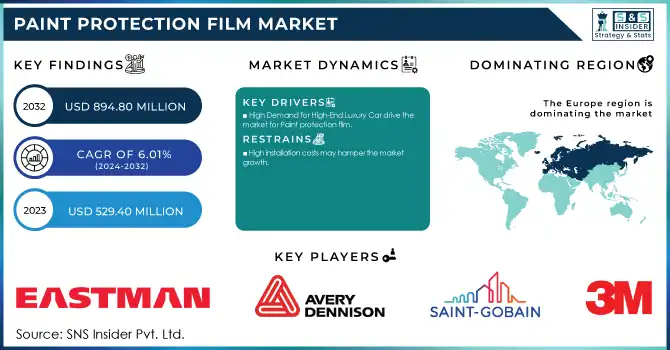

The Paint Protection Film Market size was USD 529.40 Million in 2023 and is expected to reach USD 894.80 Million by 2032 and grow at a CAGR of 6.01 % over the forecast period of 2024-2032.

Get E-PDF Sample Report on Paint Protection Film Market - Request Sample Report

The global paint protection film (PPF) market is mainly attributed to the increasing vehicle aesthetics demand. This is particularly true for the luxury and sports car owner who has become a more discerning keeper of his or her car, wanting to retain the fit, finish, and resale value of the vehicle. PPFs offer a high-end option for keeping all those scratches, chips, stains, and UV damage away from your vehicle's exterior while retaining the factory paint finish. With increasing disposable incomes and an upsurge in the number of consumers preferring vehicles personalized, consumers are looking for an advanced protective film that not only provides protection but also enhances the beauty of the vehicle. The trend is also supported by the rising number of luxury vehicles in developing markets, where keeping a new car looking as good as new is a major concern for a lot of owners.

According to the Second Advance Estimates of National Income, 2022-23, released by the Ministry of Statistics and Programme Implementation, India's per capita net national income at current prices was estimated at ₹1,50,906 for 2021-22 and ₹1,69,496 for 2022-23, indicating a rise in disposable incomes.

Advancements in film technology have significantly contributed to the growth of the Paint Protection Film (PPF) market. Over the years, manufacturers have developed highly sophisticated films with enhanced features that offer superior protection and performance. Modern PPFs are equipped with self-healing properties, allowing them to recover from minor scratches and abrasions when exposed to heat, thus ensuring long-lasting protection and maintaining the vehicle's aesthetic appeal. Additionally, these films now come with increased resistance to UV rays, which helps prevent discoloration and fading of the vehicle's paint. Innovations have also led to the creation of thinner, more flexible films that provide better coverage without compromising on durability or clarity. These technological advancements not only improve the functionality of PPFs but also make them more attractive to consumers, driving their widespread adoption across various vehicle segments.

Drivers

High Demand for High-End Luxury Car drive the market for Paint protection film.

One of the major factors driving the Paint Protection Film (PPF) market is the growth in the need for high-end luxury cars. With the increase in consumers' wealth, especially from the emerging markets, the market for luxury and premium vehicles is booming. Luxury or expensive car owners focus on maintaining the looks and value of their cars and look for long-term protective products. PPFs have emerged over recent years as the only credible solution to protect luxury car owners' paintwork against damage from vagaries of road debris, scratches, UV rays , and other factors. Predictably, these films tend to be particularly favored by owners of Ferrari, Lamborghini, and Porsche vehicles especially since they help keep the car looking showroom new, thus increasing its resale value. Luxury car buyers very much want solutions that are designed to not only protect but also help to beautify their cars and those solutions that are more tailored to protect fully the beauty of the cars they are customizing. Newer PPFs are fitted with self-healing properties which help the film regain after little scratches along with more advanced translucency so that there is no dull paint in the original finish.

Restraint

High installation costs may hamper the market growth.

Installation cost is the major barrier to the growth of the paint protection film (PPF) market. Although PPF provides many advantages including safeguarding against scratches, stains, and UV rays, both purchasing the product and the costs for installation by professionals may be significant upfront investments. As PPF can be an expensive product (part of the cost of high-quality films, in addition to the labor process of installing it), this is a barrier to consumers on a budget. The need for professional installation to ensure the film sticks properly and does not damage the vehicle with poor application often requires special technicians and equipment which add to the overall price. As a result, for many consumers, especially those with mid-range or budget cars, the high installation prices may also start making the solution less palatable versus other alternatives, such as waxing, or DIY protection solutions.

By Type

Thermal Plastic Polyurethane (TPU) held the largest market share around 65% in 2023. TPU is an extremely durable, thin, flexible material that is mostly wear-resistant, UV-resistant, and resistant to environmental conditions a perfect match for automotive protection. This flexibility allows TPU to bend around the curves of a vehicle surface, leaving a perfect finish, while remaining effective in protecting the paint below from scratches, chips, and stains. Another great quality of TPU, it can repair itself from minor scratches or abrasions when heated, keeping the car in immaculate condition. This property of the material to preserve its transparency over time, even after long-term exposure to UV radiation, makes it a very interesting solution for its application in the automotive industry, where the aesthetics of the components do matter. In addition, TPU films are easy to install, do not turn yellow, and remain shiny so they offer superior long-term protection to car owners.

By Application

Automotive & Transportation held the largest market share around 60% in 2023. An increase in demand for vehicle protection & maintaining the aesthetic of vehicles is projected to drive the decade automotive & transportation segment. With the growing popularity of luxury vehicles and the expanding automotive market, the need to maintain the aesthetics and resale value of the car is higher than ever. PPF (Paint Protection Film) is long-lasting and trustworthy vehicle protection from scratches, chips, and environmental damage like UV rays, bird droppings, and chemical contaminants. This has solidified its place as a must-have in the automotive aftermarket, especially for luxury vehicles and EVs that emphasize paint-saving measures. Furthermore, rising consumer awareness regarding the extended benefits of PPF such as lowering maintenance costs and improving the aesthetics of the vehicle is further propelling its demand in the automotive industry. The transportation sector is expected to be the significant revenue generator for the global PPF market, as the automotive industry is one of the largest contributors to global economic activity.

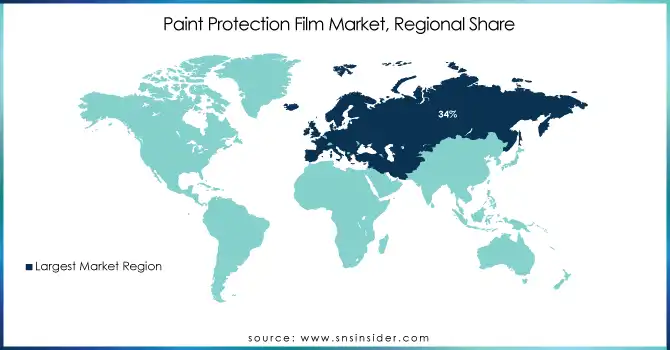

Europe region held the major share of the paint protection film market of more than 34% in 2023. There is a high demand for luxury segment vehicles and rising awareness towards vehicle protection solutions. It is also home to the largest automotive market in the world, with some of the biggest high-quality carmakers such as BMW, Audi, and Mercedes-Benz in Germany, along with luxury brands such as Ferrari in Italy and plenty more across France. This, in turn, has resulted in great potential for goods that preserve the design and resale worth of the autos. One of the major factors contributing to the increased usage of PPF in the region is the adoption of high-performance and luxury cars, in which consumers do not hesitate to pay reasonable amounts for a protective film against external impact while preserving the aesthetic and financial value of their cars.

Moreover, European consumers have grown more cognizant of the value of PPF, such as its ability to protect the paintwork from scratches, UV degradation, and other environmental pollutants. The consumers in the region have become more aware of vehicle ownership and with a growing desire for automotive customization, the demand is what drives the growth of the PPF market in the region. Moreover, the growing emphasis on sustainable solutions and ecological aspects in Europe's auto sector is also pushing consumers towards durability-oriented protection. PPF has become one of the indispensable factors of the European automotive aftermarket industry, and as a result, Europe remains in the first place in the market share.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players

3M (Scotchgard Paint Protection Film Pro Series, Scotchgard Clear Paint Protection Film)

Saint-Gobain (Solar Gard Paint Protection Film, Solar Gard Clearshield Pro)

Avery Dennison Corporation (Avery Dennison Supreme Protection Film, Avery Dennison Conform Chrome Wrap)

Eastman Chemical Company (Llumar Paint Protection Film, V-Kool Automotive Film)

XPEL, Inc. (XPEL Ultimate Plus, XPEL Stealth)

Ziebart International Corporation (Ziebart Paint Protection Film, Z-Shield)

Renolit SE (Renolit X-TREME, Renolit Care System)

Garware Hi-tech Film Ltd (Garware Paint Protection Film, Garware Nano Hybrid Film)

Schweitzer-Mauduit International, Inc. (Suntuitive PPF, CarGuard PPF)

Hexis S.A.S (Hexis Bodyfence, Hexis Bodyguard)

Luxer Film (Luxer Clear Protection Film, Luxer Matte Protection Film)

Madico, Inc. (Madico Paint Protection Film, Madico Matte Finish Film)

Oracal (Oraguard 290, Oraguard 210)

KDX Film (KDX Auto PPF, KDX Clear Shield)

Shenzhen Lushan Automotive Film Co., Ltd. (Lushan PPF, Lushan Tinted Protection Film)

SolarGard (SolarGard ClearShield Ultra, SolarGard CarbonXP)

SunTek (SunTek Paint Protection Film, SunTek Ultra PPF)

FlexiShield (FlexiShield Paint Protection Film, FlexiShield Stealth Film)

Pinnacle Film (Pinnacle Ceramic PPF, Pinnacle Ultra PPF)

XtraShield (XtraShield Nano PPF, XtraShield Gloss Finish Film)

Recent Development:

In 2024: 3M launched the Scotchgard Paint Protection Film Pro Series with enhanced durability and self-healing properties, offering better protection against scratches, stone chips, and other paint damage. The product also features improved clarity and a high-gloss finish

In 2023: Saint-Gobain introduced a new version of its Solar Gard Paint Protection Film with improved resistance to discoloration and enhanced UV protection, aimed at increasing longevity and maintaining aesthetic appeal for luxury vehicles.

In 2023: Avery Dennison expanded its portfolio with the launch of Supreme Protection Film Xtreme, which incorporates advanced self-healing technology and offers superior performance in terms of durability and stain resistance.

| Report Attributes | Details |

| Market Size in 2023 | US$ 529.40 Mn |

| Market Size by 2032 | US$ 894.80 Mn |

| CAGR | CAGR of 6.01% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material Type (Thermoplastic Polyurethane (TPU), Polyvinyl chloride (PVC), Others) • By End user (Automotive & Transportation, Electrical & Electronics, Aerospace & Defence, Other) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | 3M, Saint-Gobain, Avery Dennison Corporation, Eastman Chemical Company, XPEL, Inc., Ziebart international Corporation, Renolit SE, Garware hi-tech Film Ltd, Schweitzer-Mauduit international, Inc., Hexis S.A.S |

| Key Drivers | • High Demand of for High-End Luxury Vehicles drive the market of Paint protection film. |

| Market Opportunities | • High Installation costs may hamper the market growth. |

Ans. USD 894.80 Million is the projected Paint Protection Film market size of market by 2032.

Ans. The CAGR Growth rate of Paint Protection Film Market over the forecast period is 6.01%.

Ans: USD 529.40 Million was the market size of the Paint Protection Film Market in 2023.

Ans: Automotive sector is the fast-growing user of Paint Protection Film

Ans. Drivers

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 By Production Capacity and Utilization, by Country, By Type, 2023

5.2 Feedstock Prices, by Country, By Type, 2023

5.3 Regulatory Impact, by Country, By Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, Type, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 By Product Benchmarking

6.3.1 By Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion Plans and New Product Launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Paint Protection Film Market Segmentation, By Material Type

7.1 Chapter Overview

7.2 Thermoplastic Polyurethane (TPU)

7.2.1 Thermoplastic Polyurethane (TPU) Trends Analysis (2020-2032)

7.2.2 Thermoplastic Polyurethane (TPU) Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Polyvinyl chloride (PVC)

7.3.1 Polyvinyl chloride (PVC) Market Trends Analysis (2020-2032)

7.3.2 Polyvinyl chloride (PVC) Market Size Estimates and Forecasts to 2032 (USD Million)

7.4 Others

7.4.1 Others Trends Analysis (2020-2032)

7.4.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

8. Paint Protection Film Market Segmentation, by Application

8.1 Chapter Overview

8.2 Automotive & Transportation

8.2.1 Automotive & Transportation Market Trends Analysis (2020-2032)

8.2.2 Automotive & Transportation Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Electrical & Electronics

8.3.1 Electrical & Electronics Market Trends Analysis (2020-2032)

8.3.2 Electrical & Electronics Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 Aerospace & Defense

8.4.1 Aerospace & Defense Market Trends Analysis (2020-2032)

8.4.2 Aerospace & Defense Market Size Estimates and Forecasts to 2032 (USD Million)

8.5 Others

8.5.1 Others Market Trends Analysis (2020-2032)

8.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Million

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Paint Protection Film Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.2.3 North America Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.2.4 North America Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.2.5 USA

9.2.5.1 USA Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.2.5.2 USA Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.2.6 Canada

9.2.6.1 Canada Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.2.6.2 Canada Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.2.7 Mexico

9.2.7.1 Mexico Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.2.7.2 Mexico Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Paint Protection Film Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.3.1.3 Eastern Europe Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.3.1.4 Eastern Europe Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.5 Poland

9.3.1.5.1 Poland Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.3.1.5.2 Poland Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.6 Romania

9.3.1.6.1 Romania Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.3.1.6.2 Romania Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.3.1.7.2 Hungary Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.3.1.8.2 Turkey Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.3.1.9.2 Rest of Eastern Europe Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Paint Protection Film Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.3.2.3 Western Europe Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.3.2.4 Western Europe Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.5 Germany

9.3.2.5.1 Germany Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.3.2.5.2 Germany Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.6 France

9.3.2.6.1 France Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.3.2.6.2 France Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.7 UK

9.3.2.7.1 UK Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.3.2.7.2 UK Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.8 Italy

9.3.2.8.1 Italy Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.3.2.8.2 Italy Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.9 Spain

9.3.2.9.1 Spain Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.3.2.9.2 Spain Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.3.2.10.2 Netherlands Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.3.2.11.2 Switzerland Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.12 Austria

9.3.2.12.1 Austria Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.3.2.12.2 Austria Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.3.2.13.2 Rest of Western Europe Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Paint Protection Film Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.4.3 Asia Pacific Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.4.4 Asia Pacific Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.5 China

9.4.5.1 China Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.4.5.2 China Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.6 India

9.4.5.1 India Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.4.5.2 India Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.5 Japan

9.4.5.1 Japan Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.4.5.2 Japan Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.6 South Korea

9.4.6.1 South Korea Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.4.6.2 South Korea Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.7 Vietnam

9.4.7.1 Vietnam Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.2.7.2 Vietnam Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.8 Singapore

9.4.8.1 Singapore Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.4.8.2 Singapore Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.9 Australia

9.4.9.1 Australia Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.4.9.2 Australia Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.4.10.2 Rest of Asia Pacific Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Paint Protection Film Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.5.1.3 Middle East Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.5.1.4 Middle East Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.5 UAE

9.5.1.5.1 UAE Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.5.1.5.2 UAE Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.5.1.6.2 Egypt Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.5.1.7.2 Saudi Arabia Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.5.1.8.2 Qatar Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.5.1.9.2 Rest of Middle East Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Paint Protection Film Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.5.2.3 Africa Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.5.2.4 Africa Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.5.2.5.2 South Africa Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.5.2.6.2 Nigeria Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Paint Protection Film Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.6.3 Latin America Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.6.4 Latin America Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6.5 Brazil

9.6.5.1 Brazil Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.6.5.2 Brazil Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6.6 Argentina

9.6.6.1 Argentina Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.6.6.2 Argentina Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6.7 Colombia

9.6.7.1 Colombia Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.6.7.2 Colombia Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Paint Protection Film Market Estimates and Forecasts, By Material Type (2020-2032) (USD Million)

9.6.8.2 Rest of Latin America Paint Protection Film Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10. Company Profiles

10.1 3M

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Product / Services Offered

10.1.4 SWOT Analysis

10.2 Saint-Gobain

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Product/ Services Offered

10.2.4 SWOT Analysis

10.3 Avery Dennison Corporation

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Product/ Services Offered

10.3.4 SWOT Analysis

10.4 Eastman Chemical Company

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Product/ Services Offered

10.4.4 SWOT Analysis

10.5 XPEL Inc.

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Product/ Services Offered

10.5.4 SWOT Analysis

10.6 Ziebart international Corporation

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Product/ Services Offered

10.6.4 SWOT Analysis

10.7 Renolit SE

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Product/ Services Offered

10.7.4 SWOT Analysis

10.8 Garware hi-tech Film Ltd

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Product/ Services Offered

10.8.4 SWOT Analysis

10.9 Schweitzer-Mauduit international Inc.

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Product/ Services Offered

10.9.4 SWOT Analysis

10.10 Hexis S.A.S

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Product/ Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Material Type

Thermoplastic Polyurethane (TPU)

Polyvinyl chloride (PVC)

Others

By Application

Automotive & Transportation

Electrical & Electronics

Aerospace & Defense

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Ammonium Sulfate Market Size was valued at USD 4.06 Billion in 2023 and is expected to reach USD 6.15 Billion by 2032, at a CAGR of 4.73% from 2024-2032.

The Micro Flute Paper Market size was USD 74.91 billion in 2023 and is expected to Reach USD 120.99 billion by 2032 and grow at a CAGR of 5.47% over the forecast period of 2024-2032.

Explore the Fatty Acid Ester Market, including its applications in personal care, pharmaceuticals, and food. Learn about the rising demand for bio-based esters, eco-friendly products, and how fatty acid esters are used in cosmetics, lubricants, and more.

White Inorganic Pigments Market was estimated at USD 24.14 billion in 2023 and is expected to reach USD 39.14 billion by 2032 at a CAGR of 5.52% by 2024-2032.

The Squalene Market Size was valued at USD 151.2 Million in 2023 and is expected to reach USD 328.1 Million by 2032, growing at a CAGR of 9.0% over the forecast period of 2024-2032.

The Industrial and Institutional Cleaning Chemicals Market size was valued at USD 75.02 billion in 2023. It is estimated to hit USD 137.54 billion by 2031 and grow at a CAGR of 7.9% over the forecast period of 2024-2031.

Hi! Click one of our member below to chat on Phone