Pet Boarding Services Market Size Analysis:

The Pet Boarding Services Market size was valued at USD 7.6 billion in 2023 and is expected to reach USD 15.46 billion by 2032, growing at a CAGR of 8.2% over the forecast period 2024-2032.

This report delivers the most incisive statistical data and trends impacting the Pet Boarding Services Market. It includes market size and growth rate, focusing on revenue trends and growth opportunities. The report examines pet ownership trends, analyzing rising adoption rates and demographics influencing service demand. It also covers average boarding costs and spending behaviour, detailing regional differences in pricing and consumer behaviour. Explore insights on service preferences and booking trends uncovering favourite boarding styles and the role of digital booking channels. In addition, the report evaluates regulatory and safety compliance trends concerning licensing requirements and industry standards. It examines veterinary and health services within the pet boarding niche, highlighting the increasing importance of a combined care approach.

To Get more information on Pet Boarding Services Market - Request Free Sample Report

The rising number of pet owners and spending on pet care are contributing to the growth of the global pet boarding services market. The U.S. pet industry, according to recent government statistics, spends almost USD 99 billion per year on pet care products and services. Along with the pet humanization trend and the increase in dual-income households, there is an increased demand for reliable pet care solutions. The U.S. pet boarding services market has been experiencing steady growth, reaching approximately USD 4.08 billion by 2032, with a CAGR of 5.95% over the forecast period. This growth is primarily driven by the increasing trend of pet ownership, especially among millennials, who prefer high-end pet care offerings, such as luxury boarding, daycare, and grooming services. Market growth is also being propelled by the rise in disposable income and the increasing consumer demand for premium pet care experiences.

Pet Boarding Services Market Dynamics

Drivers

-

The increasing humanization of pets, where owners treat their pets as family members, is driving demand for premium pet care services, including boarding facilities that offer personalized and high-quality care.

The humanization of pets has led to a significant increase in demand for premium pet care services, including boarding facilities that provide personalized and high-quality care. Pet ownership has changed over the years and now people view their pets as family members, which has raised expectations for their care and well-being. This shift is evident in the growing popularity of luxury pet boarding services. For instance, WagWorks in Fulham, London, offers members-only daycare with monthly fees ranging from £210 to £840, providing extensive care and enrichment activities for dogs. Likewise, places like Camp Canine in California and Happy Tails in New York provide resort-esque amenities like obstacle courses, swimming pools, grooming and training services. This trend is reinforced by rising spending on pet-related services. In the UK, total spending on pets in 2022 was almost £10 billion, demonstrating owners' desire to pay for better care options.

Additionally, the emotional bond between pet owners and their animals has deepened. A survey involving 30,000 Australian participants revealed that 73% seek emotional support from their pets over human partners, 58% share their beds with their pets, and 32% kiss their pets on the lips. This special bond motivates owners to search for boarding facilities that can provide not merely care, but also interaction and enrichment opportunities for their beloved canines. As pet owners continue to prioritize their pets' well-being, the demand for high-quality, personalized boarding services is expected to rise, presenting significant opportunities for growth and innovation within the pet care industry.

Restraint

-

The pet boarding market is becoming increasingly competitive, leading to pricing pressures and challenges in maintaining profitability while offering high-quality services.

The growth of pet boarding services has led to increased competition in this market, as many small-sized service providers continue to enter the pet boarding services market. Market fragmentation has accelerated, forcing incumbents to pursue strategic moves to maintain or grow their market positions. In March 2024, for example, Dogtopia announced a new store design aiming to have an increased playroom space with an overall smaller footprint to improve service offerings and operational efficiency. In May 2023, We Love Pets Ltd announced a partnership with Husse, a leading pet food brand, to expand and improve their product offerings, which is a reflection of a trend whereby companies work together to offer more comprehensive pet care solutions.

Furthermore, an increasing number of dual-income households has contributed to the demand for tireless pet care services, contributing to competitive providers. Their facilities continue to further improve, allowing the service experience in the health and wellness sector. As they shift gears to compete with each other, service diversification and partnerships become key drivers in the service experience. Such initiatives are important to ensure the brands sustain relevance and profits among their rivals of ever-increasing competition and changing consumer preferences.

Opportunity

-

Diversifying services to include specialized offerings such as pet spa treatments, training programs, and wellness packages can attract discerning pet owners and enhance revenue streams.

The pet boarding services market is experiencing significant growth, driven by the increasing humanization of pets and owners' willingness to invest in premium care. On the other hand, branching out into other service categories like pet spa treatments, training programs, and wellness packages opens up a wealth of opportunities in this industry. Such as luxury dog daycare places like Happy Tails in New York City that provide playgrounds, obstacle courses, grooming, and a dog therapist, as well as a canine psychic. Members pay the monthly fee of $1,350 for such services, which speaks to the premium pet owners are willing to pay for high-quality care. In London, WagWorks provides members-only daycare, ranging from £210 to £840 per month, with a focus on care and enrichment for dogs. This is symptomatic of the increase in pet expenditure, totaling just shy of £10 billion in the UK as of 2022.

The pet groomers and boarding industry in the USA was worth $14.7 billion in 2024 alone, showing the volume of business available. Furthermore, 41% of Gen Z pet parents are spending money to train their pets professionally, and virtual training services are expected to see the most growth in the market this quarter and beyond. And, by adding specialized services such as spa treatments, training programs, and wellness packages to the pet boarding experience, facilities can adapt to the ongoing trends of pet owners, meet the growing demands of the public better, increase customer satisfaction, and potentially develop more revenue streams from one of the fastest-growing industries in the world.

Challenge

-

Ensuring compliance with various regulations related to pet welfare, hygiene, and safety poses operational challenges for pet boarding facilities, requiring ongoing investment in staff training and facility maintenance.

Ensuring compliance with pet welfare, hygiene, and safety regulations presents a significant challenge for pet boarding facilities. In regions like Tamil Nadu, India, there are currently no specific regulations governing pet boarding facilities, leading to concerns about inadequate management, insufficiently trained personnel, and substandard conditions that can jeopardize animal welfare. To address these challenges, substantial investments are being made in staff training and facility upgrades. For instance, a $4.9 million animal studies training center was recently inaugurated at Wyong TAFE, Australia, aiming to equip over 480 students with the skills necessary for careers in animal care and veterinary nursing. This initiative underscores the growing emphasis on professional training to meet industry standards and ensure the well-being of animals in boarding facilities. The absence of standardized regulations and the need for continuous investment in staff development and facility improvements highlight the complexities pet boarding services face in maintaining compliance and delivering high-quality care.

Pet Boarding Services Market Segmentation Analysis

By Service Type

The short-term boarding segment captured the leading share of the market in 2023. This dominating growth is being driven by an increasing number of pet owners who view their pets as members of the family and prefer short-term visits when on business trips or travel. The boarding services are typically short from a few hours to a few days per week boardings which is significantly more economical and fits busy people who have pets at home. Statistics from the government show that as the pet care industry is reorienting itself more towards non-medical services like boarding, short-term boarding services have flourished in particular. Short-term boarding facilities are also increasingly attractive due to their ease of booking and the range of amenities that they can offer.

The number of dual-income households grows, and vacations and business travels have increased in frequency, which gives a boost to short-term boarding services. In 2023, expenses for pet grooming, dog walking, and boarding amounted to USD 12.6 billion according to the American Pet Products Association, illustrating how essential non-medical pet services are becoming. The flexibility of short-term boarding allows pet owners to ensure their pets are well cared for during short absences, making it a preferred choice.

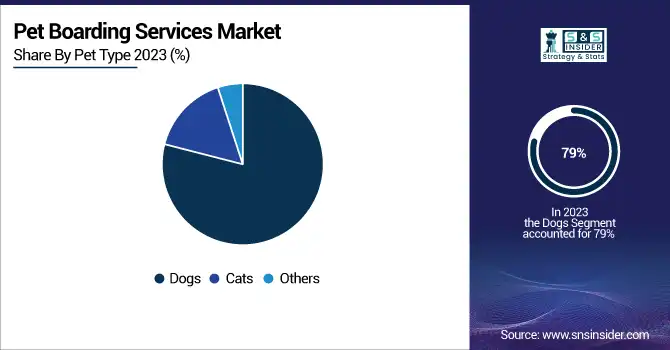

By Pet Type

The dogs segment dominated the market with the highest revenue share 79% in 2023. This is mainly due to the high adoption rates of dogs across the globe, especially in developed countries. For example, the American Veterinary Medical Association estimated that in 2022 the United States had around 90 million pet dogs. The cat segment is projected to grow at the highest CAGR during the forecast period, owing to the growing awareness of the care of cats and the rising adoption of cats as pets. Government data indicates a growing trend among cat owners who are seeking premium boarding services designed to meet their pets' unique needs, leading to significant growth in this segment.

The trend of pet humanization also plays a significant role in the growth of cat boarding services, as owners seek high-quality care for their pets. For example, due to an increase in the total number of pet cats by 6.8% in 2023 in China, there is rising demand for specialized cat sleeping and meal services. As cat owners increasingly view their furry friends as family members, the expenditure for their care has also increased, fuelling the demand for premium boarding services for cats.

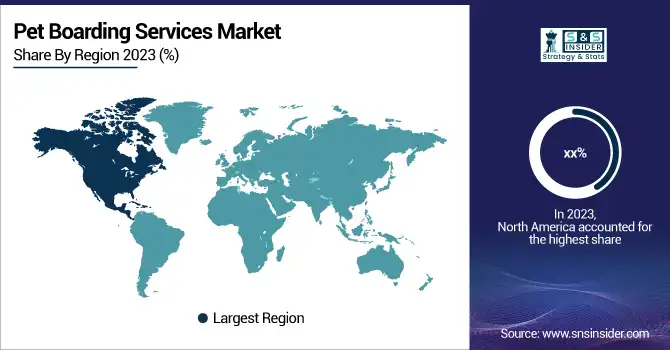

Regional Insights

The North American pet boarding services market accounted for the largest share in 2023, owing to high pet ownership and strong pet care infrastructure. In 2023, the region accounted for 42% share of the global market share, indicating its robust position in the global pet care market. The prevalence of pet owners in the U.S. and Canada, where pets are treated as family members, also contributes to its dominance. In 2023 alone, pet owners in the United States spent 136 billion dollars on their pets, with a substantial share used on pet care services such as boarding. Therefore, being a built-in country in the world, North America has been providing countless pet-owned societies with a well-organized basic to luxury pet boarding that serves a variety of pet needs. The market leadership in this region can be attributed to the presence of established pet care companies and the availability of boarding services. The broader appeal of pet boarding services in North America is also supported by technological improvements and a range of innovative services like online booking tools and pet monitoring systems.

The Asia Pacific region is growing with the fastest CAGR, driven by increasing urbanization and rising disposable incomes. In 2023, the number of pet dogs in China reached 51.75 million, up 1.1% from the previous year, while the number of pet cats increased by 6.8% to 69.8 million. The region has witnessed a growth of pet ownership which in turn is increasing demand for pet boarding services. The Asia Pacific's rapid growth can be attributed to changing consumer preferences and growing disposable income, allowing owners to spend more on premium boarding services. Technology integration and diverse service offerings by boarding service providers are also key trends shaping the market in this region. The rise in pet-friendly travel and the increasing awareness of pet mental health further contribute to the growth of the pet boarding market in the Asia Pacific.

Get Customized Report as per Your Business Requirement - Enquiry Now

Pet Boarding Services Market Key Players

-

Camp Bow Wow

-

Dogtopia Enterprises

-

Fetch! Pet Care

-

PARADISE 4 PAWS.

-

PetBacker

-

PetSmart LLC

-

Swifto Inc.

-

We Love Pets

Recent Developments in the Pet Boarding Services Market

-

In November 2023, Blackstone announced its intention to acquire Rover for $2.3 billion, a deal that was completed in February 2024.

-

March 2024: Dogtopia Debuts New Store Design Business Model with Expanded Playroom Space and a More Compacted Footprint than Prior Layouts.

-

In March 2024, this Fanwood-based franchise specializing in dog boarding and daycare announced a $10 million investment from its largest multi-unit franchisee.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 7.6 Billion |

| Market Size by 2032 | USD 15.46 Billion |

| CAGR | CAGR of 8.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Long term, Short term) • By Pet Type (Dogs, Cats, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

A Place for Rover, Inc., Camp Bow Wow, Dogtopia Enterprises, Fetch! Pet Care, Holidog.com, PARADISE 4 PAWS, PetBacker, PetSmart LLC, Swifto Inc., We Love Pets |