Pallet Racking Market Report Scope & Overview:

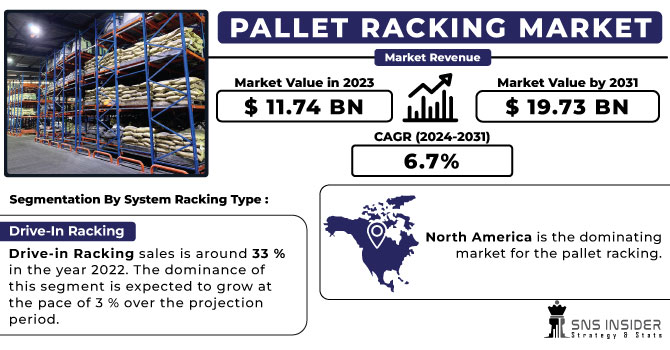

The Pallet Racking Market size was USD 11.74 billion in 2023 and is expected to Reach USD 19.73 billion by 2031 and grow at a CAGR of 6.7 % over the forecast period of 2024-2031.

In 2022 the selective pallet product category accounted for more than 44.45% of global revenues, which represented a dominant position in this sector. The system has an affordable design with a large selection of sizes and accessories, making it an excellent choice for standard storage and utility services. Moreover, it is likely that this segment will benefit from the increasing consumption of products in all application sectors.

Get More Information on Pallet Racking Market - Request Sample Report

Due to the increase in the number of warehouses, supermarkets, hypermarkets and others, the retail application segment led the industry in 2022 and accounted for more than 34.35% of global revenue. Furthermore, the optimal use of different types of racks allows efficient space allocation and product alignment for retailers' warehouses.

Major factors driving growth in the market are an increase in imports and exports between various economic sectors, as well as a rise in labour costs. In addition, the market is supported by the various developments of key players. Indeed, Mecalux S.A. has set up a new computerised warehouse in the United Kingdom of Yamazaki Mazak that can store as many as 60 containers with an average weight of 500 kg per container.

MARKET DYNAMICS

KEY DRIVERS:

-

Rapid expansion of the e-commerce sector is giving boom to the market

By 2022, the global market for online shopping will have reached US$ 16.6 trillion. There is a growing need for effective warehousing solutions as the volume of e commerce increases rapidly. Pallet track systems are essential for E-commerce operations, making it possible to use more horizontal space and streamline the order fulfilment process.

-

There is a need for more storage space in the context of urban development and industry growth.

RESTRAIN:

-

Rising cost of investments

The introduction of pallet racking systems involves significant upfront costs, which may be a challenge for businesses with restricted capital budgets, in particular smaller ones.

OPPORTUNITY:

-

The growth of vertical farming and urban agriculture

It is possible to develop specific pallet racking systems for vertical growing in order to support the emergence of this sector, as urbanization and vertical agriculture gain momentum.

CHALLENGES:

-

Safety Concerns is a major challenge to deal with.

A major challenge is to ensure that the pallet rack system is installed, maintained and used safely. Accident, injury and potential liability may be caused if safety standards are not complied with.

IMPACT OF RUSSIAN UKRAINE WAR

The war caused the price of steel, the main component of pallet racks, to skyrocket. As of March 8, 2022, the price of hot rolled coil has increased by 45% since the start of the war. War also disrupted supply chains, making it harder and more expensive to source materials for pallet racking. Due to these factors, pallet racking prices have increased by an average of 20% since the beginning of the war. This makes it more difficult for businesses to buy pallet racking and leads to a decrease in demand for this product. In the first quarter of 2022, global pallet racking sales decreased by 10% compared to the same period in 2021. The war is expected to continue to negatively impact the pallet racking market in the coming months.

Overall, the war between Russia and Ukraine is having a significant negative impact on the pallet racking market. Steel prices soar, supply chains are disrupted and demand falls. This will continue in the coming months.

IMPACT OF ONGOING RECESSION

The economic downturn has led to a decline in economic activity, which reduces the demand for pallet racking. Businesses are less likely to invest in new pallet racking when facing financial difficulties. As a result, the global pallet racking market is expected to decline by 3% in 2023.

This decline will be more pronounced in developed markets, where the economic downturn is having a greater impact.

In the United States, for example, the pallet racking market is expected to decline by 5% by 2023.

KEY MARKET SEGMENTS

By System

-

Mobile Racking

-

Hybrid/Customized Racking

-

Conventional

-

Shuttle Racking

By System Racking Type

-

Selective Racking

-

Pallet Flow Racking

-

Cantilever Racking

-

Carton Flow Racking

-

Drive-In Racking

-

Push Back Racking

Drive-in Racking sales is around 33 % in the year 2022. The dominance of this segment is expected to grow at the pace of 3 % over the projection period.

By Frame Load Capacity

-

0-5 ton

-

5-15 ton

-

More Than 15 ton

By End Use

-

Food & Beverage

-

Manufacturing

-

Retail

-

Automotive

-

Warehouse

REGIONAL ANALYSIS

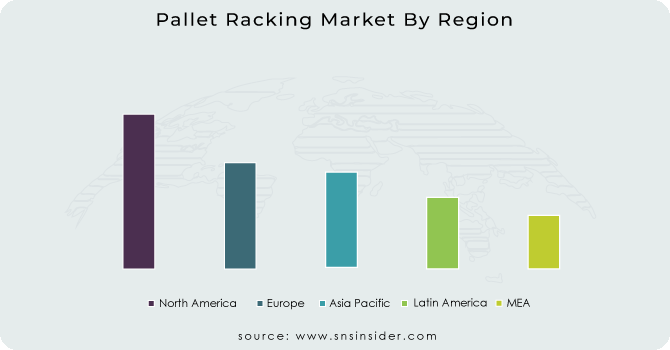

North America is the dominating market for the pallet racking. The total market share North America holds is around USD 4792.5 million in the year 2022 and is expected to dominate over the forecast period. The presence of major e-commerce hubs such as Walmart and Amazonis giving boost to the market in the region. The market is expected to increase by 13% in the United States.

Europe is holding the second largest market share for the pallet Racking market. There is a rising demand from the end use industries such as automotive, food and beverage, over the forecast period. The shift in consumer preference and rising warehousing activities is significantly rising the demand for the Pallet Racking market over the projection period. Garmany is holding the major market share in the region whereas UK is the fastest growing market over the forecast period. The UK market is expected to grow with the growth rate of 3%.

Asia Pacific region is expected to grow significantly over the projection period. Rising population is expected to boost the retail market in this region as well as favourable goods which require pallet racking. India, which is rising economy is expected to make significant investments in future towards e-commerce sector, which will give rise to the market.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

- Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some major key players in the Pallet Racking market are Mecalux, Daifuku, Elite Storage Solutions, Advance Storage Products, Steel King, Hannibal Industries, AR Racking, Unarco Material Handling, Averys, Kion Group and other players.

Elite Storage Solutions-Company Financial Analysis

RECENT DEVELOPMENT

-

In March 2023, For warehouse automation solution, Maersk tests BionicHIVE.

-

In the South, U.S. Pallet Racks Inc. has been established as Nucor Warehouse System's main stocking distributor and a provider of pallet containers and material handling equipment.

| Report Attributes | Details |

| Market Size in 2023 | US$ 11.74 Bn |

| Market Size by 2031 | US$ 19.73 Bn |

| CAGR | CAGR of 6.7 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by System (Mobile Racking, Hybrid/Customized Racking, Conventional, Shuttle Racking) • by System Racking Type (Selective Racking, Pallet Flow Racking, Cantilever Racking, Carton Flow Racking, Drive-In Racking, Push Back Racking) • by Frame Load Capacity (0-5 ton, 5-15 ton, More Than 15 ton) • by End Use (Food & Beverage, Manufacturing, Retail, Automotive, Warehouse) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Mecalux, Daifuku, Elite Storage Solutions, Advance Storage Products, Steel King, Hannibal Industries, AR Racking, Unarco Material Handling, Averys, Kion Group |

| Key Drivers | • Rapid expansion of the e-commerce sector is giving boom to the market • There is a need for more storage space in the context of urban development and industry growth. |

| Market Opportunities | • The growth of vertical farming and urban agriculture |