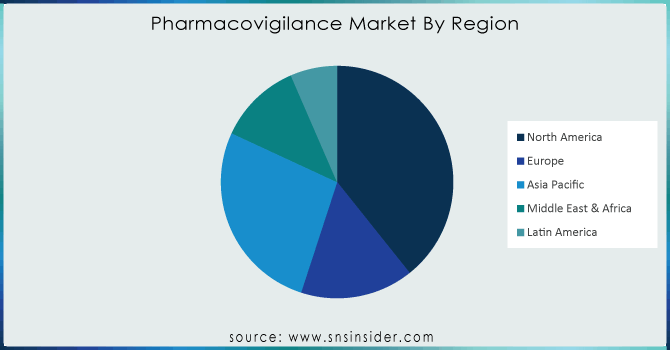

Pharmacovigilance Market Regional Analysis :

North America dominated the pharmacovigilance market with 60.01% in 2023, driven by a concentration of major pharmaceutical companies, stringent regulatory frameworks (like the FDA's REMS), and a high prevalence of drug-related issues. The U.S., in particular, is a major market due to its large drug consumption and rigorous regulatory oversight.

Europe is another key region, characterized by robust regulatory standards (e.g., EMA's RMP), a growing number of clinical trials, and increasing drug development activities. The region has witnessed a surge in adverse drug reaction reporting, emphasizing the need for robust pharmacovigilance.

The Asia Pacific region is emerging as a significant market due to its cost-effective clinical trial landscape and growing pharmaceutical industry. Countries like India, China, Singapore, and South Korea are becoming outsourcing hubs, attracting global pharma companies.

Need any customization research on Pharmacovigilance Market - Enquiry Now

Key Players:

ArisGlobal, Cognizant, IBM, Clinquest Group B.V. (Linical Americas), Accenture, Laboratory Corporation of America Holdings, IQVIA,Capgemini, ICON plc., ITClinical, ClinChoice (formerly FMD K&L), TAKE Solutions Limited, Wipro, Parexel International (MA) Corporation, BioClinica Inc. (Clario), United BioSource LLC and others.

Recent Developments

-

Companies like ICON plc is forming collaborations to accelerate clinical trial execution in specialized areas such as medical dermatology.

-

Organizations like Parexel are releasing industry insights and trends to support the biopharmaceutical industry in drug development.

-

Key players such as Oracle are incorporating AI into their pharmacovigilance solutions to enhance drug safety monitoring capabilities.

| Report Attributes | Details |

| Market Size in 2023 | US$ 7.20 Bn |

| Market Size by 2032 | US$ 18.52 Bn |

| CAGR | CAGR of 11.09% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By product Life Cycle • By Service Provider • By Type • By Process Flow • By Therapeutic • By End Use |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | ArisGlobal, IQVIA Inc., Accenture, Cognizant, IBM, Clinquest Group B.V. (Linical Americas), Laboratory Corporation of America Holdings, Capgemini, ICON plc., ITClinical, ClinChoice (formerly FMD K&L), TAKE Solutions Limited, Wipro, Parexel International (MA) Corporation, BioClinica Inc. (Clario), United BioSource LLC, and others. |

| Key Drivers | • The Pharmacovigilance Market Grows With Greater Public Attention |

| Market Restraints | • Concerns Regarding Funding And Uneven Healthcare Budget Distribution Negatively Impact On Pharmacovigilance Market Growth |