Get More Information on Paraffin Wax Market - Request Sample Report

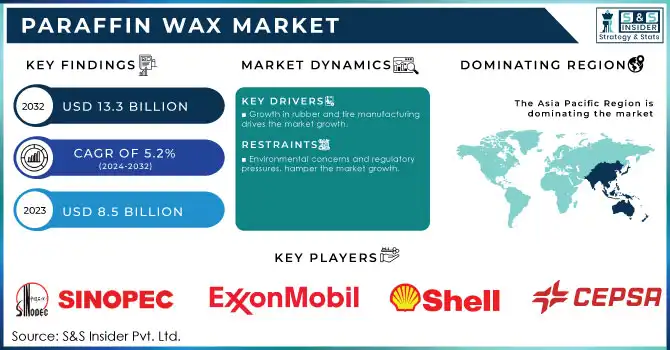

The Paraffin Wax Market Size was valued at USD 8.5 Billion in 2023. It is expected to grow to USD 13.3 Billion by 2032 and grow at a CAGR of 5.2% over the forecast period of 2024-2032.

The demand for paraffin wax has witnessed substantial growth, especially in the packaging industry, which is being significantly influenced by sustainability and the expansion of global trade. While several industries have pivoted towards more environmentally friendly approaches to their products, paraffin wax is being adopted in developments for recyclable and biodegradable packaging materials due to its water resistance and barrier properties. This inclination towards sustainable packaging is a reaction to the growing environmental concerns and regulatory pressure over plastic waste. Moreover, the expansion of global trade due to the boom in e-commerce and international trade activity has also contributed to the increasing demand for paraffin-wax-coated packing, especially for the food and beverage industry. The increasingly interconnected global market needs decent quality delivery of paraffin wax is effective in defending the freshness of merchandise with coating as an outer layer, which enhances the shelf life and contrasting quality while traveling.

The International Trade Administration (ITA) highlights that the U.S. alone exported over USD 152 billion worth of food products in 2022, many of which rely on packaging materials that include paraffin wax for preserving freshness and extending shelf life during international shipping.

The increasing demand for candles, especially paraffin wax, is primarily due to their low cost, their multifunctionality, and the optimal retention of fragrance and color. The use of candles is mainly a decorative purpose but also has therapeutic benefits which is becoming popular more than ever such as in aromatherapy. With the growing use of candles for relaxation and the atmosphere found in home wellness regimes, the demand for high-quality paraffin wax candles keeps increasing. Moreover, the rising number of celebration events around the world, including festivals, weddings, and vacations, is also driving the demand for candles. Whilst classic merchandising segments remain strong, the Asia-Pacific and Middle East markets for candles are growing rapidly.

The United Nations (UN) estimates that by 2030, almost 60% of the world’s population will live in urban areas, with substantial growth in urban populations in Asia and the Middle East. This urbanization trend is expected to increase consumer spending on home-related products like candles, as people invest in home décor and wellness products.

Drivers

Growth in rubber and tire manufacturing drives the market growth.

Manufacturing of rubber and tire is one of the major applications of paraffin wax, thus bolstering adopting other applications is projected to grow, thereby driving demand for paraffin wax. Used in rubber processing, paraffin wax enhances rubber product properties such as those of tire rubbers. It is a protective layer that helps to resist surface cracking, oxidation, and degradation of rubber therefore prolonging the service life of rubber components. In tire production, paraffin wax is especially useful because it facilitates the manufacturing process, keeps them from sticking during production, and adds a smooth finish to the tires. With car ownership and the overall manufacture of automobiles growing in emerging markets, the pressure for tires on a global basis mount with it. An increase in tire usage leads to the demand for paraffin wax used in the tire manufacturing process. In addition, the rebound of the automotive industry from the pandemic, along with advancements in electric vehicle (EV) tire technologies, and increased vehicle production across nations such as China, India, and the U.S., are also anticipated to provide an uptick to the demand for paraffin wax in rubber and tire applications.

The U.S. Department of Energy (DOE) highlighted that the electric vehicle market in the U.S. grew by 65% in 2022, reaching more than 800,000 EVs sold. This growth in EVs is influencing tire manufacturing, as these vehicles require specialized tires.

Restraint

Environmental concerns and regulatory pressures. hamper the market growth.

Paraffin Wax market dynamics environmental concerns and regulatory pressures play a major restraining factor for the growth of the paraffin wax market. With growing consciousness towards environmental issues, several governments are enforcing stringent regulations to minimize the use of petrochemical products. The European Green Deal as well as targets to reduce carbon emissions have been prompting industries to transition toward greener and more sustainable alternatives. This has resulted in rising requirements for bio-based waxes such as soy and beeswax, both of which are renewable, biodegradable, and environmentally friendly. Also, consumers are increasingly awareness of the sustainability of the products they buy which encourages the country to shift to buying products that have a renewable source. As such, long-term market growth is now threatened for paraffin wax unless the industry can develop more commercially viable production processes that comply with the expanding range of environmental regulations coupled with a growing producer emphasis on alternative carbon neutral or sustainable production methods or increasingly more environmentally sound consumer preferences in many markets worldwide.

By Application

Candle held the largest market share around 62% in 2023. It is owing to their extensive use for decorative, ceremonial, and functional uses. The material most used in the manufacture of candles is paraffin wax, which is inexpensive, easy to handle, and has great combustion properties. Other than that, because it retains fragrance and holds color well, it is good for use in scented and decorative candles, which are popular for atmosphere, relaxation, and therapeutic applications such as aromatherapy. Moreover, the increasing trend of using candles in home décor, wellness traditions, and celebratory occasions has catapulted the demand for paraffin wax. In 2023, self-care is the global norm, and candle-making is inextricably linked with that trend; thus, the prevalence and cheap production of paraffin wax have ensured its place at the top of the candle-making chain. While candles are increasingly becoming a part of households across the world, the market share is led by paraffin wax-based candles, which ultimately remain the primary material used in the production.

Need Any Customization Research On Paraffin Wax Market - Inquiry Now

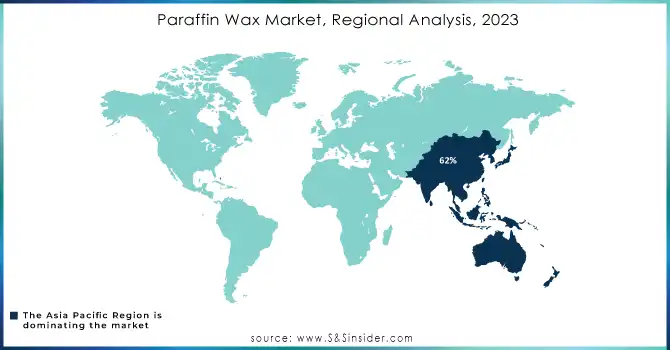

Asia Pacific held the largest market share around 62% in 2023. Owing to high industrialization, growing consumer demands, and high production in manufacturing industries Paraffin wax is used in various applications such as for candles, packaging, cosmetics, and rubber manufacturing, whereas the growing economies of the region especially in countries such as China, India, and Japan are fueling the increasing demand for paraffin wax. As the largest global consumer and producer of paraffin wax, China is a major driver of the regional market. Furthermore, an expanding middle class and disposable income in the region are also boosting the consumption of paraffin wax used in consumer goods such as candles, cosmetics, and packaged food. The strong manufacturing base in Asia Pacific also creates a continuous growth for paraffin wax amongst industrial applications such as coatings and lubricants. In addition, increasing urbanization, infrastructural development, and the growing E-commerce sector within this region further drive the paraffin wax-coated products market demand for packaging materials.

Sinopec (Fully Refined Paraffin Wax, Semi-Refined Paraffin Wax)

ExxonMobil (Microcrystalline Wax, ParaPro High Melting Wax)

Royal Dutch Shell PLC (Shellwax S100, Shellwax T32)

CEPSA (Cerasur Fully Refined Wax, Cerasur Micro Wax)

Petrobras (Paraffin Wax Type A, Type B Wax)

Calumet Specialty Products Partners (Bulk Paraffin Wax, Packaged Paraffin Wax)

PetroChina Company Limited (Hydrogenated Wax, Semi-Refined Wax)

ENEOS Corporation (Fully Refined Wax, Melt Wax 120)

Sasol Limited (Fischer-Tropsch Wax, Paraffin Wax)

HollyFrontier Corporation (Multiwax 180-M, Multiwax 445)

Evonik Industries (Viscosoft Wax, Dynasole Wax)

International Group Inc. (IGI) (IGI 1260A, IGI 4627A)

Honeywell International (Micronized Paraffin Wax, Micronized Polyethylene Wax)

Nippon Seiro Co., Ltd. (Hard Paraffin Wax, Semi-Refined Wax)

Trecora Resources (Pentane Blended Wax, Wax Blend 145)

Apar Industries Ltd. (Industrial Wax, Decorative Wax)

H&R Group (CeraPol Paraffin Wax, Multi-functional Wax)

Lukoil (Fully Refined Wax, Special Grade Wax)

Panama Petrochem (Slack Wax, Rubber Process Oil Wax)

TotalEnergies SE (Paraffin Wax N60, Total Wax 90)

In 2023, ExxonMobil expanded its paraffin wax production capacity with a new plant in Asia to meet the growing demand for high-quality waxes used in candles, packaging, and cosmetics.

In 2023, Sasol, company, announced the development of a new bio-based paraffin wax variant derived from renewable resources. This product is aimed at addressing growing consumer demand for more sustainable and eco-friendly alternatives to traditional petroleum-based waxes.

In 2022, Shell Chemicals introduced new advancements in paraffin wax technology designed to improve the product's environmental footprint. The company focused on increasing the efficiency of its production processes to reduce emissions and enhance the quality of its paraffin wax offerings.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 8.5 Billion |

| Market Size by 2032 | US$ 13.3 Billion |

| CAGR | CAGR of5.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Candles, Packaging, Cosmetics, Hot Melts, Board Sizing, Rubber, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Sinopec, ExxonMobil, Royal Dutch Shell PLC, CEPSA, Petrobras, Calumet Specialty Products Partners, PetroChina Company Limited, ENEOS Corporation, Sasol Limited, HollyFrontier Corporation, Evonik Industries, International Group Inc. (IGI), Honeywell International, Nippon Seiro Co., Ltd., Trecora Resources, Apar Industries Ltd., H&R Group, Lukoil, Panama Petrochem, TotalEnergies SE.and Others |

| Key Drivers | • Growth in rubber and tire manufacturing drives the market growth. |

| RESTRAINTS | • Environmental concerns and regulatory pressures. hamper the market growth. |

Ans: The Paraffin Wax Market was valued at USD 8.5 Billion in 2023.

Ans: The expected CAGR of the global Paraffin Wax Market during the forecast period is 5.2%.

Ans: The candle application will grow rapidly in the Paraffin Wax Market from 2024-2032.

Ans: Growth in rubber and tire manufacturing drives the market growth.

Ans: China led the Paraffin Wax Market in the Asia Pacific region with the highest revenue share in 2023.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Type, 2023

5.2 Feedstock Prices, by Country, by Type, 2023

5.3 Regulatory Impact, by Country, by Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, by Type, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Paraffin Wax Market Segmentation, By Application

7.2 Candles

7.2.1 Candles Market Trends Analysis (2020-2032)

7.2.2 Candles Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Packaging

7.3.1 Packaging Market Trends Analysis (2020-2032)

7.3.2 Packaging Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Cosmetics

7.4.1 Cosmetics Market Trends Analysis (2020-2032)

7.4.2 Cosmetics Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Hot Melts

7.5.1 Hot Melts Market Trends Analysis (2020-2032)

7.5.2 Hot Melts Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Board Sizing

7.6.1 Board Sizing Market Trends Analysis (2020-2032)

7.6.2 Board Sizing Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 Rubber

7.7.1 Rubber Market Trends Analysis (2020-2032)

7.7.2 Rubber Market Size Estimates and Forecasts to 2032 (USD Billion)

7.8 Others

7.8.1 Others Market Trends Analysis (2020-2032)

7.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Regional Analysis

8.1 Chapter Overview

8.2 North America

8.2.1 Trends Analysis

8.2.2 North America Paraffin Wax Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

8.2.3 North America Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.2.2 USA

8.2.2.1 USA Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.2.3 Canada

8.2.3.1 Canada Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.2.4 Mexico

8.2.4.1 Mexico Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3 Europe

8.3.1 Eastern Europe

8.3.1.1 Trends Analysis

8.3.1.2 Eastern Europe Paraffin Wax Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

8.3.1.3 Eastern Europe Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.1.4 Poland

8.3.1.4.1 Poland Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.1.5 Romania

8.3.1.5.1 Romania Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.1.6 Hungary

10.3.1.8.1 Hungary Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.1.7 Turkey

8.3.1.7.1 Turkey Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.1.8 Rest of Eastern Europe

8.3.1.8.1 Rest of Eastern Europe Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.2 Western Europe

8.3.2.1 Trends Analysis

8.3.2.2 Western Europe Paraffin Wax Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

8.3.2.3 Western Europe Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.2.4 Germany

8.3.2.4.1 Germany Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.2.5 France

8.3.2.5.1 France Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.2.6 UK

8.3.2.6.1 UK Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.2.7 Italy

8.3.2.7.1 Italy Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.2.8 Spain

8.3.2.8.1 Spain Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.2.9 Netherlands

8.3.2.9.1 Netherlands Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.2.10 Switzerland

8.3.2.10.1 Switzerland Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.2.11 Austria

8.3.2.11.1 Austria Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.3.2.12 Rest of Western Europe

8.3.2.12.1 Rest of Western Europe Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.4 Asia-Pacific

8.4.1 Trends Analysis

8.4.2 Asia-Pacific Paraffin Wax Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

8.4.3 Asia-Pacific Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.4.4 China

8.4.4.1 China Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.4.5 India

8.4.5.1 India Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.4.6 Japan

8.4.6.1 Japan Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.4.7 South Korea

8.4.7.1 South Korea Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.4.8 Vietnam

8.4.8.1 Vietnam Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.4.9 Singapore

8.4.9.1 Singapore Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.4.10 Australia

8.4.10.1 Australia Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.4.11 Rest of Asia-Pacific

8.4.11.1 Rest of Asia-Pacific Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.5 Middle East and Africa

8.5.1 Middle East

8.5.1.1 Trends Analysis

8.5.1.2 Middle East Paraffin Wax Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.5.1.4 UAE

8.5.1.4.1 UAE Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.5.1.5 Egypt

8.5.1.5.1 Egypt Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.5.1.6 Saudi Arabia

8.5.1.6.1 Saudi Arabia Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.5.1.7 Qatar

8.5.1.7.1 Qatar Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.5.1.8 Rest of Middle East

8.5.1.8.1 Rest of Middle East Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.5.2 Africa

8.5.2.1 Trends Analysis

8.5.2.2 Africa Paraffin Wax Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

8.5.2.3 Africa Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.5.2.4 South Africa

8.5.2.4.1 South Africa Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.5.2.5 Nigeria

8.5.2.5.1 Nigeria Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.5.2.6 Rest of Africa

8.5.2.6.1 Rest of Africa Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.6 Latin America

8.6.1 Trends Analysis

8.6.2 Latin America Paraffin Wax Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

8.6.3 Latin America Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.6.4 Brazil

8.6.4.1 Brazil Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.6.5 Argentina

8.6.5.1 Argentina Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.6.6 Colombia

8.6.6.1 Colombia Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

8.6.7 Rest of Latin America

8.6.7.1 Rest of Latin America Paraffin Wax Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9. Company Profiles

9.1 Sinopec

9.1.1 Company Overview

9.1.2 Financial

9.1.3 Products/ Services Offered

9.1.4 SWOT Analysis

9.2 ExxonMobi

9.2.1 Company Overview

9.2.2 Financial

9.2.3 Products/ Services Offered

9.2.4 SWOT Analysis

9.3 Royal Dutch Shell PLC

9.3.1 Company Overview

9.3.2 Financial

9.3.3 Products/ Services Offered

9.3.4 SWOT Analysis

9.4 CEPSA

9.4.1 Company Overview

9.4.2 Financial

9.4.3 Products/ Services Offered

9.4.4 SWOT Analysis

9.5 Petrobras

9.5.1 Company Overview

9.5.2 Financial

9.5.3 Products/ Services Offered

9.5.4 SWOT Analysis

9.6 Calumet Specialty Products Partners

9.6.1 Company Overview

9.6.2 Financial

9.6.3 Products/ Services Offered

9.6.4 SWOT Analysis

9.7 PetroChina Company Limited

9.7.1 Company Overview

9.7.2 Financial

9.7.3 Products/ Services Offered

9.7.4 SWOT Analysis

9.8 ENEOS Corporation

9.8.1 Company Overview

9.8.2 Financial

9.8.3 Products/ Services Offered

9.8.4 SWOT Analysis

9.9 Sasol Limited

9.9.1 Company Overview

9.9.2 Financial

9.9.3 Products/ Services Offered

9.9.4 SWOT Analysis

9.10 HollyFrontier Corporation

9.10.1 Company Overview

9.10.2 Financial

9.10.3 Products/ Services Offered

9.10.4 SWOT Analysis

10. Use Cases and Best Practices

11. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Application

Candles

Packaging

Cosmetics

Hot melts

Board Sizing

Rubber

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Biocompatible Coatings Market was valued at USD 16.23 Billion in 2023 and is expected to reach USD 41.18 Billion by 2032, at a CAGR of 10.90% from 2024-2032.

The Mulching Materials Market size was valued at USD 3.5 Billion in 2023 & will grow to USD 6.8 Billion by 2032 and grow at a CAGR of 7.7% by 2024-2032.

The Wood Adhesives Market Size was valued at USD 7.0 billion in 2023 and is expected to reach USD 14.7 Billion by 2032 & grow at a CAGR of 8.7% by 2024-2032.

The Agricultural Textiles Market was valued at USD 15.8 billion in 2023 and will reach USD 24.3 billion by 2032 and grow at a CAGR of 4.9% by 2024-2032.

Polypropylene Catalyst Market size was USD 4.04 billion in 2023 and is expected to reach USD 8.07 billion by 2032, growing at a CAGR of 7.98% from 2024-2032.

Polyether Ether Ketone (PEEK) Market was valued at USD 770.75 Mn in 2023 and is expected to reach USD 1394.28 Mn by 2032, at a CAGR of 6.73% from 2024-2032.

Hi! Click one of our member below to chat on Phone