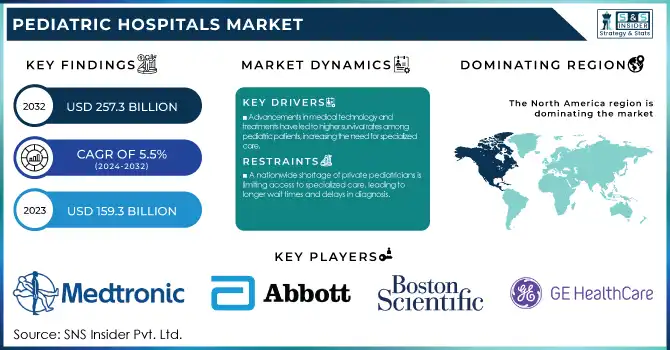

The Pediatric Hospitals Market was valued at USD 159.3 billion in 2023 and is expected to reach USD 257.3 billion by 2032, growing at a CAGR of 5.5% over the forecast period 2024-2032.

To Get more information on Pediatric Hospitals Market - Request Free Sample Report

The Pediatric Hospitals Market Report provides critical statistical insights and trends shaping the industry. Pediatrics highlights incidence and prevalence rates for pediatric diseases and prescription trends by region with the most commonly prescribed medications. The report analyzes healthcare spending trends, including government, private, and out-of-pocket spending on pediatric care. It also investigates drug volume trends, looking at pharmaceutical production and consumption in paediatrics. The report also explores hospital infrastructure and bed capacity, tracing the growth of pediatric and specialized care facilities. It evaluates technological integration that centers on the adoption of EHR, telemedicine, and AI-driven diagnostics in pediatric hospitals. Such information is valuable and holds up-to-date processes where emerging trends and challenges can be recognized and ensured by the stakeholders. The pediatric hospitals market can broadly be divided into emergency medicine, pediatric surgery, etc., and has been witnessing robust growth as each hospital improves its existing services and adds new areas of specialization as per the advice of healthcare professionals and organizations. In October 2023, the World Health Organization estimated that 5 million children under the age of 5 died, 47 percent of them in the first month of their lives. This statistic highlights the essential need for specialized pediatric care.

Drivers

Advancements in medical technology and treatments have led to higher survival rates among pediatric patients, increasing the need for specialized care.

Advancements in medical technology and treatments have significantly improved survival rates among pediatric patients, leading to an increased demand for specialized pediatric care. For example, the All India Institute of Medical Sciences (AIIMS) in New Delhi boasts a 75-80% survival rate among children treated for cancer, managing around 400 new pediatric cancer patients annually. Advances in genomic medicine are also leading to better outcomes. Research initiatives in Australia aim to enhance diagnostic accuracy and personalized treatments for rare childhood diseases, with the goal of achieving a 70% diagnostic success rate and diagnosing all affected children within their first year. Further, the growing use of Artificial Intelligence (AI) in pediatric care is revolutionizing diagnosis and treatment planning. AI-driven tools assist in the real-time analysis of vast data sets, which is vital for managing diseases such as asthma and diabetes, as well as for identifying potential health risks at an early stage and facilitating timely interventions.

Restraints:

A nationwide shortage of private pediatricians is limiting access to specialized care, leading to longer wait times and delays in diagnosis.

There is also a shortage of private pediatricians, and this is a major restraint for the pediatric hospitals market, which reduces the access to specialized care for children. It has also led to long waiting times for pediatric specialist appointments in the United States, where some patients may wait more than a year for needed consultations. This delay can negatively impact early diagnosis and treatment, which are of utmost importance in pediatric care. Several factors contribute to this shortage. Moreover, pediatricians have traditionally been one of the least well-paid medical specialists, earning up to 25% less than their colleagues, a disincentive for medical graduates, especially ones with large student debt. Moreover, many pediatric patients are covered by Medicaid, which reimburses pediatricians less than private insurance or Medicare, making the specialty less appealing to enter. The implications of this scarcity are far-reaching. This can result in families having to travel long distances or even move to find essential pediatric services, which adds stress and strain to the family financially. Increased reports of child health issues and decreased access to pediatric care can lead to delayed treatments that may result in chronic health issues that could have long-term financial implications.

Opportunities:

Healthcare infrastructure expansion is currently one of the most significant opportunities in the pediatric hospital market to enhance access to specialized pediatric care worldwide. Recent trends highlight this pattern, indicating an increased focus on the growing demand for pediatric care. Children's Health and UT Southwestern Medical Center have proposed a $5 billion new pediatric health campus in Dallas’s Southwestern Medical District. Covering more than 33 acres, the nearly 2 million-square-foot hospital will comprise two 12-story towers and one eight-story tower, replacing the current Children’s Medical Center Dallas. This expansion will increase inpatient capacity by 38%, adding 552 beds, and is expected to open within the next six to seven years.

Similarly, in North Carolina, UNC Health and Duke Health are collaborating to build the state's first standalone children's hospital. The proposed facility with 500 beds will include an outpatient care center and a behavioral health center, with construction projected to start by 2027 and take six years to be completed. The $2.5 billion project is expected to greatly enhance access to care for regional children. The largest hospital in the world specializing in pediatric oncology was built in Egypt alongside this research; it was the Children’s Cancer Hospital Egypt, with 320 beds. The hospital serves almost half of all pediatric cancer cases in Egypt and has many facilities, including playrooms, a library and a 90,000-square-foot park, to help with holistic care. This is a sign of a global commitment to building pediatric health care infrastructure in an ever-growing demand for specialized services, helping to improve health outcomes for children in the United States and around the world.

Challenges:

The high cost of pediatric care creates barriers to access for many families, leading to delayed or forgone necessary treatments and worsened health outcomes

Pediatric healthcare costs are on the rise, which causes many challenges for families and healthcare systems around the world. In the United States, medical spending for children with mental health diagnoses increased 31% from 2017 to 2021, with an average of $4,361 spent per child each year. That increase added to an estimated $31 billion spent on child mental health services in 2021, nearly half of all spending on pediatric medical care. This problem is compounded by the severe shortage of pediatric healthcare workers. A report published in 2024 by the Children’s Hospital Association identified widespread vacancies in multiple pediatric specialties, with shortages most acute in the neurological, behavioral and mental health specialties. This shortage contributes to longer wait times and decreased access to critical services, which negatively impacts children's health outcomes.

Geographic disparities further exacerbate access to care. Children residing in rural areas are over six times more likely to be admitted to hospitals lacking pediatric services compared to their urban counterparts. Nearly half of these rural hospitalizations do not result in transfers to facilities equipped with pediatric care, underscoring the critical need to expand pediatric services in underserved regions. Furthermore, rising global healthcare costs, such as an estimated medical expense increase of 10.4% in 2025, are on the rise. The increase is being driven by the development of new medical technologies and pharmaceuticals, as well as increased demand for healthcare services. This trend poses sustainability challenges for healthcare systems and financial burdens on families.

By therapeutic area

In 2023, the respiratory segment held the largest revenue share of 21% of the market. The health of children is certainly influenced by varied environmental determinants, among which respiratory diseases constitute the most important ones. For children under the age of 18, asthma is one of the most common chronic diseases, with an estimated 5.1 million children diagnosed in the US, according to the Centers for Disease Control and Prevention (CDC). Acute lower respiratory infections, including pneumonia, have been estimated to cause 15% of all deaths in children younger than 5 years worldwide, according to the World Health Organization. Government agencies across the globe have realised the need to deal with paediatric pulmonary issues. For example, the U.S. Environmental Protection Agency (EPA) has introduced tough air quality standards and educational programs to reduce kids' exposure to environmental toxins that can provoke respiratory issues. The European Respiratory Society has also been advocating for policies to improve air quality and reduce the burden of respiratory diseases in children.

Additionally, increasing uptake of respiratory care technologies, including high-flow nasal cannula therapy and non-invasive ventilation predominantly among the pediatric population, are further steering the growth of this particular segment. The pediatric respiratory care market has also seen growth due to innovations in treatment that have improved treatment outcomes and decreased the duration of stay of pediatric patients being treated for respiratory conditions.

By type

In 2023, the for-profit privately owned segment held the largest revenue share in the market at 40%. These factors partially explain this dominance at for-profit medical institutions, which leverage their profitability to buy state-of-the-art equipment, attract premier medical doctor talent, and design services for a subset of patients. In 2022, about 24% of all community hospitals in the United States were investor-owned for-profit facilities, according to the American Hospital Association. The for-profit pediatric hospitals have shown themselves capable of responding rapidly to market demands and of putting in place innovative models of care. Private facilities and practitioners usually have greater freedom to designate their resources, enabling them to invest in cutting-edge technology and facilities that can draw patients and qualified providers alike. The U.S. Government Accountability Office found that, compared with their non-profit competitors, for-profit hospitals had higher margins in general and were more likely to provide certain specialized services. The growth of for-profit pediatric hospitals has led to the implementation of value-based care models, which align with government incentives to improve the quality of healthcare while managing costs. The Centers for Medicare & Medicaid Services (CMS) has championed similar models, and for-profit organizations have quickly capitalized on them, frequently improving patient outcomes and operational efficiencies.

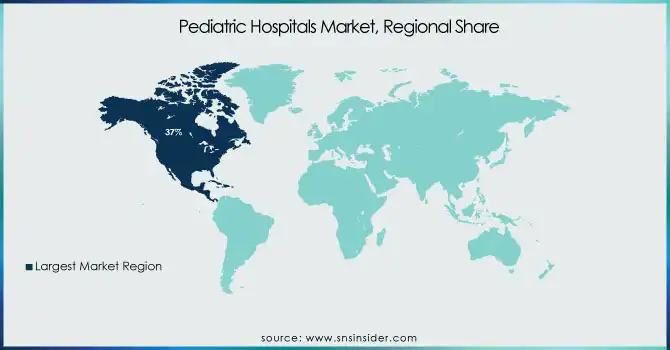

North America held the dominant market share of 37% in the pediatric hospitals market in 2023. These growth factors can be attributed to the advanced healthcare infrastructure, stringent healthcare expenditure, and pediatric research and innovation. In 2022, there were 223 children’s hospitals in the United States, which provide specialized care to millions of children each year, according to the American Hospital Association. The U.S. government demonstrated its dedication to the health of children with its investment in universal coverage for pediatric care. "The National Institutes of Health (NIH), the nation's largest supporter of biomedical research this year appropriated nearly $4.7 billion to pediatric research, exemplifying the nation's commitment to improving children's health outcomes.

Asia Pacific is expected to grow at the fastest CAGR during the forecast period. Exploding demand owing to the rising healthcare expenditure, better healthcare infrastructure, and increasing awareness about pediatric health problems, especially in overpopulated countries like China and India, are acting as drivers for this market. In India, the government has been rolling out schemes such as the Rashtriya Bal Swasthya Karyakram (RBSK) that has made it mandated to provide comprehensive health services to all children until 18 years of age. According to China's National Health Commission, there were 564 children's hospitals at the end of 2022, a substantial increase over the years, which reflects the Chinese government's attention toward pediatric healthcare services. These driving factors, along with the region's massive pediatric population, make it a lucrative market for the pediatric hospital sector.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Service Providers/Manufacturers

Medtronic (MiniMed 670G Insulin Pump, StealthStation Surgical Navigation System)

Abbott Laboratories (FreeStyle Libre 3 Continuous Glucose Monitor, Proclaim Plus Spinal Cord Stimulation System)

Edwards Lifesciences (SAPIEN Transcatheter Heart Valve, HEMOsphere Advanced Monitoring Platform)

Boston Scientific (LATITUDE Patient Management System, SYNERGY Stent System)

Johnson & Johnson (Ethicon) (HARMONIC Scalpel, ENDOLOOP Ligature)

GE Healthcare (Giraffe OmniBed Carestation, BiliSoft Phototherapy System)

Philips Healthcare (IntelliVue Patient Monitors, Affiniti Ultrasound System)

Siemens Healthineers (MAGNETOM MRI Systems, ACUSON Ultrasound Systems)

Stryker Corporation (LIFEPAK Defibrillators, Neptune Waste Management System)

Zimmer Biomet (ROSA Robotics Surgical System, Vanguard Knee System)

Baxter International (SIGMA Spectrum Infusion System, AMIA Automated Peritoneal Dialysis System)

Fresenius Medical Care (2008 Series Hemodialysis Machines, Liberty Cycler for Peritoneal Dialysis)

Cardinal Health (Kangaroo Feeding Pumps, Alaris Infusion Pumps)

Becton, Dickinson and Company (BD) (BD Pyxis Medication Dispensing System, BD Alaris Infusion Pumps)

3M Health Care (Bair Hugger Temperature Management System, Tegaderm Dressings)

Thermo Fisher Scientific (Applied Biosystems Genetic Analyzers, Ion Torrent Next-Generation Sequencers)

Roche Diagnostics (cobas 8000 Modular Analyzer Series, ACCUTREND Plus System)

Danaher Corporation (Beckman Coulter) (DxH 900 Hematology Analyzer, AU5800 Clinical Chemistry Analyzer)

Smith & Nephew (PICO Single Use Negative Pressure Wound Therapy System, VERSAJET II Hydrosurgery System)

Dräger (Babylog VN500 Neonatal Ventilator, Jaundice Meter JM-105)

In February 2025, Children's Health and The University of Texas Southwestern Medical Center announced plans for a new $5 billion pediatric health campus in Dallas, Texas. This state-of-the-art facility aims to address the growing demand for comprehensive pediatric services in the region.

In September 2024, the U.S. Department of Health and Human Services announced a new initiative to enhance mental health services for children and adolescents, dedicating $1.2 billion to increase access to pediatric mental health care nationwide.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 159.3 Billion |

| Market Size by 2032 | USD 257.3 Billion |

| CAGR | CAGR of 5.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Publicly/Government-Owned, Not-for-profit privately Owned, For-profit privately Owned) • By Therapeutic Area (Endocrinology, Gastroenterology, Neurology, Cardiology, Nephrology, Ophthalmology, Allergy & Immunology, Oncology, Respiratory, Anesthesiology, Other Therapeutic Area) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Medtronic, Abbott Laboratories, Edwards Lifesciences, Boston Scientific, Johnson & Johnson (Ethicon), GE Healthcare, Philips Healthcare, Siemens Healthineers, Stryker Corporation, Zimmer Biomet, Baxter International, Fresenius Medical Care, Cardinal Health, Becton, Dickinson and Company (BD), 3M Health Care, Thermo Fisher Scientific, Roche Diagnostics, Danaher Corporation (Beckman Coulter), Smith & Nephew, Dräger |

Ans. The projected market size for the Pediatric Hospitals Market is USD 257.3 Billion by 2032.

Ans: The North American region dominated the Pediatric Hospitals Market in 2023.

Ans. The CAGR of the Pediatric Hospitals Market is 5.5% During the forecast period of 2024-2032.

Ans: Advancements in medical technology and treatments have led to higher survival rates among pediatric patients, increasing the need for specialized care.

Ans: The For-profit privately owned segment dominated the Pediatric Hospitals Market.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence Rates (2023)

5.2 Pediatric Healthcare Spending (2023)

5.3 Drug Volume: Production and Usage Trends in Pediatric Pharmaceuticals

5.4 Hospital Infrastructure and Bed Capacity by Region

5.5 Technological Integration in Pediatric Hospitals (2023)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Pediatric Hospitals Market Segmentation, By Type

7.1 Chapter Overview

7.2 Publicly/Government-Owned

7.2.1 Publicly/Government-Owned Market Trends Analysis (2020-2032)

7.2.2 Publicly/Government-Owned Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Not-for-profit privately Owned

7.3.1 Not-for-profit privately Owned Market Trends Analysis (2020-2032)

7.3.2 Not-for-profit privately Owned Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 For-profit privately Owned

7.4.1 For-profit privately Owned Market Trends Analysis (2020-2032)

7.4.2 For-profit privately Owned Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Pediatric Hospitals Market Segmentation, By Therapeutic Area

8.1 Chapter Overview

8.2 Endocrinology

8.2.1 Endocrinology Market Trends Analysis (2020-2032)

8.2.2 Endocrinology Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Gastroenterology

8.3.1 Gastroenterology Market Trends Analysis (2020-2032)

8.3.2 Gastroenterology Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Neurology

8.4.1 Neurology Market Trends Analysis (2020-2032)

8.4.2 Neurology Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Cardiology

8.5.1 Cardiology Market Trends Analysis (2020-2032)

8.5.2 Cardiology Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Nephrology

8.6.1 Nephrology Market Trends Analysis (2020-2032)

8.6.2 Nephrology Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Ophthalmology

8.7.1 Ophthalmology Market Trends Analysis (2020-2032)

8.7.2 Ophthalmology Market Size Estimates and Forecasts to 2032 (USD Billion)

8.8 Allergy & Immunology

8.8.1 Allergy & Immunology Market Trends Analysis (2020-2032)

8.8.2 Allergy & Immunology Market Size Estimates and Forecasts to 2032 (USD Billion)

8.9 Oncology

8.9.1 Oncology Market Trends Analysis (2020-2032)

8.9.2 Oncology Market Size Estimates and Forecasts to 2032 (USD Billion)

8.10 Respiratory

8.10.1 Respiratory Market Trends Analysis (2020-2032)

8.10.2 Respiratory Market Size Estimates and Forecasts to 2032 (USD Billion)

8.11 Anesthesiology

8.11.1 Anesthesiology Market Trends Analysis (2020-2032)

8.11.2 Anesthesiology Market Size Estimates and Forecasts to 2032 (USD Billion)

8.12 Other Therapeutic Area

8.12.1 Other Therapeutic Area Market Trends Analysis (2020-2032)

8.12.2 Other Therapeutic Area Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Pediatric Hospitals Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.2.4 North America Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.2.5.2 USA Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.2.6.2 Canada Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.2.7.2 Mexico Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Pediatric Hospitals Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.5.2 Poland Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.6.2 Romania Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Pediatric Hospitals Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.4 Western Europe Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.5.2 Germany Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.6.2 France Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.7.2 UK Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.8.2 Italy Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.9.2 Spain Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.12.2 Austria Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Pediatric Hospitals Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.4 Asia Pacific Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.5.2 China Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.5.2 India Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.5.2 Japan Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.6.2 South Korea Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.2.7.2 Vietnam Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.8.2 Singapore Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.9.2 Australia Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Pediatric Hospitals Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.4 Middle East Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.5.2 UAE Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Pediatric Hospitals Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.2.4 Africa Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.2.7.2 Rest of Africa Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Pediatric Hospitals Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.6.4 Latin America Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.6.5.2 Brazil Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.6.6.2 Argentina Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.6.7.2 Colombia Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Pediatric Hospitals Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Pediatric Hospitals Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

10. Company Profiles

10.1 Medtronic

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 Abbott Laboratories

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Edwards Lifesciences

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Boston Scientific

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Johnson & Johnson (Ethicon)

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 GE Healthcare

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Philips Healthcare

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Siemens Healthineers

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Stryker Corporation

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Zimmer Biomet

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Publicly/Government-Owned

Not-for-profit privately Owned

For-profit privately Owned

By Therapeutic Area

Endocrinology

Gastroenterology

Neurology

Cardiology

Nephrology

Ophthalmology

Allergy & Immunology

Oncology

Respiratory

Anesthesiology

Other Therapeutic Area

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Colorectal Cancer Screening Market size was valued at USD 15.36 billion in 2023 and is expected to reach USD 27.83 billion by 2032, growing at a CAGR of 6.85% from 2024-2032.

The Neurorehabilitation Market was valued at USD 1.95 billion in 2023 and expected to reach USD 6.18 billion by 2032, at a CAGR of 13.68%.

Fecal Calprotectin Testing Market was valued at USD 4.51 billion in 2023 and is expected to reach USD 12.23 billion by 2032, growing at a CAGR of 11.61% from 2024-2032.

The Forensic Technology Market Size was valued at USD 4.50 Billion in 2023, and is expected to reach USD 10.80 Billion by 2032, and grow at a CAGR of 9.07% over the forecast period 2024-2032.

The Medical Gas Analyzers Market was valued at USD 264.48 Mn in 2023 and is expected to reach USD 371.7 Mn by 2032, growing at a CAGR of 3.86% from 2024 to 2032.

Platelet Rich Plasma Market was valued at USD 0.75 billion in 2023 & is expected to reach USD 2.62 billion by 2032, growing at a CAGR of 14.98% from 2024-2032.

Hi! Click one of our member below to chat on Phone