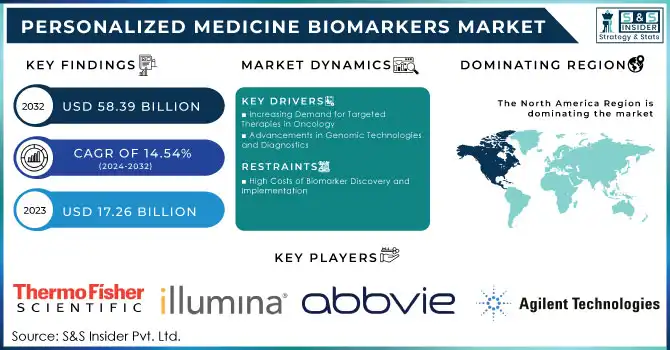

The Personalized Medicine Biomarkers Market was valued at USD 17.26 billion in 2023 and is expected to reach USD 58.39 billion by 2032, growing at a CAGR of 14.54% from 2024-2032.

Get More Information on Personalized Medicine Biomarkers Market - Request Sample Report

The Personalized Medicine Biomarkers Market is progressing swiftly because of the rising trend toward tailored treatments, propelled by advancements in precision medicine and the heightened need for targeted therapies. Biomarkers allow healthcare providers to customize treatments by pinpointing which patients are most likely to respond well to particular therapies, minimizing negative effects, and enhancing overall treatment results. Oncology continues to be the primary application area, with biomarkers such as PD-L1, BRCA1/2, and EGFR becoming critical for diagnostic and treatment choices. Liquid biopsies represent a developing innovation in cancer treatment, enabling the early identification of cancer biomarkers via minimally invasive blood tests. In neurology, research on biomarkers has grown considerably, facilitating early detection and monitoring of diseases like Alzheimer’s and Parkinson’s. Research shows that employing biomarkers in Alzheimer’s diagnosis can enhance accuracy to more than 90%, providing opportunities for early intervention. Moreover, pharmacogenomics, which examines the impact of genetic differences on drug reactions, is gaining significance in personalized care, especially for treating depression, cardiovascular issues, and cancer.

Regulatory agencies, such as the FDA, are endorsing biomarker research via initiatives like the Biomarker Qualification Program, promoting faster approvals and more transparent guidelines. Recent progress in technology, especially in AI, is improving biomarker discovery by recognizing new biomarkers and forecasting patient outcomes with greater accuracy. Major companies in the industry, such as IBM Watson Health and Roche, are significantly investing in AI-based biomarker platforms for cancer and metabolic disorders. Collaborations between public and private sectors, like the Biomarkers Consortium, are driving this expansion, with more than USD 100 million contributed in recent years to promote biomarker research. With the growth of personalized medicine, the biomarker market is poised to transform diagnostic and treatment methods in various therapeutic areas, delivering more accurate, efficient, and accessible care for patients.

With the expansion of precision medicine, the personalized medicine biomarkers market is set to play a crucial role in the transformation of healthcare, supporting the creation of effective and affordable treatment strategies. This market indicates a significant change from a uniform approach to customized healthcare solutions designed to meet specific patient requirements, representing a major advancement in the domain of precision medicine.

Drivers

Increasing Demand for Targeted Therapies in Oncology

A key factor propelling the Personalized Medicine Biomarkers market is the rising need for targeted treatments, particularly in cancer care. Personalized medicine utilizes biomarkers to pinpoint particular molecular targets, allowing for more efficient treatment alternatives by concentrating on the unique attributes of a patient's tumor. In oncology, biomarkers play a vital role in detecting mutations, choosing the appropriate medication, and assessing treatment efficacy, resulting in better patient outcomes.

Furthermore, the U.S. Food and Drug Administration (FDA) has authorized over 20 targeted cancer therapies in the last ten years, highlighting the growing acknowledgment of the importance of personalized treatment. The capability to provide customized therapies to patients according to their distinct genetic characteristics has generated significant interest in personalized biomarkers for cancer treatment.

Advancements in Genomic Technologies and Diagnostics

Improvements in genomic technologies, such as next-generation sequencing (NGS), have greatly advanced the personalized medicine biomarkers industry. NGS facilitates high-throughput sequencing of DNA and RNA, making it possible to identify genetic variations and biomarkers linked to diseases. This technology has transformed how healthcare professionals identify conditions and tailor treatments, especially in intricate diseases such as cancer, cardiovascular issues, and neurological disorders.

These technological innovations are improving the precision of biomarker identification and the creation of diagnostic tests, fueling the need for personalized medicine. Furthermore, numerous firms, including Illumina and Thermo Fisher Scientific, have introduced new sequencing technologies that offer quicker and more cost-effective biomarker analysis, thereby boosting the expansion of this market.

Restraint

High Costs of Biomarker Discovery and Implementation

A major constraint for the Personalized Medicine Biomarkers market is the substantial expenses linked to biomarker discovery, validation, and application. Creating customized biomarkers necessitates significant research and clinical testing, which are both resource-demanding and time-intensive. The expenses associated with carrying out genomic research, securing regulatory approvals, and producing diagnostic tests based on biomarkers can be excessive, especially for smaller biotech companies and healthcare practitioners.

Additionally, although genomic sequencing technologies have progressed significantly, they still necessitate specialized infrastructure and trained professionals, which can increase the total expense. This might restrict the uptake of personalized medicine, particularly in low-resource areas or developing markets where healthcare funding is limited. Moreover, reimbursement challenges for biomarker-based assessments in certain areas also hinder market expansion. Although personalized medicine holds great potential, the financial obstacles linked to these technologies may hinder their widespread use and restrict access for a larger patient demographic.

By Application

The early detection/screening segment dominated the market holding the highest market share of 35% in 2023. The expansion of the segment can be linked to the demand for early intervention. For patients exhibiting the biomarker associated with a therapy's response, the likelihood of survival relies on the treatment pathway. For example, the presence of the HER2/neu protein serves as a prognostic indicator for breast cancer. Additionally, KRAS is a commonly mutated oncogene in colorectal cancer and serves as a biomarker indicating resistance to anti-EGFR monoclonal antibody treatment. Additionally, the advancement of new technologies for the early identification of different conditions is also driving the market's growth.

The treatment Selection segment is to expand at a notable CAGR of 13% during the forecast period, Personalized medicine biomarkers aid in selecting the most appropriate patients for early-phase clinical trials, based on the tumor's molecular features. They likewise offer details about the action mechanism of a specific medication. The emphasis in oncology drug development has transitioned from developing non-specific cytotoxic chemotherapies to creating molecularly targeted therapies due to the discovery of specific mutations that effectively predict a drug's efficacy in a molecularly defined patient population. Furthermore, an improved range of treatments boosts the chances of addressing the condition, which in turn drives the need for personalized medicine biomarkers.

by Indication

In 2023, oncology held the most significant market share at 41%, fueled by the rising incidence of cancer globally. The World Health Organization estimates that by 2040, cancer cases could increase to 29.5 million, requiring improved diagnostic and treatment methods. Personalized medicine customizes treatment according to individual genetic and molecular characteristics, improving the effectiveness of cancer therapies while reducing side effects. GLOBOCAN reported that there were 18,741,966 cancer instances worldwide in 2022. Of these, there were 9,566,825 cases reported in men, whereas 9,175,141 cases were noted in women. The need for biomarkers that can forecast patient reactions to targeted therapies and immunotherapies is swiftly growing, enabling earlier diagnosis and enhancing overall patient results in oncology, thereby driving market expansion in this area.

The diabetes segment is the fastest-growing sector and is anticipated to expand at a CAGR of % throughout the forecast duration. The diabetes sector is seeing significant expansion in the personalized medicine biomarkers market, propelled by the increasing worldwide incidence of diabetes. As per the IDF Diabetes Atlas, the worldwide count of people with diabetes is increasing and is projected to rise by 46% between 2020 and 2045, whereas the global population is expected to grow by only 20%. Personalized medicine, concentrating on customizing treatments according to specific biomarkers, is vital in diabetes management as it helps identify patients at risk for complications and enhances therapeutic approaches. The need for biomarkers that can forecast glycemic control, insulin sensitivity, and various metabolic reactions is growing, promoting progress in targeted treatments and enhancing patient results in diabetes management.

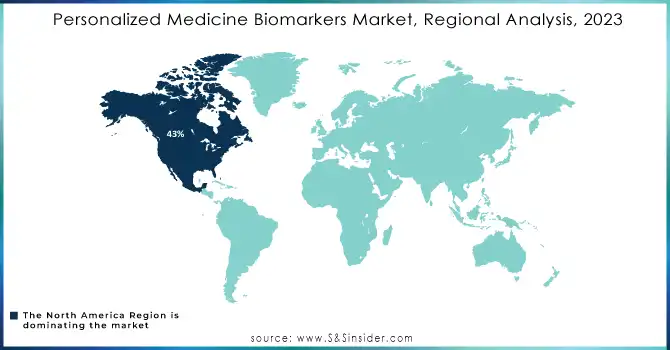

The North American region dominated the Personalized Medicine Biomarkers market with 43% in 2023, mainly fueled by the presence of top biotechnology firms, sophisticated healthcare systems, and substantial funding in research and development. The U.S., especially, is notable for its strong healthcare system, significant need for customized treatments, and supportive government initiatives, like the 21st Century Cures Act, which streamlines the approval process for new medications and medical devices, including biomarkers. Moreover, the rising incidence of chronic illnesses and the heightened emphasis on precision medicine have also bolstered the market's robustness in North America. The presence of sophisticated sequencing technologies, along with robust reimbursement policies, has further enhanced the use of personalized medicine biomarkers in this area.

The Asia Pacific area is the fastest growing personalized medicine biomarkers market, fueled by swift improvements in healthcare systems, a rising prevalence of chronic illnesses, and an escalating emphasis on personalized healthcare options. Nations such as China and India are at the forefront of clinical research and precision medicine adoption, backed by government programs focused on enhancing healthcare accessibility and affordability. As these countries allocate resources to genomics research and biotechnological advancements, the need for personalized medicine biomarkers is projected to grow, driven by expanding healthcare industries and a rising number of biotech startups concentrating on biomarker identification and confirmation.

Need Any Customization Research On Personalized Medicine Biomarkers Market - Inquiry Now

Key Players

Thermo Fisher Scientific (Oncomine Tumor Mutation Load Assay, Ion AmpliSeq Cancer Hotspot Panel)

Roche Diagnostics (cobas EGFR Mutation Test v2, Elecsys BRAHMS PCT)

Illumina (TruSight Oncology 500, NovaSeq 6000 Sequencing System)

AbbVie (Venclexta (venetoclax), AndroGel (testosterone gel))

Qiagen (QIAamp DNA Blood Mini Kit, Therascreen EGFR RGQ PCR Kit)

Agilent Technologies (SureSelect Clinical Research Exome Kit, Dako PD-L1 IHC 22C3 pharmDx)

Merck & Co. (Keytruda (pembrolizumab), FoundationOne CDx)

Bristol Myers Squibb (Opdivo (nivolumab), Empliciti (elotuzumab))

Bio-Rad Laboratories (Droplet Digital PCR (ddPCR) System, Bio-Plex Pro Human Cytokine 27-Plex Assay)

PerkinElmer (AlphaLISA Human Biomarker Kits, LabChip GX GXII Touch System)

GE Healthcare (PET/CT Scanner Discovery MI, MRI Scanner SIGNA Premier)

Novartis (Kymriah (tisagenlecleucel), Cosentyx (secukinumab))

Thermo Fisher Scientific (Oncomine Comprehensive Assay, Ion Proton System)

Abbott Laboratories (Alinity m, ARCHITECT i2000SR)

Beckman Coulter (Access 2 Immunoassay System, UniCel DxC 600 Pro)

Cardiff Oncology (ONCOS-102, ONCOS-103)

Myriad Genetics (myRisk Hereditary Cancer Test, EndoPredict Test)

Gilead Sciences (KTE-X19 (KTE-C19), Yescarta (axicabtagene ciloleucel))

Hologic (Aptima HPV Assay, ThinPrep Pap Test)

Guardant Health (Guardant360 Liquid Biopsy Test, GuardantOMNI Genomic Profiling Test)

Key suppliers

These suppliers provide essential tools and technologies that support personalized medicine biomarkers, ranging from diagnostic assays to sequencing systems and imaging solutions.

Thermo Fisher Scientific

Roche Diagnostics

Illumina

Qiagen

Agilent Technologies

PerkinElmer

Bio-Rad Laboratories

GE Healthcare

Guardant Health

Abbott Laboratories

Recent Developments

In August 2024, Paige revealed the introduction of OmniScreen, a cutting-edge AI-powered biomarker module aimed at examining over 505 genes and detecting 1,228 molecular biomarkers from typical H&E-stained digital pathology slides.

In June 2024, Sapience Therapeutics, Inc., a biotech firm specializing in peptide therapies for cancer and immune system irregularities, shared fresh clinical and biomarker findings from its Phase 2 ST101 trial.

In August 2024, the FDA gave the go-ahead for Illumina's cancer biomarker test, facilitating quick pairing of patients with targeted treatments. This progress improves personalized medicine, enabling more accurate treatment choices based on unique biomarker profiles in cancer treatment.

In April 2024, Bio-Rad Laboratories introduced its initial ultrasensitive multiplexed digital PCR test, the ddPLEX ESR1 Mutation Detection Kit, designed for clinical research. This test allows accurate identification of ESR1 mutations in breast cancer, aiding progress in translational research, treatment choice, and disease tracking within the oncology and biomarkers market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 17.26 Billion |

| Market Size by 2032 | US$ 58.39 Billion |

| CAGR | CAGR of 14.54% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Application (Early Detection/Screening, Diagnosis, Treatment Selection, Monitoring) •By Indication (Oncology, Neurology, Diabetes, Autoimmune Diseases, Cardiology, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Becton, Dickinson and Company, Novo Nordisk, Thermo Fisher Scientific, F. Hoffmann-La Roche Ltd., Illumina, Agilent Technologies, Bio-Rad Laboratories, Abbott Laboratories, Qiagen, Myriad Genetics, Siemens Healthineers, PerkinElmer, Danaher Corporation, Genomic Health, Quest Diagnostics, Foundation Medicine, Exact Sciences, NanoString Technologies, Caris Life Sciences, Guardant Health, and other players. |

| Key Drivers | • Increasing Demand for Targeted Therapies in Oncology •Advancements in Genomic Technologies and Diagnostics |

| Restraints | •High Costs of Biomarker Discovery and Implementation. |

Ans- The Personalized Medicine Biomarkers Market was valued at USD 17.26 billion in 2023 and is expected to reach USD 58.39 billion by 2032.

Ans – The CAGR rate of the Personalized Medicine Biomarkers Market during 2024-2032 is 14.54%.

Ans- The Oncology segment dominated the market by 41%

Ans- North America held the largest revenue share by 43%.

Ans-Asia Pacific is the fastest-growing region in the Personalized Medicine Biomarkers Market.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence (2023)

5.2 Prescription Trends, (2023), by Region

5.3 Drug Volume: Production and usage volumes of pharmaceuticals.

5.4 Healthcare Spending: Expenditure data by government, insurers, and out-of-pocket by patients.

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Personalized Medicine Biomarkers Market Segmentation, by Application

7.1 Chapter Overview

7.2 Early Detection/Screening

7.2.1 Early Detection/Screening Market Trends Analysis (2020-2032)

7.2.2 Early Detection/Screening Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3 Diagnosis

7.2.3.1 Diagnosis Market Trends Analysis (2020-2032)

7.2.3.2 Diagnosis Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.4 Treatment Selection

7.2.4.1Treatment Selection Market Trends Analysis (2020-2032)

7.2.4.2Treatment Selection Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.5 Monitoring

7.2.51 Monitoring Market Trends Analysis (2020-2032)

7.2.5.2 Monitoring Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Personalized Medicine Biomarkers Market Segmentation, by Indication

8.1 Chapter Overview

8.2 Oncology

8.2.1 Oncology Market Trends Analysis (2020-2032)

8.2.2 Oncology Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.3.1 By Type

8.2.3.1.1 By Type Market Trends Analysis (2020-2032)

8.2.3.1.2 By Type Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.3.2 By Circulating Biomarkers

8.2.3.2.1 By Circulating Biomarkers Market Trends Analysis (2020-2032)

8.2.3.2.2 By Circulating Biomarkers Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Neurology

8.3.1 Neurology Market Trends Analysis (2020-2032)

8.3.2 Neurology Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Diabetes

8.4.1 Diabetes Market Trends Analysis (2020-2032)

8.4.2 Diabetes Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Autoimmune Diseases

8.5.1 Autoimmune Diseases Market Trends Analysis (2020-2032)

8.5.2 Autoimmune Diseases Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Cardiology

8.6.1 Cardiology Market Trends Analysis (2020-2032)

8.6.2 Cardiology Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Others

8.7.1 Others Market Trends Analysis (2020-2032)

8.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Personalized Medicine Biomarkers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.2.4 North America Personalized Medicine Biomarkers Market Estimates and Forecasts, by Cancer Forms (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.2.5.2 USA Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.2.6.2 Canada Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.2.7.2 Mexico Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Personalized Medicine Biomarkers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.3.1.5.2 Poland Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.3.1.6.2 Romania Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.3.1.7.2 Hungary Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.3.1.8.2 Turkey Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Personalized Medicine Biomarkers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.3.2.4 Western Europe Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.3.2.5.2 Germany Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.3.2.6.2 France Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.3.2.7.2 UK Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.3.2.8.2 Italy Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.3.2.9.2 Spain Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Healthcare Predictive Analytic Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.3.2.12.2 Austria Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Personalized Medicine Biomarkers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.4.4 Asia Pacific Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.4.5.2 China Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.4.5.2 India Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.4.5.2 Japan Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.4.6.2 South Korea Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.2.7.2 Vietnam Healthcare Predictive Analytic Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.4.8.2 Singapore Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.4.9.2 Australia Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Personalized Medicine Biomarkers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.5.1.4 Middle East Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.5.1.5.2 UAE Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Personalized Medicine Biomarkers Market Estimates and Forecasts, by Mode of Action (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Personalized Medicine Biomarkers Market Estimates and Forecasts, by Cancer Forms (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Personalized Medicine Biomarkers Market Estimates and Forecasts, by Mode of Action (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Personalized Medicine Biomarkers Market Estimates and Forecasts, by Cancer Forms (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.5.1.8.2 Qatar Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Personalized Medicine Biomarkers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.5.2.4 Africa Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.5.2.5.2 South Africa Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.5.2.7.2 Rest of Africa Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Personalized Medicine Biomarkers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.6.4 Latin America Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.6.5.2 Brazil Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.6.6.2 Argentina Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Personalized Medicine Biomarkers Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

9.6.7.2 Colombia Personalized Medicine Biomarkers Market Estimates and Forecasts, by Indication (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Personalized Medicine Biomarkers Market Estimates and Forecasts, by Mode of Action (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Personalized Medicine Biomarkers Market Estimates and Forecasts, by Cancer Forms (2020-2032) (USD Billion)

10. Company Profiles

10.1 Thermo Fisher Scientific

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 Roche Diagnostics.

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Illumina

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 AbbVie

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Agilent Technologies

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Merck & Co

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Bio-Rad Laboratories

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 PerkinElmer

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 GE Healthcare

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Abbott Laboratories

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Personalized Medicine Biomarkers by Application

Early Detection/Screening

Diagnosis

Treatment Selection

Monitoring

Personalized Medicine Biomarkers by Indication

Oncology

By Type

By Circulating Biomarkers

Neurology

Diabetes

Autoimmune Diseases

Cardiology

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization to meet the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Lateral Flow Assays Market Size was valued at USD 10.94 billion in 2023 and is expected to reach USD 18.59 billion by 2032 and grow at a CAGR of 6.09% over the forecast period 2024-2032.

The Smart Inhalers Market was valued at USD 1.63 Billion in 2023 and is estimated to reach USD 5.30 Billion by 2032 with a growing CAGR of 14.01% over the forecast period of 2024-2032.

Microplate Reader Market was valued at USD 486.89 million in 2023 and is expected to reach USD 941.32 million by 2032, growing at a CAGR of 7.6% from 2024-2032.

The Cold Pain Therapy Market Size was valued at USD 1.91 billion in 2023, and is expected to reach USD 2.96 billion by 2032, and grow at a CAGR of 5% over the forecast period 2024-2032.

The Optometry Equipment Market was valued at USD 4.37 billion in 2023 and is expected to reach USD 7.63 billion by 2032, growing at a CAGR of 6.39% from 2024-2032.

The Artificial Intelligence In Animal Health Market was valued at USD 1.28 billion in 2023 and is expected to reach USD 7.06 billion by 2032, growing at a CAGR of 20.94% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone