Get More Information on Palm Oil Market - Request Sample Report

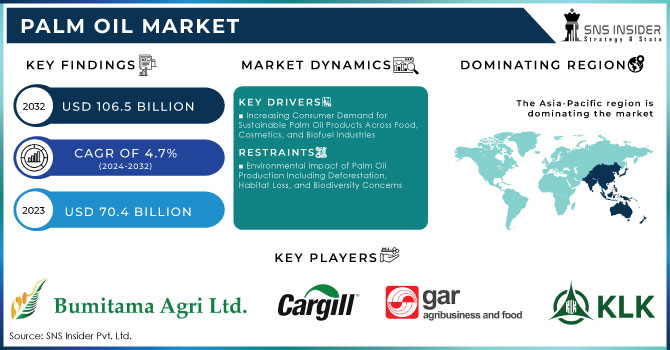

The Palm Oil Market Size was valued at USD 70.4 billion in 2023, and is expected to reach USD 106.5 billion by 2032, and grow at a CAGR of 4.7% over the forecast period 2024-2032.

Dynamic changes in the palm oil market are determined by changes in demand patterns, sustainability efforts, and geopolitical factors. Wilmar International Ltd., Sime Darby Plantation Berhad, IOI Corporation Berhad, and Golden Agri-Resources Ltd are major firms in the industry. All these respond to changing circumstances in the industry. One of the fundamental causes that is likely to continue changing the dynamics of this market is the continually increasing global demand for palm oil in food products, cosmetics, and biofuels. Of late, considerations of sustainability and environmental aspects have become key issues in market dynamics. Firms engage in sustainable activities to fulfill the growing demand of consumers and to meet regulatory requirements. Secondly, palm oil-producing countries in Latin America have been realizing increases in exports as they tap into growing markets. For example, palm oil exports from Latin America surged to the highest level in May 2024, mainly from countries like Colombia, which is rapidly growing its footprint globally.

Sustainability initiatives remain at the heart of the market. Third-party sustainable palm oil certification remains an attractive option for the leaders of the major companies in the industry. For instance, KLK and Felda Global Ventures Holdings Berhad currently maintain their certification programs to gain better opportunities in the market. Therefore, the growing production capacity of the major producers has affected the market. A March 2024 report shows that global palm oil output went up by 2% from last year, and in fact, indicates how this commodity continues to be pretty resilient against the challenges of the market. Indonesia and Malaysia alone hold the market, as producers such as Musim Mas Holdings and Bumitama Agri Ltd. are strengthening their operations to meet the growth markets.

Recent events have underscored the fact that palm oil is not only an essential commodity for any product in most sectors around the world but also scores high in popularity. For instance, in May 2024, some of the environmental effects of Malaysian palm oil plantations started to draw wider debates into deforestation and biodiversity losses. This has forced big players like Cargill Inc. and First Resources Ltd. to work aggressively toward improving their supply chain transparency and adoption of zero-deforestation policies. This will be what shapes the future of the industry, as companies seek to achieve alignment with this global goal of sustainability through responsible sourcing and production.

Apart from sustainability, another new determinant of palm oil is technological development. The companies are aggressively incorporating new-age agriculture to enhance productivity and efficiency. Improved agricultural practices coupled with policies for enhanced productivity improved the exports from Latin American economies like Brazil and Colombia in May 2024. The key players are employing the use of latest technologies, including monitoring through satellites, to monitor plantations and then bring down their environment footprint. Such innovation has so far enabled companies, including Wilmar International Ltd and IOI Corporation Berhad, to stand in competitive grounds.

The palm oil market is now very dynamic both for established players and newcomers who strive to achieve the growth of today with sustainability. Companies are making all efforts to keep pace with all the surging global demand and fulfill the environment concerns by innovating and responsible practices. For example, a 2% growth in production reported in March 2024 was testimony to the continuing ability of the industry to be flexible and grow. The future of the market will depend more on how companies would just balance their economic and environmental interests and that sustainability will stay as a key constituent in their strategy.

Drivers:

Increasing Consumer Demand for Sustainable Palm Oil Products Across Food, Cosmetics, and Biofuel Industries

The move towards sustainability has given the palm oil market an immense boost, especially in the food and cosmetics sectors. With growing environmental concerns, consumers demand ingredients that are sustainably sourced. Palm oil produces much higher yields per hectare than other vegetable oils and has become the first choice for those manufacturers who want to be sustainable without sacrificing too much in costs. Major food and cosmetics brands now promise to use only certified palm oil from suppliers ranked under the Roundtable on Sustainable Palm Oil (RSPO). Such a commitment not only will help keep up the sustainability of the supply chain but also enhance their reputation with environmentally conscious consumers. Given the versatility, stability, and not too steep a price, compared to other oils, palm oil, increasing demand for this item in products as varied as baked goods to cosmetic care underlined its course. This, from a biological perspective, meant the palm oil market would also experience pretty dramatic growth along the trends wherein consumers will also be leaving room for production based on sustainability by producers.

Growing Biofuel Industry Increasingly Utilizes Palm Oil as a Key Feedstock for Biodiesel Production

The growing biofuel industry will therefore be a significant driver for the palm oil market moving forward. In many countries, the governments have focused on reducing the amount of greenhouse gas emissions as well as energy dependence on fossil fuels by replacing these with renewable sources of energy. Biofuels have therefore emerged rapidly as an alternative form of energy from fossil fuels with growing usage of palm oil feedstock for the production of biodiesel whose physical attributes are considered to be favorable. Indonesia and Malaysia, the world's largest producers of palm oil, have established blending mandates for biodiesel to support their renewable energy policies. Growing demand for biodiesel increases total palm oil usage but provides economic incentives for producing palm oil. Improved technology will further facilitate the introduction of palm oil to the biofuel industry with the creation of more efficient ways of producing biofuel. Increased investment and innovation in optimizing palm oil use in biofuels will, in the near future, be attributed to the global world's increasing need for renewable energy.

Restraint:

Environmental Impact of Palm Oil Production Including Deforestation, Habitat Loss, and Biodiversity Concerns

Despite palm oil’s advantages, the palm oil industry has critical issues with environmental challenges such as deforestation and biodiversity loss. At the start of expansion for palm oil plantations, it is well-documented that they typically take over tropical rainforests, which further leads to the loss of other precious ecosystems. Apart from direct threats to wildlife habitats, these causes of deforestation also contribute to rising levels of carbon dioxide in the atmosphere from stored carbon dioxide. Furthermore, the biodiversity lost in palm oil plantation activity results in potential risks to the stability and resilience of ecosystems. Due to growing awareness among the public regarding these matters, consumers and activists are now demanding that there be sustainable practices related to the production of palm oil. This has been met with pressure from regulatory authorities on producers them to adopt more environment-friendly practices, thereby putting added cost pressures on producers and affecting profit margins accordingly. As a result, companies producing palm oil will feel the pressure to satisfy the demand of consumers but at the same time address the environmental implications in sourcing. Growth in the market and sustainability might have a great restraint on the palm oil industry in the future.

Opportunity:

Advancements in Sustainable Palm Oil Production Practices Creating Pathways for Market Growth and Environmental Benefits

Innovations in sustainable production practices may present opportunities for palm oil market development and adoption. This is because consumers continue to ask for more responsibly sourced products, and increasing the sustainability of palm oil cultivation is important. Several initiatives-agroforestry, precision agriculture, cover crops-would enhance the environmental performance of palm oil plantations. The above practices reduce deforestation, improve soil quality, and also enhance biodiversity. New technologies - remote sensing and data analytics, for example - now enable farmers to increase their yields while minimizing harm to the environment. Lastly, combining the efforts of the farmers, NGOs, and government institutions can start certification schemes to promote such sustainable practices. This shift toward innovation benefits producers with both economic advantages-open increasing markets and consumer trust-and sustainable production in the long run, as is the case with palm oil becoming an important agriculture commodity. Sustainability can focus on positioning palm oil as a flagship in responsible sourcing and environmental stewardship.

Challenge:

Market Volatility and Economic Uncertainties Affecting Pricing, Supply, and Demand Dynamics Globally

Price volatility and global economic uncertainty are continued test to the palm oil market, which nowadays has significant implications for producers and consumers alike. Palm oil prices can therefore become volatile from various causes, which include variation in supply caused by climatic events, reductions in demand from the main importing countries, as well as competition from other vegetable oils. For instance, droughts or floods may severely affect the production of palm oil, leading to a sharp rise in prices. Geopolitical issues, including trade policy, often overshadow predictability and directly affect palm oil exports and import prices. All these factors can put considerable risk on the palm oil producing industries as firms' relatively thin profit margins make it arduous to move in volatile prices. In addition, end consumers would also end up paying more. A decline in demand for palm oil products would be inevitable. Such a problem has to be tackled from all sides, starting from better risk management strategies to the exploration of diversified markets and setting up stronger supply chains that can handle the ebbs and flows of the economy. The complexity the palm oil industry has to face to ensure sustainable growth despite uncertainty cannot be overstated.

By Nature

In 2023, the conventional segment dominated the Palm Oil Market, capturing an estimated market share of approximately 85%. Conventional palm oil accounts for the largest share of the total production since it is readily available and has a lower production cost compared to organic palm oil. Production of conventional palm oil occurs through traditional farming practices that often involve the use of chemical fertilizers and pesticides, which enhance yield as well as profitability by very high margins for the farmer. For example, Indonesia and Malaysia, producers of the majority of the world's palm oil, rely considerably on traditional; this will enable them to provide big chunks of global appetite in food, cosmetics, and the fast-growing biofuel markets. Cost is also another aspect on the side of conventional palm oil: cheaper, palm oil can be sourced by most manufacturers in most price-sensitive markets. Despite growing adoption by health-conscious consumers and environmentally conscious brands, organic palm oil remains scarce, and it tends to have a premium price. Large producers Unilever and Nestlé are starting to introduce more sustainable options into their products; still, conventional sources account for far more of total production.

By Product Type

In 2023, Crude Palm Oil (CPO) dominated the Palm Oil Market, holding an estimated market share of approximately 48%. The dominant base for Crude Palm Oil is its versatility nature and wide application in industries. CPO is widely used in food applications, such as different cooking oils, margarines, and processed foods, and is thus very commonly found in households and food manufacturing processes. The major palm oil producers include countries like Indonesia and Malaysia. It exports most of its CPO to global markets. Global markets further refine it into products such as Refined Bleached Deodorized (RBD) Palm Oil and Palm Kernel Oil. High yield CPO, along with relatively lower cost in comparison to refined products, makes it an attractive choice for manufacturers in need of keeping their cost of goods sold competitive. Also, the rising demand of biodiesels is helping the positive aspect of the CPO segment due to its increased use as feedstock in the production of biodiesel, thereby further expanding the market. Other types of products produced in addition to CPO, for instance, RBD Palm Oil, and the Palm Kernel Oil, enhance the market, but CPO is the largest due to its extensive application and cost-effective properties.

By End-use

In 2023, the Food & Beverage segment dominated the Palm Oil Market, accounting for an estimated market share of approximately 60%. The main promoter of dominance for the Food & Beverage segment is the fact that palm oil is widely used as a component in cooking oils, margarine, and other processed foods. Palm oil has exceptional properties, fitting extremely well with high-heat stability and extended shelf life, making it a preference for manufacturers within the food space. For instance, large food companies like Nestlé and Unilever utilize this ingredient in a broad product portfolio, ranging from snack foods to baked products in a bid to fulfill consumers' demands for cheap, multi-purpose ingredients. Moreover, the rising demand for palm oil in emerging markets is attributed to the fact that it is cheaper than other oils in many markets, and this development has further solidified the market position of the segment. With the increasing health consciousness of consumers, the food industry too is headed towards sustainably sourcing palm oil coupled with initiatives for responsible sourcing practices, thereby enhancing the appeal for that segment. While there is a share of other end-use applications like Biofuel & Energy and Personal Care & Cosmetics, Food & Beverage is the largest and most influencing of all so far and has thus led the market concerning overall consumption of palm oil.

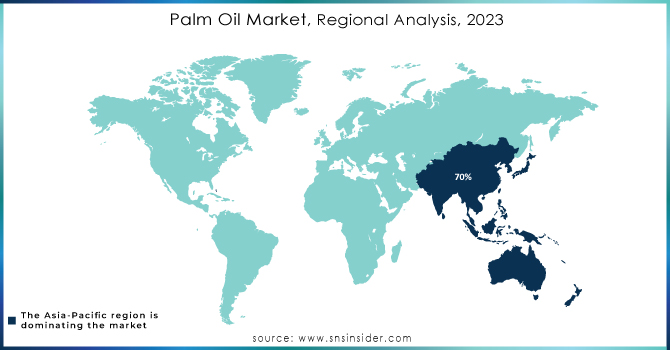

In 2023, Asia-Pacific dominated the Palm Oil Market, capturing an estimated market share of approximately 70%. Asia-Pacific continues to lead the palm oil market mainly because these countries are among the world's largest producers and consumers of palm oil, with large players such as Indonesia and Malaysia at the forefront. Both nations together produce more than 85% of the world's palm oil by taking advantage of favorable climatic conditions and extended plantations. For instance, palm oil in Indonesia is a major contributor to its economy not only through employment but also through export revenue in exchange for tapping its ever-increasing demand for food, cosmetics, and biofuels. In addition, the high population and growth rate of people moving into cities in this region have led to high consumption of processed foods and cooking oils that continue to propel demand for more palmy produce. Other than the current supply chains and supportive state policies for the growth of oil palms, the region has also been empowered to remain the market leader and the biggest and most influential market for palm oil in the global scenario, coincidentally located in the Asia-Pacific.

Moreover, in 2023, Africa emerged as the fastest-growing region in the Palm Oil Market, with an estimated Compound Annual Growth Rate (CAGR) of 8%. Growth in the palm oil sector in Africa can be attributed to increased investments in palm oil plantations and processing facilities. Countries such as Nigeria and Ghana take an active role in enhancing their palm oil production capabilities to meet not only local demand but also international demand. To give a simple example, Nigeria, with its huge potential for palm oil cultivation, is reviving its palm oil industry. There are planned measures to reduce imports and increase local production. Continued efforts towards improving agriculture and infrastructure will lead to growth in this area and make the continent a profitable market for investors and producers. The rising awareness of the versatility of palm oil in the different applications, including food products, personal care, and biofuels, is stimulating interest and growth in the African palm oil market. Therefore, a whole expansion of the African palm oil market is envisioned over the coming years, fueled by a combination of local consumption and export demand.

Need any customization research on Palm Oil Market - Enquiry Now

Bumitama Agri Ltd. (Crude Palm Oil, Palm Kernel Oil)

Cargill Inc. (Refined Palm Oil, Palm Fat)

Felda Global Ventures Holdings Berhad (Crude Palm Oil, Palm Oil Products)

First Resources Ltd. (Crude Palm Oil, Refined Palm Oil)

Golden Agri-Resources Ltd. (Crude Palm Oil, RBD Palm Oil)

IOI Corporation Berhad (Refined Palm Oil, Palm Kernel Oil)

Kuala Lumpur Kepong Berhad (KLK) (Crude Palm Oil, RBD Palm Oil)

Musim Mas Holdings (Crude Palm Oil, Palm Kernel Oil)

Sime Darby Plantation Berhad (Crude Palm Oil, RBD Palm Oil)

Wilmar International Ltd. (RBD Palm Oil, Palm Oil Products)

Austindo Nusantara Jaya Tbk (Crude Palm Oil, Palm Kernel Oil)

BASF SE (Fatty Acid Derivatives, Palm Oil-based Surfactants)

Coconut Holdings Inc. (Refined Coconut Oil, Palm Oil Products)

Dharma Satya Nusantara Tbk (Crude Palm Oil, RBD Palm Oil)

Green Palm (Sustainable Palm Oil Certificates, Green Palm Oil Products)

Maritim Palm Oil Sdn Bhd (Crude Palm Oil, Palm Oil Products)

PT. Astra Agro Lestari Tbk (Crude Palm Oil, RBD Palm Oil)

PT. Perkebunan Nusantara III (Crude Palm Oil, Palm Oil Products)

PT. Sinar Mas Agro Resources and Technology Tbk (Crude Palm Oil, RBD Palm Oil)

PT. Tani Indo Sejahtera (Crude Palm Oil, Palm Kernel Oil)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 70.4 Billion |

| Market Size by 2032 | US$ 106.5 Billion |

| CAGR | CAGR of 4.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Nature (Organic, Conventional) • By Product Type (CPO, RBD Palm Oil, Palm Kernel Oil, Fractionated Palm Oil) • By End-use (Food & Beverage, Personal Care & Cosmetics, Biofuel & Energy, Pharmaceuticals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Wilmar International Ltd., Sime Darby Plantation Berhad, IOI Corporation Berhad, Golden Agri-Resources Ltd., Felda Global Ventures Holdings Berhad, Musim Mas Holdings, Cargill Inc., Bumitama Agri Ltd., Kuala Lumpur Kepong Berhad (KLK), First Resources Ltd. and other key players |

| Key Drivers | • Increasing Consumer Demand for Sustainable Palm Oil Products Across Food, Cosmetics, and Biofuel Industries • Growing Biofuel Industry Increasingly Utilizes Palm Oil as a Key Feedstock for Biodiesel Production |

| RESTRAINTS | • Environmental Impact of Palm Oil Production Including Deforestation, Habitat Loss, and Biodiversity Concerns |

Ans: The Palm Oil Market is expected to grow at a CAGR of 4.7%

Ans: The Palm Oil Market Size was valued at USD 70.4 billion in 2023, and is expected to reach USD 106.1 billion by 2032

Ans: Advancements in sustainable palm oil production practices create pathways for market growth and environmental benefits

Ans: Market volatility and economic uncertainties affecting pricing, supply, and demand dynamics globally

Ans: The Asia Pacific region dominated the Palm Oil market holding the largest market share of about 70% during the forecast period.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization Analysis by Region

5.2 Feedstock Prices Analysis by Region

5.3 Regulatory Impact: Effects of regulations on production and usage.

5.4 Environmental Metrics Analysis by Region

5.5 Innovation and R&D

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Palm Oil Market Segmentation, by Nature

7.1 Chapter Overview

7.2 Organic

7.2.1 Organic Market Trends Analysis (2020-2032)

7.2.2 Organic Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Conventional

7.3.1 Conventional Market Trends Analysis (2020-2032)

7.3.2 Conventional Market Size Estimates and Forecasts to 2032 (USD Million)

8. Palm Oil Market Segmentation, by Product Type

8.1 Chapter Overview

8.2 CPO

8.2.1 CPO Market Trends Analysis (2020-2032)

8.2.2 CPO Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 RBD Palm Oil

8.3.1 RBD Palm Oil Market Trends Analysis (2020-2032)

8.3.2 RBD Palm Oil Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 Palm Kernel Oil

8.4.1 Palm Kernel Oil Market Trends Analysis (2020-2032)

8.4.2 Palm Kernel Oil Market Size Estimates and Forecasts to 2032 (USD Million)

8.5 Fractionated Palm Oil

8.5.1 Fractionated Palm Oil Market Trends Analysis (2020-2032)

8.5.2 Fractionated Palm Oil Market Size Estimates and Forecasts to 2032 (USD Million)

9. Palm Oil Market Segmentation, by End-use

9.1 Chapter Overview

9.2 Food & Beverage

9.2.1 Food & Beverage Market Trends Analysis (2020-2032)

9.2.2 Food & Beverage Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 Personal Care & Cosmetics

9.3.1 Personal Care & Cosmetics Market Trends Analysis (2020-2032)

9.3.2 Personal Care & Cosmetics Market Size Estimates and Forecasts to 2032 (USD Million)

9.4 Biofuel & Energy

9.4.1 Biofuel & Energy Market Trends Analysis (2020-2032)

9.4.2 Biofuel & Energy Market Size Estimates and Forecasts to 2032 (USD Million)

9.5 Pharmaceuticals

9.5.1 Pharmaceuticals Market Trends Analysis (2020-2032)

9.5.2 Pharmaceuticals Market Size Estimates and Forecasts to 2032 (USD Million)

9.6 Others

9.6.1 Others Market Trends Analysis (2020-2032)

9.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Palm Oil Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.2.3 North America Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.2.4 North America Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.2.5 North America Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.2.6 USA

10.2.6.1 USA Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.2.6.2 USA Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.2.6.3 USA Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.2.7 Canada

10.2.7.1 Canada Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.2.7.2 Canada Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.2.7.3 Canada Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.2.8 Mexico

10.2.8.1 Mexico Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.2.8.2 Mexico Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.2.8.3 Mexico Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Palm Oil Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.1.3 Eastern Europe Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.3.1.4 Eastern Europe Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.3.1.5 Eastern Europe Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.1.6 Poland

10.3.1.6.1 Poland Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.3.1.6.2 Poland Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.3.1.6.3 Poland Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.1.7 Romania

10.3.1.7.1 Romania Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.3.1.7.2 Romania Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.3.1.7.3 Romania Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.3.1.8.2 Hungary Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.3.1.8.3 Hungary Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.3.1.9.2 Turkey Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.3.1.9.3 Turkey Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.3.1.10.2 Rest of Eastern Europe Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.3.1.10.3 Rest of Eastern Europe Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Palm Oil Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.2.3 Western Europe Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.3.2.4 Western Europe Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.3.2.5 Western Europe Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.2.6 Germany

10.3.2.6.1 Germany Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.3.2.6.2 Germany Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.3.2.6.3 Germany Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.2.7 France

10.3.2.7.1 France Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.3.2.7.2 France Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.3.2.7.3 France Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.2.8 UK

10.3.2.8.1 UK Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.3.2.8.2 UK Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.3.2.8.3 UK Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.2.9 Italy

10.3.2.9.1 Italy Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.3.2.9.2 Italy Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.3.2.9.3 Italy Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.2.10 Spain

10.3.2.10.1 Spain Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.3.2.10.2 Spain Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.3.2.10.3 Spain Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.3.2.11.2 Netherlands Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.3.2.11.3 Netherlands Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.3.2.12.2 Switzerland Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.3.2.12.3 Switzerland Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.2.13 Austria

10.3.2.13.1 Austria Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.3.2.13.2 Austria Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.3.2.13.3 Austria Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.3.2.14.2 Rest of Western Europe Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.3.2.14.3 Rest of Western Europe Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Palm Oil Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.4.3 Asia Pacific Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.4.4 Asia Pacific Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.4.5 Asia Pacific Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.4.6 China

10.4.6.1 China Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.4.6.2 China Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.4.6.3 China Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.4.7 India

10.4.7.1 India Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.4.7.2 India Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.4.7.3 India Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.4.8 Japan

10.4.8.1 Japan Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.4.8.2 Japan Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.4.8.3 Japan Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.4.9 South Korea

10.4.9.1 South Korea Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.4.9.2 South Korea Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.4.9.3 South Korea Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.4.10 Vietnam

10.4.10.1 Vietnam Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.4.10.2 Vietnam Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.4.10.3 Vietnam Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.4.11 Singapore

10.4.11.1 Singapore Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.4.11.2 Singapore Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.4.11.3 Singapore Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.4.12 Australia

10.4.12.1 Australia Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.4.12.2 Australia Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.4.12.3 Australia Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.4.13.2 Rest of Asia Pacific Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.4.13.3 Rest of Asia Pacific Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Palm Oil Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.1.3 Middle East Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.5.1.4 Middle East Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.5.1.5 Middle East Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.5.1.6 UAE

10.5.1.6.1 UAE Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.5.1.6.2 UAE Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.5.1.6.3 UAE Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.5.1.7.2 Egypt Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.5.1.7.3 Egypt Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.5.1.8.2 Saudi Arabia Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.5.1.8.3 Saudi Arabia Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.5.1.9.2 Qatar Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.5.1.9.3 Qatar Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.5.1.10.2 Rest of Middle East Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.5.1.10.3 Rest of Middle East Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Palm Oil Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.2.3 Africa Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.5.2.4 Africa Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.5.2.5 Africa Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.5.2.6.2 South Africa Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.5.2.6.3 South Africa Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.5.2.7.2 Nigeria Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.5.2.7.3 Nigeria Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.5.2.8.2 Rest of Africa Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.5.2.8.3 Rest of Africa Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Palm Oil Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.6.3 Latin America Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.6.4 Latin America Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.6.5 Latin America Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.6.6 Brazil

10.6.6.1 Brazil Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.6.6.2 Brazil Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.6.6.3 Brazil Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.6.7 Argentina

10.6.7.1 Argentina Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.6.7.2 Argentina Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.6.7.3 Argentina Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.6.8 Colombia

10.6.8.1 Colombia Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.6.8.2 Colombia Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.6.8.3 Colombia Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Palm Oil Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.6.9.2 Rest of Latin America Palm Oil Market Estimates and Forecasts, by Product Type (2020-2032) (USD Million)

10.6.9.3 Rest of Latin America Palm Oil Market Estimates and Forecasts, by End-use (2020-2032) (USD Million)

11. Company Profiles

11.1 Wilmar International Ltd.

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Sime Darby Plantation Berhad

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 IOI Corporation Berhad

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Golden Agri-Resources Ltd.

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Felda Global Ventures Holdings Berhad

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Musim Mas Holdings

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Cargill Inc.

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Bumitama Agri Ltd.

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Kuala Lumpur Kepong Berhad (KLK)

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 First Resources Ltd.

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Nature

Organic

Conventional

By Product Type

CPO

RBD Palm Oil

Palm Kernel Oil

Fractionated Palm Oil

By End-use

Food & Beverage

Personal Care & Cosmetics

Biofuel & Energy

Pharmaceuticals

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Industrial cleaning chemical market Size was valued at expected to reach USD 72.59 billion by 2032, and USD 47.4 billion in 2023 and grow at a CAGR of 4.85% over the forecast period 2024-2032

The Methanol Market Size was valued at USD 33.7 billion in 2023, and expected to reach USD 54.5 billion by 2032, and grow at a CAGR of 5.5% over the forecast period 2024-2032.

The Cold Chain Monitoring Market Size was USD 5.7 Billion in 2023 and is expected to reach $22.1 Billion by 2032 and grow at a CAGR of 16.2% by 2024-2032.

The Drilling Lubricants Market Size was USD 2.5 Billion in 2023 and is expected to reach USD 3.7 Billion by 2032 and grow at a CAGR of 4.6% by 2024-2032.

The Cotton Yarn Market size was valued at USD 81.95 Billion in 2023 and is expected to reach USD 117.69 Billion by 2032 and grow at a CAGR of 4.10% over the forecast period of 2024-2032.

The Liquid Ring Compressors Market Size was USD 1.22 Billion in 2023 and will reach to USD 1.97 Billion by 2032 and grow at a CAGR of 5.6% by 2024-2032.

Hi! Click one of our member below to chat on Phone