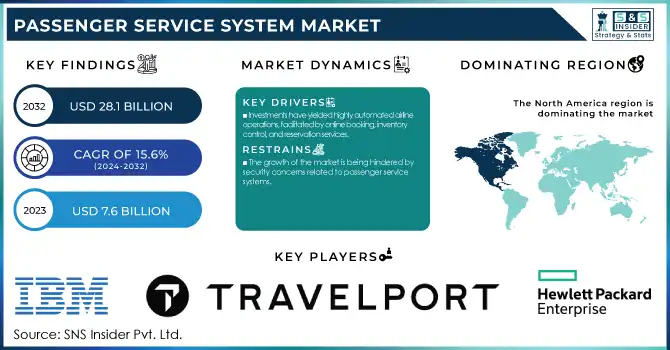

The Passenger Service System Market size was valued at USD 7.6 Billion in 2023. It is expected to grow to USD 28.1 Billion by 2032 and grow at a CAGR of 15.6% over the forecast period of 2024-2032.

Get more information on Passenger Service System Market - Request Sample Report

The increasing adoption of mobile applications in the Passenger Service System (PSS) market reflects airlines' focus on enhancing convenience and personalization for travelers. This is due to the rise of smartphones and a growing consumer expectation of seamless digital experiences, airlines are investing in mobile-friendly platforms that can perform important functions such as bookings, check-ins, and itinerary management. Moreover, Airlines' emphasis on improving passenger convenience and personalization is shown in the growing use of mobile applications in the Passenger Service System (PSS) sector. Airlines are investing in mobile-friendly platforms that can handle crucial tasks like bookings, check-ins, and itinerary management because of the proliferation of smartphones and the rising expectations of consumers for seamless digital experiences. Through their smartphone apps, passengers may track their bags, choose seats, get real-time flight information, and pay for additional auxiliary services. Through configurable features like trip-specific advice and personalized promos, this enhancement not only makes the user more comfortable but also improves client retention.

For example, the International Air Transport Association (IATA) noted that over 50% of passengers prefer using airline apps for real-time updates, boarding passes, and seat selection.

This change to subscription-based models within the PSS market highlights an increasing focus on affordable and adaptable solutions. A growing number of vendors provide Software-as-a-Service (SaaS) models that remove large up-front investments for airlines and substitute a manageable subscription fee. There are various advantages of this model which provides airlines with scalable platforms that can respond to changing volumes of passengers, and also the evolving operational needs. In addition, SaaS-based PSS promises regular updates, greater security, and seamless integration with other digital tools and technologies to become an appealing option for airlines looking to modernize their service offerings at the same time as fine-tuning budgets.

For instance, the U.S. Department of Commerce's 2024 projections suggest that SaaS solutions contribute significantly to reducing administrative inefficiencies across sectors.

Drivers

The growth of the passenger service system market is being driven by the expansion of the aviation industry, as it seeks to provide an enhanced user experience. With a steady increase in air travelers, there is a higher demand for efficient passenger service system solutions to handle the increased passenger volume and streamline operations. Furthermore, the growing competition among airlines is also increasing the demand for passenger service systems to provide an improved traveling experience. Passengers now expect a seamless journey experience, which further raises the demand for passenger service systems that offer enhanced user experience. These systems play a vital role in managing passenger data, enabling airlines to offer personalized services, loyalty programs, and efficient customer support. As a result, the expanding airline industry is driving the demand for advanced passenger service systems, ultimately leading to enhanced passenger satisfaction and loyalty, and driving business growth. in 2023, according to the Indian Aerospace and Defense Bulletin, Indian domestic airlines experienced a significant surge in passengers, accounting for 506 lakh passengers. This figure demonstrates a prominent annual expansion of 42% compared to 2022 when there were 354 lakh domestic passengers. The surge in the number of flyers is thus contributing to the growth of the passenger service system market, as it aims to offer an improved travel experience.

Restraint

The growth of the market is being hindered by security concerns related to passenger service systems.

The more prominent security threats hinder the growth of the passenger service system (PSS) market. With systems managing huge volumes of sensitive passenger data ranging from personal identification details to payment data and travel itineraries, they are an appealing target for cyberattacks. While data breaches lead to data privacy issues, they also affect everyday airline operations, which affects their customer trust and confidence. For example, ongoing incidents through ransomware attacks or system intrusions in the past few years have pointed to the weakness of both legacy and cloud-based systems.

Additionally, regulatory initiatives like the General Data Protection Regulation (GDPR) in Europe and other national data protection laws create heavy penalties for non-compliance which increases pressure on airlines & service providers to improve security. Even though advanced cybersecurity tools have been available for a while now, the difficulty of integration and low-priced offerings with limited security means that a robust security framework may not be available or attractive to the smaller airline adopting or upgrading a PSS solution a scenario that limits the growth potential of the market. Such characteristics highlight the importance of continuous innovation in PSS platform security against risk and market support.

Opportunities

By harnessing the power of AI, passenger service solutions can analyze vast amounts of passenger data and extract valuable insights. These algorithms are instrumental in understanding passenger preferences, behaviors, and travel patterns, allowing passenger service systems to offer personalized services based on this derived data. AI-powered web engines provide tailored travel options, ancillary services, and personalized promotions, resulting in enhanced customer satisfaction and increased revenue. Additionally, AI-powered chatbots and virtual assistants are capable of handling customer inquiries, providing real-time support, and assisting with various customer service tasks. This not only ensures that airlines can offer round-the-clock customer support but also enables quick responses to passenger queries and efficient problem resolution through the utilization of AI solutions.

Market segmentation

By Component

Services held the largest market share around 68% in 2023. Services is a vital aspect for the airlines since they often do not have the in-house knowledge to handle the complexity of modern cloud-based and subscription model PSS solutions. This inevitably creates a demand for ongoing monitoring, customizations, and augmented cybersecurity needs further allocating the resources to professional service providers. In addition, the increasing pace of technological change requires updates and technical support, which makes services an essential piece of the market's revenue model. Thus, the service segment is larger than software in terms of market share, as it fills the essential part needed to maintain and improve PSS functionalities.

By Service

Airline Reservation System held the largest market share around 32% in 2023. This dominance can be explained by the fact that a PSS is responsible for the largest part of an airline's operations, essentially managing flight bookings, ticket sales, and seat allocation. It allows airlines to manage their inventory for travels by individual travelers, travel agents, and third-party platforms effectively, facilitating ticketing and real-time information by flight availability.

With most of the airlines in the world changing their operations digitally, the airline reservation system has turned into a focal point for airlines, provisioning bookings and connecting with other aspects like internet booking systems, loyalty systems, etc. The way it has been embraced as of late both by legacy and low-cost carriers lends its significance to generating income and providing customer satisfaction. Moreover, the trend for mobile booking apps and personalized travel has led to an increased need for enhanced reservation systems, making these the dominant segment of the PSS market.

By Deployment

On-premises held the largest market share around 62% in 2023. It is because of its security, customization, and data control benefits. Many airlines opt for on-premises solutions, as they can keep sensitive passenger information in-house, which minimizes dependency on third-party cloud providers, which in turn can reduce the risk of data breaches. This model is especially popular among legacy carriers and operators in geographies with strict data sovereignty regulations as national laws could mandate the local storage and processing of data. Moreover, on-premise systems offer the highest level of tailored solutions for specific operational requirements, which is a critical aspect in the event of airlines that have complex networks or large-scale operations. Even with the increasing shift to cloud-based solutions, for many airlines, the reliability and control maintained by on-premises infrastructure is still top-of-mind, particularly for core functions such as reservation systems and departure control.

Regional Analysis

The North America region held the largest share 49% of the Passenger Service System Market. This is due to factors including advanced aviation infrastructure with technology adoption and the presence of major industry players. Home to some of the biggest and most technologically advanced airlines of the U.S. and Canada, which are early adopters of innovative solutions set to enhance customer experience and improve operational efficiency. To stay ahead of the competition in the dynamic global environment, these airlines intend to implement an advanced PSS platform that includes its reservations and inventory management, as well as loyalty and customer care systems. Additionally, the United States also has a significant market size in this industry. According to experts in the field, the growth in the U.S. can be attributed to the substantial investments made in government-supported infrastructure projects and the efficient provision of information on passenger transport services.

The Asia Pacific region is projected to register the fastest Compound Annual Growth Rate (CAGR) of 12%. This can be attributed to the ongoing digitalization trend across various industries, including aviation. The adoption of passenger service system solutions, which provide online booking capabilities, self-service options, mobile applications, and personalized digital experiences, is being driven by digital transformation. Furthermore, the expansion of the aviation industry is playing a significant role in accelerating market growth. This expansion aims to effectively manage the rising number of passengers, optimize operations, and enhance the overall customer experience. The high demand for Passenger Service Systems in this region can be attributed to the presence of several developing and potential countries, including India, Japan, and China. These nations offer attractive opportunities for vendors operating in this field.

Need any customization research on Passenger Service System Market - Enquire Now

Key Players

Recent Development:

| Report Attributes | Details |

| Market Size in 2023 | US$ 7.6 Bn |

| Market Size by 2032 | US$ 28.1 Bn |

| CAGR | CAGR of 15.6 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Services) • By Organizational Size (Large Enterprises, Small and Medium Enterprises) • By Deployment Mode (Public Cloud, Private Cloud, Hybrid Cloud) • By Industry Vertical (BFSI, IT and Telecom, Retail, Healthcare, Manufacturing, Government, Travel and Hospitality, Education, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | IBM Corporation, Travelport Worldwide Ltd., KIU System Solutions, Information Systems Associates FZE, IBS Software Services Pvt. Ltd., Bravo Passenger Solutions Pte Limited, Hewlett Packard Enterprise, Enoya-one LTD., Travel Technology Interactive, Unisys Corporation, Hexaware Technologies Ltd., Mercator Limited, Hitit Computer Services A.S., Intelisys Aviation Systems Inc., Amadeus IT Group SA, Radixx International, Inc., Travelsky Technology Ltd., Sabre Corp., Sirena-Travel JSCS |

| Key Drivers | • Investments have yielded highly automated airline operations, facilitated by online booking, inventory control, and reservation services. |

| Market Restraints | • The growth of the market is being hindered by security concerns related to passenger service systems. |

Ans: The Passenger Service System Market size was valued at USD 7.6 billion in 2023.

Ans. The Passenger Service System Market is to grow at a CAGR of 15.6 % From 2024 to 2032.

Ans: Yes, you can ask for the customization as pas per your business requirement.

Ans. The forecast period of the Passenger Service System Market is 2024-2031.

Ans.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Type

3.2 Bottom-up Type

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Network Infrastructure Expansion, by Region

5.3 Cybersecurity Incidents, by Region (2020-2023)

5.4 Cloud Services Usage, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Type Benchmarking

6.3.1 Type specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new Age Cohort launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Passenger Service System Market Segmentation, By Component

7.1 Chapter Overview

7.2 Software

7.2.1 Software Market Trends Analysis (2020-2032)

7.2.2 Software Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Services

7.3.1 Services Market Trends Analysis (2020-2032)

7.3.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Passenger Service System Market Segmentation, By Service

8.1 Chapter Overview

8.2 Airline Reservation System

8.2.1 Airline Reservation System Market Trends Analysis (2020-2032)

8.2.2 Airline Reservation System Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Airline Inventory System

8.3.1 Airline Inventory System Market Trends Analysis (2020-2032)

8.3.2 Airline Inventory System Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Departure Control System

8.4.1 Departure Control System Market Trends Analysis (2020-2032)

8.4.2 Departure Control System Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Internet Booking System

8.5.1 Internet Booking System Market Trends Analysis (2020-2032)

8.5.2 Internet Booking System Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Loyalty System

8.6.1 Loyalty System Market Trends Analysis (2020-2032)

8.6.2 Loyalty System Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Customer Care System

8.7.1 Customer Care System Market Trends Analysis (2020-2032)

8.7.2 Customer Care System Market Size Estimates and Forecasts to 2032 (USD Billion)

8.8 Others

8.8.1 Others Market Trends Analysis (2020-2032)

8.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Passenger Service System Market Segmentation, By Deployment Mode

9.1 Chapter Overview

9.2 Cloud

9.2.1 Cloud Market Trends Analysis (2020-2032)

9.2.2 Cloud Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 On-premises

9.3.1 On-premises Market Trends Analysis (2020-2032)

9.3.2 On-premises Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Passenger Service System Market Segmentation, By Solution

10.1 Chapter Overview

10.2 Inventory Management

10.2.1 Inventory Management Market Trends Analysis (2020-2032)

10.2.2 Inventory Management Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Loyalty Management

10.3.1 Loyalty Management Market Trends Analysis (2020-2032)

10.3.2 Loyalty Management Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Reservation Management

10.4.1 Reservation Management Market Trends Analysis (2020-2032)

10.4.2 Reservation Management Market Size Estimates and Forecasts to 2032 (USD Billion)

10.5 Others

10.5.1 Others Market Trends Analysis (2020-2032)

10.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Passenger Service System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.4 North America Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.2.5 North America Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.2.6 North America Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.7.2 USA Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.2.7.3 USA Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.2.7.4 USA Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.8.2 Canada Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.2.8.3 Canada Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.2.8.4 Canada Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.9.2 Mexico Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.2.9.3 Mexico Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.2.9.4 Mexico Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Passenger Service System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.7.2 Poland Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.1.7.3 Poland Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.1.7.4 Poland Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.8.2 Romania Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.1.8.3 Romania Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.1.8.4 Romania Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turke Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Passenger Service System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.4 Western Europe Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.5 Western Europe Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.2.6 Western Europe Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.7.2 Germany Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.7.3 Germany Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.2.7.4 Germany Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.8.2 France Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.8.3 France Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.2.8.4 France Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.9.2 UK Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.9.3 UK Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.2.9.4 UK Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.10.2 Italy Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.10.3 Italy Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.2.10.4 Italy Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.11.2 Spain Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.11.3 Spain Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.2.11.4 Spain Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.14.2 Austria Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.14.3 Austria Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.2.14.4 Austria Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Passenger Service System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.4 Asia Pacific Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.4.5 Asia Pacific Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.4.6 Asia Pacific Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.7.2 China Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.4.7.3 China Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.4.7.4 China Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.8.2 India Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.4.8.3 India Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.4.8.4 India Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.9.2 Japan Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.4.9.3 Japan Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.4.9.4 Japan Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.10.2 South Korea Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.4.10.3 South Korea Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.4.10.4 South Korea Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.11.2 Vietnam Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.4.11.3 Vietnam Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.4.11.4 Vietnam Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.12.2 Singapore Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.4.12.3 Singapore Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.4.12.4 Singapore Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.13.2 Australia Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.4.13.3 Australia Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.4.13.4 Australia Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Passenger Service System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.4 Middle East Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.1.5 Middle East Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.5.1.6 Middle East Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.7.2 UAE Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.1.7.3 UAE Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.5.1.7.4 UAE Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Passenger Service System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.4 Africa Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.2.5 Africa Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.5.2.6 Africa Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Afric Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Passenger Service System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.4 Latin America Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.6.5 Latin America Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.6.6 Latin America Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.7.2 Brazil Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.6.7.3 Brazil Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.6.7.4 Brazil Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.8.2 Argentina Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.6.8.3 Argentina Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.6.8.4 Argentina Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.9.2 Colombia Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.6.9.3 Colombia Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.6.9.4 Colombia Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Passenger Service System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Passenger Service System Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Passenger Service System Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Passenger Service System Market Estimates and Forecasts, By Solution (2020-2032) (USD Billion)

12. Company Profiles

12.1 IBM Corporation

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Product / Services Offered

12.1.4 SWOT Analysis

12.2 Travelport Worldwide Ltd.

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Product / Services Offered

12.2.4 SWOT Analysis

12.3 KIU System Solutions

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Product / Services Offered

12.3.4 SWOT Analysis

12.4 Information Systems Associates FZE

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Product / Services Offered

12.4.4 SWOT Analysis

12.5 IBS Software Services Pvt. Ltd.

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Product / Services Offered

12.5.4 SWOT Analysis

12.6 Bravo Passenger Solutions Pte Limited

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Product / Services Offered

12.6.4 SWOT Analysis

12.7 Hewlett Packard Enterprise

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Product / Services Offered

12.7.4 SWOT Analysis

12.8 Enoya-one LTD

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Product / Services Offered

12.8.4 SWOT Analysis

12.9 Travel Technology Interactive

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Product / Services Offered

12.9.4 SWOT Analysis

12.10 Hexaware Technologies Ltd.

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Product/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Component

Software

Services

By Service

Airline Reservation System

Airline Inventory System

Departure Control System

Internet Booking System

Loyalty System

Customer Care System

Others

By Deployment Mode

Cloud

On-premises

By Solution

Inventory Management

Loyalty Management

Reservation Management

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Architectural Services Market Size was valued at USD 374.45 Billion in 2023 and is expected to reach USD 709.52 Billion by 2032 and grow at a CAGR of 7.41% over the forecast period 2024-2032.

The Freelance Platforms Market was valued at USD 5.2 billion in 2023 and is expected to reach USD 21.6 billion by 2032, growing at a CAGR of 17.18% by 2032.

The Enterprise Network Infrastructure Market was valued at USD 62.2 Billion in 2023 and will reach USD 100.4 Billion by 2032, growing at a CAGR of 5.49% by 2032.

The Application Performance Monitoring Market was valued at USD 7.26 Billion in 2023 and is expected to reach USD 22.81 Billion by 2032, growing at a CAGR of 34.61% over the forecast period 2024-2032.

The Asia Pacific Global Capability Centers Market Size was USD 81.61 Bn in 2023 and will reach $310.73 Bn by 2032 and grow at a CAGR of 14.46% by 2024-2032.

Social Media Management Market size was valued at USD 21.9 Billion in 2023 and will grow to USD 138.4 Billion by 2032 and grow at a CAGR of 22.8% by 2032.

Hi! Click one of our member below to chat on Phone