Payment Security Software Market Report Scope & Overview:

Payment Security Software Market was valued at USD 27.56 billion in 2023 and is expected to reach USD 94.53 billion by 2032, growing at a CAGR of 14.74% from 2024-2032.

Get More Information on Payment Security Software Market - Request Sample Report

The payment security software market is witnessing considerable expansion, fueled by the growing number of online transactions and the heightened worries about cybercrime and fraud. In 2023, the overall value of digital payment transactions in the U.S. is expected to hit USD 2.04 trillion, showcasing the continued movement toward digital transactions. With the increasing integration of digital payment systems into daily business activities, organizations are making significant investments in strong security measures to safeguard sensitive information. Retail e-commerce sales are projected to surpass USD 4.1 trillion globally in 2024, consequently increasing the need for improved payment security. Elements like regulatory obligations, the shift to cloud-based platforms, and the increasing prevalence of mobile wallets are driving the growth of the market. The worldwide transition to contactless and digital payments has generated an increased demand for sophisticated security technologies, emphasized by Visa's purchase of Featurespace in December 2024 to improve fraud prevention.

The demand for payment security software is expected to continue its upward trajectory, as businesses and consumers alike prioritize safety and privacy in digital financial transactions. The surge in e-commerce, mobile payments, and digital banking has made payment systems prime targets for cyberattacks. As a result, the adoption of encryption, tokenization, multi-factor authentication, and other advanced security features is becoming increasingly common across industries. This heightened demand is not only prevalent in traditional sectors like banking but also in retail, healthcare, and government, all of which are investing in payment security to safeguard sensitive financial data.

Looking ahead, there are numerous opportunities in the payment security software market, particularly in emerging markets where digital payments are still expanding. With the rise of technologies like artificial intelligence and machine learning, companies have the opportunity to develop more sophisticated, real-time fraud detection and prevention solutions. Additionally, the growing trend of mobile commerce presents a significant opportunity for payment security software providers to innovate, offering seamless yet secure payment experiences for consumers on the go. In December 2024, Mastercard announced plans to enhance digital payment security by adopting passwordless payments, focusing on tokenization and biometric authentication, which aligns with this demand. As the market matures, there will be increasing demand for integrated solutions that combine security with enhanced user experience and compliance, opening the door for innovative, tailored offerings.

Payment Security Software Market Dynamics

Drivers

-

Escalating Cybersecurity Threats Due to Digitalization of Payment Systems Fueling Demand for Advanced Payment Security Software Solutions

As payment systems continue to shift toward digital platforms, there is a significant rise in cyberattacks and fraud attempts targeting financial transactions. The growing sophistication of cybercriminals, alongside the expanding volume of online transactions, has heightened concerns about the security of sensitive financial data. Organizations are under increasing pressure to safeguard their systems from breaches that could result in financial losses, legal repercussions, and damage to customer trust. In response, the demand for advanced payment security software is surging, as businesses seek comprehensive solutions to protect data, ensure secure payment processing, and comply with stringent regulatory standards. With the increasing complexity of digital payments, robust security measures are essential to mitigate risks and maintain confidence in electronic transactions, driving a sustained growth in the payment security software market.

-

Expansion of E-Commerce and Online Retail Pushing the Demand for Robust Payment Security Solutions to Combat Fraud and Data Theft

The rapid growth of e-commerce and online retail activities has led to an increase in the number of digital transactions, intensifying the risk of online payment fraud and data breaches. As more consumers and businesses embrace online shopping, cybercriminals are finding new ways to exploit vulnerabilities in payment systems, targeting both personal and financial information. This surge in e-commerce activity necessitates the adoption of advanced payment security software to protect transactions and ensure the confidentiality of customer data. With the rise of various payment methods, including mobile wallets and contactless options, securing these transactions has become a top priority for retailers. To stay competitive and maintain customer trust, businesses are investing heavily in payment security software that can offer real-time fraud detection, secure transaction processing, and compliance with evolving regulatory requirements.

Restraints

-

High Implementation Costs and Their Impact on the Widespread Adoption of Payment Security Software Among Small and Medium-Sized Enterprises

The adoption of advanced payment security software often requires significant financial investment, which includes the costs of software acquisition, system integration, staff training, and ongoing maintenance. For small and medium-sized enterprises (SMEs), these costs can be prohibitively high, limiting their ability to implement comprehensive security solutions. Many SMEs face budget constraints, which may force them to opt for less effective, lower-cost alternatives or forego robust security measures altogether. Additionally, the complexity involved in integrating new security systems with existing IT infrastructure further adds to the expense. These financial barriers are exacerbated by the need for continuous updates and system enhancements to keep pace with evolving cyber threats, leading to long-term financial commitments that smaller businesses may struggle to justify. This presents a challenge to the widespread adoption of payment security software across all business sizes.

-

The Constantly Evolving Nature of Cyber Threats Poses Challenges for Payment Security Software Solutions to Maintain Effectiveness

As cyberattacks become increasingly sophisticated, payment security software must continuously adapt to new and emerging threats. The rapid pace at which cybercriminals develop novel attack methods requires that security software remains up-to-date to effectively counteract these risks. However, some existing software solutions may struggle to keep pace with these evolving threats, limiting their ability to provide complete protection. This ongoing need for updates, patches, and system enhancements can be both time-consuming and costly for businesses, leading to gaps in security if updates are delayed or neglected. Additionally, the complexity of continuously evolving threats creates challenges for software developers in ensuring their solutions remain relevant and effective. Consequently, organizations must constantly invest in improving their security systems, which can be resource-intensive and may cause delays in addressing vulnerabilities, hindering the overall effectiveness of payment security software.

Payment Security Software Market Segment Analysis

By Component

In 2023, the Solutions segment dominated the Payment Security Software Market, capturing the highest revenue share of about 65%. This dominance can be attributed to the increasing need for advanced, comprehensive security solutions to protect digital payment transactions. As businesses expand their online presence and digital payment methods, they require sophisticated tools to secure customer data, prevent fraud, and ensure compliance with regulatory standards. The broad adoption of technologies such as encryption, tokenization, and multi-factor authentication within the solutions category has further fueled its market share.

The Services segment is expected to grow at the fastest CAGR of approximately 16.52% from 2024 to 2032. This rapid growth is driven by the increasing demand for tailored support, consulting, and maintenance services that help businesses optimize their payment security systems. As cyber threats evolve and security solutions become more complex, organizations are seeking expert guidance for seamless integration, ongoing updates, and real-time monitoring. This growing need for continuous support and expertise in managing payment security systems is propelling the services segment’s expansion at an accelerated pace.

By Industry Verticals

In 2023, the Banking, Financial Services, and Insurance segment led the Payment Security Software Market, holding the largest revenue share of approximately 27%. This dominance stems from the high volume of sensitive financial transactions processed within the sector, requiring stringent security measures to protect against data breaches, fraud, and cyberattacks. As financial institutions and insurers increasingly adopt digital payment platforms, the need for robust payment security software to meet compliance standards and safeguard customer information has driven substantial investments in security solutions within this industry.

The IT and Telecommunications segment is expected to grow at the fastest CAGR of about 17.02% from 2024 to 2032. This rapid growth is largely driven by the increasing reliance on digital communication channels and cloud-based services, which have amplified the vulnerability to cyber threats. As more businesses and consumers engage in online services, the need for secure, high-performance payment solutions within the IT and telecommunications sectors has surged. The rising demand for secure data transmission and seamless integration of payment systems into digital infrastructures is fueling the expansion of the market in this segment.

By Mode of Payment

In 2023, the Mobile Payment Security Software segment dominated the Payment Security Software Market, accounting for the highest revenue share of approximately 40%. This dominance is driven by the rapid adoption of mobile wallets and payment apps, which have become integral to everyday transactions. With consumers increasingly relying on smartphones for financial activities, there is a growing need to secure mobile payment platforms against fraud, data breaches, and cyberattacks. The convenience and widespread use of mobile payments have made them a primary target for cyber threats, necessitating advanced security solutions.

The Online Payment Security Software segment is expected to grow at the fastest CAGR of about 16.37% from 2024 to 2032. This growth is primarily fueled by the accelerating shift towards e-commerce and digital services, as more businesses expand their online presence. With online transactions becoming a primary method of commerce, there is an increasing demand for robust security solutions to protect against rising threats such as phishing, hacking, and fraud. As both consumers and businesses prioritize secure online payment experiences, this segment is positioned for significant expansion in the coming years.

Regional Analysis

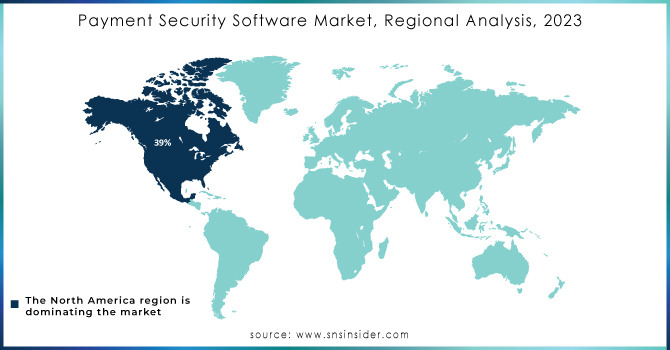

In 2023, North America dominated the Payment Security Software Market, capturing the highest revenue share of approximately 38%. This leadership is attributed to the region’s advanced technological infrastructure, widespread adoption of digital payment methods, and stringent regulatory requirements, such as PCI-DSS, which mandate high security standards for financial transactions. Additionally, the presence of major financial institutions, e-commerce platforms, and tech giants in North America has driven a strong demand for cutting-edge payment security solutions to mitigate growing cybersecurity threats and ensure consumer confidence.

The Asia Pacific region is expected to grow at the fastest CAGR of about 16.82% from 2024 to 2032. This rapid growth is fueled by the region’s expanding digital payment landscape, particularly in emerging markets where mobile payments and e-commerce are on the rise. As more consumers in Asia Pacific shift to digital transactions, the need for secure payment systems becomes paramount. The region’s increasing investment in technology and infrastructure, coupled with a rising focus on combating cyber threats, positions Asia Pacific for significant expansion in the payment security software market.

Do You Need any Customization Research on Payment Security Software Market - Enquire Now

Key Players

-

MagTek Inc. (MagTek Card Readers, MagTek Secure Payment Solutions)

-

Transaction Network Services Inc. (TNS Payment Gateway, TNS Secure Payments)

-

PayPal (PayPal Fraud Protection, PayPal Commerce Platform)

-

Forter (Forter Fraud Prevention, Forter Account Protection)

-

CyberSource (CyberSource Fraud Management, CyberSource Payment Gateway)

-

Verifi (Verifi Chargeback Prevention, Verifi Order Insight)

-

Symantec (Broadcom) (Symantec Data Loss Prevention, Symantec Endpoint Protection)

-

Thales (Thales CipherTrust, Thales HSM)

-

Gemalto (Gemalto SafeNet, Gemalto Identity Protection)

-

SecurePay (SecurePay Fraud Prevention, SecurePay Payment Gateway)

-

RSA Security (RSA FraudAction, RSA SecurID)

-

Visa (Visa Advanced Authorization, Visa Risk Manager)

-

Mastercard (Mastercard SecureCode, Mastercard Identity Check)

-

TransUnion (TransUnion Fraud Detection, TransUnion Credit Risk)

-

Fiserv (Fiserv Fraud Detection, Fiserv Payment Gateway)

-

Ingenico Group (Ingenico Payment Gateway, Ingenico Fraud Detection)

-

Worldpay (Worldpay Fraud Prevention, Worldpay Payment Gateway)

-

BlueSnap (BlueSnap Fraud Prevention, BlueSnap Payment Solutions)

-

Payoneer (Payoneer Payment Gateway, Payoneer Fraud Prevention)

-

Trustwave (Trustwave Managed Security Services, Trustwave Threat Detection)

-

Sift (Sift Digital Trust Platform, Sift Account Protection)

-

ACI Worldwide (ACI Worldwide Fraud Detection, ACI Worldwide Payments Hub)

-

Kount (Kount Fraud Prevention, Kount Payment Gateway)

-

TokenEx (TokenEx Tokenization, TokenEx Payment Gateway)

Recent Developments:

-

In April 2024, Transaction Network Services launched Complete Commerce, a comprehensive, end-to-end payments solution designed to address the complexities of digital payment systems. The solution integrates TNS’ Accept, Connect, and Orchestrate portfolios to deliver a secure and efficient payment experience for businesses globally.

-

In 2024, MagTek and InVue partnered to release an innovative mobile payment and digital transaction solution, aiming to enhance security and functionality for mobile payment systems. This collaboration combines MagTek’s secure payment technology with InVue’s retail solutions to provide a comprehensive platform for businesses and consumers.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 27.56 Billion |

| Market Size by 2032 | USD 94.53 Billion |

| CAGR | CAGR of 14.74% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Services, Solutions) • By Mode of Payment (Mobile Payment Security Software, Point-of-sale Systems and Security, Online Payment Security Software) • By Industry Verticals (Banking, Financial Services and Insurance, Retail, Healthcare, Government, IT and Telecommunications, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | MagTek Inc., Transaction Network Services Inc., PayPal, Forter, CyberSource, Verifi, Symantec (Broadcom), Thales, Gemalto, SecurePay, RSA Security, Visa, Mastercard, TransUnion, Fiserv, Ingenico Group, Worldpay, BlueSnap, Payoneer, Trustwave, Sift, ACI Worldwide, Kount, TokenEx |

| Key Drivers | • Escalating Cybersecurity Threats Due to Digitalization of Payment Systems Fueling Demand for Advanced Payment Security Software Solutions • Expansion of E-Commerce and Online Retail Pushing the Demand for Robust Payment Security Solutions to Combat Fraud and Data Theft |

| RESTRAINTS | • High Implementation Costs and Their Impact on the Widespread Adoption of Payment Security Software Among Small and Medium-Sized Enterprises • The Constantly Evolving Nature of Cyber Threats Poses Challenges for Payment Security Software Solutions to Maintain Effectiveness |