Get More Information on Peripheral Neuropathy Market - Request Free Sample Report

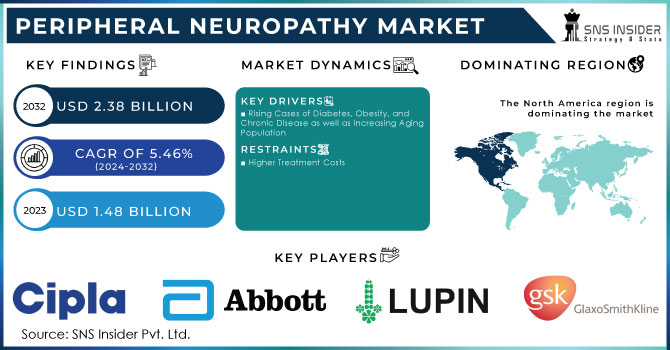

The Peripheral Neuropathy Market valued USD 1.48 billion in 2023, estimated to surpass USD 2.38 billion by 2032 with a compound annual growth rate of 5.46% over the forecast period 2024-2032.

Peripheral neuropathy is not age or background specific, but some are more affected than others. Although diabetes is the most common cause, many other potential factors can raise risk as well that is infections of any kind, metabolic issues in general inherited diseases traumatizing events toxins aging itself. The overarching term for multiple types of nerve damage is peripheral neuropathy, which affects many people in a range scenario which is likely the case for approximately 2.4% of people worldwide. Among those over 45 years of age, the rate rises to anywhere from 5% to 7%, showing an increased risk with aging.

Awareness for chronic toxicities of cancer treatments such as Taxane-induced peripheral neuropathy, is one of the rising factors in driving peripheral neuropathy market. An increasing number of patients will live with long-term neuropathy, driving the need for better diagnosis and approaches to management and treatment. This drives the pipeline of medications, therapies and other interventions that help relieve neuropathy symptoms while enhancing quality of life for patients. According to the study published in the Journal of the National Cancer Institute in 2017, serves an important reminder of the necessity for better communication about latent side effects. Other evidence indicates that long-term peripheral neuropathy - a symptom of numbness and tingling in the hands and feet - after taxane-based chemotherapy is common.

An increasing number of people suffer from diabetes worldwide, and therefore it is more vulnerable to developing peripheral neuropathy that is diabetes mellitus is a progressive non-communicable disease affecting millions of people all over the world. In addition, diabetic neuropathy affects at least 50% of all patent with diabetes. This nerve damage complication gives one more facet to the challenge of caring for this disease. Over the last few decades, DM has shown an alarming rise in both developed and developing countries. Globally, a record 537 million adults aged 20-79 now live with diabetes. These figures are expected to get even worse in the future, with projections predicting a rise up to 643 million by 2030 and an astounding increase of people infected for this coming decade till 2045, according to nature article published in June 2024.

A recent study by Nature article in June 2024, examined the prevalence of peripheral neuropathy in a population of 225 patients with type I (2.2%) and type II (97.8%) diabetes. Moreover, over half (56%) of the participants had a diabetic history of less than five years, suggesting an emphasis on the relatively early stages of the disease. Researchers utilized the Michigan Neuropathy Screening Instrument, a well-established tool for detecting DPN in diabetic patients while the study itself doesn't provide a specific prevalence statistic, it reflects how cross-sectional studies can quantify DPN in diabetic populations. Real-world prevalence estimates vary, but large-scale reviews suggest DPN affects roughly 43% of diabetic patients. This highlights the significant impact of DPN on this population.

Diabetic peripheral neuropathy is a disease in which millions of people suffer across the globe. Early detection is crucial to proper management, especially with diabetic patients. This is why an innovative initiative was launched not just to raise awareness of the condition but also to collect important epidemiological data that will present how widespread and severe it really can be. According to a study, granted by the Asia Book of Records has been achieved through screening peripheral neuropathy for millions. The screening for neuropathy is being conducted by CORONA in the "May 2024 Neuropathy Awareness Week initiative".

Market Dynamics

Rising Cases of Diabetes, Obesity, and Chronic Disease as well as increasing Aging Population:

The peripheral neuropathy market is ready to experience exponential growth due to many opportunities such as the rising prevalence of the diseases, huge economic burden, and availability of drugs in markets. With an example of diabetes serving as one of the prime suspects behind peripheral neuropathy, Diabetes has been cited as a "global health emergency" in America.

According to the IDF Diabetes Atlas (2021), showed that more than 10% of adults aged 20-79 have diabetes and almost half are undiagnosed. This underscores the necessity for improved awareness programs. Technological advances engineer a smarter future ahead an alarming 783 million people—affected 1 in 8 adults would be living with diabetes, a steep 46% increase from current previsions by the year 2045. Unsurprisingly, type 2 diabetes is the prime suspect which is affecting more than 90% of diabetics. Needless to say, this upward surge comes from a tangled web - through different kinds of social, economic, and environmental factors as well including genetics.

As the global population ages, the risk of peripheral neuropathy naturally increases. Elderly individuals are more prone to age-related conditions like diabetes and vascular problems, both of which contribute to nerve damage. The global obesity epidemic is another concerning factor. Excess weight puts individuals at higher risk for developing diabetes and other chronic conditions that can lead to peripheral neuropathy. Beyond diabetes, other chronic illnesses like cancer, hypothyroidism, and kidney disorders can also cause peripheral neuropathy. The increasing prevalence of these conditions further fuels market growth. For instance, a 2020 report by the International Agency for Research on Cancer highlighted nearly 20 million new cancer cases globally, highlighting the substantial number of individuals potentially susceptible to neuropathy due to chemotherapy.

Advances being made in the development of various medications and therapies for peripheral neuropathy are good news to hopeful patients, with both traditional (pharmacological) as well as alternative drug treatments usable within the peripheral neuropathy market. The February 2021 phase 2/3-tractable clinical trial example (for venlafaxine for paclitaxel-induced neuropathy) illustrates the high level of active study in this area.

Overall, the rising prevalence of diabetes, the aging population, increasing obesity rates, and the burden of chronic diseases all contribute to a significant growth potential in the peripheral neuropathy market. As research efforts continue to develop new treatment options, the peripheral neuropathy market is expected to see further expansion in the coming years.

Higher Treatment Costs

The significant cost of medications and therapies for peripheral neuropathy can be a major barrier for patients and healthcare systems alike. This can limit patient access to treatment and hinder peripheral neuropathy market expansion.

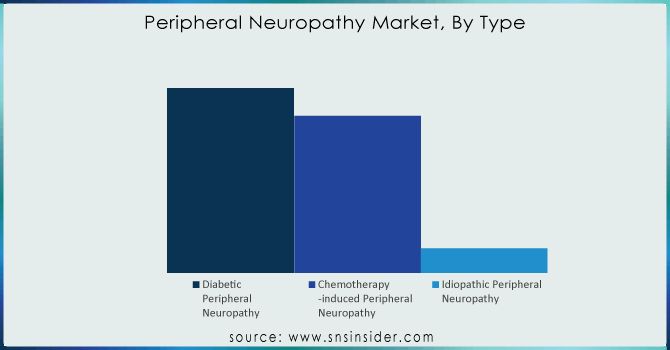

Diabetic Peripheral Neuropathy

Chemotherapy-induced Peripheral Neuropathy

Idiopathic Peripheral Neuropathy

HIV/AIDS Associated Peripheral Neuropathy

The peripheral neuropathy market can be segmented based on the type of nerve damage. Diabetic peripheral neuropathy was the dominant segment, with 53.02% of the market share in 2023. This dominance is primarily driven by the concerning rise in the number of young diabetic patients experiencing neuropathy, coupled with the growing presence of companies developing treatments for this specific condition.

Positive developments are emerging in the fight against peripheral neuropathy. For instance, in September 2021, Biogen Inc. reported promising results from a Phase 2 clinical trial (CONVEY study) evaluating vixotrigine, a potential non-opioid treatment for small fiber neuropathy (SFN), a type of peripheral neuropathy. Such advancements in clinical trials offer hope for the future development of effective therapies for this condition.

Need any customization research on Peripheral Neuropathy Market - Enquiry Now

By Treatment

Pharmacological Therapies

Pain Relievers

Anti-seizure Medications

Antidepressants

Non-Pharmacological Therapies

Transcutaneous Electrical Nerve Stimulation

Plasma Exchange

Intravenous Immune Globulin

Others

The peripheral neuropathy market can be segmented based on the treatment approach used. Pharmacological therapies, encompassing medications, hold the dominant share of the 58.09% market revenue in 2023. This dominance reflects their role as the primary tool for managing peripheral neuropathy.

In February 2021, a promising development emerged with the initiation of a Phase 2/3 clinical trial by Mendel AI and Cairo University. This study investigates the potential of venlafaxine, a medication, in mitigating paclitaxel-induced peripheral neuropathy, a complication of cancer treatment. This signifies ongoing research into non-pharmacological options for managing this condition.

Hospitals and Clinics

Ambulatory Centers

Others

The peripheral neuropathy market can be segmented based on the treatment setting. Hospitals and clinics were dominated with 76.03% of the largest market share in 2023. This dominance is likely due to several factors like the increasing prevalence of chronic diseases, a major contributor to peripheral neuropathy, which leads more patients to seek care in these settings. Hospitals and clinics are often the first point of contact for diagnosis and initial treatment of peripheral neuropathy. These facilities typically have the expertise and access to various treatment methods, making them a comprehensive option for patients.

Moreover, other than traditional approaches, May 2021 saw promising results from a Phase II trial conducted by Pure Green Pharmaceuticals Inc. This trial investigated the use of a sublingual cannabidiol (CBD) tablet for diabetic peripheral neuropathy. The encouraging outcome, with a reported pain reduction of approximately 50%, suggests potential for further exploration of CBD as a treatment option.

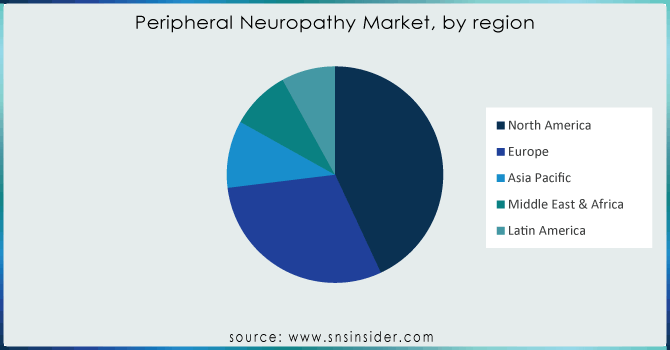

North America held the leading position in peripheral neuropathy with a 43.06% market share in 2023. This dominance can be attributed to several key factors including the rising number of diabetic individuals in North America is a significant driver. Diabetes is a major risk factor for developing peripheral neuropathy. The well-established healthcare infrastructure in North America facilitates earlier diagnosis and access to treatment options for peripheral neuropathy. An increased awareness of peripheral neuropathy among diabetic patients in North America is likely leading to more timely diagnosis and treatment seeking, further contributing to the peripheral neuropathy market size.

Europe holds the second-largest market share. This is fueled by a growing number of treatment options, rising patient awareness, and a promising pipeline of new therapies. Notably, Germany holds the largest market share within Europe, while the UK is experiencing the fastest growth.

The Asia-Pacific region is expected to witness the most significant growth in the coming years. This surge is attributed to factors like increasing healthcare expenditure and a rapidly growing geriatric population susceptible to chronic diseases like diabetes and cancer, which are major risk factors for peripheral neuropathy. China is currently the leader in this region, but India is experiencing the fastest growth.

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

GlaxoSmithKline plc, Lupin Limited, Abbott Laboratories, Cipla Limited, Bristol Myers Squibb, Eli Lilly and Company, Novartis AG, Merck and Co. Inc., Pfizer Inc. Reddy's Laboratories, and others.

In Jan 2023, Researchers at the Salk Institute (US) published a groundbreaking study in Nature. They found that low levels of the amino acid serine increased the risk of peripheral neuropathy in diabetic mice. This exciting discovery opens doors for exploring serine supplementation as a potential treatment to alleviate neuropathy symptoms, and perhaps even pave the way for future cure development.

In Jan 2023, Neuralace Medical Inc. (US) announced a significant step forward with the enrollment of the first patients in their Axon Therapy and Painful Diabetic Neuropathy (AT-PDN) study. This clinical trial, aiming to recruit around 80 patients across five sites led by Dr. Lora Brown at TruWell Health (Florida), represents a promising avenue for exploring new treatment options for diabetic neuropathy.

| Report Attributes | Details |

| Market Size in 2023 | US$ 1.48 Bn |

| Market Size by 2032 | US$ 2.38 Bn |

| CAGR | CAGR of 5.46% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Diabetic Peripheral, Neuropathy, Chemotherapy-induced Peripheral Neuropathy, Idiopathic Peripheral Neuropathy, HIV/AIDS Associated Peripheral Neuropathy) • By Treatment (Pharmacological Therapies, Non-Pharmacological Therapies, Others) • By End User (Hospitals & Clinics, Ambulatory Care, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | GlaxoSmithKline plc, Lupin Limited, Abbott Laboratories, Cipla Limited, Bristol Myers Squibb, Eli Lilly and Company, Novartis AG, Merck and Co. Inc., Pfizer Inc. Reddy's Laboratories, and others. |

| Key Drivers | • Rising Cases of Diabetes, Obesity, and Chronic Disease as well as increasing Aging Population |

| Market Restraints | • Higher Treatment Costs |

Ans: The Peripheral Neuropathy Market is growing at a CAGR of 5.46% Over the Forecast Period 2024-2032.

Rise in the number of peripheral neuropathy cases all around the globe which positively impacts the demand.

The latest technology in the developed and the emerging citers of the North America is the reason this region will dominate the market

High cost of peripheral neuropathy treatment.

Ans: The Peripheral Neuropathy Market Size is projected to reach US$ 2.38 Bn by 2032.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Peripheral Neuropathy Market Segmentation, By Type

7.1 Introduction

7.2 Diabetic Peripheral Neuropathy

7.3 Chemotherapy-induced Peripheral Neuropathy

7.4 Idiopathic Peripheral Neuropathy

7.5 HIV/AIDS Associated Peripheral Neuropathy

8. Peripheral Neuropathy Market Segmentation, By Treatment

8.1 Introduction

8.2 Pharmacological Therapies

8.2.1 Pain Relievers

8.2.2 Anti-seizure Medications

8.2.3 Antidepressants

8.3 Non-Pharmacological Therapies

8.3.1 Transcutaneous Electrical Nerve Stimulation

8.3.2 Plasma Exchange

8.3.3 Intravenous Immune Globulin

8.4 Others

9. Peripheral Neuropathy Market Segmentation, By End-user

9.1 Introduction

9.2 Hospitals and Clinics

9.3 Ambulatory Centers

9.4 Others

10. Regional Analysis

10.1 Introduction

10.2 North America

10.2.1 Trend Analysis

10.2.2 North America Peripheral Neuropathy Market by Country

10.2.3 North America Peripheral Neuropathy Market By Type

10.2.4 North America Peripheral Neuropathy Market By Treatment

10.2.5 North America Peripheral Neuropathy Market By End-user

10.2.6 USA

10.2.6.1 USA Peripheral Neuropathy Market By Type

10.2.6.2 USA Peripheral Neuropathy Market By Treatment

10.2.6.3 USA Peripheral Neuropathy Market By End-user

10.2.7 Canada

10.2.7.1 Canada Peripheral Neuropathy Market By Type

10.2.7.2 Canada Peripheral Neuropathy Market By Treatment

10.2.7.3 Canada Peripheral Neuropathy Market By End-user

10.2.8 Mexico

10.2.8.1 Mexico Peripheral Neuropathy Market By Type

10.2.8.2 Mexico Peripheral Neuropathy Market By Treatment

10.2.8.3 Mexico Peripheral Neuropathy Market By End-user

10.3 Europe

10.3.1 Trend Analysis

10.3.2 Eastern Europe

10.3.2.1 Eastern Europe Peripheral Neuropathy Market by Country

10.3.2.2 Eastern Europe Peripheral Neuropathy Market By Type

10.3.2.3 Eastern Europe Peripheral Neuropathy Market By Treatment

10.3.2.4 Eastern Europe Peripheral Neuropathy Market By End-user

10.3.2.5 Poland

10.3.2.5.1 Poland Peripheral Neuropathy Market By Type

10.3.2.5.2 Poland Peripheral Neuropathy Market By Treatment

10.3.2.5.3 Poland Peripheral Neuropathy Market By End-user

10.3.2.6 Romania

10.3.2.6.1 Romania Peripheral Neuropathy Market By Type

10.3.2.6.2 Romania Peripheral Neuropathy Market By Treatment

10.3.2.6.4 Romania Peripheral Neuropathy Market By End-user

10.3.2.7 Hungary

10.3.2.7.1 Hungary Peripheral Neuropathy Market By Type

10.3.2.7.2 Hungary Peripheral Neuropathy Market By Treatment

10.3.2.7.3 Hungary Peripheral Neuropathy Market By End-user

10.3.2.8 Turkey

10.3.2.8.1 Turkey Peripheral Neuropathy Market By Type

10.3.2.8.2 Turkey Peripheral Neuropathy Market By Treatment

10.3.2.8.3 Turkey Peripheral Neuropathy Market By End-user

10.3.2.9 Rest of Eastern Europe

10.3.2.9.1 Rest of Eastern Europe Peripheral Neuropathy Market By Type

10.3.2.9.2 Rest of Eastern Europe Peripheral Neuropathy Market By Treatment

10.3.2.9.3 Rest of Eastern Europe Peripheral Neuropathy Market By End-user

10.3.3 Western Europe

10.3.3.1 Western Europe Peripheral Neuropathy Market by Country

10.3.3.2 Western Europe Peripheral Neuropathy Market By Type

10.3.3.3 Western Europe Peripheral Neuropathy Market By Treatment

10.3.3.4 Western Europe Peripheral Neuropathy Market By End-user

10.3.3.5 Germany

10.3.3.5.1 Germany Peripheral Neuropathy Market By Type

10.3.3.5.2 Germany Peripheral Neuropathy Market By Treatment

10.3.3.5.3 Germany Peripheral Neuropathy Market By End-user

10.3.3.6 France

10.3.3.6.1 France Peripheral Neuropathy Market By Type

10.3.3.6.2 France Peripheral Neuropathy Market By Treatment

10.3.3.6.3 France Peripheral Neuropathy Market By End-user

10.3.3.7 UK

10.3.3.7.1 UK Peripheral Neuropathy Market By Type

10.3.3.7.2 UK Peripheral Neuropathy Market By Treatment

10.3.3.7.3 UK Peripheral Neuropathy Market By End-user

10.3.3.8 Italy

10.3.3.8.1 Italy Peripheral Neuropathy Market By Type

10.3.3.8.2 Italy Peripheral Neuropathy Market By Treatment

10.3.3.8.3 Italy Peripheral Neuropathy Market By End-user

10.3.3.9 Spain

10.3.3.9.1 Spain Peripheral Neuropathy Market By Type

10.3.3.9.2 Spain Peripheral Neuropathy Market By Treatment

10.3.3.9.3 Spain Peripheral Neuropathy Market By End-user

10.3.3.10 Netherlands

10.3.3.10.1 Netherlands Peripheral Neuropathy Market By Type

10.3.3.10.2 Netherlands Peripheral Neuropathy Market By Treatment

10.3.3.10.3 Netherlands Peripheral Neuropathy Market By End-user

10.3.3.11 Switzerland

10.3.3.11.1 Switzerland Peripheral Neuropathy Market By Type

10.3.3.11.2 Switzerland Peripheral Neuropathy Market By Treatment

10.3.3.11.3 Switzerland Peripheral Neuropathy Market By End-user

10.3.3.12 Austria

10.3.3.12.1 Austria Peripheral Neuropathy Market By Type

10.3.3.12.2 Austria Peripheral Neuropathy Market By Treatment

10.3.3.12.3 Austria Peripheral Neuropathy Market By End-user

10.3.3.13 Rest of Western Europe

10.3.3.13.1 Rest of Western Europe Peripheral Neuropathy Market By Type

10.3.3.13.2 Rest of Western Europe Peripheral Neuropathy Market By Treatment

10.3.3.13.3 Rest of Western Europe Peripheral Neuropathy Market By End-user

10.4 Asia-Pacific

10.4.1 Trend Analysis

10.4.2 Asia-Pacific Peripheral Neuropathy Market by Country

10.4.3 Asia-Pacific Peripheral Neuropathy Market By Type

10.4.4 Asia-Pacific Peripheral Neuropathy Market By Treatment

10.4.5 Asia-Pacific Peripheral Neuropathy Market By End-user

10.4.6 China

10.4.6.1 China Peripheral Neuropathy Market By Type

10.4.6.2 China Peripheral Neuropathy Market By Treatment

10.4.6.3 China Peripheral Neuropathy Market By End-user

10.4.7 India

10.4.7.1 India Peripheral Neuropathy Market By Type

10.4.7.2 India Peripheral Neuropathy Market By Treatment

10.4.7.3 India Peripheral Neuropathy Market By End-user

10.4.8 Japan

10.4.8.1 Japan Peripheral Neuropathy Market By Type

10.4.8.2 Japan Peripheral Neuropathy Market By Treatment

10.4.8.3 Japan Peripheral Neuropathy Market By End-user

10.4.9 South Korea

10.4.9.1 South Korea Peripheral Neuropathy Market By Type

10.4.9.2 South Korea Peripheral Neuropathy Market By Treatment

10.4.9.3 South Korea Peripheral Neuropathy Market By End-user

10.4.10 Vietnam

10.4.10.1 Vietnam Peripheral Neuropathy Market By Type

10.4.10.2 Vietnam Peripheral Neuropathy Market By Treatment

10.4.10.3 Vietnam Peripheral Neuropathy Market By End-user

10.4.11 Singapore

10.4.11.1 Singapore Peripheral Neuropathy Market By Type

10.4.11.2 Singapore Peripheral Neuropathy Market By Treatment

10.4.11.3 Singapore Peripheral Neuropathy Market By End-user

10.4.12 Australia

10.4.12.1 Australia Peripheral Neuropathy Market By Type

10.4.12.2 Australia Peripheral Neuropathy Market By Treatment

10.4.12.3 Australia Peripheral Neuropathy Market By End-user

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Peripheral Neuropathy Market By Type

10.4.13.2 Rest of Asia-Pacific Peripheral Neuropathy Market By Treatment

10.4.13.3 Rest of Asia-Pacific Peripheral Neuropathy Market By End-user

10.5 Middle East & Africa

10.5.1 Trend Analysis

10.5.2 Middle East

10.5.2.1 Middle East Peripheral Neuropathy Market by Country

10.5.2.2 Middle East Peripheral Neuropathy Market By Type

10.5.2.3 Middle East Peripheral Neuropathy Market By Treatment

10.5.2.4 Middle East Peripheral Neuropathy Market By End-user

10.5.2.5 UAE

10.5.2.5.1 UAE Peripheral Neuropathy Market By Type

10.5.2.5.2 UAE Peripheral Neuropathy Market By Treatment

10.5.2.5.3 UAE Peripheral Neuropathy Market By End-user

10.5.2.6 Egypt

10.5.2.6.1 Egypt Peripheral Neuropathy Market By Type

10.5.2.6.2 Egypt Peripheral Neuropathy Market By Treatment

10.5.2.6.3 Egypt Peripheral Neuropathy Market By End-user

10.5.2.7 Saudi Arabia

10.5.2.7.1 Saudi Arabia Peripheral Neuropathy Market By Type

10.5.2.7.2 Saudi Arabia Peripheral Neuropathy Market By Treatment

10.5.2.7.3 Saudi Arabia Peripheral Neuropathy Market By End-user

10.5.2.8 Qatar

10.5.2.8.1 Qatar Peripheral Neuropathy Market By Type

10.5.2.8.2 Qatar Peripheral Neuropathy Market By Treatment

10.5.2.8.3 Qatar Peripheral Neuropathy Market By End-user

10.5.2.9 Rest of Middle East

10.5.2.9.1 Rest of Middle East Peripheral Neuropathy Market By Type

10.5.2.9.2 Rest of Middle East Peripheral Neuropathy Market By Treatment

10.5.2.9.3 Rest of Middle East Peripheral Neuropathy Market By End-user

10.5.3 Africa

10.5.3.1 Africa Peripheral Neuropathy Market by Country

10.5.3.2 Africa Peripheral Neuropathy Market By Type

10.5.3.3 Africa Peripheral Neuropathy Market By Treatment

10.5.3.4 Africa Peripheral Neuropathy Market By End-user

10.5.3.5 Nigeria

10.5.3.5.1 Nigeria Peripheral Neuropathy Market By Type

10.5.3.5.2 Nigeria Peripheral Neuropathy Market By Treatment

10.5.3.5.3 Nigeria Peripheral Neuropathy Market By End-user

10.5.3.6 South Africa

10.5.3.6.1 South Africa Peripheral Neuropathy Market By Type

10.5.3.6.2 South Africa Peripheral Neuropathy Market By Treatment

10.5.3.6.3 South Africa Peripheral Neuropathy Market By End-user

10.5.3.7 Rest of Africa

10.5.3.7.1 Rest of Africa Peripheral Neuropathy Market By Type

10.5.3.7.2 Rest of Africa Peripheral Neuropathy Market By Treatment

10.5.3.7.3 Rest of Africa Peripheral Neuropathy Market By End-user

10.6 Latin America

10.6.1 Trend Analysis

10.6.2 Latin America Peripheral Neuropathy Market by country

10.6.3 Latin America Peripheral Neuropathy Market By Type

10.6.4 Latin America Peripheral Neuropathy Market By Treatment

10.6.5 Latin America Peripheral Neuropathy Market By End-user

10.6.6 Brazil

10.6.6.1 Brazil Peripheral Neuropathy Market By Type

10.6.6.2 Brazil Peripheral Neuropathy Market By Treatment

10.6.6.3 Brazil Peripheral Neuropathy Market By End-user

10.6.7 Argentina

10.6.7.1 Argentina Peripheral Neuropathy Market By Type

10.6.7.2 Argentina Peripheral Neuropathy Market By Treatment

10.6.7.3 Argentina Peripheral Neuropathy Market By End-user

10.6.8 Colombia

10.6.8.1 Colombia Peripheral Neuropathy Market By Type

10.6.8.2 Colombia Peripheral Neuropathy Market By Treatment

10.6.8.3 Colombia Peripheral Neuropathy Market By End-user

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Peripheral Neuropathy Market By Type

10.6.9.2 Rest of Latin America Peripheral Neuropathy Market By Treatment

10.6.9.3 Rest of Latin America Peripheral Neuropathy Market By End-user

11. Company Profiles

11.1 GlaxoSmithKline plc

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 The SNS View

11.2 Lupin Limited

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 The SNS View

11.3 Abbott Laboratories

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 The SNS View

11.4 Cipla Limited

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 The SNS View

11.5 Bristol Myers Squibb

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 The SNS View

11.6 Eli Lilly and Company

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 The SNS View

11.7 Novartis AG

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 The SNS View

11.8 Merck and Co. Inc.

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 The SNS View

11.9 Pfizer Inc.

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 The SNS View

11.10 Reddy's Laboratories

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 The SNS View

12. Competitive Landscape

12.1 Competitive Benchmarking

12.2 Market Share Analysis

12.3 Recent Developments

12.3.1 Industry News

12.3.2 Company News

12.3.3 Mergers & Acquisitions

13. Use Case and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Transplant Diagnostics Market Size was valued at USD 5.40 billion in 2023 and is expected to reach USD 10.25 billion by 2032 and grow at a CAGR of 7.39% over the forecast period 2024-2032.

The Nuclear Magnetic Resonance Spectroscopy Market size was USD 1.31 billion in 2023, expected to reach USD 2.08 billion by 2032 and grow at a CAGR of 5.26%.

The Oncology-Based Molecular Diagnostics Market was valued at USD 2.76 billion in 2023 and is expected to reach USD 7.71 billion by 2032, growing at a CAGR of 12.12% over the forecast period of 2024-2032.

The Dental Tourism Market was valued at USD 10.91 billion in 2023 and is expected to reach USD 65.4 billion by 2032, growing at a CAGR of 22.03% over the forecast period 2024-2032.

Burn Ointment Market Size was valued at USD 1.01 Billion in 2023 and is expected to reach USD 1.71 billion by 2032, growing at a CAGR of 6.04% over the forecast period 2024-2032.

Hereditary Testing Market size was valued at USD 7.1 billion in 2023 and is expected to reach USD 14.6 billion by 2032, with a CAGR of 8.3% from 2024 to 2032.

Hi! Click one of our member below to chat on Phone