To Get More Information on Parkinson’s Disease Treatment Market - Request Sample Report

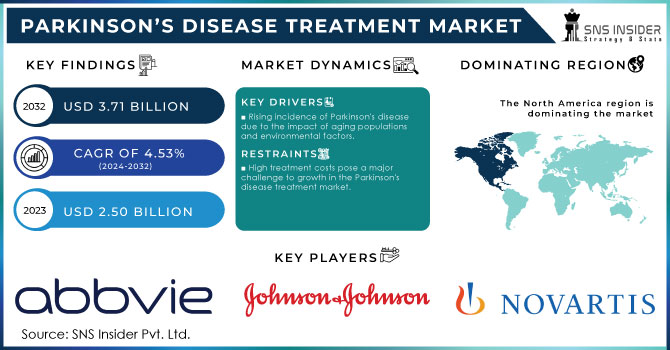

The Parkinson’s Disease Treatment Market size was valued at USD 2.50 Billion in 2023 and is expected to reach USD 3.71 Billion by 2032 and grow at a CAGR of 4.53% over the forecast period 2024-2032.

The Parkinson's disease treatment market is growing rapidly due to the rising number of cases and improvements in treatment choices. The market now incorporates a wide variety of therapeutic methods, such as traditional medication and cutting-edge treatments like deep brain stimulation and gene therapy. Medical treatments have always been the foundation of managing Parkinson's disease. Levodopa, the standard treatment and precursor to dopamine, is commonly combined with other medications to help control symptoms like tremors, rigidity, and bradykinesia. In the United States in 2023, around 1 million people with Parkinson's disease still rely on levodopa as a mainstay of treatment. Levodopa is prescribed to approximately 70% of individuals with Parkinson's disease at some point in their condition as a primary therapy. Estimates suggest that the market for Parkinson's disease drugs, such as levodopa, in the United States is significant, amounting to billions of dollars due to the medication's crucial role in managing symptoms. Dopamine agonists, MAO-B inhibitors, and COMT inhibitors also contribute significantly to improving the efficacy of levodopa treatment or decreasing dopamine degradation in the brain. Nevertheless, the prolonged use of these drugs can result in issues such as motor fluctuations and dyskinesia, motivating researchers and pharmaceutical firms to investigate more precise and inventive methods.

Around 1 million Americans who have Parkinson's disease were assessed for Deep Brain Stimulation (DBS), with a focus on 15% of these individuals who did not respond well to their medication. DBS was a possible treatment for 10% of individuals with severe, medication-resistant symptoms of essential tremor, a condition that impacts roughly 10 million Americans. More than 25,000 DBS surgeries were carried out in the United States in 2023 at over 150 specialized facilities. The price for a DBS surgery typically falls between USD 40,000 and USD 60,000, and many leading insurance companies, such as Medicare and Medicaid, provide coverage for authorized uses. This surgery involves placing electrodes in certain areas of the brain to control unusual brain activity. DBS has been proven to greatly enhance motor symptoms in advanced Parkinson's disease patients who do not respond sufficiently to medication anymore. Although it is not a remedy, it provides patients with an improved quality of life by lessening the severity of tremors, rigidity, and movement challenges.

| Treatment | How Does It Work |

|---|---|

| Cannabidiole | Cannabidiol (CBD) has emerged as a promising adjunct in the management of Parkinson's disease, offering potential benefits across several symptoms. CBD has shown potential in reducing dyskinesia, a common side effect of dopaminergic medications used for Parkinson’s. |

| Ayurveda | Ayurveda, the traditional Indian system of medicine, offers a holistic approach to managing Parkinson’s disease by focusing on balancing the body’s doshas, particularly Vata, which governs movement and communication. |

| Medications | • Levodopa/Carbidopa: Converts to dopamine in the brain, improving motor symptoms. • Dopamine Agonists: Mimic dopamine effects in the brain. • MAO-B Inhibitors: Prevents the breakdown of dopamine by inhibiting the MAO-B enzyme. • COMT Inhibitors: Prolongs the effects of levodopa by inhibiting its breakdown. • Anticholinergics: Reduces tremors by blocking acetylcholine, a neurotransmitter involved in movement. • Amantadine: May help with motor symptoms and dyskinesias by increasing dopamine release and blocking glutamate. |

| Deep Brain Stimulation (DBS) | Electrodes: Implanted in specific brain areas, they deliver electrical impulses to reduce symptoms and improve motor function. |

| Surgical Procedures | • Pallidotomy: Destroys a small part of the brain involved in movement control to improve symptoms. • Thalamotomy: Targets the thalamus to reduce tremors and improve motor function. |

| Physical Therapy | • Exercise: Aim to improve mobility, strength, and balance through tailored physical exercises. • Occupational Therapy: Helps with daily activities and adaptations to manage motor and non-motor symptoms. |

| Speech Therapy | Speech Exercises: Assists with voice volume and articulation, improving communication skills affected by Parkinson's disease. |

| Experimental Treatments | • Gene Therapy: Aims to modify genes to improve dopamine production or neuronal survival. • Stem Cell Therapy: Researching the use of stem cells to replace damaged neurons and restore dopamine levels. • New Medications: Ongoing research into drugs that target different aspects of Parkinson's disease, including novel approaches to symptom management. |

Drivers

Rising incidence of Parkinson's disease due to the impact of aging populations and environmental factors.

The increase in Parkinson's disease cases worldwide is a major factor contributing to market expansion. Parkinson's disease is a prevalent neurodegenerative disorder that becomes more common as individuals age. With the increasing number of elderly people worldwide, there is a projected increase in the number of individuals impacted by Parkinson's disease, leading to a higher need for successful treatment options. Studies on disease patterns show that there is an increasing incidence of Parkinson's disease attributed to factors like longer life spans and shifts in lifestyle and environmental conditions. For example, living in cities and being exposed to environmental pollutants have been associated with an increased likelihood of developing Parkinson's disease. Furthermore, improvements in diagnostic methods have resulted in more precise and timelier diagnoses, helping to fuel the rising number of reported cases. Increased awareness of Parkinson's disease in both the general public and medical professionals has resulted in more regular and earlier identification of the condition. Awareness campaigns, educational programs, and better diagnostic tools have led to a rise in the detection of Parkinson's cases, resulting in a larger number of patients in need of treatment. The growing prevalence of Parkinson's disease is fueling the need for improved and more efficient treatment alternatives. Pharmaceutical companies are driven to fund research and development in order to meet the needs of an expanding patient population, leading to increased market growth.

Advancements in healthcare infrastructure and accessibility are driving growth.

Enhancements in healthcare facilities and availability are having a positive effect on the Parkinson's Disease Treatment Market. Improved healthcare systems, advanced diagnostic tools, and greater access to specialized care help in the more efficient handling of Parkinson’s disease. Developments in healthcare infrastructure, such as the creation of dedicated Parkinson's clinics and top-tier centers, offer patients the opportunity to receive thorough care. These facilities provide a comprehensive approach to managing the disease by offering specialized teams that include neurologists, experts in movement disorders, and physiotherapists. Telehealth services and virtual consultations have enhanced patients' ability to receive care in distant or underprivileged regions. These services allow patients to access professional advice and treatment regardless of their location, bridging gaps in healthcare availability. Furthermore, enhanced insurance coverage and reimbursement policies for treatments of Parkinson's disease have simplified the process for patients to obtain crucial therapies. Insurance providers are increasingly acknowledging the importance of advanced therapies and are providing improved coverage choices, lessening the financial strain on individuals. Improvements in healthcare infrastructure and accessibility lead to improved management of diseases and outcomes for patients, which spur growth in the Parkinson’s Disease Treatment Market.

Restraints

High treatment costs pose a major challenge to growth in the Parkinson's disease treatment market.

The high treatment expenses are a significant limitation on the Parkinson's Disease Treatment Market. Innovative interventions like deep brain stimulation (DBS) and new medication forms can be costly and are not always included in insurance coverage. The significant obstacle for numerous patients to access life-changing therapies is the expensive nature of these treatments. Substantial research and development costs are required for the creation and manufacturing of new drugs and medical devices, which impact the pricing of these treatments. Furthermore, patients face increased financial strain due to the expenses of continuous monitoring and follow-up care. The healthcare systems and insurance providers also face challenges due to the expensive treatment costs. In certain areas, healthcare budget limitations and restrictions on reimbursement could limit access to advanced treatments for Parkinson's, creating disparities in availability. Efforts to tackle these cost-related challenges involve pushing for policy reforms, researching cost-efficient treatment alternatives, and enhancing pricing transparency. Nevertheless, the substantial expense continues to be a major limitation on the expansion of the market.

By Drug Class

Carbidopa-levodopa held a market share of over 30% in 2023. This combined treatment is the most efficient and commonly recommended for controlling symptoms of Parkinson's disease. Carbidopa stops levodopa from turning into dopamine in areas other than the brain, allowing for a higher amount of levodopa to reach the brain for conversion into dopamine. This aids in reducing motor symptoms such as tremors and rigidity. Its leadership is credited to its lengthy record of usage, substantial clinical data backing up its effectiveness, and a firmly established safety history.

Dopamine Agonists are experiencing the quickest growth rate during the forecast period within the Parkinson's disease treatment market. These medications imitate dopamine's effects in the brain, assisting in controlling motor symptoms and potentially postponing the necessity for Carbidopa-Levodopa treatment. They are especially useful in the beginning phases of Parkinson's and as a supplementary treatment in later stages. Ongoing research, newer formulations, and the rising need for medications with reduced side effects and longer-lasting effects are fueling their growth. Medications such as Mirapex (pramipexole) by Pfizer demonstrate the growing importance of Dopamine Agonists.

By Sales Channel

The retail sector held a major market share of 61% in 2023 and dominated the market because of its widespread coverage and convenience. Retail pharmacies and stores are essential for patients who need consistent and easy access to their medications. This section has advantages from its extensive distribution system and the capability to provide a range of products, such as medications for hospitals and over-the-counter remedies. Retail pharmacies such as CVS Health and Walgreens have positioned themselves as important participants in this industry, offering extensive services and individualized attention for individuals with Parkinson's disease.

The hospital sector is accounted to have a faster CAGR during 2024-2032. Hospitals offer specialized treatment, such as advanced procedures and surgical actions, which are generally not offered in retail environments. The increasing amount of hospitals with advanced treatment options for Parkinson's disease is a factor in this expansion. For instance, top institutions such as the Mayo Clinic and Cleveland Clinic are at the forefront of providing holistic Parkinson's care programs that include medical, surgical, and rehabilitative therapies.

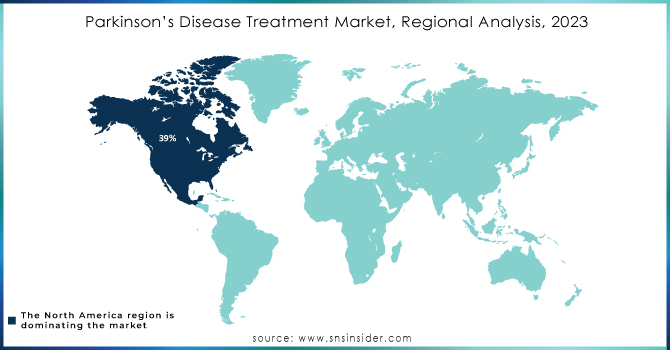

North America dominated in 2023 with a 39% market share, due to its top-notch healthcare facilities, substantial R&D investments, and strong awareness regarding neurological conditions. The area has a significant number of major pharmaceutical companies, such as AbbVie and Pfizer, that are working on advanced treatments like deep brain stimulation (DBS) devices and dopamine-based therapies. The rising number of older individuals in the U.S. and Canada is also playing a role in the growing occurrence of Parkinson's disease.

The Asia-Pacific region is to experience the most rapid growth rate during the forecast period 2024-2032, mainly as a result of higher healthcare spending and growing recognition of neurological conditions. Nations such as China and India are experiencing notable expansion due to enhancements in healthcare infrastructure and the accessibility of affordable treatment choices. Sun Pharmaceutical and Takeda are actively aiding in the advancement and availability of Parkinson’s treatments in the local community.

Do You Need any Customization Research on Parkinson’s Disease Treatment Market - Enquire Now

The major key players in the market are:

AbbVie (Duopa, Rytary)

Johnson & Johnson (Inbrija, Nupovio)

Novartis (Aimovig, Pimavanserin)

Teva Pharmaceutical Industries (Azilect, Seroquel)

UCB Pharma (Neupro, Briviact)

Prevail Therapeutics- acquired by Elli Lilly (Propel)

Voyager Therapeutics (VY-AADC, VY-HTT01)

Inflazome (INP104, INP102)

Denali Therapeutics (DNL747, DNL343) & Other Players

In March 2023, Stimwave Technologies introduced new non-invasive neuromodulation therapy for Parkinson’s Disease. The therapy allows for controlling the symptoms of the disease such as tremors, rigidity, etc. through targeted stimulation.

In September 2022, BrainStorm Cell Therapeutics introduced Nurown, a cell-based therapy for Parkinson’s Disease. The proposed therapy includes the implantation of modified stem cells for neural repair.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.80 Billion |

| Market Size by 2032 | USD 15.95 Billion |

| CAGR | CAGR of 11.92% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Drug Class (Carbidopa-Levodopa, Dopamine Agonists, MAO-B Inhibitors, COMT Inhibitors, Anticholinergics, Others) • By Sales Channel (Hospital, Retail, Online) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AbbVie, Johnson & Johnson, Novartis, Teva Pharmaceutical Industries, UCB Pharma, Prevail Therapeutics (acquired by Eli Lilly), Voyager Therapeutics, Inflazome, Denali Therapeutics |

| Key Drivers | • Rising incidence of Parkinson's disease due to the impact of aging populations and environmental factors. • Advancements in healthcare infrastructure and accessibility are driving growth. |

| Restraints | • High treatment costs pose a major challenge to growth in the Parkinson's disease treatment market. |

Ans: The Parkinson’s Disease Treatment Market is expected to grow at a CAGR of 11.92% during 2024-2032.

Ans: Parkinson’s Disease Treatment Market size was USD 5.80 Billion in 2023 and is expected to Reach USD 15.95 Billion by 2032.

Ans: Rising incidence of Parkinson's disease due to the impact of aging populations and environmental factors.

Ans: The retail pharmacy segment dominated the Parkinson’s Disease Treatment Market.

Ans: North America dominated the Parkinson’s Disease Treatment Market in 2023.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Parkinson’s Disease Treatment Incidence and Prevalence (2023)

5.2 Parkinson’s Disease Treatment Hospital Trends, (2023), by Region

5.3 Parkinson’s Disease Treatment Drug Volume: Production and usage volumes of pharmaceuticals.

5.4 Hospitalcare Spending, by region, (Government, Commercial, Private, Out-of-Pocket), 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Parkinson’s Disease Treatment Market Segmentation, by Drug Class

7.1 Chapter Overview

7.2 Carbidopa-Levodopa

7.2.1 Carbidopa-Levodopa Market Trends Analysis (2020-2032)

7.2.2 Carbidopa-Levodopa Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Dopamine Agonists

7.3.1 Dopamine Agonists Market Trends Analysis (2020-2032)

7.3.2 Dopamine Agonists Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 MAO-B Inhibitors

7.4.1 MAO-B Inhibitors Market Trends Analysis (2020-2032)

7.4.2 MAO-B Inhibitors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 COMT Inhibitors

7.5.1 COMT Inhibitors Market Trends Analysis (2020-2032)

7.5.2 COMT Inhibitors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Anticholinergics

7.6.1 Anticholinergics Market Trends Analysis (2020-2032)

7.6.2 Anticholinergics Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 Others

7.7.1 Others Market Trends Analysis (2020-2032)

7.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Parkinson’s Disease Treatment Market Segmentation, by Sales Channel

8.1 Chapter Overview

8.2 Hospital

8.2.1 Hospital Market Trends Analysis (2020-2032)

8.2.2 Hospital Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Retail

8.3.1 Retail Market Trends Analysis (2020-2032)

8.3.2 Retail Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Online

8.4.1 Online Market Trends Analysis (2020-2032)

8.4.2 Online Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Parkinson’s Disease Treatment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.2.4 North America Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.2.5.2 USA Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.2.6.2 Canada Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.2.7.2 Mexico Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Parkinson’s Disease Treatment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.3.1.5.2 Poland Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.3.1.6.2 Romania Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Parkinson’s Disease Treatment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.3.2.4 Western Europe Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.3.2.5.2 Germany Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.3.2.6.2 France Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.3.2.7.2 UK Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.3.2.8.2 Italy Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.3.2.9.2 Spain Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.3.2.12.2 Austria Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.4 Asia-Pacific

9.4.1 Trends Analysis

9.4.2 Asia-Pacific Parkinson’s Disease Treatment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia-Pacific Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.4.4 Asia-Pacific Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.4.5.2 China Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.4.5.2 India Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.4.5.2 Japan Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.4.6.2 South Korea Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.2.7.2 Vietnam Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.4.8.2 Singapore Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.4.9.2 Australia Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.4.10 Rest of Asia-Pacific

9.4.10.1 Rest of Asia-Pacific Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia-Pacific Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Parkinson’s Disease Treatment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.5.1.4 Middle East Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.5.1.5.2 UAE Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Parkinson’s Disease Treatment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.5.2.4 Africa Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa Parkinson’s Disease Treatment Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

9.5.2.7.2 Rest of Africa Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Parkinson’s Disease Treatment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.6.4 Latin America Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.6.5.2 Brazil Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.6.6.2 Argentina Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.6.7.2 Colombia Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Parkinson’s Disease Treatment Market Estimates and Forecasts, by Drug Class (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Parkinson’s Disease Treatment Market Estimates and Forecasts, by Sales Channel (2020-2032) (USD Billion)

10. Company Profiles

10.1 AbbVie

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 Johnson & Johnson

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Novartis

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Teva Pharmaceutical Industries

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 UCB Pharma

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Prevail Therapeutics (acquired by Eli Lilly)

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Voyager Therapeutics

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Inflazome

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Denali Therapeutics

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Drug Class

Carbidopa-Levodopa

Dopamine Agonists

MAO-B Inhibitors

COMT Inhibitors

Anticholinergics

Others

By Sales Channel

Hospital

Retail

Online

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Patch-Based Wound Healing Products Market was valued at USD 1.35 billion in 2023 and is expected to reach USD 1.99 billion by 2032, growing at a CAGR of 4.42% over the forecast period 2024-2032.

The Continuous Glucose Monitoring Market Size was valued at USD 4.62 Billion in 2023, and is expected to reach USD 8.82 Billion by 2032, and grow at a CAGR of 7.80%.

The Scanning Electron Microscopes Market Size was valued at USD 4.75 Billion in 2023, and is expected to reach USD 9.36 Billion by 2032, and grow at a CAGR of 9.77%.

Johne’s Disease Diagnostics Market Size was valued at USD 652.6 million in 2023 and is expected to reach USD 1076.6 million by 2032, growing at a CAGR of 5.7% over the forecast period 2024-2032.

The Biosurgery Market was valued at USD 20.11 billion in 2023 and is projected to reach USD 46.20 billion by 2032 and grow at a CAGR of 9.69% from 2024 to 2032.

The Pharmacy Benefit Management Market size was estimated at USD 553.4 billion in 2023 and is expected to reach USD 934.9 billion by 2032 at a CAGR of 6.0% during the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone