Paperboard Folding Carton Market scope & overview:

Get More Information on Paperboard Folding Carton Market - Request Sample Report

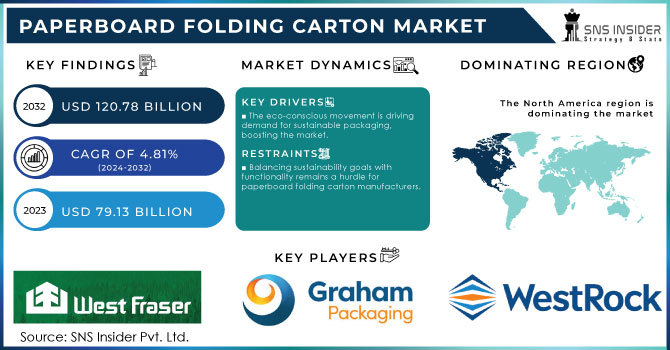

Paperboard Folding Carton Market Size was valued at USD 79.13 billion in 2023 and is expected to reach USD 120.78 billion by 2032 and grow at a CAGR of 4.81% by 2024-2032

The paperboard folding carton market stands poised for significant growth fueled by evolving consumer preferences, stricter environmental regulations, and continuous technological advancements. Sustainability remains a key driver, with the eco-friendly nature of paperboard propelling demand. Furthermore, the integration of smart packaging and augmented reality opens doors for innovation, allowing brands to enhance customer engagement and add value to their packaging solutions.

Additionally, collaborations throughout the supply chain, including packaging manufacturers, recyclers, and governing bodies, are fostering a circular economy for paperboard folding cartons. Sonoco Products Company, a South Carolina-based industry leader, delivers a comprehensive range of consumer packaging, industrial products, and packaging supply chain services worldwide. By optimizing recycling infrastructure and promoting closed-loop systems, stakeholders can minimize environmental impact and maximize resource efficiency. Looking ahead, untapped opportunities lie in expanding the use of paperboard folding cartons into niche markets like healthcare and electronics. Customized solutions tailored to these industries can unlock new revenue streams and propel further market growth.

MARKET DYNAMICS:

KEY DRIVERS:

The eco-conscious movement is driving demand for sustainable packaging, boosting the market.

Eco-consciousness is fueling the paperboard folding carton market within medical device packaging. Growing concern about plastic waste is pushing consumers and businesses towards sustainable solutions. Paperboard's recyclability and biodegradability make it an attractive alternative, propelling its market growth.

Stricter plastic regulations are driving the move to paperboard folding cartons.

RESTRAINTS:

Balancing sustainability goals with functionality remains a hurdle for paperboard folding carton manufacturers.

The market faces a challenge in bridging the gap between consumer demand for both eco-friendly packaging and robust product protection. Continuous innovation and investment in R&D are crucial to develop sustainable solutions that don't compromise on functionality.

Compliance with environmental regulations gives paperboard folding cartons a competitive edge in the marketplace.

OPPORTUNITIES:

Cutting-edge printing and design tech allows for intricate, attractive cartons.

The rise of sophisticated printing and digital technologies creates a market opportunity for paperboard folding cartons by enabling visually striking product presentations, enhanced brand visibility, and cost-effective customization for businesses of all sizes.

E-commerce's demand for lightweight, durable paperboard folding cartons fuels market growth.

CHALLENGES:

Paperboard folding carton makers face volatile raw material costs.

Paperboard folding carton manufacturers face a challenge in fluctuating raw material costs, particularly pulp prices and supply chain disruptions. These factors directly impact the overall production cost, potentially squeezing profit margins.

Paperboard folding cartons face competition from alternative packaging options.

IMPACT OF RUSSIA-UKRAINE WAR

The war in Ukraine has adversely impacted the paperboard folding carton market by disrupting the already troubled supply chain. This shortage affects all paper types. Previously, Russia, Ukraine, and Belarus together exported over €12 billion worth of wood each year, playing a vital role in the market. European paper mills can no longer get materials from these countries, and some European producers even have factories there. Financial problems make the supply chain problems even more difficult. Sanctions restrict Russia's access to global banking systems, making it harder for European mills to do business there. Ukraine used to import over 440,000 tons of paper and board from Europe, mainly from Germany, Finland, and Poland. This trade is likely on hold for a significant amount of time. While Russia exported paper to the EU (especially Italy, Germany, and Poland), European mills can adjust to find new buyers. The bigger concern is the rise in energy prices due to the war. Since both paper and pulp production rely heavily on energy, the sanctions and rising costs of natural gas and coal will push prices up across the globe.

IMPACT OF ECONOMIC SLOWDOWN

The recent economic slowdown is expected to cause a temporary decline in the paperboard folding carton market. An anticipated decline in consumer spending on goods is expected to result in a 3.8% decrease in carton shipments for 2023 compared to the prior year. However, the long-term forecast remains positive with an average growth of 0.4% annually expected over the next five years, reaching 5.4 million tons. This growth is driven by factors like increasing demand for non-durable goods and a projected rise in consumer spending despite the slowdown.

KEY MARKET SEGMENTS:

By Type

Paperboard folding cartons come in standard and aseptic varieties. Aseptic cartons hold dominant position due to their ability to keep liquids fresh without refrigeration. Special sterilization process that extends shelf life and reduces the need for preservatives. As consumers seek convenient, long-lasting, and eco-friendly options, aseptic cartons' lightweight and recyclable build make them a market favorite.

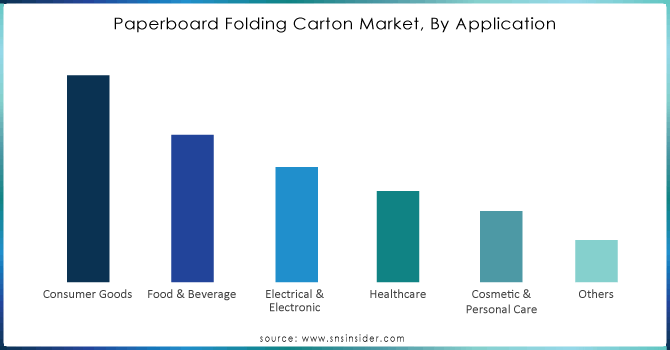

By Application

Paperboard folding cartons find uses across various industries, with food & beverage leading by market share of 43%. Their versatility lets them handle diverse shapes and sizes while ample space allows for compelling graphics and information. Additionally, their eco-friendly nature and lightweight sturdiness align with consumer preferences and logistics needs. The electrical and electronics segment is another growth area, driven by the rising demand for consumer electronics that often use folding cartons as packaging.

Need any customization research on Paperboard Folding Carton Market - Enquiry Now

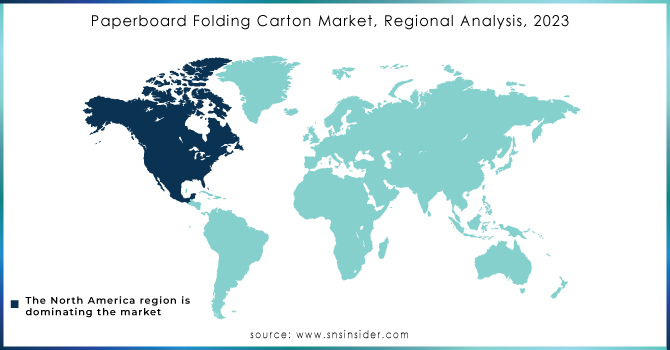

REGIONAL ANALYSES

North America leads the paperboard folding carton market for two main reasons. The region has a large and successful food and beverage industry, which uses a lot of these cartons. North America has strict laws that encourage sustainable packaging, which aligns perfectly with the eco-friendly benefits of paperboard folding cartons.

Europe follows North America in paperboard folding carton market share, driven by a growing focus on eco-friendly practices and regulations. Germany holds the biggest market share within Europe, while the UK market witnesses the fastest growth. The Asia-Pacific region is poised for the fastest growth in paperboard folding cartons fueled by a booming economy, surging consumer demand for sustainable packaging, and a rapidly expanding food and beverage sector. Within this region, China holds the largest market share, while India is experiencing the fastest growth.

KEY PLAYERS

The major key players are West Fraser Timber Co. Ltd., Graphic Packaging International LLC, Sonoco Products Company, Smurfit Kappa Group, International Paper Company, WestRock Company, Mondi Group, Elopak, Mayr-Melnhof Karton AG, Huhtamaki Oyj, Nippon Paper Industries Co. Ltd., Metsa Board Oyj, Oji Holdings Corporation and other key players.

RECENT DEVELOPMENT

Smurfit Kappa and Avery Dennison joined forces in November 2023 to create eco-friendly pressure-sensitive labels for folding cartons, using recycled and recyclable materials.

In October 2023, WestRock partnered with Henkel to create eco-friendly folding cartons made from recycled and recyclable materials for Henkel's personal care products.

Graphic Packaging International (GPI) strategically acquired Specialty Folding Carton, a prominent U.S. producer, in September 2023.

In September 2023, International Paper and Mondi teamed up to develop eco-friendly folding cartons for food and beverages, prioritizing recycled and recyclable materials.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 79.13 Bn |

| Market Size by 2032 | US$ 120.78 Bn |

| CAGR | CAGR of 4.81% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Standard Carton, Aseptic Carton) • By Application (Consumer Goods, Food & Beverage, Electrical & Electronic, Healthcare, Cosmetic & Personal Care, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | West Fraser Timber Co. Ltd., Graphic Packaging International LLC, Sonoco Products Company, Smurfit Kappa Group, International Paper Company, WestRock Company, Mondi Group, Elopak, Mayr-Melnhof Karton AG, Huhtamaki Oyj, Nippon Paper Industries Co. Ltd., Metsa Board Oyj, Oji Holdings Corporation |

| Key Drivers | • The eco-conscious movement is driving demand for sustainable packaging, boosting the market. • Stricter plastic regulations are driving the move to paperboard folding cartons. |

| Key Restraints | • Balancing sustainability goals with functionality remains a hurdle for paperboard folding carton manufacturers. • Compliance with environmental regulations gives paperboard folding cartons a competitive edge in the marketplace. |

Ans: The Paperboard Folding Carton Market is expected to grow at a CAGR of 4.81%.

Ans: Paperboard Folding Carton Market size was USD 79.13 billion in 2023 and is expected to Reach USD 115.23 billion by 2031.

Ans: The eco-conscious movement is driving demand for sustainable packaging, boosting the market.

Ans: Balancing sustainability goals with functionality remains a hurdle for paperboard folding carton manufacturers.

Ans: North America dominating in the Paperboard Folding Carton Market.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Impact Analysis

5.1 Impact Of Russia Ukraine Crisis

5.2 Impact of Economic Slowdown on Major Countries

5.2.1 Introduction

5.2.2 United States

5.2.3 Canada

5.2.4 Germany

5.2.5 France

5.2.6 UK

5.2.7 China

5.2.8 Japan

5.2.9 South Korea

5.2.10 India

6. Value Chain Analysis

7. Porter’s 5 Forces Model

8. Pest Analysis

9. Paperboard Folding Carton Market Segmentation, By Type

9.1 Introduction

9.2 Trend Analysis

9.3 Standard Carton

9.4 Aseptic Carton

10. Paperboard Folding Carton Market Segmentation, By Application

10.1 Introduction

10.2 Trend Analysis

10.3 Consumer Goods

10.4 Food & Beverage

10.5 Electrical & Electronic

10.6 Healthcare

10.7 Cosmetic & Personal Care

10.8 Others

11. Regional Analysis

11.1 Introduction

11.2 North America

11.2.1 Trend Analysis

11.2.2 North America Paperboard Folding Carton Market by Country

11.2.3 North America Paperboard Folding Carton Market By Type

11.2.4 North America Paperboard Folding Carton Market By Application

11.2.5 USA

11.2.5.1 USA Paperboard Folding Carton Market By Type

11.2.5.2 USA Paperboard Folding Carton Market By Application

11.2.6 Canada

11.2.6.1 Canada Paperboard Folding Carton Market By Type

11.2.6.2 Canada Paperboard Folding Carton Market By Application

11.2.7 Mexico

11.2.7.1 Mexico Paperboard Folding Carton Market By Type

11.2.7.2 Mexico Paperboard Folding Carton Market By Application

11.3 Europe

11.3.1 Trend Analysis

11.3.2 Eastern Europe

11.3.2.1 Eastern Europe Paperboard Folding Carton Market by Country

11.3.2.2 Eastern Europe Paperboard Folding Carton Market By Type

11.3.2.3 Eastern Europe Paperboard Folding Carton Market By Application

11.3.2.4 Poland

11.3.2.4.1 Poland Paperboard Folding Carton Market By Type

11.3.2.4.2 Poland Paperboard Folding Carton Market By Application

11.3.2.5 Romania

11.3.2.5.1 Romania Paperboard Folding Carton Market By Type

11.3.2.5.2 Romania Paperboard Folding Carton Market By Application

11.3.2.6 Hungary

11.3.2.6.1 Hungary Paperboard Folding Carton Market By Type

11.3.2.6.2 Hungary Paperboard Folding Carton Market By Application

11.3.2.7 Turkey

11.3.2.7.1 Turkey Paperboard Folding Carton Market By Type

11.3.2.7.2 Turkey Paperboard Folding Carton Market By Application

11.3.2.8 Rest of Eastern Europe

11.3.2.8.1 Rest of Eastern Europe Paperboard Folding Carton Market By Type

11.3.2.8.2 Rest of Eastern Europe Paperboard Folding Carton Market By Application

11.3.3 Western Europe

11.3.3.1 Western Europe Paperboard Folding Carton Market by Country

11.3.3.2 Western Europe Paperboard Folding Carton Market By Type

11.3.3.3 Western Europe Paperboard Folding Carton Market By Application

11.3.3.4 Germany

11.3.3.4.1 Germany Paperboard Folding Carton Market By Type

11.3.3.4.2 Germany Paperboard Folding Carton Market By Application

11.3.3.5 France

11.3.3.5.1 France Paperboard Folding Carton Market By Type

11.3.3.5.2 France Paperboard Folding Carton Market By Application

11.3.3.6 UK

11.3.3.6.1 UK Paperboard Folding Carton Market By Type

11.3.3.6.2 UK Paperboard Folding Carton Market By Application

11.3.3.7 Italy

11.3.3.7.1 Italy Paperboard Folding Carton Market By Type

11.3.3.7.2 Italy Paperboard Folding Carton Market By Application

11.3.3.8 Spain

11.3.3.8.1 Spain Paperboard Folding Carton Market By Type

11.3.3.8.2 Spain Paperboard Folding Carton Market By Application

11.3.3.9 Netherlands

11.3.3.9.1 Netherlands Paperboard Folding Carton Market By Type

11.3.3.9.2 Netherlands Paperboard Folding Carton Market By Application

11.3.3.10 Switzerland

11.3.3.10.1 Switzerland Paperboard Folding Carton Market By Type

11.3.3.10.2 Switzerland Paperboard Folding Carton Market By Application

11.3.3.11 Austria

11.3.3.11.1 Austria Paperboard Folding Carton Market By Type

11.3.3.11.2 Austria Paperboard Folding Carton Market By Application

11.3.3.12 Rest of Western Europe

11.3.3.12.1 Rest of Western Europe Paperboard Folding Carton Market By Type

11.3.2.12.2 Rest of Western Europe Paperboard Folding Carton Market By Application

11.4 Asia-Pacific

11.4.1 Trend Analysis

11.4.2 Asia Pacific Paperboard Folding Carton Market by Country

11.4.3 Asia Pacific Paperboard Folding Carton Market By Type

11.4.4 Asia Pacific Paperboard Folding Carton Market By Application

11.4.5 China

11.4.5.1 China Paperboard Folding Carton Market By Type

11.4.5.2 China Paperboard Folding Carton Market By Application

11.4.6 India

11.4.6.1 India Paperboard Folding Carton Market By Type

11.4.6.2 India Paperboard Folding Carton Market By Application

11.4.7 Japan

11.4.7.1 Japan Paperboard Folding Carton Market By Type

11.4.7.2 Japan Paperboard Folding Carton Market By Application

11.4.8 South Korea

11.4.8.1 South Korea Paperboard Folding Carton Market By Type

11.4.8.2 South Korea Paperboard Folding Carton Market By Application

11.4.9 Vietnam

11.4.9.1 Vietnam Paperboard Folding Carton Market By Type

11.4.9.2 Vietnam Paperboard Folding Carton Market By Application

11.4.10 Singapore

11.4.10.1 Singapore Paperboard Folding Carton Market By Type

11.4.10.2 Singapore Paperboard Folding Carton Market By Application

11.4.11 Australia

11.4.11.1 Australia Paperboard Folding Carton Market By Type

11.4.11.2 Australia Paperboard Folding Carton Market By Application

11.4.12 Rest of Asia-Pacific

11.4.12.1 Rest of Asia-Pacific Paperboard Folding Carton Market By Type

11.4.12.2 Rest of Asia-Pacific Paperboard Folding Carton Market By Application

11.5 Middle East & Africa

11.5.1 Trend Analysis

11.5.2 Middle East

11.5.2.1 Middle East Paperboard Folding Carton Market by Country

11.5.2.2 Middle East Paperboard Folding Carton Market By Type

11.5.2.3 Middle East Paperboard Folding Carton Market By Application

11.5.2.4 UAE

11.5.2.4.1 UAE Paperboard Folding Carton Market By Type

11.5.2.4.2 UAE Paperboard Folding Carton Market By Application

11.5.2.5 Egypt

11.5.2.5.1 Egypt Paperboard Folding Carton Market By Type

11.5.2.5.2 Egypt Paperboard Folding Carton Market By Application

11.5.2.6 Saudi Arabia

11.5.2.6.1 Saudi Arabia Paperboard Folding Carton Market By Type

11.5.2.6.2 Saudi Arabia Paperboard Folding Carton Market By Application

11.5.2.7 Qatar

11.5.2.7.1 Qatar Paperboard Folding Carton Market By Type

11.5.2.7.2 Qatar Paperboard Folding Carton Market By Application

11.5.2.8 Rest of Middle East

11.5.2.8.1 Rest of Middle East Paperboard Folding Carton Market By Type

11.5.2.8.2 Rest of Middle East Paperboard Folding Carton Market By Application

11.5.3 Africa

11.5.3.1 Africa Paperboard Folding Carton Market by Country

11.5.3.2 Africa Paperboard Folding Carton Market By Type

11.5.3.3 Africa Paperboard Folding Carton Market By Application

11.5.2.4 Nigeria

11.5.2.4.1 Nigeria Paperboard Folding Carton Market By Type

11.5.2.4.2 Nigeria Paperboard Folding Carton Market By Application

11.5.2.5 South Africa

11.5.2.5.1 South Africa Paperboard Folding Carton Market By Type

11.5.2.5.2 South Africa Paperboard Folding Carton Market By Application

11.5.2.6 Rest of Africa

11.5.2.6.1 Rest of Africa Paperboard Folding Carton Market By Type

11.5.2.6.2 Rest of Africa Paperboard Folding Carton Market By Application

11.6 Latin America

11.6.1 Trend Analysis

11.6.2 Latin America Paperboard Folding Carton Market by Country

11.6.3 Latin America Paperboard Folding Carton Market By Type

11.6.4 Latin America Paperboard Folding Carton Market By Application

11.6.5 Brazil

11.6.5.1 Brazil Paperboard Folding Carton Market By Type

11.6.5.2 Brazil Paperboard Folding Carton Market By Application

11.6.6 Argentina

11.6.6.1 Argentina Paperboard Folding Carton Market By Type

11.6.6.2 Argentina Paperboard Folding Carton Market By Application

11.6.7 Colombia

11.6.7.1 Colombia Paperboard Folding Carton Market By Type

11.6.7.2 Colombia Paperboard Folding Carton Market By Application

11.6.8 Rest of Latin America

11.6.8.1 Rest of Latin America Paperboard Folding Carton Market By Type

11.6.8.2 Rest of Latin America Paperboard Folding Carton Market By Application

12. Company Profiles

12.1 Graphic Packaging International LLC

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.1.5 The SNS View

12.2 International Paper Company

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.2.5 The SNS View

12.3 WestRock Company

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.3.5 The SNS View

12.4 Smurfit Kappa Group

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.4.5 The SNS View

12.5 Sonoco Products Company

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.5.5 The SNS View

12.6 Mondi Group

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.6.5 The SNS View

12.7 Elopak

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.7.5 The SNS View

12.8 West Fraser Timber Co. Ltd.

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.8.5 The SNS View

12.9 Mayr-Melnhof Karton AG

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.9.5 The SNS View

12.10 Huhtamaki Oyj

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

12.10.5 The SNS View

12.11 Nippon Paper Industries Co. Ltd.

12.11.1 Company Overview

12.11.2 Financial

12.11.3 Products/ Services Offered

12.11.4 SWOT Analysis

12.11.5 The SNS View

12.12 Metsa Board Oyj

12.12.1 Company Overview

12.12.2 Financial

12.12.3 Products/ Services Offered

12.12.4 SWOT Analysis

12.12.5 The SNS View

12.13 Oji Holdings Corporation

12.13.1 Company Overview

12.13.2 Financial

12.13.3 Products/ Services Offered

12.13.4 SWOT Analysis

12.13.5 The SNS View

13. Competitive Landscape

13.1 Competitive Benchmarking

13.2 Market Share Analysis

13.3 Recent Developments

13.3.1 Industry News

13.3.2 Company News

13.3.3 Mergers & Acquisitions

14. USE Cases And Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Standard Carton

Aseptic Carton

By Application

Consumer Goods

Food & Beverage

Electrical & Electronic

Healthcare

Cosmetic & Personal Care

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Molded Fiber Packaging Market Size was valued at USD 10.20 Billion in 2023 and is expected to reach USD 15.69 Billion by 2032 and grow at a CAGR of 5% over the forecast period 2024-2032.

The Pharmaceutical Packaging Market size was valued at USD 137.80 billion in 2023 and is expected to Reach USD 311.87 billion by 2032 and grow at a CAGR of 9.5% over the forecast period of 2024-2032.

The Thermoformed Healthcare Packaging Market Size was valued at $48.41 billion in 2023 & will reach $94.53 billion by 2032 growing at a CAGR of 7.72% from 2024-2032

The Anti-counterfeit Packaging Market size was USD 161 billion in 2023 and is expected to reach USD 237.87 billion by 2031 and grow at a CAGR of 5 % over the forecast period of 2024-2031.

The PET Packaging Market size was valued at USD 77.24 billion in 2023 and is expected to Reach USD 120.85 billion by 2032 and grow at a CAGR of 5.1% over the forecast period of 2024-2032.

The Trash Bags Market size was USD 12.95 billion in 2023 and is expected to Reach USD 26.10 billion by 2032 and grow at a CAGR of 8.1% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone