Pharmaceutical Contract Packaging Market Size Analysis:

The Pharmaceutical Contract Packaging Market size was valued at USD 15.30 billion in 2023 and is expected to grow at a CAGR of 8.33% to reach USD 31.56 billion by 2032. The pharmaceutical contract packaging market is growing steadily, with the increasing complexity of pharmaceutical formulations and the rising demand for innovative and secure packaging solutions. With the global pharmaceutical industry focusing on biologics, personalized medicine, and specialty drugs, the need for advanced packaging technologies such as pre-filled syringes, blister packs, and tamper-proof solutions has surged significantly. Other regulatory requirements emphasizing drug safety, anti-counterfeiting measures, and sustainability continue to drive the adoption of specialized packaging services. Smarter packaging solutions, involving RFID tags and QR codes to enhance supply chain transparency, are increasingly being incorporated in contract packaging services.

To get more Pharmaceutical Contract Packaging Market - Request Free Sample Report

The trend of outsourcing is propelling the market since pharmaceutical companies would like to reduce operational costs and accelerate product launches. In addition to cost efficiencies, contract packaging provides expertise in navigating complex regulatory landscapes, especially in international markets. Sustainability has also become a critical focus for the market, and providers have adopted eco-friendly materials and processes to align with global environmental goals. These advances and evolving pharmaceutical needs are likely to sustain robust growth in the pharmaceutical contract packaging market. Biologics often require greater standards of sterility and containment, so contract packaging providers are investing in advanced facilities and technologies to meet these requirements.

Pharmaceutical Contract Packaging Market Dynamics

Drivers

-

Increased demand for biologics and specialty drugs propels the pharmaceutical contract packaging market

The increasing incidence of chronic diseases, such as cancer, diabetes, and autoimmune disorders, has boosted the demand for biologics and specialty drugs, which require advanced and secure packaging solutions. The high sensitivity of biologics and strict temperature control requirements have also increased the adoption of sterile and tamper-evident packaging technologies. For example, injectables are one of the chief delivery methods for biologics and account for more than 40% of pharmaceutical demand for packaging in developed geographies such as North America and Europe. This trend necessitates pharmaceutical companies to transfer packaging operations to specialized contract packaging providers with sufficient infrastructure and expertise.

-

Strict Packaging Requirements for Drug Safety helps to boost the market growth

Stringent global regulatory requirements regarding the packaging of medicines-often including the US Drug Supply Chain Security Act and EU's Falsified Medicines Directive-will influence a great number of companies towards new-generation packaging solutions due to compliance with serialization requirements, anti-tamper designs, and authentication to make packaging more complex and costly to obtain. For instance, it is estimated that adherence to serialization requirements increased global pharmaceutical packaging costs by as much as 15–20%. Contract packaging providers who offer advanced technological capabilities as well as regulatory expertise are perfectly suited to meet this need thereby fueling market growth.

Restraint

-

Logistics management challenges and rising costs restraining the pharmaceutical contract packaging market

The increasing operational costs coupled with the complex supply chain management need further challenges the pharmaceutical contract packaging market. The complex interplay between pharmaceutical manufacturers, regulatory authorities and logistics providers leads to repeated delays and waste. Another major factor fuelling the change in prices is the adoption of sophisticated packaging technologies such as serialization and smart packaging that have immensely raised production costs. For instance, the packaging cost of manufacturers may go up by 10–15% approximately. These aspects do not allow such smaller pharma firms to outsource packaging services, thereby restraining the market's growth potential.

Pharmaceutical Contract Packaging Market Segmentation Overview

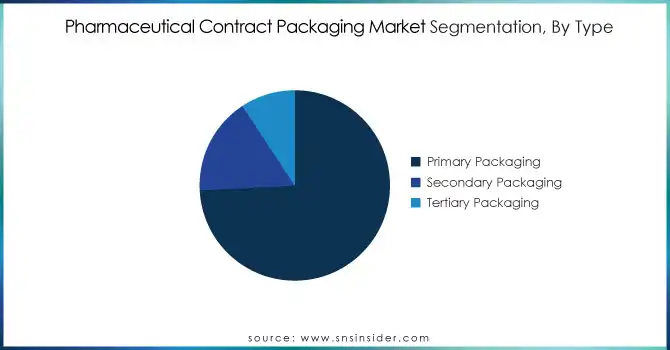

By Type

In 2023, the primary packaging segment dominated the market with 74% of the market share. This is largely because, of the critical nature of primary packaging for pharmaceuticals due to the need for quality, safety, and compliance with pharmaceutical products. The contact materials, such as blister packs, bottles, vials, and ampoules are essential, as these are needed to maintain the quality and efficacy of the drugs. Primary packaging acts as the first interaction between the drug and the patient; it is thus responsible for ensuring functionality as well as ensuring the safety of the patient and regulatory compliance. All the above factors continue to fuel the demand for primary packaging solutions in the pharmaceutical industry.

The secondary packaging segment will witness substantial growth in the coming years, driven chiefly by the growing emphasis on branding, consumer safety, and regulatory compliance. Secondary packaging encompasses outer protective components like cartons, boxes, labels, and instructional leaflets. It acts as the first shield of defense in transportation, safeguarding the product while providing stability. Furthermore, secondary packaging is also essential for compliance with serialization and traceability requirements, which are increasingly becoming the norm in the fight against counterfeiting as well as increasing transparency in the supply chain.

By Material

The plastics and polymers segment dominated the market and accounted for the highest market share of 39% in 2023. These plastics and polymers have various advantages including their versatility, cost-effectiveness, durability, and ease of manufacturing. Such plastics and polymers are widely used for the production of bottles, blister packs, vials, and ampoules, among other forms of specialized pharmaceutical packaging due to their moldability in any form or shape. The plastic and polymer market can also be tailored to satisfy particular regulatory requirements, such as sterility, tamper-proofing, and child resistance, making them the most popular for chemical and pharmaceutical packaging.

Paper and paperboard are expected to be the fastest growing segment in the market with a CAGR of 11% throughout the forecast period due to growing demand for green and environmentally friendly packaging solutions. With the growing concerns about plastic waste and the need for sustainability, many companies are turning to biodegradable and recyclable materials that minimize environmental impact. Paper and paperboard, being low-cost, versatile, and renewable resources, are emerging as attractive alternatives for secondary packaging, aligning with the global push toward eco-friendly practices.

Pharmaceutical Contract Packaging Market Regional Outlook

In 2023, the North American pharmaceutical contract packaging market dominated with a market share of 34% of the market. The packaging suppliers of North America are increasingly equipped with advanced technologies that meet the needs of various segments of the pharmaceutical industry, including vaccines, biologics, and advanced therapies. This is managed with all these high-end requirements, expertly professionalized, and backed with hi-tech infrastructure, which consolidates its position its most global leader in pharmaceutical contract packaging in the world.

In 2023, the Asia Pacific pharmaceutical contract packaging market is expected the fastest CAGR of 10.19% during the forecast period by robust public & private emerging trends driving the spur in the pace of technology, rise in healthcare needs, and extensive order outsourcing in services sectors). Competitive pricing and technologies are linked with a large scale of manufacture, which makes the Asia-Pacific region an attractive pharmaceutical hub. Contract packaging is especially important to India, as it holds tremendous potential to create growth through exports to meet global market demands, as well as fulfilling a sizeable share of local domestic market demand.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Pharmaceutical Contract Packaging Companies

-

Catalent, Inc. (Blister Packaging, Bottle Filling Services)

-

Sharp Packaging Services (Clinical Trial Packaging, Blister Pack Design)

-

PCI Pharma Services (Secondary Packaging, Serialization Services)

-

WestRock Company (Folding Cartons, Adherence Packaging Solutions)

-

Amcor Plc (Child-resistant Blisters, Flexible Pouches)

-

Gerresheimer AG (Plastic Vials, Syringe Systems)

-

Aptar Pharma (Nasal Spray Packaging, Metered Dose Inhalers)

-

Schott AG (Glass Ampoules, Pre-filled Syringes)

-

CCL Industries Inc. (Pressure-sensitive Labels, Shrink Sleeves)

-

Baxter International Inc. (Sterile IV Solutions Packaging, Parenteral Packaging

-

Nelipak Healthcare Packaging (Thermoformed Trays, Blister Packs)

-

Sonoco Products Company (Composite Cans, Blister Cards)

-

Romaco Group (Strip Packaging Machines, Sachet Filling Systems)

-

Vetter Pharma International GmbH (Aseptic Fill and Finish, Prefilled Syringe Packaging)

-

SGD Pharma (Glass Bottles, Injectable Vials)

-

West Pharmaceutical Services, Inc. (Injection Systems, Container Closure Systems)

-

Mondi Group (Medical Barrier Packaging, Laminated Foils)

-

Sealed Air Corporation (Vacuum Packaging, Sterile Packaging Films)

-

Körber Pharma Packaging (Blister Lines, Serialization Software)

-

Nipro Corporation (Glass Cartridges, Rubber Stoppers)

Key suppliers

These suppliers play an essential role in the pharmaceutical contract packaging supply chain by delivering critical materials and components used in developing and producing various packaging solutions.

-

Berry Global Group, Inc. Suppliers

-

Tekni-Plex, Inc. Suppliers

-

Avery Dennison Corporation Suppliers

-

Alpla Group Suppliers

-

Constantia Flexibles Group GmbH Suppliers

-

RPC Group (Berry Global) Supplier

-

Placon Corporation Suppliers

-

Bemis Company, Inc. (Amcor) Suppliers

-

WestRock Healthcare Packaging Suppliers

-

Klöckner Pentaplast Group Suppliers

Recent Developments in Pharmaceutical Contract Packaging Industry

-

In October 2024, Ardena, a leading pharmaceutical Contract Development and Manufacturing Organization (CDMO) with GMP-certified facilities in Belgium, Spain, the Netherlands, and Sweden, announced the signing of a definitive agreement to acquire Catalent's manufacturing facility located in Somerset, New Jersey.

-

In May 2024, Sharp, a global leader in contract packaging, clinical supply services, and small-scale sterile manufacturing, revealed plans to expand its Macungie, Pennsylvania site in North America.

-

In June 2024, PCI Pharma Services, a leading provider of integrated pharmaceutical packaging and clinical trial services, announced its plans to construct a new pharmaceutical packaging facility at the CityNorth Business Campus.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 15.30 Billion |

| Market Size by 2032 | US$ 31.56 Billion |

| CAGR | CAGR of 8.33% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Primary Packaging, Secondary Packaging, Tertiary Packaging) • By Material (Plastics & Polymers, Paper & Paperboard, Glass, Aluminum Foil, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Catalent, Inc., Sharp Packaging Services, PCI Pharma Services, WestRock Company, Amcor Plc, Gerresheimer AG, Aptar Pharma, Schott AG, CCL Industries Inc., Baxter International Inc., Nelipak Healthcare Packaging, Sonoco Products Company, Romaco Group, Vetter Pharma International GmbH, SGD Pharma, West Pharmaceutical Services, Inc., Mondi Group, Sealed Air Corporation, Körber Pharma Packaging, Nipro Corporation, and other players. |

| Key Drivers | •Increased demand for biologics and specialty drugs propels the pharmaceutical contract packaging market •Strict Packaging Requirements for Drug Safety help to the boost the market growth |

| Restraints | •Logistics management challenges and rising costs restraining the pharmaceutical contract packaging market |