Pharmaceutical CRO Market Size Analysis

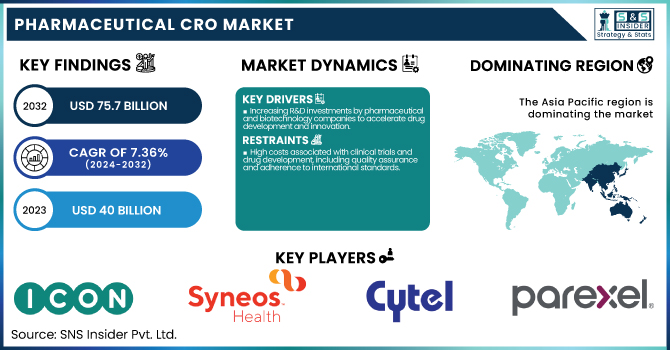

The Pharmaceutical CRO Market was valued at USD 40 billion in 2023 and is expected to reach USD 75.7 billion by 2032, growing at a CAGR of 7.36% over the forecast period 2024-2032.

The Pharmaceutical Contract Research Organization (CRO) Market report includes key statistical insights and trends, including incidence and prevalence rates by therapeutic area, influencing clinical trials. Analysis coverage includes clinical trial volume and success rates with phase-wise distribution and regional variations. This report analyzes revenue and growth trends in the market and focuses on the outsourcing trends between pharma and biotech companies. It takes a close look at regulatory compliance at the FDA, the EMA, and other regulatory agencies and how this impacts trial timelines.

To Get more information on Pharmaceutical CRO Market - Request Free Sample Report

The study also examines the application of AI and digital technologies in clinical research like AI-powered analytics, electronic data capture, and decentralized trials lending greater efficiency. This report provides a data-driven view of evolving market dynamics shaping the future of pharmaceutical CRO services. The increasing complexity of clinical trials along with rising R&D costs and stringent regulatory requirements is driving the growth of the pharmaceutical CRO market. Based on the data from the U.S. Food and Drug Administration (FDA), the annual number of investigational new drug (IND) applications has increased about 7% each year in the last five years, which is evidence of the rising demand for CRO services.

Pharmaceutical CRO Market Dynamics

Drivers

-

Increasing R&D investments by pharmaceutical and biotechnology companies to accelerate drug development and innovation.

The pharmaceutical industry has been experiencing an unprecedented increase in research and development (R&D) investment due to the need for rapid drug discovery and market competition. In 2023, Merck & Co. led the sector with an unprecedented R&D expenditure of USD 30.5 billion, accounting for 50.8% of its total revenue. This represented a 126% growth from the previous year, cementing Merck's dedication to innovation. Similarly, Roche spent USD 15.56 billion for R&D in 2023, which was a significant amount of its revenue. Both Johnson & Johnson and Novartis spent heavily on R&D, investing USD 15.09 billion and USD 11.37 billion in 2022, respectively. These investments are not limited to traditional pharmaceutical giants. Eli Lilly, for example, has prevented slower delivery by expanding its R&D via mergers and acquisitions, including the July 2023 USD 1.93 billion acquisition of Versanis, and the October 2023 USD 1.4 billion acquisition of Point Biopharma. The moves are part of Eli Lilly strengthening its pipeline in areas including obesity and radiopharmaceuticals.

In addition, companies are increasingly adopting emerging technologies in their R&D processes. For example, Antiverse, a Cardiff University Innovation Campus start-up, has teamed up with Japan's Nxera to use AI for antibody design for drug development. Underpinned by exclusive access to trillions of data points, this partnership highlights a new era of AI-powered drug discovery, working towards shortening the conventional 15-year, USD 1-2 billion timeframe required for development.

Restraint

-

High costs associated with clinical trials and drug development, including quality assurance and adherence to international standards.

The pharmaceutical industry faces great challenges from the high costs involved in clinical trials and drug development. Phase III trials, necessary to evaluate a drug’s efficacy and safety, can be especially costly, with costs as high as USD 53 million, depending on the therapeutic area. Recruiting large numbers of patients, long study durations, and advanced data monitoring/analysis requirements drive these costs. It must be noted that the introduction of initiatives such as the FDA's newly announced Project Optimus, which is being introduced to the industry to drive healthy drug dosing practices that support positive patient safety events, will also likely increase the size and complexity of trials, leading to development timelines being extended by anywhere from 6-12 months. He added that having to comply can drive up operational costs, which can be a financial burden, particularly for smaller companies. Moreover, the financial burden is exacerbated by the high attrition rates in drug development, where a significant proportion of candidates fail during clinical phases, leading to sunk costs without marketable products. As a result, these financial pressures may stifle innovation and restrict patients' access to new treatments.

Opportunity

-

Adoption of advanced technologies such as artificial intelligence (AI) and machine learning (ML) to enhance clinical trial efficiency and data accuracy.

Using artificial intelligence (AI) and machine learning (ML) for clinical trials is an exciting opportunity for pharmaceutical Contract Research Organizations (CROs) to maximize efficiency and reduce costs. In a recent survey, 49% of pharmaceutical and biotechnology companies reported that they were implementing AI and big data in their programs an increase of 10% since 2019. Moreover, 82 percent of respondents felt that embracing digital tools could enhance returns on R&D.

Major industry players are investing in AI-driven drug discovery. For instance, Advanced Micro Devices Inc. AMD announced a USD 20 million investment in Absci Corp, which specializes in AI-backed drug discovery, intending to speed up drug development and cut costs. The Boston Consulting Group (BCG) estimates that the adoption of digital technology and AI could disrupt approximately USD 18 billion, or 40%, of the current CRO market value. This disruption is anticipated to be driven by a transition towards tech-enabled automated solutions, augmenting productivity and transforming current practices.

Challenge

-

Navigating complex and evolving regulatory landscapes across different regions, which can lead to operational challenges and increased costs.

Pharmaceutical Contract Research Organizations (CROs) face significant challenges in navigating complex and evolving regulatory landscapes. In 2023, only 12% of global commercial clinical drug trials were conducted in the European Economic Area (EEA) down from 22% in 2013 a decline primarily attributable to the region’s complex and lengthy regulatory processes. This has caused 60,000 fewer patients to enroll in clinical trials in 2023, as compared to 2018. The United Kingdom's Medicines and Healthcare Products Regulatory Agency (MHRA) is struggling with limited resources and capacity, which discourages investment from pharmaceutical companies. More than 80% of drugmakers have cited the UK's regulatory environment as a major factor working against investment, with key concerns that the MHRA has limited capacity and is unpredictable. Regulatory exclusivities can delay the entry of competing therapies to the market in the United States. Liquidia’s lawsuit is challenging that exclusivity grant and it further highlights the contrasts CROs have when it comes to navigating regulatory protections and patent battles. These examples highlight the diverse regulatory hurdles faced by CROs, such as navigating intricate approval procedures, the resource constraints of regulatory agencies, and the management of exclusivity rights, which can obstruct both clinical trial progress and market accessibility.

Pharmaceutical CRO Market Segmentation Analysis

By Type

In 2023, the pharmaceutical CRO market was dominated by the clinical segment, which accounted for 74% market share. This dominant market share can be driven by multiple factors such as the rise in complexity of a clinical trial and another demand for specialized expertise in delivering this research. According to the information shared by the National Center for Biotechnology Information (NCBI), the number of registered clinical trials worldwide has grown by an average of 10% annually over the past five years, reaching over 400,000 active studies in 2024.

Increasing costs related to drug development further supports the dominance of the clinical segment. The U.S. Government Accountability Office (GAO) reported that the average cost to develop a new drug has increased to USD 2.6 billion in 2023, up from USD 2.1 billion in 2018. As the costs have continued to rise, pharmaceutical companies have turned to outsource clinical trial operations to contract research organizations (CROs), which can provide cost-efficient options and specialized expertise. In addition, the FDA is 15% each of the number of new drugs approved through 2024, compared to last year, and a new pipeline of drugs to clinical testing. Additionally, recent advances in drug development combined with a growing focus on rare diseases and personalized medicine have drastically increased the demand for clinical CRO services.

By Molecule Type

The small molecule segment dominated the pharmaceutical CRO market with a 68% revenue share in 2023. This significant market share can be attributed to several factors, including the continued prevalence of small molecule drugs in the pharmaceutical industry and their lower development costs compared to biologics. As of 2024, the FDA reported that 75% of all new drug approvals were for small-molecule drugs, showing their continued importance to the pharma landscape. Moreover, the small molecule segment is projected to be driven by the growing focus on targeted therapies and precision medicine. Over 60% of oncology drugs in clinical development are small molecules, according to the National Cancer Institute (NCI), and many of them are designed to target specific genetic mutations or molecular pathways. As a result, there has been an increasing demand for Contract Research Organisation (CRO) providers that can offer services in this space, from drug discovery to early development with small molecules. In addition, the U.S. Department of Health and Human Services (HHS) reported a 12% increase in funding for small molecule drug research (USD 3.2 billion) in 2024 compared to the previous year. The growing need for CROs due to this increased investment has also boosted the small molecule segment of the CRO market.

By Service

In 2023, the clinical monitoring segment accounted for the largest shares of the pharmaceutical CRO market. The importance of clinical monitoring in maintaining the safety, quality, and integrity of clinical trials explains why this is a leadership position. The number of clinical trial inspections conducted in 2024 is 20% higher than the previous year, further emphasizing the importance of maintaining strong clinical monitoring practices, it said. The technical complexity of clinical studies and the need for specialized skills to manage these studies also compliment the growth attributed to the clinical monitoring segment. The NIH has noted a 30% increase in multi-site clinical trials in 2024 as compared to 2020, leading to the need for a greater, yet more sophisticated monitoring methodology.

In addition, risk-based monitoring (RBM) strategies have significantly helped in the growth of this segment. The EMA reported that over 60% of clinical trials in Europe implemented RBM approaches in 2024, up from 40% in 2020. This shift to more cost-effective and goal-oriented monitoring approaches has led to the growing need for targeted clinical monitoring services offered by CROs. The expansion of the market share of the clinical monitoring segment is also attributed to the high focus on data quality and integrity in clinical research. Over the past three years, the Office for Human Research Protections (OHRP) has observed a 25% rise in clinical trial findings associated with data integrity issues, highlighting the importance of maintaining strong monitoring practices.

By Therapeutic Areas

In 2023, oncology led the global pharma CRO industry with a 31% market share. The dominant market share is largely due to the rising global burden of cancer and continual investments in oncology research. As per the National Cancer Institute (NCI), funding for cancer research surpassed USD 7.2 billion in 2023, indicating a USD 15% increase compared to 2022. The oncology segment accounts significant share of the market and the complex nature of cancer clinical trials and the requirement for specialized expertise further support its domination. The FDA reported a 25% increase in the number of oncology drug approvals in 2023 compared to 2018, indicating a robust pipeline of cancer therapies requiring extensive clinical testing.

Moreover, growing oncology precision medicine has boosted the demand for specialized CRO services such as biomarker discovery and validation. According to the NIH's Precision Medicine Initiative, funding for cancer-related precision medicine projects increased in 2023 by 40% to USD 500 million. In addition, the trend towards combination therapies and immunotherapies for cancer treatment strengthens the oncology region's leadership. According to the American Society of Clinical Oncology (ASCO), more than half of late-stage oncology clinical trials in 2023 involved combination therapies or immunotherapies, resulting in increased complexity around trial design and the need for specialized CRO expertise.

Pharmaceutical CRO Market Regional Insights

The Asia Pacific region was dominated the pharmaceutical CRO market in 2023, with a 45% share. Reasons for this dominance include lower operational costs, a larger patient pool, and improved regulatory structures. The China National Medical Products Administration (NMPA) reported that applications for clinical trials in China have grown by 30% in 2024 from the previous year. In 2024, there was a 25% increase in the number of registered clinical trials, according to the Indian Council of Medical Research (ICMR).

North America region is projected to grow with the fastest CAGR during the forecast period. This rapid growth is driven by the presence of major pharmaceutical companies, significant R&D investments, and a favorable regulatory environment. Also, the U.S. National Institutes of Health (NIH) announced funding for biomedical research in the amount of USD 47.5 billion, which is 5% more than in 2025. Meanwhile, the European market was also witnessing impressive growth with The European Medicines Agency (EMA) revealing that the number of clinical trial applications in 2024 will increase by 15% from the previous year. It is supported by the vibrant EU Clinical Trials Regulation, which seeks to harmonise and streamline clinical research processes across member states, and drive growth in innovative therapies within the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Pharmaceutical CRO Market

-

ICON PLC (Clinical Development, Commercialization Services)

-

Syneos Health (Clinical Trial Management, Medical Affairs)

-

Cytel (Adaptive Trial Design, Statistical Software)

-

Parexel (Clinical Trial Management, Regulatory Consulting)

-

IQVIA (Clinical Research Services, Real-World Evidence Solutions)

-

Labcorp Drug Development (Preclinical Testing, Clinical Trial Management)

-

PPD (Thermo Fisher Scientific) (Clinical Trial Services, Laboratory Services)

-

Charles River Laboratories (Preclinical Services, Safety Assessment)

-

Medpace (Full-Service Clinical Development, Regulatory Consulting)

-

KCR (Clinical Development Solutions, Functional Service Provision)

-

Worldwide Clinical Trials (Phase I-IV Clinical Trial Services, Bioanalytical Lab Services)

-

PRA Health Sciences (Product Registration, Post-Marketing Services)

-

Covance (Drug Development Services, Nutritional Testing)

-

WuXi AppTec (Laboratory Testing, Clinical Development)

-

Pharm-Olam (Clinical Trial Management, Medical Monitoring)

-

Clinipace (Clinical Operations, Data Management)

-

Novotech (Clinical Development Services, Regulatory Affairs)

-

Tigermed (Clinical Trial Services, Data Solutions)

-

Frontage Laboratories (Bioanalytical Services, CMC Services)

-

Eurofins Scientific (Pharmaceutical Testing, Genomic Services)

Recent Developments in the Pharmaceutical CRO Market

-

In January 2025 IQVIA launched an AI-based clinical trial optimization platform, aimed at maximizing patient recruitment and trial retention rates. For early adopters of the platform, the company noted a 30% reduction in timelines from trial to signing the contract.

-

In November 2024, Charles River Laboratories acquired a leading preclinical CRO specializing in oncology research, strengthening its position in the rapidly growing immuno-oncology market. The acquisition is expected to increase Charles River's oncology-related revenue by 25% in the coming year.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 40 Billion |

| Market Size by 2032 | USD 75.7 Billion |

| CAGR | CAGR of 7.36% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Drug Discovery, Pre-Clinical, Clinical) • By Service (Project Management/Clinical Supply Management, Medical Writing, Data Management, Regulatory/Medical Affairs, Clinical Monitoring, Quality Management/ Assurance, Patient And Site Recruitment, Biostatistics, Investigator Payments, Laboratory, Technology, Others) • By Molecule Type (Small Molecules, Large Molecules) • By Therapeutic Areas (Oncology, CNS Disorders, Infectious Diseases, Pain Management, Immunological Disorders, Diabetes, Cardiovascular Disease, Respiratory Diseases, Ophthalmology, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ICON PLC, Syneos Health, Cytel, Parexel, IQVIA, Labcorp Drug Development, PPD (Thermo Fisher Scientific), Charles River Laboratories, Medpace, KCR, Worldwide Clinical Trials, PRA Health Sciences, Covance, WuXi AppTec, Pharm-Olam, Clinipace, Novotech, Tigermed, Frontage Laboratories, Eurofins Scientific |