Get More Information on Packaging Tape Printing Market - Request Sample Report

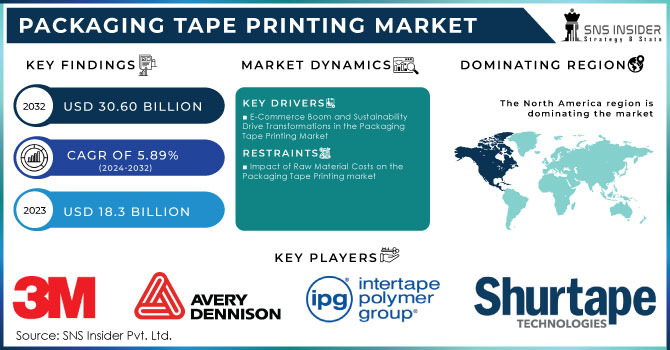

The Packaging Tape Printing Market Size was valued as USD 18.3 Billion by 2023 and expected to reach at USD 30.60 Billion by 2032 and grow at a CAGR of 5.89% over the forecast period 2024-2032.

The packaging tape printing market is undergoing a transformative shift, largely influenced by advancements in technology, a rising demand for customization, and an increasing focus on sustainability. As brands recognize the importance of custom-printed packaging tape for enhancing brand visibility and conveying essential product information, there has been a notable uptick in its adoption. This trend has been particularly pronounced with the surge in e-commerce, where companies seek innovative packaging solutions to differentiate themselves in a crowded marketplace. A pivotal aspect of this evolution is the adoption of modern printing technologies, especially digital and flexographic printing. While flexographic printing remains popular for its cost-effectiveness in large-scale production, digital printing is gaining traction for smaller runs and personalized applications. Currently, digital printing accounts for approximately 30% of packaging tape production, with projections suggesting this could rise to 50% by 2032. This shift highlights the industry's need for higher quality and operational efficiency, as digital methods offer greater flexibility and superior color accuracy. Additionally, the integration of automation in manufacturing processes is driving productivity improvements, with businesses that implement automated systems reporting up to a 50% increase in output. By 2032, it is expected that around 70% of manufacturers will have fully automated their operations, positioning themselves to meet evolving market demands effectively

The packaging tape printing market is increasingly prioritizing sustainable and eco-friendly solutions in response to a growing consumer demand for environmentally responsible products. Manufacturers are actively exploring materials that minimize environmental impact, such as recycled and biodegradable adhesives, to align with global sustainability initiatives. This shift is influenced by regulatory pressures and the need to meet customer preferences for greener options. Companies like Avery Dennison and Tesa are investing in the development of environmentally friendly tape products that fulfill practical requirements while reducing their ecological footprint. The demand for personalized and customized packaging is propelling the adoption of digital printing technologies. Digital printing empowers brands to differentiate themselves in a competitive landscape by offering high-quality, small-batch printing that requires minimal setup. This technology facilitates rapid design changes, tailored messaging, and unique branding opportunities-essential elements in today's online shopping environment, where personalized consumer interactions are paramount. As businesses leverage digital solutions to create customized packaging tape, they enhance brand visibility and engagement with consumers. Given that 81% of consumers feel they must trust a brand before making a purchase, establishing a strong brand identity is critical for driving sales and fostering customer loyalty. Cultivating loyalty results in repeat purchases, which can be achieved at just 20% of the cost of acquiring new customers. Recognizing the importance of branding for both revenue and profit margins, companies must explore all available avenues for enhancing brand awareness.

Drivers

E-Commerce Boom and Sustainability Drive Transformations in the Packaging Tape Printing Market

The rapid growth of online shopping is greatly boosting the packaging tape printing (PTP) market, with companies looking for creative packaging options to increase brand recognition and enhance customer satisfaction. Projected to reach nearly $3 trillion globally, online shopping sales are driving companies to invest in custom packaging to stand out in a competitive marketplace. By 2032, around half of packaging tape printing is projected to be done digitally, compared to the 30% in 2023, showcasing an increasing need for customization and fast production. Moreover, there is an expected 40% increase in the adoption of sustainable materials for printing packaging tape by 2032, due to increased consumer knowledge and regulatory demands. Businesses that are implementing automated systems are seeing an increase in productivity by as much as 50%, and it is estimated that 70% of manufacturers will have fully automated their operations by 2032. The merging of technological progress and the focus on sustainability is forming a dynamic environment for printing packaging tape, as companies deal with the challenges of contemporary online commerce while placing importance on environmentally-friendly methods and customer contentment.

Restraints

Impact of Raw Material Costs on the Packaging Tape Printing market

The fluctuations in raw material prices, particularly for adhesives and substrates, represent a significant challenge for the packaging tape printing (PTP) market. As manufacturers face rising production costs due to supply chain disruptions, geopolitical factors, and increased demand, maintaining profit margins becomes increasingly difficult. This often results in higher prices for consumers, which can lead to reduced demand, especially among price-sensitive customers, ultimately affecting total sales. these price variations hinder businesses from establishing competitive pricing, complicating long-term planning and investment in advanced production technologies. To mitigate these challenges, manufacturers may seek alternative materials or suppliers, implement cost-cutting strategies, or invest in research and development for eco-friendly options. However, these solutions can involve considerable costs and time, adding complexity to the market environment. Recent findings reveal that 90% of supply chain and procurement managers indicate significant rises in raw material costs, with 76% expecting further increases in the near future. Moreover, 45% of businesses report that raw material supply disruptions or shortages severely impact their operations. This situation is further exacerbated by the rise in online shopping, which surged during lockdowns as physical stores closed, thereby intensifying pressure on packaging suppliers and service providers to efficiently meet the demands of consumers receiving deliveries at home. This interplay between fluctuating raw material prices and the evolving dynamics of consumer behavior underscores the critical challenges facing the PTP market

By Type

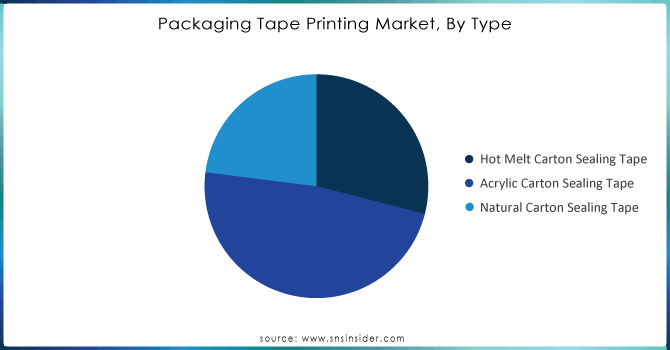

In 2023, Acrylic Carton Sealing Tape dominated the Packaging Tape Printing market, capturing 48% of the revenue share. This segment's growth can be attributed to its excellent adhesion properties, allowing it to bond effectively with various surfaces like cardboard and plastic, ensuring secure packaging essential for shipping. Its resistance to UV light and durability make it suitable for both indoor and outdoor applications, reducing the frequency of replacements and resulting in cost savings for businesses. Moreover, the introduction of eco-friendly acrylic tapes that utilize sustainable materials is in line with the growing trend towards sustainability, appealing to environmentally conscious consumers. Customization options further enhance brand visibility, crucial for businesses competing in the e-commerce landscape. The surge in online shopping has increased the demand for reliable packaging solutions, with acrylic tape favored in logistics for its strong adhesion and ease of use. Notable companies, such as Scotch and Duck Brand, are investing in product development, launching new lines of eco-friendly and customizable acrylic tapes to meet market demands. As manufacturers continue to innovate and enhance adhesive technologies, the segment is poised for sustained growth, reflecting a commitment to sustainability and performance

Need Any Customization Research On Packaging Tape Printing Market - Inquiry Now

By Raw Material

In the Packaging Tape Printing market, Polypropylene became the top raw material in 2023, capturing a notable 56% of the revenue share. The reason for this supremacy is the exceptional adhesive properties of polypropylene, enabling it to effectively stick to different surfaces such as cardboard and plastic, thus securing the integrity of shipped goods. Its low weight aids in cutting down on shipping expenses, making it the top pick for manufacturers looking to improve packaging efficiency. Moreover, polypropylene tapes are recognized for their strength, providing protection against moisture, chemicals, and UV light, ultimately prolonging the lifespan of goods in packaging. As the need for environmentally friendly packaging grows, manufacturers are investigating alternatives like recycled polypropylene. 3M and Shurtape Technologies have launched creative polypropylene tape products that improve performance while also considering sustainability issues. Continued investments in research and development will be essential in enhancing the importance of polypropylene in the industry as the market progresses.

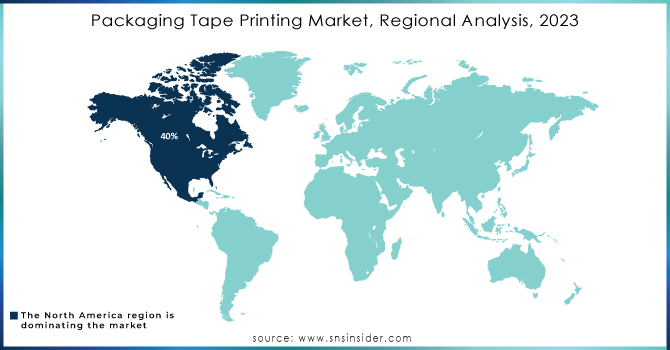

In the Packaging Tape Printing market in 2023, North America dominated with around 40% of the overall revenue. The surge in the e-commerce industry has led to a need for reliable packaging solutions, greatly influencing leadership in this sector. The area's advanced logistics system enables businesses to invest significantly in quality packaging tape for secure and on-time deliveries. Multiple factors play a role in the strong market presence of North America. The surge in online shopping, largely driven by the pandemic, has prompted retailers to improve their packaging methods, with a majority choosing personalized options to boost brand recognition and consumer happiness. Moreover, manufacturers in North America are at the forefront of technological advancements in the production of packaging tape, with a focus on creative adhesive formulas and sustainable materials to cater to changing consumer preferences. The trend towards sustainable packaging options is growing, with companies more and more turning to recycled and biodegradable materials in order to meet environmental laws and satisfy consumer needs. Key players like 3M, Avery Dennison, and Intertape Polymer Group are broadening their range of products and boosting research and development spending, driving market expansion. With the changing e-commerce industry, North America is expected to maintain a leading role in the packaging tape printing market, thanks to advancements and dedication to environmentally-friendly practices.

In 2023, the Asia-Pacific region became the quickest-growing market for printing packaging tape, driven by robust economic growth, a rapidly growing e-commerce industry, and increased need for effective packaging solutions. The rise in e-commerce, especially in nations such as China and India, has resulted in a higher demand for attractive and dependable packaging, causing companies to improve their packaging tactics. Furthermore, the urbanization and industrial expansion in the area, particularly in up-and-coming manufacturing centers such as Vietnam and Thailand, have increased the need for efficient packaging solutions. Technological progress is also crucial, with manufacturers embracing new adhesive formulas and eco-friendly materials to cater to changing consumer desires. Companies are placing more emphasis on eco-friendly materials and recycled products as environmental awareness grows, leading to an increasing popularity of sustainability initiatives. Companies like Avery Dennison and Tesa SE have introduced eco-friendly tapes and creative packaging options designed specifically for the Asian market.

Some of the major key Players in Packaging Tape Printing market who provide products and offering:

3M Company (Scotch Packaging Tape)

Avery Dennison Corporation (Avery Dennison Carton Sealing Tapes)

Intertape Polymer Group Inc. (IPG Tape Products)

Shurtape Technologies LLC (Shurtape Packaging Tapes)

Scapa Group plc (Scapa Packaging Solutions)

Nitto Denko Corporation (Nitto Packaging Tapes)

Tesa SE (Tesa Packaging Solutions)

Lintec Corporation (Lintec Packaging Tapes)

Advance Tapes International Ltd. (Advance Tapes Packaging Tapes)

Adhesives Research Inc. (AR Specialty Tapes)

Achem Technology Corporation (Achem Packaging Tapes)

Lamart Corp. (Lamart Packaging Solutions)

Berry Global Inc. (Berry Packaging Tapes)

Mactac (Mactac Packaging Solutions)

Cantech (Cantech Industrial Tapes)

Chuo Sogo (Chuo Sogo Adhesive Tapes)

Nippon Paper Industries Co., Ltd. (Nippon Paper Packaging Tapes)

Shin-Etsu Chemical Co., Ltd. (Shin-Etsu Specialty Tapes)

American Packaging Corporation (American Packaging Adhesive Tapes)

Pro Tapes & Specialties, Inc. (Pro Tapes Packaging Tapes)

Avery Dennison Performance Tapes (Avery Dennison Specialty Packaging Tapes)

Others

On January 8, 2024, Filtrona Tapes announced the relaunch of its Supastrip Prism tear tape, featuring a new range of holographic films designed to enhance packaging security and create striking visual effects for brand differentiation. This innovative tape is suitable for various fast-moving consumer goods (FMCG) applications, including personal care and food packaging, allowing brands to improve their on-shelf impact while maintaining easy opening functionality

On July 10, 2024, the packing tape industry in Sivakasi introduced innovative tapes featuring QR codes, enhancing branding and customer engagement. This development allows businesses, from small shops to large corporations, to incorporate their logos and product information directly on packing materials, increasing visibility and recognition

From January 9-11, 2024, the Gulf Print & Pack exhibition will showcase over 250 exhibitors at the Dubai World Trade Center, featuring live demonstrations of the latest technology and software in the industry. This event promises to highlight innovations that are shaping the future of packaging and printing

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 18.3 Billion |

| Market Size by 2032 | USD 30.60 Billion |

| CAGR | CAGR of 5.89% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Hot Melt Carton Sealing Tape, Acrylic Carton Sealing Tape, Natural Carton Sealing Tape) • By Raw Material (Polypropylene, Polyvinyl Chloride, Polyester) • By Application (Food & Beverages, Consumer Durables, Transportation & Logistics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | 3M Company, Avery Dennison Corporation, Intertape Polymer Group Inc., Shurtape Technologies LLC, Scapa Group plc, Nitto Denko Corporation, Tesa SE, Lintec Corporation, Advance Tapes International Ltd., Adhesives Research Inc., Achem Technology Corporation, Lamart Corp., Berry Global Inc., Mactac, Cantech, Chuo Sogo, Nippon Paper Industries Co., Ltd., Shin-Etsu Chemical Co., Ltd., American Packaging Corporation, Pro Tapes & Specialties, Inc., and Avery Dennison Performance Tapes, among others. |

| Key Drivers | • E-Commerce Boom and Sustainability Drive Transformations in the Packaging Tape Printing Market |

| RESTRAINTS | • Impact of Raw Material Costs on the Packaging Tape Printing market |

Ans: The Packaging Tape Printing Market grow at a CAGR of 5.89% over the forecast period of 2024-2032.

Ans: The Packaging Tape Printing Market was valued as USD 18.3 Billion by 2023 and expected to reach at USD 30.60 Billion by 2032

Ans: A major growth factor for the Packaging Tape Printing Market is the rapid expansion of the e-commerce sector, which is driving the demand for reliable and efficient packaging solutions

Ans: The Polropylene segment dominated the Packaging Tape Printing Market.

Ans: North America dominated the Packaging Tape Printing Market in 2023.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization Analysis by Region

5.2 Feedstock Prices Analysis by Region

5.3 Regulatory Impact: Effects of regulations on production and usage.

5.4 Environmental Metrics Analysis by Region

5.5 Innovation and R&D

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Packaging Tape Printing Market Segmentation, by Type

7.1 Chapter Overview

7.2 Hot Melt Carton Sealing Tape

7.2.1 Hot Melt Carton Sealing Tape Market Trends Analysis (2020-2032)

7.2.2 Hot Melt Carton Sealing Tape Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Acrylic Carton Sealing Tape

7.3.1 Acrylic Carton Sealing Tape Market Trends Analysis (2020-2032)

7.3.2 Acrylic Carton Sealing Tape Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Natural Carton Sealing Tape

7.4.1 Natural Carton Sealing Tape Market Trends Analysis (2020-2032)

7.4.2 Natural Carton Sealing Tape Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Packaging Tape Printing Market Segmentation, by Raw Material

8.1 Chapter Overview

8.2 Polypropylene

8.2.1 Polypropylene Market Trends Analysis (2020-2032)

8.2.2 Polypropylene Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Polyvinyl Chloride

8.3.1 Polyvinyl Chloride Market Trends Analysis (2020-2032)

8.3.2 Polyvinyl Chloride Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Polyester

8.4.1 Polyester Market Trends Analysis (2020-2032)

8.4.2 Polyester Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Packaging Tape Printing Market Segmentation, by Application

9.1 Chapter Overview

9.2 Food & Beverages

9.2.1 Food & Beverages Market Trends Analysis (2020-2032)

9.2.2 Food & Beverages Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Consumer Durables

9.3.1 Consumer Durables Market Trends Analysis (2020-2032)

9.3.2 Consumer Durables Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Metals & Heavy Machinery

9.4.1 Metals & Heavy Machinery Market Trends Analysis (2020-2032)

9.4.2 Metals & Heavy Machinery Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Transportation & Logistics

9.5.1 Transportation & Logistics Market Trends Analysis (2020-2032)

9.5.2 Transportation & Logistics Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Others

9.6.1 Others Market Trends Analysis (2020-2032)

9.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Packaging Tape Printing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.4 North America Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.2.5 North America Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.6.2 USA Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.2.6.3 USA Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.7.2 Canada Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.2.7.3 Canada Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.8.2 Mexico Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.2.8.3 Mexico Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Packaging Tape Printing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.3.1.6.3 Poland Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.3.1.7.3 Romania Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Packaging Tape Printing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.3.2.5 Western Europe Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.3.2.6.3 Germany Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.7.2 France Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.3.2.7.3 France Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.8.2 UK Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.3.2.8.3 UK Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.3.2.9.3 Italy Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.3.2.10.3 Spain Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.3.2.13.3 Austria Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4 Asia-Pacific

10.4.1 Trends Analysis

10.4.2 Asia-Pacific Packaging Tape Printing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia-Pacific Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.4 Asia-Pacific Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.4.5 Asia-Pacific Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.6.2 China Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.4.6.3 China Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.7.2 India Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.4.7.3 India Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.8.2 Japan Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.4.8.3 Japan Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.9.2 South Korea Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.4.9.3 South Korea Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.4.10.3 Vietnam Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.11.2 Singapore Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.4.11.3 Singapore Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.12.2 Australia Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.4.12.3 Australia Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia-Pacific Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia-Pacific Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Packaging Tape Printing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.4 Middle East Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.5.1.5 Middle East Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.5.1.6.3 UAE Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Packaging Tape Printing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.4 Africa Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.5.2.5 Africa Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Packaging Tape Printing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.4 Latin America Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.6.5 Latin America Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.6.2 Brazil Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.6.6.3 Brazil Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.7.2 Argentina Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.6.7.3 Argentina Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.8.2 Colombia Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.6.8.3 Colombia Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Packaging Tape Printing Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Packaging Tape Printing Market Estimates and Forecasts, by Raw Material (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Packaging Tape Printing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11. Company Profiles

11.1 3M Company

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Avery Dennison Corporation

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Intertape Polymer Group Inc.

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Shurtape Technologies LLC

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Scapa Group plc

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Nitto Denko Corporation

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Tesa SE

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Lintec Corporation

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Advance Tapes International Ltd.

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Adhesives Research Inc

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Hot Melt Carton Sealing Tape

Acrylic Carton Sealing Tape

Natural Carton Sealing Tape

By Raw Material

Polypropylene

Polyvinyl Chloride

Polyester

By Application

Food & Beverages

Consumer Durables

Transportation & Logistics

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia-Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Metalized Flexible Packaging Market size was valued at USD 4.72 billion in 2023 and is expected to Reach USD 6.98 billion by 2031 and grow at a CAGR of 5.01% over the forecast period of 2024-2031.

The Aseptic Packaging Market size was USD 79.19 billion in 2023 and is expected to Reach USD 178.74 billion by 2031 and grow at a CAGR of 10.68 % over the forecast period of 2024-2031.

The Sachet Packaging Market size was USD 8.65 billion in 2023 and is expected to Reach USD 13.27 billion by 2031 and grow at a CAGR of 5.5% over the forecast period of 2024-2031.

The Stick Packaging Market Size was valued at USD 909.805 million in 2023 and will reach $1378.80 million by 2032 and grow at a CAGR of 4.75% by 2024-2032.

Packaging Laminates Market Size was valued at USD 6.4 billion in 2023 and is expected to reach USD 9.03 billion by 2031 and grow at a CAGR of 4.4% over the forecast period 2024-2031.

The Industrial Drum Market size was USD 12.96 billion in 2023 and is expected to Reach USD 23.98 billion by 2031 and grow at a CAGR of 8% over the forecast period of 2024-2031.

Hi! Click one of our member below to chat on Phone