Get more information on PET Foam Market - Request Sample Report

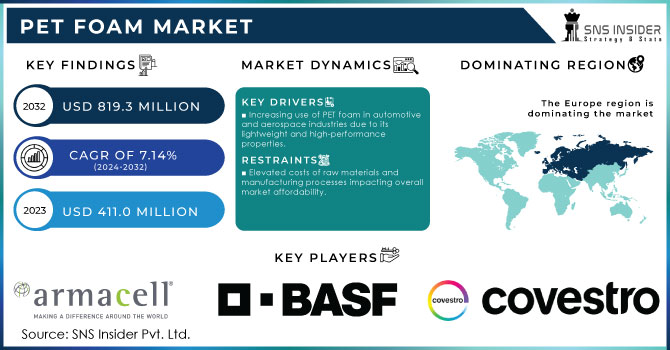

The PET Foam Market Size was valued at USD 411.0 million in 2023, and is expected to reach USD 819.3 million by 2032, and grow at a CAGR of 7.14% over the forecast period 2024-2032.

The large-scale growth of the PET foam market is influenced by technology and the growing need for sustainability. PET foam offers superior mechanical properties, lightweight composition, and flexibility, making it suitable for more diversified applications than other foams. This has led to expanding the pet foam market into different applications such as automotive, aerospace, and marine applications. Innovation leading to increased performance and environmental sustainability has been the hallmark of the market's growth.

In April 2024, 3A Composites announced capacity expansion at its Airex PET foam production facilities. The company will meet the rising demand for high-performance PET foam solutions in the global market by increasing production to a greater extent. This helps 3A Composites to cater better to different applications and thereby represents a direction followed by more and more companies with increasing production capacities, quite in line with growing demands in the market. It marks an achievement for the company to ensure industry commitment toward many end-use applications with solutions addressing the rising demand for PET foam.

Similarly, Magna unveiled in October of 2023 what it calls industry-first innovation: 100% melt-recyclable foam and trim seating solutions. This product marks a significant leap in the evolution of automotive manufacturing and drives recyclability and the environmental footprint. The initiative of Magna sets a new standard in the offerings of the automotive scene, it continues on its journey toward sustainable material use and the production process during the design and phase of manufacturing of the products. Additionally, Sunreef Yachts made waves in the marine segment in October 2023 by using structural foam derived from recycled PET bottles in its yacht structure. On one hand, this kind of approach utilizes recycled materials while enhancing performance and sustainability in marine vessels. The commitment of Sunreef Yachts to sustainability and resource efficiency sets it apart because of using recycled PET foam, which is right in line with a broader industry trend toward more sustainable construction practices.

The introduction of 100% PET trays designed for freight efficiency at Tekniplex marked a significant contribution to sustainable packaging in May 2022. The outcome brings much together into the shift toward more sustainable, more efficient packaging solutions. Taken from the perspective of waste reduction and enhancement of environmental performance, the new trays offered by Tekniplex are reflective of an industry-wide increase in emphasis on sustainability and optimization of the packaging processes. Moreover, in March 2022, Armapet launched Eco50: the world's first Environmental Product Declaration (EPD) for PET-based insulating foam, allowing for transparent information on the environmental effects of the foam, thereby further promoting transparency and sustainability in building materials. The launch of EPD focuses on industry commitment to its philosophy of environmentally friendly products and good practices for sustainable construction and civil engineering.

These trends demonstrate the dynamic PET foam market with innovations that are now always present and the recent emphasis on sustainability. With advancements in production technologies and changes in new material applications, these upgraded industries come into being because the demand for high-performance and eco-friendly products develops.

Market Dynamics:

Drivers:

Increasing use of PET foam in automotive and aerospace industries due to its lightweight and high-performance properties.

The trends of the use of PET foam in automotive and aerospace tend to be correlated with lightness and performance properties, thus yielding significant advantages in these sectors. In general, the use of PET foam in the automotive industry reduces the weight remarkably, with the low density of the material ensuring better fuel efficiency and performance. For instance, major automobile producers have embraced PET foam for many components, such as interior car panels, trunk linings, and automotive seating systems, for its possible weight saving potential without lowering strength or safety. In addition, it will enhance general vehicle efficiency and also gear towards global environmental policies of reduced carbon emission and more stringent fuel economy standards. The aerospace field extensively uses PET foam in aircraft parts, like cabin panels and structural parts, for the good strength-to-weight ratio. However, it's the maintenance of structural integrity while being lightweight that supports the optimization of aircraft performance and reduction in fuel consumption. For example, the top companies in the aerospace industry have created aircraft interior and sandwich panel structures with PET foam. As a result, fairly important weight reduction targets are achieved, and aerodynamic efficiency is improved. The performance properties like toughness, excellent insulation, and impact resistance for PET foam will promote its further feasibility in many such sectors as a material of critical importance to weight and strength characteristics in the applications.

Enhanced focus on eco-friendly and recyclable materials driving innovation and adoption in various applications.

The focus on eco-friendly and recyclable materials has seriously driven the pace of innovation and adoption in the PET foam market as industries increasingly prioritize their own sustainability and environmental responsibility. With an intensification of concerns over climate change and the depletion of natural resources, manufacturers are producing products with PET foam emphasizing recyclability as well as reduced environmental footprint for its objectives. For example, several companies are now producing PET foam from recycled post-consumer plastic bottles. This not only takes waste out of landfills but also decreases the demand for virgin material, supporting international goals for sustainability and environmental consciousness among consumers and businesses. It has truly been a great stride in the use of eco-friendly PET foam during the construction industry for insulation and architectural applications, which prove to ensure high performance rather than presenting a greener alternative than traditional materials. The automotive sector has also accepted PET foam for various other components like interior trims and paneling wherein recycled PET foam has not only ensured fulfilling stringent environmental standards but also the needed durability and functionality. This trend fosters innovation in the development of production techniques, for instance, the improvement in recycling processes and new formulation development that makes PET foam even more environmentally friendly, a factor that seems to boost its consumption amongst different applications.

Restraint:

Elevated costs of raw materials and manufacturing processes impacting overall market affordability.

High raw material and production process costs are a major restraint in the PET foam market as their total cost will inhibit penetration in the market. The high-grade PET resins raw material, which is expensive, along with state-of-the-art processing technologies, drive the production process costs up for PET foam. Changes in the petrochemical feedstock prices of PET resins further stress costs to the manufacturers. Such higher-cost production may further be limited by cost-sensitive applications and industries since it will certainly push prices for end-users high. Another factor that contributes to the high price of PET foam is the specialized equipment and energy-intensive processes required for high-quality production. This in turn narrows the market's capacity to compete with other materials that could potentially have a less expensive solution, and so, in fact, impacts the overall growth and affordability of products involving PET foam.

Opportunity:

Increasing integration of recycled PET foam in marine construction opens new growth avenues for the market.

Increasing usage of recycled PET foam in marine construction points to a promising prospect for the PET foam market as the marine industry increasingly strives towards sustainability and reduces its environmental footprint. Other uses of recycled PET foam can help manufacturers enhance the ecological profile of final products while taking advantage of excellent durability and lightweight properties by using them in boat hulls, deck structures, and insulation systems. Replacing materials in products with recycled PET foam is compatible with the broader industry practices that shift previous standpoints towards greener practices and meet demands for regulatory requirements in terms of lower environmental impact. The PET foam market for recycled PET foam is likely to keep growing as more marine construction projects adopt sustainable materials, opening up new avenues for the growth and innovation of this market.

Challenge:

Stricter environmental regulations and standards may pose challenges for manufacturing and product development.

Stricter environmental regulations and standards are high challenges to the PET foam market, requiring more strict standards on the design of manufacturing processes and products. Governments and regulatory bodies are enforcing stricter rules in capping environmental influences, forcing manufacturers to change techniques of production to agree to the requirements that usually require new technology and process investments. For example, more stringent regulations regarding lower emissions or more eco-friendly usage materials could increase operational expenditures and become somewhat of a hassle within the manufacturing line. Conversely, new regulations regarding recyclability or biodegradability might force major reformulation of PET foam products, making it a long and arduous process at great cost. Such regulatory pressure would then stagnate firms' ability to innovate and maintain cost-effectiveness and subsequently lower their competitiveness and market standing.

By Raw Material

In 2023, the virgin PET segment dominated the PET foam market, with an estimated market share of approximately 65%. This comes from the higher availability of virgin PET and its consistency in quality compared to that of recycled PET. Virgin PET foam is widely preferred in heavy industries, particularly in car production and aerospace, where performance and safety standards are rather restricted by the predictability of properties in such materials. For example, automotive suppliers rely on virgin PET because of its very good strength, lightweight nature, and ease of processing; thus, it is significantly used in the manufacture of seat cushions and panels. While recycled PET attracts more consumption to benefit the environment, virgin PET remains highly in demand. This is for situations where strict material characteristics must be adhered to by the manufacturers.

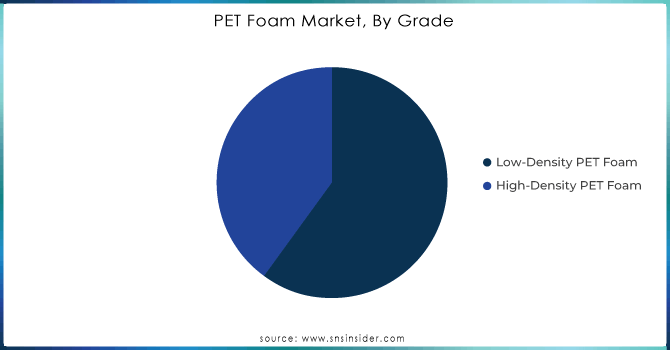

By Grade

The High-Density PET Foam dominated the PET foam market in the year 2023, capturing an estimated market share of around 60%. This dominance is largely based on the better mechanical properties of high strength, rigidity, and resistance to wear and tear, which adds up to heavy-duty applications in various sectors like aerospace, automotive, and wind energy. For example, in aerospace, high-density PET foam is primarily used in structural parts and interiors that demand a high strength level while having minimal weight. Likewise, in wind energy, high-density PET foam is utilized in the turbine blades: its high density ensures durability over a long period and hence will stay in operational performance for a long time. Such applications need materials that can even face heavy loads and other extreme conditions. That is why high-density PET foam is in high demand today.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Application

In 2023, Wind Energy dominated the PET foam segment, accounting for around 40% market share. The dominant market share of Wind Energy can be attributed to the increasing demand for lightweight, robust, and high-performance materials in the production of wind turbine blades. PET foam, particularly high-density variants, is widely used in the core of turbine blades because of its excellent mechanical properties, such as strength and fatigue resistance, which are crucial for withstanding extreme environmental conditions. As the world continues pushing limits for renewable energy, wind energy production is on the rise, with most wind turbine manufacturers focusing on PET foam as a means to improve efficiency and further lighten up the overall system. In addition, PET foam's recyclability complements wind energy companies' sustainability agendas and pushes it into a greater adoption rate in this application.

Regional Analysis

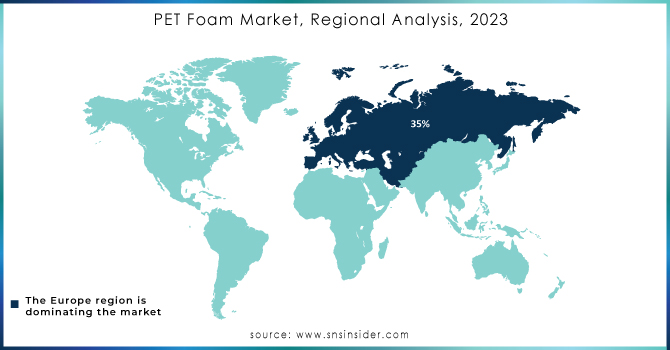

In 2023, Europe dominated the PET foam, accounting for a market share of over 35%. This is attributed to the high emphasis placed on sustainability and renewable energy projects together with advanced manufacturing sectors in this region. Europe has been ranked amongst the premier regional users of wind energy, with an immense related demand for PET foam for use in manufacturing turbine blades. The most critical contributors are Germany, Denmark, and Spain, as they are highly aggressive in the development of wind energy. Besides, the region has strict environmental regulations and exhibits a keen interest in product recyclability, which has resulted in PET foam used in various industries, including the automotive and construction sectors. The reasons for innovation by European manufacturers in recycled PET foam further suggest that this region is going to be a stronghold in the market.

3A Composites (Airex, Baltek)

A One Packing Co. Limited (PET Foam Board, PET Foam Sheet)

Armacell (ArmaFORM, ArmaPET)

BASF SE (Basotect, Styrodur)

Carbon-Core Corp. (CarbonCore, CarbonCore PET)

Changzhou Tiansheng New Materials Co. Ltd. (Tiansheng PET Foam, Tiansheng Core)

Corelite Inc. (CoreLite PET, CoreLite Foam)

Covestro AG (Baytherm, Baybond)

Diab Group (Divinycell, Divinycell H)

Evonik Industries AG (Rohacell, Rigid Foam)

HEXCEL Corporation (HexWeb, HexLight)

Huntsman International Llc (CoreShell, Araldite)

J.H. Ziegler Gmbh (Ziegler PET Foam, Ziegler Core)

Nitto Denko Corporation (Nitto PET Foam, Nitto Core)

Petro Polymer Shargh (Petrofoam, PetroPET)

SABIC (Sabic PET Foam, Sabic Core)

Saint-Gobain (SG Foam, Saint-Gobain PET)

Sekisui Plastics Co. Ltd (Sekisui PET Foam, Sekisui Core)

Solvay SA (Solvay PET Foam, Solvay Core)

Toray Industries, Inc. (Toray PET Foam, TorayCore)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 411.0 Million |

| Market Size by 2032 | US$ 819.3 Million |

| CAGR | CAGR of 7.14% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Raw Material (Virgin PET, Recycled PET) •By Grade (Low-Density PET Foam, High-Density PET Foam) •By Application (Wind Energy, Transportation, Marine, Packaging, Building, Construction, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Huntsman International Llc, Carbon-Core Corp., Armacell, Nitto Denko Corporation, Diab Group, BASF SE, Sekisui Plastics Co. Ltd, Changzhou Tiansheng New Materials Co. Ltd., Petro Polymer Shargh, 3A Composites, Corelite Inc., A One Packing Co. Limited, J.H. Ziegler Gmbh, Acrylic Depot and other key players |

| Key Drivers | • Increasing use of PET foam in automotive and aerospace industries due to its lightweight and high-performance properties • Enhanced focus on eco-friendly and recyclable materials driving innovation and adoption in various applications |

| RESTRAINTS | • Elevated costs of raw materials and manufacturing processes impacting overall market affordability |

The secondary type of research is done by this report.

Ans: The PET Foam Market is expected to grow at a CAGR of 7.4%

Ans: The Middle East & Africa region has the highest share of the PET Foam Market.

Ans: The increasing use of PET foam in automotive and aerospace industries due to its lightweight and high-performance properties and Enhanced focus on eco-friendly and recyclable materials driving innovation and adoption in various applications is the driver for the PET Foam market

Ans: The PET Foam Market Size was valued at USD 411.0 million in 2023, and is expected to reach USD 819.3 million by 2032

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization Analysis by Region

5.2 Raw Material Price Analysis by Region

5.3 Regulatory Impact: Effects of regulations on production and usage.

5.4 Environmental Metrics Analysis by Region

5.5 Innovation and R&D

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. PET Foam Market Segmentation, by Raw Material

7.1 Chapter Overview

7.2 Virgin PET

7.2.1 Virgin PET Market Trends Analysis (2020-2032)

7.2.2 Virgin PET Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Recycled PET

7.3.1 Recycled PET Market Trends Analysis (2020-2032)

7.3.2 Recycled PET Market Size Estimates and Forecasts to 2032 (USD Million)

8. PET Foam Market Segmentation, by Grade

8.1 Chapter Overview

8.2 Low-Density PET Foam

8.2.1 Low-Density PET Foam Market Trends Analysis (2020-2032)

8.2.2 Low-Density PET Foam Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 High-Density PET Foam

8.3.1 High-Density PET Foam Market Trends Analysis (2020-2032)

8.3.2 High-Density PET Foam Market Size Estimates and Forecasts to 2032 (USD Million)

9. PET Foam Market Segmentation, by End User

9.1 Chapter Overview

9.2 Wind Energy

9.2.1 Wind Energy Market Trends Analysis (2020-2032)

9.2.2 Wind Energy Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 Transportation

9.3.1 Transportation Market Trends Analysis (2020-2032)

9.3.2 Transportation Market Size Estimates and Forecasts to 2032 (USD Million)

9.4 Marine

9.4.1 Marine Market Trends Analysis (2020-2032)

9.4.2 Marine Market Size Estimates and Forecasts to 2032 (USD Million)

9.5 Packaging

9.5.1 Packaging Market Trends Analysis (2020-2032)

9.5.2 Packaging Market Size Estimates and Forecasts to 2032 (USD Million)

9.6 Building

9.6.1 Building Market Trends Analysis (2020-2032)

9.6.2 Building Market Size Estimates and Forecasts to 2032 (USD Million)

9.7 Construction

9.7.1 Construction Market Trends Analysis (2020-2032)

9.7.2 Construction Market Size Estimates and Forecasts to 2032 (USD Million)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America PET Foam Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.2.3 North America PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.2.4 North America PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.2.5 North America PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.2.6 USA

10.2.6.1 USA PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.2.6.2 USA PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.2.6.3 USA PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.2.7 Canada

10.2.7.1 Canada PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.2.7.2 Canada PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.2.7.3 Canada PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.2.8 Mexico

10.2.8.1 Mexico PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.2.8.2 Mexico PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.2.8.3 Mexico PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe PET Foam Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.1.3 Eastern Europe PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.3.1.4 Eastern Europe PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.3.1.5 Eastern Europe PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.6 Poland

10.3.1.6.1 Poland PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.3.1.6.2 Poland PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.3.1.6.3 Poland PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.7 Romania

10.3.1.7.1 Romania PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.3.1.7.2 Romania PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.3.1.7.3 Romania PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.8 Hungary

10.3.1.8.1 Hungary PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.3.1.8.2 Hungary PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.3.1.8.3 Hungary PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.9 Turkey

10.3.1.9.1 Turkey PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.3.1.9.2 Turkey PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.3.1.9.3 Turkey PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.3.1.10.2 Rest of Eastern Europe PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.3.1.10.3 Rest of Eastern Europe PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe PET Foam Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.2.3 Western Europe PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.3.2.4 Western Europe PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.3.2.5 Western Europe PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.6 Germany

10.3.2.6.1 Germany PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.3.2.6.2 Germany PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.3.2.6.3 Germany PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.7 France

10.3.2.7.1 France PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.3.2.7.2 France PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.3.2.7.3 France PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.8 UK

10.3.2.8.1 UK PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.3.2.8.2 UK PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.3.2.8.3 UK PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.9 Italy

10.3.2.9.1 Italy PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.3.2.9.2 Italy PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.3.2.9.3 Italy PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.10 Spain

10.3.2.10.1 Spain PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.3.2.10.2 Spain PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.3.2.10.3 Spain PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.3.2.11.2 Netherlands PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.3.2.11.3 Netherlands PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.3.2.12.2 Switzerland PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.3.2.12.3 Switzerland PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.13 Austria

10.3.2.13.1 Austria PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.3.2.13.2 Austria PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.3.2.13.3 Austria PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.3.2.14.2 Rest of Western Europe PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.3.2.14.3 Rest of Western Europe PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific PET Foam Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.4.3 Asia Pacific PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.4.4 Asia Pacific PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.4.5 Asia Pacific PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.6 China

10.4.6.1 China PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.4.6.2 China PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.4.6.3 China PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.7 India

10.4.7.1 India PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.4.7.2 India PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.4.7.3 India PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.8 Japan

10.4.8.1 Japan PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.4.8.2 Japan PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.4.8.3 Japan PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.9 South Korea

10.4.9.1 South Korea PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.4.9.2 South Korea PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.4.9.3 South Korea PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.10 Vietnam

10.4.10.1 Vietnam PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.4.10.2 Vietnam PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.4.10.3 Vietnam PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.11 Singapore

10.4.11.1 Singapore PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.4.11.2 Singapore PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.4.11.3 Singapore PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.12 Australia

10.4.12.1 Australia PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.4.12.2 Australia PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.4.12.3 Australia PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.4.13.2 Rest of Asia Pacific PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.4.13.3 Rest of Asia Pacific PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East PET Foam Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.1.3 Middle East PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.5.1.4 Middle East PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.5.1.5 Middle East PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.6 UAE

10.5.1.6.1 UAE PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.5.1.6.2 UAE PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.5.1.6.3 UAE PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.7 Egypt

10.5.1.7.1 Egypt PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.5.1.7.2 Egypt PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.5.1.7.3 Egypt PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.5.1.8.2 Saudi Arabia PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.5.1.8.3 Saudi Arabia PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.9 Qatar

10.5.1.9.1 Qatar PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.5.1.9.2 Qatar PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.5.1.9.3 Qatar PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.5.1.10.2 Rest of Middle East PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.5.1.10.3 Rest of Middle East PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa PET Foam Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.2.3 Africa PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.5.2.4 Africa PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.5.2.5 Africa PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.2.6 South Africa

10.5.2.6.1 South Africa PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.5.2.6.2 South Africa PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.5.2.6.3 South Africa PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.5.2.7.2 Nigeria PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.5.2.7.3 Nigeria PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.5.2.8.2 Rest of Africa PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.5.2.8.3 Rest of Africa PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America PET Foam Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.6.3 Latin America PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.6.4 Latin America PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.6.5 Latin America PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6.6 Brazil

10.6.6.1 Brazil PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.6.6.2 Brazil PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.6.6.3 Brazil PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6.7 Argentina

10.6.7.1 Argentina PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.6.7.2 Argentina PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.6.7.3 Argentina PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6.8 Colombia

10.6.8.1 Colombia PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.6.8.2 Colombia PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.6.8.3 Colombia PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America PET Foam Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Million)

10.6.9.2 Rest of Latin America PET Foam Market Estimates and Forecasts, by Grade (2020-2032) (USD Million)

10.6.9.3 Rest of Latin America PET Foam Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11. Company Profiles

11.1 Huntsman International Llc

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Carbon-Core Corp.

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Armacell

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Nitto Denko Corporation

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Diab Group

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 BASF SE

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Sekisui Plastics Co. Ltd

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Changzhou Tiansheng New Materials Co. Ltd.

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Petro Polymer Shargh

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 3A Composites

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

11.11 Corelite Inc.

11.11.1 Company Overview

11.11.2 Financial

11.11.3 Products/ Services Offered

11.11.4 SWOT Analysis

11.12 A One Packing Co. Limited

11.12.1 Company Overview

11.12.2 Financial

11.12.3 Products/ Services Offered

11.12.4 SWOT Analysis

11.13 J.H. Ziegler Gmbh

11.13.1 Company Overview

11.13.2 Financial

11.13.3 Products/ Services Offered

11.13.4 SWOT Analysis

11.14 Acrylic Depot

11.14.1 Company Overview

11.14.2 Financial

11.14.3 Products/ Services Offered

11.14.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Raw Material

Virgin PET

Recycled PET

By Grade

Low-Density PET Foam

High-Density PET Foam

By Application

Wind Energy

Transportation

Marine

Packaging

Building

Construction

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Reactive Hot Melt Adhesives Market was USD 1.74 Billion in 2023 and is expected to reach USD 3.40 Billion by 2032, growing at a CAGR of 7.72% from 2024-2032.

Wood Pellets Market size was USD 10.6 billion in 2023 and is expected to reach USD 20.5 billion by 2032, growing at a CAGR of 7.5% from 2024 to 2032.

Aerosol Market Size was valued at USD 85.4 Billion in 2023 and is expected to reach USD 150.2 billion by 2032, growing at a CAGR of 6.5% from 2024 to 2032.

Steel Wire Market was valued at USD 102.1 billion in 2023 and is expected to reach USD 167.4 billion by 2032, growing at a CAGR of 5.7% from 2024 to 2032.

Bromobenzene Market Size was valued at USD 1,231.30 Million in 2023 and is expected to reach USD 1,853.90 Million by 2032, at a CAGR of 4.70% from 2024-2032.

The Carbon Fiber Reinforced Plastics Market Size was USD 17.10 Billion in 2023 & will reach USD 32.80 Bn by 2032 & grow at a CAGR of 7.6% by 2024-2032.

Hi! Click one of our member below to chat on Phone