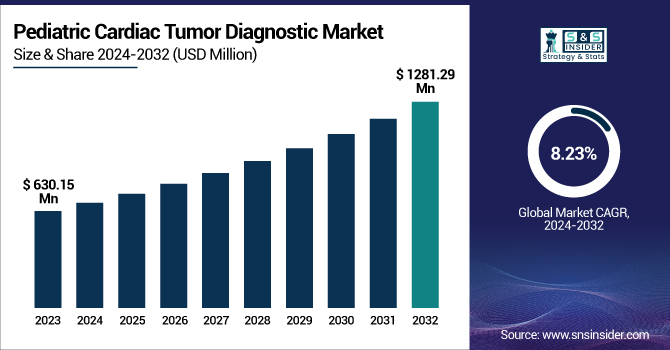

Pediatric Cardiac Tumor Diagnostic Market Size Analysis:

The Pediatric Cardiac Tumor Diagnostic Market Size was valued at USD 630.15 million in 2023 and is expected to reach USD 1281.29 million by 2032, growing at a CAGR of 8.23% from 2024 to 2032.

To Get more information on Pediatric Cardiac Tumor Diagnostic Market - Request Free Sample Report

The Pediatric Cardiac Tumor Diagnosis Market report offers useful statistical information, such as the occurrence and incidence of pediatric cardiac tumors, with regional variation and demographic patterns. The report also analyzes prescription patterns by region, with details about the adoption rates of diagnostic technologies such as echocardiography, MRI, and CT scans to identify pediatric cardiac tumors. Moreover, the report includes healthcare expenditure in different sectors (government, commercial, private, out-of-pocket), giving insights into how regions spend resources on pediatric cardiac tumor diagnostics and treatment. These insights aid in a thorough understanding of the market dynamics and regional differences.

The U.S. Pediatric Cardiac Tumor Diagnostic Market size was USD 82.49 million in 2023 and is expected to reach USD 171.58 million by 2032, growing at a CAGR of 8.20% over the forecast period of 2024-2032.

The market is driven by advancements in imaging technologies, increasing awareness about early disease detection, and improvements in pediatric cardiology care. Non-invasive diagnostic techniques such as echocardiography, MRI, and CT scans play a crucial role in identifying cardiac tumors in children at an early stage. Additionally, ongoing research and development in genetic testing and molecular diagnostics are enhancing diagnostic accuracy. The growing collaboration between healthcare institutions and research organizations is further supporting innovation in pediatric cardiac tumor detection and treatment planning.

Pediatric Cardiac Tumor Diagnostic Market Dynamics

Drivers

-

Advancements in diagnostic technology are driving the pediatric cardiac tumor diagnostic market growth.

The ongoing development of diagnostic technologies, such as high-resolution echocardiography, MRI, and CT scans, is fueling the Pediatric Cardiac Tumor Diagnostic Market growth. The enhanced precision and early detection of these technologies allow clinicians to detect pediatric cardiac tumors at earlier stages, facilitating timely intervention. For example, the greater application of 3D echocardiography and cardiac MRI has greatly improved imaging quality and accuracy in pediatric diagnosis. In consonance with the recent reports, there has been a growth of more than 20% in pediatric cardiology use of MRI during the previous five years, benefiting the effective detection of cardiac tumors. The innovation is beneficial to improve outcomes and follow up treatment for child patients.

-

Growing Awareness and Early Detection Programs are accelerating the market to grow.

An increased awareness of pediatric cardiac tumor instances among both doctors and society in general contributes significantly to boosting the growth rate of the market. More efforts and screening programs for early detection have led to enhanced diagnosis and treatment outcomes. For example, pediatric cardiology centers in the United States have implemented routine screenings for congenital heart disease and cardiac tumors, leading to a greater rate of detection. According to a recent study, the rate of early detection of pediatric cardiac tumors has risen by 15% in the last three years because of these efforts. This increased consciousness results in improved healthcare choices and higher demand for sophisticated diagnostic equipment, hence propelling the market.

Restraint

-

The High Cost of Diagnostic Procedures is restraining the market from growing.

A major constraint in the Pediatric Cardiac Tumor Diagnostic Market is the expense of diagnostic tests, which may reduce access to basic screening and diagnostic technologies. Highly sophisticated diagnostic technologies such as MRI, CT scan, and echocardiography for the heart tend to cost substantial amounts of money, both in equipment and operating costs. This may be particularly burdensome to healthcare systems within developing countries or low-income contexts where resources are constrained. Also, the expense of conducting routine screenings for pediatric cardiac tumors can be a financial burden on families, particularly those who lack extensive insurance coverage. For example, the expense of a single MRI scan may be over $1,000 in certain areas, which is not affordable for most. This economic burden restricts early detection and timely treatment of cardiac tumors in children, which in turn affects patient outcomes.

Opportunities

-

The increasing development of non-invasive diagnostic methods offers a great opportunity for the pediatric cardiac tumor diagnostic market.

Emerging technologies like cardiac ultrasound, contrast echocardiography, and MRI with decreased sedation offer opportunities to diagnose cardiac tumors without invasive procedures, decreasing risk and discomfort for pediatric patients. Growing use of wearable cardiac monitors and AI-based diagnostic platforms may also enable real-time detection of anomalies, facilitating early diagnosis. Government support and initiatives to enhance the healthcare of children are also catalyzing spending on pediatric-specific research and diagnostic platforms. These innovations and support infrastructures pave the way for further market expansion and improved pediatric cardiac care outcomes.

Challenges

-

Limited Awareness and Diagnosis of Rare Cardiac Tumors are challenging the growth of the market.

One of the greatest challenges in the Pediatric Cardiac Tumor Diagnostic Market is low awareness and misdiagnosis of rare pediatric cardiac tumors. Most pediatric cardiac tumors are asymptomatic during their early stages or may have symptoms similar to more prevalent cardiac conditions, which can cause delays in diagnosis. Physicians are not always aware of these unusual conditions, making it even harder to identify them on time. Furthermore, certain areas can also be devoid of access to sophisticated diagnostic technologies used for precise diagnosis, thereby compounding the problem. All these contribute to misdiagnosis and underdiagnosis, which hurt the general prognosis of children suffering from such tumors, posing a great challenge to the market.

Pediatric Cardiac Tumor Diagnostic Market Segmentation Analysis

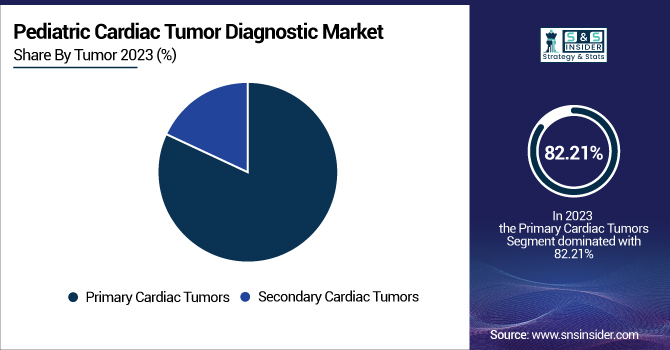

By Tumor

The primary cardiac tumors segment dominated the pediatric cardiac tumor diagnostic market with an 82.21% market share in 2023 because primary cardiac tumors are more frequently seen in pediatric populations than secondary tumors. More pediatric cardiac tumors, including rhabdomyomas, which are managed most often in children, are due to primary cardiac tumors, which develop within the heart. These cancers are diagnosed at an early stage by routine screening or when symptoms become apparent, which results in a higher rate of detection. Also, the widespread use of imaging technologies like echocardiography and MRI has enabled the detection of primary tumors at an earlier stage, which further reinforces the stronghold of this segment in the market.

The Secondary Cardiac Tumors segment is experiencing the fastest growth with 8.58% CAGR throughout the forecast period on account of numerous reasons, such as the increasing incidence of pediatric cancers with metastasis to the heart, and progress in diagnostic equipment that increases the rates of detection of metastatic tumors. Secondary tumors are less frequent in children but have been increasingly detected with enhanced imaging and diagnostic technologies. As survival rates for many pediatric cancers continue to increase, more children are surviving longer, which means there is a greater chance that these cancers will metastasize to the heart. This trend, combined with increased awareness and improvements in imaging technology, places the secondary cardiac tumor segment on the fast track for growth in the forecast years.

By Type

The Echocardiography segment dominated the pediatric cardiac tumor diagnostic market with a 61.25% market share in 2023 because of its non-invasive character, availability, and established efficacy in diagnosing tumors of the heart in children. Echocardiography is the most common first-line imaging modality used in pediatric cardiology since it captures real-time, high-quality images of the structure and function of the heart without the need for sedation or invasive procedures. This makes it especially well-suited to diagnose pediatric patients, who can sometimes need special attention and little discomfort. Moreover, echocardiography is inexpensive, easily accessible, and very effective at identifying frequent pediatric cardiac tumors, like rhabdomyomas, which are often found during routine examinations or when investigating symptoms such as arrhythmias or heart failure.

By End Use

The Hospitals and Clinics segment dominated the Pediatric Cardiac Tumor Diagnostic Market with a 74.12% market share in 2023 because it plays a key role in offering specialized pediatric cardiac care. These facilities have modern diagnostic equipment like echocardiography, MRI, and CT scans, which are needed to diagnose pediatric cardiac tumors accurately. Hospitals and clinics also have the required infrastructure, such as pediatric cardiology specialists, to effectively handle and cure these ailments. In addition, they provide a host of diagnostic tests and are most likely the initial contact point for parents bringing in their children for treatment, further reinforcing the dominance of this segment.

The Government Health Department segment is anticipated to have the fastest growth during the forecast period as a result of growing government spending on healthcare infrastructure, especially across low- and middle-income nations. Such departments are becoming more concerned with enhancing access to pediatric care, such as diagnostic treatment for unusual illnesses like cardiac tumors. As more government funding is diverted to public health programs, particularly for pediatric services and early diagnostics, the demand for sophisticated diagnostic technology will increase in public healthcare facilities. Also, government healthcare programs for enhanced healthcare access to underprivileged populations will further enhance the growth of this segment.

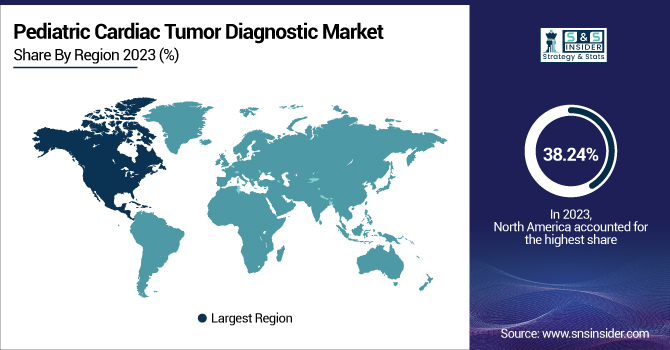

Pediatric Cardiac Tumor Diagnostic Market Regional Analysis

North America dominated the pediatric cardiac tumor diagnostic market with a 38.24% market share in 2023, owing to its developed healthcare infrastructure, high healthcare spending, and universal use of state-of-the-art diagnostic technologies. The United States, specifically, is a leader in both the prevalence of high-resolution imaging technologies such as MRI, CT scans, and echocardiography, as well as the expertise of pediatric cardiology professionals. Besides this, the existence of a high number of specialist pediatric cardiac treatment centers and hospitals adds strength to the market position in North America. Private insurance coverage and government-sponsored programs also guarantee that there is increased availability of sophisticated diagnostic equipment, and thus the dominance of the market region.

Asia Pacific is the fastest-growing region in the pediatric cardiac tumor diagnostic market with 8.83% CAGR throughout the forecast period, due to rapid improvements in healthcare infrastructure, growing disposable incomes, and rising government emphasis on healthcare reforms. Nations such as China, India, and Japan are experiencing high growth in the use of sophisticated diagnostic equipment, fueled by growing awareness regarding pediatric cardiac ailments. As the investments in diagnostic equipment and healthcare facilities continue to rise, in tandem with more healthcare professionals getting specialized in pediatric cardiology, the region has high prospects for high growth over the next few years. Furthermore, the widening coverage of healthcare insurance and an increase in medical tourism for special treatment add to the growth potential of the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Pediatric Cardiac Tumor Diagnostic Market Key Players

-

Abbott (Alinity i System, Architect i2000SR)

-

Roche Diagnostics (Cobas e601, Cobas 4800 System)

-

Siemens Healthineers (Atellica Solution, ADVIA Centaur XP)

-

Thermo Fisher Scientific (Applied Biosystems QuantStudio, Ion GeneStudio S5 System)

-

GE Healthcare (LOGIQ E10, Vivid T9)

-

Philips Healthcare (Affiniti 70, iU22 Ultrasound System)

-

Medtronic (Cardiac Surgery Solutions, HeartWare HVAD System)

-

Boston Scientific (Watchman FLX, Rhythmia Mapping System)

-

Biotronik (Caresense, Edora CRT-P)

-

Zimmer Biomet (Verasense, VitaFlex)

-

Edwards Lifesciences (SAPIEN 3, CENTRIMAG)

-

Johnson & Johnson (Janssen Pharmaceuticals) (Xarelto, Biosense Webster)

-

Cardinal Health (EndoVive, Thermo Scientific)

-

AbbVie (Venclexta, Imbruvica)

-

Stryker (Physio-Control, LifePak 15)

-

Elekta (Unity System, Versa HD)

-

Canon Medical Systems (Aplio i900, Aquilion ONE)

-

Mindray (Resona 7, M9 Ultrasound)

-

Hitachi Medical Corporation (Aquilion Lightning, ARIETTA 850)

-

Carestream Health (DRX-1 System, CS 7200 Mammography System)

Suppliers (These suppliers provide advanced diagnostic equipment, medical imaging systems, and laboratory instruments that support the diagnosis and treatment of pediatric cardiac conditions, including cardiac tumors.) in Pediatric Cardiac Tumor Diagnostic Market

-

Illumina, Inc.

-

Thermo Fisher Scientific

-

GE Healthcare

-

Philips Healthcare

-

Siemens Healthineers

-

Roche Diagnostics

-

Abbott

-

Medtronic

-

Boston Scientific

-

Stryker

Recent Development in the Pediatric Cardiac Tumor Diagnostic Market

-

In December 2023 Abbott obtained 510(k) clearance from the FDA for its blood-based Total Bilirubin2 assay, mainly intended to assist in the diagnosis of liver, hematological, and metabolic disorders. Although this is especially useful for neonatal jaundice, it also indicates Abbott's continued push to improve pediatric diagnostics, which could be extended to oncology-related uses in the future.

-

In 2023, Roche obtained approval for its Elecsys β-Amyloid and Phospho-Tau assays to detect Alzheimer 's-associated markers in cerebrospinal fluid. Though this development targets neurological diagnostics, it has the potential to be useful for developing pediatric diagnostic markets, such as detecting rare pediatric cancers and tumors.

-

In February 2023, Thermo Fisher Scientific diversified its diagnostics portfolio by purchasing Binding Site Group, which expands its specialty diagnostic capabilities, for example, in multiple myeloma. Though this acquisition has an oncology diagnostics focus, it highlights the dedication of Thermo Fisher to developing diagnostic technology, with which pediatric oncology may have implications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 630.15 million |

| Market Size by 2032 | US$ 1281.29 million |

| CAGR | CAGR of 8.23% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Tumor (Primary Cardiac Tumors, Secondary Cardiac Tumors) • By Type (Echocardiography, Magnetic Resonance Imaging (MRI), Computed Tomography (CT) Scan, Others) • By End Use (Hospitals and Clinics, Government Health Department, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Abbott, Roche Diagnostics, Siemens Healthineers, Thermo Fisher Scientific, GE Healthcare, Philips Healthcare, Medtronic, Boston Scientific, Biotronik, Zimmer Biomet, Edwards Lifesciences, Johnson & Johnson (Janssen Pharmaceuticals), Cardinal Health, AbbVie, Stryker, Elekta, Canon Medical Systems, Mindray, Hitachi Medical Corporation, Carestream Health, and other players. |