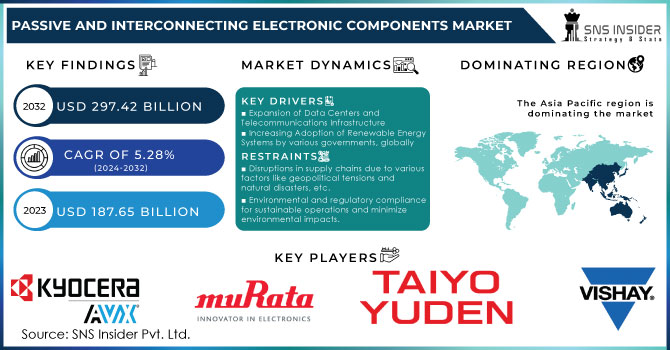

Passive and Interconnecting Electronic Components Market Report Scope & Overview:

Get More Information on Passive and Interconnecting Electronic Components Market - Request Sample Report

The Passive and Interconnecting Electronic Components Market Size was valued at USD 187.65 billion in 2023 and is expected to reach USD 297.42 billion by 2032 and grow at a CAGR of 5.28% over the forecast period 2024-2032.

The passive and interconnecting electronic components market growth is triggered by the rapid pace of technology evolutions, miniaturization of electronic equipment, and development & deployment of IoT and AI. The demand for smart homes and intelligent devices increases, implying that the components that ensure the work of the smart devices should be extremely reliable and durable. Smart homes reached around USD 140 billion in 2023, and the market's prevalence is largely due to the indispensable nature of these components in a wide array of electronic devices and systems. According to IBEF, the Indian appliance and consumer electronics market reached USD 10.93 billion in 2019. The appliances and consumer electronics industry is expected to double to reach USD 21.18 billion by 2025.

The automotive industry's shift towards electric vehicles (EVs) and advanced driver-assistance systems (ADAS) has created substantial opportunities. EVs require efficient power management systems, which in turn drive the need for passive components like capacitors and inductors. For instance, Vishay Intertechnology recently introduced a new series of high-voltage capacitors designed for automotive and industrial applications, enhancing its product portfolio in the Passive and Interconnecting Electronic Components Market. According to the Governor’s Highway Safety Association, to recover the initial investment, over 95% of all new models sold would have to feature at least one ADAS. Currently, over 90% of vehicles on sale in the U.S. offer at least one advanced system, and there is a commitment to making Automatic Emergency Braking standard by 2022.

Market Dynamics

Drivers

- Expansion of Data Centers and Telecommunications Infrastructure

The global expansion of cloud computing, data storage, and high-speed internet services industries has led to the development of many data centers worldwide. These facilities require a wide range of electronic components to ensure fast and efficient operation in terms of data processing, storage, and transmission. Passive components in power supply units UPS are easily applicable in control cabinets for power supply. These components include supercapacitors, ceramic and aluminum electrolytic capacitors, transformers, chokes or inductors, resistors, and varistors.

Due to the nature and efficient high-speed operation, 5G technology requires high-frequency passive and interconnecting components and connectors with significantly higher data rates as well as reduced signal travel times. In addition, the growing use of edge computing and IoT technology ensures that overall operations and maintenance networking solutions are decentralized, which is likely to increase the need for passive and interconnecting components on the world market.

- Increasing Adoption of Renewable Energy Systems by various governments, globally

Solar power, wind power, and other renewable energy sources require passive and interconnecting components for power conversion and energy storage. Capacitors, resistors, inductors, and connectors are among the necessary components used in renewable sources to facilitate power usage and energy authentication. In solar power, the components are used for the photovoltaic inverter, battery management, and power optimizers. For wind power, the components are used in various parts of a wind turbine, for instance, power generation and control; communication in the machine is facilitated by connectors, and various control systems also use the unique components.

Integration of renewable energy into the grid is also one factor that enhances the need for advanced passive and interconnecting components to help in achieving grid power flow, voltage control, and grid stability. Furthermore, renewable energy is the trend globally, with countries aiming to switch to sustainable energy and reduction of carbonizing energy. This has led to investment in the passive and interconnecting electronic components market as new opportunities are available from the number of new renewable energy projects raised by governments and private facilitates.

Restraints

- Disruptions in supply chains due to various factors like geopolitical tensions and natural disasters, etc.

The global supply chain for electronic components is complex and consists of several stages that include raw material extraction, component manufacturing, assembling the end product, and distributing it to the final customers. Thus, any problem at any stage of the supply chain might affect the availability and the pricing of components. For example, the most recent COVID-19 pandemic revealed the weakness of global supply chains and caused issues with component availability and the delay of many end products. The outcome of these disruptions causes longer lead time for the components, higher prices, and lower availability for the whole industry.

- Environmental and regulatory compliance for sustainable operations and minimize environmental impacts.

There are very serious environmental aspects to the production and disposal of electronic components, as a result, regulatory bodies are focusing more and more on complying with these standards. New regulations and governmental bodies are constantly emerging to reduce or eliminate the impact that electronic components leave on the environment, these can be quite complex and difficult to comply with. An example of such a regulation could be the restriction of hazardous substances as a result of this regulation being enforced in the European Union manufacturers would need to find alternatives to hazardous materials while also redesigning their manufacturing processes which can cost a lot of financial resources, in addition, some producers may find it difficult to comply with these standards, which can result in an interruption of the supply chain.

Market Segmentation

By Components

The interconnecting segment held the largest revenue share of 55.0% in 2023. The segment’s growth is credited to the need for a reliable and secure method of connecting different electronic components in an electronic circuit. Connectors allow manufacturers to easily assemble, repair, or upgrade various components of an electronic system. As such, their versatility is critical in the modern technologically advancing world where adaptability decreases costs and shortens the time to market for new products.

The passive segment captured the fastest CAGR during the forecast period 2024-2032. The growth of the segment is probably due to the growing advancements and invention of smaller passive electronic components that can fit in small electronic devices.

By Application

The consumer electronics segment occupied a market share of 35.0% in 2023. The dominance of the market rise is primarily attributed to the rising growth of consumer electronic devices, such as smartphones and home appliances. Moreover, the increase in the segment is driven by the advent of smart devices.

The automotive segment is expected to experience the fastest CAGR during the forecast period 2024-2032. The rise is owed to various factors, including vehicle electrification, rising sales of ADAS technologies, and increasing integration of connected car technologies in vehicles. For Example, Murata Manufacturing Co., Ltd., launched a new series of compact-type high-capacitance multilayer ceramic capacitors with enhanced reliability for the automotive industry.

Need any customization research on Passive and Interconnecting Electronic Components Market - Enquiry Now

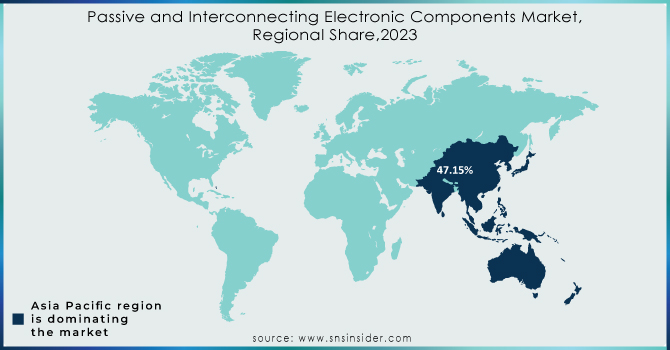

Regional Analysis

Asia Pacific, the dominating region, captured a market share revenue of 47.15% in 2023. The growth of the electronics manufacturing base and technical advancements of 5G technology boost the market in the region. There is a wide range of electronic products manufacturing and exporting companies in the region, which significantly raises the target market’s growth rate. China is a worldwide leader in the manufacturing of electronic components. Although a wide range of the industry’s companies document-producing large firms already exists, the market growth in the country is tremendously driven by the well-developed base of electronics manufacturing.

The North American market is expected to grow at a CAGR of 5.68% from 2024 to 2032. The growth of the market in the region is largely attributed to the rising demand for advanced technologies as well as increasing industrial automation. The U.S. and Canadian governments and businesses invest in such technological advancements as AI, IoT, etc. These technologies require a wide range of passive and interconnecting electronic components as well as increasing industrial automation, which significantly boosts the target market’s growth rate. The anticipated rise of the 5G network infrastructure significantly boosts the market demand for new installation of networks and telecom devices.

Key Players

The key players in the Passive and Interconnecting Electronic Components market are Kyocera AVX Corporation, Vishay Intertechnology Inc., Murata Manufacturing Co., TDK Corporation, Taiyo Yuden Ltd, TE Connectivity, Samsung Electro-mechanics, Hosiden Corporation, Yageo Group, Nichicon Corporation, Fenghua Electronics Ltd., ROHM Co. Ltd., Molex, Samtec, Amphenol Corp, Panasonic Corporation, Fujitsu, Hon Hai Precision, Hirose Electric Co. Ltd, Mouser Electronics, & Other Players.

Recent Development

-

In February 2024, the TDK company released the MHQ1005075HA series of inductors for an automotive high-frequency circuit. An inductor is made with a fail-safe structure designated for a 1005 size format 1.0 x 0.5 x 0.7 mm and varies an inductor from 1.0 nH to 56 nH. The line of inductors was adapted to improve the systems of cars and their reliability.

-

In November 2023, the Finolex Cables company presented to its current line business LAN cable passives. The release reflected not in cables but in LAN passive components: patch cords, information outlets, patch cards, and faceplates were introduced. The line was produced for the data center, IT network, conference room, and branch office. The new line was introduced to increase connectivity.

|

Report Attributes |

Details |

|---|---|

|

Market Size in 2023 |

USD 187.65 billion |

|

Market Size by 2032 |

USD 297.42 Billion |

|

CAGR |

CAGR of 5.28% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Components (Passive, Interconnecting) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Kyocera AVX Corporation, Vishay Intertechnology Inc., Murata Manufacturing Co., TDK Corporation, Taiyo Yuden Ltd, TE Connectivity, Samsung Electro-mechanics, Hosiden Corporation, Yageo Group, Nichicon Corporation, Fenghua Electronics Ltd., ROHM Co. Ltd., Molex, Samtec, Amphenol Corp, Panasonic Corporation, Fujitsu, Hon Hai Precision, Hirose Electric Co. Ltd, Mouser Electronics |

|

Key Drivers |

• Expansion of Data Centers and Telecommunications Infrastructure |

|

RESTRAINTS |

• Disruptions in supply chains due to various factors like geopolitical tensions and natural disasters, etc. |