Palletizer Market Key Insights:

To Get More Information on Palletizer Market - Request Sample Report

The Palletizer Market size was USD 2.77 billion in 2023 and is expected to Reach USD 4.05 billion by 2032 and grow at a CAGR of 4.32% over the forecast period of 2024-2032.

The palletizer market has been experiencing substantial growth, primarily driven by the increasing demand for automation across industries such as manufacturing, logistics, and packaging. Palletizers are integral in automating the process of stacking products onto pallets, a critical function for handling large volumes of items in warehouses, distribution centers, and production lines. By incorporating these machines into operations, companies improve efficiency, cut labor costs, and enhance safety by reducing human intervention in high-risk environments.

Technological advancements in automation, especially in robotics and machine vision systems, have been key drivers of market growth. Industries like food and beverage, pharmaceuticals, chemicals, and consumer goods are adopting palletizing systems to optimize their operations. With an increasing need for faster production cycles and cost-effective product handling, automated palletizing solutions are becoming more essential. Robotic palletizers, known for their adaptability to various product sizes and configurations, are particularly favored. These systems can easily adjust to different product types, making them a preferred choice for businesses with diverse inventories. The shift towards Industry 4.0, with its emphasis on smart manufacturing and real-time data monitoring, has also contributed to the market's growth. The integration of the Internet of Things (IoT) into palletizing systems enhances process monitoring, improves machine uptime, and drives operational efficiency. Moreover, the focus on sustainability within supply chains has prompted further interest in automated palletizers. These systems help reduce energy consumption and waste, supporting eco-friendly practices in packaging and logistics.

| Feature | Description | Commercial Products |

|---|---|---|

| Automation | Incorporates automated systems to increase speed and accuracy in palletizing. | FANUC Palletizing Robots, KUKA Palletizing Systems |

| Load Capacity | Capable of handling different weight ranges of products for various industries. | Schaefer Palletizer, ABB IRB 6600 |

| Flexibility | Offers adaptable configurations for handling a variety of products and sizes. | Mitsubishi Electric Palletizers, Columbia Palletizer |

| Energy Efficiency | Designed to minimize energy consumption while maximizing performance. | Kawasaki Robotics Palletizer, Bastian Solutions Palletizing Systems |

| Integration | Easily integrates with existing production lines and warehouse systems. | Dematic Palletizing Solutions, Intelligrated Automated Palletizing |

| Speed | Capable of rapid cycle times for high throughput in manufacturing. | WAKI Robotic Palletizers, Intersys Robotic Systems |

| Space Efficiency | Compact designs optimized for limited space while maximizing throughput. | Swisslog Palletizing Systems, Festo Robotic Palletizers |

| Precision | Offers high precision in stacking products on pallets for safe transport. | KUKA Robotics Palletizing Systems, Yaskawa Motoman Palletizer |

| Safety Features | Built-in safety protocols to prevent accidents during operation. | Fanuc M-20iA Palletizer, ABB SafeMove Technology |

| User-Friendly Interface | Simplified controls for easy operation and monitoring. | SSI Schaefer Palletizing Systems, Toshiba Palletizer Control Panels |

MARKET DYNAMICS

DRIVERS

- The rising demand for automation in industries like automotive, food and beverage, and pharmaceuticals is boosting the use of palletizers to improve efficiency, reduce labor costs, and increase productivity.

The growing demand for automation across various industries, particularly in sectors like automotive, food and beverage, and pharmaceuticals, is a key driver behind the increasing adoption of palletizers. As businesses strive to streamline their operations and improve production efficiency, automated palletizing systems have become integral to modern manufacturing and logistics processes. These systems provide significant advantages by automating the labor-intensive task of stacking products onto pallets, which can otherwise be slow, error-prone, and costly when performed manually.

In the automotive industry, where precision and speed are critical, automated palletizers help meet production demands by quickly handling heavy parts and components, reducing downtime, and ensuring consistent product stacking. Similarly, in the food and beverage sector, where high-speed production lines are necessary to meet consumer demand, palletizing automation ensures products are packaged efficiently, with minimal human intervention, while adhering to hygiene and safety standards. The pharmaceutical industry, with its need for high precision and compliance, benefits from automated palletizers that offer exact stacking and sorting capabilities, reducing the risk of errors and contamination. By automating the palletizing process, companies can achieve substantial cost savings, particularly by reducing labor costs associated with manual handling. Additionally, automation enhances overall productivity by increasing throughput, enabling faster processing times, and ensuring consistent quality control. As industries continue to evolve and focus on operational efficiency, the demand for automated palletizers is expected to grow, helping businesses meet the challenges of a competitive and fast-paced market environment.

- Technological advancements in AI and IoT have created smarter, more flexible palletizing systems that improve efficiency, enable real-time monitoring, and support predictive maintenance for better performance.

Technological advancements, particularly in Artificial Intelligence (AI) and the Internet of Things (IoT), have significantly transformed the palletizing market, making systems smarter, more flexible, and highly efficient. AI-powered palletizers are capable of learning and adapting to various tasks, improving their ability to handle different products and packaging types with minimal human intervention. By utilizing machine learning algorithms, these systems can optimize the arrangement of products on pallets, ensuring maximum space utilization and reducing the risk of product damage during transportation.

The integration of IoT enables real-time monitoring of palletizing processes, providing operators with critical data on system performance, inventory levels, and the condition of equipment. This data-driven approach allows businesses to make informed decisions and improve operational workflows. IoT sensors can also track the health of palletizers, alerting operators to potential malfunctions before they lead to breakdowns, which significantly reduces downtime. Predictive maintenance is another advantage offered by these technological innovations. By analyzing data from various sensors and monitoring systems, AI and IoT can predict when components will require maintenance, reducing the need for reactive repairs and lowering the risk of unexpected system failures. This proactive approach helps businesses optimize maintenance schedules, minimize disruptions, and extend the life of palletizing equipment. Overall, the combination of AI and IoT technologies enhances the flexibility, performance, and reliability of palletizing systems, driving greater efficiency and cost savings across industries like manufacturing, logistics, and e-commerce.

RESTRAIN

- The high upfront cost of automated palletizing systems, including installation and maintenance, presents a significant barrier to adoption for small and medium-sized businesses, especially in budget-constrained regions.

One of the significant challenges faced by small and medium-sized businesses in adopting automated palletizing systems is the high initial investment required for purchasing, installing, and maintaining the equipment. Automated palletizers, particularly those equipped with advanced robotics, AI, or IoT technology, involve substantial upfront costs. These costs not only cover the hardware and software but also the installation, customization, and system integration necessary to ensure the palletizer functions seamlessly with existing production lines. For businesses operating on limited budgets, these expenses can be a major deterrent, especially when compared to the more affordable, manual palletizing alternatives.

Moreover, the maintenance of automated systems adds an ongoing financial burden. While they reduce labor costs in the long run, businesses still need to allocate resources for regular servicing, spare parts, software upgrades, and potential repairs. In many cases, businesses may need to hire or train specialized personnel to manage and troubleshoot these sophisticated systems, further increasing costs. This high initial and ongoing investment is particularly challenging for small and medium enterprises (SMEs) in regions where there are budget constraints or where financial support mechanisms for automation adoption are limited. As a result, many SMEs are unable to justify the expense of automation, opting instead for manual labor solutions that are more cost-effective in the short term. Consequently, this financial barrier slows the widespread adoption of automated palletizing systems in certain industries, limiting their ability to compete with larger, more resource-rich competitors.

KEY SEGMENTATION ANALYSIS

By Product Type

The Boxes and Cases segment dominated with the share over 42% in 2023. This dominance is attributed to the widespread use of boxes and cases across various industries, including food and beverage, pharmaceuticals, and consumer goods. These packaging formats are standardized, facilitating efficient handling and stacking processes. Automated palletizers are extensively employed to manage the high volume of goods packaged in boxes and cases, optimizing stacking patterns and maximizing pallet load stability.

By Industry

The Food & Beverages segment dominated with the share over 38% in 2023, driven by the growing need for high-speed packaging and efficient handling. As consumer demands for faster production and delivery increase, food and beverage manufacturers are turning to automation to streamline their operations. Palletizers play a critical role in enhancing production efficiency by automating the stacking, sorting, and packaging processes. These systems are essential for handling large volumes of products while maintaining accuracy and speed. The need for consistent packaging and compliance with stringent regulatory standards, such as food safety and hygiene, further boosts the demand for automated palletizing solutions.

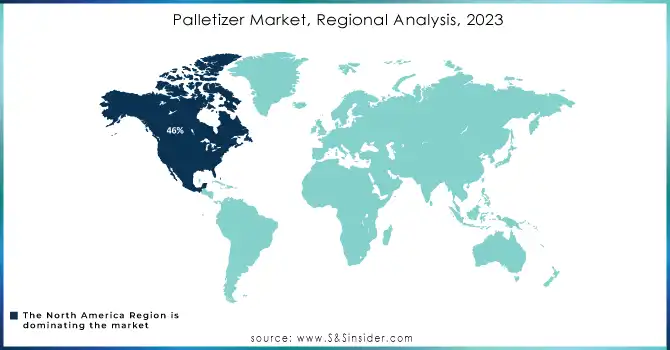

KEY REGIONAL ANALYSIS

The North American region dominated with the share over 46% in 2023due to the presence of leading companies and continuous advancements in technology. Industries such as food and beverage, pharmaceuticals, and logistics are increasingly adopting automated solutions to enhance efficiency and reduce labor costs. The region’s strong manufacturing base, coupled with the high adoption of robotics and automation, contributes significantly to market growth. The demand for palletizers is driven by the need for streamlined operations and improved supply chain management.

The Asia Pacific region is the fastest-growing in the palletizer market. Countries like China, Japan, and India are experiencing rapid industrialization, with a strong focus on expanding manufacturing sectors. The region is witnessing increased adoption of automation technologies across industries, driven by the need for cost-effective, efficient, and scalable solutions. Additionally, the booming e-commerce and logistics sectors are fueling the demand for palletizers, making Asia Pacific a key area of growth.

Do You Need any Customization Research on Palletizer Market - Inquire Now

Key Players

-

KUKA AG (Robotic Palletizing Systems, Automation Solutions)

-

Kion Group AG (Linde Material Handling, Automated Palletizers)

-

Columbia Machine Inc (Robotic Palletizers, Conventional Palletizing Systems)

-

Fanuc Corporation (Industrial Robots for Palletizing, Robotic Automation Systems)

-

Honeywell International Inc (Smart Palletizing Systems, Robotics for Warehouse Automation)

-

Concetti SpA (Automatic Palletizing Systems, Bag Palletizers)

-

Okura Yusoki Co Ltd (Robotic Palletizers, Automated Packaging Systems)

-

ABB Ltd (Palletizing Robots, Automation Solutions)

-

Fuji Yosoki Kogyo Co Ltd (Box Palletizers, Robotic Palletizing Systems)

-

Premier Tech (Bagging & Palletizing Solutions, Automated Systems)

-

Bastian Solutions (Automated Palletizing Solutions, Robotic Integration)

-

Mitsubishi Electric Corporation (Palletizing Robots, Automation Equipment)

-

Yaskawa Electric Corporation (Robotic Palletizers, Industrial Robotics)

-

Rockwell Automation (Automated Palletizing Systems, Control Solutions)

-

Schneider Electric (Automated Palletizing Solutions, Smart Factory Systems)

-

Sepro Group (Robotic Palletizing Systems, Robotics for Packaging Lines)

-

Schaefer Systems International (Palletizing Systems, Material Handling Automation)

-

JLS Automation (Automated Palletizing and Depalletizing Systems, Packaging Systems)

-

FANUC Robotics (Robotic Palletizing, Automated Palletizing Systems)

-

Stäubli Robotics (Industrial Robots, Palletizing Solutions)

Suppliers for Automated palletizing systems, robotic arms, industrial robots of Palletizer Market

-

KUKA Robotics

-

FANUC Corporation

-

Honeywell Intelligrated

-

Mecalux

-

Columbia/Okura LLC

-

SIAT S.p.A.

-

Beckhoff Automation

-

Palletizer Systems, Inc.

-

Interroll Group

-

Zebra Technologies

RECENT DEVELOPMENTS

In July 2024: BW Flexible Systems has introduced the SYMACH 3500S palletizer, designed to offer high-speed stacking for bags, bales, crates, and cases. This model merges the Thiele Master 3500 experience with SYMACH's advanced palletizing platform. It features a compact design, making it ideal for space-restricted areas, and includes a user-friendly interface.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.77 billion |

| Market Size by 2032 | USD 4.05 billion |

| CAGR | CAGR of 4.32%From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Conventional Palletizers (High Level Palletizers, Low Level Palletizers) Robotic Palletizers (Traditional Robot Palletizers, Cobot Palletizers) • By Product Type (Bags, Boxes and Cases, Pails and Drums, Other Product Types) • By Industry (Food & Beverages, Chemicals, Pharmaceuticals, Cosmetics & Personal Care, E-commerce and Retail, Textiles) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | KUKA AG, Kion Group AG, Columbia Machine Inc, Fanuc Corporation, Honeywell International Inc, Concetti SpA, Okura Yusoki Co Ltd, ABB Ltd, Fuji Yosoki Kogyo Co Ltd, Premier Tech, Bastian Solutions, Mitsubishi Electric Corporation, Yaskawa Electric Corporation, Rockwell Automation, Schneider Electric, Sepro Group, Schaefer Systems International, JLS Automation, FANUC Robotics, Stäubli Robotics. |

| Key Drivers | • The rising demand for automation in industries like automotive, food and beverage, and pharmaceuticals is boosting the use of palletizers to improve efficiency, reduce labor costs, and increase productivity. • Technological advancements in AI and IoT have created smarter, more flexible palletizing systems that improve efficiency, enable real-time monitoring, and support predictive maintenance for better performance. |

| RESTRAINTS | • The high upfront cost of automated palletizing systems, including installation and maintenance, presents a significant barrier to adoption for small and medium-sized businesses, especially in budget-constrained regions. |