Petrochemical Packaging Market Report Scope & Overview:

The Petrochemical Packaging Market Size was valued at USD 1104.31 billion in 2023 and is expected to reach USD 1869.23 billion by 2031 and grow at a CAGR of 6.8% over the forecast period 2024-2031.

Stringent regulations governing the packaging of hazardous petrochemicals stand out as a key catalyst propelling the Petrochemical Packaging Market. These regulations, exemplified by the ADR European Agreement, mandate the adoption of suitable packaging materials and technologies to avert accidents and environmental risks. This regulatory environment not only enforces high safety standards but also compels packaging manufacturers to continually innovate. Another pivotal growth driver is the escalating demand for storage containers, particularly drums, in the petrochemical sector. Shrink drum liners and similar drum solutions are favored for their safety and compatibility with petrochemicals, underscoring the significance of secure packaging solutions in the flourishing petrochemical packaging market.

Get More Information on Petrochemical Packaging Market - Request Sample Report

Packaging petrochemicals presents significant challenges for market players. Inadequate packaging can result in lasting environmental harm and pose risks to warehouse workers and end-users. Despite the harmful environmental effects of plastics, they have been the primary packaging material for petrochemicals due to their safety and effectiveness in this context.

MARKET DYNAMICS

KEY DRIVERS:

-

In the forthcoming years, the petrochemical market is anticipated to experience notable growth driven by rising global demand for petrochemical products.

Population growth, increasing disposable incomes, urbanization, and industrialization in emerging economies are key factors propelling the demand for petrochemical-based products. The burgeoning middle class, particularly in countries such as China and India, is playing a significant role in driving the demand for various consumer goods, automobiles, and construction materials. This trend is fueling the growth of the petrochemical market as manufacturers seek to meet the rising demand for essential products across diverse sectors.

-

Environmental concerns and the push for sustainable practices.

RESTRAIN:

-

The fluctuating prices of raw materials, to impact the cost of packaging solutions.

OPPORTUNITY:

-

Ongoing advancements in petrochemical technologies are positioned to have a notable impact on shaping the market's future trajectory.

Advancements in feedstock conversion, process refinement, and catalyst innovation are set to boost the efficiency, output, and eco-friendliness of petrochemical manufacturing. Additionally, the adoption of advanced refining methods and exploration of alternative feedstock sources, such as biomass and waste materials, are expected to become more prevalent, facilitating the production of environmentally sustainable petrochemicals.

-

Development of innovative bulk packaging solutions like Intermediate Bulk Containers.

CHALLENGES:

-

The complexity of international regulations and compliance standards further complicates the packaging process.

Impact Of Russia Ukraine War

The Russia-Ukraine crisis has had significant implications for the global packaging industry, including the petrochemical packaging market. The conflict has led to the shutdown of key facilities, such as Ukraine's largest petrochemical plant, Karpatneftekhim, and has disrupted operations at major glass packaging providers in the region. This has resulted in immediate impacts on the sector, including rising raw material prices and challenges in business operations.

The crisis has disrupted the supply and pricing of key petrochemical feedstocks like naphtha, leading producers to cut operations or switch to alternatives due to volatile crude prices. Additionally, European petrochemical capacity, reliant on the Druzhba pipeline, has been affected, exacerbating the situation. Furthermore, the war has exposed vulnerabilities in the security of raw material supplies critical for industrial production, including those needed for petrochemical packaging. Supply chain disruptions, caused by export restrictions and logistical challenges, have highlighted the fragility of global markets to geopolitical tensions.

Impact of Economic Slowdown

Consumers, confronted with inflation, have curtailed spending on non-essential items like toys, clothing, and plastic-packaged iced coffee. In response, retailers have initiated clearance sales to clear surplus inventory. Petrochemical companies are now adjusting their production levels to align with the declining demand. Dow, the world's leading chemical company, recently announced a global reduction in polyethylene production, commonly used in packaging, by approximately 15.5%. Additionally, Houston-based Westlake Corp. has halted styrene production at its Lake Charles facility, a key component in rubber and food containers.

The current economic slowdown significantly affects the Petrochemical Packaging Market through reduced demand from key industries like automotive, construction, and consumer goods, leading to supply chain disruptions and increased operational costs for manufacturers. As consumer spending declines, so does the demand for polyethylene, a soft plastic commonly used for packaging various products, with its demand closely mirroring gross domestic product trends.

KEY MARKET SEGMENTS

By Material

-

Plastic

-

Metal

-

Wood

-

Others

By Product

-

Intermediate Bulk Containers

-

Pails and Drums

-

Flexitanks

-

Others

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Capacity

-

100-250 Liters

-

250-500 Liters

-

More than 500 Liters

By Chemical Type

-

Olefins

-

Aromatic

The petrochemical packaging market involves utilizing petrochemical-derived materials for various packaging applications. This includes olefins, derived from crude oil or natural gas, commonly used for plastic packaging. Aromatics are also utilized for producing resins and fibers, while materials like polystyrene, polypropylene, and polyethylene find extensive use in packaging across industries like food, beverages, pharmaceuticals, and personal care.

By Type

-

Propylene

-

Benzene

-

Polystyrene

-

Ethylene

-

Methanol

-

Others

By Application

-

Polymers

-

Surfactants

-

Paints & Coatings

-

Rubber

-

Dyes

-

Adhesive & Sealants

-

Others

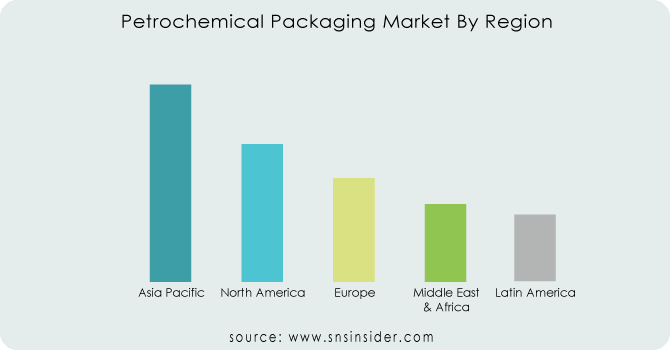

REGIONAL ANALYSIS

Asia-Pacific commands a dominant market share approximately 40.2% and revenue in the Petrochemical Packaging sector, fueled by the escalating transportation of petrochemicals across the region. The burgeoning industrial activities and increased focus on efficient packaging contribute to Asia-Pacific's leadership position.

Meanwhile, North America is poised to be the swiftest-growing region in the forecast period, propelled by the substantial presence of key market players and continuous technological advancements in packaging solutions. The region's dynamic market landscape and commitment to innovation position it for significant growth, highlighting the pivotal role it plays in the evolving dynamics of the petrochemical packaging industry.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some of the major players in the Petrochemical Packaging Market are Amcor Plc, LC Packaging, ILC Dover LP, Brambles Ltd, Arena Products Inc, Qingdao LAF Packaging Co., Ltd., CDF Corporation, Nittel, Qbig Packaging, Zasfa Composite Containers Pvt Ltd and other players.

Amcor Plc -Company Financial Analysis

RECENT DEVELOPMENTS

-

In the first half of next year, Nayara Energy, India's second largest private oil company, announced that it will begin to operate a new polypropylene unit marking its entry into this lucrative petrochemical business.

-

In order to become a greener petrochemical producer, South Koreas SK Geo Centric Co. will use recycling materials for the packaging of its products as it intends to introduce environmentally friendly processes in all production stages.

-

In May 2020, Greif Inc. launched GCube Connect IBCs, developed for storing and transporting liquids and materials with Sigfox 0G network connectivity.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1104.31 Billion |

| Market Size by 2031 | US$ 1869.23 Billion |

| CAGR | CAGR of 6.8 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Plastic, Metal, Wood, Others) • By Product (Intermediate Bulk Containers, Pails And Drums, Flexitanks, Others) • By Capacity (100-250 Liters, 250-500 Liters, More Than 500 Liters) • By Chemical Type (Olefins, Aromatic) • By Type (Propylene, Benzene, Polystyrene, Ethylene, Methanol, Others) • By Application (Polymers, Surfactants, Paints & Coatings, Rubber, Dyes, Adhesive & Sealants, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amcor Plc, LC Packaging, ILC Dover LP, Brambles Ltd, Arena Products Inc, Qingdao LAF Packaging Co., Ltd., CDF Corporation, Nittel, Qbig Packaging, Zasfa Composite Containers Pvt Ltd |

| Key Drivers | • In the forthcoming years, the petrochemical market is anticipated to experience notable growth driven by rising global demand for petrochemical products. • Environmental concerns and the push for sustainable practices. |

| Restraints | • The fluctuating prices of raw materials, to impact the cost of packaging solutions. |