Get More Information on Pharmaceutical Packaging Equipment Market - Request Sample Report

The Pharmaceutical Packaging Equipment Market size was valued at USD 6.80 billion in 2023 & is expected to surpass USD 10.91 billion by 2032, with a growing CAGR of 5.42% over the forecast period 2024-2032.

Pharmaceutical packaging equipment, like sealers, labellers, and case packers, automates tasks for streamlined production and consistent quality. However, the future is not just about automation; artificial intelligence (AI) is transforming the market. AI-powered vision systems offer superior quality control, while algorithms predict maintenance needs and optimize packaging design to minimize waste. AI even integrates with anti-counterfeiting measures to ensure patient safety. In essence, pharmaceutical packaging equipment is becoming not just automated, but intelligent, paving the way for a future of heightened efficiency, safety, and cost-effectiveness in the pharmaceutical industry.

For instance, A whopping 80% of professionals are already utilizing AI for drug discovery, potentially cutting the usual 5–6-year process down to just a year. This efficiency boost is attracting investment, with 95% of companies pouring resources into AI capabilities. AI's impact goes beyond speed – it can streamline clinical trials, saving significant costs and time. By 2025, AI is estimated to unlock a massive USD 350- USD 410 billion in annual value for pharmaceutical companies.

The diverse nature of pharmaceuticals, from precisely measured liquids to various solid forms, necessitates flexibility in packaging equipment. Manufacturers require equipment that can adapt to their unique needs, leading to a strong market for versatile and reliable solutions.

The global landscape of pharmaceutical manufacturing reveals a geographically concentrated picture. Asia dominates production, with India leading the pack at a staggering 48% share. China follows closely behind at 13%. While Europe still holds a significant presence at 22%, North America's contribution sits at 10%. The remaining 7% is attributed to various other countries. This data highlights the growing importance of Asian nations in the pharmaceutical supply chain.

To stay at the forefront of India's pharmaceutical industry, Nichrome has partnered with leading suppliers from Southeast Asia and Europe. This collaboration brings cutting-edge technology and solutions to the Indian market.

Pharmaceuticals depend on flawless execution of both packaging and labelling for success. Reliable packaging equipment ensure medications are delivered safely and efficiently, while clear labelling allows for proper identification and regulatory compliance. This winning combination safeguards both the product and the consumer. To meet the demands of the pharmaceutical industry, packaging machinery needs to be a perfect blend of flexibility, reliability, and high-efficiency. This focus on advanced technology ensures that medications and other products are packaged quickly, consistently, and according to ever-evolving needs.

Mespack's innovative pharmaceutical packaging machinery empowers labs and manufacturers to ensure optimal preservation of medications. This translates to safeguarding product quality, stability, safety, and efficacy. Their focus on advanced packaging recognizes the critical role it plays in the pharmaceutical industry – protecting life-saving drugs from environmental risks throughout their journey to patients.

The relentless pursuit of patient safety, quality, and compliance in the pharmaceutical industry is fueling a boom in the pharmaceutical packaging equipment market. Key players play a critical role by ensuring products are packaged securely, safeguarding their effectiveness and preventing contamination or tampering.

Advancements in packaging equipment technology are streamlining and boosting productivity in pharmaceutical manufacturing.

The rise of customized and specialized drugs is pushing the boundaries of packaging innovation, demanding adaptable solutions. Whether it's liquids, solids, or other dosage forms, pharmaceutical packaging equipment needs to be versatile enough to meet the unique needs of each product. As the pharmaceutical industry pushes the boundaries of drug development, the demand for sophisticated packaging equipment that ensures product quality, safety, and compliance will continue to surge. Overall, this will further propel the growth of the pharmaceutical packaging equipment market, solidifying its role as the guardian of safe and effective medications.

Booming Pharma Needs Drive Packaging Equipment Market

The pharmaceutical packaging equipment market is thriving, driven by a number of factors such as the demand for pharmaceuticals is on the rise. This is fueled by a combination of efforts by drug companies to differentiate their brands with targeted advertising and new formulations, a growing population with chronic diseases due to lifestyle changes, and expanding government healthcare initiatives that provide wider insurance coverage. In the US alone, Medicare spending reached a staggering USD 900 billion in 2021, reflecting the increasing need for medications across the board. This translates to a growing demand for efficient and advanced packaging solutions to handle the diverse range of drugs being produced. Strict regulations play a crucial role that is agencies like the FDA and EMA have stringent guidelines to ensure the safety, efficacy, and quality of pharmaceuticals. Complying with regulations is paramount, so pharmaceutical companies prioritize investing in packaging equipment that meets the established safety and quality standards. This includes features like tamper-evident packaging to prevent product manipulation and serialization for meticulous tracking throughout the supply chain.

Innovation is another key driver that is with the advancements in packaging equipment technology are transforming the industry. Automation and robotics are leading to increased efficiency and reduced errors, while smart packaging with RFID tags, QR codes, and sensors allows for real-time product monitoring and improved traceability. Sustainability is also a growing concern. Pharmaceutical companies are seeking eco-friendly solutions, driving the demand for equipment that utilizes recyclable materials and supports sustainable practices.

Overall, the confluence of rising pharmaceutical demand, strict regulations, technological advancements, and a growing focus on sustainability is propelling the pharmaceutical packaging equipment market towards continued growth.

The Rise of Refurbished Equipment: Cost-Effective Solutions for Manufacturers

Manufacturers are discovering a win-win situation with refurbished equipment. The turnaround time is significantly faster compared to waiting for brand new machines to be built and delivered. This is a game-changer for manufacturers facing tight production deadlines and perhaps the biggest advantage, is the substantial cost savings. Refurbished equipment offers significant cost savings, typically priced 40-50% lower than brand-new machinery.

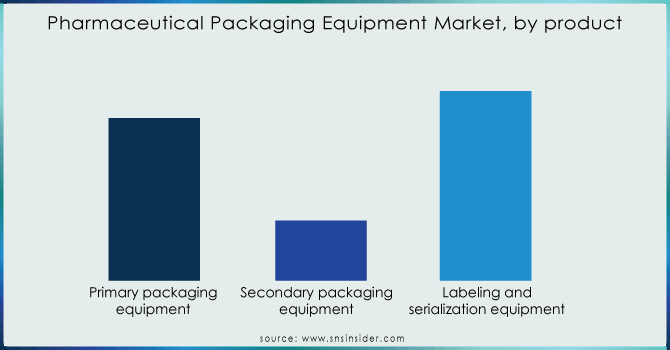

Labelling and serialization equipment were dominated in the pharmaceutical packaging equipment, with 40% share in 2023. This dominance is due to its critical role in ensuring medication safety. Strict government regulations demand accurate and traceable information on each product, and labelling/serialization equipment delivers. Additionally, maintaining a sterile environment during processing and packaging is essential, and this equipment helps maintain that sterility. By prioritizing both safety and compliance, labelling and serialization equipment is leading the pack in market growth.

Need any customization research on Pharmaceutical packaging equipment Market - Enquiry Now

The Automatic segment is emerged as the dominated in the pharmaceutical packaging equipment market, projected to held a commanded 42.7% share in 2023. This dominance stems from a multi-pronged approach to addressing critical needs in the industry. Firstly, minimizing human intervention through automation is paramount to maintaining hygiene and cleanliness in manufacturing facilities, especially in the wake of the COVID-19 pandemic. Automatic equipment significantly reduces the risk of contamination during the packaging process. Secondly, these machines offer a significant boost in efficiency and speed. Faster processing times for filling and sealing medications translate to increased production output, crucial for meeting market demands. Finally, the growing popularity of child-resistant, interactive, and active packaging solutions can also be seamlessly handled by automatic equipment, showcasing its versatility and with these advantages, the automatic segment is not only leading the market but also surging the fastest growth trajectory.

The Asia Pacific region dominated in the pharmaceutical packaging equipment market, held a commanded 39% share in 2023. This dominance is fueled by a booming pharmaceutical industry across the region. Several factors contribute to this growth: a rising population, increasing healthcare needs, and significant investments in the pharmaceutical sector itself. This surge in production necessitates advanced and efficient packaging equipment to handle the larger volumes.

China, a major player in pharmaceutical manufacturing, is experiencing particularly strong growth in its demand for packaging equipment. This is driven by their expanding pharmaceutical industry and the need for advance packaging solutions. As China prioritizes production efficiency, product safety, and strict regulatory compliance, there's a rising demand for specific equipment like blister packaging machines, vial filling systems, and track-and-trace technology. Pharmaceutical companies are seeking modern, automated solutions to meet the growing need for high-quality and diverse medications.

Europe's pharmaceutical industry is another key driver of the packaging equipment market. Advancements in pharmaceutical technologies and the launch of new medicines are fueling the demand for this equipment across Europe, leading to steady market growth in the region. This trend is expected to continue, with companies like Gerresheimer capitalizing on it by launching new products specifically designed for the development of novel medications and vaccines.

The major Players are Robert Bosch GmbH, Bausch+Ströbel Maschinefabrik Ilshofen GmbH+Co. KG, Gerresheimer, Marchesini Group S.p.A, OPTIMA Packaging Group, I.M.A. Industria Macchine Automatiche SpA, Venia LLC, Romaco Group, ProMach, Inc., Accutek Pharmaceutical Equipment Companies, Inc., Herma GmbH, Dara Pharmaceutical Equipment, CKD Corporation, MULTIVAC Group, NJM Packaging, Trustar Pharma Pack Equipment, Co. Ltd., Harro Höfliger, MG2 s.r.l., ACIC Pharmaceuticals Inc., Inline Filling Systems and others.

MULTIVAC Strengthens South Asia Presence with New Production Facility

In December 2023, MULTIVAC Group solidified its commitment to the South Asian market by inaugurating a brand-new production facility in India. This $9 million investment boasts a modern 10,000-square-meter complex and is poised to be operational in early 2024. The initial workforce of 60 will focus on enhancing customer service in India, Sri Lanka, and Bangladesh by offering faster delivery times through regional proximity.

Enhanced Pouch Filling Solution:

Further demonstrating their commitment to innovation, MULTIVAC Group launched the Pouch Loader for chamber belt machines in May 2023. This semi-automatic system is a game-changer, offering significant improvements in performance, hygiene, efficiency, and ergonomics for filling film pouches and loading them into packaging machines.

| Report Attributes | Details |

| Market Size in 2023 | US$ 6.80 billion |

| Market Size by 2032 | US$ 10.91 Billion |

| CAGR | CAGR of 5.42% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Machine Type (Bottling Line, Cartoning, Form-fill-seal (FFS), Blister Packaging, Capping & Closing, Filling & Sealing, Labelling, Decorating & Coding, Palletizing, Wrapping & Bundling) • By Product (Primary packaging equipment, Secondary packaging equipment, Labelling and serialization equipment) • By Automation (Automatic, Semi-automatic, Manual) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Robert Bosch GmbH, Bausch+Ströbel Maschinefabrik Ilshofen GmbH+Co. KG, Gerresheimer, Marchesini Group S.p.A, OPTIMA Packaging Group, I.M.A. Industria Macchine Automatiche SpA, Venia LLC, Romaco Group, ProMach, Inc., Accutek Pharmaceutical Equipment Companies, Inc., Herma GmbH, Dara Pharmaceutical Equipment, CKD Corporation, MULTIVAC Group, NJM Packaging, Trustar Pharma Pack Equipment, Co. Ltd., Harro Höfliger, MG2 s.r.l., ACIC Pharmaceuticals Inc., Inline Filling Systems and others. |

| Key Drivers | • Booming Pharma Needs Drive Packaging Equipment Market |

| Restraints | • The Rise of Refurbished Equipment: Cost-Effective Solutions for Manufacturers |

Ans: The estimated compound annual growth rate is 5.42% during the forecast period for the Pharmaceutical Packaging Equipment market.

Ans: The projected market value of the Pharmaceutical Packaging Equipment market is estimated USD 6.80 billion in 2023 and expected to reach USD 10.91 billion by 2032.

Ans: Booming pharma needs drive packaging equipment market is one of the drivers of the Pharmaceutical Packaging Equipment market.

Ans: The rise of refurbished equipment with cost-effective solutions for manufacturers hamper the market growth which is one of the restraints of the Pharmaceutical Packaging Equipment market.

Ans: Asia Pacific is the dominating region with 39% market share in the Pharmaceutical Packaging Equipment market.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Pharmaceutical Packaging Equipment Market Segmentation, By Machine Type

7.1 Introduction

7.2 Bottling Line

7.3 Cartoning

7.4 Form-fill-seal (FFS)

7.5 Blister Packaging

7.6 Capping & Closing

7.7 Filling & Sealing

7.8 Labelling, Decorating & Coding

7.9 Palletizing

7.10 Wrapping & Bundling

8. Pharmaceutical Packaging Equipment Market Segmentation, By Product

8.1 Introduction

8.2 Primary packaging equipment

8.3 Secondary packaging equipment

8.4 Labelling and serialization equipment

9. Pharmaceutical Packaging Equipment Market Segmentation, By Automation

9.1 Introduction

9.2 Automatic

9.3 Semi-automatic

9.4 Manual

10. Regional Analysis

10.1 Introduction

10.2 North America

10.2.1 Trend Analysis

10.2.2 North America Pharmaceutical Packaging Equipment Market by Country

10.2.3 North America Pharmaceutical Packaging Equipment Market By Machine Type

10.2.4 North America Pharmaceutical Packaging Equipment Market By Product

10.2.5 North America Pharmaceutical Packaging Equipment Market By End User

10.2.6 USA

10.2.6.1 USA Pharmaceutical Packaging Equipment Market By Machine Type

10.2.6.2 USA Pharmaceutical Packaging Equipment Market By Product

10.2.6.3 USA Pharmaceutical Packaging Equipment Market By End User

10.2.7 Canada

10.2.7.1 Canada Pharmaceutical Packaging Equipment Market By Machine Type

10.2.7.2 Canada Pharmaceutical Packaging Equipment Market By Product

10.2.7.3 Canada Pharmaceutical Packaging Equipment Market By End User

10.2.8 Mexico

10.2.8.1 Mexico Pharmaceutical Packaging Equipment Market By Machine Type

10.2.8.2 Mexico Pharmaceutical Packaging Equipment Market By Product

10.2.8.3 Mexico Pharmaceutical Packaging Equipment Market By End User

10.3 Europe

10.3.1 Trend Analysis

10.3.2 Eastern Europe

10.3.2.1 Eastern Europe Pharmaceutical Packaging Equipment Market by Country

10.3.2.2 Eastern Europe Pharmaceutical Packaging Equipment Market By Machine Type

10.3.2.3 Eastern Europe Pharmaceutical Packaging Equipment Market By Product

10.3.2.4 Eastern Europe Pharmaceutical Packaging Equipment Market By End User

10.3.2.5 Poland

10.3.2.5.1 Poland Pharmaceutical Packaging Equipment Market By Machine Type

10.3.2.5.2 Poland Pharmaceutical Packaging Equipment Market By Product

10.3.2.5.3 Poland Pharmaceutical Packaging Equipment Market By End User

10.3.2.6 Romania

10.3.2.6.1 Romania Pharmaceutical Packaging Equipment Market By Machine Type

10.3.2.6.2 Romania Pharmaceutical Packaging Equipment Market By Product

10.3.2.6.4 Romania Pharmaceutical Packaging Equipment Market By End User

10.3.2.7 Hungary

10.3.2.7.1 Hungary Pharmaceutical Packaging Equipment Market By Machine Type

10.3.2.7.2 Hungary Pharmaceutical Packaging Equipment Market By Product

10.3.2.7.3 Hungary Pharmaceutical Packaging Equipment Market By End User

10.3.2.8 Turkey

10.3.2.8.1 Turkey Pharmaceutical Packaging Equipment Market By Machine Type

10.3.2.8.2 Turkey Pharmaceutical Packaging Equipment Market By Product

10.3.2.8.3 Turkey Pharmaceutical Packaging Equipment Market By End User

10.3.2.9 Rest of Eastern Europe

10.3.2.9.1 Rest of Eastern Europe Pharmaceutical Packaging Equipment Market By Machine Type

10.3.2.9.2 Rest of Eastern Europe Pharmaceutical Packaging Equipment Market By Product

10.3.2.9.3 Rest of Eastern Europe Pharmaceutical Packaging Equipment Market By End User

10.3.3 Western Europe

10.3.3.1 Western Europe Pharmaceutical Packaging Equipment Market by Country

10.3.3.2 Western Europe Pharmaceutical Packaging Equipment Market By Machine Type

10.3.3.3 Western Europe Pharmaceutical Packaging Equipment Market By Product

10.3.3.4 Western Europe Pharmaceutical Packaging Equipment Market By End User

10.3.3.5 Germany

10.3.3.5.1 Germany Pharmaceutical Packaging Equipment Market By Machine Type

10.3.3.5.2 Germany Pharmaceutical Packaging Equipment Market By Product

10.3.3.5.3 Germany Pharmaceutical Packaging Equipment Market By End User

10.3.3.6 France

10.3.3.6.1 France Pharmaceutical Packaging Equipment Market By Machine Type

10.3.3.6.2 France Pharmaceutical Packaging Equipment Market By Product

10.3.3.6.3 France Pharmaceutical Packaging Equipment Market By End User

10.3.3.7 UK

10.3.3.7.1 UK Pharmaceutical Packaging Equipment Market By Machine Type

10.3.3.7.2 UK Pharmaceutical Packaging Equipment Market By Product

10.3.3.7.3 UK Pharmaceutical Packaging Equipment Market By End User

10.3.3.8 Italy

10.3.3.8.1 Italy Pharmaceutical Packaging Equipment Market By Machine Type

10.3.3.8.2 Italy Pharmaceutical Packaging Equipment Market By Product

10.3.3.8.3 Italy Pharmaceutical Packaging Equipment Market By End User

10.3.3.9 Spain

10.3.3.9.1 Spain Pharmaceutical Packaging Equipment Market By Machine Type

10.3.3.9.2 Spain Pharmaceutical Packaging Equipment Market By Product

10.3.3.9.3 Spain Pharmaceutical Packaging Equipment Market By End User

10.3.3.10 Netherlands

10.3.3.10.1 Netherlands Pharmaceutical Packaging Equipment Market By Machine Type

10.3.3.10.2 Netherlands Pharmaceutical Packaging Equipment Market By Product

10.3.3.10.3 Netherlands Pharmaceutical Packaging Equipment Market By End User

10.3.3.11 Switzerland

10.3.3.11.1 Switzerland Pharmaceutical Packaging Equipment Market By Machine Type

10.3.3.11.2 Switzerland Pharmaceutical Packaging Equipment Market By Product

10.3.3.11.3 Switzerland Pharmaceutical Packaging Equipment Market By End User

10.3.3.12 Austria

10.3.3.12.1 Austria Pharmaceutical Packaging Equipment Market By Machine Type

10.3.3.12.2 Austria Pharmaceutical Packaging Equipment Market By Product

10.3.3.12.3 Austria Pharmaceutical Packaging Equipment Market By End User

10.3.3.13 Rest of Western Europe

10.3.3.13.1 Rest of Western Europe Pharmaceutical Packaging Equipment Market By Machine Type

10.3.3.13.2 Rest of Western Europe Pharmaceutical Packaging Equipment Market By Product

10.3.3.13.3 Rest of Western Europe Pharmaceutical Packaging Equipment Market By End User

10.4 Asia-Pacific

10.4.1 Trend Analysis

10.4.2 Asia-Pacific Pharmaceutical Packaging Equipment Market by Country

10.4.3 Asia-Pacific Pharmaceutical Packaging Equipment Market By Machine Type

10.4.4 Asia-Pacific Pharmaceutical Packaging Equipment Market By Product

10.4.5 Asia-Pacific Pharmaceutical Packaging Equipment Market By End User

10.4.6 China

10.4.6.1 China Pharmaceutical Packaging Equipment Market By Machine Type

10.4.6.2 China Pharmaceutical Packaging Equipment Market By Product

10.4.6.3 China Pharmaceutical Packaging Equipment Market By End User

10.4.7 India

10.4.7.1 India Pharmaceutical Packaging Equipment Market By Machine Type

10.4.7.2 India Pharmaceutical Packaging Equipment Market By Product

10.4.7.3 India Pharmaceutical Packaging Equipment Market By End User

10.4.8 Japan

10.4.8.1 Japan Pharmaceutical Packaging Equipment Market By Machine Type

10.4.8.2 Japan Pharmaceutical Packaging Equipment Market By Product

10.4.8.3 Japan Pharmaceutical Packaging Equipment Market By End User

10.4.9 South Korea

10.4.9.1 South Korea Pharmaceutical Packaging Equipment Market By Machine Type

10.4.9.2 South Korea Pharmaceutical Packaging Equipment Market By Product

10.4.9.3 South Korea Pharmaceutical Packaging Equipment Market By End User

10.4.10 Vietnam

10.4.10.1 Vietnam Pharmaceutical Packaging Equipment Market By Machine Type

10.4.10.2 Vietnam Pharmaceutical Packaging Equipment Market By Product

10.4.10.3 Vietnam Pharmaceutical Packaging Equipment Market By End User

10.4.11 Singapore

10.4.11.1 Singapore Pharmaceutical Packaging Equipment Market By Machine Type

10.4.11.2 Singapore Pharmaceutical Packaging Equipment Market By Product

10.4.11.3 Singapore Pharmaceutical Packaging Equipment Market By End User

10.4.12 Australia

10.4.12.1 Australia Pharmaceutical Packaging Equipment Market By Machine Type

10.4.12.2 Australia Pharmaceutical Packaging Equipment Market By Product

10.4.12.3 Australia Pharmaceutical Packaging Equipment Market By End User

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Pharmaceutical Packaging Equipment Market By Machine Type

10.4.13.2 Rest of Asia-Pacific Pharmaceutical Packaging Equipment Market By Product

10.4.13.3 Rest of Asia-Pacific Pharmaceutical Packaging Equipment Market By End User

10.5 Middle East & Africa

10.5.1 Trend Analysis

10.5.2 Middle East

10.5.2.1 Middle East Pharmaceutical Packaging Equipment Market by Country

10.5.2.2 Middle East Pharmaceutical Packaging Equipment Market By Machine Type

10.5.2.3 Middle East Pharmaceutical Packaging Equipment Market By Product

10.5.2.4 Middle East Pharmaceutical Packaging Equipment Market By End User

10.5.2.5 UAE

10.5.2.5.1 UAE Pharmaceutical Packaging Equipment Market By Machine Type

10.5.2.5.2 UAE Pharmaceutical Packaging Equipment Market By Product

10.5.2.5.3 UAE Pharmaceutical Packaging Equipment Market By End User

10.5.2.6 Egypt

10.5.2.6.1 Egypt Pharmaceutical Packaging Equipment Market By Machine Type

10.5.2.6.2 Egypt Pharmaceutical Packaging Equipment Market By Product

10.5.2.6.3 Egypt Pharmaceutical Packaging Equipment Market By End User

10.5.2.7 Saudi Arabia

10.5.2.7.1 Saudi Arabia Pharmaceutical Packaging Equipment Market By Machine Type

10.5.2.7.2 Saudi Arabia Pharmaceutical Packaging Equipment Market By Product

10.5.2.7.3 Saudi Arabia Pharmaceutical Packaging Equipment Market By End User

10.5.2.8 Qatar

10.5.2.8.1 Qatar Pharmaceutical Packaging Equipment Market By Machine Type

10.5.2.8.2 Qatar Pharmaceutical Packaging Equipment Market By Product

10.5.2.8.3 Qatar Pharmaceutical Packaging Equipment Market By End User

10.5.2.9 Rest of Middle East

10.5.2.9.1 Rest of Middle East Pharmaceutical Packaging Equipment Market By Machine Type

10.5.2.9.2 Rest of Middle East Pharmaceutical Packaging Equipment Market By Product

10.5.2.9.3 Rest of Middle East Pharmaceutical Packaging Equipment Market By End User

10.5.3 Africa

10.5.3.1 Africa Pharmaceutical Packaging Equipment Market by Country

10.5.3.2 Africa Pharmaceutical Packaging Equipment Market By Machine Type

10.5.3.3 Africa Pharmaceutical Packaging Equipment Market By Product

10.5.3.4 Africa Pharmaceutical Packaging Equipment Market By End User

10.5.3.5 Nigeria

10.5.3.5.1 Nigeria Pharmaceutical Packaging Equipment Market By Machine Type

10.5.3.5.2 Nigeria Pharmaceutical Packaging Equipment Market By Product

10.5.3.5.3 Nigeria Pharmaceutical Packaging Equipment Market By End User

10.5.3.6 South Africa

10.5.3.6.1 South Africa Pharmaceutical Packaging Equipment Market By Machine Type

10.5.3.6.2 South Africa Pharmaceutical Packaging Equipment Market By Product

10.5.3.6.3 South Africa Pharmaceutical Packaging Equipment Market By End User

10.5.3.7 Rest of Africa

10.5.3.7.1 Rest of Africa Pharmaceutical Packaging Equipment Market By Machine Type

10.5.3.7.2 Rest of Africa Pharmaceutical Packaging Equipment Market By Product

10.5.3.7.3 Rest of Africa Pharmaceutical Packaging Equipment Market By End User

10.6 Latin America

10.6.1 Trend Analysis

10.6.2 Latin America Pharmaceutical Packaging Equipment Market by Country

10.6.3 Latin America Pharmaceutical Packaging Equipment Market By Machine Type

10.6.4 Latin America Pharmaceutical Packaging Equipment Market By Product

10.6.5 Latin America Pharmaceutical Packaging Equipment Market By End User

10.6.6 Brazil

10.6.6.1 Brazil Pharmaceutical Packaging Equipment Market By Machine Type

10.6.6.2 Brazil Pharmaceutical Packaging Equipment Market By Product

10.6.6.3 Brazil Pharmaceutical Packaging Equipment Market By End User

10.6.7 Argentina

10.6.7.1 Argentina Pharmaceutical Packaging Equipment Market By Machine Type

10.6.7.2 Argentina Pharmaceutical Packaging Equipment Market By Product

10.6.7.3 Argentina Pharmaceutical Packaging Equipment Market By End User

10.6.8 Colombia

10.6.8.1 Colombia Pharmaceutical Packaging Equipment Market By Machine Type

10.6.8.2 Colombia Pharmaceutical Packaging Equipment Market By Product

10.6.8.3 Colombia Pharmaceutical Packaging Equipment Market By End User

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Pharmaceutical Packaging Equipment Market By Machine Type

10.6.9.2 Rest of Latin America Pharmaceutical Packaging Equipment Market By Product

10.6.9.3 Rest of Latin America Pharmaceutical Packaging Equipment Market By End User

11. Company Profiles

11.1 Robert Bosch GmbH

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 The SNS View

11.2 Bausch+Ströbel Maschinefabrik Ilshofen GmbH+Co. KG

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 The SNS View

11.3 Gerresheimer

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 The SNS View

11.4 Marchesini Group S.p.A

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 The SNS View

11.5 I.M.A. Industria Macchine Automatiche SpA

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 The SNS View

11.6 Venia LLC

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 The SNS View

11.7 Romaco Group

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 The SNS View

11.8 ProMach, Inc.

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 The SNS View

11.9 Accutek Pharmaceutical Equipment Companies, Inc.

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 The SNS View

11.10 Herma GmbH

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 The SNS View

12. Competitive Landscape

12.1 Competitive Benchmarking

12.2 Market Share Analysis

12.3 Recent Developments

12.3.1 Industry News

12.3.2 Company News

12.3.3 Mergers & Acquisitions

13. Use Case and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Machine Type

Bottling Line

Cartoning

Form-fill-seal (FFS)

Blister Packaging

Capping & Closing

Filling & Sealing

Labelling, Decorating & Coding

Palletizing

Wrapping & Bundling

By Product

Primary packaging equipment

Secondary packaging equipment

Labelling and serialization equipment

By Automation

Automatic

Semi-automatic

Manual

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Dermatology Devices Market Size was valued at USD 15.2 Billion in 2023 and is expected to reach USD 40.56 Billion by 2032, growing at a CAGR of 11.54% over the forecast period 2024-2032.

The Blood Pressure Monitors Market size was valued at USD 1.81 Billion in 2023 and is estimated to grow to USD 4.28 Billion by 2032, with a 10.04% CAGR.

Digital X-Ray Systems Market was valued at $ 7.9 billion in 2023 and is expected to reach $ 15.4 billion by 2032 and grow at a CAGR of 7.8% from 2024 to 2032.

The Anatomic Pathology Track and Trace Solutions Market Size was valued at USD 642.97 million in 2022, and is expected to reach USD 1460.53 million by 2030 and grow at a CAGR of 10.8% over the forecast period 2023-2030.

The Vitrectomy Devices Market Size was valued at USD 1.19 billion in 2023, and will reach USD 1.89 billion by 2032, Growing at CAGR of 5.28% from 2024-2032.

The Digital Diabetes Management Market Size was valued at USD 18.8 billion in 2023, and is expected to reach USD 59.7 billion by 2032, and grow at a CAGR of 13.7% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone