Get More Information on Peer to peer lending Market - Request Sample Report

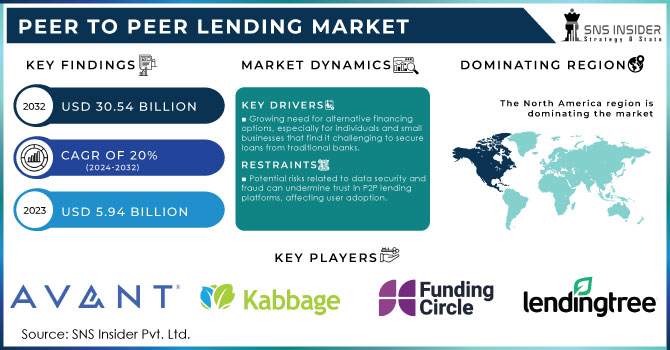

Peer to peer lending Market was valued at USD 5.94 billion in 2023 and is expected to grow to USD 30.54 billion by 2032 and grow at a CAGR of 20% over the forecast period of 2024-2032.

Rising need for alternative financing options is fuelling the growth of peer 2peer (P2p) lending market. P2P lending platforms are an appealing alternative for people and small businesses, as traditional sources of loans or investments like banks may not always be accessible. These digital platforms create an ecosystem for soft credit, providing access to a larger market of loans and enabling borrowers with poor establish ability-to-pay credentials to borrow money. This growth has been driven by technological innovation. thanks to online platforms and digital infrastructure that fuel peer-to-peer communication between borrowers and lenders. No intermediaries and machine learning algorithms increased efficiency in the credit risk assessment; lending decisions are now quicker as compared to traditional methods. Investors have recorded average returns of between 5% and 7% per year from P2P lending platforms. In 2024, many countries have announced a series of new rules or amendments to help safeguard the interests of investors and increase transparency in P2P lending. The European Union, for example has begun new disclosure obligations of P2P-platforms to make sure that all investors can rate risks better.

However, the possibility of higher returns than traditional investment opportunities is also driven the peer-to-peer lending market. P2Ps enable individuals to lend money directly into loans, offering an alternative form of risk and reward that could beat standard returns by a savings account or other financially savvy alternatives. What more, the heightened transparency and easy-to-understand processes of these platforms have only added to their appeal. This allows borrowers to compare loan terms, rates and fees so they can make an educated decision and without all the extensive paperwork. Moreover, the rapid expansion of fintech companies in the U.S. and increased integration P2P lending across BFSI domain is driving market growth. Use of advanced technologies, like AI and ML is growing on P2P lending platforms. Close to 40% of platforms are using these technologies for credit scoring and risk management. Investor returns for US based P2P lending platforms have traditionally averaged about 6%-8% per year, give or take a little surrounding loan level credit risk and platform performance. About 70% of US P2P platforms´ borrowers are individuals needing personal loans. The remaining 30 percent are small businesses looking for a loan. State of AI and Machine Learning: Around 50% of P2P lending platforms in the US are now augmenting their practices with artificial intelligence, primarily to help improve credit scoring models as well new fraud detection.

Drivers

Growing need for alternative financing options, especially for individuals and small businesses that find it challenging to secure loans from traditional banks.

Innovations in digital platforms, advanced algorithms, and data analytics streamline the lending process, making P2P lending more efficient and accessible.

P2P lending offers potentially higher returns compared to traditional savings or investment options, attracting more investors to the market.

P2P platforms provide borrowers with clear loan terms and flexible repayment options, making them an attractive choice for personal and business loans.

The growing demand for alternative financing options, especially from individuals and small businesses that have difficulty obtaining loans through traditional banking services is acting as the major driver of global Peer-to-Peer (P2P) Lending market. Traditional banks tend to have stricter lending criteria making it difficult for those with low credit scores or small businesses just getting started access the loans they need. P2P lending platforms bridge the gap by making borrowing much easier and streamlined. A TransUnion survey from 2023, for example, found that approximately 60% of small business owners felt they couldn't readily get loans through traditional banks and turned to alternative financing avenues such as P2P lending instead. This demand is only further driven by the flexibility and convenience provided through P2P lending platforms. Lending Club, for example, international survey across 24 banks in early 2024 that said borrowers have indicated a faster approval process as one of the key reasons 70% of consumers decided to get loans from Lending Club as compared to traditional banks. 65% percent also valued adjusting the loan amount and payback time to be more personalized, per a release.

Restraints

Inconsistent or evolving regulations in different regions can pose challenges to the growth and operations of P2P lending platforms.

Higher risk of default, especially with borrowers who have limited credit history or are considered high-risk, can deter potential lenders.

Potential risks related to data security and fraud can undermine trust in P2P lending platforms, affecting user adoption.

One of the major challenges for the peer-to-peer (P2P) lending market is regulatory uncertainties, which differ case by case based on regions. Because P2P lending is such a new financial model, many governments and financial regulators are still working on putting good frameworks in place to control how it works. Some examples include India's Reserve Bank of India (RBI) proposed guidelines back in 2017 and there have been changes to the P2P market since that time, raising potential hurdles for these platform operators working hard to comply with new demands. In the U.S. for example, there is federal oversight by way of the Securities and Exchange Commission (SEC) but each state has its own set of laws making it fairly complex to operate a P2P platform everywhere in America. Such regulatory uncertainty can directly translate into higher compliance costs, market entry delays and the threat of sudden changes in operations should new rules nationwide. Greater than 40% of P2P platforms had listed regulatory challenges as a leading impediment towards growth in the year-2023 survey.

By type

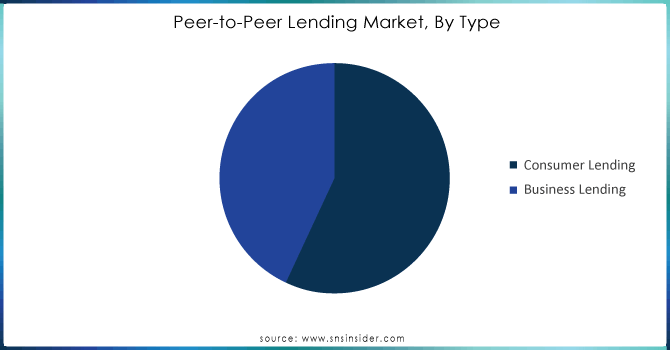

The P2P lending market was led by the consumer lending segment, which generated more than 58% of revenue share in 2023. P2P lending also appeals to consumers looking for loans at lower interest rates than most traditional banks or credit unions. P2P lenders are able to offer more competitive rates because they provide their services on far lower margins than traditional banks who allocate large overhead costs. Moreover, the automated underwriting process at P2P platforms helps both in lowering the cost of lending and thus is an attractive option for anyone seeking to borrow money cheaply.

The vertical of business lending is anticipated to undergo the highest growth, registering a CAGR in excess of 21.8% during the forecast period, For P2P most of the businesses started opting since it helps to avoid so many formalities and hard procedures for loan approval on bank traditional loans. Since P2P loans are also digital in nature, the application process is faster and more convenient for many small businesses. In addition, P2P loans are especially popular for startups and small businesses because they generally come with lower funding caps thus, making them an attractive financing option to these types of enterprises.

Need any customization research on Peer-to-Peer Lending Market - Enquiry Now

By End-use

Non-business loans segment led the P2P lending market in 2023, representing over 73% of revenue share. Individuals use personal loans to cover numerous financial needs like debt consolidation, home repair and renovation projects a or remodel homes again for cheap medical expenses education & funeral expenses etc. And with the flexibility of loan sizes and tenures, P2P lending platforms are a perfect choice for personal loans with smaller amounts and shorter repayment plans.

Business loans are estimated to be the fastest growing segment at 22.1% CAGR during forecast period of2024-2032, small- and medium-sized enterprises (SMEs) find it difficult to secure a traditional bank loan when they are in the early stages or times of financial uncertainty. P2P lending platforms provide another avenue, enabling these kinds of businesses access to more suitable financial options that can allow them seek out the capital they need for expansion and growth. In addition, businesses looking for quicker access to capital in order take advantage of opportunities or meet short-term finance requirements find the quick and efficient loan application processes on P2P platforms appealing.

Regional Analysis

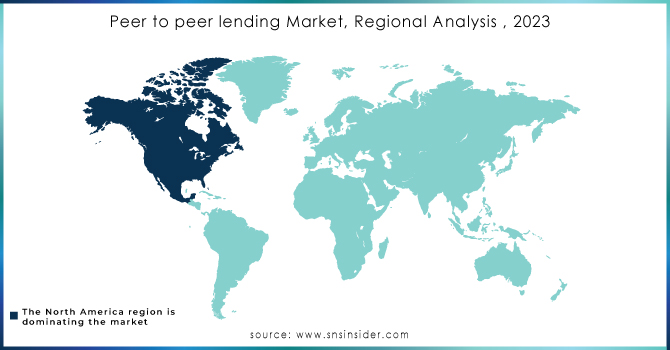

North America emerged as a leading region with more than 33% of revenue share in the year, 2023. As a result of the region already having an established financial ecosystem that was innovative and technology focused has allowed P2P lending portals to grow in popularity with both borrowers seeking funding solutions as well investors looking for higher returns. The widespread use of digital platforms in North America also means there is a large population comfortable with applying for loans and transferring money online, making P2P lending particularly popular. The region has been arguing for a relatively emerging regulatory framework, laying down the foundation needed for P2P lending platform growth.

On the other hand, Asia Pacific is anticipated to grow at a highest CAGR of 22% throughout the forecast period. The region is home to a large number of unbanked or underbanked, people with limited access to traditional financial services. With an alternative funding source available through P2P lending, the demand for credit has increased throughout the region. In addition, Asia Pacific is the world's fastest-growing economic region and a driving force for entrepreneurship as well small business development. With P2P lending platforms being another avenue that these businesses are using to access capital, the growth of P2P lending in turn is driven by business across this region.

The major key players are Avant, LLC., Funding Circle, Kabbage Inc., Lending Club Corporation, LendingTree, LLC, OnDeck, Prosper Funding LLC, RateSetter, Social Finance, Inc, Zopa Bank Limited.

Recent Developments

| Report Attributes | Details |

| Market Size in 2023 | USD 5.94 Bn |

| Market Size by 2032 | USD 30.54 Bn |

| CAGR | CAGR of 20% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Consumer Lending, Business Lending) • By Loan Type (Secured, Unsecured) • By Purpose Type (Repaying Bank Debt, Family Celebration, Credit Card Recycling, Buying Car, Education, Home Renovation, Others) • By End-user (Non Business Loans, Business Loans) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Avant, LLC., Funding Circle, Kabbage Inc., Lending Club Corporation, LendingTree, LLC, OnDeck, Prosper Funding LLC, RateSetter, Social Finance, Inc, Zopa Bank Limited. |

| Key Drivers | • Growing need for alternative financing options, especially for individuals and small businesses that find it challenging to secure loans from traditional banks. • Innovations in digital platforms, advanced algorithms, and data analytics streamline the lending process, making P2P lending more efficient and accessible. |

| Market Opportunities | • Inconsistent or evolving regulations in different regions can pose challenges to the growth and operations of P2P lending platforms. |

Ans:- The Peer-to-Peer Lending Market size was valued at USD 5.94 Bn in 2023.

Ans: Yes, you can customize the report as per your requirements.

Ans:- In 2023, North America accounted largest market share for the Peer-to-Peer Lending Market.

Ans:- The major key players are Avant, LLC., Funding Circle, Kabbage Inc., Lending Club Corporation, LendingTree, LLC, OnDeck, Prosper Funding LLC, RateSetter, Social Finance, Inc, Zopa Bank Limited.

Ans:- The study includes a comprehensive analysis of worldwide Peer-to-Peer Lending Market trends, as well as present and future market forecasts.market's major drivers, opportunities, and constraints and Porter's five forces analysis aids etc

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Network Infrastructure Expansion, By Region

5.3 Cybersecurity Incidents, By Region (2020-2023)

5.4 Cloud Services Usage, By Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Peer to peer lending Market Segmentation, by Type

7.1 Chapter Overview

7.2 Consumer Lending

7.2.1 Consumer Lending Market Trends Analysis (2020-2032)

7.2.2 Consumer Lending Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Business Lending

7.3.1 Business Lending Market Trends Analysis (2020-2032)

7.3.2 Business Lending Market Size Estimates and Forecasts to 2032 (USD Million)

8. Peer to peer lending Market Segmentation, by Loan Type

8.1 Chapter Overview

8.2 Secured

8.2.1 Secured Market Trends Analysis (2020-2032)

8.2.2 Secured Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Unsecured

8.3.1 Unsecured Market Trends Analysis (2020-2032)

8.3.2 Unsecured Market Size Estimates and Forecasts to 2032 (USD Million)

9. Peer to peer lending Market Segmentation, by Purpose Type

9.1 Chapter Overview

9.2 Repaying Bank Debt

9.2.1 Repaying Bank Debt Market Trends Analysis (2020-2032)

9.2.2 Repaying Bank Debt Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 Family Celebration

9.3.1 Family Celebration Market Trends Analysis (2020-2032)

9.3.2 Family Celebration Market Size Estimates and Forecasts to 2032 (USD Million)

9.4 Credit Card Recycling

9.4.1 Credit Card Recycling Market Trends Analysis (2020-2032)

9.4.2 Credit Card Recycling Market Size Estimates and Forecasts to 2032 (USD Million)

9.5 Buying Car

9.5.1 Buying Car Market Trends Analysis (2020-2032)

9.5.2 Buying Car Market Size Estimates and Forecasts to 2032 (USD Million)

9.6 Education

9.6.1 Education Market Trends Analysis (2020-2032)

9.6.2 Education Market Size Estimates and Forecasts to 2032 (USD Million)

9.7 Home Renovation

9.7.1 Home Renovation Market Trends Analysis (2020-2032)

9.7.2 Home Renovation Market Size Estimates and Forecasts to 2032 (USD Million)

9.8 Others

9.8.1 Others Market Trends Analysis (2020-2032)

9.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

10. Peer to peer lending Market Segmentation, by end user

10.1 Chapter Overview

10.2 Non Business Loans

10.2.1 Non Business Loans Market Trends Analysis (2020-2032)

10.2.2 Non Business Loans Market Size Estimates and Forecasts to 2032 (USD Million)

10.3 Business Loans

10.3.1 Business Loans Market Trends Analysis (2020-2032)

10.3.2 Business Loans Market Size Estimates and Forecasts to 2032 (USD Million)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Peer to peer lending Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.2.3 North America Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.2.4 North America Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.2.5 North America Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.2.6 North America Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.2.7 USA

11.2.7.1 USA Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.2.7.2 USA Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.2.7.3 USA Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.2.7.4 USA Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.2.7 Canada

11.2.7.1 Canada Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.2.7.2 Canada Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.2.7.3 Canada Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.2.7.3 Canada Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.2.8 Mexico

11.2.8.1 Mexico Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.2.8.2 Mexico Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.2.8.3 Mexico Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.2.8.3 Mexico Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Peer to peer lending Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.3.1.3 Eastern Europe Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.1.4 Eastern Europe Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.3.1.5 Eastern Europe Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.3.1.5 Eastern Europe Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.3.1.6 Poland

11.3.1.6.1 Poland Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.1.6.2 Poland Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.3.1.6.3 Poland Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.3.1.6.3 Poland Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.3.1.7 Romania

11.3.1.7.1 Romania Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.1.7.2 Romania Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.3.1.7.3 Romania Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.3.1.7.3 Romania Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.3.1.8 Hungary

11.3.1.8.1 Hungary Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.1.8.2 Hungary Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.3.1.8.3 Hungary Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.3.1.8.3 Hungary Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.3.1.9 Turkey

11.3.1.9.1 Turkey Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.1.9.2 Turkey Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.3.1.9.3 Turkey Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.3.1.9.3 Turkey Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.1.11.2 Rest of Eastern Europe Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.3.1.11.3 Rest of Eastern Europe Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.3.1.11.3 Rest of Eastern Europe Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Peer to peer lending Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.3.2.3 Western Europe Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.4 Western Europe Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.3.2.5 Western Europe Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.3.2.5 Western Europe Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.3.2.6 Germany

11.3.2.6.1 Germany Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.6.2 Germany Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.3.2.6.3 Germany Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.3.2.6.3 Germany Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.3.2.7 France

11.3.2.7.1 France Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.7.2 France Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.3.2.7.3 France Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.3.2.7.3 France Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.3.2.8 UK

11.3.2.8.1 UK Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.8.2 UK Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.3.2.8.3 UK Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.3.2.8.3 UK Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.3.2.9 Gamingaly

11.3.2.9.1 Gamingaly Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.9.2 Gamingaly Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.3.2.9.3 Gamingaly Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.3.2.9.3 Gamingaly Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.3.2.11 Spain

11.3.2.11.1 Spain Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.11.2 Spain Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.3.2.11.3 Spain Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.3.2.11.3 Spain Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.3.2.11 Netherlands

11.3.2.11.1 Netherlands Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.11.2 Netherlands Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.3.2.11.3 Netherlands Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.3.2.11.3 Netherlands Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.3.2.12 SwGamingzerland

11.3.2.12.1 SwGamingzerland Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.12.2 SwGamingzerland Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.3.2.12.3 SwGamingzerland Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.3.2.12.3 SwGamingzerland Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.3.2.13 Austria

11.3.2.13.1 Austria Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.13.2 Austria Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.3.2.13.3 Austria Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.3.2.13.3 Austria Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.3.2.14 Rest of Western Europe

11.3.2.14.1 Rest of Western Europe Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.14.2 Rest of Western Europe Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.3.2.14.3 Rest of Western Europe Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.3.2.14.3 Rest of Western Europe Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Peer to peer lending Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.4.3 Asia Pacific Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.4 Asia Pacific Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.4.5 Asia Pacific Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.4.5 Asia Pacific Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.4.6 China

11.4.6.1 China Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.6.2 China Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.4.6.3 China Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.4.6.3 China Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.4.7 India

11.4.7.1 India Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.7.2 India Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.4.7.3 India Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.4.7.3 India Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.4.8 Japan

11.4.8.1 Japan Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.8.2 Japan Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.4.8.3 Japan Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.4.8.3 Japan Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.4.9 South Korea

11.4.9.1 South Korea Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.9.2 South Korea Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.4.9.3 South Korea Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.4.9.3 South Korea Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.4.11 Vietnam

11.4.11.1 Vietnam Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.11.2 Vietnam Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.4.11.3 Vietnam Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.4.11.3 Vietnam Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.4.11 Singapore

11.4.11.1 Singapore Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.11.2 Singapore Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.4.11.3 Singapore Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.4.11.3 Singapore Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.4.12 Australia

11.4.12.1 Australia Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.12.2 Australia Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.4.12.3 Australia Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.4.12.3 Australia Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.4.13 Rest of Asia Pacific

11.4.13.1 Rest of Asia Pacific Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.13.2 Rest of Asia Pacific Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.4.13.3 Rest of Asia Pacific Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.4.13.3 Rest of Asia Pacific Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Peer to peer lending Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.5.1.3 Middle East Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.1.4 Middle East Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.5.1.5 Middle East Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.5.1.5 Middle East Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.5.1.6 UAE

11.5.1.6.1 UAE Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.1.6.2 UAE Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.5.1.6.3 UAE Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.5.1.6.3 UAE Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.5.1.7 Egypt

11.5.1.7.1 Egypt Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.1.7.2 Egypt Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.5.1.7.3 Egypt Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.5.1.7.3 Egypt Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.5.1.8 Saudi Arabia

11.5.1.8.1 Saudi Arabia Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.1.8.2 Saudi Arabia Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.5.1.8.3 Saudi Arabia Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.5.1.8.3 Saudi Arabia Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.5.1.9 Qatar

11.5.1.9.1 Qatar Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.1.9.2 Qatar Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.5.1.9.3 Qatar Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.5.1.9.3 Qatar Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.1.11.2 Rest of Middle East Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.5.1.11.3 Rest of Middle East Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.5.1.11.3 Rest of Middle East Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Peer to peer lending Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.5.2.3 Africa Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.2.4 Africa Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.5.2.5 Africa Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.5.2.8.3 Africa Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.5.2.6 South Africa

11.5.2.6.1 South Africa Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.2.6.2 South Africa Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.5.2.6.3 South Africa Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.5.2.8.3 South Africa Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.5.2.7 Nigeria

11.5.2.7.1 Nigeria Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.2.7.2 Nigeria Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.5.2.7.3 Nigeria Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.5.2.8.3 Nigeria Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.5.2.8 Rest of Africa

11.5.2.8.1 Rest of Africa Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.2.8.2 Rest of Africa Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.5.2.8.3 Rest of Africa Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.5.2.8.3 Rest of Africa Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Peer to peer lending Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.6.3 Latin America Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.6.4 Latin America Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.6.5 Latin America Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.6.5 Latin America Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.6.6 Brazil

11.6.6.1 Brazil Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.6.6.2 Brazil Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.6.6.3 Brazil Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.6.6.3 Brazil Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.6.7 Argentina

11.6.7.1 Argentina Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.6.7.2 Argentina Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.6.7.3 Argentina Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.6.7.3 Argentina Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.6.8 Colombia

11.6.8.1 Colombia Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.6.8.2 Colombia Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.6.8.3 Colombia Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.6.8.3 Colombia Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.6.9 Rest of Latin America

11.6.9.1 Rest of Latin America Peer to peer lending Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.6.9.2 Rest of Latin America Peer to peer lending Market Estimates and Forecasts, by Loan Type (2020-2032) (USD Million)

11.6.9.3 Rest of Latin America Peer to peer lending Market Estimates and Forecasts, by Purpose Type (2020-2032) (USD Million)

11.6.9.3 Rest of Latin America Peer to peer lending Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

12. Company Profiles

12.1 Avant, LLC.

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Funding Circle

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Kabbage Inc.

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Lending Club Corporation

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 LendingTree, LLC

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 OnDeck

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Prosper Funding LLC

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 RateSetter

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Social Finance, Inc.

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Zopa Bank Limited.

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Consumer Lending

Business Lending

By Loan Type

Secured

Unsecured

By Purpose Type

Repaying Bank Debt

Family Celebration

Credit Card Recycling

Buying Car

Education

Home Renovation

Others

By End-user

Non Business Loans

Business Loans

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

3D Printing Market Size was valued at USD 21.1 billion in 2023 and is expected to reach USD 118.9 billion by 2032, growing at a CAGR of 21.2 % over the forecast period 2024-2032.

The Commercial Artificial Intelligence Market Size was valued at USD 2.28 Billion in 2023 and is expected to reach USD 39.39 Billion by 2032, and grow at a CAGR of 37.25% over the forecast period 2024-2032.

Cognitive Process Automation Market was valued at USD 6.55 billion in 2023 and will reach USD 53.48 billion by 2032, growing at a CAGR of 26.33% by 2032.

The Sports Analytics Market Size was valued at USD 3.53 billion in 2023 and is witnessed to reach USD 20.48 billion by 2032 and grow at a CAGR of 22.51% over the forecast period 2024-2032.

The MulteFire Market was valued at USD 1.6 billion in 2023 and is expected to reach USD 19.6 billion by 2032, growing at a CAGR of 31.69% from 2024-2032.

The Green IT Services Market was valued at USD 18.8 Billion in 2023 and is expected to reach USD 69.4 Billion by 2032, growing at a CAGR of 15.65% from 2024-2032.

Hi! Click one of our member below to chat on Phone