Panel Filters Market Report Scope & Overview:

The Panel Filters Market size was USD 8.5 billion in 2023 and is expected to reach USD 12.3 billion by 2032 and grow at a CAGR of 4.1% over the forecast period of 2024-2032.

Get E-PDF Sample Report on Panel Filters Market - Request Sample Report

The trend of rise in demand for air filtration systems such as panel filters has also grown due to the advanced systems in HVAC (Heating, ventilation, and air-conditioning). With the pandemic disrupting lives globally and many people becoming more conscious about pollution; concerns over indoor air quality are becoming increasingly critical these days as well, leading to an HVAC system evolution that emphasizes increased efficiency and sustainability technologies. Now, modern HVACs focus on energy efficiency, better air purification, and smarter features which ensure that they run optimally. For example, improved air filtration media, like HEPA (High-Efficiency Particulate Air) and activated carbon filters, has increased the capability of an HVAC system to capture smaller particles, allergens, and even pathogens.

Furthermore, smart sensors and IoT (Internet of Things) integration enable these systems to monitor and regulate air quality on the fly, promoting a more pristine, comfortable space. The need for these filtration technologies is resulting in the demand for high-efficiency panel filters which are capable of meeting the high-performance standards offered by modern HVAC systems, to maintain energy efficiently as well as good indoor air quality in various residential, commercial, and industrial buildings.

According to the DOE, energy-efficient HVAC systems can reduce energy consumption by up to 30% compared to older models. The DOE’s Energy Star program provides ratings for HVAC systems that meet these high-efficiency standards, driving demand for innovative HVAC technologies.

The automotive industry is the major factor influencing the panel filters market owing to rising vehicle production along with rising demand for fuel efficiency programs coupled with the need for ensuring air quality. Panel filters are another essential part of vehicle air intake systems since they ensure the efficient flow of clean, pure air to the engine. Keeping contaminants out of the engine to ensure proper functionality, also aids in maximizing engine performance and improving fuel economy. The world is moving towards stricter control of environmental regulations including emissions and air quality standards leading automakers to develop high-performance filters for their vehicles. These filters assist with regulatory compliance by trapping harmful particles and contaminants from the air and ensuring compliance with tighter regulations on emissions. Consequently, also fueled by regulatory frameworks demanding ever cleaner emissions from vehicles, consumers favoring improved fuel economy, and inherent consumer and environmental awareness, the demand for high-quality panel filters is soaring.

The World Health Organization (WHO) has identified vehicle emissions as a major contributor to air pollution, with vehicle exhaust being a significant source of particulate matter (PM) and NOx. According to the U.S. EPA, transportation accounts for approximately 28% of total greenhouse gas emissions in the United States, with passenger vehicles being the largest source.

Panel Filters Market Dynamics

Drivers

-

Increasing public consciousness of air quality drives the market growth.

Increasing public consciousness of air quality is a significant driver of market growth, particularly in sectors like automotive and HVAC, where air filtration plays a critical role in ensuring cleaner air. With the knowledge of ures, respiratory problems, cardiovascular diseases, and allergic diseases caused by air pollution people are looking for solutions that provide you with clean air both at home and outdoors. Consequently, customers have become more conscious of selecting vehicles with optimized air purifying parts to minimize harmful chemicals and comfort air quality in the cabins. Likewise, on the HVAC side, both residential and commercial customers are adopting air conditioning and heating systems with high-efficiency filters for a healthier indoor environment. At the same time, to meet the requirements of the public, governments, too, are tightening air quality standards that will contribute to increased demand for advanced air purification technologies. The rising awareness of the need for clean air (purified air) among individuals and industries will propel the demand for air filter products such as panel filters which in turn will result in the market growth across end-use industries.

The European Environment Agency (EEA) has issued air quality guidelines and reports that over 100 million Europeans are exposed to harmful levels of air pollution. The EEA’s air quality assessment emphasizes the need for stricter pollution control measures, which has led to increased adoption of air filtration technologies in residential, commercial, and automotive sectors across Europe.

Restraint

-

High cost of advanced filtration technologies may hamper the market growth.

The high cost of advanced filtration technologies poses a significant restraint on the growth of the panel filters market. With the increasing demand for advanced and specialized filters like HEPA and activated carbon filters, the prices too go up. These cutting-edge filters, while also significantly better in purifying, catching, and filtering air, cost more than a conventional filter. The difference in prices can prove to be a major issue for consumers, but even more so for businesses, especially in more price-elastic markets or among smaller businesses with tighter budgets! Moreover, since advanced filters hold a larger number of pollutants, they tend to need replacement much sooner, which incurs further expenses in the long term. This is an obstacle to their adoption because in widespread industries such as automotive and HVAC, cost is a major factor to consider in the overall system design and the upfront and life cycle costs of these high filtration efficiency devices are often prohibitive. Thus, while the advancements in newer filtration technologies promise healthier and more efficient air clean-up, costs are still prohibitive for mass-market adoption in lower-budget or less-regulated regions/sectors.

Panel Filters Market Segmentation:

By Type

Reusable panel filters held the largest market share around 69% in 2023 due to their cost efficiency, environmental sustainability, and long-life usage. Unlike many single-use filters, these reusable filters dispose of dirt when they are washed and can be cleaned and reused, resulting in less need for replacements and lower operational costs over time. It also makes them a particularly appealing solution for places looking to save money over time, such as those in commercial or residential settings. Moreover, increasing emphasis on sustainability and waste reduction has further fueled the demand for reusable filters as they can reduce the environmental footprint of disposable filters.

By Material

Synthetic panel filters held the largest market around 36% in 2023. They are made of synthetic fibers like polyester or polypropylene, are more efficient at trapping airborne particles such as dust, pollen, and some bacteria while allowing higher airflow. Synthetics are durable materials and yearn for a long operating time withstanding all rough conditions the filters are subjected to. Hence synthetic filters are suitable for application in high-demanding industries like automotive, HVAC, and industrial applications, where consistent performance and reliability are of utmost importance. Synthetic filters tend to be also required to be washed and reused, which further increases their cost-effectiveness over time, again increasing their popularity. Their widespread market share can also be attributed to the custom-size production of synthetic filters to cater to varying filtration needs across various sectors.

By Application

Non-residential held the largest market share around 64% in 2023. There are non-residential buildings like offices, factories, hospitals, schools, and shopping malls that need advanced air filtration solutions to provide healthy indoor air quality, health and safety regulations, and comfort for employees, customers, and patients. It is used for large and central HVAC systems in commercial and industrial environments to keep dust, toxins, and allergies from building occupants and appliances. Moreover, with stricter regulation norms towards air quality and awareness regarding the negative impact of low indoor air quality on productivity & health, businesses are also increasingly investing in efficient filtration systems. The dominance of the panel filter market by the non-residential segment is also driven by the increasing demand for clean and healthy indoor environments.

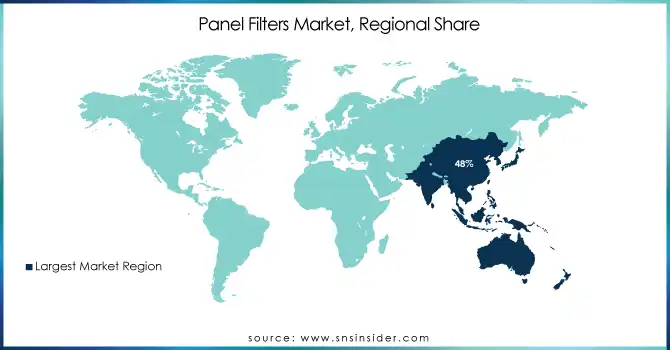

Panel Filters Market Regional Analysis:

Asia Pacific held the highest market share around 48% in 2023. This is owing to rapid urbanization, and industrialization in the region, the Asia Pacific region acquired the largest market share in the panel filters market followed by North America. Air pollution and environmental sustainability have been one of the most pressing challenges in one of the most populous regions of the world, hence the demand for efficient air filtration solutions for both residential and commercial sectors. With significant air quality regulations in place in large economies including China, India, and Japan, industries ranging from automotive, HVAC, and manufacturing have witnessed a transition to advanced filtration technologies. Moreover, the demand for clean air solutions, especially in urban areas, has been further fueled by the increasing middle-class population and rising disposable incomes in these economies. Moreover, rapid growth in construction and industry in the region also increases the demand for panel filters to prevent air-borne contaminants from damaging workplaces, commercial buildings, and public infrastructure. As more governments call for stricter clean air regulations and industries aim to meet the demands of environmental legislation, the panel filter market in the Asia Pacific region continues to be a leader.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players:

-

Donaldson Company (PowerCore Air Filtration, Ultra-Web Filters)

-

AAF International (Air Filters, Gas Turbine Filters)

-

Mann+Hummel (Provent Air Filters, Cabin Air Filters)

-

Freudenberg Filtration Technologies (Purotex, Microglass Filters)

-

Parker Hannifin (Parker Filtration Systems, Parker Air Filtration)

-

AFPRO Filtration Group (Ventilation Filters, Industrial Filters)

-

Camfil AB (F7 HEPA Filters, Gas Phase Filtration)

-

Filtration Group (Air and Gas Filters, Liquid Filters)

-

3M (3M Filtrete, 3M Clean-Flow Air Filters)

-

Ikerlan (Air Filtration Solutions, Carbon Filters)

-

Lennox International (PureAir Filters, HEPA-UV Air Purifiers)

-

Daikin Industries (Daikin Air Filters, Daikin Gas Filters)

-

Koch Filter (HVAC Filters, High-Efficiency Filters)

-

Donaldson Filtration Solutions (Filter Elements, Dust Collectors)

-

Sullair (Air Intake Filters, Industrial Filters)

-

TACMINA (Air Filters, Water Filters)

-

Vokes Air (Vokes Filters, High-Performance Filters)

-

Nederman (Air Cleaners, Dust Collector Filters)

-

Ahlstrom-Munksjö (Filtration Media, Air Filtration Materials)

-

Dwyer Instruments (DF-Filter Series, Air Pressure Filters)

Recent Development:

-

In 2024, Parker Hannifin Corporation launched its ChromGas Hydrogen Fuel (H2F) and Zero Air Gas (ZAG) generators. These products are designed to enhance the performance of gas chromatography instruments in laboratory settings.

-

In 2023, Camfil AB has been focusing on improving its range of air filtration solutions for HVAC systems to meet the growing demand for better indoor air quality.

-

In 2023, Mann+Hummel developed a new line of high-efficiency panel filters that cater to both residential and commercial markets, aligning with increasing regulatory standards on air quality.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

US$ 8.5 Billion |

|

Market Size by 2032 |

US$ 12.3 Billion |

|

CAGR |

CAGR of 4.1% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Type (Disposable Panel Filters, Reusable Panel Filters |

|

Regional Analysis/Coverage |

North America (USA, Canada, Mexico), Europe |

|

Company Profiles |

Donaldson Company (US), AAF International (US), Mann+Hummel(Germany), Freudenberg Filtration Technologies (Germany)Parker Hannifin (US), AFPRO Filtration Group (Netherlands) and Camfil AB (Sweden) |

|

Key Drivers |

• Increasing public consciousness of air quality. |

|

Restraints |

• Increasing environmental worries. |